Escolar Documentos

Profissional Documentos

Cultura Documentos

Mayor Miner Press Release

Enviado por

Anonymous CEfEUBVWDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Mayor Miner Press Release

Enviado por

Anonymous CEfEUBVWDireitos autorais:

Formatos disponíveis

OFFICE OF THE MAYOR

Hon. Stephanie A. Miner, Mayor

FOR IMMEDIATE RELEASE

DATE: December 15, 2015

CONTACT: Alexander Marion

Press Secretary (315) 448-8044

CITY TAKES LEGAL ACTION AGAINST

COR DEVELOPMENT OVER INNER HARBOR

TAX DEAL WITH COUNTY IDA

Tax Breaks Approved Today By OCIDA Will Reportedly Save COR

Approximately $44 Million

Miner: I Cant Stand By While Millions of Dollars in Public Funds

Go To a Developer Without Securing a Binding Agreement for Jobs

For Citizens Most in Need of Work

SYRACUSE, N.Y. The City of Syracuse today began legal action against COR Development

Company, LLC regarding its action to seek a special tax deal with Onondaga County Industrial

Development Authority (OCIDA). The City maintains COR deliberately sought a tax relief deal

from OCIDA to allow the company to avoid a community benefits agreement with the City that

would have bound COR to provide project-related jobs to city residents.

We are taking this action because the people of Syracuse deserve more than a promise of

trickledown economic development in exchange for another sweetheart tax break worth

millions, said Syracuse Mayor Stephanie A. Miner. It has been the policy of my

administration to extend a PILOT agreement only if there is a commensurate community benefit

to the public written into the deal. By doing this end run with OCIDA, COR avoided entering

into a binding agreement to meet perhaps our most pressing need: to provide jobs and training to

people so they can escape poverty.

"The recent OCIDA vote to give COR a PILOT was done with absolute disregard for the Citys

taxpayers, said Common Councilor Khalid Bey, who chairs the Councils economic

development committee. Go figure that this public entity would blatantly ignore the wishes and

best interests of the Citys residents. OCIDAs action circumvents the City's leverage to assure

work opportunities and affordable living for City residents. Its actions like this that engenders a

distaste for government in so many."

233 EAST WASHINGTON STREET * SYRACUSE, NEW YORK 13202

315-448-8005 | www.syrgov.net

Facebook | YouTube | Twitter | Flickr | Instagram

OFFICE OF THE MAYOR

Hon. Stephanie A. Miner, Mayor

FOR IMMEDIATE RELEASE

DATE: December 15, 2015

CONTACT: Alexander Marion

Press Secretary (315) 448-8044

In its lawsuit, the City maintains that COR deliberately deceived the City about its intention to

seek a PILOT agreement to avoid negotiating a specific community benefits agreement. The City

of Syracuse states that throughout its 4 year working relationship, COR repeatedly stated it

would not seek, and did not ask to negotiate, a special tax deal known as a payment in lieu of

taxes (PILOT).

The City pointed out that COR sought a tax deal with OCIDA which does not have a Minority

and Women-owned Business Enterprise (MWBE) preference policy. MWBE policies have been

used for years by governments to assure that projects benefiting from public monies set goals for

a minimum percentage of the projects contacts to go to minority and women-owned businesses.

The Syracuse Industrial Development Agency (SIDA), which COR sidestepped, has an MWBE

policy. It states that projects that receive agency support provide, and use its best efforts to

provide, opportunities for the purchase of equipment, goods and services from: (i) business

enterprises located in the City of Syracuse; (ii) certified minority and/or woman-owned business

enterprises; and, (iii) business enterprises that employ residents of the City of Syracuse.

Consideration will be given by the Agency to the projects efforts to comply, and compliance,

with this objective at any time an extension of benefits is awarded, or involvement by the

Agency with the project, is requested by the project.

Unlike OCIDA, SIDA is required to spend 100 percent of its fees generated when it issues bonds

for projects within the City of Syracuse. Most recently, SIDA spent $1.5 million on property

demolitions in the City.

As an example of a successful commitment to job creation, the Mayor cited the first phase of the

Joint Schools Construction Board. For that $150 million construction project, the City achieved

its goal of 15 percent for MWBE subcontractors. It also achieved another goal of 10 percent of

women and minority workers on the job. In addition, the JSCB also funded a job training

program.

Mayor Miner added: Today, OCIDA gave COR a tax benefit agreement with no real and

effective community benefit to the people of Syracuse.

233 EAST WASHINGTON STREET * SYRACUSE, NEW YORK 13202

315-448-8005 | www.syrgov.net

Facebook | YouTube | Twitter | Flickr | Instagram

OFFICE OF THE MAYOR

Hon. Stephanie A. Miner, Mayor

FOR IMMEDIATE RELEASE

DATE: December 15, 2015

CONTACT: Alexander Marion

Press Secretary (315) 448-8044

The Inner Harbor is composed of a number of valuable parcels of developable land in the City of

Syracuse. COR has been the recipient of almost $32 million in taxpayer subsidies, including

$1.5 million in City revenues for infrastructure improvements.

###

233 EAST WASHINGTON STREET * SYRACUSE, NEW YORK 13202

315-448-8005 | www.syrgov.net

Facebook | YouTube | Twitter | Flickr | Instagram

Você também pode gostar

- Oberst IndictmentDocumento4 páginasOberst IndictmentAnonymous CEfEUBVWAinda não há avaliações

- 2016 State Fair CouponsDocumento5 páginas2016 State Fair CouponsAnonymous CEfEUBVWAinda não há avaliações

- Reader Discretion Advised Oswego Court DocumentsDocumento21 páginasReader Discretion Advised Oswego Court DocumentsAnonymous CEfEUBVWAinda não há avaliações

- Marcellus School District Lead LetterDocumento1 páginaMarcellus School District Lead LetterAnonymous CEfEUBVWAinda não há avaliações

- Exelon LetterDocumento3 páginasExelon LetterTim KnaussAinda não há avaliações

- NRC ReportDocumento43 páginasNRC ReportAnonymous CEfEUBVWAinda não há avaliações

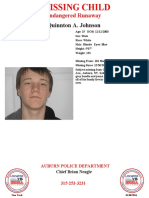

- Missing PersonDocumento1 páginaMissing PersonAnonymous CEfEUBVWAinda não há avaliações

- Mayors of Four Largest Upstate Cities Announce Support For Statewide Ridesharing LegislationDocumento3 páginasMayors of Four Largest Upstate Cities Announce Support For Statewide Ridesharing LegislationAnonymous CEfEUBVWAinda não há avaliações

- Missing Auburn TeenDocumento1 páginaMissing Auburn TeenAnonymous CEfEUBVWAinda não há avaliações

- Airshow ScheduleDocumento1 páginaAirshow ScheduleAnonymous CEfEUBVWAinda não há avaliações

- Cra Z JewelsDocumento3 páginasCra Z JewelsAnonymous CEfEUBVWAinda não há avaliações

- Lottery Money by CountyDocumento2 páginasLottery Money by CountyAnonymous CEfEUBVWAinda não há avaliações

- Lakeview Amphitheater - Orange Lot Parking MapDocumento1 páginaLakeview Amphitheater - Orange Lot Parking MapAnonymous CEfEUBVWAinda não há avaliações

- Gary Thibodeau's Appeal RequestDocumento82 páginasGary Thibodeau's Appeal Requestchrsbakr100% (1)

- 2016 State of The City AddressDocumento22 páginas2016 State of The City AddresschrsbakrAinda não há avaliações

- Letter To Judge Sherwood - Amanda HellmannDocumento2 páginasLetter To Judge Sherwood - Amanda HellmannAnonymous CEfEUBVWAinda não há avaliações

- 2-26-16 Accountability Status Press ReleaseDocumento2 páginas2-26-16 Accountability Status Press ReleaseAnonymous CEfEUBVWAinda não há avaliações

- Missing PosterDocumento1 páginaMissing PosterAnonymous CEfEUBVWAinda não há avaliações

- Thibodeau DecisionDocumento64 páginasThibodeau DecisionAnonymous CEfEUBVWAinda não há avaliações

- Missing FlyerDocumento1 páginaMissing FlyerAnonymous CEfEUBVWAinda não há avaliações

- Fully Redacted Viera-Suarez Laura #27545 Decision 1-15-2016Documento12 páginasFully Redacted Viera-Suarez Laura #27545 Decision 1-15-2016Anonymous CEfEUBVWAinda não há avaliações

- New York Lottery Aid To Education: Fiscal Year 2014-2015Documento4 páginasNew York Lottery Aid To Education: Fiscal Year 2014-2015Anonymous CEfEUBVWAinda não há avaliações

- Spring Allergy Capitals 2016 RankingsDocumento4 páginasSpring Allergy Capitals 2016 RankingsChris BurnsAinda não há avaliações

- Wintertime Events and January CalendarDocumento8 páginasWintertime Events and January CalendarAnonymous iaDb2DVnMwAinda não há avaliações

- Wintertime Events and January CalendarDocumento10 páginasWintertime Events and January CalendarAnonymous iaDb2DVnMwAinda não há avaliações

- Whitesboro Mayor StatementDocumento2 páginasWhitesboro Mayor StatementAnonymous CEfEUBVWAinda não há avaliações

- COR Motion To DismissDocumento33 páginasCOR Motion To DismissAnonymous CEfEUBVWAinda não há avaliações

- Quinnton A. Johnson: Endangered RunawayDocumento1 páginaQuinnton A. Johnson: Endangered RunawayAnonymous CEfEUBVWAinda não há avaliações

- Dave Pasiak StatementDocumento1 páginaDave Pasiak StatementAnonymous CEfEUBVWAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (120)

- Letter To Mayor 1.31.20Documento3 páginasLetter To Mayor 1.31.20Adrian MojicaAinda não há avaliações

- City of Seattle - Racial Equity Analysis Memo and Attachments For Comprehensive PlanDocumento42 páginasCity of Seattle - Racial Equity Analysis Memo and Attachments For Comprehensive PlanThe UrbanistAinda não há avaliações

- Planning Power Possibilities: How UNIDAD Is Shaping Equitable Development in South Central L.A. - Executive Summary EnglishDocumento2 páginasPlanning Power Possibilities: How UNIDAD Is Shaping Equitable Development in South Central L.A. - Executive Summary EnglishKALSUDA LAPBORISUTHAinda não há avaliações

- FOIA - Massoglia - Part 2 Second Set ResponsiveDocumento101 páginasFOIA - Massoglia - Part 2 Second Set ResponsiveGabriel PiemonteAinda não há avaliações

- HCCI Letter Commonwealth GamesDocumento1 páginaHCCI Letter Commonwealth GamesThe Hamilton SpectatorAinda não há avaliações

- La Bajada Community Benefits Agreement SummaryDocumento2 páginasLa Bajada Community Benefits Agreement SummaryDallas Free PressAinda não há avaliações

- Community Benefits AgreementDocumento57 páginasCommunity Benefits AgreementColumbia Daily Spectator100% (2)

- Basic Elements of Sustainable AgricultureDocumento12 páginasBasic Elements of Sustainable AgricultureSohel Bangi0% (1)

- HSR - 13 - 57 - SB - CBA - Seminar - PP - Rev - 071414Documento56 páginasHSR - 13 - 57 - SB - CBA - Seminar - PP - Rev - 071414jackson michaelAinda não há avaliações

- Summary of Terms - Port Covington MOUDocumento7 páginasSummary of Terms - Port Covington MOUFOX45Ainda não há avaliações

- Slam Dunk or Airball? A Preliminary Planning Analysis of The Brooklyn Atlantic Yards ProjectDocumento67 páginasSlam Dunk or Airball? A Preliminary Planning Analysis of The Brooklyn Atlantic Yards ProjectNorman OderAinda não há avaliações