Escolar Documentos

Profissional Documentos

Cultura Documentos

Accounting 101 Comprehensive Problem 2

Enviado por

Jay NgDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Accounting 101 Comprehensive Problem 2

Enviado por

Jay NgDireitos autorais:

Formatos disponíveis

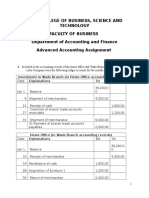

COMPREHENSIVE PROBLEM #2

GUITAR UNIVERSE, INC.

a. Prepare a bank reconciliation and make the necessary journal entries to update the

accounting records of Guitar Universe as of December 31, 2011.

Bank statement balance as of Dec 31, 2011

Add: Deposits not recorded by bank

Total

Less: Outstanding checks

Check No. 507

Check No. 511

Check No. 521

Adjusted cash balance

Depositors record balance as of Dec 31, 2011

Less: Bank service charge

NSF check from Iggy Bates

Adjusted cash balance

$46,975

$16,500

$63,475

$4000

$9000

$8000

$45000

$25

$2500

Bank service charges

Account Receivable (NSF check from Iggy

Bates)

Cash

25

2500

b. Marketable Securities

Unrealized holding gain on investment

To increase reported value of marketable

securities to $27,500 from $25000

2500

c. Uncollectible accounts expense (for

December)

Allowance for doubtful accounts

$21000

$42,475

$2525

$42,475

2525

2500

3500

3500

d. Cost of goods sold

Inventory

1350

e. Office supplies expense

Office supplies

300

f. Insurance expense

Prepaid insurance

600

g. Depreciation expense

Accumulated depreciation

5000

h. Unearned customer deposits

Sales

i. Income Tax Expense accrued during

December

3200

1350

300

600

5000

3200

6000

Income tax payable

6000

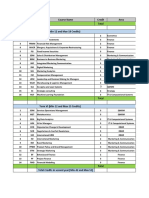

j. Guitar Universe, Incs Adjusted Trial Balance at Dec 31, 2011

Cash

Marketable Securities

Account Receivable

Allowance for doubtful accounts

Merchandise inventory

Office supplies

Prepaid insurance

Building and fixtures

Accumulated depreciation

Land

Account payable

Unearned customer deposits

Income taxes payable

Capital stock

Retained earnings

Unrealized holding gain on investments

Sales

Cost of goods sold

Bank service charges

Uncollectible account expense

Salary and wages expense

Office supplies expense

Insurance expense

Utilities expense

Depreciation expense

Income tax expense

42,475

27,500

127,500

8500

248,650

900

6000

1,791,000

805,000

64,800

70,000

4800

81,000

1,000,000

240,200

8500

1,603,200

959,350

225

12,500

395,000

700

7000

3600

53,000

81,000

$3,821,200

$3,821,200

k. Guitar Universes year end income

statement

Sales

Cost of goods sold

Gross profit

Bank service charges

Uncollectible accounts expense

Salary and wages expense

Office supplies expense

Insurance expense

Utilities expense

Depreciation expense

1,603,200

959,350

643,850

225

12500

395000

700

7000

3600

53000

472,025

Income before tax

Income taxes expense

Net income

$171825

81000

$90,825

Statement of Retained Earnings Dec 31, 2011

Retained earnings Jan 1, 2011

Add: Net income

Ending retained earnings Dec, 2011

240,200

90,825

$331,025

Current assets as of Dec 31, 2011

Cash

Marketable securities

Account receivable

Less: Allowance for doubtful accounts

42475

27500

127,500

8500

Marchandise inventory

Office supplies

Prepaid insurance

Total current assets

Plant and equipment

Building and fixtures

Less: accumulated depreciation

Land

Total plant and equipment

Total assets

119000

248650

900

6000

$444,525

1,791,000

(805,000)

986,000

64800

$1,050,800

$1,495,325

Liabilities

Current liabilities:

Acct Payable

Unearned customer deposits

Income tax payable

Total current liabilities

Long term liabilities

Total liabilities

70000

4800

81000

$155,800

0

$155,800

Stockholders Equity

Capital stock

Retained earnings

Unrealized holding gain on investments

1,000,000

331,025

8500

Total stockholders equity

Total liabilities and stockholders equity

$1,339,525

$1,495,325

l. Account receivable turnover:

$1,603,200 / $119,000 = 13.5 times

Account receivable days:

365 days / 13.5 = 27 days

m. Inventory turnover:

$959,350 / $248,650 = 3.9 times

Inventory days:

365 days / 3.9 = 94 days

n. Operating cycle: 27 days + 94 days = 121 days

o. From a short term creditors perspective, the company appears to be

solvent. The company collects its account receivable in less than 30

days. The company seems to stock too much inventory because its

inventory days are 94 day.

Você também pode gostar

- Instruction: Shade The Letter of Your Choice in The Answer Sheet Provided. No Erasures AllowedDocumento6 páginasInstruction: Shade The Letter of Your Choice in The Answer Sheet Provided. No Erasures AllowedmarygraceomacAinda não há avaliações

- 1P91+F2012+Midterm Final+Draft+SolutionsDocumento10 páginas1P91+F2012+Midterm Final+Draft+SolutionsJameasourous LyAinda não há avaliações

- AaaaamascpaDocumento12 páginasAaaaamascpaRichelle Joy Reyes BenitoAinda não há avaliações

- Accounting Cycle IDocumento21 páginasAccounting Cycle IChristine PeregrinoAinda não há avaliações

- ACCT5101Pretest PDFDocumento18 páginasACCT5101Pretest PDFArah OpalecAinda não há avaliações

- Work Sheet ExampleDocumento5 páginasWork Sheet Exampleosamasad100% (1)

- CASH AND CASH EQUIVALENTS TOPICSDocumento8 páginasCASH AND CASH EQUIVALENTS TOPICSKonjiki Ashisogi JizōAinda não há avaliações

- ACC2001 Aug 2011 Practice Exam QuestionsDocumento4 páginasACC2001 Aug 2011 Practice Exam QuestionsShin TanAinda não há avaliações

- Module 5 Cash Flow Test Solution Posted Fall 2011Documento6 páginasModule 5 Cash Flow Test Solution Posted Fall 2011sonic763Ainda não há avaliações

- Cash and Accrual BasisDocumento36 páginasCash and Accrual BasisHoney LimAinda não há avaliações

- Practical Accounting Problems 1Documento4 páginasPractical Accounting Problems 1Eleazer Ego-oganAinda não há avaliações

- CH 01Documento5 páginasCH 01deelol99Ainda não há avaliações

- Financial Accounting11Documento14 páginasFinancial Accounting11AleciafyAinda não há avaliações

- Journal entries for city general fundDocumento3 páginasJournal entries for city general fundEkta Saraswat VigAinda não há avaliações

- 6int 2004 Dec QDocumento7 páginas6int 2004 Dec QFloyd DaltonAinda não há avaliações

- Hope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentDocumento6 páginasHope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentShumebeza BaylleAinda não há avaliações

- Week 6 - Solutions (Some Revision Questions)Documento13 páginasWeek 6 - Solutions (Some Revision Questions)Jason0% (1)

- City of Bingham Project FinancialsDocumento46 páginasCity of Bingham Project FinancialsNicky 'Zing' Nguyen100% (7)

- Exercises On Cash Flow StatementsDocumento3 páginasExercises On Cash Flow StatementsSam ChinthaAinda não há avaliações

- c6 Question BankDocumento25 páginasc6 Question BankWaseem Ahmad QurashiAinda não há avaliações

- Week 4Documento5 páginasWeek 4Erryn M. ParamythaAinda não há avaliações

- (A) Conard Corporation Condensed Balance Sheets December 31Documento4 páginas(A) Conard Corporation Condensed Balance Sheets December 31Abbdul AzizAinda não há avaliações

- CAT-CB Questionnaires (Encoded)Documento13 páginasCAT-CB Questionnaires (Encoded)Anob Ehij100% (1)

- Constructive Acctg. Report..... SINGLE ENTRY and ERROR CORRECTIONDocumento39 páginasConstructive Acctg. Report..... SINGLE ENTRY and ERROR CORRECTIONHoney LimAinda não há avaliações

- Homework QuestionsDocumento17 páginasHomework QuestionsAAinda não há avaliações

- Lecture 4 & 5 - Preparing Financial Statements (XYZ LTD)Documento1 páginaLecture 4 & 5 - Preparing Financial Statements (XYZ LTD)Happy AdelaAinda não há avaliações

- The Following Trial Balance Has Been Prepared by A Trainee Accounting ClerkDocumento4 páginasThe Following Trial Balance Has Been Prepared by A Trainee Accounting ClerkRadithAinda não há avaliações

- October General Journal EntriesDocumento2 páginasOctober General Journal EntriesNitish SehgalAinda não há avaliações

- E4-8 + P5-8Documento4 páginasE4-8 + P5-8Oliviane Theodora Wenno100% (1)

- Accy 517 HW PB Set 1Documento30 páginasAccy 517 HW PB Set 1YonghoChoAinda não há avaliações

- Brickwork Balance SheetDocumento4 páginasBrickwork Balance Sheetblackcloud2408Ainda não há avaliações

- Enter The Appropriate Amounts in The Shaded Cells in Columns C, E, H and K. A Red Indicates An Erroneous Number in The Cell To The Left of TheDocumento3 páginasEnter The Appropriate Amounts in The Shaded Cells in Columns C, E, H and K. A Red Indicates An Erroneous Number in The Cell To The Left of TheElsa MendozaAinda não há avaliações

- Introduction To Accounting - Fall 2011 Example - Merchandising Recording TransactionsDocumento4 páginasIntroduction To Accounting - Fall 2011 Example - Merchandising Recording Transactionsq0% (1)

- Ac550 FinalDocumento4 páginasAc550 FinalGil SuarezAinda não há avaliações

- 13 Single Entry and Incomplete Records - Additional ExercisesDocumento5 páginas13 Single Entry and Incomplete Records - Additional ExercisesMei Mei Chan100% (2)

- ACCA Dec 2011 F7 Mock PaperDocumento10 páginasACCA Dec 2011 F7 Mock PaperCharles AdontengAinda não há avaliações

- How to Reconstruct Financial Statements After an Accounting FireDocumento12 páginasHow to Reconstruct Financial Statements After an Accounting FireCindy Fry100% (2)

- Comprehensive Problems Solution Answer Key Mid TermDocumento5 páginasComprehensive Problems Solution Answer Key Mid TermGabriel Aaron DionneAinda não há avaliações

- F06 MT1 Exam Review SolsDocumento9 páginasF06 MT1 Exam Review SolsTerra ThorneAinda não há avaliações

- ICMA Questions Aug 2011Documento57 páginasICMA Questions Aug 2011Asadul Hoque100% (1)

- DAC Technologies Group International, Inc.: 4700 Little Rock, 722 10Documento4 páginasDAC Technologies Group International, Inc.: 4700 Little Rock, 722 10d054985Ainda não há avaliações

- CAT CUP 1 ELIMINATION ROUND RESULTSDocumento55 páginasCAT CUP 1 ELIMINATION ROUND RESULTSPeter PiperAinda não há avaliações

- Wild Chap 1Documento7 páginasWild Chap 1Rahul GargAinda não há avaliações

- KISIAKMDocumento1 páginaKISIAKMhgoenAinda não há avaliações

- Technician Pilot Papers PDFDocumento133 páginasTechnician Pilot Papers PDFCasius Mubamba100% (4)

- Accountig 2.25Documento3 páginasAccountig 2.25vkeylinAinda não há avaliações

- Kunci Jawaban Soal Review InterDocumento5 páginasKunci Jawaban Soal Review InterWinarto SudrajadAinda não há avaliações

- CCFM, CH 02, ProblemDocumento4 páginasCCFM, CH 02, ProblemKhizer SikanderAinda não há avaliações

- CH 5 SolutionDocumento21 páginasCH 5 SolutionJoe MichaelsAinda não há avaliações

- Accounting Week 1Documento4 páginasAccounting Week 1Muhammad Fikri MaulanaAinda não há avaliações

- Answer Key: Sample Exam 1 Dr. Goh Beng WeeDocumento8 páginasAnswer Key: Sample Exam 1 Dr. Goh Beng Weeqwerty1991srAinda não há avaliações

- AC208Documento4 páginasAC208Prox NitroAinda não há avaliações

- Transaction Analysis and Preparation of Statements Practice Problem SolutionDocumento6 páginasTransaction Analysis and Preparation of Statements Practice Problem SolutionAshish BhallaAinda não há avaliações

- HANDOUT01 - Cash and Cash EquivalentDocumento4 páginasHANDOUT01 - Cash and Cash EquivalentDymphna Ann CalumpianoAinda não há avaliações

- Make-Up AssignmentDocumento5 páginasMake-Up AssignmentRileyAinda não há avaliações

- Documents Subject Accounts Form4 9PartnershipAccountsDocumento16 páginasDocuments Subject Accounts Form4 9PartnershipAccountsCartello008Ainda não há avaliações

- Quiz ZDocumento5 páginasQuiz ZShannen CalimagAinda não há avaliações

- Economic & Budget Forecast Workbook: Economic workbook with worksheetNo EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetAinda não há avaliações

- Project Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityNo EverandProject Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityNota: 4 de 5 estrelas4/5 (2)

- RBM LFA Masyarakat KotaDocumento18 páginasRBM LFA Masyarakat KotaDeenar Tunas RancakAinda não há avaliações

- Finance, Marketing & HR courses in MBA 2nd yearDocumento28 páginasFinance, Marketing & HR courses in MBA 2nd yearGaneshRathodAinda não há avaliações

- Valeura Hse Management System PDFDocumento19 páginasValeura Hse Management System PDFAbdelkarimAinda não há avaliações

- Presentation DCC10012 Sesi 220222023Documento3 páginasPresentation DCC10012 Sesi 220222023Putry JazmeenAinda não há avaliações

- ResumeChaturyaKommala PDFDocumento2 páginasResumeChaturyaKommala PDFbharathi yenneAinda não há avaliações

- Hana Simplification List: 30th July 2018Documento12 páginasHana Simplification List: 30th July 2018Raj ShekherAinda não há avaliações

- Lean Dan 5S Pada Bidang Jasa (Healthcare) PDFDocumento9 páginasLean Dan 5S Pada Bidang Jasa (Healthcare) PDFNisaa RahmiAinda não há avaliações

- Navigating Credit Risk and Financing Options in International PaymentsDocumento22 páginasNavigating Credit Risk and Financing Options in International PaymentsNguyen Van KhanhAinda não há avaliações

- Examination Warehouse SCM Profit 2023 (1) Muhammad Hafizh Al Ahsan (22b505041182)Documento5 páginasExamination Warehouse SCM Profit 2023 (1) Muhammad Hafizh Al Ahsan (22b505041182)Muhammad hafizhAinda não há avaliações

- PCI Professional Training Course DescriptionDocumento2 páginasPCI Professional Training Course DescriptionChristian AquinoAinda não há avaliações

- CH 02Documento37 páginasCH 02Tosuki HarisAinda não há avaliações

- Concepts of Central Person and Its Significance in Different Personnel AssignmentsDocumento10 páginasConcepts of Central Person and Its Significance in Different Personnel AssignmentsRajasekar RachamadguAinda não há avaliações

- Planning Strategies: Production PlanningDocumento22 páginasPlanning Strategies: Production Planningpprasad_g9358Ainda não há avaliações

- SAP Agricultural Contract ManagementDocumento14 páginasSAP Agricultural Contract ManagementPaulo FranciscoAinda não há avaliações

- CH 10Documento4 páginasCH 10vivienAinda não há avaliações

- Raising Seed Capital: Steve Schlafman (@schlaf) RRE VenturesDocumento82 páginasRaising Seed Capital: Steve Schlafman (@schlaf) RRE Venturesrezurekt100% (2)

- IPCC SM Notes by CA Swapnil Patni Sir May 2019 PDFDocumento77 páginasIPCC SM Notes by CA Swapnil Patni Sir May 2019 PDFBlSt SamarAinda não há avaliações

- Aus Tin 20104493Documento166 páginasAus Tin 20104493david_llewellyn_smithAinda não há avaliações

- Stratman NotesDocumento2 páginasStratman NotesWakin PoloAinda não há avaliações

- Quarter 1 Lesson 1Documento24 páginasQuarter 1 Lesson 1Princess Demandante BallesterosAinda não há avaliações

- Technical Delivery Manager IT EDM 040813Documento2 páginasTechnical Delivery Manager IT EDM 040813Jagadish GaglaniAinda não há avaliações

- Application OF THE Balanced Scorecard IN Strategy Implementation by Unilever Tea Kenya LimitedDocumento50 páginasApplication OF THE Balanced Scorecard IN Strategy Implementation by Unilever Tea Kenya LimitedShokry AminAinda não há avaliações

- Housing Site AnalysisDocumento1 páginaHousing Site AnalysisFrances Irish Marasigan100% (1)

- Financial InvestmentDocumento7 páginasFinancial InvestmentGerald de BrittoAinda não há avaliações

- Week 008-Module How To Identify A Target Market and Prepare A Customer ProfileDocumento16 páginasWeek 008-Module How To Identify A Target Market and Prepare A Customer ProfileWenzel ManaigAinda não há avaliações

- Kellogg's Case Study AnalysisDocumento3 páginasKellogg's Case Study Analysissalil1235667% (3)

- Sustainable Supply Chain Evolution and FutureDocumento42 páginasSustainable Supply Chain Evolution and Futureatiqa tanveerAinda não há avaliações

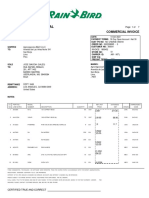

- Rain Bird International: 6991 E. Southpoint Road Tucson, AZ 85756 United States Fed Tax ID: 95-2402826Documento7 páginasRain Bird International: 6991 E. Southpoint Road Tucson, AZ 85756 United States Fed Tax ID: 95-2402826Alejandra JamboAinda não há avaliações

- Extended Warranties-Scope As Insurance Under Indian Contract ActDocumento4 páginasExtended Warranties-Scope As Insurance Under Indian Contract ActPISAPATI VISHNUVARDHAN 1950221Ainda não há avaliações

- Pyramid of QualityDocumento1 páginaPyramid of Qualitytrijunarso714Ainda não há avaliações