Escolar Documentos

Profissional Documentos

Cultura Documentos

Tax Return Project

Enviado por

Nitesh AgrawalDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Tax Return Project

Enviado por

Nitesh AgrawalDireitos autorais:

Formatos disponíveis

Instructions: Compute Dianes 2014 Taxable Income using the following information (assume all

expenses are incurred for the entire year, unless otherwise stated).

Background:

Diane Carl is a widower with 2 children (born March 04, 1977); Denise Carl who is 15 (born February 2,

2000) and is a dependent child and Matthew Carl who is 21 (born May 10, 1994) and attends college at

the University of Washington studying Accounting and dorms at the University. Diane has the following

sources of income and expenses:

Facts:

W-2 wages $87,500; Federal Tax Withheld of $14,650; Oregon State Tax Withheld of $9,000;

Diane pays $178/month for insurance premiums for her and her two children;

Trips to Florida to visit In-laws totaling $6,300;

Medical bills for Denise $5,700 ($2,600 reimbursed from insurance);

Dental of $1,200 ($500 reimbursed from insurance);

Vision and eyeglass wear totaling $500;

$12,700 from deceased husbands life insurance policy;

Home Mortgage Interest of $15,700 on $1,700,000 mortgage loan;

Home Mortgage on second home of $10,500 on loan of $900,000;

Tax Preparation Fees of $1,800;

Charitable Contributions to 50% deductible organizations [501(c)(3) Charities] totaling $2,700;

Matthews educational costs of $34,500, of which Diane paid $15,000 in tuition and $3,400 for

meal plans, and $9,000 in dorms (the rest was funded by scholarships, grants, and loans).

Diane has her own side business baking and selling cupcakes:

Flour and Supplies totaling $11,000 for the year all purchased in March on her American Express

Business Card (Diane plans to pay the bill in January of next year);

Eggs and other fresh ingredients totaling $7,000 for the year, also paid on her American Express

Card (Diane plans to pay the bull in January of next year);

Income of $12,000 paid by customers in cash, $7,000 accounts receivables for cupcakes sold

during the year but no money received yet, and a contract to provide cupcakes for 9 months

starting in September that was prepaid at that time for $15,000;

Vehicle expenses of $3,200 for delivering cupcakes (actual miles was 3,469 miles drives for

business, and 900 for personal);

Meals & Entertainment of $800 ($200 was to go to Disneyland with Denise);

Cell phone of $70/month for the entire year

Purchased an oven for $7,700 in February

Replaced a tire for $80

Repaired counter tops for $200

Baking Sheets, Pots, Pans, and Whisks totaling $900 paid for by Dianes close friend, Betsy;

Trip to cupcake convention in Las Vegas totaling $1,300 (flight was $400, room and board was

$600, $300 on food and drinks).

Additional Information:

Diane received a gift of $31,000 from her deceased husbands brother;

Diane takes care of her mother, who relies on Diane for all her support and lives in Dianes home;

Dianes Gucci purse worth $5,800 was stolen ($1,000 reimbursed by insurance);

Diane rents her second home for $1,100 per month beginning in May (maintenance and repairs

totaled $1,200 for the year and she received a refundable deposit of $2,200);

Diane paid Federal Taxes last year of $19,000;

Diane deducted $8,000 last year for Oregon Taxes on her Federal Return and received a refund

from Oregon for $1,300 this year;

Diane received Interest Income from: BECU - $200; Chase - $150; HomeStreet Bank - $300; and

Edward Jones $700;

Diane received tax-exempt municipal bond income of $1,200 from her Edward Jones Account;

Diane received $11,000 of dividend income from her Edward Jones Account; $9,200 is qualified

dividends;

Diane sold her old oven for $800 cash which was acquired on January 1, 2009 for $2,500 and was

fully depreciated for tax purposes;

Diane sold 20 shares Microsoft stock purchased on February 14 th of the current year and sold on

November 10th of the current year for $900, and purchased for $700;

Diane also sold 100 Shares Starbucks for $1,000 on December 31 st of the year that was purchased

on December 30th of the last year and was bought for $800;

Diane has no capital loss carryforwards that she can utilize for the current year.

Você também pode gostar

- FIN 534 Week 2 Chapter 3 SolutionDocumento3 páginasFIN 534 Week 2 Chapter 3 SolutionNitesh AgrawalAinda não há avaliações

- 13 MBS Direct - International Accounting, 7 - eDocumento1 página13 MBS Direct - International Accounting, 7 - eNitesh AgrawalAinda não há avaliações

- (Ch12) (ECON203) (ReviewQuestions) With AnswersDocumento3 páginas(Ch12) (ECON203) (ReviewQuestions) With AnswersNitesh AgrawalAinda não há avaliações

- Homework Week5Documento5 páginasHomework Week5Nitesh AgrawalAinda não há avaliações

- CH13 (5 Questions)Documento4 páginasCH13 (5 Questions)Nitesh Agrawal50% (2)

- 1 2Documento3 páginas1 2Nitesh AgrawalAinda não há avaliações

- Case6 AnswersDocumento7 páginasCase6 AnswersNitesh Agrawal100% (1)

- Toyota Camry Honda Accord Salvage Value: Since Ford Fusion Has Better Benefit Cost Ratio. Hence It Should Be BoughtDocumento2 páginasToyota Camry Honda Accord Salvage Value: Since Ford Fusion Has Better Benefit Cost Ratio. Hence It Should Be BoughtNitesh AgrawalAinda não há avaliações

- Chap 014Documento67 páginasChap 014Nitesh Agrawal100% (2)

- Innovative HR PracticesDocumento6 páginasInnovative HR PracticesRukmini GottumukkalaAinda não há avaliações

- SolutionsDocumento30 páginasSolutionsNitesh AgrawalAinda não há avaliações

- Assignment Sem 2 2015Documento3 páginasAssignment Sem 2 2015Nitesh AgrawalAinda não há avaliações

- Total Hourly Output & Sales of Pizzas: This Is Where I'm at With It Please Help! Thank YouDocumento2 páginasTotal Hourly Output & Sales of Pizzas: This Is Where I'm at With It Please Help! Thank YouNitesh AgrawalAinda não há avaliações

- FirstlyDocumento1 páginaFirstlyNitesh AgrawalAinda não há avaliações

- Solution 5Documento10 páginasSolution 5Nitesh AgrawalAinda não há avaliações

- In$ In$ 2011 DTA DTL DTA DTLDocumento3 páginasIn$ In$ 2011 DTA DTL DTA DTLNitesh AgrawalAinda não há avaliações

- AssignmentDocumento8 páginasAssignmentNitesh AgrawalAinda não há avaliações

- 1Documento2 páginas1Nitesh AgrawalAinda não há avaliações

- 4,5,6Documento6 páginas4,5,6Nitesh AgrawalAinda não há avaliações

- C. If Selling Price in Year 1 Remains at $10 Per Unit, How Many Units Must Be Sold in Year 1 For The Operating Profit To Be $200,000?Documento1 páginaC. If Selling Price in Year 1 Remains at $10 Per Unit, How Many Units Must Be Sold in Year 1 For The Operating Profit To Be $200,000?Nitesh AgrawalAinda não há avaliações

- AnswerDocumento1 páginaAnswerNitesh AgrawalAinda não há avaliações

- AnswerDocumento1 páginaAnswerNitesh AgrawalAinda não há avaliações

- 1Documento2 páginas1Nitesh AgrawalAinda não há avaliações

- Total Output & Sales Per Hour (Q) Total Cost (TC) $/HR Market Price (P) Total Revenue (TR) Total Economic Profit Ave Total Cost (ATC) Ave Variable Cost (AVC)Documento2 páginasTotal Output & Sales Per Hour (Q) Total Cost (TC) $/HR Market Price (P) Total Revenue (TR) Total Economic Profit Ave Total Cost (ATC) Ave Variable Cost (AVC)Nitesh AgrawalAinda não há avaliações

- QuestionDocumento1 páginaQuestionNitesh AgrawalAinda não há avaliações

- WK4 Acc WKDocumento57 páginasWK4 Acc WKNitesh AgrawalAinda não há avaliações

- Che 330 Fall 2015 Hw5 Due: Oct 4: WWW - Hse.Gov - Uk/Research/Rrpdf/Rr615 PDFDocumento1 páginaChe 330 Fall 2015 Hw5 Due: Oct 4: WWW - Hse.Gov - Uk/Research/Rrpdf/Rr615 PDFNitesh AgrawalAinda não há avaliações

- 1 Practice-QDocumento1 página1 Practice-QNitesh AgrawalAinda não há avaliações

- Che 330 Fall 2015 Hw5 Due: Oct 4: WWW - Hse.Gov - Uk/Research/Rrpdf/Rr615 PDFDocumento1 páginaChe 330 Fall 2015 Hw5 Due: Oct 4: WWW - Hse.Gov - Uk/Research/Rrpdf/Rr615 PDFNitesh AgrawalAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Ing Bank v. CIR / G.R. No. 167679 / July 22, 2015Documento1 páginaIng Bank v. CIR / G.R. No. 167679 / July 22, 2015Mini U. Soriano100% (1)

- EY Worldwide Transfer Pricing Reference Guide 2015-16 PDFDocumento360 páginasEY Worldwide Transfer Pricing Reference Guide 2015-16 PDFbogtudorAinda não há avaliações

- Exercise 2Documento15 páginasExercise 2Riezel PepitoAinda não há avaliações

- Bir Form 1604E - Schedule 3 Alphalist of Payees Subject To Expanded Withholding Tax As of December 31,2020Documento4 páginasBir Form 1604E - Schedule 3 Alphalist of Payees Subject To Expanded Withholding Tax As of December 31,2020Ric Dela CruzAinda não há avaliações

- Book Invoice PDFDocumento1 páginaBook Invoice PDFnoamaanAinda não há avaliações

- Payroll QuestionnaireDocumento16 páginasPayroll QuestionnaireVengat RamanaAinda não há avaliações

- 8.gang Rate Excel SheetDocumento3 páginas8.gang Rate Excel SheetRambhakt HanumanAinda não há avaliações

- Textbook SolutionDocumento61 páginasTextbook SolutionmmAinda não há avaliações

- Activity 1 Employee Benefits AKDocumento7 páginasActivity 1 Employee Benefits AKRalph Rivera SantosAinda não há avaliações

- Deductions: Philippines Gross Estate World Gross Estate Deductible LITDocumento3 páginasDeductions: Philippines Gross Estate World Gross Estate Deductible LITMaria LopezAinda não há avaliações

- Assignment 1 Public BudgetDocumento18 páginasAssignment 1 Public BudgetNur IzzatiAinda não há avaliações

- JNPT-Paver Block, GST FormatDocumento16 páginasJNPT-Paver Block, GST FormatrajupetalokeshAinda não há avaliações

- Income TaxationDocumento4 páginasIncome TaxationCervus Augustiniana LexAinda não há avaliações

- Income TaxationDocumento13 páginasIncome TaxationJpagAinda não há avaliações

- Revenue Regulations No. 02-40Documento46 páginasRevenue Regulations No. 02-40zelayneAinda não há avaliações

- Partnership OperationDocumento3 páginasPartnership OperationShane NayahAinda não há avaliações

- Abft1024 T2 - LtyDocumento2 páginasAbft1024 T2 - Ltylfc778Ainda não há avaliações

- Accounting Principles, Liabilities & Payroll System in An Ethiopian ContextDocumento15 páginasAccounting Principles, Liabilities & Payroll System in An Ethiopian ContextAbdu AliAinda não há avaliações

- OD226087962276144000Documento1 páginaOD226087962276144000Biswa JitAinda não há avaliações

- Anabo, Ivan G. (2550m Vat)Documento3 páginasAnabo, Ivan G. (2550m Vat)Ivan AnaboAinda não há avaliações

- Tax Invoice Seller Buyer: (AED) (AED) (AED)Documento2 páginasTax Invoice Seller Buyer: (AED) (AED) (AED)ZiZo AgnoAinda não há avaliações

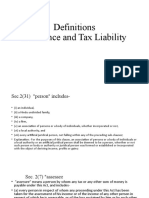

- Definitions Residence and Tax LiabilityDocumento23 páginasDefinitions Residence and Tax LiabilityVicky DAinda não há avaliações

- April Salary PDFDocumento1 páginaApril Salary PDFomkassAinda não há avaliações

- Chapter 1 Productivity and Yield Section 1.1 Functional Productivity Example 1.1 Nokia CellphoneDocumento4 páginasChapter 1 Productivity and Yield Section 1.1 Functional Productivity Example 1.1 Nokia CellphoneRoselie BarbinAinda não há avaliações

- 1120 & 1120s Corporation Tax Organizer - Long VersionDocumento13 páginas1120 & 1120s Corporation Tax Organizer - Long VersionExactCPAAinda não há avaliações

- FAR ProblemsDocumento7 páginasFAR ProblemsClaire GarciaAinda não há avaliações

- 11 Soriano Et Al V Secretary of Finance and The CIRDocumento1 página11 Soriano Et Al V Secretary of Finance and The CIRAnn QuebecAinda não há avaliações

- Income Taxation Reviewer PDFDocumento65 páginasIncome Taxation Reviewer PDFPaulo Joshua Abasolo BetacheAinda não há avaliações

- Solved Laurie Gladin Owns Land and A Building That She HasDocumento1 páginaSolved Laurie Gladin Owns Land and A Building That She HasAnbu jaromiaAinda não há avaliações

- Hilado vs. CIRDocumento1 páginaHilado vs. CIRAlan GultiaAinda não há avaliações