Escolar Documentos

Profissional Documentos

Cultura Documentos

DWC Legazpi Practical Accounting One Liabilities

Enviado por

yukiro rinevaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

DWC Legazpi Practical Accounting One Liabilities

Enviado por

yukiro rinevaDireitos autorais:

Formatos disponíveis

Divine Word College of Legazpi

COLLEGE OF BUSINESS EDUCATION,

Legazpi City

PRACTICAL ACCOUNTING ONE

SEPTEMBER 25, 2005

LIABILITIES

1. In an effort to increase sales, Mills Company inaugurated a sales promotional campaign on June 30, 2005.

Mills placed a coupon redeemable for a premium in each package of cereal sold. Each premium cost Mills P

20 and five coupons must be presented by a customer to receive a premium. Mills estimated that only 60% of

the coupons issued will be redeemed. For the six months ended December 31, 2005, the following

information is available:

Pagkages of

Premiums

Coupons

cereal sold

purchased

redeemed

160,000

12,000

40,000

What is the estimated liability for premium claims outstanding at December 31, 2005?

a. 288,000

b. 169,000

c. 384,000

d. 224,000

2. Summa Company manufactures a special product. To promote the sale of the product, a premium is offered to

customers who send in three wrappers and remittance of P 25. The distribution cost per premium is P 5. Data

for the premium are.

2004

2005

Sales

4,000,000

5,000,000

Premium purchase at P 80 each

400,000

416,000

Number of premiums distributed

4,000

5,500

Number of premiums to be distributed

in next period

200

500

The premium expense for 2005 should be

a. 464,000

b. 348,000

c. 360,000

d. 0

3. During 2005 Day Company sold 500,000 boxes of cake mix under a new sales promotional program. Each

box contains one coupon, which entitles the customer to a baking pan upon remittance of P 40. Day pays P

50 per pan and P 5 for handling and shipping. Day estimates that 80% of the coupons will be redeemed, even

though only 300,000 coupons had been processed during 2005. What amount should Day report as a liability

for unredeemed coupons at December 31, 2005?

a. 1,500,000

b. 5,000,000

c. 1,000,000

d. 3,000,000

4. In packages of its product, Curran Company includes coupons that may be presented at retail stores to obtain

discounts on other Curran products. Retailers are reimbursed for the face amount of coupons redeemed plus

10% of that amount for handling costs. Curran honors requests for coupon redemption by retailers up to three

months after the consumer redemption date, Curran estimates that 70% of all coupons issued will ultimately

be redeemed. Information relating to coupons issued by Curran during 2005 is as follows:

Consumer expiration date

12/31/2005

Total face amount of coupons issued

600,000

Total payments to retailers as of 12/31/2005

220,000

What amount should Current report as a liability for unredeemed coupons at December 31, 2005?

a. 242,000

b. 308,000

c. 0

d. 200,000

5. Mile Company sells washing machines that carry a three-year warranty against manufacturers defects.

Based on company experience, warranty costs are estimated at P 300 per machine. During 2005 Mile sold

2,400 washing machines and paid warranty costs of P 170,000. In its income statement for the year ended

December 31, 2005, Mike should report warranty expense of

a. 550,000

b. 170,000

c. 720,000

d. 240,000

6. East Company manufactures stereo systems that carry a two-year warranty against defects. Based on past

experience, warranty costs are estimated at 5% of sales for the warranty period. During 2005, stereo system

sales amounted to P 5,000,000 and warranty costs of P 100,000 were incurred. In its income statement for

the year ended December 31, 2005 Each should report warranty expense of

a. 100,000

b. 250,000

c. 150,000

d. 125,000

7. In 2004, Dubious Company began selling new line of products that carry a two-year warranty against defects.

Based upon past experience with other products, the estimated warranty costs related to peso sales are as

follows:

First year of warranty

2%

Second year of warranty

5%

Sales and actual warranty expenditure for 2004 and 2005 are presented below:

2004

2005

Sales

5,000,000

7,000,000

Actual warranty costs

100,000

300,000

What is the estimated liability on December 31, 2005?

a. 390,000

b. 490,000

c. 440,000

d. 840,000

8. Villa Company estimates its annual warranty expense at 8% of net sales. The following data relate to calendar

year 2005.

Net sales

?

Warranty liability account, December 31, 2005:

THIRD SESSION

Page 1 of 14

Divine Word College of Legazpi

COLLEGE OF BUSINESS EDUCATION,

Legazpi City

9.

10.

11.

12.

13.

14.

15.

16.

PRACTICAL ACCOUNTING ONE

SEPTEMBER 25, 2005

Before adjustment

100,000 debit

After adjustment

540,000 debit

What is the amount of net sales?

a. 1,250,000

b. 5,500,000

c. 8,000,000

d. 6,750,000

At December 31, 2005, Rustan Boutique had 1,000 gift certificates outstanding, which had been sold to

customers during 2005 for P 500 each. Rustan operates on a gross margin of 60% of its sales. What amount

of revenue pertaining to the 1,000 outstanding gift certificates should be deferred at December 31, 2005?

a. 200,000

b. 0

c. 300,000

d. 500,000

Cobb Department Store sells gift certificates redeemable only when merchandise is purchased. These gift

certificates have an expiration date of two years after issuance date. Upon redemption or expiration, Cobb

recognize the unearned revenue as realized. Information for 2005 is as follows:

Unearned revenue, 01/01/2005

650,000

Gift certificates sold

2,250,000

Gift certificates redeemed

1,950,000

Expired gift certificates

100,000

Cost of goods sold

60%

On December 31, 2005 what amount should Cobb report as unearned revenue?

a. 950,000

b. 510,000

c. 850,000

d. 570,000

Greene Company sells office equipment service contracts agreeing to service equipment for a two-year

period. Cash receipts from contracts are credited to unearned service contract revenue and service contract

costs are charged to service contract expense as incurred. Revenue from service contracts is recognized as

earned over the lives of the contracts. Additional information for the year ended December 31, 2005, is as

follows:

Unearned service contract revenue at January 1, 2005

600,000

Cash receipts from service contracts sold

980,000

Service contract revenue recognized

860,000

Service contract expense

520,000

What amount should Green report as unearned service contract revenue at December 31, 2005?

a. 480,000

b. 490,000

c. 460,000

d. 720,000

In November and December 2005, Dorr Company, a newly organized magazine publisher, received P

720,000 for 1,000 three-year subscriptions at P 240 per year, starting with the January 2006 issue. Dorr

elected to include the entire P 720,000 in its 2005 income tax return. What amount should Dorr report in its

2005 income statement for subscription revenue?

a. 0

b. 40,000

c. 240,000

d. 720,000

Fell Company operates a retail grocery store that is required by law to collect refundable deposits of P 5 on

soda cans. Information for 2005 follows:

Liability for refundable deposits - 12/31/04

150,000

Cans of soda sold in 2005

100,000

Soda cans returned in 2005

110,000

On February 1, 2005, Fell subleased space and received a P 25,000 deposit to be applied against rent at the

expiration of the lease in 2007. In Fells December 31, 2005, balance sheet, the current and noncurrent

liabilities for deposits were

a. Current - 100,000

;

Non-current - 25,000

b. Current - 100,000

;

Non-current - 0

c. Current - 25,000

;

Non-current - 100,000

d. Current - 125,000

;

Non-current - 0

Black Company requires advance payments with special orders for machinery constructed to customer

specifications. These advances are nonrefundable. Information for 2005 is as follows:

Customer advances - December 31, 2004

1,180,000

Advances received with orders in 2005

1,840,000

Advances applied to orders shipped in 2005

1,640,000

Advances applicable to orders canceled in 2005

500,000

In Blacks December 31, 2005 balance sheet, what amount should be reported as a current liability for

advances from customers?

a. 880,000

b. 1,380,000

c. 0

d. 1,480,000

Ronald Company has an incentive compensation plan under which a branch manager received 10% of the

branchs income after deduction of the bonus but before deduction of income tax. Branch income for 2005

before the bonus and income tax was P 1,650,000. The tax rate was 32%. The 2005 bonus amounted to

a. 126,000

b. 165,000

c. 150,000

d. 180,000

The bonus agreement of Christian Company provides that the general manager shall receive an annual

bonus of 10% of the net income after bonus and tax. The income tax rate is 32%. The general manager

receives P 272,000 for the year as bonus. The income before bonus and tax is

a. 3,728,000

b. 4,000,000

c. 2,720,000

d. 4,272,000

THIRD SESSION

Page 2 of 14

Divine Word College of Legazpi

COLLEGE OF BUSINESS EDUCATION,

Legazpi City

PRACTICAL ACCOUNTING ONE

SEPTEMBER 25, 2005

17. On September 1, 2004, Pine Company issued a note payable to National Bank in the amount of P 1,800,000,

bearing interest at 12%. and payable in three equal annual principal payments of P 600,000. On this date, the

banks prime rate was 11%. The first interest and principal payment was made on September 1, 2005. At

December 31, 2005, Pine should record accrued interest payable of

a. 48,000

b. 66,000

c. 44,000

d. 72,000

18. Included in Easy Corporations liability account balances at December 31, 2004, was a note payable in the

amount of P 1,200,000. The note is dated October 1, 2004, bears interest at 15%, and is payable in three

equal annual payments of P 400,000. The first interest and principal payment was made on October 1, 2005.

In its 2005 income statement, what amount should Easy report as interest expense for this note?

a. 30,000

b. 180,000

c. 165,000

d. 135,000

19. Eliot Corporations liabilities at December 31, 2005, were as follows:

Accounts payable and accrued interest

200,000

12% note payable issued November 1, 2004

maturing July 1, 2006

60,000

10% debentures payable, next annual principal installment

of P 100,000 due February 1, 2006

700,000

On March 1, 2006, Eliot consummated a noncancelable agreement with the lender to refinance the 12% note

payable on a long-term basis on readily determinable terms that have not yet been implement. Both parties

are financially capable of honoring the agreements provisions. Eliots December 31, 2005, financial

statements were issued on March 31, 2006. In its December 31, 2005 balance sheet, Eliot should report

current liabilities at

a. 300,000

b. 260,000

c. 200,000

d. 360,000

20. At December 31, 2005, Reed Corporation owed note payable of P 1,000,000, with maturity date of April 30,

2006. This note did not arise from transactions in the normal course of business. On February 1, 2006, Reed

issued P 3,000,000 of ten-year bonds with the intention of using part of the bond proceeds to liquidate the P

1,000,000 of note payable maturing in April. On March 1, 2006, Reed did in fact liquidate the P 1,000,000 of

note payable, using proceeds from the bond issue. Reeds December 31, 2005, financial statements were

issued on March 29, 2006. How much of the P 1,000,000 note payable should be classified as noncurrent in

Reeds balance sheet at December 31, 2005?

a. 100,000

b. 1,000,000

c. 900,000

d. 0

21. On December 31, 2005, Largo Company had a P 750,000 note payable outstanding, due July 31, 2006.

Largo borrowed the money to finance construction of a new plant. Largo planned to refinance the note by

issuing long-term bonds. Because Largo temporarily had excess cash, it prepaid P 250,000 of the note on

January 12, 2006. In February 2006, Largo completed a P 1,500,000 bond offering. Largo will use the bond

offering proceeds to repay the note payable at its maturity and to pay construction costs during 2006. On

March 31, 2006, Largo issued its 2005 financial statements. What amount of the note payable should Largo

include in the current liabilities section of its December 31, 2005 balance sheet?

a. 0

b. 750,000

c. 500,000

d. 250,000

22. On December 31, 2005, Mith Company was a defendant in a pending lawsuit. The suit arose from the alleged

defect of a product that Mith sold in 2004. In the opinion of MIths attorney, it is probable that Mith will have to

pay P 500,000, and it is reasonably possible that MIth will have to pay P 600,000. as a result of this lawsuit. In

its 2005 financial statements, Mith would report.

a. An accrued liability of P 500,000 only.

b. No information about this lawsuit.

c. An accrued liability of P 600,000 only

d. An accrued liability of P 500,000 and would disclose a contingent liability of an additional P 100,000.

23. On November 5, 2005, a Dunn Corporation truck was in an accident with an auto driven by Bell. Dunn

received notice on January 12, 2006 of a lawsuit for P 700,000 damages for personal injuries suffered by Bell.

Dunns counsel believes it is probable that Bell will be awarded an estimated amount in the range between P

200,000 and P 450,000, and that P 300,000 is the best estimate of potential liability than any other amount.

Dunns accounting year ends on December 31, and the 2005 financial statements were issued on March 2,

2006. What amount of provision should Dunn accrue at December 31, 2005?

a. 0

b. 200,000

c. 300,000

d. 450,000

24. During 2005, Smith Company filed suity against West Company seeking damages for patent infringement. At

December 31, 2005, Smiths legal counsel believed that it was probable that Smith would be successful

against West for estimated amount of P 1,500,000. In March 2006, Smith was awarded P 1,000,000 and

received full payment thereof. In Smiths 2005 financial statements issued February 2006, how should this

award be reported?

a. As a receivable and revenue of P 1,000,000.

b. As a disclosure of a contingent asset of P 1,000,000.

c. As a receivable and deferred revenue of P 1,000,000.

d. As a disclosure of a contingent asset of P 1,500,000.

THIRD SESSION

Page 3 of 14

Divine Word College of Legazpi

COLLEGE OF BUSINESS EDUCATION,

Legazpi City

PRACTICAL ACCOUNTING ONE

SEPTEMBER 25, 2005

25. During January 2005, Haze Company won a litigation award for 1,500,000 which was tripled to P 4,500,000

to include punitive damages. The defendant, who is financially stable, has appealed only the P 3,000,000

punitive damages. Haze was awarded P 5,000,000 in an unrelated suit it filed, which is being appealed by the

defendant. Counsel is unable to estimate the outcome of these appeals. In its 2005 financial statements,

Haze should report what amount of pretax gain?

a. 1,500,000

b. 9,500,000

c. 5,000,000

d. 4,500,000

BONDS PAYABLE

1. Glen Corporation had the following long-term debt:

Sinking fund bonds, maturing in installments

1,100,000

Industrial revenue bonds, maturing in installments

900,000

Subordinated bonds, maturing on a single date

1,500,000

The total of the serial bonds amounted to

a. 2,000,000

b. 1,500,000

c. 3,500,000

d. 2,400,000

2. Blue Corporations December 31, 2005, balance sheet contained the following items in the noncurrent

liabilities section:

9% registered debentures, callable in 2008,

due in 2011

3,500,000

11% collateral trust bonds, convertible into common

stock beginning in 2007, due in 2010

3,000,000

10% subordinated debentures (P 300,000 maturing

annually beginning in 2007)

1.500,000

What is the total amount of term bonds?

a. 5,000,000

b. 3,500,000

c. 3,000,0000

d. 6,500,000

3. Hancock Companys December 31, 2005, balance sheet contained the following items in the noncurrent

liabilities section:

Unsercured

9% registered bonds (P 250,000 maturing

annually beginning in 2007)

2,750,000

11% convertible bonds, callable beginning in 2007,

due 2010

1,250,000

Secured

12% guaranty security bonds, due 2009

2,500,000

10% commodity backed bonds (P 500,000 maturing

annually beginning in 2006)

2,000,000

What are the total amounts of serial bonds and debenture bonds?

a. Serial bonds - 4,500,000

;

Debenture bonds - 4,000,000

b. Serial bonds - 2,000,000

;

Debenture bonds - 6,500,000

c. Serial bonds - 4,750,000

;

Debenture bonds - 4,000,000

d. Serial bonds - 4,750,000

;

Debenture bonds - 1,250,000

4. On October 1, 2005, Share Company issued 5,000 of the P 1,000 face value 12% bonds at 110. The bonds

which mature on January 1, 2010, pay interest semiannually on January 1 and July 1. Shane paid bond issue

cost of P 200,000. How much cash was received from the issuance of the bonds on October 1?

a. 5,550,000

b. 5,650,000

c. 5,300,000

d. 5,450,000

5. During 2005 Cain Corporation incurred the following costs in connection with the issuance of bonds:

Printing and engraving

150,000

Legal fees

800,000

Fees paid to independent accountants for registration

information

100,000

Commissions paid to underwriter

900,000

What amount should be recorded as a deferred charge to be amortized over the term of the bonds?

a. 1,050,000

b. 1,950,000

c. 1,850,000

d. 1,000,000

6. On July 1, 2005, Carol Company issued at 104, five thousand of its 10%, P 1,000 bonds. The bonds were

issued through an underwriter to whom Carol paid bond issue cost of P 125,000. On July 1, 2005, Carol

should report the bond liability at

a. 5,325,000

b. 5,075,000

c. 4,875,000

d. 5,200,000

7. Dixon Company incurred costs of P 330,000 when it issued on August 31, 2005, 5-year debenture bonds

dated April 1, 2005. What amount of bond issue expense should Dixon report in its income statement for the

year ended December 31, 2005?

a. 49,500

b. 24,000

c. 330,000

d. 22,000

8. Boni Corporation issued P 5,000,000 face value, 12%, 10-year bonds on October 1, 2005, at 95. The bonds

are dated October 1, 2005 and pay semiannual interest on April 1 and October 1. What is the interest

expense to be reported for the year 2005?

a. 600,000

b. 625,000

c. 156,250

d. 150,000

THIRD SESSION

Page 4 of 14

Divine Word College of Legazpi

COLLEGE OF BUSINESS EDUCATION,

Legazpi City

PRACTICAL ACCOUNTING ONE

SEPTEMBER 25, 2005

9. Adora Company shows the following on December 31, 2005:

Bonds payable - 12% maturing

December 31, 2015

5,000,000

Premium on bonds payable

200,000

5,200,000

Bonds payable - 14% maturing

December 31, 2010

2,000,000

Discount on bonds payable

(100,000)

Bond issue cost

(30,000)

1,870,000

No bonds were retired during 2005. What is the interest expense for 2005?

a. 874,000

b. 880,000

c. 873,000

d. 886,000

10. On November 1, 2005, Mason Corporation issued P 4,000,000 of its 10-year, 8% term bonds dated October

1, 2005. The bonds were sold to yield 10% with total proceeds of P 3,500,000 plus accrued interest. Interest is

paid every April 1 and October 1. What should Mason report for interest payable in its December 31, 2005,

balance sheet?

a. 80,000

b. 87,500

c. 100,000

d. 53,333

11. On June 30, 2005, King Company had outstanding 9%, P 5,000,000 face value bonds maturing on June 30,

2010. Interest was payable semiannually every June 30 and December 31. On June 30, 2005,after

amortization was recorded for the period, the unamortized bond premium and bond issue cost were P 30,000

and P 50,000 respectively. On that date, King acquired all its outstanding bonds on the open market at 98 and

retired them. At June 30, 2005, what amount should King recognize as gain before income tax on redemption

of bonds?

a. 20,000

b. 120,000

c. 180,000

d. 80,000

12. On January 1, 2005, Harlet Company redeemed its 15-year bonds of P 5,000,000 par value for 102. The

bonds were originally issued on January 1, 1993 at 98 with a maturity date of January 1, 2008. The bond

issue cost relating to this transaction was P 200,000. Harlet amortizes discounts, premiums, and bond issue

costs using the straight line method. What amount of extraordinary loss should Harlet recognize on the

redemption of these bonds?

a. 160,000

b. 100,000

c. 0

d. 120,000

13. On February 1, 2002, Dax Company issued 12%, P 2,000,000 face amount, 10-year bonds for P 2,234,000

plus accrued interest. The bonds are dated November 1, 2001 and interest is payable on May 1 and

November 1. Dax reacquired all of these bonds at 102 on May 1, 2005, and retired them. Ignoring the income

tax effect, what was Daxs gain on the bond retirement?

a. 194,000

b. 116,000

c. 234,000

d. 236,000

14. On January 1, 2005, Ward Corporation issued its 9% bonds in face amount of P 4,000,000, which mature on

January 1, 2010. The bonds were issued for P 3,756,000 to yield 10%, resulting in bond discount of P

244,000. Ward uses the interest method of amortizing bond discount. Interest payable annually on December

31. At December 31, 2005, Wards unamortized bond discount should be

a. 206,440

b. 208,000

c. 204,000

d. 228,400

15. On January 1, 2005, Wolf Corporation issued its 10% bonds in the face amount of P 5,000,000, which mature

on January 1, 2010. The bonds were issued for P 5,675,000 to yield 8%, resulting in bond premium of P

675,000. Wolf uses the interest method on amortizing bond premium. Interest is payable annually on

December 31. At December 31, 2005, Wolfs adjusted unamortized bond premium should be

a. 675,000

b. 507,500

c. 629,000

d. 607,500

16. On January 2, 2005, West Company issued 9% bonds in teh amount of P 5,000,000, which mature on

January 2, 2015. The bonds were issued for P 4,695,000 to yield 10%. Interest is payable annually on

December 31. West uses the interest method of amortizing bond discount. In its June 30, 2005 balance sheet,

what amount should West report as bonds payable?

a. 4,695,000

b. 5,000,000

c. 4,710,250

d. 4,704,750

17. On December 31, 2005, Cey Company had outstanding 12% P 5,000,000 face amount convertible bonds

maturing on December 31, 2010. Interest is payable on June 30 and December 13. Each P 1,000 bond is

convertible into 50 shares of Ceys P 10 par common stock. On December 31, 2005, the unamortized balance

in the premium on bonds payable account was P 300,000. On December 31, 2005, 2,00 bonds were

converted when Ceys common stock had a market price of P 24 per share. Cey incurred P 20,000 in

connection with the conversion. Using the book value method, Ceys entry to record conversion should

include a credit to additional paid-in capital of

a. 1,380,000

b. 1,120,000

c. 1,100,000

d. 1,400,000

18. Spare Corporation had two issues of securities outstanding: common stock and a 12% convertible bond issue

in the face amount of P 10,000,000. Interest payment dates of the bond issue are June 30 and December 31.

The conversion clause in the bond indenture entitles the bondholders to receive 40 shares of P 20 par value

common stock in exchange for each P 1,000 bond. On June 30, 2005, the holder of P 5,000,000 face value

bonds exercised the conversion privilege. The market price of the bonds on that date was P 1,100 per bond

and the market price of the common stock was P 30. The total unamortized bond discount at the date of

conversion was P 500,000. How much additional paid-in capital should be recognized by reason of

conversion of bonds into common stock?

THIRD SESSION

Page 5 of 14

Divine Word College of Legazpi

COLLEGE OF BUSINESS EDUCATION,

Legazpi City

a. 800,000

1.

2.

3.

4.

5.

6.

7.

b.

c. 600,000

PRACTICAL ACCOUNTING ONE

SEPTEMBER 25, 2005

d. 750,000

LEASES

Kew Company leases and operates a retail store. The following information relates to the lease for the year

ended December 31, 2005:

a. The store lease, an operating lease, calls for a base monthly rent of P 15,000 on the first day of each

month.

b. Additional rent is computed at 6% of net sales over P 3,000,000 up to P 6,000,000 and 5% of net

sales over P 6,000,000, per calendar year.

c. Net sales for 2005 were P 9,000,000.

d. Kew paid executory costs to the lessor for property taxes of P 120,000 and insurance of P 50,000.

For 2005, Kews expenses relating to the store lease are

a. 680,000

b. 710,000

c. 540,000

d. 350,000

As an inducement to enter a lease, Arts Company, a lessor, grants Hompson Corporation, a lessee, nine

months of free rent under a five year operating lease. The lease is effective on July 1, 2005 and provides for

monthly rental of P 200,000 to begin April 1, 2006. In Hompsons income statement for the year ended June

30, 2006, rent expense should be reported as

a. 1,800,000

b. 600,000

c. 2,040,000

d. 510,000

Conn Corporation owns an office building and normally charges tenants P 3,000 per square meter per year for

office space. Because the occupancy rate is low, Conn agreed to lease 1,000 square meters to Hanson

Company at P 1,200 per square meter for the first year of a three-year operating lease. Rent for remaining

years will be at P 3,000 rate. Hanson moved into the building on January 1, 2005, and paid the first years rent

in advance. What amount of rental revenue should Conn report from Hanson in its income statement for the

year ended September 30, 2005?

a. 1,800,000

b. 2,400,000

c. 1,200,000

d. 900,000

On July 1, 2005, Gee Company leased a delivery truck from Marr Company under a 3-year operating lease.

Total rent for the term of the lease will be P 360,000, payable as follows:

12 months at P 5,000 =

P 60,000

12 months at P 7,500 =

90,000

12 months at P 17,500 =

210,000

All payments were made when due. In Marrs June 30, 2007, balance sheet, the accrued rent receivable

should be reported at

a. 210,000

b. 90,000

c. 120,000

d. 0

Rapp Company leased a new machine to Lake Company on January 1, 2005. The lease expires on January

1, 2010. The annual rental is P 900,000. Additionally, on January 1, 2005, Lake paid P 500,000 to Rapp as a

lease bonus and P 250,000 as a security deposit to be refunded upon expiration of the lease. In Rapps 2005

income statement, the amount of rental revenue should be

a. 1,000,000

b. 1,400,000

c. 1,250,000

d. 900,000

On January 1, 2005, Clay Company leased a new machine from Saxe Company. The following data relate to

the lease transaction at the inception of the lease:

Lease term

10 years

Annual rental payable at beginning of each lease year

500,000

Useful life of machine

15 years

Implicit interest rate

10%

Present value of annuity of 1 in advance for 10 periods at 10%

6.76

Present value of annuity of 1 in arrears for 10 periods at 10%

6.15

Fair value of the machine

4,000,000

The lease has no renewal option, and the possession of the machine reverts to Saxe when the lease

terminates. At the inception of the lease, Clay should record a lease liability of

a. 4,000,000

b. 0

c. 3,075,000

d. 3,380,000

On January 2, 2005, Ashe Company entered into a ten-year noncancelable lease requiring year-end

payments of P 100,000. Ashes incremental borrowing rate is 12%, while the lessors implicit interest rate,

known to Ashe, is 10%. Present value factors for an ordinary annuity for ten periods are 6.145 at 10%, and

5.650 at 12%. Ownership of the property remains with the lessor at expiration of the lease. There is no

bargain purchae option. The leased property has an estimated economic life of 12 years. What amount should

Ashe capitalize for this leased property on January 2, 2005?

a. 1,000,000

b. 614,500

c. 0

d. 565,000

THIRD SESSION

Page 6 of 14

Divine Word College of Legazpi

COLLEGE OF BUSINESS EDUCATION,

Legazpi City

PRACTICAL ACCOUNTING ONE

SEPTEMBER 25, 2005

8. On January 2, 2005, Nori Company entered into a 5-year lease for drilling equipment. Nori accounted for the

acquisition as a finance lease for P 2,400,000, which includes a P 100,000 bargain purchase option. At the

end of the lease, Nori expects to exercise the bargain purchase option. Nori estimates that the equipments

fair value will be P 200,000 at the end of its 8-year life. Nori regularly uses straight-line depreciation on similar

equipment. For the year ended December 31, 2005, what maount should Nori recognize as depreciation

expense on the leased asset?

a. 275,000

b. 300,000

c. 480,000

d. 460,000

Nun Company leased machinery from Chin Company on January 1, 2005, for a 10-year period (useful life of

the asset is 20 years). Equal annual payments under the lease are P 200,000 and are due on January 1 of

each year starting January 1, 2005. The present value at January 1, 2005 of the lease payments over the

lease term discounted at 10% was P 1,352,000. Nuns incremental borrowing rate was 12%. The lease is

appropriately accounted for as a finance lease by Nun because there is a very nominal bargain purchase

option.

9. What should be the liability under capital lease to be shown as noncurrent on the December 31, 2005?

a. 1,215,920

b. 1,067,200

c. 973,920

d. 1,090,240

10. What is the interest expense for the year 2005?

a. 200,000

b. 106,720

c. 0

d. 115,200

11. What is the depreciation for the year 2005?

a. 20,000

b. 115,200

c. 67,600

d. 135,200

12. On January 1, 2005, Blaugh Company signed a long-term lease for an office building. The terms of the lease

required Blaugh to pay P 100,000 annually, beginning December 30, 2005, and continuing each year for 30

years. The lease qualifies as a finance lease. On January 1, 2005, the present value of the lease payments is

P 1,125,000 at the 8% interest rate implicit in the lease. In Blaughs December 31, 2005, balance sheet, the

lease liability should be

a. 1,025,000

b. 1,125,000

c. 2,900,000

d. 1,115,000

13. On January 1, 2005, Vick Company as lessee signed a ten-year noncancellable lease for a machine

stipulating annual payments of P 200,000. The first payment was made on January 1, 2005. Vick

appropriately treated this transaction as a finance lease. The ten lease payments have a present value of P

1,350,000 at January 1, 2005, based on implicit interest of 10%. For the year ended December 31, 2005, Vick

should record interest expense of

a. 135,000

b. 0

c. 115,000

d. 65,000

Peg Company leased equipment from Howe Corporation on July 1, 2005 for an 8-year period. Equal

payments under the lease are P 600,000 and are due on July 1 of each year. The first payment was made on

July 1, 2005.

The interest rate contemplated by Peg and Howe is 10%. The cash selling price of the equipment is P

3,520,000, and the cost of the equipment on Howes accounting records is P 2,800,000. The lease is

appropriately recorded as a sales type lease.

14. What is the gain on sale of the equipment that Howe should recognize for 2005?

a. 720,000

b. 360,000

c. 45,000

d. 90,000

15. What is the interest revenue that Howe should recognize for 2005

a. 176,000

b. 352,000

c. 146,000

d. 292,000

16. Glade Company leases computer equipment to customers under direct financing leases. The equipment

has no residual value at the end of the lease and the leases do not contain bargain purchase options.

Glade wishes to earn 8% interest on a 5-year lease of equipment with a fair value of P 323,400. The

present value of an annuity due of 1 at 8% for 5 years is 4.312. What is the total amount of interest

revenue that Glade will earn over the life of the lease?

a. 75,000

b. 51,600

c. 129,360

d. 139,450

17. On January 1, 2005, Hook Company sold equipment with a carrying amount of P 1,000,000, and a

remaining useful life of 10 years, to Maco Drilling for P 1,500,000. Hook immediately leased the

equipment back under a 10-year finance lease with a present value of P 1,500,000 and will depreciate

the equipment using the straight-line method. Hook made the first annual lease payment of P 244,120 in

December 2005. In the December 31, 2005 balance sheet, the unearned gain on equipment sale should

be

a. 0

b. 255,880

c. 450,000

d. 500,000

18. On December 31, 2005, oyoboygwapo Company purchased a tractor from Cheliff Company.

Simultaneous with the sale, Cheliff leased back the tractor for 12 years for its use in the new farm that is

developing. The sales price of the tractor was P 7,800,000, while its carrying amount in the books of

Cheliff as of the date of the sale was P 5,850,000. Cheliffs engineers have estimated that the remaining

economic life of the tractor is 15 years. Cheliff is a wholly-owned subsidiary of a US company. What is

the amount that Cheliff should report as deferred gain from the sale of the tractor at December 31, 2005

in its reporting package for use in consolidation with the Head Office accounts?

a. 1,820,000

b. 1,787,500

c. 1,950,000

d. 0

THIRD SESSION

Page 7 of 14

Divine Word College of Legazpi

COLLEGE OF BUSINESS EDUCATION,

Legazpi City

PRACTICAL ACCOUNTING ONE

SEPTEMBER 25, 2005

19. On June 30, 2005, May ann Sud Company sold equipment with an estimated useful life of eleven years

and immediately leased it back for three years. The equipments carrying amount was P 450,000. The

sales price was P 430,000 and the fair value of the equipment was P 465,000. In its June 30, 2005

balance sheet, what amount should Lang report as deferred loss?

a. 15,000

b. 20,000

c. 35,000

d. 0

20. On December 31, 2005 Gwapoako Company sold XYZ Company an equipment with a remaining useful

life of 10 years. At the same time, Gwapoako leased back the equipment for 4 years. The leaseback is

an operating lease. Data relative to the sale and leaseback are:

Sales price

6,000,000

Fair value of equipment on the date of sale

5,000,000

Carrying amount of equipment

3,500,000

In Gwapoakos 2005 income statement, how much gain from the sale and leaseback should be

reported?

a. 1,000,000

b. 2,500,000

c. 1,500,000

d. 1,750,000

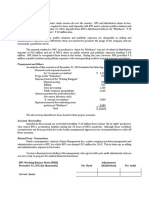

ACCOUNTING FOR INCOME TAX

1. Pat Company reported a pretax financial income of P 5,000,000 for the year ended December 31, 2005.

The following items are included in the determination of the financial income:

Estimated litigation loss which will become tax deductible

when settled in the future

300,000

Dividend received

100,000

Revenue from an installment sale which will be recognized

as taxable income as received over the next three years

600,000

Income tax rate

32%

Pat Company should report current tax expense for the year 2005 at

a. 1,472,000

b. 1,568,000

c. 1,664,000

d. 1,600,000

2. Mile Company, which began operations on January 1, 2005, recognizes income from long-term

construction contracts under the percentage of completion method in its financial statements and the

cost recovery method for income tax reporting. Income under each method follows:

Cost Recovery

Percentage of Completion

2005

600,000

2006

800,000

1,200,000

2007

1,400,000

1,700,000

2,200,000

3,500,000

The income tax rate is 32%. On December 31, 2007 balance sheet, Mike Company should report a

deferred tax liability of

a. 1,120,000

b. 416,000

c. 544,000

d. 704,000

3. Among the items reported on Cord Companys income statement for the year ended December 31, 2005

were:

Payment of penalty

50,000

Insurance premium on life of an officer with Cord

as beneficiary

100,000

Temporary differences amount to

a. 50,000

b. 100,000

c. 150,000

d. 0

4. MariaPalad Company leased a building and received P 400,000 annual rental payment on June 15,

2005. The beginning of the lease was July 1, 2005. Rental income is taxable when received. The income

tax rate is 32%. Mariapalad had no other permanent or temporary differences. Mariapalad determined

that no valuation is needed. What amount of deferred tax asset should Mariapalad report in its December

31, 2005 balance sheet?

a. 0

b. 64,000

c. 136,000

d. 128,000

5. On its December 31, 2005 balance sheet, Sheen Company had income tax payable of P 260,000 and a

current deferred tax asset of P 400,000 before determining the need for a valuation allowance. Sheen

had reported a current deferred tax asset of P 300,000 at December 31, 2004. No estimated tax

payments were made during 2005. At December 31, 2005, Sheen determined that it was more likely than

not that 10% of the deferred tax asset would not be realized. In its 2005 income statement, what amount

should Sheen report as total income tax expense?

a. 200,000

b. 260,000

c. 160,000

d. 170,000

THIRD SESSION

Page 8 of 14

Divine Word College of Legazpi

COLLEGE OF BUSINESS EDUCATION,

Legazpi City

PRACTICAL ACCOUNTING ONE

SEPTEMBER 25, 2005

6. On January 2, 2004, Midland Company purchased a machine for P 1,400,000. This machine has a 5year useful life, a residual value of P 200,000, and is depreciated using the straight-line method for

financial statement purposes. For tax purposes, depreciation expense was P 500,000 for 2004 and P

400,000 for 2005. Midlands 2005 income before tax and depreciation expense was P 2,000,000 and its

tax rate was 32%. If Midland has made no estimated tax payments during 2005, what amount of current

income tax liability would Midland report in its December 31, 2005 balance sheet?

a. 550,400

b. 640,000

c. 563,200

d. 512,000

7. Cascade Range Company is determining the amount of its pretax financial income for 2005 by making

adjustment to taxable income from the companys 2005 income tax return. The tax return indicates

taxable income of P 380,000, on which a tax liability of P 121,600 has been recognized (P 380,000 x

32% = P 121,600). Following is the list of items that may be required to determine pretax financial

income from the amount of taxable income:

a. Accelerated depreciation for income tax purposes was P 134,000; straight-line depreciation on

these assets is P 80,000.

b. Goodwill amortization of P 45,000 was not included as a deduction in the tax return, but may be

deducted in the income statement.

c. Several expenses were included in the income tax return on an estimated basis. These items will

be in the income statement at the same amount but are subject to change if new information in

the future indicates that the original estimates were inaccurate.

d. Interest on treasury bills was not included in the tax return. During the year, P 24,700 was

received on these investments.

Cascade Ranges pretax financial income amounts to

a. 413,700

b. 458,700

c. 389,000

d. 359,700

Zeff Company prepared the following reconciliation of its pretax financial statement income to taxable

income for the year ended December 31, 2005, its first year of operations:

Pretax financial income

1,600,000

Nontaxable interest received

(50,000)

Long-term loss accrual in excess of deductible amount

100,000

Depreciation in excess of financial depreciation

(250,000)

Taxable income

1,400,000

The company has a legal enforceable right offset a current tax asset against current tax liability.

8. Assuming the income tax is 32%, what amount should Zeff report as income tax expense - current

portion in its 2005 income statement?

a. 448,000

c. 416,000

b. 512,000

d. 496,000

9. In its December 31, 2005 balance sheet, what should Zeff report as deferred tax liability?

a. 0

b. 48,000

c. 32,000

d. 80,000

10. Caleb Company has three financial statement elements for which the December 31, 2005 book value is

different from the December 31, 2005 tax basis:

Book value

Tax basis Difference

Equipment

200,000

120,000

80,000

Prepaid officers

insurance policy

75,000

0

75,000

Warranty liability

50,000

0

50,000

As a result of these differences, future taxable amounts are

a. 155,000

b. 50,000

c. 80,000

d. 205,000

STOCKHOLDERS' EQUITY

1. The accounts below appear in the December 31, 2005 trial balance of Mara Company:

Authorized common stock

5,000,000

Unissued common stock

2,000,000

Subscribed common stock

1,000,000

Subscription receivable

400,000

Additional paid-in capital

500,000

Retained earnings unappropriated

600,000

Retained earnings appropriated

300,000

Revaluation surplus

200,000

Treasury stock, at cost

300,000

In its December 31, 2005 balance sheet, Mara should report total stockholders equity at

a. 5,200,000

b. 5,500,000

c. 4,900,000

d. 5,000,000

THIRD SESSION

Page 9 of 14

Divine Word College of Legazpi

COLLEGE OF BUSINESS EDUCATION,

Legazpi City

PRACTICAL ACCOUNTING ONE

SEPTEMBER 25, 2005

2. The stockholders equity section of Glee Company revealed the following information on December 31,

2005.

Preferred stock, P 100 par

2,300,000

Paid in capital in excess of par-preferred

805,000

Common stock, P 15 par

5,250,000

Paid-in capital in excess of par-common

2,750,000

Subscribed common stock

500,000

Retained earnings

1,900,000

Note Payable

4,000,000

Subscriptions receivable - common

400,000

How much is the legal capital?

a. 8,050,000

b. 7,650,000

c. 9,950,000

d. 11,605,000

3. Munn Corporations records included the following stockholders equity accounts:

Preferred stock, par value P15, authorized

200,000 shares

2,550,000

Additional paid-in-capital, preferred stock

150,000

Common stock, no par, P 50 stated value, 100,000

shares authorized

3,000,000

In Munns statement of stockholders equity, the number of issued and outstanding shares for each class

of stock is

a. Common stock - 60,000

;

Preferred stock - 170,000

b. Common stock - 60,000

;

Preferred stock - 180,000

c. Common stock - 63,000

;

Preferred stock - 170,000

d. Common stock - 63,000

;

Preferred stock - 180,000

4. Ashe Corporation was organized on January 1, 2005, with authorized capital of 100,000 shares of P 20

par value common stock. During 2005 Ashe had the following transactions affecting stockholders equity:

January 10

- Issued 25,000 shares at P 22 a share

March 25

- Issued 1,000 shares for legal services when the fair value was P 24 a

share.

September 30

- Issued 5,000 shares for a tract of land when the fair value was P 26 a

share

What amount should Ashe report for additional paid-in capital at December 31, 2005?

a. 84,000

c. 54,000

b. 80,000

d. 50,000

5. Nerve Company was organized on January 1, 2005. On that date it issued 200,000 shares at P 15 per

share (400,000 shares were authorized). During the period January 1, 2005, through December 31,

2006, Nerve reported net income of P 750,000 and paid cash dividends of P 380,000. On January 5,

2006, Nerve purchased 12,000 shares of its common stock at P 12 per share. On December 31, 2006,

8,000 treasury shares were sold at P 8 per share and retired the remaining 4,000 shares. What is the

total stockholders equity on December 31, 2006?

a. 3,290,000

b. 3,306,000

c. 3,338,000

d. 3,370,000

6. Presented below is the stockholders equity section of the Caper Corporation on January 1, 2005.

Common stock, par value P 20 authorized

50,000 shares; issued and outstanding

30,000 shares

600,000

Capital in excess of par value

150,000

Retained earnings

230,000

During 2005, the following transactions occurred relating to stockholders equity.

a. 1,000 shares were reacquired at P 28 per share.

b. 900 shares were reacquired at P 30 per share.

c. 1,500 shares of treasury were sold at P 32 per share.

For the year ended December 31, 2005, Caper reported net income of P 110,000. What should the

company report as total stockholders equity on the December 31, 2005 balance sheet?

a. 1,071,000

b. 1,078,000

c. 1,083,000

d. 973,000

7. On July 1, 2005, Alto Corporation declared a 1 for 5 reverse stock split, when the market value of stock

was P 100 per share. Prior to the split, Alto had 10,000 shares of P 10 par value common stock issued

and outstanding. After the split, the par value of the stock is

a. 10

b. 20

c. 50

d. 2

THIRD SESSION

Page 10 of 14

Divine Word College of Legazpi

COLLEGE OF BUSINESS EDUCATION,

Legazpi City

PRACTICAL ACCOUNTING ONE

SEPTEMBER 25, 2005

8. Beck Corporation issued 200,000 shares of common stock when it began operations in 2004 and issued

an additional 100,000 shares in 2005. Beck also issued preferred stock convertible to 100,000 shares of

common stock. In 2006, Beck purchased 75,000 shares of its common stock and held it in treasury. At

December 31, 2006, how many shares of Becks common stock were outstanding?

a. 400,000

b. 325,000

c. 300,000

d. 225,000

9. In 2005, Orlando Company issued for P105 per share, 8,000 shares of P 100 par value convertible

preferred stock. One share of preferred stock can be converted into three shares of Orlandos P 25 par

value common stock at the option of the shareholder.

In August 2006, all of the preferred stock was converted into common stock. The market value of the

common stock on the date of conversion was P30 per share. What amount should be credited to

additional paid-in-capital as a result of the issuance of the preferred stock and its subsequent conversion

into common stock?

a. 120,000

b. 240,000

c. 200,000

d. 80,000

10. On July 1, 2005, Vail Corporation issued rights to stockholders to subscribe to additional shares of its

common stock. One right was issued for each share owned. A stockholder could purchase one additional

share for 10 rights plus P 15 cash. The rights expired on September 30, 2005. On July 1, 2005, the

market price of a share with the right attached was P 40 while the market price of one right alone was P

2. Vails stockholders equity on June 30, 2005 comprised the following:

Common stock, P 25 par value, 40,000 shares

issued and outstanding

1,000,000

Additional paid-in-capital

600,000

Retained earnings

800,000

By what amount should Vails retained earnings decrease as a result of issuance of the stock rights on

July 1, 2005?

a. 0

b. 50,000

c. 80,000

d. 100,000

11. On May 1, Kreal Corporation issued P 1,000,000, 20-year, 10% bonds for P 1,320,000. Each P 1,000

bond had two detachable warrants eligible for the purchase of one share each of Kreals P 50 par value

common stock for P60. Immediately after the bonds were issued, Kreals securities had the following

market values:

10% bond without warrant

1,050

Warrant

25

Common stock, P 50 par value

65

What amount of the bond issue proceeds should Kreal record as an increase in stockholders equity?

a. 320,000

c. 50,000

b. 60,000

d. 10,000

12. On January 1, 2005, Pal Corporation granted stock options to key employees for the purchase of 40,000

shares of the companys common stock at P 25 per share. The options are intended to compensate

employees for the next two years. The options are exercisable within a four-year period beginning

January 1, 2007 by grantees still in the employ of the company. The market price of Pals common stock

was P 40 per share at the date of grant. The fair value of each stock option is P 20. No stock options

were terminated during the year. What amount should Pal charge to compensation expense for the year

ended December 31, 2005?

a. 600,000

b. 300,000

c. 800,000

d. 400,000

13. On January 2, 2005, Morey Corporation granted Dean, its president, 20,000 stock appreciation rights for

past services. Those rights are exercisable immediately and expire on January 1, 2008. On exercise,

Dean is entitled to receive cash for the excess of hte stocks market price on the exercise date over the

market price on the grant date. Dean did not exercise any of the rights during 2005. The market price of

Moreys stock was P 30 on January 2, 2005 and P 45 on December 31, 2005. As a result of the stock

appreciation rights, Morey should recognize compensation expense for 2005 of

a. 0

b. 100,000

c. 300,000

d. 600,000

14. Wolf Companys grant of 30,000 stock appreciation rights enables key employees to receive cash equal

to the difference between P 20 and the market price of the stock on the date each right is exercised. The

service period is 2005 through 2007, and the rights are exercisable in 2008 and 2009. The market price

of the stock was P 25 and P 28 on December 31, 2005 and 2006, respectively. What amount shoud Wolf

report as the liability under the stock appreciation rights plan in its December 31, 2006, balance sheet?

a. 0

b. 130,000

c. 160,000

d. 240,000

15. On January 1, 2005, XYZ Company offered its chief executive officer stock appreciation rights with the

following terms:

Predetermined price on Jan. 1, 2005

P 100 per share

THIRD SESSION

Page 11 of 14

Divine Word College of Legazpi

COLLEGE OF BUSINESS EDUCATION,

Legazpi City

16.

17.

18.

19.

20.

PRACTICAL ACCOUNTING ONE

SEPTEMBER 25, 2005

Number of shares

10,000 shares

Service period

3 years

Exercise date

Dec. 31, 2007

The stock appreciation rights are exercised on December 31, 2007. The quoted price of XYZ Company

stock is as follows:

January 1, 2005

100

December 31, 2005

118

December 31, 2006

112

December 31, 2007

124

What is the compensation expense that should be recognized for the year 2006?

a. 160,000

b. 60,000

c. 80,000

d. 20,000

The December 31, 2005 condensed balance sheet of Wurzburg Services, an individual proprietorship,

follows:

Current sales

280,000

Equipment (net)

260,000

540,000

Liabilities

140,000

Tony Wurzburg, Capital

400,000

540,000

Fair values at December 31, 2005 are as follows:

Current assets

320,000

Equipment

420,000

Liabilities

140,000

On January 2, 2006, Wurzburg Services was incorporated with 5,000 shares at P 20 par value common

stock issued. How much should be credited to additional paid-in capital?

a. 460,000

b. 640,000

c. 500,000

d 400,000

On March 1, 2005, Rita Corporation issued 10,000 shares of its P 20 par value common stock and 20,000

shares of its P 20 par value convertible preferred stock for a total P 800,000. At this date, the common stock

was selling for P 36 per share, and the convertible preferred stock was selling for P 27 per share. What

amount of the proceeds should be allocated to the convertible preferred stock?

a. 600,000

b. 540,000

c. 480,000

440,000

Pointe Company issued all of its outstanding common shares for P 390 in 2005. On January 5, 2006, Pointe

acquired 200,000 shares of its stock at P 360 per share and retired them. Pointes equity accounts as at

December 31, 2005 follow:

Retained earnings

75,000,000

Additional paid-in capital

162,000,000

Common stock, P 300 par value 2,000,000 shares

authorized 1,800,000 shares issued and outstanding

540,000,000

What shall be the balance in the additional paid-in capital account immediately after the retirement of the

shares?

a. 156,000,000

b. 150,000,000 c. 144,000,000

d. 168,000,000

Vicar Company was organized on January 1,2005 with 100,000 authorized shares of P 100 par value

common stock. On January 5, Vicar issued 75,000 shares at P 140 per share on December 27. Vicar

purchased 5,000 shares at P 110 per share. Vicar used the par value method to record the purchase of the

treasury shares. What would be the balance in the additional paid in capital from treasury stock account on

December 31, 2005?

a. 200,000

b. 150,000

c. 50,000

d. 0

On December 31, 2005, Cey Company had outstanding 10%, P 1,000,000 face amount convertible bonds

maturing on December 31, 2010. Interest is payable on June 30 and December 31. Each P 1,000 bond is

convertible into 50 shares of Ceys P 10 par common stock. On December 31, 2005, the unamortized balance

in the premium on bonds payable account was P 60,000. On December 31, 2005, 400 bonds were converted

when Ceys common stock had a market price of P 24 per share. Cey incurred P 4,000 in connection with the

conversion. Using the book value method, Ceys entry to record the conversion should include a credit to

additional paid in capital of

a. 176,000

b. 220,000

c. 276,000

d. 280,000

RETAINED EARNINGS

1. Cyan Corporation issued 20,000 shares of P 5 par common stock at P 10 per share. On December 31, 2004,

Cyan's retained earnings were P 300,000. In March 2005, Cyan reacquired 5,000 shares of its common stock

at P 20 per share. In June 2005, Cyan sold 1,000 of these shares to its corporate officers for P 25 per share.

Cyan uses the cost method to record treasury stock. Net income for the year ended December 31, 2005 was

P 60,000. At December 31, 2005, what amount should Cyan report as retained earnings?

THIRD SESSION

Page 12 of 14

Divine Word College of Legazpi

COLLEGE OF BUSINESS EDUCATION,

Legazpi City

PRACTICAL ACCOUNTING ONE

SEPTEMBER 25, 2005

a. 380,000

b. 375,000

c. 360,000

d. 365,000

2. East Corporation, a calendar year company, had sufficient retained earnings in 2005 as a basis for dividends

but was temporarily short of cash. East declared a dividend of P 100,000 on April 1, 2005 and issued

promissory notes to its stockholders in lieu of cash. The notes, which were date April 1, 2005, had a maturity

date of March 31, 2006 and a 10% interest rate. How should East account for the scrip dividend and related

interest?

a. Debit retained earnings for P 110,000 on April 1, 2005.

b. Debit retained earnings for P 100,000 on April 1, 2005 and debit interest expense for

P 10,000 on March 31, 2006.

c. Debit retained earnings for P 110,000 on March 31, 2006.

d. Debit retained earnings for P 100,000 on April 1, 2005 and debit interest expense for

P 7,500 on December 31, 2005.

3. In 2004, Elm Company bought 10,000 shares of Oil Corporation at a cost of P 200,000. On January 15, 2005,

Elm declared a property dividend of the Oil stock to shareholders of record on February 1, 2005, payable on

February 15, 2005. During 2005, the Oil stock had the following market value:

January 15

250,000

February 1

260,000

February 15

240,000

The net effect of the foregoing transactions on retained earnings during 2005 should be reduction of

a. 250,000

b. 240,000

c. 260,000

d. 200,000

4. Franta Corporation was authorized to issue 100,000 shares of P 50 par value stock on January 1, 2005.

Eighty thousand shares were sold during the first year at P 50 per share and 4,000 shares were later

reacquired as treasury at P 65 per share. A stock split of 5 for 1 was approved on December 31, 2005. On

January 31, 2006, a 10% stock dividend was paid and on March 1, 2006, the treasury stock was reissued at P

68 per share. The number of shares issued and outstanding on March 1, 2006 is

a. 418,000

b. 440,000

c. 422,000

d. 438,000

5. On May 18, 2005, Sol Corporation's board of directors declared a 10% stock dividend. The market price of

Sol's 30,000 outstanding shares of P 20 par value common stock was P 90 per share on that date. The stock

dividend was distributed on July 21, 2006, when the stock's market price was P 100 per share. What amount

should Sol credit to additional paid in capital for this stock dividend?

a. 210,000

b. 240,000

c. 300,000

d. 270,000

6. On September 30, 2005, Grey Company issued 4,000 shares of its P 100 par common stock in connection

with a stock dividend. The market value per share on the date of declaration was P 150. Grey's stockholder's

equity accounts immediately before issuance of the stock dividend shares were as follows:

Common stock, P 100 par, 50,000 shares authorized

20,000 shares outstanding

2,000,000

Additional paid in capital

3,000,000

Retained earnings

1,500,000

What should be the retained earnings balance immediately after the stock dividend?

a. 1,500,000

b. 1,100,000

c. 900,000

d. 2,100,000

7. On June 30, 2005, when the company's stock was selling at P 40 per share, its capital accounts were as

follows:

Common stock, par P 25, authorized 150,000 shares,

55,000 shares issued of which 5,000 shares

are in treasury

1,375,000

Retained earnings

2,000,000

Treasury stock, at cost

150,000

If a 100% stock dividend were declared and that all the treasury shares were issued as stock dividends and

the balance from the unissued shares, how much retained earnings should be capitalized?

a. 1,125,000

b. 1,275,000

c. 1,800,000

d. 1,250,000

8. At December 31, 2005, Eagle Corporation reported P 1,750,000 of appropriated retained earnings for the

construction of a new office building, which was completed in 2006 at a total cost of P 1,500,000. In 2006,

Eagle appropriated P 1,200,000 of retained earnings for the construction of a new plant. Also, P 2,000,000 of

cash was restricted for the retirement of bonds due in 2007. In its December 31, 2006 balance sheet, Eagle

should report what amount of appropriated retained earnings?

a. 3,200,000

b. 1,450,000

c. 2,950,000

d. 1,200,000

THIRD SESSION

Page 13 of 14

Divine Word College of Legazpi

COLLEGE OF BUSINESS EDUCATION,

Legazpi City

PRACTICAL ACCOUNTING ONE

SEPTEMBER 25, 2005

9. At January 1, 2005, Rama Corporation had 20,000 shares of P1 par value treasury stock that had been

acquired in 20004 at P 12 per share. In May 2005, Rama issued 15,000 of these treasury shares at P 10 per

share. The cost method is used to record treasury stock transactions. At December 31, 2005, what amount

should Rama show in notes to financial statements as a restriction of retained earnings as a result of its

treasury stock transactions?

a. 10,000

b. 5,000

c. 90,000

d. 60,000

10. The stockholder's equity section of Brown Company's December 31, 2005 balance sheet consisted the

following:

Common stock, P 30 par, 100,000 shares

authorized and outstanding

3,000,000

Additional paid in capital

1,500,000

Retained earnings (deficit)

(2,100,000)

On January 2, 2006, Brown put into effect a stockholder-approved quasi - reorganization by reducing the par

value of the stock to P 5 and eliminating the deficit against additional paid in capital. Immediately after quasi reorganization, what amount should Brown report as additional paid-in capital?

a. 4,000,000

b. 1,900,000

c. 600,000

d. 1,500,000

Jade Company showed the following stockholders' equity on January 1, 2005:

Common stock:

Authorized - 3,000 shares

Issued 1,500,000 shares

1,500,000

Additional paid in capital

15,000,000

Retained earnings

8,100,000

Treasury stock, 100,000 shares at cost

( 900,000)

Stockholders' equity

23,700,000

All of the outstanding common stock and treasury stock were originally issued in 2002 for P 11 per share. The

treasury stock is common stock reacquired on March 31, 2002. During 2005 the following events or

transactions occurred relating to stockholders' equity:

a. February 12 - Issued 4,000 shares of unissued common stock for P 12.50 per share.

b. June 15 - Declared cash dividend of P 0.20 per share to stockholders of record on April 1 and payable on

April 15. This was the first dividend ever declared.

c. September 20 - The president retired. Jade purchased from the retiring president 100,000 shars of

common stock for 13.00 per share which was equal to market value on this date. This stock was

canceled.

d. December 15 - Declared a cash dividend of P 0.20 per share to stockholders of record on January 2,

2006, and payable on January 15, 2006.

e. At December 31, Jade is being sued by two separate parties for patent infringement. The management

and outside legal counsel share the following opinion regarding these suits:

Suit

Likelihood of losing the suity

Estimated Loss

#1

Reasonably possible

600,000

#2

Probable

400,000

11. The issuance of 400,000 shares of common stock on February 12, caused additional paid-in capital to

increase by

a. 400,000

b. 4,000,000

c. 4,600,000

d. 5,000,000

12. The retirement of 100,000 shares of common stock on September 20, caused additional paid-in capital to

decrease by

a. 100,000

b. 1,000,000

c. 1,200,000

d. 1,300,000

13. Jade Wants to appropriate retained earnings for all loss contingencies, that are not properly accruable by a

charge to expense. How much of loss contingencies should be appropriated by a charge to unappropriated

retained earrings?

a. 1,000,000

b. 500,000

c. 400,000

d. 600,000

14. How much cash dividends should be charged against unappropriated retained earnings in 2005?

a. 340,000

b. 680,000

c. 700,000

d. 360,000

15. How much should be shown in the notes to financial statements as restriction on retained earnings because

of acquisition of treasury stock?

a. 1,300,000

b. 900,000

c. 200,000

d. 1,200,000

THIRD SESSION

Page 14 of 14

Você também pode gostar

- FormulaDocumento10 páginasFormulaAngel Alejo Acoba100% (1)

- ALL SubjectsDocumento11 páginasALL SubjectsMJ YaconAinda não há avaliações

- National Mock Board Examination 2017 Financial Accounting and ReportingDocumento9 páginasNational Mock Board Examination 2017 Financial Accounting and ReportingSam0% (1)

- Current Liabilities GuideDocumento3 páginasCurrent Liabilities GuideKim Cristian MaañoAinda não há avaliações

- Acct. 162 - EPS, BVPS, DividendsDocumento5 páginasAcct. 162 - EPS, BVPS, DividendsAngelli LamiqueAinda não há avaliações

- Assignment Ppfrs 16Documento3 páginasAssignment Ppfrs 16Joseph DoctoAinda não há avaliações

- Impairment of Asset: Cash Generating UnitDocumento28 páginasImpairment of Asset: Cash Generating UnitLumongtadJoanMaeAinda não há avaliações

- Acctg13 PPE ProblemsDocumento4 páginasAcctg13 PPE ProblemsKristel Keith NievaAinda não há avaliações

- FAR - RQ - Investment in AssociatesDocumento2 páginasFAR - RQ - Investment in AssociatesKriane Kei50% (2)

- QuizDocumento32 páginasQuizEloisaAinda não há avaliações

- AUDProb TEST BANKDocumento28 páginasAUDProb TEST BANKFrancine HollerAinda não há avaliações

- FAR 19MC Provisions Contingent Liabilities and Contingent Assetse 1Documento4 páginasFAR 19MC Provisions Contingent Liabilities and Contingent Assetse 1admiral spongebob100% (1)

- Additional Problems DepnRevaluation and ImpairmentDocumento2 páginasAdditional Problems DepnRevaluation and Impairmentfinn heartAinda não há avaliações

- Notes and Loans ReceivableDocumento10 páginasNotes and Loans ReceivableKent TumulakAinda não há avaliações

- Diagnostic Exam 1 23 AKDocumento11 páginasDiagnostic Exam 1 23 AKAbegail Kaye BiadoAinda não há avaliações

- Ac3a Qe Oct2014 (TQ)Documento15 páginasAc3a Qe Oct2014 (TQ)Julrick Cubio EgbusAinda não há avaliações

- Lecture Notes On Quasi-ReorganizationDocumento2 páginasLecture Notes On Quasi-ReorganizationalyssaAinda não há avaliações

- Depreciation, Asset Costs, Capitalization SEODocumento7 páginasDepreciation, Asset Costs, Capitalization SEOLara Lewis Achilles50% (2)

- Multiple Choice: Choose The Best Answer Among The Choices. Write Your Answers in CAPITAL Letters. (2 Points Per Requirement)Documento3 páginasMultiple Choice: Choose The Best Answer Among The Choices. Write Your Answers in CAPITAL Letters. (2 Points Per Requirement)Kimmy ShawwyAinda não há avaliações

- D15Documento12 páginasD15neo14Ainda não há avaliações

- Calculating Investment Income from AssociatesDocumento2 páginasCalculating Investment Income from Associatesmiss independent100% (1)

- K12 Philippines Whereabouts PDFDocumento37 páginasK12 Philippines Whereabouts PDFsichhahaAinda não há avaliações

- Test BankDocumento136 páginasTest BankLouise100% (1)

- Finals Answer KeyDocumento11 páginasFinals Answer Keymarx marolinaAinda não há avaliações

- I-Theories: Intangibles & Other AssetsDocumento19 páginasI-Theories: Intangibles & Other Assetsaccounting filesAinda não há avaliações

- Fa2prob3 1Documento3 páginasFa2prob3 1jayAinda não há avaliações

- Compound Financial Instrument LmsDocumento28 páginasCompound Financial Instrument LmsRosethel Grace Gallardo100% (1)

- Current LiabilitiesDocumento9 páginasCurrent LiabilitiesErine ContranoAinda não há avaliações

- Lanzuela, Hanzel Lapiz, Sharlene May Lee, Mei Yin Lopez, Benhur Macarembang, Hanan Cpar ObligationsDocumento22 páginasLanzuela, Hanzel Lapiz, Sharlene May Lee, Mei Yin Lopez, Benhur Macarembang, Hanan Cpar ObligationsFeizhen MaeAinda não há avaliações

- Exercises - LiabilitiesDocumento2 páginasExercises - LiabilitiesMac Ferds0% (1)

- Quiz in AE 09 (Current Liabilities)Documento2 páginasQuiz in AE 09 (Current Liabilities)Arlene Dacpano0% (1)

- Since 1977 Bonds Payable SolutionsDocumento3 páginasSince 1977 Bonds Payable SolutionsNah HamzaAinda não há avaliações

- Financial Accounting ExamDocumento12 páginasFinancial Accounting Examjano_art21Ainda não há avaliações

- Cost Behavior AnalysisDocumento18 páginasCost Behavior AnalysiskathleenAinda não há avaliações

- Homework on investment property analysisDocumento2 páginasHomework on investment property analysisCharles TuazonAinda não há avaliações

- Far Eastern University - Makati: Discussion ProblemsDocumento2 páginasFar Eastern University - Makati: Discussion ProblemsMarielle SidayonAinda não há avaliações

- 62230126Documento20 páginas62230126ROMULO CUBIDAinda não há avaliações

- Intermediate Accounting Exam 2 ReviewDocumento1 páginaIntermediate Accounting Exam 2 ReviewBLACKPINKLisaRoseJisooJennieAinda não há avaliações

- On January 1Documento3 páginasOn January 1Jude Santos0% (1)

- Cel 1 Prac 1 Answer KeyDocumento15 páginasCel 1 Prac 1 Answer KeyNJ MondigoAinda não há avaliações

- Accounting for Employee Benefits, Leases and Other LiabilitiesDocumento3 páginasAccounting for Employee Benefits, Leases and Other LiabilitiesmarygraceomacAinda não há avaliações

- Compound Financial Instruments and Note PayableDocumento4 páginasCompound Financial Instruments and Note PayablePaula Rodalyn MateoAinda não há avaliações

- Liabilities BSA 5-2sDocumento7 páginasLiabilities BSA 5-2sJustine GuilingAinda não há avaliações

- Current Liabilities - QuizDocumento4 páginasCurrent Liabilities - QuizArvin PaculanangAinda não há avaliações

- Liabs 2Documento3 páginasLiabs 2Iohc NedmiAinda não há avaliações

- ToaDocumento5 páginasToaGelyn CruzAinda não há avaliações

- Conceptual FrameworkDocumento9 páginasConceptual FrameworkAveryl Lei Sta.Ana0% (1)

- Auditing ProblemsDocumento4 páginasAuditing ProblemsCristineJoyceMalubayIIAinda não há avaliações

- Orang Co. perpetual inventory system calculationsDocumento3 páginasOrang Co. perpetual inventory system calculationsJobelle Candace Flores AbreraAinda não há avaliações

- What A ProblemDocumento4 páginasWhat A ProblemEleazar SalazarAinda não há avaliações

- Auditing Problems Problem 1Documento8 páginasAuditing Problems Problem 1Gherome AlejoAinda não há avaliações

- LeasesDocumento9 páginasLeasesCris Joy BiabasAinda não há avaliações

- Assignment 3Documento4 páginasAssignment 3Anna Mae NebresAinda não há avaliações

- Loans and Receivables - Long TermDocumento3 páginasLoans and Receivables - Long TermAleezaAngelaSanchezNarvadezAinda não há avaliações

- FAR 2841 - Equity-summary-DIYDocumento4 páginasFAR 2841 - Equity-summary-DIYEira Shane100% (1)

- Pract 1 - Exam2Documento2 páginasPract 1 - Exam2Sharmaine Rivera MiguelAinda não há avaliações

- Auditing Problems AP 007 to 010 SolutionsDocumento6 páginasAuditing Problems AP 007 to 010 SolutionsSerena Van der WoodsenAinda não há avaliações

- All Subj - Mock Board Exam BBDocumento9 páginasAll Subj - Mock Board Exam BBMJ YaconAinda não há avaliações

- Audit of liabilities quiz problemsDocumento4 páginasAudit of liabilities quiz problemsEarl Donne Cruz100% (4)

- 21 - Intangible AssetsDocumento6 páginas21 - Intangible AssetsralphalonzoAinda não há avaliações

- ACCOUNTING THEORY AND PROCESSDocumento39 páginasACCOUNTING THEORY AND PROCESSLouie de la TorreAinda não há avaliações

- Auditing Theory-100 Questions - 2015Documento20 páginasAuditing Theory-100 Questions - 2015yukiro rinevaAinda não há avaliações

- Irregular Verbs List: V1 Base Form V2 Past Simple V3 Past ParticipleDocumento4 páginasIrregular Verbs List: V1 Base Form V2 Past Simple V3 Past Participleyukiro rinevaAinda não há avaliações

- Section C: MALICIOUS and DESTRUCTIVE Programs: VirusDocumento1 páginaSection C: MALICIOUS and DESTRUCTIVE Programs: Virusyukiro rinevaAinda não há avaliações

- Enuma ElisashDocumento23 páginasEnuma Elisashyukiro rinevaAinda não há avaliações

- Lit 2 PrepDocumento10 páginasLit 2 Prepyukiro rinevaAinda não há avaliações

- CIS ProjectDocumento1 páginaCIS Projectyukiro rinevaAinda não há avaliações

- PC Based Fa CtsDocumento24 páginasPC Based Fa Ctsyukiro rinevaAinda não há avaliações

- Jonathan BDocumento1 páginaJonathan Byukiro rinevaAinda não há avaliações

- Lit 2 PrepDocumento10 páginasLit 2 Prepyukiro rinevaAinda não há avaliações

- AutomotiveDocumento1 páginaAutomotiveyukiro rinevaAinda não há avaliações

- Auditing Theory SyllabusDocumento7 páginasAuditing Theory Syllabusrajahmati_28Ainda não há avaliações

- Auditing Theory SyllabusDocumento7 páginasAuditing Theory Syllabusrajahmati_28Ainda não há avaliações

- Written By: Unknown: Yardsticks To Value Stocks in Different SectorsDocumento5 páginasWritten By: Unknown: Yardsticks To Value Stocks in Different SectorsKrs_Rs_4407Ainda não há avaliações

- Chapter 10-Investments in Noncurrent Operating Assets-AcquisitionDocumento34 páginasChapter 10-Investments in Noncurrent Operating Assets-AcquisitionYukiAinda não há avaliações

- Accounting Formulas and ConceptsDocumento10 páginasAccounting Formulas and ConceptsDilip KumarAinda não há avaliações

- Prelio SDocumento55 páginasPrelio Sjohnface12Ainda não há avaliações

- Corporate Finance LectureDocumento124 páginasCorporate Finance LectureMuhammad Kashif ZafarAinda não há avaliações

- Principles of Acc. II Lecture NoteDocumento54 páginasPrinciples of Acc. II Lecture NoteJemal Musa83% (6)

- Equities and Tobin's QDocumento18 páginasEquities and Tobin's Qapi-26324170Ainda não há avaliações

- Chapter 16Documento14 páginasChapter 16Basmah727100% (1)

- ACC1701 Mock Exam With SolutionDocumento13 páginasACC1701 Mock Exam With SolutionMingkang SweeAinda não há avaliações

- Covid 19 Proof Multibagger StocksDocumento20 páginasCovid 19 Proof Multibagger StocksKarambir Singh DhayalAinda não há avaliações

- P2 Workbook Q PDFDocumento91 páginasP2 Workbook Q PDFShelley ThompsonAinda não há avaliações

- Revision ExercisesDocumento2 páginasRevision ExercisesMimidou ZeenAinda não há avaliações

- Audit Quality and The Value Relevance of Fair ValuesDocumento32 páginasAudit Quality and The Value Relevance of Fair ValuesranamuhammadazeemAinda não há avaliações

- FIN 310 - Chapter 2 Questions - AnswersDocumento7 páginasFIN 310 - Chapter 2 Questions - AnswersKelby BahrAinda não há avaliações

- Edvinsson, L. - 1997 - Developing Intellectual Capital at Skandia PDFDocumento10 páginasEdvinsson, L. - 1997 - Developing Intellectual Capital at Skandia PDFreg_kata123Ainda não há avaliações

- Study of Cash Management at ICICI BankDocumento84 páginasStudy of Cash Management at ICICI BankRini Nigam100% (1)

- Ca Final SFM Test Paper QuestionDocumento8 páginasCa Final SFM Test Paper Question1620tanyaAinda não há avaliações

- Unit 6: Ind As 28: Investments in Associates and Joint VenturesDocumento29 páginasUnit 6: Ind As 28: Investments in Associates and Joint Venturesvandv printsAinda não há avaliações

- Valuation Chapter 4 FinManDocumento40 páginasValuation Chapter 4 FinManSteven Kyle PeregrinoAinda não há avaliações

- Project Proposal For The Construction of Fuel Station ServiceDocumento32 páginasProject Proposal For The Construction of Fuel Station ServiceRedwan58% (12)

- Swedish Match CaseDocumento6 páginasSwedish Match Casezach12345100% (8)

- HBL Financial AnalysisDocumento27 páginasHBL Financial AnalysisRabab Ali0% (1)