Escolar Documentos

Profissional Documentos

Cultura Documentos

SRMA Steel Newsletter 16th Issue

Enviado por

SuhailAhmedDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

SRMA Steel Newsletter 16th Issue

Enviado por

SuhailAhmedDireitos autorais:

Formatos disponíveis

SRMA STEEL NEWS

SRMA

Steel Re Rolling Mills

Association of India

www.sram.co.in

Steel Re-Rolling Mills

Association of India

www.srma.co.in Email : srmakol@srma.co.in

Sl. No,

1.

2.

3.

Name

Shri B.M. Beriwala,

Chairman

Shri Jagmel Singh Matharoo,

Vice Chairman

Shri Ramesh Kumar Jain,

Treasurer

4.

Shri Sanjay Jain

5.

Shri Kailasj Goel

6.

Shri G P Agarwal

7.

Shri O P Agarwal

8.

Shri S K Sharda

9.

Shri Sandip Kumar Agarwal

10.

Shri S. S. Sanganeria

11.

Shri Sanjay Surekha

12.

Shri R P Agarwal

13.

Shri S. S. Bagaria

14.

15.

16.

17.

18.

19.

20.

21.

Shri Girish Agarwal

Shri Goutam Khanna

Shri Suresh Bansal

Shri Rajiv Jajodia

Shri Bhusan Agarwal

Shri Mahesh Agarwal

Shri Sita Ram Gupta

Shri Ashok Bardeja

Page 1 of 15 16th Issue

Steel Re Rolling Mills Association of India visit www.srma.co.in

SRMA STEEL NEWS

SRMA

Steel Re Rolling Mills

Association of India

www.sram.co.in

CONTENTS

Executive Summary

The Present Scenario and Future Prospects of Indian Iron

and Steel

Key Imperatives Towards Realizing 2025 Vision

Second generation technologies for SRRM sector

Environment & Safety Focus

Labour & Legal News [Skill Development Mission Govt. of West

Bengal]

Taxation News

Event & Latest Steel News

Page 2 of 15 16th Issue

Steel Re Rolling Mills Association of India visit www.srma.co.in

SRMA STEEL NEWS

SRMA

Steel Re Rolling Mills

Association of India

www.sram.co.in

Presently Indian Steel industry is primarily based in raw material industry as for the production of one tonne of

steel, an integrated plant consumes 4 tonnes of raw materials. India with its abundant availability of high grade Iron

ore, the requisite technical base and cheap skilled labour is thus well placed for the development of steel industry

and to provide a strong manufacturing base for the metallurgical industries.

Indian Steel Industrys structure is comprises of several interdependent and interlinked segments for value addition,

broadly classified as the integrated or the majors producers and non-integrated or the Secondary Producers. India has

played a pioneering role in the recycling of scrap for the production of Steel through EAF/Induction Furnaces and

the rolling of both the Long and the Flat Products in Mini/Midi Mills at highly competitive prices.

Various scope for the reduction of production costs by the Secondary Sector through the technological upgradation,

particularly by the Electric Arc and the Induction Furnace Producers, through the conversion of Electric Arc

Furnaces to Twin shell Furnaces. Follow to the technological developments in the past decade, the non integrated

producers and the integrated compact Mills have emerged as low cost producers of Finished steel due to low capital

investment and breakeven points intense customer orientation and flexibility in altering the product-wise.

Vital job of steel producers should nurture the domestic market and the exports should not be at the cost of the

domestic industry. The U.S. Govt. has recently imposed a duty of 10% on the exports of the Melting scrap, to

improve domestic availability and stabilize prices and other countries have also adopted similar measures from time

to time. India as Global and manufacturing and outsourcing base. Apart from the vast domestic market, India has

also bright prospects to develop as a global manufacturing and outsourcing base for Iron and Steel based products.

The restructuring process at this critical stage be pushed through and economy opened up by the removal of all

bottlenecks and barriers and the projected investments on infrastructure development and housing, sharp growth of

Auto and Consumer Durables sector, foreign exchange reserves are indicative of sustained growth in Steel demand.

It is time for the steel industry to undertake modernization and expansion projects to cut the production costs and

prices as high Custom duties and prices retard industrial growth.

Indian steel industry has by and big operated in an insulated environment with high Custom Tariffs and Non-tariff

barriers. It must be realized that the competition changes the entire work culture, objectives and the efficiency of an

organization to achieve global competitiveness and several industries in India have already achieved this objective.

Indian industry therefore must endeavor and adopt effective measures to exploit the vast potential of the domestic

rural markets, expansion of the Manufacturing Sector and infrastructure development, to generate the demand for

steel products. The rise in the Indian per capita consumption even to the Asian average shall boost the demand for

Steel products by at least 100 million tonnes. It is therefore vital that the steel producers should nurture the domestic

market and the exports should not be at the cost of the domestic industry.

The Indian Auto and the Engineering Goods Sector with its inherent strengths has bright prospects to become an

integral part of the global production systems and multiply its current exports several folds in the coming years.

There is need for collaborative research between the Steel and Engineering industry for market development and

benchmarking with global standards of quality and prices to achieve the objective. The Govt. has thus to play a

pivotal role in providing the overall policy framework and coordination for the smooth implementation of

the development plans.

The policies focusing towards protectionism to competition and development, to break the vicious circle of high

prices and low demand. Indian steel industry has by and large operated in an insulated environment with high

Custom Tariffs and Non-tariff barriers. It must be realized that the competition changes the entire work culture,

objectives and the efficiency of an organization to achieve global competitiveness and several industries in India

have already achieved this objective. India has inherent comparative cost advantages in the production of steel.

Page 3 of 15 16th Issue

Steel Re Rolling Mills Association of India visit www.srma.co.in

SRMA STEEL NEWS

SRMA

Steel Re Rolling Mills

Association of India

www.sram.co.in

The steel industry is often considered to be an indicator of economic

progress, because of the critical role played by steel in

infrastructural and overall economic development. The per capita

usage of steel gives an indication of the technological

advancement of a nation.

The present status of the industry

India has one of the richest reserves of all the raw materials

required for the industry, namely land, capital, cheap labour, iron

ore, power, coal etc. Yet we are 5th in the world ranking for

production of steel. We produced 66.8 million tonnes in 2010-11,

while China, at the top of the list, produced 626.7 million tonnes.

Our per capita consumption of steel in India (at 50 kg per

annum) is well below the world average (at about 200 kg per annum) and much below that of the developed world

(around 350 kg per annum).

Vision 2020 of the Indian Steel Industry

The National Steel Policy 2005 aims at increasing the total steel production of the country to 110 million tonnes

per year (in 2019-20) from 38 million tonnes (in 2004-05). This was supposed to require a compounded annual

growth of about 7.3%. The total production in 2010 was 66.8 million tonnes. The compounded annual growth from

2005 to 2010 has been more than 9% which is better than the expected growth. But most of these are a result of the

brownfield expansion projects of the existing steel companies. But to continue with the same growth rate, we need

new Greenfield projects.

Currently Industry faced the problems

Many steel giants signed MoUs with several state governments (especially Jharkhand, Odisha, Chattisgarh and West

Bengal) for new projects but none of them have materialized. It has taken 5 long years for Tata Steels Kalinganagar

(Odisha) project to complete the rehabilitation and resettlement process. JSWs proposed Salboni plant (W.B) hasnt

been allotted the required amount of land, and moreover the government, recently, took control over about 400 acres

of land bought by the company because of a state rule that any outsider cant buy more than 24 acres of village land.

POSCO is facing massive resistance from the natives of Jagatsinghpur (Odisha) for land acquisition while many

other steel plants are awaiting aid from the government in terms of either land or infrastructure.

What is the effect we are facing due to this?

The steel industry has given rise to a good number of townships which are rich, advanced, well maintained and has

better lifestyles than the rest of the country. Jamshedpur, Vijaynagar, Bokaro Steel City, Rourkela, Bhilai,

Vishakhapatnam are just a few to name. There are many more cities waiting to be added onto this elite list. Other

infrastructural development (roads, railways, ports, power) would take place owing the development of the steel

industry. Huge amount of employment (10 lakhs jobs per year) would be generated because of this.

But this is sure to take longer than the speculated time if the present rate of land acquisition and the governments

listlessness continues. The government ensuring faster support (in terms of permissions, lands etc.) would mean a

faster growth rate of the country, and a step closer to becoming the superpower of the world. Thus one thing which

seems very clear is that if Vision 2020 needs to be achieved, then steel industry is where we need to focus.

Page 4 of 15 16th Issue

Steel Re Rolling Mills Association of India visit www.srma.co.in

SRMA STEEL NEWS

SRMA

Steel Re Rolling Mills

Association of India

www.sram.co.in

India has one of the largest reserves of goodquality iron ore globally. In

future, meeting domestic demand for iron ore will have to take precedence

over meeting export demand. In other words, India would need to leverage

its vast reserves to ensure consistent iron ore supply to domestic steel

companies at fair prices. There are two other factors that make raw material

prices critical to investments in steel plant: high cost of capital, and delays in

land acquisition and clearances. These factors put additional downward

pressure on return on steel investments. For coking coal, ramping up of

domestic production as well as securing overseas supplies will be critical to

meet Indias growing demand. Domestic miners should invest in enhancing

coal washing and beneficiation capabilities. Miners should also actively

acquire overseas assets to ensure lowcost availability of coking coal for steel companies. Indian steel companies

should focus their research and development efforts on improving coking coal productivity.

Streamline land acquisition and clearances processes explore the option of a cluster driven approach where the

government appoints a SPV as a nodal agency to acquire land and clearances; optimize the clearance process to

reduce number of touch points at the state and central levels. Innovative models need to be explored to lower the

lead times resulting from delays in land acquisition and clearance processes. One option to lower lead times can be

to follow a clusterdriven approach in which a Special Purpose Vehicle (SPV) is set up to speed up land

acquisition and clearances. Additionally, the clearance process needs to be optimized by reducing the number of

touch points at the state and central levels. Currently, the clearance process involves multiple levels of clearance

from state and central government agencies. This leads to longer lead times for projects. Simplification of this

process will go a long way in speeding up the overall process of setting up steel plants.

The steel industry is likely to be the backbone of Indias growth in future. The government needs to consider

providing the steel industry with infrastructure status. This will enable funding and borrowing from abroad at

cheaper rates. Additionally, lower taxation will further help improve return on investment, aiding the financial

closure process for steel plants. India needs to grow its construction output approximately four times over the next

12 years as it aspires to bridge the infrastructure gaps, spurring incremental steel demand. This can be achieved only

if the government speeds up execution through faster land acquisition and clearances. India should also look at

exploring necessary regulatory enablers to increase use of steel in construction.

Freight cost is an important component of overall landed cost, and therefore, it not only affects industry profitability, but also

affects the countrys relative cost competitiveness in world trade. In order to secure a freight advantage, India should prioritize

land infrastructure for transportation. Earmarking and investing in dedicated freight corridors would be a good step in this

direction. Additionally, timely and adequate supplies of power and water resources are critical enablers for realizing the vision.

India should focus on timely completion of power projects and ensure allocation of water resources to steel plants. Transforming

Indias growth path in steel would require a fundamental change in human resource management and development. For that

purpose, adequate funds should be deployed for setting up infrastructure for higher education and vocational training. Industry

institute partnerships should be promoted for inservice training of employees. Also, a closer collaboration with industry is

necessary to ensure that training imparted is relevant to the contemporary needs of the job.

The government can explore additionally employing policy measures like differential pricing of resources, setting up industrial

parks, incentivizing higher R&D, etc. to promote efficient utilization of resources. Indias steel sector needs significant capital

infusion and necessary technology enablers to realize its aspired growth. It is, therefore, necessary to use international industry

summits and conferences as platforms to publicize the goals of Indias steel industry and associated policy enablers to evoke

interest among global investors. Attracting global investors to invest in Indias steel story would not only assure access to low

cost capital, but would also facilitate appropriate technology partnerships to make Indias steel industry truly worldclass.

Page 5 of 15 16th Issue

Steel Re Rolling Mills Association of India visit www.srma.co.in

SRMA STEEL NEWS

SRMA

Steel Re Rolling Mills

Association of India

www.sram.co.in

Brainstorming UNDPs meeting on second generation technologies for SRRM sector. On 23rd May,

at Heritage Village of Manesar. Gurgaon, Haryana

UNDP is undertaking a program for energy efficiency in 300 rolling mills.

For this purpose they are recruiting persons for a period of 10 months,

who will visit all the 300 rolling mills on regular basis to ensure that the

concern rolling mills are actually implementing the technology proposed

by the UNDP. This programme is for a period of 10 months.

In addition to the programme for re-rolling industry, UNDP is also

initiating energy efficiency programme in the induction furnaces, these

being most power intensive. That existing burners have become obsolete

and require replacement by regenerated burners, which would not only

increase the production capacity but also reduce consumption of energy.

Understanding SRRM Sector in India

50% of rerolling mills are located in three clusters viz Mandi Gobindgarh, Bhavnagar & Raipur.

60-70% are scrap based mills with capacity as 1-3 TPH using primitive operating practices (fuel 75-100 kg/T,

scale loss 4-5%)

Balance 30-40% are ingot based with maximum capacity as 20 TPH (Average capacity 8-12 TPH, Fuel 60-80

kg/T, Scale loss 2-3.5%)

90% are pulverized coal fired.

Sale-purchase Scenario in SRRM Sector (Mandi Gobindgarh Cluster)

Purchase of raw material @ Rs.34500-35000/T

Sale price @ Rs.37500-38000/T i.e. conversion cost Rs.2500-3500/T

Fuel @ Rs.650/T

Electricity @ Rs.700/T

Product loss (assuming 3%) : Rs.1050/T

Labour wages & maintenance of various components in mill : Rs.500-700/T

The above breakup reveals that profitability could be realized only if better technological options be explored to reduce

mainly product loss besides energy consumption.

Measures to reduce Product Loss

Proper Furnace design:

Expertise for furnaces design and its manufacture available only for oil & gas as fuel (being used by only 5% mills in

the country) and for higher capacity ingot based mills based on local expertise.

Need for establishing scientific design and manufacturer for pulverized coal fired or multi-fuel fired furnaces

specifically for scrap based mills.

Proper air fuel ratio:

Fully automated PID controls (pressure/temp./O2) available for oil and gas fired mills

Need for developing semi automated PID controls for solid fuels and also effective pulverizer for proper fuel

preparation.

Development of handy/onsite fuel testing facilities.

Utilization of Product/Scale Loss

Scale loss in MGG Cluster : 45000 TPA (worth Rs.45-50 crore)

Present utilization through sale at Rs.3-4/kg.

Being exported to China for iron recovery.

Need to explore technology for setting up a common facility in MGG cluster e.g. sintering plant.

Page 6 of 15 16th Issue

Steel Re Rolling Mills Association of India visit www.srma.co.in

SRMA STEEL NEWS

SRMA

Steel Re Rolling Mills

Association of India

www.sram.co.in

To aim for an accident-free working environment is everyones responsibility.

Many steel companies have found it is possible to reduce dramatically the umber of

accidents at work by giving safety the necessary priority. Much can be done to

improve the situation further. The safety performance of our industry still varies

significantly between different businesses and between different departments in the

same business. The best show what can be achieved. This report is the result of an

exchange of ideas and experience between safety specialists and line managers from

IISI member companies around the world. It was commissioned by the IISI Board

of Directors and undertaken by the IISI Committee on Human Resources. It is

essential reading for all steel industry managers who wish to take up the challenge

of making the steel industry an accident-free working environment.

The Board of Directors comprises the Chief Executive Officers of the leading sixty steel enterprises around the world. The

Board approved the findings of the report and committed IISI to help its members achieve an accident-free working environment.

First, the publication of this report should be given wide circulation amongst managers in the steel industry. Secondly, a series of

regional seminars will be held to enable managers to share new ideas on improving safety. Thirdly, IISI will collect statistics

from its member companies to record progress on reducing accident rates.

This report was prepared by a special Working Group set up by the IISI Committee on Human Resources at the request of the

IISI Board of Directors. The report contains advice and recommendations on how to improve steel plant safety based on the

experience of senior line managers and safety specialists from IISI member companies around the world. It is addressed to senior

management, plant managers, safety managers and other specialist staff

in steel companies. The reports general remarks are supported by individual cases and examples.

Three components are essential to progress in steel plant safety:

1.

2.

3.

The condition of the work place environment.

The training and competence of employees.

The motivation and behaviour of employees.

The first two components have been discussed in previous reports on safety and, therefore, this report focuses on the potential of

the third element. The principal recommendations that appear in the report relate to the elements which are judged essential by

all the members of the Working Group:

1.

2.

Substantial commitment and leadership of safety by management - with both heartsand minds.

A change in the attitude and behaviour of individuals and working groups with respect to safety in all aspects of our

companies.

3. The elimination of a two-tier approach to safety.

For the first element, this requires:

A strong and visible commitment from the very top of the company and communicated to and shared by all levels of

management.

The setting of examples and the raising of standards by managers who must do themselves what they tell others to do.

Safety Slogan

An ounce of prevention is worth a pound of cure.

Be a safety hero: Score an accident zero.

Be aware. Take care.

Before you start, be safety smart.

Safety is as simple as ABC: Always Be Careful.

Safety awareness saves lives.

Page 7 of 15 16th Issue

Steel Re Rolling Mills Association of India visit www.srma.co.in

SRMA STEEL NEWS

SRMA

Steel Re Rolling Mills

Association of India

www.sram.co.in

Skill Development Mission Govt. of West Bengal

PLAN FOR SKILL DEVELOPMENT

Utilization of existing infrastructure.

Creation of New Infrastructure.

Setting up of monitoring mechanism at District level.

Initiatives taken by the Line Departments of Government of West Bengal

Technical Education & Training Department.

Labour Department.

Micro & Small Scale Enterprises & Textile Department.

Panchayat & Rural Development Department.

Food Processing & Horticulture Department.

Information & Technology Department.

Initiatives of Labour Department

Providing skill upgradation training to the pre-departure emigrant trainees.

Providing 50% fund assistance to the registered job seekers participating in vocational training.

Organizing mock test for various competitive examinations. Arranging vocational guidance/

counseling programme for assessment of job seekers ability to avail of the opportunities in

employment market.

Initiatives of Micro & Small Scale Enterprises

10185 nos of sericulturists have been trained up for skill upgradation in plantation, rearing &

reeling activities in the last FY.

275 micro & small entrepreneurs have been trained for skill development in the last FY.

Page 8 of 15 16th Issue

Steel Re Rolling Mills Association of India visit www.srma.co.in

SRMA STEEL NEWS

SRMA

Steel Re Rolling Mills

Association of India

www.sram.co.in

Providing skill upgradation training for Lac cultivators,

coir cultivators, bee keepers etc.

Arranged advanced skill training for 42 handicraft

artisans in last FY.

EDP Programmes have been arranged for 1830

enterprenuers in last FY.

About Rs. 1.32 crore has been spent for skill development in the last FY.

Initiatives of Panchyat & Rural Development Department

Skill training in:

Animal Resource Development in Dairy, Piggery, Goatery, Duckery, Poultry etc.

Horticulture, floriculture, vermicompost and other bio-manure preparation.

Apiary collection or processing of other forest products.

Food processing inclduing spice making.

Making items from leather, horns and other animal products.

Pottery, shoe making, bamboo/ cane product, mat, pati making.

Weaving, embroidery and garment making, jeweller making etc. Initiatives of Food Processing &

Horticulture Department

Skill Development training through different schemes like National Horticulture Mission,

ASIDE,RIDF etc.

3 years Diploma Courses are offered in two Govt. Polytechnics.

Skill training on pre & post harvest management, horticulture farmers, pre sowing techniques for

potatoes, high density cultivation of pineapples, organic farming in mango orchards, litchi orchards

organic farming of vegetables.

Skill training in production of exotic vegetables like broccoli, capsicum etc. Initiatives of Information &

Technology Department

One academic council is monitoring the syllabus & training for the manpower requirement of IT

industries.

Page 9 of 15 16th Issue

Steel Re Rolling Mills Association of India visit www.srma.co.in

SRMA STEEL NEWS

SRMA

Steel Re Rolling Mills

Association of India

www.sram.co.in

TAXATION NEWS

TAX PROPOSALS IN INTERIM BUDGET (Vote on Accounts) 2014-15

While there are no changes in direct tax rates the interim budget has proposed some relief in excise

duties to some sectors reeling in slow growth. This relief is by way of reduction in excise duty rate for a

th

period upto 30 June, 2014

Direct Taxes :

No Change in Income Tax and Other tax rates\

10 percent surcharge on super rich assesses having annual income of over Rs. 1 crore will

continue

5 percent surcharge on corporate with turnover of Rs. 10 crore or above

In case of foreign companies, surcharges increased from 2 percent to 5 percent

st

Moratorium provided on interest on education loan taken before 31 March, 2009

Other additional surcharges will also continue till new Finance Act is enacted.

Direct Tax Code to be taken forward by the new government

Indirect taxes

Excise duty towered by 6 percent on SUVs, 4 percent for car and commercial vehicles and 4

percent on scooters / motor cycles

Reduction in duties on chases and tailors also

Excise duty reduced by 2 percent for capital goods and consumer durables (electronic goods,

kitchen appliances, Laptop, AC etc.)

Excise duty mobile phones slashed and rationalized with / without Cenvat credit- it will be 6

percent with Cenvat credit or 1 percent without Cenvat credit

Rice brought at par with paddy on levy of Service Tax and loading, unloading, packing, storage

and warehousing of rice shall be exempt from service tax.

Blood bank to be exempt from Service Tax like clinical establishments

To encourage domestic production of soaps/ oleo chemicals, customs duty on non-edible

industrial oils, fatty acids and fatty alcohols rationalized at 7.5 percent

Exemption from CVD on imported road construction machinery withdrawn will help domestic

production.

Central Excise : Reduction In Excise Duty From 12% to 10% On All goods

falling under chapter 84 and chapter 85

Central Government has announced reduction in excise duty from 12% to 10% on all goods failing

under chapter 84 and chapter 85 of the Schedule to the Central Excise Tariff Act for the period upto

30.06.2014 which includes consumer durable (e.g. television sets, refrigerators, set top box, telephone

set, CD , DVDs washing machine, personal computers etc.) and capital goods (e.g. machineries, boilers,

turbines, forklift trucks, printing devises, electric motors and generators etc.) The rates can be reviewed at

the time of the regular Budget.

Page 10 of 15 16th Issue

Steel Re Rolling Mills Association of India visit www.srma.co.in

SRMA STEEL NEWS

SRMA

Steel Re Rolling Mills

Association of India

www.sram.co.in

Indian Pellet & DRI Summit 2014

Policy <> Price <> Trade <> Technology <> Networking

Organiser : SteelMint Events

Venue : ITC Sonar, Kolkata

Date : Friday 27 t h June,2014

Website : http://events.steelmintgroup.co m/index.php

Minerals, Metals, Metallurgy & Materials (MMMM) 2014

4-7, September 2014

Pragati Maidan

New Delhi

For Booking & Enquiries

International Trade and Exhibitions India Pvt. Ltd.

1106-1107, Kailash Building, 26 K.G. Marg, New Delhi- 110001, India

Tel: +91 11 40828282

Gagan Sahni: +919810036183

Varun Sharma:+91 11 40828208

Smita Roy: +91 11 40828217

Sandeep Arora: +91 11 40828227

9th Asian Stainless Steel Conference 4-5 June 2014

Organizer : Metal Bulletin Events and SMR

Venue

: Ritz Carlton, Hong Hong

Date

: 4-5 June 2014

Website

: https://www.metalbulletin.com/EventRegister/7128/Events/9th-Asian-StainlessSteel-Conference.html?Ev

--------------------------------------------------------------------------------------------------------------------------------------------

The 15th Guangzhou International Stainless Steel Industry

Exhibition

Organiser : Guangzhou Julang Exhibition Design Co. Ltd.

Venue

: China Import and Export Fair Pazhou Complex B Area First Floor

Date

: June 16-18, 2014

Website : http://www.julang.com.cn/

Page 11 of 15 16th Issue

Steel Re Rolling Mills Association of India visit www.srma.co.in

SRMA STEEL NEWS

SRMA

Steel Re Rolling Mills

Association of India

www.sram.co.in

STEEL NEWS

Modi Magic - India Inc looks up with hope after dismal FY 14

Change of regime has brought about concerted efforts by the Indian economy and industry to obliterate painful past with meagre

4.7% GDP growth lowest in last 25 years.

Riding the crest on soaring aspirations after the dismal economic performance the new government has suddenly dawned

optimism which remains to translate into concrete action and demand.

Even though some of key economic indicators showed blip in last quarter it was a case of too little too late. Government hemmed

by runaway inflation and fiscal deficit was engaged in liquidity squeezing to control nearly double digit inflation.

Adding to the growth challenge is an adverse global economic climate that is hemming in the country's exports growth. The

sector accounts for nearly a quarter of the domestic economy.

Meanwhile, hopes of an economic revival have attracted copious capital inflows, triggering a rally in the country's financial

markets. The BSE index is already the best performing equity index in Asia this year. The Indian rupee too, has hit an 11-month

high to the dollar.

New government has chipped in with 10 point agenda to unshackle the gigantic potential of Indian economy as follows

1. Build up confidence In bureaucracy

2. Education, health, water, energy & roads get top priority

3. Mechanism for inter-ministerial issues

4. Addressing concerns about economy

5. Stability and sustainability in government policy

6. Welcome innovative ideas. Give bureaucrats independence to work without pressure

7. Transparency in governance. E-auction will be promoted In tendering & government work

8. Infrastructure and investment reforms

9. Implement policy in time bound manner

10. People oriented system to be put in place ,stress on addressing peoples problems

The action oriented agenda smacks of clarity, certainty and timely implementation of policies is what the industry desires and

when translated into action, a sound basis will be set for investments to flow in.

Steel industry is looking with avid interest of unshackling slew of new infrastructure projects and thrust on housing leading to

spike in steel consumption. Union budget is likely to come up with sector wise tax stimulus to infuse life. At the same time the

government cannot let off liquidity surge when inflation remains recalcitrant. However infusion of FDI in key sectors will

provide the necessary liquidity for growth and demand generation.

In the housing sector target to provide house all the government staff as part of social responsibility by 2022 under PPP model

will certainly give fillip to steel demand.

Policy measures taken in short term is likely to translate into demand by Q3 and Q4, FY15 bringing some relief to economy and

industry. USD 1 trillion infrastructure investment plan of FYP 12 had proved to be non-starter in the last regime but with stable

and decisive government in place fireworks are round the corner.

Source Strategic Research Institute, Steel Guru

(www.steelguru.com)

Page 12 of 15 16th Issue

Steel Re Rolling Mills Association of India visit www.srma.co.in

SRMA STEEL NEWS

SRMA

Steel Re Rolling Mills

Association of India

www.sram.co.in

New steel minister Mr Tomar to review status of steel projects

PTI quoted Mr Narendra Singh Tomar, who took charge of Steel Ministry, as saying that he will review progress of steel projects

and will fix accountability on the officials, who are found to be responsible for delays.

He said that "We will review the current status of the projects and understand the reasons for their delays. If we find that the

delays are on the part of the officials, we will fix the accountability on them."

Mr Tomar said that the growth of the country depends on the growth of the steel sector.

He said that We will look into the problems being faced by the sector and make efforts to address them. If there are any

irregularities found in any department under his ministries, it will be throughly probed and those held accountable would not be

spared.

Source - PTI

(www.steelguru.com)

SAIL expects better steel demand in 2014-15

It is reported that Steel Authority of India Limited expects the current financial year to March to be better than 2013-14 on the

back of softening in input prices, relative stabilisation of the rupee and likely easier interest rates, which may drive steel

consumption in the country.

The company said at a post earnings conference call that the current financial year would be better. The input prices are also on

the lower side, the rupee has also centred and we feel that the impact of this would be available and the interest rates are also

coming down steadily

The company also expects to reap the benefits of the enhanced capacities from the current financial year where modernisation

and expansion is underway.

The management said that the companys net sales realisation for May will be down by INR 800 to INR 850 per tonne as

compared to March, for the June quarter, the product prices were down by INR 500 to INR 700 per tonne from the last quarter.

Acknowledging there was a lull in demand in the market post March, the company said that it had hiked discounts which is

offered to customers while keeping the base prices intact.

Source www.freepressjournal.in

(www.steelguru.com)

MOIL plans INR 600 crore ferroalloy plant in Bhilai

Times of India reported that PSU Manganese Ore India Limited is planning to forge a three way joint venture with Steel

Authority of India Limited and Rashtriya Ispat Nigam Limited to set up a ferroalloys plant at an investment of over INR 600

crore at Bhilai in Chhattisgarh state.

A source in the ministry of steel said that "Originally, there were plans to strike a separate JV with SAIL and RINL, with a plant

each at Bhilai and Bobbili in Andhra Pradesh. The Andhra plant could not take off due to the power crisis in the state. At the

same time, suitable bids did not come in for the Bhilai venture. Now, it has been finally decided to have a common plant at

Bhilai, where SAIL has its unit."

Page 13 of 15 16th Issue

Steel Re Rolling Mills Association of India visit www.srma.co.in

SRMA STEEL NEWS

SRMA

Steel Re Rolling Mills

Association of India

www.sram.co.in

A source said that the plant will have a capacity of 150,000 tonne per annum. This will be advantageous to both MOIL and the

steel makers. The former will get an assured market while the latter will get an assured supply of ferroalloys an essential

ingredient in steel making.

The source said that earlier, MOIL planned to have 50% stake in each of the JVs. Now, the modalities are still being worked out

but a part of the project will be funded with debt.

Source - Times of India

(www.steelguru.com)

Indian Iron ore Mining Mess - Major hurdles ahead for Odisha miners

Business Standard reported that although the Supreme Court, which ordered the shutdown of mines involved in

irregular mining in Odisha on May 16th, has asked the Odisha government to decide within 6 months on whether or

not to extend their leases, the imbroglio is likely to continue longer than that.

After the court order, a high powered committee of the state government recommended the renewal of the leases of

13 of the 26 mines provided they fulfilled three conditions.

1. Pay the penalty for excessive mining

2. Get permission for total diversion of the forest land inside the lease area, instead of seeking forest diversion in

parcels

3. Get approval for using tribal land

The miners hope to get around the first condition by filing an affidavit stating that they would pay the penalty if the

court orders them to do so, given that the matter is sub judice. Odisha had imposed a fine of INR 65,500 crore on

over a hundred miners for extracting more than the permitted ore between 2000 and 2010.

It's the other 2 conditions that have the miners worried. Earlier, mine-owners would seek diversion of forest land in

parts, as and when they required the area within the lease boundary to expand their mining operations. Now,

according to a circular issued by the Union ministry of environment and forest, it is mandatory for them to get the

ministry's nod for diversion of the entire forest land within their lease area.

Getting approval for using tribal land within the lease area is another big concern. Since 2002, the Odisha

government has disallowed sale or leasing out of tribal land to non-tribal persons. Hence, those mine-owners who

had not taken possession of the tribal land within their lease boundary before the cut-off date and were mining the

land by paying a rent to the tribal land-owners now find themselves in the soup. A mine owner said that "Getting a

clearance for the entire forest land in one go will be a Herculean task. Given the pace at which forest clearances are

given, this will take three to 5 years."

Source Business Standard

(www.steelguru.com)

Steel Ministry suggestions to new government in India

Business Standard reported that diluting PSUs' stake to 51%, ensuring raw material security to steel makers and

steps to boost production are among a dozen suggestions by the Steel Ministry for the new government. The

presentation comes ahead of Mr Narendra Modi led BJP government taking charge.

In a presentation for the Cabinet Secretary, the ministry suggested that the new government should bring down

stakes in steel PSUs to 51% and utilise the proceeds for development. Steel Authority of India, Rashtriya Ispat

Nigam, iron ore miner NMDC Limited, manganese ore producer MOIL Limited and pellet maker KIOCL Limited are

the major PSUs under the administrative control of the Steel Ministry. Government has 80% stake each in SAIL,

Page 14 of 15 16th Issue

Steel Re Rolling Mills Association of India visit www.srma.co.in

SRMA STEEL NEWS

SRMA

Steel Re Rolling Mills

Association of India

www.sram.co.in

NMDC and MOIL. RINL and KIOCL are yet to be listed. It can rake in a whole lot of funds by pruning its stakes down

to 51% in these companies.

The ministry has also suggested that there is a need to reform the current raw material policy and allot captive mines

to steel producers so that they meet at least half of their long-term requirements. There is also a need to introduce

single-window mechanism for streamlining the allocation of raw materials.

It was also stated that there is need to create special mining zones through a special legislation and prepare

comprehensive environment, forest management plans for areas declared to be bearing raw material like iron ore and

coal. The ministry also suggested that initiatives should be taken to raise country's steel production capacity to 300

million tonne per annum within the next 10 to 15 years from around 100 million tonne per annum now.

It said that to achieve this goal, special purpose vehicles should be created in collaboration with state governments to

fast track land acquisition and statutory clearances. Officials said that In line with power sector, which is entitled to

duty-free imports of gas, steel sector should also be allowed to import critical raw material like iron ore, natural gas

and scrap without any duty.

Source Business Standard

(www.steelguru.com)

India : CG Update, New VAT/CST may benefit small & Medium Scale Steel Makers

According to CG Budget announcement w.e.f Apr 2014 the VAT/CST charges implemented as per the

industry capital categorization. The steel industry falling under the small scale (capital less than 1 crore)

and medium scale (capital less than 10 crore) is being charged by 3% VAT. However large scale (capital more

than 10 crore but less than 100 crore) industry is being charged by 5% VAT.

(www.steelmint.com)

Indian 8 core industries post 4.2pct growth in April

According to the core sector data released by the Indian commerce ministry on the eight key industries, coal, crude oil, natural

gas, refinery products, fertilisers, steel, cement and electricity, has grown at 4.2% in April 2014

April 2014 data

1. Cement production Up by 6.7%

2. Electricity generation Up by 11.2%

3. Natural gas production Down by 7.7%

4. Crude oil production Down by 0.1%

5. Fertilisers Up by 11.1%

6. Coal Up by 3.3%

7. Petroleum refinery product Down by 0.1%

8. Steel output Up by 3.1%

The growth, though indicates an uptick in the economic activity, it is also due to a weak base in the last fiscal, which witnessed a

growth of 3.7 per cent only.

Source Strategic Research Institute, Steel Guru

(www.steelguru.com)

Page 15 of 15 16th Issue

Steel Re Rolling Mills Association of India visit www.srma.co.in

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Some Tips About The Classification of Wire Breakages Part A - 2012 PDFDocumento2 páginasSome Tips About The Classification of Wire Breakages Part A - 2012 PDFNabeel Ameer100% (1)

- Delhi NCR PIN CodeDocumento13 páginasDelhi NCR PIN CodeSuhailAhmedAinda não há avaliações

- F2328 05 (Reapproved 2011)Documento4 páginasF2328 05 (Reapproved 2011)krishna1401Ainda não há avaliações

- Invitation For Tender - P3Documento2 páginasInvitation For Tender - P3SuhailAhmedAinda não há avaliações

- Registration Slip: Sl. No. ReplyDocumento3 páginasRegistration Slip: Sl. No. ReplySuhailAhmedAinda não há avaliações

- Table IIDocumento20 páginasTable IISuhailAhmedAinda não há avaliações

- Research Intern ApplicationDocumento2 páginasResearch Intern ApplicationSuhailAhmedAinda não há avaliações

- 11884new Syllabus ITTDocumento11 páginas11884new Syllabus ITTSuhailAhmedAinda não há avaliações

- New York State Department of Financial Services: Report On Cyber Security in The Banking SectorDocumento13 páginasNew York State Department of Financial Services: Report On Cyber Security in The Banking SectorSuhailAhmedAinda não há avaliações

- Activities USA Japan China Korea India PlanningDocumento3 páginasActivities USA Japan China Korea India PlanningSuhailAhmedAinda não há avaliações

- Global Scenario On Supply, Demand and Price Outlook For Vegetable Oils - 2014Documento9 páginasGlobal Scenario On Supply, Demand and Price Outlook For Vegetable Oils - 2014SuhailAhmedAinda não há avaliações

- Exim Code Item Description PolicyDocumento1 páginaExim Code Item Description PolicySuhailAhmedAinda não há avaliações

- Earn A Buck DelhiDocumento1 páginaEarn A Buck DelhiSuhailAhmedAinda não há avaliações

- MMTC 1Documento88 páginasMMTC 1SuhailAhmedAinda não há avaliações

- Unit-1 Comparative Politics - Nature, Significance and EvolutionDocumento7 páginasUnit-1 Comparative Politics - Nature, Significance and EvolutionSuhailAhmed100% (1)

- 2014 CCCP Last Year PaperDocumento13 páginas2014 CCCP Last Year PaperSuhailAhmedAinda não há avaliações

- Competency Mapping MMTCDocumento56 páginasCompetency Mapping MMTCpdprojAinda não há avaliações

- Minutes of The 5th Meeting of The PMC Under The Chairmanship of Secretary HUADocumento14 páginasMinutes of The 5th Meeting of The PMC Under The Chairmanship of Secretary HUARahul SrivastavaAinda não há avaliações

- Ch8. Welding Symbols PDFDocumento66 páginasCh8. Welding Symbols PDFMEHMET SIDDIK TEKDEMİRAinda não há avaliações

- Welding of Stainless Steels & Duplex: Roshan RampureDocumento74 páginasWelding of Stainless Steels & Duplex: Roshan Rampureapurva karleAinda não há avaliações

- Valve Material Application PDFDocumento16 páginasValve Material Application PDFSudherson Jagannathan100% (1)

- Commercial Catalog PIVADocumento12 páginasCommercial Catalog PIVAVanja Zoric SundicAinda não há avaliações

- Pvm-Eg-4750-C (No Comments)Documento16 páginasPvm-Eg-4750-C (No Comments)abdelillahAinda não há avaliações

- Lesson Plan SMAW 12Documento8 páginasLesson Plan SMAW 12Jymaer GeromoAinda não há avaliações

- FormatDocumento27 páginasFormatAnsaf AskyAinda não há avaliações

- RockwoolDocumento40 páginasRockwoolMimin Proyek ApaajaAinda não há avaliações

- CBC TemplateDocumento8 páginasCBC TemplateVanessa TuazonAinda não há avaliações

- Brittle Fracture TWIDocumento13 páginasBrittle Fracture TWIHouman Hatamian100% (1)

- Foundations of Materials Science and Engineering 5th Edition Smith Solutions ManualDocumento39 páginasFoundations of Materials Science and Engineering 5th Edition Smith Solutions Manualcacoonnymphaea6wgyct100% (15)

- Aplication LetterDocumento24 páginasAplication Letterputra muzal candraAinda não há avaliações

- Suvranil Resume 4ALSTMDocumento10 páginasSuvranil Resume 4ALSTMBanerjee SuvranilAinda não há avaliações

- Handbook To Bc1 2023Documento59 páginasHandbook To Bc1 2023cklconAinda não há avaliações

- A Review of Postweld Heat Treatment Code ExemptionDocumento46 páginasA Review of Postweld Heat Treatment Code ExemptionReza GhavamiAinda não há avaliações

- Case Study: CrankshaftsDocumento12 páginasCase Study: CrankshaftsDHRUV SINGHALAinda não há avaliações

- As 3588-1996 Shower Bases and Shower ModulesDocumento7 páginasAs 3588-1996 Shower Bases and Shower ModulesSAI Global - APACAinda não há avaliações

- The Premium Structural Solution: Hot-Finished Structural Hollow SectionsDocumento8 páginasThe Premium Structural Solution: Hot-Finished Structural Hollow SectionsJoséRegueiroAinda não há avaliações

- Test Description (Information Only)Documento2 páginasTest Description (Information Only)dayalramAinda não há avaliações

- 3.3. Oes-Td-Int-005-Fs-Mm02Documento6 páginas3.3. Oes-Td-Int-005-Fs-Mm02sumit kumarAinda não há avaliações

- Abschn 04Documento52 páginasAbschn 04dongwook712Ainda não há avaliações

- Astm E1647 09Documento5 páginasAstm E1647 09jimmyjohn74Ainda não há avaliações

- Hammer Development CoalDocumento12 páginasHammer Development Coalppd9890Ainda não há avaliações

- AMS4907MDocumento10 páginasAMS4907Mremaja1249Ainda não há avaliações

- Steeel ObjectivesDocumento20 páginasSteeel ObjectivessaikiranAinda não há avaliações

- Asme WPS Demo PWHT PDFDocumento3 páginasAsme WPS Demo PWHT PDFGanesh rohitAinda não há avaliações

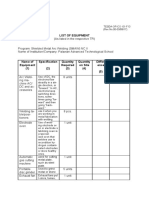

- Smaw List of Equipment Tesda-Op-Co-01-F13Documento3 páginasSmaw List of Equipment Tesda-Op-Co-01-F13Manilyn GaranganaoAinda não há avaliações