Escolar Documentos

Profissional Documentos

Cultura Documentos

Notice: Banks and Bank Holding Companies: Formations, Acquisitions, and Mergers

Enviado por

Justia.comTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Notice: Banks and Bank Holding Companies: Formations, Acquisitions, and Mergers

Enviado por

Justia.comDireitos autorais:

Formatos disponíveis

20914 Federal Register / Vol. 70, No.

77 / Friday, April 22, 2005 / Notices

Dated: April 18, 2005. FEDERAL TRADE COMMISSION The FTC Act and other laws the

Mark J. Tenhundfeld, Commission administers permit the

General Counsel. Agency Information Collection collection of public comments to

[FR Doc. 05–8037 Filed 4–21–05; 8:45 am] Activities; Reinstatement of Existing consider and use in this proceeding as

BILLING CODE 6725–01–P

Collection; Comment Request appropriate. All timely and responsive

AGENCY: Federal Trade Commission public comments will be considered by

(Commission or FTC). the Commission and will be available to

FEDERAL RESERVE SYSTEM the public on the FTC Web site, to the

ACTION: Notice.

extent practicable, at http://www.ftc.gov.

Formations of, Acquisitions by, and SUMMARY: The FTC intends to conduct As a matter of discretion, the FTC makes

Mergers of Bank Holding Companies a survey of consumers to advance its every effort to remove home contact

understanding of the incidence of information for individuals from the

The companies listed in this notice public comments it receives before

have applied to the Board for approval, consumer fraud and to allow the FTC to

better serve people who experience placing those comments on the FTC

pursuant to the Bank Holding Company Web site. More information, including

Act of 1956 (12 U.S.C. 1841 et seq.) fraud. The survey is a follow-up to the

FTC’s Consumer Fraud Survey routine uses permitted by the Privacy

(BHC Act), Regulation Y (12 CFR part Act, may be found in the FTC’s privacy

225), and all other applicable statutes conducted in 2003 and released in

August 2004. Before gathering this policy at http://www.ftc.gov/ftc/

and regulations to become a bank privacy.htm.

holding company and/or to acquire the information, the FTC is seeking public

assets or the ownership of, control of, or comments on its proposed consumer FOR FURTHER INFORMATION CONTACT:

the power to vote shares of a bank or research. Comments will be considered Requests for additional information

bank holding company and all of the before the FTC submits a request for should be addressed to Nathaniel C.

banks and nonbanking companies Office of Management and Budget Wood, Assistant Director, Officer of

owned by the bank holding company, (OMB) review under the Paperwork Consumer and Business Education,

including the companies listed below. Reduction Act (PRA), 44 U.S.C. 3501– Bureau of Consumer Protection, Federal

The applications listed below, as well 3520. Trade Commission, 601 Pennsylvania

as other related filings required by the DATES: Comments must be submitted on Avenue, NW., NJ–2267, Washington, DC

Board, are available for immediate or before June 21, 2005. 20580, (202) 326–3407,

inspection at the Federal Reserve Bank ADDRESSES: Interested parties are consumersurvey@ftc.gov.

indicated. The application also will be invited to submit written comments. SUPPLEMENTARY INFORMATION: Under the

available for inspection at the offices of Comments should refer to ‘‘Consumer PRA, federal agencies must obtain

the Board of Governors. Interested Fraud Survey: FTC File No. P014412’’ to approval from OMB for each collection

persons may express their views in facilitate the organization of comments. of information they conduct or sponsor.

writing on the standards enumerated in A comment filed in paper form should ‘‘Collection of information’’ means

the BHC Act (12 U.S.C. 1842(c)). If the include this reference both in the text agency requests or requirements that

proposal also involves the acquisition of and on the envelope and should be members of the public submit reports,

a nonbanking company, the review also mailed or delivered to the following keep records, or provide information to

includes whether the acquisition of the address: Federal Trade Commission/ a third party. 44 U.S.C. 3502(3), 5 CFR

nonbanking company complies with the Office of the Secretary, Room H–159 1320.3(c). In 2003, OMB approved the

standards in section 4 of the BHC Act (Annex E), 600 Pennsylvania Avenue, FTC’s request to conduct a survey on

(12 U.S.C. 1843). Unless otherwise NW., Washington, DC 20580. The FTC consumer fraud and assigned OMB

noted, nonbanking activities will be is requesting that any comment filed in Control Number 3084–0125. The FTC

conducted throughout the United States. paper form be sent by courier or completed the consumer research in

Additional information on all bank overnight service, if possible, because June 2003 and issued its report,

holding companies may be obtained U.S. postal mail in the Washington area Consumer Fraud in the United States:

from the National Information Center and at the Commission is subject to An FTC Survey, in August 2004.2 As

Web site at http://www.ffiec.gov/nic/. delay due to heightened security required by section 3506(c)(2)(A) of the

Unless otherwise noted, comments precautions. Alternatively, comments PRA, the FTC is providing this

regarding each of these applications may be filed in electronic form (in opportunity for public comment before

must be received at the Reserve Bank ASCII format, WordPerfect, or Microsoft requesting that OMB reinstate the

indicated or the offices of the Board of Word) as part of or as an attachment to clearance for the survey, which expired

Governors not later than May 16, 2005. e-mail messages directed to the

A. Federal Reserve Bank of in December 2003.

following e-mail box: The FTC invites comments on: (1)

Philadelphia (Michael E. Collins, Senior consumersurvey@ftc.gov. If the

Vice President) 100 North 6th Street, Whether the proposed collections of

comment contains any material for information are necessary for the proper

Philadelphia, Pennsylvania 19105– which confidential treatment is

1521: performance of the functions of the FTC,

requested, it must be filed in paper including whether the information will

1. Univest Corporation of form, and the first page of the document

Pennsylvania, Souderton, Pennsylvania; have practical utility; (2) the accuracy of

must be clearly labeled ‘‘Confidential.’’ 1 the FTC’s estimate of the burden of the

to retain 8.53 percent of the voting

shares of New Century Bank, proposed collections of information; (3)

1 Commission Rule 4.2(d), 16 CFR 4.2(d). The

Phoenixville, Pennsylvania. ways to enhance the quality, utility, and

comment must be accompanied by an explicit

request for confidential treatment, including the

clarity of the information to be

Board of Governors of the Federal Reserve collected; and (4) ways to minimize the

System, April 18, 2005. factual and legal basis for the request, and must

identify the specific portions of the comment to be burden of collecting information on

Robert deV. Frierson, withheld from the public record. The request will those who are to respond, including

Deputy Secretary of the Board. be granted or denied by the Commission’s General

Counsel, consistent with applicable law and the

[FR Doc. 05–8100 Filed 4–21–05; 8:45 am] public interest. See Commission Rule 4.9(c), 16 CFR 2 The Report is available at http://www.ftc.gov/

BILLING CODE 6210–01–P 4.9(c). reports/consumerfraud/040805confraudrpt.pdf.

VerDate jul<14>2003 16:59 Apr 21, 2005 Jkt 205001 PO 00000 Frm 00060 Fmt 4703 Sfmt 4703 E:\FR\FM\22APN1.SGM 22APN1

Você também pode gostar

- The California Privacy Rights Act (CPRA) – An implementation and compliance guideNo EverandThe California Privacy Rights Act (CPRA) – An implementation and compliance guideAinda não há avaliações

- USA - OECD Convention On Bribery of Foreign Officials in International Business Transactions - Implemented Steps & Enforcement Sanctions 1998 - 2010Documento113 páginasUSA - OECD Convention On Bribery of Foreign Officials in International Business Transactions - Implemented Steps & Enforcement Sanctions 1998 - 2010Zim VicomAinda não há avaliações

- FTC 2020 0045 0001 - ContentDocumento3 páginasFTC 2020 0045 0001 - ContentSpit FireAinda não há avaliações

- Federal Register / Vol. 76, No. 46 / Wednesday, March 9, 2011 / Proposed RulesDocumento9 páginasFederal Register / Vol. 76, No. 46 / Wednesday, March 9, 2011 / Proposed RulesMarketsWikiAinda não há avaliações

- FCRA 40 Years Report (2011)Documento117 páginasFCRA 40 Years Report (2011)Jillian Sheridan100% (1)

- Fbot FactsheetDocumento2 páginasFbot FactsheetMarketsWikiAinda não há avaliações

- Federal Register / Vol. 75, No. 229 / Tuesday, November 30, 2010 / NoticesDocumento3 páginasFederal Register / Vol. 75, No. 229 / Tuesday, November 30, 2010 / NoticesMarketsWikiAinda não há avaliações

- Federal Register 011414Documento16 páginasFederal Register 011414MarketsWikiAinda não há avaliações

- Chairman Simons Final QFRs 03.01.19Documento38 páginasChairman Simons Final QFRs 03.01.19Anonymous HzWycmAinda não há avaliações

- Federal Register / Vol. 63, No. 213 / Wednesday, November 4, 1998 / NoticesDocumento2 páginasFederal Register / Vol. 63, No. 213 / Wednesday, November 4, 1998 / NoticeslaurenAinda não há avaliações

- Federal Register 02 28061Documento2 páginasFederal Register 02 28061POTUSAinda não há avaliações

- Prohibition Against FraudDocumento9 páginasProhibition Against FraudMarketsWikiAinda não há avaliações

- T 2-P A E, T P L BT, P P T M B T P A S D P R I M - PDocumento23 páginasT 2-P A E, T P L BT, P P T M B T P A S D P R I M - PMarketsWikiAinda não há avaliações

- Federal Register / Vol. 76, No. 165 / Thursday, August 25, 2011 / NoticesDocumento3 páginasFederal Register / Vol. 76, No. 165 / Thursday, August 25, 2011 / NoticesMarketsWikiAinda não há avaliações

- Before The Federal Communications Commission Washington, D.C. 20554Documento7 páginasBefore The Federal Communications Commission Washington, D.C. 20554Berin SzókaAinda não há avaliações

- Proposed Rules: Commodity Futures Trading Commission 17 CFR Chapter IDocumento5 páginasProposed Rules: Commodity Futures Trading Commission 17 CFR Chapter IMarketsWikiAinda não há avaliações

- Federal Reserve Board FOIA Logs 2016-2019Documento345 páginasFederal Reserve Board FOIA Logs 2016-2019slavenumerounoAinda não há avaliações

- 2017.06.21 Response To Senator Warner LetterDocumento5 páginas2017.06.21 Response To Senator Warner LetterMarkWarner100% (2)

- MD Digital Ad Complaint (As-Filed)Documento20 páginasMD Digital Ad Complaint (As-Filed)corey RingAinda não há avaliações

- Of Consumer Information, Advice, Education, Advocacy and EnforcementDocumento8 páginasOf Consumer Information, Advice, Education, Advocacy and EnforcementMark ReinhardtAinda não há avaliações

- Federal Register / Vol. 76, No. 182 / Tuesday, September 20, 2011 / Proposed RulesDocumento11 páginasFederal Register / Vol. 76, No. 182 / Tuesday, September 20, 2011 / Proposed RulesMarketsWikiAinda não há avaliações

- U.S. CONSUMER PRODUCT SAFETY COMMISSION Fact SheetDocumento3 páginasU.S. CONSUMER PRODUCT SAFETY COMMISSION Fact SheetAdam ForgieAinda não há avaliações

- Federal Register / Vol. 77, No. 116 / Friday, June 15, 2012 / Proposed RulesDocumento6 páginasFederal Register / Vol. 77, No. 116 / Friday, June 15, 2012 / Proposed RulesMarketsWikiAinda não há avaliações

- Memo To FSGG AppropriationsDocumento5 páginasMemo To FSGG AppropriationsBreitbart NewsAinda não há avaliações

- FTC Consumer ComplaintsDocumento2 páginasFTC Consumer ComplaintsJack DuffeyAinda não há avaliações

- Complaint - FGI v. Consumer Financial Protection Bureau #22-Cv-2069Documento9 páginasComplaint - FGI v. Consumer Financial Protection Bureau #22-Cv-2069Gabe KaminskyAinda não há avaliações

- Ley Estadounidense de FranquiciasDocumento58 páginasLey Estadounidense de FranquiciasAriadna SantaellaAinda não há avaliações

- FTC Facebook Facial Id 2011 Before FTCDocumento33 páginasFTC Facebook Facial Id 2011 Before FTCSean RamseyAinda não há avaliações

- Federal Register / Vol. 76, No. 29 / Friday, February 11, 2011 / Proposed RulesDocumento91 páginasFederal Register / Vol. 76, No. 29 / Friday, February 11, 2011 / Proposed RulesMarketsWikiAinda não há avaliações

- Description: Tags: 120798Documento2 páginasDescription: Tags: 120798anon-73137Ainda não há avaliações

- Glba Factsheet FinalDocumento2 páginasGlba Factsheet FinalMarketsWikiAinda não há avaliações

- Ri Yo Coppa FRNDocumento2 páginasRi Yo Coppa FRNJlakAinda não há avaliações

- FTC Sharpens Its AI Agenda With Novel Impersonation RulemakingDocumento4 páginasFTC Sharpens Its AI Agenda With Novel Impersonation RulemakingQuibian Salazar-MorenoAinda não há avaliações

- FCC Initiates Proceeding Regarding Revocation and Termination of China Telecom (Americas) Corporation'S AuthorizationsDocumento2 páginasFCC Initiates Proceeding Regarding Revocation and Termination of China Telecom (Americas) Corporation'S AuthorizationsDeep ClipsAinda não há avaliações

- Treasury RFI SOFR FRN3Documento3 páginasTreasury RFI SOFR FRN3LaLa BanksAinda não há avaliações

- Business and Human Rights SurveyDocumento4 páginasBusiness and Human Rights SurveyAmol MehraAinda não há avaliações

- FEDERAL RESERVE ADOPTS E-DISCLOSURE RULESDocumento33 páginasFEDERAL RESERVE ADOPTS E-DISCLOSURE RULESFlaviub23Ainda não há avaliações

- Compensation CommitteesDocumento25 páginasCompensation CommitteesMarketsWikiAinda não há avaliações

- Whistleblower QaDocumento2 páginasWhistleblower QaMarketsWikiAinda não há avaliações

- Federal Register-02-28263Documento1 páginaFederal Register-02-28263POTUSAinda não há avaliações

- FTC PowersDocumento8 páginasFTC PowersJoseph Rinoza PlazoAinda não há avaliações

- DCCA Violation of State LawDocumento4 páginasDCCA Violation of State LawDigitaleye HawaiiAinda não há avaliações

- In The United States District Court For The Western District of Texas Austin DivisionDocumento48 páginasIn The United States District Court For The Western District of Texas Austin DivisionSpit FireAinda não há avaliações

- Public Notice: FCC Enforcement AdvisoryDocumento2 páginasPublic Notice: FCC Enforcement Advisorybbrown8331Ainda não há avaliações

- Federal Register / Vol. 78, No. 1 / Wednesday, January 2, 2013 / Rules and RegulationsDocumento6 páginasFederal Register / Vol. 78, No. 1 / Wednesday, January 2, 2013 / Rules and RegulationsMarketsWikiAinda não há avaliações

- ICO Press Release Decision 01 2024 FINALDocumento1 páginaICO Press Release Decision 01 2024 FINALBernewsAinda não há avaliações

- Federalregister 042711 CDocumento147 páginasFederalregister 042711 CMarketsWikiAinda não há avaliações

- Federalregister 022411 BDocumento38 páginasFederalregister 022411 BMarketsWikiAinda não há avaliações

- The Washington Legal Foundation: Federal Trade CommissionDocumento12 páginasThe Washington Legal Foundation: Federal Trade CommissionantitrusthallAinda não há avaliações

- Teva Whistleblower (SEC Response)Documento38 páginasTeva Whistleblower (SEC Response)Mike KoehlerAinda não há avaliações

- United States of America Before Federal Trade CommissionDocumento4 páginasUnited States of America Before Federal Trade CommissionSkip OlivaAinda não há avaliações

- 2.14.17 Flowers Ethics FOIA RequestDocumento4 páginas2.14.17 Flowers Ethics FOIA RequestDaily Caller News FoundationAinda não há avaliações

- Propose Nov 25Documento6 páginasPropose Nov 25MarketsWikiAinda não há avaliações

- dn_3359_notice_01302019sglDocumento3 páginasdn_3359_notice_01302019sglReymart SangalangAinda não há avaliações

- Federal Reserve System 12 CFR 205 (Regulation E Docket No. R-1041) Electronic Fund Transfers Agency: ActionDocumento22 páginasFederal Reserve System 12 CFR 205 (Regulation E Docket No. R-1041) Electronic Fund Transfers Agency: ActionFlaviub23Ainda não há avaliações

- Reply Comment of 28 State AGsDocumento41 páginasReply Comment of 28 State AGsEzra HercykAinda não há avaliações

- SEC rules on Prosperity.com schemeDocumento4 páginasSEC rules on Prosperity.com schemeRiss GammadAinda não há avaliações

- By Electronic Mail: Covington BurlingDocumento5 páginasBy Electronic Mail: Covington BurlingMarketsWikiAinda não há avaliações

- Federal Communications Commission 445 12 Street, S.W. Washington, D. C. 20554Documento2 páginasFederal Communications Commission 445 12 Street, S.W. Washington, D. C. 20554Phil WolffAinda não há avaliações

- Description: Tags: 120704aDocumento2 páginasDescription: Tags: 120704aanon-834106Ainda não há avaliações

- Arbabsiar ComplaintDocumento21 páginasArbabsiar ComplaintUSA TODAYAinda não há avaliações

- U.S. v. Rajat K. GuptaDocumento22 páginasU.S. v. Rajat K. GuptaDealBook100% (1)

- USPTO Rejection of Casey Anthony Trademark ApplicationDocumento29 páginasUSPTO Rejection of Casey Anthony Trademark ApplicationJustia.comAinda não há avaliações

- Divorced Husband's $48,000 Lawsuit Over Wedding Pics, VideoDocumento12 páginasDivorced Husband's $48,000 Lawsuit Over Wedding Pics, VideoJustia.comAinda não há avaliações

- Signed Order On State's Motion For Investigative CostsDocumento8 páginasSigned Order On State's Motion For Investigative CostsKevin ConnollyAinda não há avaliações

- Guilty Verdict: Rabbi Convicted of Sexual AssaultDocumento1 páginaGuilty Verdict: Rabbi Convicted of Sexual AssaultJustia.comAinda não há avaliações

- U.S. v. TomorrowNow, Inc. - Criminal Copyright Charges Against SAP Subsidiary Over Oracle Software TheftDocumento5 páginasU.S. v. TomorrowNow, Inc. - Criminal Copyright Charges Against SAP Subsidiary Over Oracle Software TheftJustia.comAinda não há avaliações

- Stipulation: SAP Subsidiary TomorrowNow Pleading Guilty To 12 Criminal Counts Re: Theft of Oracle SoftwareDocumento7 páginasStipulation: SAP Subsidiary TomorrowNow Pleading Guilty To 12 Criminal Counts Re: Theft of Oracle SoftwareJustia.comAinda não há avaliações

- Rabbi Gavriel Bidany's Sexual Assault and Groping ChargesDocumento4 páginasRabbi Gavriel Bidany's Sexual Assault and Groping ChargesJustia.comAinda não há avaliações

- Amended Poker Civil ComplaintDocumento103 páginasAmended Poker Civil ComplaintpokernewsAinda não há avaliações

- Clergy Abuse Lawsuit Claims Philadelphia Archdiocese Knew About, Covered Up Sex CrimesDocumento22 páginasClergy Abuse Lawsuit Claims Philadelphia Archdiocese Knew About, Covered Up Sex CrimesJustia.comAinda não há avaliações

- Emmanuel Ekhator - Nigerian Law Firm Scam IndictmentDocumento22 páginasEmmanuel Ekhator - Nigerian Law Firm Scam IndictmentJustia.comAinda não há avaliações

- Rabbi Gavriel Bidany's Federal Criminal Misdemeanor Sexual Assault ChargesDocumento3 páginasRabbi Gavriel Bidany's Federal Criminal Misdemeanor Sexual Assault ChargesJustia.comAinda não há avaliações

- Van Hollen Complaint For FilingDocumento14 páginasVan Hollen Complaint For FilingHouseBudgetDemsAinda não há avaliações

- Brandon Marshall Stabbing by Wife: Domestic Violence Arrest ReportDocumento1 páginaBrandon Marshall Stabbing by Wife: Domestic Violence Arrest ReportJustia.comAinda não há avaliações

- Bank Robbery Suspects Allegedly Bragged On FacebookDocumento16 páginasBank Robbery Suspects Allegedly Bragged On FacebookJustia.comAinda não há avaliações

- NY Judge: Tricycle Riding 4 Year-Old Can Be Sued For Allegedly Hitting, Killing 87 Year-OldDocumento6 páginasNY Judge: Tricycle Riding 4 Year-Old Can Be Sued For Allegedly Hitting, Killing 87 Year-OldJustia.comAinda não há avaliações

- Deutsche Bank and MortgageIT Unit Sued For Mortgage FraudDocumento48 páginasDeutsche Bank and MortgageIT Unit Sued For Mortgage FraudJustia.com100% (1)

- Wisconsin Union Busting LawsuitDocumento48 páginasWisconsin Union Busting LawsuitJustia.comAinda não há avaliações

- FBI Records: Col. Sanders (KFC - Kentucky Fried Chicken Founder) 1974 Death ThreatDocumento15 páginasFBI Records: Col. Sanders (KFC - Kentucky Fried Chicken Founder) 1974 Death ThreatJustia.comAinda não há avaliações

- Online Poker Indictment - Largest U.S. Internet Poker Cite Operators ChargedDocumento52 páginasOnline Poker Indictment - Largest U.S. Internet Poker Cite Operators ChargedJustia.comAinda não há avaliações

- Federal Charges Against Ariz. Shooting Suspect Jared Lee LoughnerDocumento6 páginasFederal Charges Against Ariz. Shooting Suspect Jared Lee LoughnerWBURAinda não há avaliações

- OJ Simpson - Nevada Supreme Court Affirms His ConvictionDocumento24 páginasOJ Simpson - Nevada Supreme Court Affirms His ConvictionJustia.comAinda não há avaliações

- Supreme Court Order Staying TX Death Row Inmate Cleve Foster's ExecutionDocumento1 páginaSupreme Court Order Staying TX Death Row Inmate Cleve Foster's ExecutionJustia.comAinda não há avaliações

- Court's TRO Preventing Wisconsin From Enforcing Union Busting LawDocumento1 páginaCourt's TRO Preventing Wisconsin From Enforcing Union Busting LawJustia.comAinda não há avaliações

- Sweden V Assange JudgmentDocumento28 páginasSweden V Assange Judgmentpadraig2389Ainda não há avaliações

- Defamation Lawsuit Against Jerry Seinfeld Dismissed by N.Y. Judge - Court OpinionDocumento25 páginasDefamation Lawsuit Against Jerry Seinfeld Dismissed by N.Y. Judge - Court OpinionJustia.comAinda não há avaliações

- 60 Gadgets in 60 Seconds SLA 2008 June16Documento69 páginas60 Gadgets in 60 Seconds SLA 2008 June16Justia.com100% (10)

- City of Seattle v. Professional Basketball Club LLC - Document No. 36Documento2 páginasCity of Seattle v. Professional Basketball Club LLC - Document No. 36Justia.comAinda não há avaliações

- Lee v. Holinka Et Al - Document No. 4Documento2 páginasLee v. Holinka Et Al - Document No. 4Justia.com100% (4)

- DDoS Attack Detection: IoT RequiredDocumento18 páginasDDoS Attack Detection: IoT RequirednishitaAinda não há avaliações

- Giving Directions Prepositions of Place PlacesDocumento1 páginaGiving Directions Prepositions of Place PlacesItzel MatiasAinda não há avaliações

- The Normative Implications of Article 35 of the FDRE ConstitutionDocumento23 páginasThe Normative Implications of Article 35 of the FDRE ConstitutionAbera AbebeAinda não há avaliações

- Pasion Sda. de Garcia v. LocsinDocumento7 páginasPasion Sda. de Garcia v. LocsinFD BalitaAinda não há avaliações

- United States Army in World War II Statistics LendLeaseDocumento46 páginasUnited States Army in World War II Statistics LendLeasePaul D Carrier100% (5)

- Bill of Particulars For Forfeiture of PropertyDocumento18 páginasBill of Particulars For Forfeiture of PropertyKrystle HollemanAinda não há avaliações

- Group 'Y' (Except Auto Tech, IAF (P), IAF (S) & Musician)Documento29 páginasGroup 'Y' (Except Auto Tech, IAF (P), IAF (S) & Musician)Anuj TomarAinda não há avaliações

- Veteran's Day Discounts and Free OffersDocumento6 páginasVeteran's Day Discounts and Free OffersJennifer Sulak100% (1)

- Diary of Anne ListerDocumento28 páginasDiary of Anne ListerSandra Psi100% (5)

- January, 2019Documento3 páginasJanuary, 2019siva reddyAinda não há avaliações

- CIR Vs American Express InternationalDocumento2 páginasCIR Vs American Express InternationalCheryl Churl100% (2)

- Tense and Verb Form TestDocumento4 páginasTense and Verb Form TestMilena Radivojević100% (5)

- PGK Precision Artillery KitDocumento2 páginasPGK Precision Artillery KithdslmnAinda não há avaliações

- Klasa - 7 - Placement - Test - Answer KeyDocumento2 páginasKlasa - 7 - Placement - Test - Answer KeyKarolina PawlakAinda não há avaliações

- Plaintiffs' Motion For Entry of JudgmentDocumento14 páginasPlaintiffs' Motion For Entry of JudgmentBen SheffnerAinda não há avaliações

- WH - FAQ - Chaoszwerge Errata PDFDocumento2 páginasWH - FAQ - Chaoszwerge Errata PDFCarsten ScholzAinda não há avaliações

- Freedom of SpeechDocumento7 páginasFreedom of Speechلبنیٰ افتخارAinda não há avaliações

- Francisco de Liano, Alberto Villa-Abrille JR and San Miguel Corporation Vs CA and Benjamin Tango GR No. 142316, 22 November 2001 FactsDocumento2 páginasFrancisco de Liano, Alberto Villa-Abrille JR and San Miguel Corporation Vs CA and Benjamin Tango GR No. 142316, 22 November 2001 FactscrisAinda não há avaliações

- SEERAH OF MUHAMMAD J BOOK 6: KEY EVENTS OF THE PROPHET'S LIFEDocumento80 páginasSEERAH OF MUHAMMAD J BOOK 6: KEY EVENTS OF THE PROPHET'S LIFEHeal ThyoldwaydsAinda não há avaliações

- Partnership REPORTDocumento4 páginasPartnership REPORTAiza A. CayananAinda não há avaliações

- Search of A Moving VehicleDocumento3 páginasSearch of A Moving VehicleKleyr De Casa AlbeteAinda não há avaliações

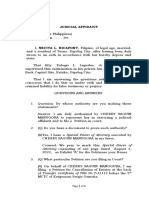

- JUDICIAL AFFIDAVIT RicafortDocumento4 páginasJUDICIAL AFFIDAVIT RicafortEulogio LagudasAinda não há avaliações

- Jurisprudence Study Material PDFDocumento39 páginasJurisprudence Study Material PDFeshivakumar bhargava100% (1)

- Development of ADR - Mediation in IndiaDocumento8 páginasDevelopment of ADR - Mediation in Indiashiva karnatiAinda não há avaliações

- Diagrama Arg. 14X14 Desde El 09 Al 23 de Febrero de 2023Documento7 páginasDiagrama Arg. 14X14 Desde El 09 Al 23 de Febrero de 2023Alejandro TurpieAinda não há avaliações

- General PrinciplesDocumento60 páginasGeneral PrinciplesRound RoundAinda não há avaliações

- 2020 UP BOC Commercial LawDocumento456 páginas2020 UP BOC Commercial LawKim Cajucom100% (1)

- Arlie Loughnan, Manifest Madness: Mental Incapacity in Criminal Law, Oxford: OxfordDocumento6 páginasArlie Loughnan, Manifest Madness: Mental Incapacity in Criminal Law, Oxford: OxfordUdruzenje PravnikaAinda não há avaliações

- (RPG) Palladium - Rifts - Weapons & EquipmentDocumento113 páginas(RPG) Palladium - Rifts - Weapons & EquipmentKristin Molle80% (5)

- B.P. Sinha, Parakulangara Govinda Menon and J.L. Kapur, JJDocumento6 páginasB.P. Sinha, Parakulangara Govinda Menon and J.L. Kapur, JJhardik gogiaAinda não há avaliações

- Dictionary of Legal Terms: Definitions and Explanations for Non-LawyersNo EverandDictionary of Legal Terms: Definitions and Explanations for Non-LawyersNota: 5 de 5 estrelas5/5 (2)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorNo EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorNota: 4.5 de 5 estrelas4.5/5 (63)

- Introduction to Negotiable Instruments: As per Indian LawsNo EverandIntroduction to Negotiable Instruments: As per Indian LawsNota: 5 de 5 estrelas5/5 (1)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpNo EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpNota: 4 de 5 estrelas4/5 (214)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsNo EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsNota: 5 de 5 estrelas5/5 (24)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingNo EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingNota: 4.5 de 5 estrelas4.5/5 (97)

- The Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesNo EverandThe Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesNota: 4 de 5 estrelas4/5 (1)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorNo EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorNota: 4.5 de 5 estrelas4.5/5 (132)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementNo EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementNota: 4.5 de 5 estrelas4.5/5 (20)

- The Power of Our Supreme Court: How Supreme Court Cases Shape DemocracyNo EverandThe Power of Our Supreme Court: How Supreme Court Cases Shape DemocracyNota: 5 de 5 estrelas5/5 (2)

- Ben & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooNo EverandBen & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooNota: 5 de 5 estrelas5/5 (2)

- Legal Research: a QuickStudy Laminated Law ReferenceNo EverandLegal Research: a QuickStudy Laminated Law ReferenceAinda não há avaliações

- Export & Import - Winning in the Global Marketplace: A Practical Hands-On Guide to Success in International Business, with 100s of Real-World ExamplesNo EverandExport & Import - Winning in the Global Marketplace: A Practical Hands-On Guide to Success in International Business, with 100s of Real-World ExamplesNota: 5 de 5 estrelas5/5 (1)

- LLC or Corporation?: Choose the Right Form for Your BusinessNo EverandLLC or Corporation?: Choose the Right Form for Your BusinessNota: 3.5 de 5 estrelas3.5/5 (4)

- Nolo's Deposition Handbook: The Essential Guide for Anyone Facing or Conducting a DepositionNo EverandNolo's Deposition Handbook: The Essential Guide for Anyone Facing or Conducting a DepositionNota: 5 de 5 estrelas5/5 (1)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseNo EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseAinda não há avaliações

- Dealing With Problem Employees: How to Manage Performance & Personal Issues in the WorkplaceNo EverandDealing With Problem Employees: How to Manage Performance & Personal Issues in the WorkplaceAinda não há avaliações

- Richardson's Growth Company Guide 5.0: Investors, Deal Structures, Legal StrategiesNo EverandRichardson's Growth Company Guide 5.0: Investors, Deal Structures, Legal StrategiesAinda não há avaliações

- Legal Writing in Plain English: A Text with ExercisesNo EverandLegal Writing in Plain English: A Text with ExercisesNota: 3 de 5 estrelas3/5 (2)