Escolar Documentos

Profissional Documentos

Cultura Documentos

Notes Inclass 5

Enviado por

Benjamin Neldner0 notas0% acharam este documento útil (0 voto)

11 visualizações4 páginasFInance

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoFInance

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

11 visualizações4 páginasNotes Inclass 5

Enviado por

Benjamin NeldnerFInance

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 4

Notes inclass 19/02

TEST module 1-2

Week 4 important worth 40%

Look at the questions for revision

Look at other chapter resources for financial institutions

Intro

-An authorized deposit-taking institution (ADI) is an entity approved by the APRA

Australian preduential regulation authority to collect deposits

-A bank is an adi approved by apra to use the term bank in its trading name

Banks make up significant component of ADIs

The business of banking

-heart of banking = accepting deposits and making loans. Also todays banks run

the payments system and trade securities.

-seek to provide a full range of financial services one-stop shop

-retail banking: small transactions, household sector

-wholesale banking: large transactions, comporate sector

Payments system

Banks playu a dominant role by facilitating:

-currency issuance

-cheque deposits and clearing

-credit and debit cards

-electronic payments

-international payments

Balance sheet management

-liquidity transformation: banks offer variety of deposits products (more towards

liquid deposits) but provide long-term loans- comfortable

-This exposes them to a balance-sheet liquidity mismatch in their sources and

uses of funds

-in normal circumstances this is not a problem because net deposit withdrawals

(at any one time) are relatively small (retail in nature)

Asset- Liability management

-asset-liability management (ALM) by a bank involves changing the structure of

its balance sheet to sustain its business

-purposes include: to ensure sufficient liquidity is on hand, to offload unwanted

assets, to protect against interest rate exposure

-deregulation has improved alm flexibility via introduction of new financial

products and financial engineering (securitisation) (superannuation fundsregular income stream low risk) (higher credit ranking less risk) decreasing the

yield the pv will be higher

Lending

-a core business function of banks.

-mortgages (home/investment) are a major part of their portfolio, and since

deregulation banks have introduced wider (e.g. fixed rate mortgages, home

equity loans).

-loans to business include overdrafts, bill lines, leasing, trade finance or term

loans may be secured or unsecured. (reflect the relevant risk exposure)

Interes rate margins (IRM)

Defined as the gap between the average rate received on a banks assets and the

average rate paid on its liabilities

IRM= IR/TA) IP

IR= interest received

IP= Interest paid

TA= Total assets

Fisher effect- inflation,

Real rate of return

IRM

-What determines the size of the IRM?

- capital adequacy and reserve requirements- regulatory/internal risk

management systems

-the marginal cost of the product- administration; establish/set-up monitor/

discharge

-elasticity of demand- sensitivity to interest rates, margins decrease with

increased competition (how much can u rip of customer)

-One approach to setting the IRM is user pays pricing is set so that each

consumer pays the full cost of their particular product.

-another approach is cross subsidy pricing where some consumer are undercharged and the bank recovers the subsidy by over-charging others

Off-Balance- Sheet activities (OBS)

-definition: activities that earn income (and involve risk) but do not create an

explicit asset or liability on balance sheet

-also known as contingent or implicit liabilities

-Banks can create contingent claims on themselves as well as others (overdraft

facilities, standby letters of credit) contingent- may or may not occur ( car

insurance)

-three categories of OBS activity:

1. fee-based services: corporate advice, underwriting, securitisation, managing

loan syndications

2. Financial services: funds management, stockbroking, travel

3. market trading: taking a poist CFD

Bank business stradegies

-one strategyZ: Citicorp involves a one stop shop financial supermarket . they

seek to profit from economies of scale (falling unit costs as size increases) and

scope (cost efficiencies arising from joint-production)

-another strategy: the BT approach is to specialize in specific niche areas such as

funds management (bt) or retail banking (st George)

Australian Banks

-the four pillars policy says it is desirable to retain four major banks to enhance

competition. This means maergers amongst the four majors are not allowed.

Other financial conglomerates remain possible, subject to ACCC approval: for

example, a major bank and an insurance giant, a takeover by a foreign bank, or a

major bank buying a smaller local bank.

Offshore activities of banks

-following deregulation, Australian banks pushed into offshore markets. This was

mainly done by:

-following an existing client base into global markets;

-competing in foreign markets at the retail level by acquiring existing branch

networks or setting up new ones; or providing speciaklized

Bank regulation

-the general regulatiuon of banks is based around both liquidity and capital

adequacy requirement s: liquidity requirements recognize the importance of

these insitiutions and maintain sufficient liquidity

Banking regulation

-capital adequacy requirements recognize the business of banking to transform

and multiply financial products and their wider impact on the general confidence

Liquidty requirements

- Apra via the preduential standard

Basel accord 1 11 111

Purpose to maintain sufficient liquidity to protect depositors in wind-up and

maintain market confidence in the banking system

Teir 1- tier 2 casnnot exceed

Basel 11 accord

-minimum capital requirement (to make capital more sensitive to risk)

-supervisory review process to ensure sound internal management processes are

in place), and

-market discipline (through increased disclosure)

Credit risk capita

-loss from borrower default

-capital requirements assessed on a risk weighted basis

-often risk assessed via internal/external credit rating

Operational risk capital

-risk of loss from inadequate/failed;- internal processes, people, systems or

external events

-capital requirements generally based on some fraction of banks gross income

Value at Riswk (VaR)/ market risk capital

-assess magnitude of losses from movements in market for value of exposure

(interest rates, exchange rates, commodity prices)

-may be adjusted by weighting for credit risk component

Você também pode gostar

- Grubfinder: PrrroDocumento5 páginasGrubfinder: PrrroBenjamin NeldnerAinda não há avaliações

- Arranged by Wheelhouse Transcribed by Matthew Stringer Song by Irving BerlinDocumento1 páginaArranged by Wheelhouse Transcribed by Matthew Stringer Song by Irving BerlinBenjamin NeldnerAinda não há avaliações

- Tall VowelsDocumento3 páginasTall VowelsBenjamin NeldnerAinda não há avaliações

- Bens Japanese Travel PlansDocumento15 páginasBens Japanese Travel PlansBenjamin NeldnerAinda não há avaliações

- Bens Japanese Travel PlansDocumento2 páginasBens Japanese Travel PlansBenjamin NeldnerAinda não há avaliações

- Hello!: NotesDocumento3 páginasHello!: NotesBenjamin NeldnerAinda não há avaliações

- 3/02 Can Have Hybrid Between Replaceable Rules and or Constitution How Its Different From A Common Law Contract Don't Have ConcensusDocumento1 página3/02 Can Have Hybrid Between Replaceable Rules and or Constitution How Its Different From A Common Law Contract Don't Have ConcensusBenjamin NeldnerAinda não há avaliações

- 480 12 Tone TechniqueDocumento4 páginas480 12 Tone TechniqueBenjamin NeldnerAinda não há avaliações

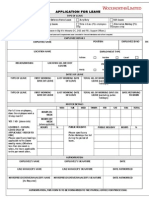

- Application For Leave: (PEL Employees Only) PEL Employees Only)Documento1 páginaApplication For Leave: (PEL Employees Only) PEL Employees Only)Benjamin NeldnerAinda não há avaliações

- Imogen HeapDocumento11 páginasImogen HeapBenjamin NeldnerAinda não há avaliações

- MeloDocumento1 páginaMeloBenjamin NeldnerAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Instructional Module: Republic of The Philippines Nueva Vizcaya State University Bayombong, Nueva VizcayaDocumento29 páginasInstructional Module: Republic of The Philippines Nueva Vizcaya State University Bayombong, Nueva VizcayaAISLINEAinda não há avaliações

- Laporan Transaksi: No. Rekening Nama Produk Mata Uang Nomor CIFDocumento2 páginasLaporan Transaksi: No. Rekening Nama Produk Mata Uang Nomor CIFDwiAinda não há avaliações

- Tutorial Chapter 3Documento3 páginasTutorial Chapter 3ASMA HANANI BINTI ANUARAinda não há avaliações

- US Credit Cards - McKinsey & CompanyDocumento9 páginasUS Credit Cards - McKinsey & Companystevtan01Ainda não há avaliações

- Cash Audit ProgramDocumento7 páginasCash Audit Program구니타67% (3)

- Marketing Activities of Products and Services of The City Bank LimitedDocumento61 páginasMarketing Activities of Products and Services of The City Bank LimitedZiaul Onim0% (1)

- BillSTMT 4588260003735455Documento2 páginasBillSTMT 4588260003735455Safwan SadiqAinda não há avaliações

- PFG Credit Card Design Solution-Part 2 Gaurav ChaturvediDocumento4 páginasPFG Credit Card Design Solution-Part 2 Gaurav Chaturvedikkiiidd0% (1)

- BIDC Registration Form 2011 p1Documento1 páginaBIDC Registration Form 2011 p1andre_duvenhageAinda não há avaliações

- BITS HD-2013 Print Challan Form .Documento1 páginaBITS HD-2013 Print Challan Form .Naveen Kumar SinhaAinda não há avaliações

- Pdic Frequently Ask QuestionsDocumento3 páginasPdic Frequently Ask QuestionsColleen Rose GuanteroAinda não há avaliações

- Hetzner 2021-06-22 R0013604788Documento2 páginasHetzner 2021-06-22 R0013604788Vitaliy PodobaAinda não há avaliações

- Monetary and Financial SystemDocumento9 páginasMonetary and Financial SystemChristopher MungutiAinda não há avaliações

- 1 Cash and Cash EquivalentsDocumento6 páginas1 Cash and Cash Equivalentsanon_752939353100% (1)

- Bank TablesDocumento8 páginasBank TablesAndrea Alejandra Cruz OrtizAinda não há avaliações

- Debtor'S Culture, Psychology, Practices and Idiosyncracies Filipino Traditional Practices Related With Credit and CollectionDocumento6 páginasDebtor'S Culture, Psychology, Practices and Idiosyncracies Filipino Traditional Practices Related With Credit and CollectionRoseanne Binayao Lontian100% (2)

- Exim Bank PDFDocumento2 páginasExim Bank PDFIngaAinda não há avaliações

- Third Space Learning Compound Interest GCSE Worksheet 1Documento12 páginasThird Space Learning Compound Interest GCSE Worksheet 1erin zietsmanAinda não há avaliações

- Banking Theory Law and PracticeDocumento29 páginasBanking Theory Law and Practicereshma100% (2)

- Andhra Bank UserguideDocumento8 páginasAndhra Bank UserguideSrinivas RaoAinda não há avaliações

- Name: Mejia, Andrew Ben M. Section: BSIT 1 - 1, AADocumento1 páginaName: Mejia, Andrew Ben M. Section: BSIT 1 - 1, AAandrewbenmejia13Ainda não há avaliações

- Analisis Kinerja Keungan Dan Pengaruhnya Terhadap Kemampuan Penyaluran Kredit Pada Bank Persero Di IndonesiaDocumento13 páginasAnalisis Kinerja Keungan Dan Pengaruhnya Terhadap Kemampuan Penyaluran Kredit Pada Bank Persero Di Indonesiakredit yoyoAinda não há avaliações

- Understanding Deposit InsuranceDocumento2 páginasUnderstanding Deposit InsuranceDesiree MarianoAinda não há avaliações

- Md Ismail: Date خيراتلاDescription 6تانايبلاAmount Amount Balance ديصرلاDocumento2 páginasMd Ismail: Date خيراتلاDescription 6تانايبلاAmount Amount Balance ديصرلاAiman Raja0% (2)

- AFA 3e PPT Chap08Documento80 páginasAFA 3e PPT Chap08Quỳnh NguyễnAinda não há avaliações

- CERSAI RegistrationDocumento3 páginasCERSAI Registrationkunalsinha5906Ainda não há avaliações

- Credit Authorisation SchemeDocumento6 páginasCredit Authorisation SchemeOngwang KonyakAinda não há avaliações

- Green Belt CertificationDocumento4 páginasGreen Belt Certificationdeepak231982Ainda não há avaliações

- Lec 4 Money MarketDocumento43 páginasLec 4 Money MarketTanmayAinda não há avaliações

- Cash Book WorksheetDocumento8 páginasCash Book WorksheetGodfreyFrankMwakalingaAinda não há avaliações