Escolar Documentos

Profissional Documentos

Cultura Documentos

General Motors

Enviado por

Sambit RoyDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

General Motors

Enviado por

Sambit RoyDireitos autorais:

Formatos disponíveis

GENERAL MOTORS: THE 2009 STORY 1

General Motors: The 2009 Story

Prateek Gupta, Pujan Kumar Verma, Pulkit Khurana,

Sambit Roy, Sanchit Taneja, Shreyans Sharma

IMT Ghaziabad (DCP)

GENERAL MOTORS: THE 2009 STORY 2

Table of Contents

Abstract................................................................................................................................3

About General Motors.........................................................................................................4

GM in 2009: The Bankruptcy..............................................................................................4

Causes..............................................................................................................................4

Area of Focus.......................................................................................................................5

Leverage Analysis................................................................................................................6

Operational Leverage.......................................................................................................6

Financial Leverage...........................................................................................................7

Combined Leverage.........................................................................................................8

Competition Analysis...........................................................................................................9

Tesla Motors....................................................................................................................9

Tata Motors....................................................................................................................11

Summary............................................................................................................................12

GENERAL MOTORS: THE 2009 STORY 3

Abstract

This report concentrates on studying the operational and financial performance of

General Motors. This report is regarding the financials of the General Motors during and after

the bankruptcy filing. This was a trying moment for the company.

Through the financial instruments we come to know how the company was able to utilize

the government funding before they start making profit.

With the help of Operating and Financial Leverage we try to understand how and when

General Motors started taking risks and making high profits.

GENERAL MOTORS: THE 2009 STORY 4

About General Motors

General Motors is an American multinational company. They are commonly known as

GM. Their headquartered in Detroit and Michigan. They design, manufacture, market and

distribute vehicle and vehicle parts. They also sell financial services. The current GM was

founded in 2009 after bankruptcy of the old GM.

The company was founded on September 16, 98 in flint, Michigan as a holding company

for McLaughlin Car Company of Canada limited and Buick. It was then controlled by William

C. Durant. GMs co-founder Charles Stewart Mott was the largest single stockholder in GM. GM

later acquired Oldsmobile. In the year 1909, Durant brought in Cadillac, Elmore, Oakland and

several others. Also in 1909, GM acquired Reliance Motor Truck Company and Rapid Motor

Vehicle Company. In the year 1911 Durant started Chevrolet Motor Car Company. In 1916 GM

was reorganized into GM Corporation. Post-war global dominance of GM was led by Alfred P.

Sloan when seven manufacturing facilities operated by Chevrolet before GM acquired and began

operations. These were added to individual factories exclusive to Cadillac, Buick, Oldsmoblie,

Oakland and other GM acquired companies. The major growth GM saw was in the 1980s when

it employed 349,000 workers and operated 150 assembly plants.

They led the global vehicle sales for 77 years from 1931-2007and is currently worlds

largest automakers by vehicle unit sales. GM produces vehicles in 37 countries under thirteen

brands: Alpheon, Chevrolet, Buick, GMC, Cadillac, Holden, Hsv, Opel, Vauxhall, Wuling,

Baojun, Jie Fang, UzDaewoo. GM holds a 20% stake in IMM and a 77% stake in GM Korea. It

also has joint ventures in countries like China, Russia, Pakistan, Uzbekistan, India, Egypt and

South Africa. GM employs 212,000 people and does business in more than 120 countries across

the globe.

But in the year 2009, GM had to close several brands like Saturn, Pontiac, and Hummer

due to financial problems. GM is now divided into five business segments: GM North America,

Opel Group, GM International Operations, GM South America and GM Financial.

GM in 2009: The Bankruptcy

Causes

There were various mistakes that lead to General Motors file for bankruptcy. The company

which once sold half the cars in US now is operating on $20 billion in government aid and would

need more billions to reorganize. Few of the major reasons are:

1. Not filling for bankruptcy sooner: The filing for bankruptcy in the year 2005 would have

better for everyone as in the year 2005 the company was stronger and the economy was

going along well enough to absorb job losses rather than waiting for the filling to

accelerate due to market collapse. This would have also saved them from a lot more of

debts that they took.

2. Incentives: After 2001 terrorist attacks GM started giving consumers 0% financing on

loans up to five years. As newness of the deal wore off they started taking $3000 as

rebate. After a few years the deals kept coming but GM stuck with their model of low

GENERAL MOTORS: THE 2009 STORY 5

3.

4.

5.

6.

rates as they were praised a lot for it. But this was starting a downfall for them as prices

kept increasing and the effect had to be incurred by the company instead. They kept low

rates and increased rebates to $6000 and later to $8000. This caused the market to go

away from them as the sticker price was getting higher than the competition.

Killing EV2 electric program: They tried to compete with Toyota in the field of electric

car and launched a test fleet. Due to PR problems the test cars were reclaimed. The real

loss for the company was shutting down of the program and losing all the R&D done

behind it. They should have benched it for use in future which would have helped them

later as the consumers were looking for something greener and as their market was going

away they would have used it for earning more profit.

Selling control of GMAC: GMAC was the financial arm behind every car pushed out of

GM factories. They were considered equal to a bank for the GM group. But in 2006 due

to cash crunch GM sold off 51% of GMAC to Cerberus for 7.4 billion in cash and 6.6

billion in staggered payments. This crippled GM from starting any new project or even

taking risk in any existing project.

Mishandling FIAT- When GM bought 20% of the Italian company for 2.4 billion in GM

shares; the deal looked as a genius move. This would have given them dominance in

European market. The second clause was that FIAT could force GM to buy the remaining

shares. But in 2005 GM paid FIAT $2 billion to get out of the deal.

Overreaction to the truck boom: After seeing the booming market for trucks, GM

overcommitted themselves towards truck manufacturing especially from Hummer brand.

But when in 2008 the fuel prices hiked and as trucks were not fuel efficient, the market

tilted away from the trucks and the over commitment towards truck backfired.

Area of Focus

We are focusing on General Motors during and after they filed for bankruptcy. What

measures where taken which were either beneficial to the resurgence of the company. What all

measures and financial instruments actually help us evaluating if they are improving or they are

still during the same phase.

We also compare General Motors with other competitors like Tesla Motors from the

United States perspective and Tata Motors from the Indian perspective. This will help us analyze

if General Motors have actually improved and utilized its bankruptcy filings. We have chosen

this two companies because Tesla Motors and Tata Motors were in a very poor state after

recession hit the market.

With the help of the operating leverage we would like two show how the company went

into a shell and started consolidating before they thrust back and gave all in when they were

financially strong so that they could earn extraordinary profits.

Through financial leverage we would like to show how General Motors have used the

money provided by the US government to bail it out of bankruptcy. On whether they used the

money usefully or did they waste the money.

GENERAL MOTORS: THE 2009 STORY 6

Leverage Analysis

Operational Leverage

Operational Leverage is a measure how growth in revenue translates in to growth or

reduction operating income. If the company has a high positive degree of operating leverage,

then the company is making unprecedented operating profits. But if the company is making high

negative degree of operating leverage, then the company is making unprecedented operating

loses. Operating leverage is a double edged sword for a company with respect to the fact that if

the company is making profits, the higher the degree of operating leverage the higher will be its

profit but if the company is making loses then it will make huge amount of profits.

The main reason for this the dependency of companies on fixed cost. If the company is

incurring high amount of fixed costs, then the operating leverage will be higher. But if the

company incurs high level of variable costs then the companys operating leverage will be lower.

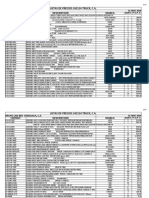

Below is the detailed data of General Motors Operating Leverage

Sales

EBIT

2014

155,42

7

1,530

2013

2012

155,92 152,25

9

6

5,131 -30,363

2011

148,86

6

5,656

2010

135,31

1

5,108

2009

57,474

-4,863

The sales and EBIT value is in thousands.

Percentage change in Sales and EBIT and Degree of Operating Leverage (year on year):

20142013

Percentage change

in Sales

Percentage change

in EBIT

DOL

-0.0032

20132012

0.0241

20122011

20112010

20102009

0.0228

0.1002

1.3543

-0.7018 -1.1690 -6.3683

217.993 48.457 279.652

9

8

1

0.1073

-2.0504

1.0709

-1.5140

The DOL or the degree of operating leverage is calculated by dividing the Percentage

change in Sales by Percentage change in EBIT. This gives us year on year change in DOL.

From the below data we can see that immediately after the year of bankruptcy the operating

leverage of the company was at -1.5. This could be due to less dependence on the fixed costs.

This could mean that they were trying to consolidate the company with the latest influx of money

from the US government. Even the following the year the the company had an operating leverage

of positive 1.07. This was again under the consolidation phase where the company was trying to

make profits but slowly.

It can be observed that in the year 2012, the company tried to go for profits but failed

miserably because it earned an operating loss of $ 30,363,000. It could be forgiven because the

GENERAL MOTORS: THE 2009 STORY 7

company had to try and start earning profits as the entire world was coming out of recession. But

as the company incurred losses the DOL was down -279. In the year 2013, we can see that the

company learned from the mistakes of 2012 and actually made profits of around $5 million. But

still this could not reduce the DOL to be on the positive side.

But in the year 2014, we can see that the there was a negative change in EBIT but also

there was negative change in Sales. This lead to a huge positive margin on degree of operating

leverage.

The initial years of low degree of operating leverage was due to the fact that they started selling

or phasing out brands that were making losses. For example, GM sold its brand Saab to a

Swedish auto maker Spyker Cars. Also the brands, Saturn and Hummer was declared defunct in

the year 2010.

These factors combined with the high operating leverage was one of the reasons that it

has paid of the bankruptcy loan and is valued as one of the top performing companies in the US.

Financial Leverage

Financial Leverage of a company is the practice of using the borrowed money from either

debt or equity to invest in an asset. This can have completely opposite impacts depending on the

investments. It may multiply gains if the right investment is carried out but it can also lead to

heavy losses if the investment goes bad i.e. if the asset prices become bearish.

Below is the detailed financial leverage of General Motors:

2014

2013

2012

2011

2010

2009

EPS

EBIT

1.75

1,530

2.71

5,131

3.1

4.94

-30,363 5,656

3.11

5,108

-3.58

-4,863

The value of EBIT is in thousands.

Percentage change in Sales and EBIT and Degree of Financial Leverage (year on year):

2014-2013 2013-2012 2012-2011 2011-2010 2010-2009

Percentage

change in Sales

Percentage

change in EBIT

DFL

-0.354

-0.126

-0.372

0.588

-1.869

-0.702

0.505

-1.169

0.108

-6.368

0.058

0.107

5.485

-2.050

0.911

The DFL or Degree of Financial Leverage is calculated by dividing the Percentage

change in EBIT by Percentage change in Sales. Higher the value of DFL higher is the return

from assets on which a company has invested in.

It is a common fact that General Motors had borrowed $ 20 Billion Dollars from the US

government in July of 2009 after its claim of bankruptcy was approved. We can observe that the

DFL value is almost one which shows that the assets invested by General Motors were relatively

safe in terms of profit. Also in its corresponding year the company had a healthy DFL of almost

5.5. This showed that the company was on the right track after borrowing from the US

government.

GENERAL MOTORS: THE 2009 STORY 8

It is to be noted that that in the following year there was a drastic drop in the DFL. This was due

to the losses incurred by the company. This meant that the assets had back fired and had incurred

losses for the company.

But the next two years after that the company has generally been having a healthy DFL

rate. These were the main reasons that the company was able to pay off the loan that it had taken

from the government during the bankruptcy by the year 2014. It had taken the company only 5

years to repay a loan of $ 20 Billion Dollar plus the interests.

Combined Leverage

Combined leverage summarizes the effect of the degree of financial leverage and the

degree of operating leverage. It is given as the percentage change of EPS with respect to

percentage change in sales.

It provides the investors the idea of the earning a company has per share with respect to

change in sales. If it has a higher and a positive degree it can be a good investment option.

For General Motors the Sales and EPS from 2009 to 2014 is provided as below

Sales

EPS

2014

155,42

7

1.75

2013

155,92

9

2.71

2012

152,25

6

3.1

2011

148,86

6

4.94

2010

135,31

1

3.11

2009

57,474

-3.58

The Degree of Total Leverage for these years are below:

20142013

Percentage

change in sales

Percentage

change in EPS

DTL

20132012

20122011

20112010

20102009

-0.003

0.024

0.023

0.100

1.354

-0.354

110.034

-0.126

-5.215

-0.372

-16.356

0.588

5.874

-1.869

-1.380

GENERAL MOTORS: THE 2009 STORY 9

Competition Analysis

Tesla Motors

Tesla Motors is a company which manufactures electric cars. It gained major traction during their

production of Roadster which was the first fully electric sports car. We have chosen this company

because in 2009, it was noted that the company was out of cash. It was only when Elon Musk the

CEO of the company had to invest his own cash to get the company out of the financial mess.

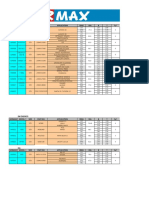

Below is the Companies DOL, DFL and DTL.

Operating Leverage:

2014

Sales

3,198,356

EBIT

-186,689

20142013

Percentage

change in

sales

Percentage

change in

EBIT

DOL

2013

2,013,496

-61,283

20132012

2012

413,256

-394,283

20122011

2011

204,242

-251,488

20112010

2010

2009

116,744

111,943

-146,838

-51,897

20102009

0.59

3.87

1.02

0.75

0.04

2.05

3.48

-0.84

-0.2181

0.57

0.554

0.71

0.95

1.83

42.65

GENERAL MOTORS: THE 2009 STORY 10

Financial Leverage:

2014

1.75

2013

2.71

2012

3.1

2011

4.94

2010

3.11

-186,689

-61,283

-394,283

-251,488

-146,838

Sales

EBIT

Percentage

change in Sales

Percentage

change in EBIT

DFL

2014-2013

2013-2012 2012-2011

2011-2010

2010-2009

0.14

2.81

-0.83

0.46

-0.40

2.05

0.07

-0.84

-3.32

0.57

-1.47

0.71

0.64

1.83

-0.22

2009

-3.58

51,89

7

Total Leverage:

2014

2013

2012

2011

2010

2009

Sales 3,198,356 2,013,496

204,2422012116,744 2011111,943

2014-413,256

20132010EPS

-2.68

-2.36

-0.62

-3.69

-2.53

-4.22

2013

2012

2011

2010

2009

Percentage

change in sales

0.59

3.87

1.02

0.75

0.04

Percentage

change in EPS

0.14

2.81

-0.83

0.46

-0.40

0.23

DTL

0.724

-0.812

0.611

-9.33

GENERAL MOTORS: THE 2009 STORY 11

We can see that for Tesla Motors, Except for the year 2010-09, it has had a very low

operating leverage and financial leverage. This is due to the fact that the the environmental cars

are not yet very common. So they are still going very slowly instead of going with full blown

risk. Tesla Motors did understand that as time passes they will have their time by increasing the

risks and hence start earning more profits.

Tata Motors

It is a subsidiary of the large conglomerate Tata Group. The Tata Motors was set up in

1945. It started building trucks initially, but in 1991 created the its first passenger vehicle Taat

Seirra followed by Tata Indica in1998 and Tata Nano in 2008. Also in 2008, it bought over the

famous British car manufacturer, Jaguar Land Rover(JLR).

Due to the launch of Nano and takeover of JLR there were some issues with its

financials. We are trying to depict should it first try to reduce its risk and concentrate on

consolidation or should it keep on continuing it riskiness.

Operating Leverage

Sales

EBIT

2015

38,651.22

-3,974.72

2014

37,209.56

-1,025.80

2013

46,581.32

174.93

20142013

Percentage

0.04

2012

54,919.24

1,341.03

20132012

-0.20

2011

47,718.51

2,196.52

20122011

-0.15

2010

38,173.39

2,829.54

20112010

0.15

2009

28,538.20

1,013.76

20102009

0.25

GENERAL MOTORS: THE 2009 STORY 12

change in

sales

Percentage

change in

EBIT

DOL

2.87

-6.86

-0.87

-0.39

-0.22

74.20

34.12

5.73

-2.58

-0.89

Financial Leverage

2014

1.75

2013

2.71

2012

3.1

2011

4.94

2010

3.11

-186,689

-61,283

-394,283

-251,488

-146,838

Sales

EBIT

Percentage

change in Sales

Percentage

change in EBIT

DFL

2009

-3.58

51,89

7

2014-2013

2013-2012 2012-2011

2011-2010

2010-2009

-15.15

0.09

-0.76

-0.86

-0.27

2.87

-5.27

-6.86

-0.01

-0.87

0.87

-0.39

2.22

-0.22

1.22

Total Leverage

Sales

EPS

2014

2013

2012

2011

2010

2009

38,651.22

37,209.56

46,581.32

54,919.24

47,718.51

38,173.39

-14.72

1.04

0.95

3.91

28.55

39.26

20112010

20102009

20142013

Percentage

change in sales

Percentage

change in EPS

DTL

20132012

20122011

0.04

-0.20

-0.15

0.15

0.25

-15.15

0.09

-0.76

-0.86

-0.27

-391.12

-0.47

4.99

-5.72

-1.09

GENERAL MOTORS: THE 2009 STORY 13

We can observe that the DOL of Tata Motors is pretty strong but the financial leverage of

the company is pretty weak. It leads to the fact that Tata motors has still not been able to invest in

the correct assets. It has faced issues regarding land acquisition in India which is one of the main

reasons for this.

Summary

We can see that the General Motors has actually performed exceptionally after it filled for

bankruptcy. It has been taken less risks in the initial years. It did not look to make huge profits as

they understood that it was the tax payers money and it had just one shot to success.

This lead to the slow but steady growth of General Motors to the initial glory days. By

2014 it was able to repay the entire $ 20 Billion plus the interest back to the government.

This shows that how a company can concentrate on reducing risks while consolidating

and later on once the financials and other strategies in place it can pick up drastically.

Currently the GMC is listed under Nasdaq and is trading around $35 per share. Also the

company is listed as one of the top 40 performing companies in Dow Jones ahead of some major

companies like American Express etc.

Você também pode gostar

- Ford ECM Full List 12-1-2018Documento69 páginasFord ECM Full List 12-1-2018Mohamed AbdallahAinda não há avaliações

- Why General Motors FailedDocumento11 páginasWhy General Motors FailedMohammad RakibAinda não há avaliações

- The Collapse of General Motors - Who Is at Fault?Documento19 páginasThe Collapse of General Motors - Who Is at Fault?fmshaon100% (1)

- General Motors Inc AnalysisDocumento9 páginasGeneral Motors Inc AnalysisUbong Akpekong100% (1)

- Cadillac Series 62Documento17 páginasCadillac Series 62Roberto Ortega MicalizziAinda não há avaliações

- Genral MotorsDocumento30 páginasGenral Motorscool_techAinda não há avaliações

- GM SWOT Analysis Examines Strengths, Weaknesses and Future OutlookDocumento3 páginasGM SWOT Analysis Examines Strengths, Weaknesses and Future Outlookmallireddy1234Ainda não há avaliações

- GM Vision to Lead in Alternative Fuel InnovationDocumento8 páginasGM Vision to Lead in Alternative Fuel InnovationAbhijit Naskar100% (1)

- General MotorsDocumento18 páginasGeneral MotorsDushyant ShahAinda não há avaliações

- GM Business PlanDocumento6 páginasGM Business PlanPriyanka NemaAinda não há avaliações

- GM SWOT 2013 analysisDocumento3 páginasGM SWOT 2013 analysisAnkur Anil Nahata100% (1)

- Alternator Catalog 20171582682690632Documento122 páginasAlternator Catalog 20171582682690632warmman suhayaAinda não há avaliações

- Case Study (General Motors Company)Documento21 páginasCase Study (General Motors Company)sidplan67% (3)

- GM Marketing Case Project Analyzes Hybrid Market OpportunityDocumento26 páginasGM Marketing Case Project Analyzes Hybrid Market OpportunityGabriela OldachAinda não há avaliações

- International Business General MotorsDocumento16 páginasInternational Business General MotorsMarieke Martens100% (1)

- 401k Calculator 3Documento18 páginas401k Calculator 3Alexander KotlerAinda não há avaliações

- General Motors Corporate GovernanceDocumento12 páginasGeneral Motors Corporate GovernanceChristopher Bommarito0% (1)

- GM's Strategy Analysis: An Internal and External AssessmentDocumento13 páginasGM's Strategy Analysis: An Internal and External Assessmentnirosh16Ainda não há avaliações

- GM's Capital Allocation Framework Drives Focus on Returns and Cash FlowDocumento6 páginasGM's Capital Allocation Framework Drives Focus on Returns and Cash FlowAlexandra Bento0% (1)

- Case Study of General Motors Using SPADEDocumento44 páginasCase Study of General Motors Using SPADERad BautistaAinda não há avaliações

- Truck Manuals Download ServiceDocumento1.397 páginasTruck Manuals Download ServiceTiqany0% (1)

- General Motors Reasons To FailureDocumento5 páginasGeneral Motors Reasons To FailureMark Antony LevineAinda não há avaliações

- SWOT Analyses of General Motors India PVTDocumento12 páginasSWOT Analyses of General Motors India PVTshan birlaAinda não há avaliações

- Construction Equipment September 2016 PDFDocumento43 páginasConstruction Equipment September 2016 PDFSandeep KumarAinda não há avaliações

- General MotorsDocumento17 páginasGeneral MotorsRobAinda não há avaliações

- Ford Etis Offline 06 2022 Repair Manuals Information DVDDocumento23 páginasFord Etis Offline 06 2022 Repair Manuals Information DVDsamuelwilliams190691rmw99% (92)

- PEST Analysis Reveals Factors Impacting Automotive IndustryDocumento10 páginasPEST Analysis Reveals Factors Impacting Automotive Industryshoky10Ainda não há avaliações

- Automotive LeasingDocumento88 páginasAutomotive Leasingnikky7771Ainda não há avaliações

- A General Motors Case StudyDocumento81 páginasA General Motors Case StudyHamed KhazaeeAinda não há avaliações

- Individual Assignment 1 - GMDocumento10 páginasIndividual Assignment 1 - GMIdayuAinda não há avaliações

- GM: What Went Wrong and What's NextDocumento15 páginasGM: What Went Wrong and What's Nextsuhaspujari93Ainda não há avaliações

- General Motors CompanyDocumento8 páginasGeneral Motors CompanyNeha Soningra100% (1)

- General MotorsDocumento15 páginasGeneral Motorsparassmc100% (1)

- GM's Global Strategy & OperationsDocumento25 páginasGM's Global Strategy & Operationscool_techAinda não há avaliações

- GM's global expansion through mergers, JVs and exportsDocumento11 páginasGM's global expansion through mergers, JVs and exportsDhananjay KumarAinda não há avaliações

- GM's History as a Leading AutomakerDocumento1 páginaGM's History as a Leading AutomakerAshish NirwaniAinda não há avaliações

- Toyota PresentationDocumento12 páginasToyota PresentationShanoonAinda não há avaliações

- PD ToyotaDocumento30 páginasPD Toyotaeducatepd67% (3)

- GE Corporate Venture EffortsDocumento8 páginasGE Corporate Venture EffortsApolline MorelleAinda não há avaliações

- Cost of Equity and Capital for Over 7000 US CompaniesDocumento15 páginasCost of Equity and Capital for Over 7000 US CompaniesPedro CooperAinda não há avaliações

- Dse Handbook 2016 New PDFDocumento44 páginasDse Handbook 2016 New PDFGoodluck SumariAinda não há avaliações

- ME6505 Dynamics of Machines Part A Q&A Unit-IIDocumento4 páginasME6505 Dynamics of Machines Part A Q&A Unit-IIkannanviknesh086319Ainda não há avaliações

- 3M Case StudyDocumento14 páginas3M Case StudyYasir AlamAinda não há avaliações

- Construction IndustryDocumento7 páginasConstruction IndustryVishal RastogiAinda não há avaliações

- Cleveland Research Company Stock Pitch 2016 EntryDocumento24 páginasCleveland Research Company Stock Pitch 2016 EntryNguyen D. Nguyen100% (1)

- Tammy gm1Documento15 páginasTammy gm1cool_techAinda não há avaliações

- GM ReportDocumento7 páginasGM ReportPiyush GoyalAinda não há avaliações

- GM Accounting Failure ResearchDocumento11 páginasGM Accounting Failure ResearchShivani JatakiyaAinda não há avaliações

- Case Study of General MotorsDocumento9 páginasCase Study of General MotorsOSCAR RENUEL POBLETEAinda não há avaliações

- Factors Affecting GM: Chevrolet India (SLEPT Analysis) : LegislationDocumento6 páginasFactors Affecting GM: Chevrolet India (SLEPT Analysis) : LegislationABHISHEK SINGHAinda não há avaliações

- GM Automotive GiantDocumento22 páginasGM Automotive GiantArshia ZainAinda não há avaliações

- General Motors Marketing AssignmentDocumento8 páginasGeneral Motors Marketing AssignmentRajveer SinghAinda não há avaliações

- Recommendation BibliographyDocumento10 páginasRecommendation BibliographyRoshan YadavAinda não há avaliações

- GM's Presence in IndiaDocumento20 páginasGM's Presence in IndiaRoshan YadavAinda não há avaliações

- GMDocumento24 páginasGMcool_techAinda não há avaliações

- GM DescriptionDocumento8 páginasGM DescriptionMuhammedShefeequePandaAinda não há avaliações

- General Motors Swot AnalysisDocumento4 páginasGeneral Motors Swot AnalysisSri YantiAinda não há avaliações

- General Motors Final Marketing PlanDocumento26 páginasGeneral Motors Final Marketing PlanAkiyama Mio100% (2)

- 2017 Financial Analysis GMDocumento40 páginas2017 Financial Analysis GMEL GHARBAOUI MOHAMMEDAinda não há avaliações

- About GMDocumento3 páginasAbout GMabdulwadoodansariAinda não há avaliações

- GM Case Study AssignmentDocumento6 páginasGM Case Study AssignmentAhmad MasriAinda não há avaliações

- Information Systems: Requirements. System, Applications, Infrastructure, and Other Information TechnologyDocumento26 páginasInformation Systems: Requirements. System, Applications, Infrastructure, and Other Information TechnologyOuvais AslamAinda não há avaliações

- General Motors Turnaround StoryDocumento13 páginasGeneral Motors Turnaround StoryABTABH AHMEDAinda não há avaliações

- Topic 5 - Answer QuestionDocumento3 páginasTopic 5 - Answer QuestionNguyen Nguyen Huynh CamAinda não há avaliações

- History::: General Motors Company, Commonly Known As GM, Is An AmericanDocumento10 páginasHistory::: General Motors Company, Commonly Known As GM, Is An AmericanVinesh KumarAinda não há avaliações

- IKEA in USDocumento20 páginasIKEA in USSambit RoyAinda não há avaliações

- BMW 7-Series Project Process ChangesDocumento27 páginasBMW 7-Series Project Process ChangesSambit RoyAinda não há avaliações

- SL No. Account Heads: Asset Year Plant Machinery 1 2 3 4 5Documento7 páginasSL No. Account Heads: Asset Year Plant Machinery 1 2 3 4 5Sambit RoyAinda não há avaliações

- Cisco ChanelingDocumento2 páginasCisco ChanelingSambit RoyAinda não há avaliações

- Cisco ChanelingDocumento2 páginasCisco ChanelingSambit RoyAinda não há avaliações

- Ipad Sales in IndiaDocumento12 páginasIpad Sales in IndiaSambit RoyAinda não há avaliações

- BMW 7-Series Project Process ChangesDocumento27 páginasBMW 7-Series Project Process ChangesSambit RoyAinda não há avaliações

- Pontiac Firebird 1979 Owner's ManualDocumento104 páginasPontiac Firebird 1979 Owner's Manual1979ws67477Ainda não há avaliações

- List of prices for Isuzu diesel engine partsDocumento77 páginasList of prices for Isuzu diesel engine partsGenesis Guaregua100% (1)

- FRENCH BRAKE PARTS PRICE LISTDocumento75 páginasFRENCH BRAKE PARTS PRICE LISTYamil Brs billterryAinda não há avaliações

- Lista Almacen General: Full 10% 30dias ContadoDocumento11 páginasLista Almacen General: Full 10% 30dias ContadoRene PezzollaAinda não há avaliações

- Lookup Chevy Transmission by Model, YearDocumento13 páginasLookup Chevy Transmission by Model, YearMarco MeloncelliAinda não há avaliações

- Jokerflash CarDocumento24 páginasJokerflash CarFabiow VishAinda não há avaliações

- History About Ford MotorsDocumento4 páginasHistory About Ford Motorsvalerie arellanoAinda não há avaliações

- Ficha 1278590930482443791Documento3 páginasFicha 1278590930482443791Ernesto NetoAinda não há avaliações

- New 2024 Chevy Silverado EVDocumento2 páginasNew 2024 Chevy Silverado EVluxury life wishesAinda não há avaliações

- Hyundai and Kia engine piston ring specificationsDocumento2 páginasHyundai and Kia engine piston ring specificationsВладимир АнаймановичAinda não há avaliações

- Reporte de Programacion de Citas Del 04 Al 09 de SeptiembreDocumento200 páginasReporte de Programacion de Citas Del 04 Al 09 de SeptiembrejennyAinda não há avaliações

- 75W-90 Technician Series MTF-FS (PDS)Documento4 páginas75W-90 Technician Series MTF-FS (PDS)Kristiano TavaresAinda não há avaliações

- Chevy Parts CatalogDocumento48 páginasChevy Parts CatalogAriannys FigueraAinda não há avaliações

- Allison Support Equipment: Parts Catalog PC2809ENDocumento15 páginasAllison Support Equipment: Parts Catalog PC2809ENamineAinda não há avaliações

- Hptuners Mpvi3 Supported VehiclesDocumento64 páginasHptuners Mpvi3 Supported VehiclesmiguelAinda não há avaliações

- GM 10 Cut Wafer LockDocumento3 páginasGM 10 Cut Wafer LockMike JoynesAinda não há avaliações

- 2024 Chevy ChevelleDocumento3 páginas2024 Chevy Chevelleluxury life wishesAinda não há avaliações

- Pontiac SunfireDocumento3 páginasPontiac SunfirerobertoAinda não há avaliações

- Bulk Part Application Total On Hand: Sealed Power PistonsDocumento7 páginasBulk Part Application Total On Hand: Sealed Power PistonsAndrey ProkofievAinda não há avaliações

- CSD Pricelist July 23Documento1 páginaCSD Pricelist July 23Madhabananda SahuAinda não há avaliações

- Horn Cigar Lighter Ford Fiesta 1.6Documento2 páginasHorn Cigar Lighter Ford Fiesta 1.6Ismael LopezAinda não há avaliações

- Mercury CougarDocumento9 páginasMercury CougarMaestría Penal Procesal XiiAinda não há avaliações

- Bendix - Power Brake Exchange - Catalog 9-550 - 1946 Through 1965 - OCR - 24 PagesDocumento24 páginasBendix - Power Brake Exchange - Catalog 9-550 - 1946 Through 1965 - OCR - 24 Pagesgreg titanAinda não há avaliações

- Linesoon Catalog (2014)Documento166 páginasLinesoon Catalog (2014)Steven CHENAinda não há avaliações

- 1/4/2023 Código ComercialDocumento6 páginas1/4/2023 Código ComercialMhtecnical SacAinda não há avaliações