Escolar Documentos

Profissional Documentos

Cultura Documentos

Statement of Cash Flows: Direct Method Indirect Method

Enviado por

eswarlalbkTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Statement of Cash Flows: Direct Method Indirect Method

Enviado por

eswarlalbkDireitos autorais:

Formatos disponíveis

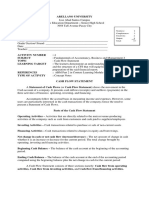

Statement of Cash Flows

A statement of cash flows is a financial statement which summarizes cash

transactions of a business during a given accounting period and classifies them

under three heads, namely, cash flows from operating, investing and financing

activities. It shows how cash moved during the period by indicating whether a

particular line item is a cash in-flow or a cash out-flow. The term cash as used in the

statement of cash flows refers to both cash and cash equivalents. Cash flow

statement provides relevant information in assessing a company's liquidity, quality

of earnings and solvency.

As stated above, a statement of cash flows comprises of three sections:

1. Cash Flows from Operating Activities

This section includes cash flows from the principal revenue generation activities

such as sale and purchase of goods and services. Cash flows from operating

activities can be computed using two methods. One is the Direct Method and the

other Indirect Method.

2. Cash Flows from Investing Activities

Cash flows from investing activities are cash in-flows and out-flows related to

activities that are intended to generate income and cash flows in future. This

includes cash in-flows and out-flows from sale and purchase of long-term assets.

3. Cash Flows from Financing Activities

Cash flows from financing activities are the cash flows related to transactions with

stockholders and creditors such as issuance of share capital, purchase of treasury

stock, dividend payments etc.

Format and Example

Following is a cash flow statement prepared using indirect method:

Company A, Inc.

Cash Flow Statement

For the Year Ended Dec 31, 2010

Cash Flows from Operating Activities:

Operating Income (EBIT)

489,000

Depreciation Expense

112,400

Loss on Sale of Equipment

7,300

Gain on Sale of Land

51,000

Increase in Accounts Receivable

84,664

Decrease in Prepaid Expenses

Decrease in Accounts Payable

Decrease in Accrued Expenses

8,000

97,370

113,860

Net Cash Flow from Operating Activities

269,806

Cash Flows from Investing Activities:

Sale of Equipment

Sale of Land

Purchase of Equipment

89,000

247,000

100,000

Net Cash Flow from Investing Activities

136,000

Cash Flows from Financing Activities:

Payment of Dividends

Payment of Bond Payable

90,000

200,000

Net Cash Flow from Financing Activities

290,000

Net Change in Cash

115,806

Beginning Cash Balance

319,730

Ending Cash Balance

435,536

Cash Flow from Operating Activities: Direct Method

The direct method to calculate cash flow from operating activities involves

determination of various types of cash receipts and payments such as cash receipts

from customers, cash paid to suppliers, cash paid for salaries, etc. and then putting

them together under the cash flow from operating section of cash flow statement.

These figures are calculated using the beginning and ending balances of various

accounts of the business and the net increase or decrease in the account. The exact

formulas to calculate various cash inflows and outflows vary. The most important

ones are given below:

Formulas

Cash Receipts from Customers =

+

Net Sales

Beginning Accounts Receivable

Ending Accounts Receivable

Cash Payments to Suppliers =

+

Purchases

Ending Inventory

Beginning Inventory

Beginning Accounts Payable

Ending Accounts Payable

Cash Payments to Employees =

+

Beginning Salaries Payable

Ending Salaries Payable

Salaries Expense

Cash Payments for Purchase of Prepaid Assets =

+

Ending Prepaid Rent, Prepaid Insurance etc.

Expired Rent, Expired Insurance etc.

Beginning Prepaid Rent, Prepaid Insurance etc.

Interest Payments =

+

Beginning Interest Payable

Ending Interest Payable

Interest Expense

Income Tax Payments =

+

Beginning Income Tax Payable

Ending Income Tax Payable

Income Tax Expense

In the formulas given above it is assumed that accounts receivable are only used for

credit sales. It is also assumed that all sales are on credit. If there are cash sales as

well, then receipts from cash sales must be included in the cash receipts from

customers to obtain a correct figure of cash flow from operating activities.

Similarly, it is assumed that accounts payable are used merely for purchases on

account and that all purchases are on credit. If there are cash purchases as well,

then cash payments for them must be included in the cash paid to suppliers. It is

important to note that here may be receipts & payments other than those discussed

above.

Once the all the cash inflows and outflows from operating activities are calculated,

they are added in the operating section of cashflows to obtain the net cashflow from

operating activities.

The following example shows the format and calculation of cash flows from

operating activities using direct method.

Example

Prepare the cash flows from operating activities section of cash flow statement by

direct method using the following information:

December 31

2011

2010

Accounts Receivable

34,130

28,410

Prepaid Rent

20,000

25,000

Prepaid Insurance

6,800

6,000

Inventory

23,030

15,450

Accounts Payable

14,590

31,300

Salaries Payable

8,310

5,120

Interest Payable

700

360

Income Tax Payable

2,340

Year Ended December 31

2011

Net Sales

64,970

Salaries Expense

8,610

Rent Expense

5,000

Insurance Expense

3,200

Interest Expense

1,650

Solution:

Cash Flow from Operating Activities:

Cash Receipts

From Customers (1)

59,250

Cash Payments

To Suppliers (2)

24,290

To Employees (3)

5,420

For Purchase of Prepaid Assets (4)

4,000

Interest (5)

1,310

Income Tax (6)

Net Cash Flow from Operating Activities

Working Notes

24,230

1) 64,970 + 28,410 - 34,130

2) 23,030 - 15,450 + 31,300 - 14,590

3) 5,120 - 8,310 + 8,610

4) 20,000 + 6,800 + 5,000 + 3,200 - 25,000 - 6,000

5) 360 - 700 + 1,650

6) 0 - 2,340 + 2,340

Você também pode gostar

- Cash Flows AccountingDocumento9 páginasCash Flows AccountingRosa Villaluz BanairaAinda não há avaliações

- Cash Flow StatementDocumento11 páginasCash Flow StatementDELFIN, LORENA D.Ainda não há avaliações

- Chapter 13 - Statement of Cash Flows SummaryDocumento13 páginasChapter 13 - Statement of Cash Flows SummaryPRITHWISH MITRAAinda não há avaliações

- Cash Flow StatementDocumento35 páginasCash Flow StatementShiv Shankar Kumar100% (1)

- Cash FlowsDocumento26 páginasCash Flowsvickyprimus100% (1)

- IAS 7, Statement of Cash Flows - A Closer Look: ArticleDocumento10 páginasIAS 7, Statement of Cash Flows - A Closer Look: ArticlevcdsvcdsvsdfAinda não há avaliações

- Fundamentals of Accountancy, Business and Management 2Documento58 páginasFundamentals of Accountancy, Business and Management 2Carmina Dongcayan100% (1)

- Lesson 5:: Cash Flow Statement (CFS)Documento17 páginasLesson 5:: Cash Flow Statement (CFS)Franz BatulanAinda não há avaliações

- Wlof Hsac Gnitarepo Gncinfina: Jumble LettersDocumento23 páginasWlof Hsac Gnitarepo Gncinfina: Jumble LettersAce Soleil RiegoAinda não há avaliações

- Cash Flow StatementDocumento57 páginasCash Flow StatementSurabhi GuptaAinda não há avaliações

- Cima F1 Chapter 4Documento20 páginasCima F1 Chapter 4MichelaRosignoli100% (1)

- Statement of Cash FlowDocumento45 páginasStatement of Cash FlowJay Bianca Abera Alistado100% (1)

- Lecture 3 Week 3 PPT 3Documento39 páginasLecture 3 Week 3 PPT 3Li Lin100% (1)

- Summary Report - Group 2: Definition of TermsDocumento8 páginasSummary Report - Group 2: Definition of TermsRigor Salonga BaldemosAinda não há avaliações

- Statement of Cash Flows: Financial Accounting Presentation byDocumento11 páginasStatement of Cash Flows: Financial Accounting Presentation bykhadijaAinda não há avaliações

- 3 CFSDocumento65 páginas3 CFSRocky Bassig100% (1)

- Cash Flow Statement Wit SumDocumento27 páginasCash Flow Statement Wit SumSunay KhaireAinda não há avaliações

- Cash Flow StatementDocumento24 páginasCash Flow StatementSHENUAinda não há avaliações

- What Is A Statement of Cash Flow?Documento3 páginasWhat Is A Statement of Cash Flow?Bea Marella CapundanAinda não há avaliações

- Session 6. The Statement of Cash FlowsDocumento22 páginasSession 6. The Statement of Cash FlowsAmrutaAinda não há avaliações

- Ias 3Documento21 páginasIas 3JyotiAinda não há avaliações

- Prepare The Statement of Cash Flows Using The Indirect MethodDocumento4 páginasPrepare The Statement of Cash Flows Using The Indirect MethodcindywAinda não há avaliações

- Ch-5 Cash Flow AnalysisDocumento9 páginasCh-5 Cash Flow AnalysisQiqi GenshinAinda não há avaliações

- Cash Flow Statement 1Documento5 páginasCash Flow Statement 1furqanAinda não há avaliações

- Cash Flow StatementDocumento17 páginasCash Flow StatementimtiazbulbulAinda não há avaliações

- Cash Flow Analysis, Gross Profit Analysis, Basic Earnings Per Share and Diluted Earnings Per ShareDocumento135 páginasCash Flow Analysis, Gross Profit Analysis, Basic Earnings Per Share and Diluted Earnings Per ShareMariel de Lara100% (2)

- Cash Flow Statement Indirect MethodDocumento5 páginasCash Flow Statement Indirect MethodSaivyjayanthiAinda não há avaliações

- 4.cash Flow Statement (CFS)Documento16 páginas4.cash Flow Statement (CFS)Efrelyn Grethel Baraya AlejandroAinda não há avaliações

- Cash Flow StatementDocumento7 páginasCash Flow Statementlianapha.dohAinda não há avaliações

- Cash Flow Management - DR ReddyDocumento103 páginasCash Flow Management - DR Reddyarjunmba119624Ainda não há avaliações

- CoA Debit Credit TeoryDocumento9 páginasCoA Debit Credit TeorymipapirolivecomAinda não há avaliações

- Financial Accounting A Business Process Approach 3rd Edition Reimers Solutions ManualDocumento49 páginasFinancial Accounting A Business Process Approach 3rd Edition Reimers Solutions Manualtecumwastorel.mio0v100% (24)

- Statement of Cash Flow - Simple ExampleDocumento5 páginasStatement of Cash Flow - Simple ExampleVinnie VermaAinda não há avaliações

- Unit Ii Accounting PDFDocumento11 páginasUnit Ii Accounting PDFMo ToAinda não há avaliações

- Acc201 Su6Documento15 páginasAcc201 Su6Gwyneth LimAinda não há avaliações

- CFAS - PAS 7 - Statement of Cash FlowDocumento14 páginasCFAS - PAS 7 - Statement of Cash FlowCarlo Lopez CantadaAinda não há avaliações

- Statement of Cash Flows - CRDocumento24 páginasStatement of Cash Flows - CRsyed100% (1)

- Theory - CASH FLOW ANALYSISDocumento7 páginasTheory - CASH FLOW ANALYSISShahina KhanAinda não há avaliações

- Importance of Financial StatementsDocumento10 páginasImportance of Financial StatementsAmrit TejaniAinda não há avaliações

- Cash Flow StatementDocumento4 páginasCash Flow Statementmajaykumar1349810Ainda não há avaliações

- Cash Flow AnalysisDocumento15 páginasCash Flow AnalysisElvie Abulencia-BagsicAinda não há avaliações

- Course: Financial Accounting & Analysis A1Documento10 páginasCourse: Financial Accounting & Analysis A1Pallavi PandeyAinda não há avaliações

- What Are Operating Activities?: Purpose of The Cash Flow StatementDocumento4 páginasWhat Are Operating Activities?: Purpose of The Cash Flow StatementMitch MinglanaAinda não há avaliações

- Financial Accounting and Analysis Sept 2022Documento11 páginasFinancial Accounting and Analysis Sept 2022meetAinda não há avaliações

- Accounting Chapter 9 NotesDocumento2 páginasAccounting Chapter 9 NotesAmy HancellAinda não há avaliações

- I. Title: Statement of Cash Flows II. Objectives:: After Accomplishing This Module, You Must Be Able ToDocumento3 páginasI. Title: Statement of Cash Flows II. Objectives:: After Accomplishing This Module, You Must Be Able ToLouix LaneAinda não há avaliações

- Chapter FourDocumento37 páginasChapter FourbiyaAinda não há avaliações

- Cash Flow StatementDocumento4 páginasCash Flow StatementRakin HasanAinda não há avaliações

- PAS 7 - Statement of Cash FlowDocumento14 páginasPAS 7 - Statement of Cash FlowCarlo Lopez Cantada100% (1)

- Cash Flow StatementDocumento38 páginasCash Flow StatementSatyajit Ghosh100% (2)

- The Cash Flow StatementDocumento6 páginasThe Cash Flow Statementacuna.alexAinda não há avaliações

- Cash Flow and BudgetingDocumento3 páginasCash Flow and BudgetingAdil MehmoodAinda não há avaliações

- Cash FlowDocumento50 páginasCash FlowAnant AJAinda não há avaliações

- Cash Flow StatementDocumento11 páginasCash Flow StatementTagele gashawAinda não há avaliações

- Data Analysis and InterpretationDocumento11 páginasData Analysis and InterpretationRiya Agarwal80% (5)

- SodaPDF-converted-finacl Assign GauriDocumento5 páginasSodaPDF-converted-finacl Assign GaurigauriAinda não há avaliações

- Financial Accounting - Information For Decisions - Session 9 - Chapter 11 PPT HmugGnI6jbDocumento41 páginasFinancial Accounting - Information For Decisions - Session 9 - Chapter 11 PPT HmugGnI6jbmukul3087_305865623Ainda não há avaliações

- DLP SCF Concepts and FormatDocumento11 páginasDLP SCF Concepts and FormatDia Did L. RadAinda não há avaliações

- Accounting Standard 3 (Revised)Documento3 páginasAccounting Standard 3 (Revised)Jazib Faraz NaqviAinda não há avaliações

- Statement of Cash Flows: Preparation, Presentation, and UseNo EverandStatement of Cash Flows: Preparation, Presentation, and UseAinda não há avaliações

- Quantitative Aptitude: Clocks &calendar Algebra Class Work & Home AssignmentDocumento4 páginasQuantitative Aptitude: Clocks &calendar Algebra Class Work & Home AssignmenteswarlalbkAinda não há avaliações

- Interviewer: How Much Salary Do You Expect?Documento1 páginaInterviewer: How Much Salary Do You Expect?eswarlalbkAinda não há avaliações

- NumbersDocumento2 páginasNumberseswarlalbkAinda não há avaliações

- Candidate: It's Shaping Yet. I'm Trying My Best To Shape It As I Want It Be. Being Satisfied With My Job Will Be The Most I Can Ask ForDocumento1 páginaCandidate: It's Shaping Yet. I'm Trying My Best To Shape It As I Want It Be. Being Satisfied With My Job Will Be The Most I Can Ask ForeswarlalbkAinda não há avaliações

- Interviewer: Would You Take Up This Job If We Offered It To You?Documento1 páginaInterviewer: Would You Take Up This Job If We Offered It To You?eswarlalbkAinda não há avaliações

- Interviewer: What Motivates You at Work?Documento1 páginaInterviewer: What Motivates You at Work?eswarlalbkAinda não há avaliações

- Candidate: Yes. I Would Definitely Take Up This Offer and Which Is Why I'm Here. I'm Confident The Company Will Recognize My TalentDocumento1 páginaCandidate: Yes. I Would Definitely Take Up This Offer and Which Is Why I'm Here. I'm Confident The Company Will Recognize My TalenteswarlalbkAinda não há avaliações

- Interviewer: What Is Your Style of Management?Documento1 páginaInterviewer: What Is Your Style of Management?eswarlalbkAinda não há avaliações

- Interviewer: What Would You Do If You and Your Colleague Have A Different Approach To Deal With A Thing?Documento1 páginaInterviewer: What Would You Do If You and Your Colleague Have A Different Approach To Deal With A Thing?eswarlalbkAinda não há avaliações

- Interviewer: How Much Salary Do You Expect?Documento1 páginaInterviewer: How Much Salary Do You Expect?eswarlalbkAinda não há avaliações

- Interviewer: What Irritates You About Co-Workers?Documento1 páginaInterviewer: What Irritates You About Co-Workers?eswarlalbkAinda não há avaliações

- Interviewer: How Would You Compensate For The Lack of Experience You Have For This Position?Documento1 páginaInterviewer: How Would You Compensate For The Lack of Experience You Have For This Position?eswarlalbkAinda não há avaliações

- What Statistical Analysis Should I UseDocumento3 páginasWhat Statistical Analysis Should I UseeswarlalbkAinda não há avaliações

- RE: Mock Interview Questions and Answers - Part 2Documento1 páginaRE: Mock Interview Questions and Answers - Part 2eswarlalbkAinda não há avaliações

- Interviewer: How Do You Rate Your Communication Skills?Documento1 páginaInterviewer: How Do You Rate Your Communication Skills?eswarlalbkAinda não há avaliações

- Interviewer: What Motivates You To Do A Good Job?Documento1 páginaInterviewer: What Motivates You To Do A Good Job?eswarlalbkAinda não há avaliações

- Interviewer: What Are Your Goals?Documento1 páginaInterviewer: What Are Your Goals?eswarlalbkAinda não há avaliações

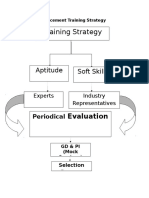

- Training Strategy: Aptitude Soft SkillsDocumento1 páginaTraining Strategy: Aptitude Soft SkillseswarlalbkAinda não há avaliações

- Interviewer: What Are Your Strengths and Weaknesses?Documento1 páginaInterviewer: What Are Your Strengths and Weaknesses?eswarlalbkAinda não há avaliações

- Think Like A Designer: Jonathan IveDocumento1 páginaThink Like A Designer: Jonathan IveeswarlalbkAinda não há avaliações

- Automobile Technical QuestionsDocumento5 páginasAutomobile Technical QuestionseswarlalbkAinda não há avaliações

- ST JohnDocumento20 páginasST JohnNa PeaceAinda não há avaliações

- 5 Star Hotels in Portugal Leads 1Documento9 páginas5 Star Hotels in Portugal Leads 1Zahed IqbalAinda não há avaliações

- Cdi 2 Traffic Management and Accident InvestigationDocumento22 páginasCdi 2 Traffic Management and Accident InvestigationCasanaan Romer BryleAinda não há avaliações

- Lab 6 PicoblazeDocumento6 páginasLab 6 PicoblazeMadalin NeaguAinda não há avaliações

- Droplet Precautions PatientsDocumento1 páginaDroplet Precautions PatientsMaga42Ainda não há avaliações

- Maths PDFDocumento3 páginasMaths PDFChristina HemsworthAinda não há avaliações

- Aluminum 3003-H112: Metal Nonferrous Metal Aluminum Alloy 3000 Series Aluminum AlloyDocumento2 páginasAluminum 3003-H112: Metal Nonferrous Metal Aluminum Alloy 3000 Series Aluminum AlloyJoachim MausolfAinda não há avaliações

- Reverse Engineering in Rapid PrototypeDocumento15 páginasReverse Engineering in Rapid PrototypeChaubey Ajay67% (3)

- Dialog Suntel MergerDocumento8 páginasDialog Suntel MergerPrasad DilrukshanaAinda não há avaliações

- Exp. 5 - Terminal Characteristis and Parallel Operation of Single Phase Transformers.Documento7 páginasExp. 5 - Terminal Characteristis and Parallel Operation of Single Phase Transformers.AbhishEk SinghAinda não há avaliações

- MMC Pipe Inspection RobotDocumento2 páginasMMC Pipe Inspection RobotSharad Agrawal0% (1)

- A PDFDocumento2 páginasA PDFKanimozhi CheranAinda não há avaliações

- Supergrowth PDFDocumento9 páginasSupergrowth PDFXavier Alexen AseronAinda não há avaliações

- Republic of The Philippines National Capital Judicial Region Regional Trial Court Manila, Branch 1Documento4 páginasRepublic of The Philippines National Capital Judicial Region Regional Trial Court Manila, Branch 1brendamanganaanAinda não há avaliações

- 21st Bomber Command Tactical Mission Report 178, OcrDocumento49 páginas21st Bomber Command Tactical Mission Report 178, OcrJapanAirRaidsAinda não há avaliações

- QA/QC Checklist - Installation of MDB Panel BoardsDocumento6 páginasQA/QC Checklist - Installation of MDB Panel Boardsehtesham100% (1)

- On CatiaDocumento42 páginasOn Catiahimanshuvermac3053100% (1)

- TSR KuDocumento16 páginasTSR KuAngsaAinda não há avaliações

- IEC Blank ProformaDocumento10 páginasIEC Blank ProformaVanshika JainAinda não há avaliações

- Rofi Operation and Maintenance ManualDocumento3 páginasRofi Operation and Maintenance ManualSteve NewmanAinda não há avaliações

- DC Servo MotorDocumento6 páginasDC Servo MotortaindiAinda não há avaliações

- Professional Regula/on Commission: Clarita C. Maaño, M.DDocumento31 páginasProfessional Regula/on Commission: Clarita C. Maaño, M.Dmiguel triggartAinda não há avaliações

- Dissertation On Indian Constitutional LawDocumento6 páginasDissertation On Indian Constitutional LawCustomPaperWritingAnnArbor100% (1)

- Oem Functional Specifications For DVAS-2810 (810MB) 2.5-Inch Hard Disk Drive With SCSI Interface Rev. (1.0)Documento43 páginasOem Functional Specifications For DVAS-2810 (810MB) 2.5-Inch Hard Disk Drive With SCSI Interface Rev. (1.0)Farhad FarajyanAinda não há avaliações

- Use of EnglishDocumento4 páginasUse of EnglishBelén SalituriAinda não há avaliações

- Profile On Sheep and Goat FarmDocumento14 páginasProfile On Sheep and Goat FarmFikirie MogesAinda não há avaliações

- RENCANA KERJA Serious Inspeksi#3 Maret-April 2019Documento2 páginasRENCANA KERJA Serious Inspeksi#3 Maret-April 2019Nur Ali SaidAinda não há avaliações

- Oracle Exadata Database Machine X4-2: Features and FactsDocumento17 páginasOracle Exadata Database Machine X4-2: Features and FactsGanesh JAinda não há avaliações

- Lockbox Br100 v1.22Documento36 páginasLockbox Br100 v1.22Manoj BhogaleAinda não há avaliações

- Ludwig Van Beethoven: Für EliseDocumento4 páginasLudwig Van Beethoven: Für Eliseelio torrezAinda não há avaliações