Escolar Documentos

Profissional Documentos

Cultura Documentos

GOLD Brochure

Enviado por

laxmiccDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

GOLD Brochure

Enviado por

laxmiccDireitos autorais:

Formatos disponíveis

GOLD

HEDGING PRICE RISK

The most sought-after precious metal is acquired throughout the world for its beauty, liquidity, investment qualities, and industrial properties

GOLD: HEDGING PRICE RISK

One of the oldest civilisations known to man,

the Sumerians of Mesopotamia, who lived in

what is modern-day Iran and Iraq, first used

gold as sacred, ornamental, and decorative

instruments in the fifth millennium B.C.

Around the same period, the early Egyptians

the richest gold-producing civilisation of the

ancient world began the art of gold

refining. Like the Sumerians, the Egyptians

used gold primarily for personal adornment,

rather than for monetary purposes, although

the kings of the fourth to sixth dynasties (c.

2700-2270 B.C.) did issue some gold coins.

The first large-scale, private issuance of pure

gold coins was under King Croesus (560-546

B.C.), the ruler of ancient Lydia, modern-day

western Turkey. Stamped with his royal

emblem of the facing heads of a lion and a

bull, these first known coins eventually became

the standard of exchange for worldwide trade

and commerce.

OVERVIEW

Gold, the most sought-after of all

precious metals, is acquired throughout

the world for its beauty, liquidity,

investment qualities, and industrial

properties. As an investment vehicle,

gold is typically viewed as a financial

asset that maintains its value and

purchasing power during inflationary

periods. However, globalization has

increased volatility across asset classes

which can be dealt with using various

risk management instruments.

and consolidate competitiveness. The

importance of risk management cannot

be overstated; India, the worlds largest

market for gold jewellery and a key

driver of global gold demand needs

such financial instruments like futures to

get its bullion industry protected from

price risk. The role of commodity futures

in risk management consists of

anticipating price movement and

shaping resource allocations and

achieving these ends can be met

through hedging.

PRICE RISK MANAGEMENT

Risk management techniques are of

critical importance for participants, such

as mining companies, processors,

companies dealing in gold and gold

products,

jewellers

and

even

governments which rely on the

proceeds of bullion consumption and

trade.

Modern

techniques

and

strategies, including market-based risk

management financial instruments,

such as Gold Futures, offered on the

MCX platform can improve efficiencies

PRICE MOVEMENT

2,000

40,000

Fear of tapering of stimulus

measures by Fed in US

Rising geopolitical tension

over Syria, Weakeness of INR

35,000

Supply Tightbness

1,500

Iraq Violence

30,000

1,000

Fear of early tapering

25,000

20,000

-Ja

3

n-1

20

500

20

-Fe

3

b-1

20

-M

13

ar-

20

-A

13

pr-

20

-M

13

ay-

20

-Ju

3

n-1

20

-J

13

ul-

3

g-1

-Au

20

20

-Se

3

p-1

-O

20

13

ct-

-N

20

3

v-1

-D

20

13

ec-

20

-Ja

4

n-1

20

-Fe

4

b-1

20

-M

14

ar-

20

-A

14

pr-

20

-M

14

ay-

20

-Ju

4

n-1

MCX (`/10 grams)

CME Parity (`/10 grams) Incl of

Custom Duty, Cess

CME ($/Troy Ounce)

GOLD: HEDGING PRICE RISK

HEDGING MECHANISM

Hedging is the process of reducing or

controlling risk. It involves taking equal

and opposite positions in two different

markets (such as physical and futures

market), with the objective of reducing

or limiting risks associated with price

change. It is a two-step process where a

gain or loss in the physical position due

to changes in price will be offset by

changes in the value on the futures

platform, thereby reducing or limiting

risks associated with unpredictable

changes in prices.

In the international arena, hedging in

gold futures takes place on a number of

exchanges, the major ones being

Chicago Mercantile Exchange (CME),

Multi Commodity Exchange of India Ltd

(MCX), Tokyo Commodity Exchange

(TOCOM) and Shanghai Futures

Exchange(SHFE).

IMPORTANCE OF HEDGING

Critical for stabilizing incomes of

corporations and individuals, reducing

risks may not always improve earnings,

but failure to manage risk will have

direct repercussion on the risk-bearers

long-term income.

To gain the most from hedging, it is

essential to identify and understand the

objectives behind hedging.

A good hedging practice, hence,

encompasses efforts on the part of

companies to get a clear picture of their

risk profile and benefit from hedging

techniques.

PARTICIPANT HEDGERS

Those who have or intend to have

physical positions in physical GOLD.

! Corporations

! Mining companies

! Market intermediaries

! Merchandisers

! Jewellers and designers

! Importers and exporters

FACTORS IMPACTING PRICE

VARIATIONS IN BULLION

! Currency exchange rates movements,

especially USD

! Gold demand from major consumer

countries like India and China

! Gold supply: China, the U.S., and South

Africa

! Changes in import duties

! Economic factors: Employment and

housing data from major economies

! Interest rate movements

! Political turmoil

FACTS ON HEDGING

! Understanding the risk profile and

appetite while formulating clear

hedging objectives.

! Hedging can shield the revenue

stream, the profitability, and the

balance sheet against adverse price

movements.

! Hedging can maximize shareholder

value.

! Under

International

Financial

Reporting

Standards

(IFRS),

beneficial options arise in effective

hedges.

! Common avoidable mistake is to

book profits on the hedge while

leaving the physical leg open

to risk.

! Hedging provides differentiation to

companies in a highly competitive

environment.

! Hedging also significantly lowers

distress

costs

in

adverse

circumstances confronting a company.

! To gain the most from hedging, it is

very essential to identify and

understand the objectives behind

hedging and get a clear picture of

their risk profile.

HEDGING EXPERIENCES

1. Titan Industries Ltd

A leader in the Indian market for

branded Jewelry and also known for

their watches, the company uses

financial instruments to manage risks.

It applies hedging principles as set out

in the accounting standards (AS)30.

All derivative transactions are

governed by company policy based on

written principles on their use,

consistent with the companys risk

management strategy.... (Extract from

the 29th Annual Report of Titan

Industries Ltd).

2. Barrick Gold Corp

A US-based gold mining company is

the worlds largest producer, operating

mines and undertaking exploration on

five continents. With mining reserves

of 104 million ounces of gold, the

company produced 7.13 million ounces

in 2013 and has an exposure (cash flow

hedge) of $110 million. Their Chairman

Mr Peter Munk has this to say,

Traditionally, gold companies were

not involved in hedging, Barrick Gold

Corp did! And before long became the

most profitable gold company in the

world. (Source: Annual Report

2013.)

3. Kaloti Jewellery Group

The group trades and hedges hundreds

of tonnes of bullion annually.

(Source: Group brochure)

4. Signet Jewelers Ltd

Signet uses gold and currency hedges to

reduce its exposure to market volatility

in the cost of gold.... (Source: Annual

Report; largest jewellery retailer in the

U.S., the UK, and Canada)

GOLD FACTS

Gold has been a valuable and highly sought-after precious metal for coinage, jewellery, and other arts since

long, even before the beginning of recorded history. In the past, the Gold Standard had been implemented as a

monetary policy, but it was widely supplanted by fiat currency starting in the 1930s. The last gold certificate and

gold coin currencies were issued in the U.S. in 1932. In Europe, most countries left the gold standard with the

start of World War I in 1914 and, with huge war debts, did not return to gold as a medium of exchange. The value

of gold is rooted in its rarity, easy handling, easy smelting, non-corrosiveness, distinct colour and nonreactiveness to other elementsqualities most other metals lack....

3

GOLD: HEDGING PRICE RISK

APPRECIATING THE BENEFITS OF HEDGING

A situation prevailing in the gold industry is given below. It demonstrates how the MCX platform may be used by participants to

manage price risk by entering into Gold Futures contracts. We will look at the impact on price movements in either direction.

THE SITUATION

Gold BOX, a company in the jewellery design business, has been competing in the overseas market. Its designer jewellery has a steady but growing market. To

develop its market share the management has realized that it needs to price its designer products competitively. In the past, the company resorted to buying and

storing gold bars. This strategy led to many problems relating to raw-material procurement decisions, especially timing of decisions and storage concerns.

Although the highly experienced personnel have been astute in most decisions, the recent movements in gold prices caused by currency movements (Quantitative

Easing, interest rate movement in Europe, and import duty structure), have led to margins getting eroded. A consultant appointed by the management has

recommended that price risk should be mitigated by taking up positions on the MCX commodity exchange.

GOING LONG: Scenarios where prices either rise or fall

On 1st January, Gold BOX, a company in the jewellery design business, enters into a contract for delivery of finished designer jewellery after three months.

Based on experience, the company has put together the following facts and observations.

The selling price of finished product and gold content in these products cannot be altered

Raw material (gold bars) will be required for actual use in mid-March

Risk of change in gold prices is perceived

Estimated requirement or consumption is 80 kg per quarter

Going long means buying the futures contract

HOW CAN THIS GOLD BOX HEDGE AGAINST PRICE RISK?

We will look at both possibilities, that is, price rise and price fall. Lets take the situation when prices rise first.

SCENARIO 1

IF PRICES WERE TO RISE

(`/10 grams)

DETAILS

MCX PLATFORM

1st January

BUY Gold Futures Contract

15th March

SELL Gold Futures Contract

PHYSICAL MARKET

DATE

GOLD SPOT PRICE GOLD FUTURES PRICE

(expiry 5th April 201X)

BUY the required quantity of

gold in the physical market

01-01-201X

29186

27842

15-03-201X

30900

30202

The net position of the above transactions will negate price risk

Futures

01-01-201X

Spot

15-03-201X

27842

BUY

15-03-201X

30202

SELL

15-03-201X

BUY

2360 (profit)

30900

Net purchase price: `28540 (`30900 - `2360)

EXPLANATION

The treasury department of Gold BOX buys a futures contract on 1st January and squares up or sell the contract on the 15th of March thereby making a profit of `2,360 per

contract . They then buy in the spot market the required physical quantity at `30,900. The net cost works out to `28,540 for 10 g. The impact on the bottom line is

`51.6 lakh (`29186 - `28540 x 80 kg).

SCENARIO 2

IF PRICES WERE TO FALL

(`/10 grams)

DETAILS

MCX PLATFORM

1st January

BUY Gold Futures Contract

15th March

SELL Gold Futures Contract

PHYSICAL MARKET

DATE

GOLD SPOT PRICE GOLD FUTURES PRICE

(expiry 5th April 201X)

BUY the required quantity of

gold in the physical market

01-01-201X

29186

27842

15-03-201X

27900

27300

The net position of the above transactions will negate price risk

Futures

01-01-201X

Spot

15-03-201X

BUY

27842

15-03-201X

SELL

15-03-201X

BUY

EXPLANATION

The treasury department of Gold BOX buys a futures contract on 1st January and squares up or sells

the contract on the 15th of March thereby making a loss of `542 on the contract. They then buy in

the spot market the required physical quantity at `27,900. The net cost for 10 g being `28,442.

4

27300

542 (loss)

27900

Net purchase price: `28442 (`27900+`542)

Note: Although both the scenarios in the above example result in a small

profit, the objective is to lock into the price so that whichever direction the

price moves Gold BOX is not adversely affected. Loss in one market is offset

by a gain in the other. Profits are only incidental.

GOLD: HEDGING PRICE RISK

APPRECIATING THE BENEFITS OF HEDGING

Gold CHEST is confronted with a scenario where volatile prices could erode its balance-sheet value. It now uses the MCX platform

to manage risk by taking positions on the Gold Futures contract and thereby protect the company value. We now look at the

impact of price movement in either direction.

THE SITUATION

Gold CHEST is a bullion dealer which imports and sells gold biscuits and bars to a number of users. This market has been extremely unpredictable due to price volatility, a

reflection of international and domestic fundamentals. Although Gold CHEST has customers only in the local market, it is severely affected by currency fluctuations, and

customers have become non-committal, resulting in an increase of stocks in its vaults. In a recent board meeting, the managements suggestion, based on international

practices, to hedge its stocks against price movement on the MCX platform has been approved. A treasury team has been put in place, besides a broker has been identified

after a critical assessment of alternative service providers. Gold CHEST is now ready to take the plunge.

GOING SHORT: Scenarios where prices either rise or fall

On 1st January, Gold CHEST, a bullion dealer, enters into a futures contract for protecting its rising inventory against adverse price movement. Experts have put

forward the following facts and observations.

Falling prices would adversely affect the bottom line as inventory valuations would fall

Valuation will take place at the end of March and inventory has been estimated at 50 kg

Risk of change in gold prices is perceived

Going short means selling the futures contract

HOW CAN GOLD CHEST HEDGE AGAINST PRICE RISK AND PROTECT ITS BALANCE SHEET?

We will look at both possibilities, that is, price fall and price rise. Lets take the situation when prices fall first.

SCENARIO 3

IF PRICES WERE TO FALL

(`/10 grams)

DETAILS

MCX PLATFORM

PHYSICAL MARKET

1st January

SELL Gold Futures Contract

31st March

BUY Gold Futures Contract Values inventory on hand, based

on the ruling spot price

DATE

GOLD SPOT PRICE GOLD FUTURES PRICE

(expiry 5th April 201X)

01-01-201X

26850

26900

31-03-201X

25950

25700

The net position of the above transactions will negate price risk and protect value

Futures

01-01-201X

Spot

31-03-201X

SELL

26900

31-03-201X

BUY

25700

31-03-201X

BUY PRICE

1200 (profit)

25950

Net Valuation /10 g: `27150 (`25950+`1200)

EXPLANATION

The treasury team Gold CHEST short sells a 5th April futures contract on 1st January and squares the contract on 31st March. Its inventory valuation will be based on

March 31 spot price of `25950; however, this fall in value (`26850-`25950) will be partially offset by the profit of `1200 on the MCX futures platform. Hence, the

bottom line will enhance by `300 per 10 g. The effect on the bottom line is `15 lakh (`300/10 g x 50 kg).

SCENARIO 4

IF PRICES WERE TO RISE

(`/10 grams)

DETAILS

MCX PLATFORM

PHYSICAL MARKET

1st January

SELL Gold Futures Contract

31st March

BUY Gold Futures Contract Values inventory on hand, based

on the ruling spot price

DATE

GOLD SPOT PRICE GOLD FUTURES PRICE

(expiry 5th April 201X)

01-01-201X

26850

26900

31-03-201X

27250

27150

The net position of the above transactions will negate price risk and protect value

Futures

01-01-201X

Spot

31-03-201X

SELL

26900

31-03-201X

BUY

31-03-201X

BUY PRICE

EXPLANATION

The treasury department of Gold CHEST sells a futures contract on 1st January and squares up the

contract on 31st March thereby making a loss of `250 . The valuation in its books will be at `27250.

This rise in value will be tempered by the loss of `250 on the MCX futures platform. Hence, the

bottom line gets enhanced by `150 (`27250-`26850 less `250) .

27150

250 (loss)

27250

Net Valuation /10 g: `27000 (`27250-`250)

Note: In the first case the prices fall as per expectations, resulting in an

overall gain. In the second, prices rise unexpectedly, resulting in a minor

loss on the futures platform; however, overall valuations rise. The objective

to lock into the price is achieved and, Gold CHESTs, balance sheet remains

protected. Profits are only incidental.

GOLD: HEDGING PRICE RISK

exchanges and incentivizes hedging.

Hedgers are no longer forced to

undertake

physical

delivery

of

commodities to prove that their

transactions are for hedging and not

speculation .

REGULATORY

BOOSTS

FOR

HEDGERS

1. Income tax exemptions for

hedging. The Finance Act, 2013, has

provided for coverage of commodity

derivatives transactions undertaken in

recognized commodity exchanges

under the ambit of Section 43(5) of the

Income Tax Act, 1961, on the lines of the

benefit available to transactions

undertaken in recognized stock

exchanges.

VOLATILITY IN GOLD

Commodity price volatility act as a source

of risk to commodities-related business, as

it instills a degree of uncertainty over the

actual finances involved in the business.

According to the Washington-based

Corporate Executive Boards survey, of the

top 10 risks faced by corporate

participants, commodity price risk was

pronounced as number one.

2. Limit on open position as against

hedging. This enables hedgers to take

positions over and above prescribed

position limits on approval by the

exchange and thus can hedge to a great

extent of their exposure in the physical

market.

This effectively means that business

profits/losses can be offset by losses/

profits undertaken in the commodity

derivatives transactions. This enhances

the attractiveness of risk management

on recognized commodity derivative

3. Early pay-in benefit. If a hedger

makes an early pay-in of commodity, he

is exempted from paying all applicable

margins.

DAILY AVERAGE VOLATILITY (GOLD MCX PRICES)

8.00%

6.00%

4.00%

2.00%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

-11

an

3-J

R-1

P

3-A

11

ul-

3-J

Vol

3-O

11

ct-

-12

12

pr-

an

3-J

3-A

12

ul-

3-J

3-O

12

ct-

YEAR 2011

ANNUALIZED VOLATILITY 18%

-13

2012

11%

13

pr-

an

3-J

3-A

13

ul-

3-J

3-O

13

ct-

-14

an

3-J

r-1

p

3-A

2013

23%

Source: MCX Research Team

HOW MUCH VOLATILITY RISK ARE YOU EXPOSED TO?

Gold: Witnessed an annualized price volatility of 23% in 2013,

which means:

A firm in the gold business with an annual turnover of

`1,000 cr was exposed to a price risk of

about `230 cr in 2013

India, with an annual gold market size of 974 tonnes worth about `2,82,000 crore, is exposed to a

risk on account of price volatility to the tune of `64,860 cr (that is, 23% of the holding value).

ARE YOU PREPARED FOR VOLATILITY RISK?

(Adoption of a risk management practice, such as hedging on the MCX Platform can

help shield against the perils of price volatility)

GOLD: HEDGING PRICE RISK

SALIENT CONTRACT SPECIFICATIONS OF GOLD FUTURES CONTRACTS

Symbol

GOLD

GOLDM

GOLDGuinea

Contracts Available

Feb, Apr, Jun, Aug, Oct, Dec

Jan, Feb, Mar, Apr, May, Jun, Jul, Aug, Sep, Oct, Nov, Dec

Last Trading Day

5th day of contract expiry month. If 5th day is a holiday

then preceding working day.

Trading Period

Monday to Friday (10.00 a.m. to 11.30 / 11.55 p.m.)

Trading Unit

1 kg

100 grams

8 grams

Quotation/ Base Value

10 grams

10 grams

8 grams

Price Quote

Ex-Ahmedabad (inclusive of all taxes and levies relating to import duty, customs but excluding

sales tax and VAT, any other additional tax or surcharge on sales tax, local taxes and octroi)

Maximum Order Size

10 kg

Tick Size

`1

Daily Price Limit

The base price limit will be 3%. Whenever the base daily price limit is breached, the relaxation

will be allowed upto 6% without any cooling off period in the trade. In case the daily price limit

of 6% is also breached, then after a cooling off period of 15 minutes, the daily price limit will be

relaxed upto 9%

Last calendar day of the

contract expiry month.

If last calendar day is a

holiday then preceding

working day.

In case price movement in international markets is more than the maximum daily price limit

(currently 9%), the same may be further relaxed in steps of 3% beyond the maximum permitted

limit, and inform the Commission immediately.

Initial Margin

Minimum 5 % or based on SPAN whichever is higher

Additional and/ or Special Margin

In case of additional volatility, an additional margin (on both buy & sell side) and/ or special

margin (on either buy or sell side) at such percentage, as deemed fit; will be imposed in respect

of all outstanding positions.

Maximum Allowable Open Position

For individual client: 2.5 MT for all Gold contracts combined together

For a member collectively for all clients: 12.5 MT or 15% of the market wide open position

whichever is higher, for all Gold contracts combined together.

Delivery Unit

1 kg

100 grams

8 grams and in multiples thereof

Delivery Period Margin

25% of the value of the open position during the delivery period

Delivery Centres

Ahmedabad.

Mumbai, Chennai, New Delhi and Hyderabad

Quality Specifications

995 purity

Delivery Logic

Compulsory

Ahmedabad.

Delhi, Mumbai, Hyderabad,

Bangalore, Chennai and Kolkata.

999 purity

Note: Please refer to the exchange circulars for latest contract specifications

GOLD: HEDGING PRICE RISK

! Deliverable

contracts

with

internationally accepted gold bars.

! Flexibility to choose from different

contract sizes

! Highly efficient and transparent

market

BENEFITS OF HEDGING ON MCX:

! Indias no. 1 commodity exchange to

trade bullion futures.

! Highly liquid contracts.

! Low impact costs (trading costs)

because of tight bid-ask spreads

! The

market is operational both

during morning and evening, and

thus participants can take part in

price discovery when global markets

are active.

INTERESTING QUOTES ON GOLD

When we have gold we have fear, and when we have none, we are in danger

(Old English proverb)

In the absence of the gold standard, there is no way to protect savings from

confiscation through inflation. There is no safe store of value

(Alan Greenspan)

The desire for gold is not for gold. It is for the means of freedom and benefit

(Ralph Waldo Emerson, 19th century American poet)

All the gold on Earth would weight 91000 tons less than the amount of steel made

around the world in an hour. Thats rare.

(Daniel M. Kehrer, Thought Leader)

But in truth, should I meet with gold or spices in great quantity, I shall remain till I

collect as much as possible, and for this purpose I proceed solely in quest of them

(Chistopher Colombus)

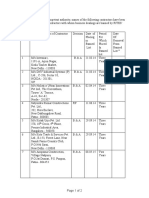

GOLD DELIVERY (IN KILOGRAMS) ON MCX

10,000

9,000

8,000

7,000

6,000

5,000

2013 World-wide Demand

Country

China

India

Europe

Middle East

US

Turkey

Thailand

Vietnam

Japan

Indonesia

Jewellery

711.4

612.7

43.6

178.5

122.8

73.3

3.5

11.9

17.6

37.9

* (Provisional)

4,000

Bars & Coins

408.7

362.1

265.2

52.7

67.5

101.9

136.6

80.3

3.7

30.1

Total

1120.1

974.8

308.9

231.2

190.3

175.2

140.1

92.2

21.3

68.0

Source: Thomson Reuters, GFMS, WGC

Global Demand Statistics (2013) - 4080 Tonnes

3,000

2,000

Jewellery

10%

1,000

Investment

22%

58%

200708

2008-09

2009-10

2010-11

2011-12

2012-13

10%

Gold

Gold Mini

Gold Guinea

Technology

2013-14

Gold Petal

Central Bank

net purchases

Source: World Gold Council

Content by: MCX Research & Planning

Designed by: Department of Corporate Communications, MCX

Please send your feedback to: research@mcxindia.com

Corporate address: Exchange Square, Chakala, Andheri (East), Mumbai - 400 093, India, Tel. No. 91-22-6731 8888,

CIN: L51909MH2002PLC135594, info@mcxindia.com, www.mcxindia.com

MCX 2014. All rights reserved.

Você também pode gostar

- Gold in The WORLDDocumento18 páginasGold in The WORLDmujib uddin siddiquiAinda não há avaliações

- Perspectives On The Diamond Industry White Paper PDFDocumento22 páginasPerspectives On The Diamond Industry White Paper PDFPaul CelenAinda não há avaliações

- Realestate - Real Estate Professionals HandbookDocumento206 páginasRealestate - Real Estate Professionals HandbookCiobanu Dan Andrei100% (4)

- Verification Handbook For Investigative ReportingDocumento79 páginasVerification Handbook For Investigative ReportingRBeaudryCCLE100% (2)

- Historical Somali Language BoksDocumento174 páginasHistorical Somali Language BoksSalmaanCadeXaajiAinda não há avaliações

- The Bilderberg GroupDocumento35 páginasThe Bilderberg GroupTimothy100% (2)

- Aqueous Metal Recovery Techniques From E-Scrap Hydrometallurgy in RecyclingDocumento10 páginasAqueous Metal Recovery Techniques From E-Scrap Hydrometallurgy in RecyclingOvijit DasAinda não há avaliações

- Aurora Was Goddess of Dawn or The Morning Glow.Documento4 páginasAurora Was Goddess of Dawn or The Morning Glow.Rebecca Chanice AcohonAinda não há avaliações

- Alluvial MiningDocumento8 páginasAlluvial MiningmeathraAinda não há avaliações

- Refining ProcessesDocumento191 páginasRefining ProcessesOmar Taha100% (1)

- Tanzanias Precious Minerals Boom Issues in Mining and MarketingDocumento164 páginasTanzanias Precious Minerals Boom Issues in Mining and MarketingSomaSorrowAinda não há avaliações

- The Guide to Precious Metals ColorsDocumento16 páginasThe Guide to Precious Metals Colorssmrithi MohanAinda não há avaliações

- The Marcos DynastyDocumento19 páginasThe Marcos DynastyRyan AntipordaAinda não há avaliações

- Jewelry Investment Runner Design 1Documento5 páginasJewelry Investment Runner Design 1Sanders Refellions100% (1)

- Minerals in BritainDocumento6 páginasMinerals in Britainchris_glaAinda não há avaliações

- Why Platinum Costs More Than Gold But Palladium May Surpass BothDocumento9 páginasWhy Platinum Costs More Than Gold But Palladium May Surpass BothPaavni SharmaAinda não há avaliações

- Mylchreest Gold London BullionDocumento59 páginasMylchreest Gold London BullionZerohedge100% (2)

- COPPER BrochureDocumento8 páginasCOPPER BrochurelaxmiccAinda não há avaliações

- Discover Placer Deposit Types and Exploration MethodsDocumento34 páginasDiscover Placer Deposit Types and Exploration MethodsFaldo MatulessyAinda não há avaliações

- Cargo Record BookDocumento7 páginasCargo Record BookTusharsorte100% (1)

- Mineral Resources Guide to Earth's Valuable MaterialsDocumento7 páginasMineral Resources Guide to Earth's Valuable MaterialsTudor PipirigAinda não há avaliações

- Barbieri.a New Environmentally Friendly Process For The Recovery of Gold From Electronic WasteDocumento8 páginasBarbieri.a New Environmentally Friendly Process For The Recovery of Gold From Electronic Wastep3lu_Ainda não há avaliações

- Interesting Facts of Gold, Believe or Not, Some Amazing Facts of Gold, Benefit of GoldDocumento23 páginasInteresting Facts of Gold, Believe or Not, Some Amazing Facts of Gold, Benefit of GoldRaghu.GAinda não há avaliações

- Hallmarking of Gold Jewellery in IndiaDocumento5 páginasHallmarking of Gold Jewellery in IndiaJuie ShahAinda não há avaliações

- Casting PlatinumDocumento8 páginasCasting PlatinumCarlos Mario Agudelo CastrillonAinda não há avaliações

- Cuplok Product GuideDocumento14 páginasCuplok Product Guideluiseduardo_plcAinda não há avaliações

- US Gold Recycling Rate 29% in 1998Documento182 páginasUS Gold Recycling Rate 29% in 1998humejiasAinda não há avaliações

- Ethiopia Gold Training ManualDocumento58 páginasEthiopia Gold Training ManualRezaAinda não há avaliações

- The Life of St. John of KronstadtDocumento47 páginasThe Life of St. John of Kronstadtfxa88Ainda não há avaliações

- Refining Precious Metal Wastes - C M HokeDocumento367 páginasRefining Precious Metal Wastes - C M HokeenzomichAinda não há avaliações

- Chapter 3 PGM GuideDocumento10 páginasChapter 3 PGM Guidetanaka nyamandiAinda não há avaliações

- Silver BrochureDocumento8 páginasSilver BrochurelaxmiccAinda não há avaliações

- Forex Risk ManagementDocumento114 páginasForex Risk ManagementManish Mandola100% (1)

- 1199 Leaching Platinum Group Metals in A Sulfuric Acidchloride Solutionae22Documento4 páginas1199 Leaching Platinum Group Metals in A Sulfuric Acidchloride Solutionae22Waskito BudiawanAinda não há avaliações

- Oxy-Acetylene Welding and CuttingDocumento96 páginasOxy-Acetylene Welding and CuttingGutenberg.orgAinda não há avaliações

- ElectroplatingDocumento5 páginasElectroplatingPraneet PokhriyalAinda não há avaliações

- Intro To Precious MetalsDocumento21 páginasIntro To Precious MetalsMariana Reis100% (1)

- Financial Statement Analysis and Valuation For Rio Tinto CompanyDocumento9 páginasFinancial Statement Analysis and Valuation For Rio Tinto CompanyBachia Trương100% (1)

- Mineral Resources of Pakistan: An Updated OverviewDocumento26 páginasMineral Resources of Pakistan: An Updated OverviewAnonymous h5OeGoX3MTAinda não há avaliações

- Metallurgy: Smelting, A Basic Step in Obtaining Usable Quantities of Most MetalsDocumento8 páginasMetallurgy: Smelting, A Basic Step in Obtaining Usable Quantities of Most MetalssiswoutAinda não há avaliações

- Goldplatingjewellery PDFDocumento12 páginasGoldplatingjewellery PDFsasikumar100% (1)

- Leaching Kinetics and Mechanisms of Surface Reactions During Cyanidation of Gold in The Presence of Pyrite or StibniteDocumento8 páginasLeaching Kinetics and Mechanisms of Surface Reactions During Cyanidation of Gold in The Presence of Pyrite or StibnitempgaperuAinda não há avaliações

- Gold 09 11 SCR PDFDocumento64 páginasGold 09 11 SCR PDFRaul Mendoza SubiaAinda não há avaliações

- New technique eliminates drawbacks of zinc process for recovering Pd and Pt from gold electrolyteDocumento2 páginasNew technique eliminates drawbacks of zinc process for recovering Pd and Pt from gold electrolyteCarlos BarzaAinda não há avaliações

- FireAssayLecture CompatibilityModeDocumento71 páginasFireAssayLecture CompatibilityModeWaskito BudiawanAinda não há avaliações

- The Project Saboteur1Documento28 páginasThe Project Saboteur1pharezeAinda não há avaliações

- RARE EARTHS 101: Essential to Green TechDocumento6 páginasRARE EARTHS 101: Essential to Green Techjj831983Ainda não há avaliações

- How to Invest in Gold: Spot Markets, Futures, ETFs, Bars and CoinsDocumento5 páginasHow to Invest in Gold: Spot Markets, Futures, ETFs, Bars and CoinsLeonard NgAinda não há avaliações

- Gold Facts - Properties of the Precious MetalDocumento2 páginasGold Facts - Properties of the Precious MetalVagula SrinivasanAinda não há avaliações

- Gold Mining TechniquesDocumento3 páginasGold Mining TechniquesDanielleAinda não há avaliações

- Gold MarketDocumento25 páginasGold MarketVirendra Jha100% (1)

- PTA Requests Funds for School ImprovementsDocumento6 páginasPTA Requests Funds for School ImprovementsJoan DalilisAinda não há avaliações

- Railway Engineering DiaryDocumento97 páginasRailway Engineering DiaryDev Sharma67% (3)

- 10 Interesting Facts About Gold - Https://egyptiansorcery - ComDocumento1 página10 Interesting Facts About Gold - Https://egyptiansorcery - ComAravenaAinda não há avaliações

- Geometry of KimberlitesDocumento48 páginasGeometry of KimberlitesIgor Kryvoshlyk100% (1)

- Precious Metals AnalysisDocumento2 páginasPrecious Metals AnalysisJunel Alapa100% (1)

- Refining Gold Jewelry Scraps and WastesDocumento22 páginasRefining Gold Jewelry Scraps and WastesCutiuta Cu MizerieAinda não há avaliações

- GoldDocumento3 páginasGoldapi-271680224100% (1)

- Second Assessment - Unknown - LakesDocumento448 páginasSecond Assessment - Unknown - LakesCarlos Sánchez LópezAinda não há avaliações

- RavsolovetichikyomhaatzmautDocumento61 páginasRavsolovetichikyomhaatzmautHirshel TzigAinda não há avaliações

- 1 Overview of The CourseDocumento27 páginas1 Overview of The CourseTapiwanashe SitholeAinda não há avaliações

- Small Scale Gold Refining Strengths and WeaknessesDocumento6 páginasSmall Scale Gold Refining Strengths and WeaknessesLeon MutambalaAinda não há avaliações

- PT (Platinum)Documento3 páginasPT (Platinum)api-281291037Ainda não há avaliações

- Is Gold a Safe Haven Investment During Financial CrisesDocumento23 páginasIs Gold a Safe Haven Investment During Financial Crisesmladen lakic100% (1)

- Listing of Mining Properties Available For Bidding PDFDocumento13 páginasListing of Mining Properties Available For Bidding PDFAba Emmanuel OcheAinda não há avaliações

- The Mercury Problem in Artisanal and Small-Scale Gold MiningDocumento13 páginasThe Mercury Problem in Artisanal and Small-Scale Gold MiningA. Rizki Syamsul BahriAinda não há avaliações

- Alluvial Mining BackgroundDocumento4 páginasAlluvial Mining BackgroundRahmadi SiahaanAinda não há avaliações

- The Objective of The Experiment: Cupellation (Fire Assay)Documento8 páginasThe Objective of The Experiment: Cupellation (Fire Assay)Ibrahim MücahitAinda não há avaliações

- A Brief Journey of A Diamond From Mine To RetailDocumento3 páginasA Brief Journey of A Diamond From Mine To RetailSovan KapriAinda não há avaliações

- Copper Rose PDFDocumento11 páginasCopper Rose PDFNatasha GreenAinda não há avaliações

- HYDROMETALLURGY LEACHING MECHANISMSDocumento42 páginasHYDROMETALLURGY LEACHING MECHANISMSThamara Cienfuegos MondragonAinda não há avaliações

- A Study of Commodity Market With Special Reference To Gold: Synopsis Report ONDocumento8 páginasA Study of Commodity Market With Special Reference To Gold: Synopsis Report ONRanbir SinghAinda não há avaliações

- GoldDocumento16 páginasGoldayyappa rajaAinda não há avaliações

- Lighthouse - Goldbug Galore - 2017-04Documento11 páginasLighthouse - Goldbug Galore - 2017-04Alexander GloyAinda não há avaliações

- Gann SquareDocumento4 páginasGann SquareAmeeth VorraAinda não há avaliações

- Box Pushing Technology PresentationDocumento13 páginasBox Pushing Technology Presentationlaxmicc100% (1)

- Importance of BaseplatesDocumento2 páginasImportance of BaseplateslaxmiccAinda não há avaliações

- CC Mix Design by KLPDocumento59 páginasCC Mix Design by KLPstruban8337100% (1)

- 1 viewNitPdf - 1707560Documento8 páginas1 viewNitPdf - 1707560laxmiccAinda não há avaliações

- 1 viewNitPdf - 1716598Documento4 páginas1 viewNitPdf - 1716598laxmiccAinda não há avaliações

- 2 Technical BidDocumento259 páginas2 Technical BidlaxmiccAinda não há avaliações

- 2-Dharm Singh Ajit SinghDocumento18 páginas2-Dharm Singh Ajit SinghlaxmiccAinda não há avaliações

- 234 2485Documento8 páginas234 2485laxmiccAinda não há avaliações

- Gladiolus Project Report by NABARDDocumento9 páginasGladiolus Project Report by NABARDBharamagoudaDalawaiAinda não há avaliações

- Steel Bridges - INSDAG PDFDocumento15 páginasSteel Bridges - INSDAG PDFsuman33Ainda não há avaliações

- E Tendering NIT ITT Works Sept 15Documento76 páginasE Tendering NIT ITT Works Sept 15laxmiccAinda não há avaliações

- E Tendering NIT ITT Works Sept 15Documento76 páginasE Tendering NIT ITT Works Sept 15laxmiccAinda não há avaliações

- Technical Bid Package IVDDocumento192 páginasTechnical Bid Package IVDlaxmiccAinda não há avaliações

- PrequalificationDocumento18 páginasPrequalificationlaxmiccAinda não há avaliações

- 2 Minutes of Pre Bid - BiratnagarDocumento10 páginas2 Minutes of Pre Bid - BiratnagarlaxmiccAinda não há avaliações

- 110515-Correction Slip 16-18 Tender DocumentDocumento5 páginas110515-Correction Slip 16-18 Tender DocumentlaxmiccAinda não há avaliações

- Code of Conduct FinalDocumento10 páginasCode of Conduct FinallaxmiccAinda não há avaliações

- E Tendering NIT ITT Works Sept 15Documento76 páginasE Tendering NIT ITT Works Sept 15laxmiccAinda não há avaliações

- Design of Truss BridgesDocumento10 páginasDesign of Truss Bridges0808276kAinda não há avaliações

- 745Documento36 páginas745laxmiccAinda não há avaliações

- Users - Roles and ResponsibilitiesDocumento5 páginasUsers - Roles and ResponsibilitieslaxmiccAinda não há avaliações

- Users - Roles and ResponsibilitiesDocumento5 páginasUsers - Roles and ResponsibilitieslaxmiccAinda não há avaliações

- 745Documento36 páginas745laxmiccAinda não há avaliações

- Banned VendorsDocumento2 páginasBanned VendorslaxmiccAinda não há avaliações

- Bilaspur Railway Tender for Ballast SupplyDocumento3 páginasBilaspur Railway Tender for Ballast SupplylaxmiccAinda não há avaliações

- PQDocumento19 páginasPQlaxmiccAinda não há avaliações

- Form ADocumento23 páginasForm AlaxmiccAinda não há avaliações

- Payroll in Tally Prime Step by Step Training NotesDocumento9 páginasPayroll in Tally Prime Step by Step Training NotesAnkita GuptaAinda não há avaliações

- Bibliography of the Butterworth TrialDocumento3 páginasBibliography of the Butterworth TrialmercurymomAinda não há avaliações

- TA Employee Referral ProgamDocumento3 páginasTA Employee Referral ProgamagalaboAinda não há avaliações

- Harga MethanolDocumento1 páginaHarga MethanolYuli NugraheniAinda não há avaliações

- Ensuring Ethical Supply ChainsDocumento19 páginasEnsuring Ethical Supply ChainsAbhishekAinda não há avaliações

- Muqam e Rabulalamin Aur Fitna Qadianiat by UbaidullahDocumento26 páginasMuqam e Rabulalamin Aur Fitna Qadianiat by UbaidullahIslamic Reserch Center (IRC)Ainda não há avaliações

- Lokesh ResumeDocumento2 páginasLokesh ResumeRaj AcharyaAinda não há avaliações

- Vak Sept. 16Documento28 páginasVak Sept. 16Muralidharan100% (1)

- Literature ReviewDocumento6 páginasLiterature Reviewapi-549249112Ainda não há avaliações

- International Portfolio TheoryDocumento27 páginasInternational Portfolio TheoryDaleesha SanyaAinda não há avaliações

- ASAP Current Approved Therapists MDocumento10 páginasASAP Current Approved Therapists MdelygomAinda não há avaliações

- GonorrhoeaDocumento24 páginasGonorrhoeaAtreyo ChakrabortyAinda não há avaliações

- LG Overnight Trader Q3 2019 EST PDFDocumento11 páginasLG Overnight Trader Q3 2019 EST PDFjim6116Ainda não há avaliações

- Texas Commerce Tower Cited for Ground Level FeaturesDocumento1 páginaTexas Commerce Tower Cited for Ground Level FeatureskasugagAinda não há avaliações

- Winchel RM Stanley MDocumento13 páginasWinchel RM Stanley MMariola AlamoAinda não há avaliações

- Tourism and Hospitality LawDocumento4 páginasTourism and Hospitality LawSarah Mae AlcazarenAinda não há avaliações

- Municipal Best Practices - Preventing Fraud, Bribery and Corruption FINALDocumento14 páginasMunicipal Best Practices - Preventing Fraud, Bribery and Corruption FINALHamza MuhammadAinda não há avaliações

- Debate Motions SparringDocumento45 páginasDebate Motions SparringJayden Christian BudimanAinda não há avaliações