Escolar Documentos

Profissional Documentos

Cultura Documentos

Financial Market and Institutions Lecture-1, 2, 3

Enviado por

Tyler vanPersieDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Financial Market and Institutions Lecture-1, 2, 3

Enviado por

Tyler vanPersieDireitos autorais:

Formatos disponíveis

Financial Market and Institutions

Lecture-1, 2, 3

Financial market:

Financial markets facilitate the flow of funds from surplus units to deficit units. Those

individuals/ households business or government who supply funds to the financial market are called

surplus units and among these thee the households is the major group in the surplus units.

On the other hand those who use the financial markets to obtain funds are called deficit units

and among the users business is the major group in the deficit units. Funds are transferred to deficit

units through the issuance of different instruments (called securities) in the financial markets by the

deficit units. The deficit units sell securities to the surplus units in order to obtain funds as par their

requirements. (Short- term or long-term)

A security is a certificate that expresses a claim on the issuer. Generally financial markets are

viewed as a system comprised of individuals and institutions, instruments and procedures that that

bring together the savers and the borrowers. It is comprised of different markets that deal with

different types of securities/ instruments in terms of different maturities and asset backing. In sum the

financial markets facilitate:

1.

2.

3.

4.

5.

6.

Raising of capital- In capital market

Transfer of risk- Derivative market

Transfer of liquidity that occurs in the money market

Price discovery- Both money and capital markets

International trade that occurs in the currency market

Global transactions with integration of international financial markets

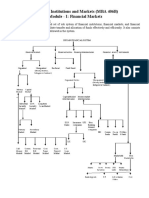

Classification of Financial markets:

The most common financial market classifications area. Debt vs. Equity market: Debt markets are markets where loans are traded. A debt

instrument is a contract that specifies the amount and schedule of when a borrower would

repay the funds provided by the lender. Equity markets on the other hand are markets where

stocks of the companies are traded. Equity represents ownership in a corporation and entitled

the equity holders to share the income of the company. [Classification based on legal

obligation of the issuer]

b. Money vs. Capital market: Money market is the market for debt securities with maturity of

one year or less. The purpose of this market is to provide liquidity to the business,

government or individuals to meet short-term needs for cash. Capital markets are the markets

for immediate or long-term debt and corporate stocks with maturities for a period longer than

one year or with no maturity mention. [Classification based on maturity of the instruments]

c. Primary vs. Secondary market: Primary market is the market in which the corporations raise

funds by issuing new stocks/ securities. On the other hand secondary market is the market for

securities already issued through primary market. Whenever a newly formed or a privately

held company is offering securities to the public for the first time, the company is said to be

going public and the process of going public is called IPO.

d. Private vs. Public market: Private markets are market in which securities are traded among

sophisticated investors who generally are known to each other and the deals in such market

can be structured to fit the parties need. Transaction in public markets take place in

standardized form because the securities are traded among large number of investors

unknown to each other. [Classification based on relationship among participants]

e. Spot vs. Future market: In spot market securities are traded for On the spot delivery basis.

Whereas future markets are markets of securities the delivery of which occurs at some future

date but the price being agreed at the time of contract. [Classification based on nature of deal

of securities]

f. Intermediate vs. Non-Intermediate market: Intermediated financial markets include market

for financial instruments that are created and traded among financial intermediaries

themselves. For example, markets for CDs and call money market. Whereas nonintermediate financial market is the market where exchange of directly issued primarily

Lawliet Prokash

Financial Market and Institutions

Lecture-1, 2, 3

securities by non-financial institutions take place such as corporate bonds and stocks are the

examples of non-intermediate financial market securities.

g. Derivate markets: A market which provides different instruments for the management of

financial risk that arises due to transaction in the financial market. Example of the derivative

instruments are forward, future and option contracts, insurance and foreign exchange market

are also the part of financial market.

Features of Financial market:

A financial market has the following features1. Existence of various individuals and institutions: Financial market usually operates through

network of different individuals and Financial Institutions called participants in the financial

market.

2. Market for transaction of financial assets: Financial assets of different maturities (Short and

long) are traded in the financial markets.

3. Interacting place for surplus and deficit unit: Financial market is the place where the deficit

units sell securities to raise funds and the surplus units buy those securities for generating

income.

4. Create investment opportunities: Through selling securities the company raise funds to invest

in their business and the surplus units buying those securities create an environment of

economy activity that boost up investment opportunities.

5. Create channels of cash flows in the economy: Funds are channeled through or indirectly in

different sectors of the economy.

6. Existence of competition and complementary organization- Financial markets operate through

functioning of different organization and instructions such as the brokers dealers etc. There

exists a strong competition among them and they are also complimentary to each other for

smooth functioning of the market.

7. Existence of regulatory bodies: Various regulatory bodies such as SEC, Central bank,

Finance ministry etc. directly and indirectly regulate and monitor the activities of financial

markets.

8. A place for maintaining liquidity: Through buy and sell of securities the financial markets

maintain liquidity of the participants.

Functions of Financial market:

Function of Financial market can be viewed as,

1.

2.

3.

4.

Intermediary functions

Financial functions

Liquidity adjustment functions

Accelerating economic growth and employment.

These are described below1. Intermediate functions: intermediate functions of financial markets includea. Transfer of resources- Financial market facilitates the transfer of real economic

resources from lenders to ultimate borrows.

b. Enhancing income- Financial markets allow lenders toward interest or dividend on

their surplus funds and thus contributing to enhancement of their ultimate income.

c. Productive usage- Financial markets allow for the productive use of the funds

borrowed and thus augmenting income and national production.

d. Capital formation- Financial markets provide facilities through which new savings

flow to aid capital formation of a country.

e. Price determination- Financial markets allow for the determination of the traded

financial assets through the interactions of the buyers and sellers. They provide a

sign for the allocation of funds in the economy based on demand and supply through

the mechanism of price discovery process.

Lawliet Prokash

Financial Market and Institutions

Lecture-1, 2, 3

f.

Sales mechanism- Financial markets provide a mechanism for selling of financial

assets by an investor so as to offer the benefit of marketability and liquidity of such

assets.

g. Information provider- The activities of the participants of the financial markets result

in generation and dissemination of information through various segments of the

market. Such information ultimately reduce the cost of transaction in the market.

2. Financial functions: It includes,

a. Providing the borrowers with funds so as to enable them to carry out their investment

plans

b. Providing the lenders with earning assets so as to enable them to earn wealth by

deploying their saved funds.

3. Liquidity adjustment function: A major function of the financial, market is to provide liquidity

adjustment to the market participants. Liquidity measures the nearness of the financial asset

to cash. Of all the financial assets traded in the financial markets, money market instruments

are most liquid in the sense that they are easily marketable into cash, at little money risk and

credit/ default risk and shorted maturities compared to capital market instruments.

By allocating a portion of wealth in the money market instruments, the wealth

allocation may reduce the risk of keeping low cash balances and at the same time avoid cost

of forgoing interest. Switching back and forth between cash holding and holding of money

market securities is a major way in which money markets are used by the participants for

adjusting their liquidity.

Money markets are used by those who have excess cash for temporary investment

and who needs funds for a shorter period of time.

4. Special role of money in the financial market: Since money is the major component in the

financial system vis--vis in the financial market, its special role need be precisely understood

in the context of financial market. In financial market, money serves a very special role of vast

importance which can be summarized as belowa. Money is the substance that the lenders lend and the borrowers borrow from the

financial market.

b. The debt contracts exchange for money are written, expressed and valued in terms of

money

c. The obligation to pay interest and the return of the principal by the borrower is a

monetary obligation.

d. As medium of exchange the demand for money is universal.

e. Monetary policy is designed by the central bank to stabilize the overall economy, but

its impact is felt most keenly in the financial market.

The participants in the financial markets:

According to behavior of the financial market participants they can be categorized in four broad

groups1. Investors- Individuals and firms purchase financial securities for earning income. They

expect a stabilized income from such investment in the form of either interest or dividend.

Their preference is stability of income from securities.

2. Speculators- They hold financial securities to take benefits of price changes. They generally

buy securities at lower price and sell at a higher price. Their primary focus is capital gain.

3. Arbitragers- Arbitrage takes place when a security is bought in one market and

simultaneously sold at higher price in another market. They try to get the benefit out of price

differences in two different markets

4. Hedgers- They hold financial securities in their own account consisting of securities of

different companies. Hedge occurs when different types of securities are held in order to have

offsetting price management. Higher prices of one security would offset the lower prices of

others.

Lawliet Prokash

Financial Market and Institutions

Lecture-1, 2, 3

Securities traded in financial markets:

Summary of popular securities-

Securities

Issued by

Money market securities

a. Treasury bill

Government

b. Certificate of

deposits (CDs)

c.

Negotiable

CDs

d. Commercial

paper

Banks and

saving

institutions

Large banks

and saving

Institutions

Banks,

Finance co.

and firms

Banks

e. Bankers

acceptance

f. Repurchase

Banks and

agreement

Firms

(REPO)

Capital market securities

a. Corporate

Corporate

bonds

Firms

b. Equity

Corporate

Securities

Firms

c. Mortgages

Financial

Institutions

and Firms

Common

Investors

Common Maturity

Secondary

market status

Different firms,

companies,

financial

Institutions

Households

13 weeks 1 year

Very high

7 days 5 years

Non-existent

Business firms

2 weeks 1 year

Moderate

Other firms

1 day 270 days

Low

30 days 270 days

High

1 day 15 days

Non-existent

10 years 30

years

No maturity

Moderate

15 years 30

years

Moderate

Firms

Firms and

Financial

Institutions

Households and

Firms

Households and

Firms

Financial

Institutions

Lawliet Prokash

Very high

Você também pode gostar

- IFS Unit-1 Notes - 20200717114457Documento9 páginasIFS Unit-1 Notes - 20200717114457Vignesh C100% (1)

- Financial Markets Overview (MBA 406BDocumento62 páginasFinancial Markets Overview (MBA 406BamitAinda não há avaliações

- Final Blackbook by Sanju PDF VARSHADocumento67 páginasFinal Blackbook by Sanju PDF VARSHAYukta SalviAinda não há avaliações

- Cfi1203 Module 1 Intro To Financial Markets and RegulationDocumento20 páginasCfi1203 Module 1 Intro To Financial Markets and RegulationLeonorahAinda não há avaliações

- Unit ThreeDocumento22 páginasUnit ThreeEYOB AHMEDAinda não há avaliações

- 12 - Chapter 5 PDFDocumento49 páginas12 - Chapter 5 PDFShipra Chaudhary100% (1)

- Chapter 02Documento19 páginasChapter 02sadfiziaAinda não há avaliações

- Introduction To Financial SystemsDocumento21 páginasIntroduction To Financial SystemsVinay ArtwaniAinda não há avaliações

- Financial Markets GuideDocumento59 páginasFinancial Markets GuideRaezel Louise VelayoAinda não há avaliações

- Financial InstitutionsDocumento115 páginasFinancial Institutionsmukesh sahooAinda não há avaliações

- Financial System Explained in 40 CharactersDocumento16 páginasFinancial System Explained in 40 CharactersAkansha SinghAinda não há avaliações

- Group 3 Financial MarketsDocumento17 páginasGroup 3 Financial MarketsLady Lou Ignacio LepasanaAinda não há avaliações

- Introduction To Financial MarketsDocumento42 páginasIntroduction To Financial MarketsPradnya HingeAinda não há avaliações

- Financial System of BangladeshDocumento2 páginasFinancial System of BangladeshFardin Ahmed MugdhoAinda não há avaliações

- IFM Transfer PricingDocumento9 páginasIFM Transfer PricingPooja Ujjwal JainAinda não há avaliações

- Corporate GOVERNANCEDocumento16 páginasCorporate GOVERNANCEkhazzeyurquicoAinda não há avaliações

- Functions of Financial SystemDocumento11 páginasFunctions of Financial SystemShah SuzaneAinda não há avaliações

- 1 - Financial System in BDDocumento15 páginas1 - Financial System in BDNourinJahanRintaAinda não há avaliações

- Mid-year acquisition consolidated statementDocumento4 páginasMid-year acquisition consolidated statementOmolaja IbukunAinda não há avaliações

- Chapter 6 (CF)Documento51 páginasChapter 6 (CF)Hossain BelalAinda não há avaliações

- Indian Financial System: FunctionsDocumento31 páginasIndian Financial System: Functionsmedha jaiwantAinda não há avaliações

- CHAPTER 6 - Monetary PolicyDocumento23 páginasCHAPTER 6 - Monetary PolicyReggie AlisAinda não há avaliações

- Untitled 1Documento3 páginasUntitled 1cesar_mayonte_montaAinda não há avaliações

- Risk Analysis And Management ToolsDocumento8 páginasRisk Analysis And Management ToolsBHARATH TEJA REDDY MUNAKALAAinda não há avaliações

- Financial Risk Management Assignment-RahulDocumento4 páginasFinancial Risk Management Assignment-Rahul05550Ainda não há avaliações

- Money MarketDocumento44 páginasMoney MarketReshma MaliAinda não há avaliações

- Capital Budgeting Decisions ExplainedDocumento21 páginasCapital Budgeting Decisions ExplainedSureshArigelaAinda não há avaliações

- 201.12 - 2 - Insolvency Act-1997Documento3 páginas201.12 - 2 - Insolvency Act-1997Biplob K. SannyasiAinda não há avaliações

- Capital MarketsDocumento16 páginasCapital MarketsChowdary PurandharAinda não há avaliações

- Auditing: Lecture # 7Documento3 páginasAuditing: Lecture # 7siddiqueicmaAinda não há avaliações

- 2020 CMA P1 A B Integrated ReportingDocumento35 páginas2020 CMA P1 A B Integrated ReportingLhenAinda não há avaliações

- REVISED NOTES OF FOREIGN EXCHANGE Unit 1 2 - 1Documento40 páginasREVISED NOTES OF FOREIGN EXCHANGE Unit 1 2 - 1komalAinda não há avaliações

- Finalcil Market - Bba Unit One &twoDocumento79 páginasFinalcil Market - Bba Unit One &twoBhagawat PaudelAinda não há avaliações

- Management AccountingDocumento375 páginasManagement Accountingvitabu mingiAinda não há avaliações

- Auditing Ethics: Lecture # 2 Fundamental PrinciplesDocumento3 páginasAuditing Ethics: Lecture # 2 Fundamental PrinciplessiddiqueicmaAinda não há avaliações

- Capital Market in BangladeshDocumento7 páginasCapital Market in BangladeshJack HunterAinda não há avaliações

- Fair Value Adjustment and Consolidation Adjustment Week 2Documento9 páginasFair Value Adjustment and Consolidation Adjustment Week 2Omolaja IbukunAinda não há avaliações

- Finance and Location Strategies For RetailingDocumento20 páginasFinance and Location Strategies For RetailingParameshwara AcharyaAinda não há avaliações

- Capital MarketDocumento38 páginasCapital Marketapi-3798892Ainda não há avaliações

- Letter of Credit: Give Assurance To Your Sellers With ICICI Bank's Letter of CreditDocumento2 páginasLetter of Credit: Give Assurance To Your Sellers With ICICI Bank's Letter of CreditSanjay ShingalaAinda não há avaliações

- 3 - Unit I - Introduction To Financial Systems and Financial MarketDocumento41 páginas3 - Unit I - Introduction To Financial Systems and Financial MarketAlexis Ann Angan AnganAinda não há avaliações

- FMI - Chap 2Documento35 páginasFMI - Chap 2alioAinda não há avaliações

- Understanding Financial Markets and InstitutionsDocumento17 páginasUnderstanding Financial Markets and Institutionskiran shahzadiAinda não há avaliações

- KLCI Futures Contracts AnalysisDocumento63 páginasKLCI Futures Contracts AnalysisSidharth ChoudharyAinda não há avaliações

- Intro To Leasing NoteDocumento5 páginasIntro To Leasing NoteZain FaheemAinda não há avaliações

- Al Financial Management May Jun 2017Documento4 páginasAl Financial Management May Jun 2017Akash79Ainda não há avaliações

- ICMAB's Intro to Cost AuditDocumento144 páginasICMAB's Intro to Cost AuditHasanur RaselAinda não há avaliações

- Acca F9 Business ValuationsDocumento6 páginasAcca F9 Business ValuationsHaseeb SethyAinda não há avaliações

- Chap15 - Time Series Forecasting & Index NumberDocumento60 páginasChap15 - Time Series Forecasting & Index NumberLando DamanikAinda não há avaliações

- Synopsis of Corporate GovernanceDocumento14 páginasSynopsis of Corporate GovernanceApoorv SrivastavaAinda não há avaliações

- Abstract of Financial Market 1Documento8 páginasAbstract of Financial Market 1mmkrishnan94100% (1)

- Risk Management: Exchange RateDocumento25 páginasRisk Management: Exchange RateAjay Kumar TakiarAinda não há avaliações

- Cost of Capital NotesDocumento9 páginasCost of Capital NotesSoumendra RoyAinda não há avaliações

- Secretarial Audit GuidelinesDocumento20 páginasSecretarial Audit GuidelinesTasminAinda não há avaliações

- CH 05 - Bonds, Bond Valuation, and Interest RatesDocumento53 páginasCH 05 - Bonds, Bond Valuation, and Interest RatesSyed Mohib HassanAinda não há avaliações

- Foreign currency risk factorsDocumento16 páginasForeign currency risk factorsHastings KapalaAinda não há avaliações

- Corporate governance practices in BangladeshDocumento5 páginasCorporate governance practices in BangladeshTahmina AfrozAinda não há avaliações

- Group Account Week 1Documento8 páginasGroup Account Week 1Omolaja IbukunAinda não há avaliações

- International Financial System: 2.1.1. Role of Financial MarketDocumento54 páginasInternational Financial System: 2.1.1. Role of Financial MarketADHITHYA SATHEESANAinda não há avaliações

- Lecture 1Documento12 páginasLecture 1Julia NyivaAinda não há avaliações

- A Study On Working Capital Management With Special Reference To Tube Products of India Limited, ChennaiDocumento41 páginasA Study On Working Capital Management With Special Reference To Tube Products of India Limited, ChennaiBasant NagarAinda não há avaliações

- Week 4 Tutorial QuestionsDocumento5 páginasWeek 4 Tutorial QuestionsJess XueAinda não há avaliações

- ABSLI Wealth Infinia BrochureDocumento16 páginasABSLI Wealth Infinia BrochureijarAinda não há avaliações

- Hotel Industry 2011Documento403 páginasHotel Industry 2011emmyk11010% (1)

- Algorithmic StrategiesDocumento1 páginaAlgorithmic Strategiesamir khAinda não há avaliações

- A Study On Lending Practices of RDCC Bank, SindhanurDocumento60 páginasA Study On Lending Practices of RDCC Bank, Sindhanurhasan0% (1)

- The-Complete-Guide-to-Trading - Corporate Finance-1-43Documento43 páginasThe-Complete-Guide-to-Trading - Corporate Finance-1-43Esteban PerezAinda não há avaliações

- Balance Sheet Ratio Analysis FormulaDocumento9 páginasBalance Sheet Ratio Analysis FormulaAbu Jahid100% (1)

- Determinants of Interest Rates (Revilla & Sanchez)Documento12 páginasDeterminants of Interest Rates (Revilla & Sanchez)Kearn CercadoAinda não há avaliações

- 2013 PDFDocumento238 páginas2013 PDFCodrutaAinda não há avaliações

- Company Valuation and Financial Analysis of Power Root (M) Sdn BhdDocumento35 páginasCompany Valuation and Financial Analysis of Power Root (M) Sdn BhdKar EngAinda não há avaliações

- Ratio AnalysisDocumento61 páginasRatio AnalysisHariharan KanagasabaiAinda não há avaliações

- Financial Statement (FS) AnalysisDocumento41 páginasFinancial Statement (FS) AnalysisJasy Nupt GilloAinda não há avaliações

- LPX Guide To The Equity IndicesDocumento21 páginasLPX Guide To The Equity IndicesRoberto PerezAinda não há avaliações

- UPF - Obrtni KapitalDocumento26 páginasUPF - Obrtni KapitalMikica RankovićAinda não há avaliações

- 4 5949794731742463536 PDFDocumento22 páginas4 5949794731742463536 PDFAnastasia Nikoláyevna100% (2)

- Project Cash Management in Banks ProjectDocumento45 páginasProject Cash Management in Banks Projectbhavikvaghani100% (1)

- Microfinancing: Rossane TanDocumento35 páginasMicrofinancing: Rossane TanJacob CarniceAinda não há avaliações

- Banking StandaloneDocumento21 páginasBanking StandaloneAnusha RaviAinda não há avaliações

- B.COM DEGREE CBCS PRIVATE EXAMINATION FINANCIAL MARKETS EXAMDocumento8 páginasB.COM DEGREE CBCS PRIVATE EXAMINATION FINANCIAL MARKETS EXAMVictor VargheseAinda não há avaliações

- Alternative Investment Funds A Robust Platform For Alternative AssetsDocumento21 páginasAlternative Investment Funds A Robust Platform For Alternative AssetsBhaskar ShanmugamAinda não há avaliações

- The Effects of Firm-Specific Factors On The Profitability of Non-Life Insurance Companies in TurkeyDocumento20 páginasThe Effects of Firm-Specific Factors On The Profitability of Non-Life Insurance Companies in TurkeyDyenAinda não há avaliações

- 2006 A Liquidity-Augmented Capital Asset Pricing ModelDocumento41 páginas2006 A Liquidity-Augmented Capital Asset Pricing ModelKhalid AbidAinda não há avaliações

- Directors Report To The Shareholders of Idlc Finance Limited 2019 944529Documento9 páginasDirectors Report To The Shareholders of Idlc Finance Limited 2019 944529sajibarafatsiddiquiAinda não há avaliações

- DGPR-The Death of Portfolio DiversificationDocumento6 páginasDGPR-The Death of Portfolio DiversificationdevnevAinda não há avaliações

- Individual Case Study Mazda: ACCT2158Documento12 páginasIndividual Case Study Mazda: ACCT2158HieuAinda não há avaliações

- Project Report Financial Analysis of Reliance Communications LTDDocumento40 páginasProject Report Financial Analysis of Reliance Communications LTDCassandra ToddAinda não há avaliações

- Cases Exercise of Causal Loop DiagramDocumento4 páginasCases Exercise of Causal Loop DiagramMuthia KhadijahAinda não há avaliações

- Comparison Between Both Company (Financial Ratio) AmdDocumento9 páginasComparison Between Both Company (Financial Ratio) AmdJoanna JacksonAinda não há avaliações

- Chapter 1,2,3 PDFDocumento36 páginasChapter 1,2,3 PDFprapoorna chintaAinda não há avaliações