Escolar Documentos

Profissional Documentos

Cultura Documentos

Quarterly Remittance Return of Final Income Taxes Withheld

Enviado por

fatmaaleahDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Quarterly Remittance Return of Final Income Taxes Withheld

Enviado por

fatmaaleahDireitos autorais:

Formatos disponíveis

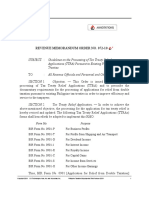

(To be filled up by the BIR)

DLN:

PSOC:

PSIC:

Quarterly Remittance Return

of Final Income Taxes Withheld

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

BIR Form No.

1603

November 2004 (ENCS)

On Fringe Benefits Paid to Employees Other than Rank and File

Fill in all applicable spaces. Mark all appropriate boxes with an X.

1 For the Year

(YYYY)

2 Quarter

1st

2nd

3rd

Months Reflected in this Return

Amended

Return?

4th

Yes

Part I

6 TIN

Background

10 Telephone No.

14 Are there payees availing of tax relief under Special Law or International Tax Treaty?

Government

Yes

Part II

Recipients

ATC

15 Alien & Filipino employed &

occupying the same position

as those of aliens employed

in selected multinational

companies

16 Non-resident Alien not Engaged

in Trade or Business

17 Others ( In General)*

No

If yes, specify

C O M PU TAT I O N O F TAX

Monetary Value of

Fringe Benefit

Percentage

Divisor

Tax Base

Grossed-up

Monetary Value

Tax

Rate

WF 320

85%

15%

WF 330

75%

25%

Tax Required

To Be Withheld

WF 360

18 Total

18A

18B

Less: Taxes Remitted in Return previously filed, if this is an Amended Return

19

20 Tax Still Due/ (Overremittance)

21

No

12 Zip Code

13 Category of Withholding Agent

19

Yes

RDO Code

11 Registered Address

Private

No

Any Taxes

Withheld?

Information

8 Line of Business/

Occupation

Withholding Agent's Name (Last Name, First Name, Middle Name for Individuals)/(Registered Name for Non-Individuals)

20

Add: Penalties

Surcharge

Interest

21A

21B

Compromise

21C

21D

22 Total Amount Still Due/ (Overremittance)

22

If overremittance, mark one box only:

To be Refunded

To be issued a Tax Credit Certificate

I/We declare, under the penalties of perjury, that this return has been made in good faith, verified by me/us, and to the best of my/our knowledge and belief,

is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

23

24

President/Vice President/Principal Officer/Accredited Tax

Agent/Authorized Representative/Taxpayer

(Signature over printed Name)

Title/Position of Signatory

Title/Position of Signatory

TIN of Accredited Tax Agent (if applicable)

Tax Agent Accreditation No. (if applicable)

Part III

Particulars

25 Cash/Bank

Debit Memo 25A

26 Check

27 Others

26A

27A

Treasurer/Asst. Treasurer

(Signature over printed Name)

Drawee Bank/

Agency

Number

Details of Payment

Date

MM DD

Amount

YYYY

25B

25C

25D

26B

26C

26D

27B

27C

27D

Stamp of Receiving

Office and

Date of Receipt

Machine Validation/Revenue Official Receipt Details (If not filed with the bank)

*Note: For tax rates and percentage of divisors, please see instruction at the back (In General)

Você também pode gostar

- 1601e - August 2011Documento2 páginas1601e - August 2011Jefrie MagdadaroAinda não há avaliações

- 1701qjuly2008 (ENCS)Documento6 páginas1701qjuly2008 (ENCS)alvie_budAinda não há avaliações

- BIR Form 2551MDocumento4 páginasBIR Form 2551MJun Casono100% (2)

- Quarterly Income Tax Return: Line of Business/OccupationDocumento4 páginasQuarterly Income Tax Return: Line of Business/OccupationMark Christian B. ApordoAinda não há avaliações

- Bir Form 1600wpDocumento2 páginasBir Form 1600wpmaeshachAinda não há avaliações

- FTP FTP - Bir.gov - PH Webadmin Forms 2551mDocumento1 páginaFTP FTP - Bir.gov - PH Webadmin Forms 2551mPeter John M. LainezAinda não há avaliações

- 1701 Mixed TemplateDocumento11 páginas1701 Mixed TemplateDaniel B. MalillinAinda não há avaliações

- Kawanihan NG Rentas Internas: 27A 27B 27C 27D 28A 28B 28C 28DDocumento4 páginasKawanihan NG Rentas Internas: 27A 27B 27C 27D 28A 28B 28C 28DfatmaaleahAinda não há avaliações

- 2551QDocumento2 páginas2551QCris David Moreno79% (14)

- Bir 1600Documento13 páginasBir 1600Adelaida TuazonAinda não há avaliações

- 1602Documento2 páginas1602Rhizz RamirezAinda não há avaliações

- Bir 1701Documento4 páginasBir 1701Vanesa Calimag ClementeAinda não há avaliações

- Remittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsDocumento5 páginasRemittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsAngela ArleneAinda não há avaliações

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocumento26 páginasMonthly Remittance Return of Income Taxes Withheld On CompensationWinchelle Dimaapi ManalaysayAinda não há avaliações

- Bir Form 1701Documento4 páginasBir Form 1701Ajoi SevillaAinda não há avaliações

- Monthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Documento1 páginaMonthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Kristine CabalteraAinda não há avaliações

- 1701qjuly2008 (ENCS)Documento5 páginas1701qjuly2008 (ENCS)Mary Rose AnilloAinda não há avaliações

- Monthly Remittance ReturnDocumento1 páginaMonthly Remittance ReturnValerieAnnVilleroAlvarezValienteAinda não há avaliações

- 2551MDocumento3 páginas2551MButch Pogi100% (2)

- Monthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Documento4 páginasMonthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Eric LeguardaAinda não há avaliações

- Bir 1701a FormDocumento2 páginasBir 1701a FormChe CacatianAinda não há avaliações

- Return of Percentage Tax Payable Under Special Laws: Kawanihan NG Rentas InternasDocumento2 páginasReturn of Percentage Tax Payable Under Special Laws: Kawanihan NG Rentas InternasAngela ArleneAinda não há avaliações

- BIR FormDocumento4 páginasBIR FormfyeahAinda não há avaliações

- Annex A - 1701A Jan 2018 - RMC 17-2019Documento2 páginasAnnex A - 1701A Jan 2018 - RMC 17-2019Joe75% (4)

- Annex A - 1701A Jan 2018Documento2 páginasAnnex A - 1701A Jan 2018jeffrey josol100% (2)

- Bir46 PDFDocumento2 páginasBir46 PDFJulia SmithAinda não há avaliações

- BIR Form 2000 filing guideDocumento3 páginasBIR Form 2000 filing guiderjgingerpenAinda não há avaliações

- BIR Form 1701-Jan-2018-Encs.-FinalDocumento6 páginasBIR Form 1701-Jan-2018-Encs.-FinalJosent Marie FranciscoAinda não há avaliações

- Bir Form 2000Documento4 páginasBir Form 2000Ricca Pearl SulitAinda não há avaliações

- Bir Form 0608Documento2 páginasBir Form 0608Kram Ynothna BulahanAinda não há avaliações

- BIR Form 1600Documento39 páginasBIR Form 1600maeshach60% (5)

- Bir 1601fDocumento3 páginasBir 1601fJuliet Jayjet Dela CruzAinda não há avaliações

- 2551 MDocumento2 páginas2551 MAdrian AyrosoAinda não há avaliações

- 1701 Jan 2018 Final With RatesDocumento4 páginas1701 Jan 2018 Final With RatesexquisiteAinda não há avaliações

- Form 1600Documento4 páginasForm 1600KialicBetito50% (2)

- Bir Form Percentage TaxDocumento3 páginasBir Form Percentage TaxEc MendozaAinda não há avaliações

- BIR Form 1701A Filing GuideDocumento3 páginasBIR Form 1701A Filing GuideRhon MarlAinda não há avaliações

- 82310BIR Form 1700Documento20 páginas82310BIR Form 1700Georgia HolstAinda não há avaliações

- 1601e PDFDocumento2 páginas1601e PDFJanKhyrelFloresAinda não há avaliações

- 1601 C CompensationDocumento2 páginas1601 C Compensationjon_cpaAinda não há avaliações

- Bir Form 0605Documento2 páginasBir Form 0605John Louise Tan100% (1)

- 2551QDocumento3 páginas2551QJerry Bantilan JrAinda não há avaliações

- Return of Percentage TaxDocumento2 páginasReturn of Percentage TaxfatmaaleahAinda não há avaliações

- 1601 CDocumento16 páginas1601 CROGELIO QUIAZON100% (1)

- BIR Form 1701QDocumento2 páginasBIR Form 1701QfileksAinda não há avaliações

- 1601E BIR FormDocumento7 páginas1601E BIR FormAdonis Zoleta AranilloAinda não há avaliações

- 2551MDocumento4 páginas2551MLecel LlamedoAinda não há avaliações

- Quarterly Income Tax Return: Yes NoDocumento3 páginasQuarterly Income Tax Return: Yes NoSusan P LauronAinda não há avaliações

- 1040 Exam Prep: Module II - Basic Tax ConceptsNo Everand1040 Exam Prep: Module II - Basic Tax ConceptsNota: 1.5 de 5 estrelas1.5/5 (2)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCNo EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCNota: 4 de 5 estrelas4/5 (5)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4No EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Ainda não há avaliações

- International Taxation In Nepal Tips To Foreign InvestorsNo EverandInternational Taxation In Nepal Tips To Foreign InvestorsAinda não há avaliações

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesAinda não há avaliações

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersAinda não há avaliações

- CTA Case No. 2740 Dated Sept 30, 1985Documento9 páginasCTA Case No. 2740 Dated Sept 30, 1985fatmaaleahAinda não há avaliações

- CTA Case No. 3357 Dated April 22, 1985Documento7 páginasCTA Case No. 3357 Dated April 22, 1985fatmaaleahAinda não há avaliações

- Rmo 72-2010Documento19 páginasRmo 72-2010Abigail JamiasAinda não há avaliações

- RMC No 17-2018Documento6 páginasRMC No 17-2018fatmaaleahAinda não há avaliações

- CTA Case No. 2433 Dated Sept 19, 1980Documento8 páginasCTA Case No. 2433 Dated Sept 19, 1980fatmaaleahAinda não há avaliações

- Advisory SystemsDocumento1 páginaAdvisory SystemsfatmaaleahAinda não há avaliações

- BOI MC No. 2022-003Documento1 páginaBOI MC No. 2022-003fatmaaleahAinda não há avaliações

- GR No. L-8506 Dated August 31, 1956Documento5 páginasGR No. L-8506 Dated August 31, 1956fatmaaleahAinda não há avaliações

- CTA Case No. 2799 Dated August 27, 1982Documento9 páginasCTA Case No. 2799 Dated August 27, 1982fatmaaleahAinda não há avaliações

- BOI MC No. 2022-002Documento1 páginaBOI MC No. 2022-002fatmaaleahAinda não há avaliações

- Itad Bir Ruling No. 294-12Documento22 páginasItad Bir Ruling No. 294-12fatmaaleahAinda não há avaliações

- CA-G.R. SP No. 29838Documento8 páginasCA-G.R. SP No. 29838fatmaaleahAinda não há avaliações

- Irr Ra 9513Documento48 páginasIrr Ra 9513fatmaaleahAinda não há avaliações

- Bir Ruling Da 469 06Documento6 páginasBir Ruling Da 469 06juliusAinda não há avaliações

- RMC No 54-2014Documento3 páginasRMC No 54-2014lktlawAinda não há avaliações

- RR 13-98Documento18 páginasRR 13-98fatmaaleahAinda não há avaliações

- Da 404 05Documento4 páginasDa 404 05fatmaaleahAinda não há avaliações

- 2016 Bir Tax Calendar PDFDocumento40 páginas2016 Bir Tax Calendar PDFAnonymous AcvhfPMj7PAinda não há avaliações

- National Internal Revenue Code of 1939Documento186 páginasNational Internal Revenue Code of 1939fatmaaleahAinda não há avaliações

- 55153rr10 17Documento2 páginas55153rr10 17fatmaaleahAinda não há avaliações

- Bir Ruling Da 469 06Documento6 páginasBir Ruling Da 469 06juliusAinda não há avaliações

- Tax Treatment of Proprietary Non-Profit HospitalsDocumento23 páginasTax Treatment of Proprietary Non-Profit HospitalsRoland ApareceAinda não há avaliações

- RR No. 11-2010Documento22 páginasRR No. 11-2010fatmaaleahAinda não há avaliações

- Tax treatment of sales between customs territory and freeport zonesDocumento6 páginasTax treatment of sales between customs territory and freeport zonesscribe03Ainda não há avaliações

- RMC 41-09Documento4 páginasRMC 41-09fatmaaleahAinda não há avaliações

- Improperly Accumulated Earnings Tax Return: Kawanihan NG Rentas Internas For Corporations May 2001 BIR Form NoDocumento6 páginasImproperly Accumulated Earnings Tax Return: Kawanihan NG Rentas Internas For Corporations May 2001 BIR Form NofatmaaleahAinda não há avaliações

- Section 2.57.4 of RR No. 2-98Documento2 páginasSection 2.57.4 of RR No. 2-98fatmaaleahAinda não há avaliações

- RMO No 17-2017Documento2 páginasRMO No 17-2017fatmaaleahAinda não há avaliações

- RMO No 17-2017Documento2 páginasRMO No 17-2017fatmaaleahAinda não há avaliações

- 1704 MqyDocumento1 página1704 MqyfatmaaleahAinda não há avaliações

- CFO TagsDocumento95 páginasCFO Tagssatyagodfather0% (1)

- Galaxy Owners Manual Dx98vhpDocumento10 páginasGalaxy Owners Manual Dx98vhpbellscbAinda não há avaliações

- Vector 4114NS Sis TDSDocumento2 páginasVector 4114NS Sis TDSCaio OliveiraAinda não há avaliações

- Strategies For StartupDocumento16 páginasStrategies For StartupRoshankumar BalasubramanianAinda não há avaliações

- Photosynthesis Lab ReportDocumento7 páginasPhotosynthesis Lab ReportTishaAinda não há avaliações

- Level 10 Halfling For DCCDocumento1 páginaLevel 10 Halfling For DCCQunariAinda não há avaliações

- Induction ClassesDocumento20 páginasInduction ClassesMichelle MarconiAinda não há avaliações

- Training Customer CareDocumento6 páginasTraining Customer Careyahya sabilAinda não há avaliações

- Propoxur PMRADocumento2 páginasPropoxur PMRAuncleadolphAinda não há avaliações

- Link Ratio MethodDocumento18 páginasLink Ratio MethodLuis ChioAinda não há avaliações

- SDS OU1060 IPeptideDocumento6 páginasSDS OU1060 IPeptideSaowalak PhonseeAinda não há avaliações

- Kaydon Dry Gas SealDocumento12 páginasKaydon Dry Gas Sealxsi666Ainda não há avaliações

- Mutual Fund PDFDocumento22 páginasMutual Fund PDFRajAinda não há avaliações

- There Is There Are Exercise 1Documento3 páginasThere Is There Are Exercise 1Chindy AriestaAinda não há avaliações

- Baobab MenuDocumento4 páginasBaobab Menuperseverence mahlamvanaAinda não há avaliações

- CS709 HandoutsDocumento117 páginasCS709 HandoutsalexAinda não há avaliações

- Form 4 Additional Mathematics Revision PatDocumento7 páginasForm 4 Additional Mathematics Revision PatJiajia LauAinda não há avaliações

- Crystallizers: Chapter 16 Cost Accounting and Capital Cost EstimationDocumento1 páginaCrystallizers: Chapter 16 Cost Accounting and Capital Cost EstimationDeiver Enrique SampayoAinda não há avaliações

- Public Private HEM Status AsOn2May2019 4 09pmDocumento24 páginasPublic Private HEM Status AsOn2May2019 4 09pmVaibhav MahobiyaAinda não há avaliações

- THE DOSE, Issue 1 (Tokyo)Documento142 páginasTHE DOSE, Issue 1 (Tokyo)Damage85% (20)

- Chromate Free CoatingsDocumento16 páginasChromate Free CoatingsbaanaadiAinda não há avaliações

- Seminar Course Report ON Food SafetyDocumento25 páginasSeminar Course Report ON Food SafetyYanAinda não há avaliações

- Factors of Active Citizenship EducationDocumento2 páginasFactors of Active Citizenship EducationmauïAinda não há avaliações

- Easa Management System Assessment ToolDocumento40 páginasEasa Management System Assessment ToolAdam Tudor-danielAinda não há avaliações

- AD Chemicals - Freeze-Flash PointDocumento4 páginasAD Chemicals - Freeze-Flash Pointyb3yonnayAinda não há avaliações

- New Hire WorkbookDocumento40 páginasNew Hire WorkbookkAinda não há avaliações

- Joining Instruction 4 Years 22 23Documento11 páginasJoining Instruction 4 Years 22 23Salmini ShamteAinda não há avaliações

- Lewis Corporation Case 6-2 - Group 5Documento8 páginasLewis Corporation Case 6-2 - Group 5Om Prakash100% (1)

- Key Fact Sheet (HBL FreedomAccount) - July 2019 PDFDocumento1 páginaKey Fact Sheet (HBL FreedomAccount) - July 2019 PDFBaD cHaUhDrYAinda não há avaliações

- Analyze and Design Sewer and Stormwater Systems with SewerGEMSDocumento18 páginasAnalyze and Design Sewer and Stormwater Systems with SewerGEMSBoni ClydeAinda não há avaliações