Escolar Documentos

Profissional Documentos

Cultura Documentos

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Enviado por

Shyam SunderTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Enviado por

Shyam SunderDireitos autorais:

Formatos disponíveis

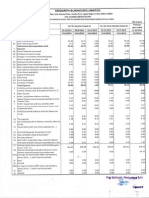

UNISYS SOFTWARES & HOLDING INDUSTRIES LIMITED

Regd. Office : 75C, Park Street, Basement, Kolkata- 700016

CIN - L51909WB1992PLC056742, Email : unisys.softwares@gmail.com, Wesbite : www.unisyssoftware.com

Statement of Unaudited Results for the Quarter & 6 months ended 30th September, 2014

Rs. in Lacs

Particulars

Sr.

No.

1 Income from Operations

a) Net Sales/Income from Operations

b) Other Operating Income

Total Income from Operations (Net)

2 Expenses

(a) Cost of Material Consumed

(b) Purchases of Stock-in-trade

4

5

6

7

8

9

Un-Audited

Audited

14,188.04

45.25

14,233.29

7,736.24

7,736.24

15,520.73

145.00

15,665.73

13,885.63

7.10

13,892.73

38,538.18

45.18

38,583.36

1,327.56

14,155.23

7,705.14

15,482.79

13,842.34

38,422.21

4.80

11.28

6.32

1,349.96

4.75

11.28

5.55

14,176.81

4.85

16.92

5.25

7,732.16

9.55

22.56

11.87

15,526.77

9.60

33.84

8.60

13,894.38

19.62

67.67

27.28

38,536.78

82.48

-

56.48

-

4.08

55.78

138.96

-

(1.65)

112.00

46.58

150.00

Profit/(Loss) from ordinary activities before finance costs

and exceptional items (3+4)

Finance Costs

82.48

57.60

56.48

-

59.86

-

138.96

57.60

110.35

-

196.58

115.11

Profit/(Loss) from ordinary activities after finance cost but

before exceptional items (3+4)

Exceptional Items

24.88

-

56.48

-

59.86

-

81.36

-

110.35

-

81.47

-

24.88

-

56.48

-

59.86

-

81.36

-

110.35

-

81.47

31.85

24.88

24.88

-

56.48

56.48

-

59.86

59.86

-

81.36

81.36

-

110.35

110.35

-

49.62

49.62

-

24.88

2,300.02

56.48

2,300.02

59.86

2,300.02

81.36

2,300.02

110.35

2,300.02

49.62

2,300.02

(d) Employees Benefit Expenses

(e) Depreciation & Amortization Expenses

(f) Other Expenses

Total Expenses

Profit/(Loss) from Operations before other Income, finance

cost and exceptional Expenses (1-2)

Other Income/(Loss)

Profit(+)/Loss(-) from ordinary activites before Tax (7-8)

10 Tax Expenses

11

12

13

14

15

Un-Audited

1,332.69

99.75

1,432.44

(c) Changes in Inventories of Finished Goods, Work-inProgress and Stock-in-Trade

3 Months

ended

30.09.2014

Corresponding Corresponding

Preceding 3

Preceding 3

6 Months

6 Months

Year to date

Months ended Months ended

ended

ended

figures as on

30.06.2014

30.09.2013

30.09.2014

30.09.2013

31.03.2014

Net Profit (+)/Loss(-) from ordinary activites after tax (910)

Extra Ordinary Items (Net of Tax Expense of Rs.

Lac)

Net Profit (+)/Loss(-) for the period (11-12)

Share of Profit/(Loss) of Associates*

Minority Interest*

Net Profit (+)/Loss(-) after tax, minority interest and Share

16 of Profit / (Loss) of Associates (13-14-15)

17 Paid-up Equity Share Capital (Face Value of Rs. 10/- each)

Reserves excluding revaluation Reserves as per last Balance

18 Sheet

Earning Per Share (before extra-ordinary items) of Rs. 10/19 each (not annualized)

(i) a) Basic

b) Diluted

Earning Per Share (after extra-ordinary items) of Rs. 10/19 each (not annualized)

(ii) a) Basic

b) Diluted

A PARTICULARS OF SHAREHOLDING

Public Shareholding

- Number of Shares

- Percentage of Share Holding

18 Promoter and Promoter Group Shareholding

a) Pledged/Encumbered

- Number of Shares

- Percentage of Shares (as a % of the total Shareholding

of Promoter and Promoter Group

- Percentage of Shares (as a % of the total Share Capital

of the Company

b) None-Encumbered

- Number of Shares

- Percentage of Shares (as a % of the total Shareholding

of Promoter and Promoter Group

- Percentage of Shares (as a % of the total Share Capital

of the Company

B INVESTOR COMPLAINTS

Pending at the beginning of the Quarter

Received during the Quarter

0.11

0.11

0.25

0.25

0.26

0.26

0.35

0.35

0.48

0.48

0.22

0.22

0.11

0.11

0.25

0.25

0.26

0.26

0.35

0.35

0.48

0.48

0.22

0.22

17,440,800

17,440,800

17,440,800

17,440,800

17,440,800

17,440,800

75.83

75.83

75.83

75.83

75.83

75.83

50,000

50,000

50,000

0.90

0.90

0.90

0.22

0.22

0.22

5,509,400

100.00

5,509,400

100.00

5,559,400

100.00

5,509,400

100.00

5,559,400

100.00

5,559,400

100.00

23.95

23.95

24.17

23.95

24.17

24.17

Nil

Nil

Disposed during the Quarter

Remaining Unresolved at the end of Quarter

3,539.48

Nil

Nil

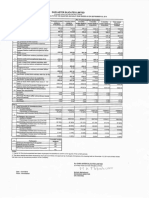

UNISYS SOFTWARES & HOLDING INDUSTRIES LIMITED

Un-Audited Segment Results for the Quarter & 6 months ended 30th September, 2014

Rs. in Lacs

Sr.

Particulars

No.

3 Months

ended

30.09.2014

Preceding 3

Preceding 3

Months ended Months ended

30.06.2014

30.09.2013

Un-Audited

1

a)

b)

c)

2

a)

b)

c)

3

a)

b)

c)

Segment Revenue

Sale of Software & Hardware / Mobile

Investment Activities

Other Income

Total Income from Operations

Segment Profit/(Loss) before Interest & Tax

Sale of Software & Hardware / Mobile

Investment Activities

Other Unallocable Activities

Profit before Tax

Capital Employed

Software & Hardware / Mobile

Investment Activities

Other Unallocable Activities

Total

Corresponding Corresponding

6 Months

6 Months

Year to date

ended

ended

figures as on

30.09.2014

30.09.2013

31.03.2014

Un-Audited

Audited

1,332.69

99.75

1,432.44

14,188.04

45.25

14,233.29

7,736.24

55.78

7,792.02

15,520.73

145.00

15,665.73

13,885.63

7.10

112.00

14,004.73

0.03

24.85

24.88

25.80

30.68

56.48

19.50

40.36

59.86

25.83

55.53

81.36

30.20

80.15

110.35

6,388.82

31,087.34

79.79

37,555.95

3,869.00

28,530.00

124.07

32,523.07

2,280.98

24,945.10

269.19

27,495.27

6,388.82

31,087.34

79.79

37,555.95

2,280.98

24,945.10

269.19

27,495.27

38,538.18

45.18

150.00

38,733.36

55.00

(123.53)

150.00

81.47

3,793.90

28,366.08

135.35

32,295.33

Notes :

1. Segmental Report as per AS-17, issued by Institute of Charterd Accountants of India is applicable for the Quarter.

2. Above resultes were reviewed by Audit Committee taken on record in Board Meeting held on 14th November, 2014.

3. The Auditors of the Company have carried out "Limited Review" of the above financial Results.

4. Figures of Previous Year/Period have been re-arranged/re-casted wherever necessary.

For Unisys Softwares & Holding Industries Ltd.

Place : Kolkata

Date : 14th November, 2014.

Sd/Jagdish Prasad Purohit

Managing Director

UNISYS SOFTWARES & HOLDING INDUSTRIES LTD

Statement of Assets & Liabilities

Rs. in Lacs

As At

30th Sept 2014

31st March 2014

Un-Audited

Audited

Particulars

A

EQUITY & LIABILITIES

1 Shareholders' Fund

(a) Share Capital

(b) Reserves and Surplus

(c) Money Received against Share Warrants

Sub-Total - Share Holders Fund

2 Share Capital Money (Pending Allotment

3 Minority Interest*

4 Non Current Liabilities

(a) Long Term Borrowings

(b) Deferred Tax Liabilities (Net)

(c) Other Long Term Liabilities

(d) Long Term Provisions

Sub-Total - Long Term Liabilities

5 Current Liabilities

(a) Short Term Borrowings

(b) Trade Payables

(c) Other Current Liabilities

(d) Short Term Provisions

2,300.02

3,620.84

2,300.02

3,539.48

5,920.86

-

5,839.50

-

1,332.60

1,332.60

1,272.60

29,043.17

2,969.73

-

24,203.49

1,923.49

31.85

Sub-Total - Current Liabilities

33,285.50

26,158.83

TOTAL EQUITY & LIABILITIES

39,206.36

33,330.93

79.44

19,957.45

16.00

-

135.35

17,727.46

16.00

-

Sub-Total - Non Current Assets

2 Current Assets

(a) Current Investments

(b) Inventories

(c) Trade Receivables

(d) Cash & Cash Equivalents

(e) Short Term Loans & Advances

(f) Other Current Assets

Sub-Total - Current Assets

20,052.89

17,878.81

6,388.82

2.52

12,762.13

19,153.47

988.45

3,793.89

131.93

10,537.85

15,452.12

TOTAL - ASSETS

39,206.36

33,330.93

ASSETS

1 Non-Current Assets

(a) Fixed Assets

(b) Goodwill on Consolidation*

(c) Non-Current Investments

(d) Deferred Tax Assets (Net)

(e) Long Term Loans & Advances

(f) Other Non-Current Assets

B. S. Kedia & Co.

Chartered Accountants

Bikaner Building,

Building, 1st Floor, Room No. 8

8/1, Lal Bazar Street,

Street, Kolkata-700 001

Tel : 033-22

033-2248

-2248 3696,

3696, Mobile : 98310 85849

Email : bsk_1@rediffmail.com

Limited Review Report by Auditors

To

The Board of Directors

M/s. Unisys Softwares & Holding Industries Limited

75C, Park Street

Kolkata-700 016

We have reviewed the accompanying statement of Un-Audited Financial Results of M/s. Unisys

Softwares & Holding Industries Limited for the Quarter ended 30th September 2014 except

for the disclosures regarding Public Shareholding and Promoter and Promoter Group

Shareholding which have been traced from disclosures made by the management and have not

been audited by us. This statement is the responsibility of the Companys Management and has

been approved by the Board of Directors/ Committee of Board of Directors. Our responsibility is

to issue a report on these financial statements based on our review.

We conducted our review in accordance with the Standard on Review Engagement (SRE) 2400,

engagements to Review Financial Statements issued by the Institute of Chartered Accountants of

India. This standard requires that we plan and perform the review to obtain moderate assurance as

to whether the financial statements are free of material misstatement. A review is limited primarily

to inquiries of company personnel and an analytical procedure applied to financial data and thus

provides less assurance than an audit. We have not performed an audit and accordingly, we do not

express an audit opinion.

Based on our review conducted as above, nothing has come to our attention that causes us to

believe that the accompanying statement of unaudited financial results prepared in accordance

with applicable accounting standards 1 and other recognized accounting practices and policies has

not disclosed the information required to be disclosed in terms of Clause 41 of the Listing

Agreement including the manner in which it is to be disclosed, or that it contains any material

misstatement.

For M/s. B. S. Kedia & Co.

Chartered Accountants

Firm Reg. No. : 317159E

Place : Kolkata

Date : November 14, 2014

Vikash Kedia

Partner

Membership Number 066852

Você também pode gostar

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Aug 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Aug 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Documento2 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento6 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento7 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2013 (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2013 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento5 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Unaudited Financial Results For The Quarter/Half Year Ended 30th September, 2014Documento4 páginasUnaudited Financial Results For The Quarter/Half Year Ended 30th September, 2014Dhruba DebnathAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento5 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For December 31, 2014 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review For December 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results For Sept 30, 2015 (Standalone) (Result)Documento2 páginasFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Auditors Report Financial StatementsDocumento57 páginasAuditors Report Financial StatementsSaif Muhammad FahadAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- 28 Consolidated Financial Statements 2013Documento47 páginas28 Consolidated Financial Statements 2013Amrit TejaniAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Documento2 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Documento2 páginasFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderAinda não há avaliações

- Absl Fy 2015Documento20 páginasAbsl Fy 2015junkyAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento7 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Result)Documento7 páginasFinancial Results & Limited Review Report For June 30, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Nov 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Nov 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento7 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Documento9 páginasStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Frequently Asked Questions in International Standards on AuditingNo EverandFrequently Asked Questions in International Standards on AuditingNota: 1 de 5 estrelas1/5 (1)

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocumento6 páginasOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderAinda não há avaliações

- JUSTDIAL Mutual Fund HoldingsDocumento2 páginasJUSTDIAL Mutual Fund HoldingsShyam SunderAinda não há avaliações

- Mutual Fund Holdings in DHFLDocumento7 páginasMutual Fund Holdings in DHFLShyam SunderAinda não há avaliações

- HINDUNILVR: Hindustan Unilever LimitedDocumento1 páginaHINDUNILVR: Hindustan Unilever LimitedShyam SunderAinda não há avaliações

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocumento2 páginasSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderAinda não há avaliações

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocumento5 páginasExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderAinda não há avaliações

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Documento1 páginaPR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderAinda não há avaliações

- Financial Results For Mar 31, 2014 (Result)Documento2 páginasFinancial Results For Mar 31, 2014 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results For March 31, 2016 (Result)Documento11 páginasStandalone Financial Results For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocumento2 páginasSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderAinda não há avaliações

- Financial Results For June 30, 2014 (Audited) (Result)Documento3 páginasFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results For September 30, 2013 (Result)Documento2 páginasFinancial Results For September 30, 2013 (Result)Shyam SunderAinda não há avaliações

- Financial Results For Dec 31, 2013 (Result)Documento4 páginasFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For September 30, 2016 (Result)Documento3 páginasStandalone Financial Results For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results For June 30, 2013 (Audited) (Result)Documento2 páginasFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results For June 30, 2016 (Result)Documento2 páginasStandalone Financial Results For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- PDF Processed With Cutepdf Evaluation EditionDocumento3 páginasPDF Processed With Cutepdf Evaluation EditionShyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Transcript of The Investors / Analysts Con Call (Company Update)Documento15 páginasTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderAinda não há avaliações

- Investor Presentation For December 31, 2016 (Company Update)Documento27 páginasInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Fina ManDocumento20 páginasFina ManhurtlangAinda não há avaliações

- PDF Abm 11 Famb1 q1 w4 Mod5 DDDocumento18 páginasPDF Abm 11 Famb1 q1 w4 Mod5 DDMargie Sorquiano Abad QuitonAinda não há avaliações

- Cost Accountancy: Bba - Ii Semester - IiiDocumento19 páginasCost Accountancy: Bba - Ii Semester - IiiNishikant RayanadeAinda não há avaliações

- Preparing Your Company For A Liquidity EventDocumento14 páginasPreparing Your Company For A Liquidity EventTawfeegAinda não há avaliações

- Negotiations, Deal StructuringDocumento30 páginasNegotiations, Deal StructuringVishakha PawarAinda não há avaliações

- Buymed BOD Q4FY23 (2023-12-21) v8 - AOP UpdateDocumento7 páginasBuymed BOD Q4FY23 (2023-12-21) v8 - AOP UpdateHenryAinda não há avaliações

- Lee vs. Lee Air Framing LTD 1961Documento9 páginasLee vs. Lee Air Framing LTD 1961Rajat Kaushik100% (1)

- Additional Self-Test ProblemsDocumento80 páginasAdditional Self-Test Problemsnsrivastav1Ainda não há avaliações

- VP Financial Planning Analysis in USA Resume John EffreinDocumento2 páginasVP Financial Planning Analysis in USA Resume John EffreinJohnEffrein2Ainda não há avaliações

- FR RTP Nov 23Documento66 páginasFR RTP Nov 23Kartikeya BansalAinda não há avaliações

- Afu 08504 - International Capital Bdgeting - Tutorial QuestionsDocumento4 páginasAfu 08504 - International Capital Bdgeting - Tutorial QuestionsHashim SaidAinda não há avaliações

- DRHP AimlDocumento636 páginasDRHP AimlSubscriptionAinda não há avaliações

- Articles of Association of Nestlé SDocumento6 páginasArticles of Association of Nestlé SGileah Ymalay Zuasola100% (1)

- Viking Form 2 ADVDocumento36 páginasViking Form 2 ADVSOeAinda não há avaliações

- Session-1 CF-2Documento13 páginasSession-1 CF-2rajyalakshmiAinda não há avaliações

- Fees Hit Private-EquityCos - Dechert StudyDocumento3 páginasFees Hit Private-EquityCos - Dechert StudyputigersAinda não há avaliações

- p2 Long SeatworkDocumento6 páginasp2 Long SeatworkLeisleiRagoAinda não há avaliações

- CASH FLOW STATEMENTS - Quiz 2Documento2 páginasCASH FLOW STATEMENTS - Quiz 2JyAinda não há avaliações

- LK Annual Report 2020-SOCI FinalDocumento226 páginasLK Annual Report 2020-SOCI FinalPT. NYAMM ASMI SEHATAinda não há avaliações

- Meetings and ResolutionDocumento11 páginasMeetings and ResolutionTrina BaruaAinda não há avaliações

- Lesson 19Documento45 páginasLesson 19nabila qayyumAinda não há avaliações

- Diskusi Akuntansi Manajemen Oleh Kelompok 6 (EX 1&2 Variable Costing)Documento3 páginasDiskusi Akuntansi Manajemen Oleh Kelompok 6 (EX 1&2 Variable Costing)Hafizd FadillahAinda não há avaliações

- Investment BankingDocumento24 páginasInvestment BankingLakshmiAinda não há avaliações

- ACCTG 101 Final Quiz: Requirement: Provide The Necessary Journal EntriesDocumento5 páginasACCTG 101 Final Quiz: Requirement: Provide The Necessary Journal EntriesCalyx ImperialAinda não há avaliações

- Ind As Summary Charts PDFDocumento47 páginasInd As Summary Charts PDFVinayak50% (2)

- Sums On Consolidation 2020 PDFDocumento3 páginasSums On Consolidation 2020 PDFRohan DharneAinda não há avaliações

- Electrotherm India LTD PDFDocumento11 páginasElectrotherm India LTD PDFTarun ChakrabortyAinda não há avaliações

- MECWIN Investment ProposalDocumento4 páginasMECWIN Investment ProposalVamsi PavuluriAinda não há avaliações

- Chapter 2 Accounting For The Service BusinessDocumento37 páginasChapter 2 Accounting For The Service BusinessKristel100% (1)

- Financial AdvisoryDocumento3 páginasFinancial Advisorybhavesh.sahuAinda não há avaliações