Escolar Documentos

Profissional Documentos

Cultura Documentos

Annual Bonus Circular 2013-14 PDF

Enviado por

girinandiniDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Annual Bonus Circular 2013-14 PDF

Enviado por

girinandiniDireitos autorais:

Formatos disponíveis

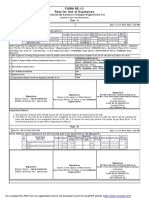

FINANCE & ACCOUNTS DIVISION

CIRCULAR

TO ALL DIVISIONAL / DEPARTMENTAL HEADS

F&A/PRA/F-722/ 829 /14

9th September, 2014

ANNUAL BONUS 2013-14

The following procedures will be followed for payment of Annual Bonus for the year 2013-14:1. ELIGIBILITY

i) All eligible employees of the Steel Company at Jamshedpur (including Tubes Division &

Growth Shop), Marketing & Sales Division, CRC(West), CREs Office (Ranchi), CREs

Office (Bhubaneswar), CREs Office (Delhi), Mines / Collieries Division, FA&M Division

and Head Office, who had worked for not less than thirty working days during the financial

year 2013-2014 shall be entitled to receive the annual bonus except persons who have been

dismissed from the services for

a) Fraud or

b) Riotous or violent behavior while on the premises, or

c) Theft, misappropriation etc.

ii) The word employees includes both permanent and temporary employees (not

Apprentices);

2. QUANTUM

All eligible employees (not covered by the superannuation scheme) at Jamshedpur (including

Tubes Div.), Head Office, CRC (West), Chief RE (Bhubaneswar), Orissa, Chief RE (Ranchi)

will be paid Annual Bonus as per following formula for the accounting year 2013-2014.

Total annual bonus amount for the accounting

Year 2013-14 (Rs.193.34 Cr)

Total Bonusable amount paid for the accounting

year 2013-14 (Rs 1250.06 Cr)

Individual employees Bonusable

amount (Basic + DA) paid for the

accounting year 2013-14

3. ROUNDING OFF

Bonus amount for permanent employees as well as separated employees including employees

separated under ESS will be rounded off to the nearest rupee. Amount up to 49 paise will be

ignored while 50 paise and above will be taken as Re. 1/-.

4. MODE OF PAYMENT

Separate bonus muster rolls would be prepared in respect of the following categories of

employees at Jamshedpur

.2

-: 2 :-

( i ) Employees on rolls, and

(ii) Employees separated up to 8th Sept., 2014 including separated under ESS.

The bonus for employees on rolls will be remitted to their bank accounts, where salary

payment is being remitted.

The following procedure will be adopted for payment of bonus to employees who have

availed ESS & separated under Job for Job (JFJ) scheme at Jamshedpur and are eligible for

bonus i)

Bonus will be remitted to their bank Accounts;

ii) Employees separated under ESS/JFJ who have not vacated Companys quarter without

permission to retain it / or not in receipt of monthly ESS pension/Maintenance Allowance

due to attainment of 60 years of age, will be paid bonus by A/c payee cheque through

Payroll Section of Finance & Accounts Division, subject to vacation of Companys

quarter and registration of claim for Bonus, wherever applicable.

Payment of bonus to separated employees other than ESS & Job for Job Scheme cases will

be made directly to their Bank Accounts except for the following cases:a.

b.

c.

Employees who were in receipt of salary by A/c. Payee cheque due to nonSubmission of Bank Account details;

Employees who have not vacated the Companys quarter and

Death cases where bonus will be paid to nominees of deceased ex-employees.

For cases under (a), (b) and (c) above, the payment will be made by A/c. Payee cheques thro

Payroll Section of Finance & Accounts Division, subject to vacation of Companys quarter /

establishment of claim, and registration of claim for Bonus, as applicable.

5. DATE OF PAYMENT

Payment to all eligible employees will be made on dates indicated below:Jamshedpur, Growth Shop, Tubes Division,

Jharia Division, West Bokaro ,OMQ and FAMD

a) Employees on rolls

- Bonus amount will be remitted to the

Bank on 12th September, 2014.

b) Separated employees

(incl. separated under ESS)

- Bonus will be remitted to the bank /

on 13th September, 2014.

c) Separated employees

(Cases under 4a, b & c above)

and including ESS separatees, who have

not vacated Companys quarter without

permission to retain it.

- Bonus will be paid by A/c. Payee cheque

from payroll Section from 17th Sept. 2014.

.3

-: 3 :-

6.

INCOME TAX

The Income Tax from bonus will be deducted at the tax rate applicable for

Individual employees/ex-employees, as per the income tax estimates made for salary/

ESS pension (including bonus) after considering the Investment Plans.

7.

The payment of Annual Bonus shall be made after recovering other dues, if any.

This may please be given wide publicity.

Rakesh Chandra

for Chief Financial Controller (FT&C)

Cc to: M.Ds Office / Gr. ED-F&Cs Office / President (TQM &SB) / Gr. Exc. VP (Finance)

All VPs/PEO/All GMs/All EICs/Chief HRM (Steel)/Chief Group IR/Chief (HRMRM)/

Chief HRM Jharia/WestBokaro / OMQ /Chief RE (Bhubaneswar)/Chief, RE (Ranchi)/

H O, Mumbai/Head (A/Cs Jharia)/Head (A/Cs- OMQ)/Head (Marketing Finance, Kolkata)/

Head (A/csWBC)/FC(Tubes)/FC (FA&MD),Kol./FC (Brgs)/FC (Wires Division)

All Chiefs & Heads of the Departments at Jamshedpur.

************

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- City of Cleveland Shaker Square Housing ComplaintDocumento99 páginasCity of Cleveland Shaker Square Housing ComplaintWKYC.comAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- 5840-SL-300f0 V03.00 HB REV1 - FullDocumento223 páginas5840-SL-300f0 V03.00 HB REV1 - FullgirinandiniAinda não há avaliações

- Pronunciation SyllabusDocumento5 páginasPronunciation Syllabusapi-255350959Ainda não há avaliações

- Noah Horwitz - Reality in The Name of God, or Divine Insistence - An Essay On Creation, Infinity, and The Ontological Implications of Kabbalah-Punctum Books (2012) PDFDocumento358 páginasNoah Horwitz - Reality in The Name of God, or Divine Insistence - An Essay On Creation, Infinity, and The Ontological Implications of Kabbalah-Punctum Books (2012) PDFGabriel Reis100% (1)

- Philo Week 8Documento4 páginasPhilo Week 8Emiel Magante100% (1)

- Supply Chain and Logistics Management: Distribution PoliciesDocumento8 páginasSupply Chain and Logistics Management: Distribution PoliciesKailas Sree ChandranAinda não há avaliações

- PESO Online Explosives-Returns SystemDocumento1 páginaPESO Online Explosives-Returns Systemgirinandini0% (1)

- Agenda For Cost Mereting To Be Held On 10th July'15Documento1 páginaAgenda For Cost Mereting To Be Held On 10th July'15girinandiniAinda não há avaliações

- Information BrochureDocumento32 páginasInformation BrochuregirinandiniAinda não há avaliações

- TRANSISTOR - IntroductionDocumento23 páginasTRANSISTOR - Introductiongirinandini100% (1)

- ScribdDocumento1 páginaScribdgirinandiniAinda não há avaliações

- More Books Expected SoonDocumento1 páginaMore Books Expected SoongirinandiniAinda não há avaliações

- TPH 768.8 Silo Balance 8947: Total Coal TonnageDocumento2 páginasTPH 768.8 Silo Balance 8947: Total Coal TonnagegirinandiniAinda não há avaliações

- Rich Text Editor FileDocumento1 páginaRich Text Editor FilegirinandiniAinda não há avaliações

- ModRich Text Editor FileDocumento1 páginaModRich Text Editor FilegirinandiniAinda não há avaliações

- Malaysian Business Law Week-11 Lecture NotesDocumento3 páginasMalaysian Business Law Week-11 Lecture NotesKyaw Thwe TunAinda não há avaliações

- Modules 1-8 Answer To Guides QuestionsDocumento15 páginasModules 1-8 Answer To Guides QuestionsBlackblight •Ainda não há avaliações

- National Budget Memorandum No. 129 Reaction PaperDocumento2 páginasNational Budget Memorandum No. 129 Reaction PaperVhia ParajasAinda não há avaliações

- CCC Guideline - General Requirements - Feb-2022Documento8 páginasCCC Guideline - General Requirements - Feb-2022Saudi MindAinda não há avaliações

- Environment Impact Assessment Notification, 1994Documento26 páginasEnvironment Impact Assessment Notification, 1994Sarang BondeAinda não há avaliações

- Edgeworth, Matt. 2018. Rivers As Material Infrastructure: A Legacy From The Past To The FutureDocumento14 páginasEdgeworth, Matt. 2018. Rivers As Material Infrastructure: A Legacy From The Past To The FutureMauro FernandezAinda não há avaliações

- "Underdevelopment in Cambodia," by Khieu SamphanDocumento28 páginas"Underdevelopment in Cambodia," by Khieu Samphanrpmackey3334100% (4)

- Persuasive Writing Exam - Muhamad Saiful Azhar Bin SabriDocumento3 páginasPersuasive Writing Exam - Muhamad Saiful Azhar Bin SabriSaiful AzharAinda não há avaliações

- UntitledDocumento9 páginasUntitledRexi Chynna Maning - AlcalaAinda não há avaliações

- Security Incidents and Event Management With Qradar (Foundation)Documento4 páginasSecurity Incidents and Event Management With Qradar (Foundation)igrowrajeshAinda não há avaliações

- Form I-129F - BRANDON - NATALIADocumento13 páginasForm I-129F - BRANDON - NATALIAFelipe AmorosoAinda não há avaliações

- CEAT PresentationDocumento41 páginasCEAT PresentationRAJNTU7aAinda não há avaliações

- Q2 Emptech W1 4Documento32 páginasQ2 Emptech W1 4Adeleine YapAinda não há avaliações

- Fare Matrix: "No Face Mask, No Ride" "Two Passengers Only"Documento4 páginasFare Matrix: "No Face Mask, No Ride" "Two Passengers Only"Joshua G NacarioAinda não há avaliações

- Cultural Materialism and Behavior Analysis: An Introduction To HarrisDocumento11 páginasCultural Materialism and Behavior Analysis: An Introduction To HarrisgabiripeAinda não há avaliações

- People V GGGDocumento7 páginasPeople V GGGRodney AtibulaAinda não há avaliações

- Pre Project PlanningDocumento13 páginasPre Project PlanningTewodros TadesseAinda não há avaliações

- Types of Love in Othello by ShakespeareDocumento2 páginasTypes of Love in Othello by ShakespeareMahdi EnglishAinda não há avaliações

- Gillette vs. EnergizerDocumento5 páginasGillette vs. EnergizerAshish Singh RainuAinda não há avaliações

- SCRIPT IRFANsDocumento2 páginasSCRIPT IRFANsMUHAMMAD IRFAN BIN AZMAN MoeAinda não há avaliações

- Case2-Forbidden CItyDocumento10 páginasCase2-Forbidden CItyqzbtbq7y6dAinda não há avaliações

- Pulsed-Field Gel Electrophoresis (PFGE) - PulseNet Methods - PulseNet - CDCDocumento2 páginasPulsed-Field Gel Electrophoresis (PFGE) - PulseNet Methods - PulseNet - CDCChaitanya KAinda não há avaliações

- Priyanshu Mts Answer KeyDocumento34 páginasPriyanshu Mts Answer KeyAnima BalAinda não há avaliações

- Supplier Claim Flow ChecklistDocumento1 páginaSupplier Claim Flow ChecklistChris GloverAinda não há avaliações

- Hedge Fund Ranking 1yr 2012Documento53 páginasHedge Fund Ranking 1yr 2012Finser GroupAinda não há avaliações