Escolar Documentos

Profissional Documentos

Cultura Documentos

Umair Shaukat Final Report

Enviado por

Shahab AshfaqueDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Umair Shaukat Final Report

Enviado por

Shahab AshfaqueDireitos autorais:

Formatos disponíveis

THE BANK OF PUNJAB

BANK OF PUNJAB

(PASSION REBORN)

THE BANK OF PUNJAB

Internship report submitted to the Department of

Management Sciences, COMSATS Institute of Information

Technology, Wah campus, in fulfillment of the requirement

for the degree of Bachelors in Business Studies.

THE BANK OF PUNJAB

Internship Report

(2014)

Internship Report

Bachelors in Business Studies program

Name:

Reg. #:

Specialization:

Telephone:

E-mail:

Institution:

Umair Shaukat

FA13-BBS-011

Finance

0312-5337918

umairshaukat15@gmail.com

COMSATS Institute of Information Technology

Company Name:

Main Telephone #s:

Postal Address:

BANK OF PUNJAB (TAXILA BRANCH)

Supervisor Name:

Telephone Number:

Faheem Nazeer

0321-5091872

Start Date for Internship:

End Date for Internship:

02 -July- 2014

30 -August- 2014

Report Date:

11-December-2014

051-4545148, 9, 4542150

Chock Sarai Kala, G T Road, Taxila

THE BANK OF PUNJAB

EVALUATION

Umair Shaukat

Completed Internship at

Bank of Punjab

Internship report submitted for the final Evaluation in Partial Fulfillment of

the requirements for the Degree of

Bachelors of Business Studies

It is certified that, the internship report and the work contained in it

conforms to all the standards set by the institute for the evaluation of any

such work.

1.

____________________________________________

2.

____________________________________________

3.

____________________________________________

4.

____________________________________________

THE BANK OF PUNJAB

ACKNOWLEDGEMENTS

All Praises to Almighty Allah (The most merciful the most beneficial), who helped me to

complete my Internship program and the report in spite of various difficulties. I would

also like to acknowledge my debts to those officers of Bank of Punjab who have been

extremely helpful for me.

My gratitude to Mr. Faheem-Bin-Saleem, He has been a permanent source of

encouragement and guidance. His helpful nature did not restrict me to the premises to the

branch but extended to any place and any matter I needed his support on.

Moreover, I would also acknowledge my debt to Mr. Faheem Nazeer,

Mr. Nasir, Mr.

Faizan, Mr. Javaid Ahmad, Ms. Samina BiBi, Mr. Habib-ullah chudary, and Mr. Abdul

Rasheed for the helpful hand they extended towards me at any time.

In short, I would always be thankful to all the managers and officers, for their courteous

and compassionate treatment given to me.

Thanks to all

THE BANK OF PUNJAB

PREFACE

For a Business Graduate the understanding and memorizing of some concepts during a

degree is not only the knowledge enough for him but its practical implementation or

observation of practical implementation makes it almost a complete knowledge.

The same kind of responsibility was assigned to me by my institution, COMSATS

institute of information technology as I am student of BBS of this institution and I was

assigned to do internship as pre-requisite of my degree and to enhance my practical skills

in the running business environment of any organization. The objective of this internship

program is to expose my self into the practical atmosphere where i can observe, analyze

and even practice the application of the professional knowledge that I have acquired

during the course of studies. For this I got a chance to do internship in Bank of Punjab

(BOP) which proved to be very beneficial for me.

After the completion of internship program, internship report has been prepared just in

accordance with the practical exposure.

Umair Shaukat

THE BANK OF PUNJAB

CONTENTS

EXECUTIVE

SUMMARY

CHAPTER 1 :-

INTRODUCTION AND BACKGROUND OF BANK OF PUNJAB

1.1

Introduction of Bank of Punjab

1.2

History of banking in Pakistan

1.3

History of Bank of Punjab

1.4

Present status of Bank of Punjab

1.5

Core Philosophies of Bank of Punjab

1.6

Vision, Mission & Objectives

CHAPTER 2 :-

MANAGEMENT SYSTEM OF BANK OF PUNJAB

2.1

Hierarchy of Bank of Punjab

2.2

Introduction of Taxila, Branch

2.3

Personnel in various sections

2.4

Managing the organization

2.5

Internship policy

CHAPTER 3 :-

PRODUCTS AND SERVICES OFFERED

3.1

Products

3.2

Services

CHAPTER 4 :-

THE BANK OF PUNJAB

INTERNSHIP PROGRAMME AT BANK OF PUNJAB, TAXILA

BRANCH

4.1

Customer Services

4.2

Account Opening

CHAPTER 5 :-

FINANCIAL ANALYSIS OF BANK OF PUNJAB

5.1

Ratio Analysis

5.2

Horizontal Analysis

5.3

Vertical Analysis

CHAPTER 6 :-

SWOT ANALYSIS AND PEST

6.1

Strengths and Weaknesses

6.2

Opportunities and Threats

CHAPTER 7 :-

CONCLUSION AND RECOMMENDATIONS

7.1

Conclusion

7.2

Recommendations

BIBLIOGRAPHY

APPENDIX

THE BANK OF PUNJAB

EXECUTIVE

SUMMARY

Banks do play a central role in the development process. They being the channels,

through which the savings of the society pass from savers to investors, transform surplus

resources into productive investments. Bank of Punjab being the same but one of the

government banks of Pakistan.

My internship report on the bank of the Punjab consists on various dimensions, which I

have learned through my observation, interviewing the bank officers and customers

during the internship period. For more accurate and up to date data, I took help from the

internet as the websites used are mentioned in Bibliography.

This report includes the background information of the bank, its emergence through

different phases, its present status and the vision and mission with core philosophies

adopted by bank of Punjab. This study mainly relates the commercial banking rather than

the Islamic banking of Bank of Punjab. By studying the Annual statement of BOP, I have

done the financial calculations and then by examining the most related reasons going

around for changing trends in calculations, i have done the financial analysis to my best

understandings. Finally, the conclusion and recommendations are given at the end as per

my best knowledge and understandings of Bank of Punjab.

THE BANK OF PUNJAB

CHAPTER 1 :-

INTRODUCTION AND BACKGROUND OF BANK OF THE PUNJAB

History of banking:

Pakistan came into being on 14th August, 1947; sufficient banking services were

available in the areas forming Pakistan. Out of the total branches of the nearly3,500 in the

undivided India, as many as about 1,500 branches were existing in theseareas.It was

agreed between the two countries that reserve bank of India shall continue to function in

the Pakistan territory until 30th September 1948 and that Indian notes would continue to

be legal tender at Pakistan until 30th September 1948.Unfortunately, relationship

between the two countries became most strained immediately after independence;

banking was mostly in the lands of Hindus who immediately started transferring their

offices and assets into India. As a result most of the banks in Pakistan were closed down

and even those which were open were not doing any effective business. The number of

banking office in Pakistan came down to about 200 on 30thJune 1948. Branches of some

European banks were also functioning in a limited manner, financing in export of crops,

and their number was limited to about 20.It was only the Habib bank, which transferred

its office from Bombay to Karachi Austral Asia bank was another bank, which was in

existence in the Pakistan territory at the time of independence. Despite of best efforts on

the part of government of Pakistan, no heady way could be made on this behalf and

reserve bank of India was in no mood to help the new country. Imperial bank of India,

agent of the reserve bank of India also started closing down its branches in Pakistan.

Reserve bank also refused to advance money to Pakistan to make essential payments such

as salaries etc., also Pakistans share of Rs.75 billion in cash Balance was with held by

bank, causing hardships to the newly born state. In view of these hopeless state affairs it

was agreed between the two countries that reserve bank would serve as monetary

authority in Pakistan only up to 30th June 1948.

1.1 INTRODUCTION OF BANK OF PUNJAB

10

THE BANK OF PUNJAB

1.2 HISTORY OF BANK OF PUNJAB

The Bank of Punjab was established in 1989 and was given the status of scheduled bank

in 1994. The Bank of Punjab is working as a scheduled commercial bank with a network

of almost 273 branches at all over major locations in the Punjab. The Bank provides all

types of banking services such as Deposits in Local Currency and client foreign currency,

remittances, and advances to business, trade, industry and agriculture. The Bank of

Punjab has indeed entered a new era of science to the nation under experience and

professional hands of its management. The Bank of Punjab plays a vital role in the

national economy through mobilization of hitherto untapped local resources, promoting

savings and providing funds for investments. The bank offers attractive rates of profit on

all deposits, opening of foreign currency accounts and handling of foreign exchange

business for example imports, exports and remittances, financing, trade and industry for

working capital requirements and money market operations. The lending policy of bank

is not only cautious and constructive but also based on principles of prudent lending with

maximum emphasis on security. The Bank provides all types of banking services such as

Deposit in Local Currency, Client Deposit in Foreign Currency, Remittances, Advances

to Business, Trade, Industry and Agriculture A wholly owned subsidiary of BOP First

Punjab Modaraba (FPM) was established in 1992 and is being managed by Punjab

Modaraba Services (Pvt) Ltd , a wholly owed subsidiary of The Bank of Punjab. Lending

under Islamic mode of finance, main vehicles are Morabaha, Ijarah &Musharaka to

encompass requirements of corporate, commercial and individual customers. Liability

generation through COMs (Certificate of Musharika) offers attractive returns to

individuals and institutional depositors for fixed tenure instruments. FPM is working to

introduce new and innovative products to enhance its range of services

AWARDS OF BANK OF PUNJAB

Excellence Award by the Central Board of Revenue

The Central Board of Revenue presented "Excellence Award" to the Bank of Punjab in

recognition of the contribution made by the bank towards Government exchequer.

11

THE BANK OF PUNJAB

3rd Kissan Time Awards

In recognition of Bank's contribution in development and growth of agricultural sector,

the Bank honored with "Top Bank for Agriculture Loans" and "Best Bank Crop

Insurance" under 3rd Kissan Time Awards year 2006.

Best Corporate Report Award

Annual Report of the Bank for the year 2005 won 5th position for "The Best Corporate

Report Award" for the financial sector, adjudicated jointly by the Institute of Chartered

Accountants of Pakistan and the Institute of Cost and Management Accountants of

Pakistan.

16th Bolan Excellence Award

The Bank was awarded Best Bank Award under 15th Bolan Excellence Awards

distributed in 2006.

Achievement Award

The Lahore Chamber of Commerce & Industry (LCCI) awarded the Bank "LCCI

Achievement Award" 2006.

The Bank of Punjab

MAJOR CUSTOMERS OF BOP

Some of the major customers of Bank of Punjab are:

Educational Institutes

Agriculturists

Pakistan Telecommunication Private Limited

WAPDA

Pharmaceutical Companies

12

THE BANK OF PUNJAB

WASA

MDA

1.3 PRESENT STATUS OF BANK OF PUNJAB

The current financial position of the Bank truly reflects the sign of improvement in the

financial health of the institution. The Management continued to focus on enhancing the

deposit base of the Bank with growth in the low cost deposits. Besides revamping

existing product lines, new products have been introduced by the bank to achieve the

desired objective of procuring low cost deposits. The Deposit base has pursued a

consistent growth pattern and has increased significantly from Rs. 266.1 Billion to Rs.

306.6 Billion at close of the year 2013. Our focus on CASA deposits has resulted in

procurement of low cost deposit; showing an increase of Rs.40.5 Billion over December

2012. Similarly, Advances have increased to Rs. 183.0 Billion showing an increase of Rs.

7.0 Billion over the preceding year. Our Investments portfolio has also increased

significantly with major concentration in government securities.

Branch Network

The Bank continued the strategy of growth and to extend the outreach to every corner of

the country, 28 new branches were opened during the year 2013 making the overall

branch network 334 with most of the branches opened in traditionally neglected areas to

provide banking services and to capitalize on market potential. The bank strived for

improving its ATMs network by increasing the number to 166, just to provide 24/7

banking services to the customers.

Lahore Central-I Region

Multan Region

Lahore Central-II Region

Faisalabad Region

Lahore North Region

Gujranwala Region

Lahore South Region

Gujrat Region

13

THE BANK OF PUNJAB

Peshawar Region

Bahawalpur Region

Islamabad Region

D.G. Khan Region

Rawalpindi Region

Jhelum Region

Sialkot Region

Sheikhupura Region

Vehari Region

Sahiwal Region

Jhang Region

Sargodha Region

Karachi Region

Credit Ratings

Credit rating by PACRA (Pakistan Credit Rating Agency) rated bank of Punjab is AA

Long Term and A1 Short Term. Both ratings are investment grade and denote very high

credit quality and very low expectation of credit risk.

Strategic Focus

The Bank continued the strategy of growth and to extend the outreach to every corner of

the country, 28 new branches were opened during the year 2013 making the overall

branch network 334 with most of the branches opened in traditionally neglected areas to

provide banking services and to capitalize on market potential. The bank strived for

improving its ATMs network by increasing the number to 166, just to provide 24/7

banking services to the customers.

During the year 2013, The Bank of Punjab entered into a new era by introducing Islamic

Banking Operations. Now, BOP has 7 fully functional online Islamic Banking Branches,

offering a range of Shariah Compliant products and services to its clients. Besides

14

THE BANK OF PUNJAB

offering deposits products, the Bank has also started financing under Murabaha,

Diminishing Musharaka and Ijarah.

Future Outlook

The bank will continue to invest in banking innovations, which include Islamic Banking,

Leasing, Home Loan and other areas of Product development to provide higher levels of

service and value to the clients. With these developments Bank of the Punjab will

continue to embark on its strategy of network enhancement and deposit mobilization.

1.4 CORE PHILOSOPHIES OF BANK OF PUNJAB

To succeed in todays volatile, interconnected and highly competitive markets, banks

need rapid access to timely information, flexible financial solutions and their alert

execution. Bank of the Punjab follows the core philosophy of satisfying its customers

through effective branch network, efficient human resource and economical products.

Some of the Fundamental Philosophies followed at the bank are:

Excellence in Service

Quality Performance

Product Innovations

Our Customer

As our first priority.

Profitability

For the prosperity of our stakeholders that allows us to constantly

invest, improve and succeed.

15

THE BANK OF PUNJAB

Corporate Social Responsibility

To Enrich the Lives of community where we operate

Recognition and Reward

For the talented and high performing employees

Excellence

In every thing we do.

Integrity

In all our dealings.

Respect

For our customers and each other.

1.5 VISSION, MISSION AND OBJECTIVES

Vision Statement

To be customer focused bank with service excellence..

Mission Statement

To exceed the expectation of our stakeholders by leveraging our relationship

with the Government of Punjab and delivering a complete range of

professional solutions with a focus on programmed driven products and

services in the agriculture and middle tier markets through a motivated team

Objectives of Bank of Punjab

To please their customers by fulfilling the financial needs as best as possible,

they believe in placing the client at the center of business and all of the

products and services.

16

THE BANK OF PUNJAB

To get maximum share of the market

To price the products optimally

To expand more the network of branches in several other cities of Pakistan

To reinforce a corporate culture that fosters learning, creativity and flexibility.

To invest further in banking innovations which include Islamic banking, SME,

Home Loans and other areas of product development to provide higher levels of services

and value to the clients.

CHAPTER 2 :-

MANAGEMENT SYSTEM OF BANK OF PUNJAB

2.1 HIERARCHY OF BANK OF PUNJAB

The Management

Management refers to the universal process of effectively and efficiently getting activities

completed with and through other people. It is a process by which certain basic functions,

which are planning, organizing, leading and controlling, are performed to achieve the

desired objectives of the organization.

Board of Directors

At the top of the human resource hierarchy sits the Board of Directors and Executive

Committee. The most important task of this level of management is strategic planning,

determining the goals and objectives and to formulate the policies.

Top Management

Top management mostly involves strategy formulation, technical planning, determining

how to best get the job done and control. Chief Managers and Branch Managers are

17

THE BANK OF PUNJAB

included in this level. They define and interpret the objectives and vision and then

formulate policies for their completion.

Middle Management, Supervisors and Employees

Departmental heads constitute this level of management at Bank of Punjab. They are

directly responsible for planning and controlling the activities of officers. Finally, the

employees activities are monitored and controlled according to the desired objectives.

18

THE BANK OF PUNJAB

ORGANIZATIONAL HIERARCHY

The Chairmen

BOARD OF DIRECTORS

CHIEF EXECUTIVE OFFICER

Executive Committee

EXECUTIVE INCHARGES

Area Manager

(North)

Area Manager

(South)

19

THE BANK OF PUNJAB

2.2 BOARD OF DIRECTORS

Name

Designation

Mr. Abdul Ghafoor Mirza

Chairman

Mr. Naeemuddin Khan

President & CEO

Mr. Javaid Aslam

Director

Mr. Muhammad Jehanzeb Khan

Secretary Finance/

Director

Mr. Tariq Mahmood Pasha

Director

Khawaja Farooq Saeed

Director

Syed Maratib Ali

Director

Mr. Saeed Anwar

Director

Dr. Umar Saif

Director

Mr. Omar Saeed

Director

Mr. Raza Saeed

Secretary to the Board

20

THE BANK OF PUNJAB

2.3 THE CORE GROUP

Executive Committee

Mr. Naeem Ud Din Khan

President & CEO

Mr. Khalid Siddiq Tirmizey

Deputy CEO

Mr. Sajjad Hussain

Group Head, Special Projects

Shahid Waqar Mahmood

Group Head Retail Banking

Mr. Moghis Rafiuddin Bokhari

Group Head, HR

Mr. Ijaz Ur Rehman Qureshi

Group Head Audit and Risk review

Mr. Mahboob ul Hassan

Group Head Special Asset

Mr. Irfanuddin

GroupHeadoperations

Mr. Tariq Maqbool

Chief Risk Officer

Corporate Information

Mr. Hamid Ashraf

Company Secretary

Mr. Nadeem Amir

Chief Financial Officer

Audit General of Pakistan

Auditors

BOP tower,

Head Office

Main Boulevard Gulberg, Lahore.

21

THE BANK OF PUNJAB

2.4 INTRODUCTION OF BANK OF PUNJAB TEXILA BRANCH.

Now days Mr Faheem-bin-Saleem is operating the branch as a branch Manager.

The Branch code is 0164.

There are 09 employees in Bank of Punjab Taxila Branch,

Bank of Punjab Taxila branch is providing up to-date facilities. If we analyze its

performance than we will find following major achievement.

Highest Car Financing and home financing in the area of Taxila.

These two achievements have been attained just in a short interval.

In Taxila branch bank of Punjab there exists bureaucracy I that means there exists

Division of labor (jobs are broken down into routine well define tasks)

Authority hierarchy (position organized with a clear chain of command)

Formal Selection

Formal rules and regulations

Career orientation (Manager are career professional not owner of units they manage)

The organization structure and have following characteristics:

High Specializations.

Rigid departmentalization

Clear chain of command

Narrow span of control

Centralization

High Formalization

22

THE BANK OF PUNJAB

2.5 PERSONNEL IN VARIOUS SECTIONS

Names, Designations of Officers at

BOP Taxila Branch

Name

1 Mr. Abdul Rasheed

2 Mr. Faheem-Bin-Saleem

Designation

AVP

Branch Manager

3 Mr. Faheem Nazeer

Manager Operations

4 Mr.Habib-Ullah-Ch

Manager Operations

5 Mr. Nasir

OG-II

6 Mr. Faizan Hussain

OG-II

7 Ms. Samina BiBi

8 Mr. Javaid

Incharge Accounts

Casher

23

THE BANK OF PUNJAB

2.6 MANAGING THE ORGANIZATION

Management Style

Management must have to adopt some administrative style to get all the activities to be

done effectively and efficiently. As far as the management styles at BOP Taxila Branch,

are concerned, there is some centralization and decentralization to some extent.

Administrative style of Branch Manager Mr. Faheem bin Saleem is authoritative. His

authoritative style was the requirement of administration. For the implementation of

strategies and getting all the activities to be done properly with an organized

environment, unity of command was the requirement of the time. In his absence, I

observed the environment of uncertainty and deregulation in the bank.

But the scenario was different in case of departmental heads. In Cash department, powers

were delegated at low levels. Employees were allowed to organized and take necessary

actions to accomplish their work properly. However there used to be a proper monitoring

of work of each employee.

Impact of Management Style on Employees

The management styles have great impact on the employee motivation and morale and

productivity.

Motivation: The term motive implies action to satisfy a need. Motivation can be defined

as a willingness to expend energy to achieve a goal or a reward. The management styles

adopted by the bank affect greatly, and employees are motivated in order to enhance their

performance and achieve the derived goals.

Morale and Productivity: The employees of the bank possess high morale, and thus

exhibit high productivity. The employees are happy and productive workers. Job attitudes

and morale are quite positive for two reasons. Firstly employees gain social Satisfaction

from interactions at the work place. Working conditions and supervision are good;

secondly high morale results from high motivation to produce

24

THE BANK OF PUNJAB

2.7 INTERNSHIP POLICY

Bank of Punjab offers internship positions to eligible students from well known

educational institutions. Branches/Offices of Bank may offer internship positions to

presentable and responsible looking candidates who fulfill the eligibility criteria.

Major objectives of offering these positions are:

To provide practical training to students.

To evaluate fresh interns as a potential source of future hiring.

General Provisions

(I) Duration of Internship

Up to maximum of two month

(II) Eligibility

Candidates for internships should be graduates or should be studying

For a graduate degree.

(III) Monthly Stipend

A stipend of Rs. 1,000/- per month shall be paid to interns upon

Completion of the internship period. Non-graduate student if accepted

for internship will not be eligible for any stipend.

(IV) Issuing Internship certificate

Internship Certificate is an official document and may only is issued under

the signatures of Branch Head or authorized officers. Copies of Internship

Evaluation Form and Internship Certificate should be retained in Branch/Unit

files for future reference.

25

THE BANK OF PUNJAB

CHAPTER 3 :PRODUCTS AND SERVICES OFFERED

3.1 PRODUCTS

Bank of Punjab offers the following products to its customers.

1.

Deposits

Current Account

P/L and Saving Account

Individual Account

Joint Account

Partnership Account

Limited Company Account

Clubs, Society, Association, or Trust Account

SNTD

TDR

Foreign Currency Deposit

Basic Banking Account

2.

Remittances

Remittance is a major function of the bank. It is the transfer of money from one place to

another place. The need for remittance is commonly felt in commercial life particularly

and in everyday life generally. By proving this service to the customers the Bank of

Punjab earns a lot of income in the form of service charges

Demand Draft (DD)

Mail Transfer (MT)

Telegraphic Transfer (TT)

Pay Order

26

THE BANK OF PUNJAB

Now we discuss all these in detail

DEMAND DRAFT (DD):

Demand draft is a written order given by the one branch of a bank on behalf of customer

to another branch of the same bank to a certain amount to the certain person.

PROCEDURE

1. A draft voucher is filled which contains the following information

Name of the parties involved

Date

Amount to be sent

Account number (if DD is crossed)

2. A credit voucher is filled in order to get the excise duty and exchange commission.

3. The sender deposits the total amount of the two vouchers i.e. the debit and credit

vouchers.

4. Then the cashier sends the cash receipt voucher to the accounts department and the

account records the amount paid in his cash scroll.

5. Accountant gives the DD leaf along with the DD voucher to his assistant who records

the senders name, amount and receivers name. After writing all the information in the

DD register he gives it to the officer along with the DD for authentication.

6. After authentication the DD is handed over to the sender and bank sends the advice to

the concerned branch. So when the party presents the DD in the concerned branch its

payment could be made.

PARTIES INVOLVED

The following parties are involved in demand draft;

1) Purchaser or Sender The purchaser is the person who sends the money to a particular

person payable ate certain branch.

2) Issuing or Drawing Branch The branch from where the demand draft is issued to

another branch of the same bank.

3) Drawer Branch in which the draft has drawn and called upon to pay the amount.

4) Payee the person who is entitled to receive the amount after presenting the demand

drafting the drawer branch.

27

THE BANK OF PUNJAB

MAIL TRANSFER

It is the transfer of money from one branch to another branch of the same bank through

mail service. In mail transfer there is no need of advice as the amount indirectly credited

to the receivers account.

PROCEDURE

1) First a voucher is filled in whish the sender writes the amount to be sent, name,

account number of the receiving person with the branch name and date.

2) A credit voucher is filled in order to deduct exchange, postage charges according to the

amount of the mail transfer.

3) The sender deposits the total amount in the cash department.

4) The cash officer gives the vouchers to the officer after affixing received cash stamp

and writing the amount in red ink.

5) Then the officer writes the amount paid in the cash scroll and gives the MT to his

assistant.

6) MT leaf is filled according to the information provided in credit voucher. He also

writes the same information in the MT register. Then he gives the MT leaf and MT

register to the officer for authentication.

TELEGRAPHIC TRANSFER

This is the most urgent method of remitting the money from one place toanother place.

This method is used when the sender desires to send urgently, in thiscase the sender

request the manager of the branch to issue TT.

PROCEDURE

For sending the TT the manager and officer apply a test. In the test themanager and

officer uses a coding technique. They write their own code numbers,which is allotted, to

them as the bank branch code. After making all the conformationthe concerned branch

makes the payment to the receiver. If the sender wants toconvey the same message

through telephone then he has to pay the charges of telephone along with the TT charges.

First the person deposits the TT amount along with the charges through the credit

voucher then his TT sent to the relevant branch.

28

THE BANK OF PUNJAB

PAY ORDER

A pay order is a written order issued by the bank on its own branch, drawn upon and

payable by itself to pay a specified sum of money to the person. The purpose of a pay

order is to transfer the fund from one place to another. It is usually not issued in favor of

the parties of other cities. Usually the pay order is issued for the local transfer of money

from one person to another or from the person to any other department. It is used for

different purposes. The purpose may be the repairs of the branch or renovation of the

branch.

PROCEDURE

The procedure of a pay order varies with the nature of the purpose. If the work is of huge

amount then first the manager writes a letter to the Zonal Chief in order

toget sanction of the work. Then the advertisement of the work is given in thenewspaper

in order to invite the contractors. But if the work is small then the branch

managerhasdiscretionary power to select the party whose rate is lowest. After finishing

the work the contractor submits the bill of work on his stamp pad. Then the bank issues a

pay order, against the pay order the contactor gets the amount from the issuing branch

3.

Lockers

4.

ATM cards

Master

Golden

5.

Financing Services

Consumer Finance

Demand Finance

Quick Cash Loan

General Purpose Loan

Agriculture Loan

I. Consumer Finance

29

THE BANK OF PUNJAB

In consumer finance Gov. Employs, business man, Gov. Semi employ can take house

hold product

2. Demand Finance

A Customer having 17 scales can avail this loan up to 25 basic salaries

3. Quick Cash Loan

Quick cash loan can avail up to 15 salaries

4. General Purpose Loan

General Purpose Loan can also avail from BOP.

5. Agriculture Loans

Loans are provided to agriculture sector.

There are many agriculture promotion schemes provided by BOP.

Kisan dost running finance facility

Kisan dost leasing finance facility

Kisan dost Cold storage finance facility

Kisan dost Green house financing scheme

Green Tractor Lease Finance Scheme

Agri Finance Branches

Agricultural Finance Scheme

Kisan Dost Tractor Scheme

Second Hand Tractor Lease Finance Scheme

Kisan Dost Aabiari Scheme

Kissan Dost Mechanization Support Scheme

Kissan Dost Farm Transport Scheme

Kissan Dost Eslah-E-Arazi Scheme

Kissan Dost Live Stock Development Scheme

Livestock Breed Improvement Trough VVW

Kissan Dost Commercial Agro Services

30

THE BANK OF PUNJAB

Kissan Dost Agri Mall Finance Scheme

Corporate Farming Finance Scheme

Commercial Lease Finance Tractor Scheme

Demand Finance-Sheds Construction and Civil Works

3.2 SERVICES

1. ATM facility.

2. On-line banking.

3. E-banking.

4. Debit Card.

5. Consumer Financing.

6. Agricultural Financing.

7. Corporate Financing.

8. Commission free remittance.

9. Zarco exchange remittance.

10. Collection of utility bills.

11. Lockers Facility.

12. Download scheduled of charge.

13. Download account opening form.

14.UAE exchange payments.

1. Online Banking

Today the competition is based on the innovation. The one who brings a product or

service prior to its competitors gets an edge. The role of technology is very important as

far as the innovation is concerned. The Bank of Punjab proudly offers the online banking

facility to its customers. It is our commitment to provide the latest technology based

services to our customers. Online banking is one of the many services that we are going

to introduce.

2.

E-banking

Not only online banking, but also through E-banking you can avail a wide range of

services by just staying at your office or home. BOP is planning to introduce Mobile

banking facilities to its customers in near future.

3.

Debit card

31

THE BANK OF PUNJAB

4.

In our endeavor to provide you versatile banking options to fulfill your financial

needs, , a Debit Card which gives you unlimited access to your current / savings account

with a simple swipe at millions of retail shops and ATMs worldwide. The BOP ATM

debit comes with a host of conveniences and benefits combined with the wide reach of

Visa Network.

5.

E-Banking

BOP is also going to introduce e-banking to facilitate its valued customers.

6.

Consumer Financing

In consumer finance Gov. employ, business man, Gov. semi employ can take house hold

product

7.

Agricultural Financing.

Loans are provided to agriculture sector.

There are many agriculture promotion schemes provided by BOP.

Kisan dost running finance facility

Kisan dost leasing finance facility

Kisan dost Cold storage finance facility

Kisan dost Green house financing scheme

Green Tractor Lease Finance Scheme

Agri Finance Branches

Agricultural Finance Scheme

Kisan Dost Tractor Scheme

Second Hand Tractor Lease Finance Scheme

Kisan Dost Aabiari Scheme

Kissan Dost Mechanization Support Scheme

Kissan Dost Farm Transport Scheme

Kissan Dost Eslah-E-Arazi Scheme

Kissan Dost Live Stock Development Scheme

Livestock Breed Improvement Trough VVW

Kissan Dost Commercial Agro Services

32

THE BANK OF PUNJAB

Kissan Dost Agri Mall Finance Scheme

Corporate Farming Finance Scheme

Commercial Lease Finance Tractor Scheme

Demand Finance-Sheds Construction and Civil Works

8. Collection of utility bills

Customers can pay their utility bills e.g. electricity, water gas, telephone, mobile, at any

of our 272 branches across Pakistan. For your convenience bills are collected on all

working days from 9:00 am to 5:00 pm (Monday to Friday) Non stop Banking and from

9:00 am to 1:30 pm on Saturday. You can also pay your bills by availing our drop box

facility. Just drop your Cheque along with bill at your branch and collect the receipt in

the evening, avoid the hustle of standing in queues and save your precious time.

Electricity

Gas

Water

Property

Telephone

9. Lockers Facility

BOP Provide Lockers Facility to customers

Discover peace of mind, enjoy personalized service and operate your locker in friendly

and pleasant environment at The Bank of Punjab.

Types

Small

Medium

Large

Extra large

33

THE BANK OF PUNJAB

These are the other services provided by the BOP.

ATM Facility

On-Line Banking

Demand Drafts

Letter of Credit

Pay Order

Mail Transfer

Debit Card

ATM Facility

Through the ATMs Customers have access to the various services such as withdrawal,

balance enquiry and mini statement? Complete security is ensured because access to the

account is only possible by entering a four digit personal identification number (PIN)

known only to the account holder. Cash withdrawal limits up to Rs.20, 000 per day.

Annual charges of ATM is Rs.250/- per card.

On-Line Banking

BOP is currently offering window-based online banking to its customers, which gives

access to information on their accounts and the liability to act on the latest information

received over the net.

Demand Drafts

BOP provides safe, speedy and reliable way to transfer money at vary reasonable rates.

Any person whether an account holder of the bank or not, can purchase a Demand Draft

from a bank branch

Letter of Credit

BOP is offering its business customers the widest range of option in the area of money

transfer. BOPs letter of credit service is with competitive rates, security, and ease of

transaction, BOP Letter of credit is the best way to do the business transactions.

Pay Order

BOP provides transfer of money using different facilities. Its pay orders are asecure and

easy way to move the money from one place to another. The charges for this service are

extremely competitive.

34

THE BANK OF PUNJAB

Mail Transfer

Moves money safely and quickly from BOP Mail Transfer service. The rates for this

service is quiet impressive as compare to the market.

DEBIT CARD

BOP Apna Cash Card is an ATM plus Debit Card.1. The front of the card will have the

following matter on it:

Card Holders Name

International Bin Number (6 Digits - XXXXXX)

Magnetic Strip

Signature Panel

Conditions of Usage

M-Net and M-Net logo

LIMITATIONS

Any non-personal account i.e. Companies, Organizations, Trust Account, Government

account and Collection account etc.

Dormant, inoperative, blocked or restricted accounts.

Accounts with NIL balance.

Term Deposit Accounts.

NIDF Accounts. (Non Interest Demand Finance Accounts)

Accounts requiring thumb / photo for operation (illiterate accounts) ATM/Debit cards

can only be issued on local currency accounts.

35

THE BANK OF PUNJAB

CHAPTER 4 :-

INTERNSHIP PROGRAMME AT BANK OF PUNJAB,

TAXILA BRANCH

My Internship in Bank of Punjab, Taxila branch from July 02, 2014 to August 30, 2014

was a great source of learnings for me. After having a short discussion, operations

manager sent me to the Credit Department, there i worked for two weeks. Although I

didnt work in all sections of credit department but as having short period of internship I

requested to send me to another department.so the next department where I work is

Remittance Department. Thereafter i was transferred to customer services and in my last

week of internship I was transferred to Account opening department. During this whole

session i learnt how to deal with customers effectively and the most important documents

needed and used by different departments for different product/service offerings.

4.1 CREDIT ADMINISTRATION

On the very first day of internship, I was advised by Mr. Faheem Nazeer (The Operations

Manager) that I should start my session from the Credits Department I remained there for

approximately two weeks.

Credit department is one of those core departments that are helping BOP Taxila branch to

earn huge revenues. I was very much pleased to hear this as I had a great desire to work

and learn something regarding Credits. In this department I have done work in personal

loans and Home finance.

So, I was sent to Mr. Faheem Bin Nazeer, Manager, who is a very nice and

helpful hand for me. I was then advised by Mr. Faheem to work with Mr. Faizan Husain.

36

THE BANK OF PUNJAB

CUSTOMER FINANCE

The Bank of Punjab Taxila provides the customer finance facility to Gov. employ,

business man, Gov. semi employ can take house hold product This facility is provided

only by Bank of Punjab Taxila branch and generate too much revenue.

Following steps must be taken while giving a loan facility

Application form filled by the client, requesting for loan.

Attestation of copy of ID card.

Consumer credit information report taken form state bank of Pakistan.

Credit line proposal which contain detailed information about the individual.

Approval of case from Area office for the loan.

Undertaking of institute and personal guarantee that the money is pay back by the

individual.

Insurance of individual.

Department Letter for transfer of salary to Bank of Punjab Taxila .

Letter of installment tells in how many installments the loan will be recovered.

Amortization schedule provide information about number of installments in

which the principal amount and interest payment is recovered.

Cheque containing the signature of individual.

HOME FINANCE

After one and a half week .I was moved to Home finance department. Mr. Faheem is

incharge of Hone finance as well as Customer relationship Manager. Mr. Faheem Nazeer

incharge of agri finance but supporting in Home finance also. From these both officers I

learnt much about this department.

37

THE BANK OF PUNJAB

In Home finance what I have learnt is as follow

Home Loan is specially designed for those who want to

To purchase a new house

To renovate the existing house

To construct a house

Procedure for Home Finance.

Home loan for the above mentioned three activities following steps must be taken

Find out the maximum limit of loan available

Gross Monthly Income (GMI) more than 20,000 Rs.

Gross Monthly Income(attested by HR if salaried) *40

Amount of Installments doesnt exceed 40% of GMI.

Maximum Tenor =20 years

Minimum Tenor =03 years

Penalty for late installment Rs 500 each.

Application form filled by the client, requesting for loan.

Legal opinion of high court Advocate for mortgage of property.

Valuation of property taken as a mortgage.

Income documents.

Consumer credit information report taken form state bank of Pakistan.

Credit line proposal which contain detailed information about the individual.

Approval of case from Area office if the loan is greater than 6millions

approval from Country Manager.

Insurance of property.

For the construction of home the legal document of the property is required for the

purpose of mortgage and the Bill of quantity is also required, which is divided into cost

of floor, walls, roofs, electricity.

38

THE BANK OF PUNJAB

In case of loan required to purchase a new house the sale deed is needed by the bank and

the ownership of newly purchased home must be in the name of bank until the whole loan

payment is made.

Documentation of Home Finance.

Copy of CNIC.

Recent photographs.

Copies of recent bank statements.

Copies of last 6months credit card bills.

Application form completely filled in & signed.

Copy of income tax return.

Property insurance covering status.

Bill of quantity for construction of home.

Estimation of renovation provided.

CIB report.

Copies of the documents of the property being mortgaged.

Copies of the agreement of sale.

National tax number.

Lawyers opinion.

Valuation report of property.

39

THE BANK OF PUNJAB

4.2 CUSTOMER SERVICES

Here my job was to help the customers to save there time and solve their problem if any.

Here my major responsibility was to solve query of the customers if any, to help new

customers to fill slips.

Here I have learnt about customer

Relationship management

Slips

Cash Deposit

Cheque deposit

Online Transfer

Credit Card

Fax

Phone Exchange

4.3 ACCOUNT OPENING

The last week of my internship i was moved to account opening. This department was

headed by the Miss Samina BiBi. I really enjoyed my stay at this department as I got to

interact with the customers directly for the first time. During my stay at this department I

got to fill the forms of individuals who wanted to get their accounts opened at BOP, fill

the cheque and deposit slips of customers who were not literate enough or needed

instructions,

OPENING A NEW ACCOUNT

Types of accounts

The types of accounts, which can be opened by a customer, are as under:

Individual (Single or in joint Names)

Sole Proprietor Ship

Partner Ship

Corporate

Trust / Charitable Organization / Association Accounts

40

THE BANK OF PUNJAB

The account can be of one of the following nature:

Current account

PLS Saving account

Basic Banking Account

Munafa hi munafa Account

Tijarat accounts

Gharayloo account

Senior Citizen Schemes

Current Accounts

Following are the main features of current account:

Non interest bearing checking account.

Minimum account opening requirement of Rs. 1000 only

Free debit card can be used to withdraw cash and make purchases at

thousands of outlets across Pakistan which provides access to funds 24

hours a day.

No restriction on number of withdrawals and on number of deposit

If the account holder fails to maintain a minimum BOP of Rs. 10000 in a

month then services charges of Rs. 50 per month are deducted.

For online funds transfer service charges of Rs. 50 plus withholding tax

are debited in the current account holders account.

PLS Saving Accounts

The features of saving account are as follows:

Profit & Loss Sharing Saving Bank Account.

Minimum account opening requirement of Rs. 500 only.

No restriction on number of withdrawals and number of deposits.

PLS saving account is subject to zakat deduction. On 1st of Ramadan zakat

is deducted from the account.

41

THE BANK OF PUNJAB

Free debit card can be used to withdraw cash and make purchases at

thousands of outlets across Pakistan which provides access to funds 24

hours a day.

Services charges on online funds transfer are Rs. 100 plus withholding tax.

MUNAFA HI MUNAFA

This a/c is open with minimum amount of 01 lake. On this a/c profit is monthly

basis and profit will be credits in youre a/c automatically

Basic Banking Account

It has the following characteristics:

Initial deposit for account opening is Rs. 1,000 with no minimum BOP

requirement.

Non interest bearing checking account.

Maximum 2 deposits & 2 withdrawals through cheque are allowed.

Free debit card can be used to withdraw cash and make purchases at

thousands of outlets across Pakistan which provides access to funds 24

hours a day.

No restriction on ATM withdrawal.

ZIADA MUNAFA SAVING ACCOUNT

This a/c is open with minimum amount of 01 lake. On this a/c profit is monthly basis and

profit will be credits in youre a/c automatically

Ziada Munafa Saving Account is high yield account. This is for those clients who want a

good return on their investment. The characteristics of Ziada Munafa Saving Account

are:

Any Pakistani resident over the age of 18 can open this account. This

account is for individual/joint customers only. Other customers like

companies, corporate etc are not eligible for opening of this account.

Minimum BOP requirement for opening this account is Rs. 10,000/- with

a maximum of Rs.1, 000,000/-

There is no restriction on deposit transactions.

42

THE BANK OF PUNJAB

ACCOUNT OPENING REQUIRMENT

Earlier in this chapter i have mentioned the types of account and a brief description of

different types of account. As there are different parties who can open an account, so the

account opening requirements varies from one type of account to another. However some

generalization can be made in account opening.

FOR BUSINESS CONCERNS

In case of account opened by a business concern there are some documents that are

needed to be attached with the account opening form. The details of these documents are

given below.

Limited Company:

Copy of certificate of incorporation.

Memorandum of Association.

List of Directors.

Certificate of Commencement of Business.

Copies of NIC of Directors.

Partnership:

Partnership deed certified copy

NIC photocopies of all partners.

Partnership mandate for account signed by all the partners.

A letter duly signed by all the partners containing the operating

instructions of the account also has to be taken.

Sole Proprietorship / Individual:

NIC/ Passport photocopy

Letter from Proprietor confirming sole proprietorship

43

THE BANK OF PUNJAB

FINANCIAL ANALYSIS

To analyze the financial position of BOP, different tools are use, which includes Ratio

Analysis, Common size Analysis of the last five years. Importance of Financial Analysis

IMPORTANCE OF FINANCIAL ANALYSIS

Financial analysis involves the use of various financial statements. These statements do

several things. First the balance sheet and the second is income statement. The balance

sheet summarizes the assets, liabilities, and owners equity of a business at a point in

time, while the income statement summarizes revenues and expenses of a firm over a

particular period of time. A conceptual framework for financial analysis provides the

analyst with an interlocking means for structuring the analysis.

CHAPTER 5 :-

5.1 RATIO ANALYSIS

(5.1.1) PROFITABILITY RATIOS

(1) Net profit margin =

(Net profit / Interest earned) *100

2013

2012

2011

2010

2009

7.90%

7.07%

14.20%

-222.0%

-645.0%

INTERPRETATION:

44

THE BANK OF PUNJAB

This ratio provides a primary appraisal of net profits related to investment. As this years

ratio much stronger than previous years so whether the markup went high or the

customers increased, so first reason is true. Hence earnings increased as mark up has

increased.

(2) Return on Deposits = (Net profit/Total deposits) *100

2013

2012

2011

2010

2009

0.62%

0.65%

0.12%

-1.94%

-5.28%

INTERPRETATION:

Bank of Punjab has received more deposits as well the increased markup, hence profit

has increased more rapidly as compared to deposits.

(3) Return on Advances =

(Net profit/Total advances) *100

2013

2012

2011

2010

2009

1.12%

1.16%

0.023%

-3.0%

-8.32%

INTERPRETATION:

This ratio shows how much profit the bank is earning from the total advances given for

earnings. Profit has been earned upon advances but as compared to previous years there

is a slight increase in profits with respect to advances but in 2013 it is a decrease.

45

THE BANK OF PUNJAB

(4) Return on Investment = (Net profit after tax/ Investment)

2013

2012

2011

2010

2009

0.0142

0.0134

0.0003

0.0717

0.174

INTERPRETATION:

The ROI shows how profitable a company's assets are in generating revenue.

I.e. how many rupees of earnings they derive from each rupee of assets. This ratio for

Bank of Punjab is high of this year because of higher profits earned this year by the bank.

Return on Equity =

(Net profit after taxes/ Shareholders equity) *100

2013

2012

2011

2010

2009

14.2%

14.1%

2.7%

-11.20%

-16.40%

INTERPRETATION:

ROE measures the rate of return on the owners equity of the common stock. It measures

a firm's efficiency at generating profits from every rupee of net assets, and shows how

well a company uses investment rupees to generate earnings growth. As we can see that

this year the equity of the shareholders has been utilized efficiently as compared to

previous years.

46

THE BANK OF PUNJAB

(5.1.2) LEVERAGE RATIOS

(1) Debt to equity =

(total debt / Shareholders equity)

2013

2012

2011

2010

2009

25.20

25.84

25.34

62.47

34.31

INTERPRETATION:

This ratio shows the capital structure of the firm that how leveraged is the firm. This year

it is a green signal as debt ratio has been decreased.

(2) Debt to Total Assets ratio = Total Debts / Total Assets

2013

2012

2011

2010

2009

0.96

0.96

0.96

0.98

0.97

INTERPRETATION:

This ratio is a measure of debts of a company as compared to its total assets. As banks

deal in debts so if banks increase with the passage of time, its advances should also

increase in parallel. This ratio for bank of Punjab has been quite consistent over the years

and quite equal to it s total assets. If these debts are increasing then these should be

properly utilized so that total assets can also be increased in parallel. But the management

should try to decrease this ratio in upcoming years.

47

THE BANK OF PUNJAB

(5.1.3) CAPITALIZATION RATIOS

Cash dividend to net income= Cash Dividend / Net income

2013

2012

2011

2010

2009

0.0718

0.12

0.97

-0.099

0.091

INTERPRETATION:

This ratio shows the portion of the profit or net income paid to the shareholders in the

form of cash dividend. As the net income of 2013 has increased but ratio has decreased,

the main reason is that this year bank has issued stock dividend to shareholders instead of

cash dividend.

(5.1.4) ASSET EFFICIENCY RATIOS

Assets turn over= Market income / Total Assets

2013

2012

2011

2010

2009

0.068

0.074

0.073

0.079

0.072

INTERPRETATION:

48

THE BANK OF PUNJAB

This is the ratio, which uncovers management's ability to function in competitive

situations while not excluding intangible assets. This ratio also shows that whether the

firm is using its resources well or not. Bank of Punjab has been utilizing its resources

well as compared to the previous years but in 2013 it become low.

(5.1.5) ASSET EFFICIENCY RATIOS

Stockholders equity to total liability= Shareholders equity/Total liability

2013

2012

2011

2010

2009

0.039

0.038

0.039

0.016

0.029

INTERPRETATION:

This ratio shows the comparison of equity to total liabilities. This year increase in ratio

shows more utilization of equity.

(5.1.5) OTHER BANKING RATIOS

(1) Advances to deposit ratio = Total advances/ Total deposits

2013

2012

2011

2010

2009

0.51

0.56

0.53

0.58

0.63

49

THE BANK OF PUNJAB

INTERPRETATION:

This ratio shows the outflow versus the inflow of cash in the form of advances and

deposits respectively. As the ratio has slight change due to increase in deposit but in 2013

it slightly decreases.

(2) Cash Ratio = (Cash &Balances with treasury banks+

Balances with other banks)

/ Deposits

2013

2012

2011

2010

2009

0.091

0.076

0.085

0.085

0.079

INTERPRETATION:

This ratio shows comparison of how much our cash is deposited against deposits of

others in our bank. In 2007 our deposits were higher than our clients.

(3)Cash Reserve Ratio = Cash &balance with treasury banks/deposits

2013

2012

2011

2010

2009

0.077

0.065

0.53

0.070

0.068

INTERPRETATION:

This ratio indicates the reserve which a bank has maintained against the deposits of others

(customers). The reserve for deposits has increased as compared to previous year.

50

THE BANK OF PUNJAB

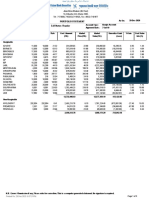

5.2 HORIZONTAL ANALYSIS

Horizontal analysis is a technique for evaluating a series of financial data over a period of

time to determine the amount and percentage increase OR decrease that has taken place.

Actually this analysis shows the trend in performance and position of the company over

the number of years which makes it easy to understand and compare the performance of

the concern.

I have used the financial statement data years 2009-2013 and compared the each item of

the financial statements and showed the Banks trend from one year to another.

51

THE BANK OF PUNJAB

Horizontal Analysis

BANK OF PUNJAB

Balance Sheets

Balance sheet

Assets

cash and balance with treasury banks

balance with other banks

lendings to financial institutions

investments

advances

operating fixed asset

differed fixed assets-net

other assets

Liabilities

bills payables

borrowings

deposits and other accounts

sub ordinated loans

liabilities against assets subject to financial

lease

deferred tax liabilities

other liabilities

Presented by

share capital

discount on issue of shares

reserves

accumulated losses

share deposited money

surplus on revaluation of assets -net of tax

2013

2012

2011

2010

2009

182.62

195.14

1082.76

214.03

129.63

102.55

105.92

274.22

162.8

132.62

14.19

148.35

223.66

123.3

101.35

109.64

251.02

153.31

128.02

165.03

706.88

159.68

104.78

104.97

116.49

278.16

129.66

107.87

149.89

693.81

97.3

99.58

103.13

117.97

168.46

106.14

100

100

100

100

100

100

100

100

100

172.03

162.41

160.62

0

11.99

171.39

318.26

139.4

0

18.09

97.14

177.8

124.65

0

39.34

66.36

82.1

109.07

0

69.76

100

100

100

0

100

0

177.54

161.15

0

159.47

151.9

0

138.49

128.41

0

111.12

121.39

0

100

100

199.53

-43.91

-14.03

249.98

85.67

228.66

100

220.8

116.14

138.97

2635.54

195.5

100

356.09

129.23

154.68

2635.54

182.59

100

374.22

131.35

-15.76

1550.32

52.63

100

100

100

100

100

100

140.23

219.36

254.01

201.65

98.83

173.78

111.78

58.84

100

100

52

THE BANK OF PUNJAB

Horizontal Analysis

BANK OF PUNJAB

INCOME STATMENT

PROFIT AND LOSS ACCOUNT

2013

2012

2011

2010

2009

Markup/returned/interest earned

Markup/returned/interest expense

Net mark up /interest income

Provision against non-performing loans

and advances-net

Provision for diminutions in the value of

investments-net

Bad debts written off directly

154.88

106.24

118.72

-7.28

157.68

118.40

63.26

-10.45

132.23

110.78

-11.57

-34.24

116.48

98.84

-17.27

6.06

100

100

100

100

2.30

22.55

60.33

289.55

100

0.00

-6.38

-34.36

0.00

-7.35

-21.28

0.00

-25.38

-16.17

0.00

32.63

28.80

0

100

100

118.03

14.93

59.55

-1120.33

116.04

24.00

65.83

-1166.97

110.25

31.16

64.66

-265.64

85.60

43.88

54.32

-236.08

100

100

100

100

360.10

221.55

162.12

-72.73

-722.55

112.98

143.81

-53.52

451.22

95.29

89.68

-36.85

-1510.48

91.23

83.63

17.83

100

100

100

100

171.29

0.00

0.00

5934.89

173.89

-20.68

0.00

-20.77

146.06

0.00

0.00

-5112.09

150.22

-10.52

0.00

-10.56

130.31

0.00

0.00

25.82

0.00

-25.81

0.00

-3.28

113.06

0.00

0.00

202.14

0.00

-29.01

0.00

43.25

100

0

0

100

100

100

0

100

Net Markup/returned/interest earned

Non Mark-up / Interest Income

Fee, commission and brokerage income

Dividends income

Income from dealing in foreign currencies

(Loss)/gain on sale and redemption of

securities

Unrealized loss on revaluation of

investments

classified as held for trading

Other income

Total non markup/interest

income

Non Mark-up / Interest expense

Administrative Expenses

Provision against Other assets

Provision against off balance sheet item

other charges

Total Non Mark-up / Interest expense

Extra ordinary/unusual items

Gain/Loss Before Taxation

53

THE BANK OF PUNJAB

Taxation -current

-prior years

-deferred

0.00

-17.91

-24.70

-18.97

166.05

Gain/Loss After Taxation

(accumulated loss)/unappropriated profit

brought forward

Transfer to reserve for issuance of bonus share

Reversal of excess management fee accrued last year

Transfer from statutory reserve to

-13.39

accumulated loss

Transfer from general reserve to

0.19

accumulated loss

Transfer from surplus on revaluation of

-1046.20

fixed assets-net of tax

4754.69

accumulated loss carried forward

10870.64

Basic loss/earning per share (after tax)

-11.71

Diluted loss earning per share ( after tax)

-11.71

-921.09

-8.07

5.34

-17.28

184.77

0.01

-3.99

-4.06

-2.92

187.79

1.86

49.21

50.07

40.09

135.06

100

100

100

100

100

-11.29

-2.40

0.00

100

0.00

0.00

0.00

100

0.00

90.24

95.00

100

5222.61

12286.17

-14.12

-14.12

5217.76

13670.85

-2.81

-2.81

3736.40

13894.63

38.44

38.44

100

100

100

100

54

THE BANK OF PUNJAB

5.3 VERTICAL ANALYSIS

Vertical analysis is that analysis in which each items within the financial statement so the

each item of company is expressed in terms of a percentage of a base amount. This helps

in analyzing whether each of those particular items of the company has how much

percentage of their total value in continuous years.

For the purpose of analysis and comparison current year data shown in percentage is

compared with the data in percentage of the last year. One can easily judge the favorable

and unfavorable changes in two years financial statements.

I have used the three years financial statement data, i.e. years 2009-2013 and compared

the each item of the financial statements and showed the Banks trend from one year to

another.

55

THE BANK OF PUNJAB

VERTICLE ANALYSIS

BANK OF PUNJAB

BALANCE SHEET

Balance sheet

Assets

cash and balance with treasury banks

balance with other banks

lendings to financial institutions

investments

advances

operating fixed asset

differed fixed assets-net

other assets

Liabilities

bills payables

borrowings

deposits and other accounts

sub ordinated loans

liabilities against assets subject to financial lease

deferred tax liabilities

other liabilities

Presented by

share capital

discount on issue of shares

reserves

accumulated losses

share deposited money

surplus on revaluation of assets -net of tax

2013

2012

2011

2010

2009

7%

1%

3%

35%

45%

1%

4%

4%

100%

5%

0%

0%

39%

45%

1%

4%

4%

100%

6%

1%

3%

33%

45%

1%

5%

6%

100%

6%

1%

3%

25%

53%

2%

6%

4%

100%

6%

1%

0%

27%

56%

2%

6%

3%

100%

11%

169%

2278%

0%

0%

0%

62%

2521%

0%

78%

-2%

11%

-84%

4%

93%

0%

7%

100%

12%

361%

2151%

0%

0%

0%

61%

2585%

0%

43%

10%

-103%

-51%

137%

87%

0%

13%

100%

8%

234%

2231%

0%

0%

0%

61%

2535%

0%

50%

18%

-133%

-65%

159%

94%

0%

6%

100%

16%

319%

5767%

0%

0%

0%

145%

7078%

0%

146%

56%

-399%

20%

277%

80%

0%

20%

100%

14%

229%

3111%

0%

0%

0%

77%

3431%

0%

86%

9%

-179%

-74%

11%

89%

0%

11%

100%

56

THE BANK OF PUNJAB

VERTICLE ANALYSIS

BANK OF PUNJAB

INCOME STATMENTS

PROFIT AND LOSS ACCOUNT

2013

2012

2011

2010

2009

Markup/returned/Interest earned

Markup/returned/Interest expense

Net mark up /Interest income

Provision against non-performing loans and

advances-net

Provision for diminutions in the value of

investments-net

Bad debts written off directly

100%

83%

17%

-3%

100%

91%

9%

-4%

100%

102%

-2%

-15%

100%

103%

-3%

3%

100%

122%

22%

59%

0%

1%

3%

15%

6%

0%

-3%

19%

0%

0%

-3%

12%

0%

0%

-13%

11%

0%

0%

18%

-21%

0%

0%

65%

-87%

0%

3%

1%

1%

6%

0%

0%

5%

15%

34%

3%

1%

1%

6%

0%

0%

2%

13%

25%

4%

1%

1%

2%

0%

0%

2%

10%

20%

3%

2%

1%

2%

0%

0%

3%

10%

-11%

4%

6%

2%

-1%

0%

0%

3%

14%

-73%

21%

0%

0%

0%

22%

12%

0%

0%

18%

1%

0%

0%

19%

6%

0%

0%

19%

0%

-1%

0%

0%

18%

0%

0%

19%

0%

4%

0%

0%

23%

0%

0%

19%

0%

0%

0%

19%

-92%

0%

0%

Net Markup/returned/Interest earned

Non Mark-up / Interest Income

Fee, commission and brokerage income

Dividends income

Income from dealing in foreign currencies

(Loss)/gain on sale and redemption of securities

Unrealized loss on revaluation of investments

classified as held for trading

Other income

Total non markup/interest income

Non Mark-up / Interest Expense

Administrative Expenses

Provision against Other assets

Provision against off balance sheet item

other charges

Total Non Mark-up / Interest expense

Extra ordinary/unusual items

57

THE BANK OF PUNJAB

Gain/Loss Before Taxation

Taxation -current

-prior years

-deferred

Gain/Loss After Taxation

(accumulated loss)/unappropriated profit brought

forward

Transfer to reserve for issuance of bonus share

Reversal of excess management fee accrued last

year

Transfer from statutory reserve to accumulated loss

Transfer from general reserve to accumulated loss

Transfer from surplus on revaluation of fixed

assets-net of tax

accumulated loss carried forward

Basic loss/earning per share (after tax)

Diluted loss earning per share ( after tax)

12%

1%

0%

3%

4%

8%

-53%

6%

1%

-3%

1%

-1%

7%

-57%

2%

0%

0%

1%

1%

1%

-70%

-34%

0%

0%

-12%

-12%

-22%

-57%

-92%

0%

1%

-28%

-28%

-65%

-49%

0%

0%

0%

0%

0%

0%

0%

0%

0%

0%

-2%

0%

0%

-1%

0%

0%

0%

0%

0%

0%

0%

0%

19%

29%

0%

-54%

-47%

0%

0%

-59%

-52%

0%

0%

-70%

-69%

0%

0%

-57%

-79%

0%

0%

-2%

-1%

0%

0%

CHAPTER 6 :-

58

THE BANK OF PUNJAB

SWOT ANALYSIS

SWOT analysis is an acronym that stands for strengths, weakness, opportunities, and

threats SWOT analysis is careful evaluation of an organizations internal strengths and

weakness as well as its environment opportunities and threats.SWOT analysis is a

situational which includes strengths, weaknesses, opportunities and threats that affect

organizational performance. The overall evaluation of a company strengths, weaknesses,

opportunities and threats is called SWOT analysis In SWOT analysis the best strategies

accomplish an organizations mission by:

Exploiting an organizations opportunities and strength.

Neutralizing it threats.

Avoiding or correcting its weakness.

SWOT analysis is one of the most important steps in formulating strategy using the

organization mission as a context; managers assess internal strengths distinctive

competencies and weakness and external opportunities and threats. The goal is to then

develop good strategies and exploit opportunities and strengths neutralize threats and

avoid weaknesses

STRENGTH

The Bank officers of BOP are considered as one of the most able professionals in the

banking world. However, they have added some local flavor in accordance with their

targeted segmented. In my observation that they interact with their clients as if they are

their personal friends and discuss about their problems as their own.

As a result of the compassionate and personalized services of the officers, the

clients perception for BOP is very high. They have trust and feel themselves to

be secure while dealing with BOP.

BOP has opened all its branches at commercial areas so that the customers or

clients face no problems in reaching to the bank.

BOP has got a reliable and easy to use internal computer system. Every

information regarding the transactions in customers deposits has been

computerized. Data are properly maintained.

Good security system

Not excellent but good facilities are given to employees

WEAKNESSES

Lack of proper internal controls is one of the major weaknesses of BOP. It is also pointed

by the auditor in his review.

59

THE BANK OF PUNJAB

BOP has formulized a lot of products and services for its customers, even more

than other commercial banks, but any advertisement on electronic media has not

been seen.

I observed during my internship that some of the employees were burdened with

over work. So I think that the work should be distributed according to their post

and capabilities.

Biased selection of employees

OPPORTUNITIES

Satisfy dynamic consumer needs, BOP has made significant in roads in its entire service

spectrum. A lot of products have been introduced especially in Retail Banking

(Agriculture side) and people are increasingly becoming loyal to the bank and because of

feasible transactions. Optimum pricing and branding strategies of the bank are helping to

make customer feel secure and convenient.

All the opportunities of the 21st century are to be availed in the information

technology. Information technology is the future of this dynamic world. Therefore

BOP should emphasize much on IT, especially on E-Banking. Bank can design

universal account like other foreign banks, to enhance online facilities.

BOP has introduced a number of financial schemes including special Deposit

Accounts. These accounts have their unique features. Therefore, with the

commencement of new schemes there can even be a greater increase in its

deposits

THREATS

Despite the difficult circumstances that confronted the banking sector in particular and

the country in general, BOP has been still highly profitable. But, the facts cant be denied

and there might be an adverse impact of such situation.

BOP is facing a strong competition by its competitors, Business of all

these Banks are growing at very high pace.

60

THE BANK OF PUNJAB

CHAPTER 7 :-

CONCLUSION AND RECOMMENDATIONS

7.1 CONCLUSION

By analyzing the financial statements of the bank, I came across to know that it is one of

the most growing banks in the subcontinent. Now they should carry on with the present

management which too k it from one of the ordinary bank to this level. No doubt

professionalism and internal controls of the bank are one of the major issues which may

results some major losses to the bank. Bias in hirings and between colleagues should be

removed.

RECOMMENDATIONS:SUGGESTIONS FOR REMOVING WEAKNESSES

INTERNAL CONTROL