Escolar Documentos

Profissional Documentos

Cultura Documentos

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Enviado por

Shyam SunderDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Enviado por

Shyam SunderDireitos autorais:

Formatos disponíveis

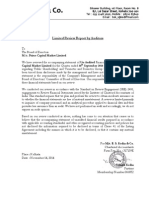

Mukesh Choudhary & Associates

Chartered Accountants

Limited Review Report by Auditors

The Board of Directors

M/s. Dynamic Portfolio Management & Services Limited

We have reviewed the accompanying statement of Un-Audited financial results of M/s.

Dynamic Portfolio Management & Services Limited for the Quarter ended 30th

September 2014 except for the disclosures regarding Public Shareholding and

Promoter and Promoter Group Shareholding which have been traced from disclosures

made by the management and have not been audited by us. This statement is the

responsibility of the Companys Management and has been approved by the Board of

Directors/ Committee of Board of Directors. Our responsibility is to issue a report on

these financial statements based on our review.

We conducted our review in accordance with the Standard on Review Engagement

(SRE) 2400, engagements to Review Financial Statements issued by the Institute of

Chartered Accountants of India. This standard requires that we plan and perform the

review to obtain moderate assurance as to whether the financial statements are free of

material misstatement. A review is limited primarily to inquiries of company personnel

and an analytical procedure applied to financial data and thus provides less assurance

than an audit. We have not performed an audit and accordingly, we do not express an

audit opinion.

Based on our review conducted as above, nothing has come to our attention that causes

us to believe that the accompanying statement of unaudited financial results prepared in

accordance with applicable accounting standards 1 and other recognized accounting

practices and policies has not disclosed the information required to be disclosed in terms

of Clause 41 of the Listing Agreement including the manner in which it is to be

disclosed, or that it contains any material misstatement.

For Mukesh Choudhary & Associates

Chartered Accountants

Place : Kolkata

Date : November 14, 2014

Mukesh Kumar Choudhary

Partner

Membership Number 062099

Office : Commerce House, 2-A, Ganesh Chandra Avenue, Kolkata - 700 013, Tel : 2213 2869

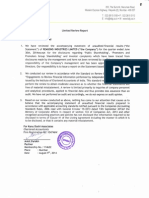

Dynamic Portfolio Management & Services Limited

Regd. Office : 53A, Mirza Ghalib Street, 4th Floor, Kolkata-700 016.

CIN : L74140WB1994PLC063178, Email - dpms.kolkata@gmail.com, Web : www.dynamicwealthservices.com

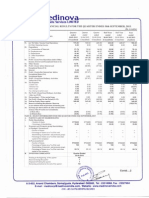

Rs. in Lacs

Statement of Unaudited Results for the Quarter & 6 months ended 30th September 2014

Particulars

Sr.

No.

1 Income from Operations

a) Net Sales/Income/(Loss) from Investing Activities

b) Other Operating Income

Total Income from Operations (Net)

2 Expenses

(a) Cost of Material Consumed

(b) Purchases of Stock-in-trade

4

5

6

7

8

9

Corresponding 3 Corresponding 6 Corresponding 6

Months ended

Months ended

Months ended

30.09.2013

30.09.2014

30.09.2013

Un-Audited

Year to date

figures as on

31.03.2014

Un-Audited

Audited

4.19

9.25

13.44

(14.48)

17.43

2.95

(23.67)

39.04

15.37

(25.62)

34.66

9.04

39.16

19.49

58.65

(39.15)

1.07

0.11

0.17

0.06

0.87

2.29

(15.30)

0.98

0.11

1.80

2.22

2.29

11.59

0.96

0.14

0.04

1.58

2.72

(54.45)

2.05

0.22

1.97

2.28

3.16

13.88

1.92

0.26

1.12

2.29

2.79

8.38

20.87

3.85

0.58

1.37

2.15

5.22

108.40

(0.36)

-

1.85

-

0.23

0.04

1.49

-

0.66

0.04

1.63

-

Profit/(Loss) from ordinary activities before finance costs

and exceptional items (3+4)

Finance Costs

(0.36)

(0.01)

1.85

0.01

0.27

-

1.49

-

0.70

-

1.63

0.01

Profit/(Loss) from ordinary activities after finance cost but

before exceptional items (3+4)

Exceptional Items

(0.35)

-

1.84

-

0.27

-

1.49

-

0.70

-

1.61

-

(0.35)

-

1.84

-

0.27

-

1.49

-

0.70

-

1.61

1.16

(0.35)

(0.35)

-

1.84

1.84

-

0.27

0.27

-

1.49

1.49

-

0.70

0.70

-

0.45

0.45

-

(0.35)

1,169.18

1.84

1,169.18

0.27

1,169.18

1.49

1,169.18

0.70

1,169.18

0.45

1,169.18

(d) Employees Benefit Expenses

(e) Depreciation & Amortization Expenses

(f) BSE Revocation, Depository & RTA Fees

(g) Provision for Standard Assets

(h) Other Expenses

Total Expenses

Profit/(Loss) from Operations before other Income, finance

cost and exceptional Expenses (1-2)

Other Income/(Loss)

Profit(+)/Loss(-) from ordinary activites before Tax (7-8)

10 Tax Expenses

Net Profit (+)/Loss(-) from ordinary activites after tax (911 10)

Lac)

12 Extra Ordinary Items (Net of Tax Expense of Rs.

13 Net Profit (+)/Loss(-) for the period (11-12)

14 Share of Profit/(Loss) of Associates*

15 Minority Interest*

Net Profit (+)/Loss(-) after tax, minority interest and Share

16 of Profit / (Loss) of Associates (13-14-15)

17 Paid-up Equity Share Capital (Face Value of Rs. 10/- each)

Reserves excluding revaluation Reserves as per last Balance

18 Sheet

Earning Per Share (after extra-ordinary items) of Rs. 10/19 each (not annualized)

(ii) a) Basic

b) Diluted

A PARTICULARS OF SHAREHOLDING

Public Shareholding

- Number of Shares

- Percentage of Share Holding

18 Promoter and Promoter Group Shareholding

a) Pledged/Encumbered

- Number of Shares

- Percentage of Shares (as a % of the total Shareholding

of Promoter and Promoter Group

- Percentage of Shares (as a % of the total Share Capital

of the Company

b) None-Encumbered

- Number of Shares

- Percentage of Shares (as a % of the total Shareholding

of Promoter and Promoter Group

- Percentage of Shares (as a % of the total Share Capital

of the Company

B INVESTOR COMPLAINTS

Pending at the beginning of the Quarter

Received during the Quarter

Notes :

25.58

84.45

110.03

74.36

(7.36)

(0.00)

(0.00)

0.02

0.02

0.00

0.00

0.01

0.01

0.01

0.01

0.00

0.00

(0.00)

(0.00)

0.02

0.02

0.00

0.00

0.01

0.01

0.01

0.01

0.00

0.00

10,174,800

10,174,800

10,215,800

10,174,800

10,215,800

10,174,800

87.03

87.03

87.38

87.03

87.38

87.03

Earning Per Share (before extra-ordinary items) of Rs. 10/19 each (not annualized)

(i) a) Basic

b) Diluted

1.

2.

3.

4.

Preceding 3

Months ended

30.06.2014

(27.86)

29.79

1.93

(c) Changes in Inventories of Finished Goods, Work-inProgress and Stock-in-Trade

3 Months

ended

30.09.2014

1,517,000

100.00

1,517,000

100.00

1,476,000

100.00

1,517,000

100.00

1,476,000

100.00

1,517,000

100.00

12.97

12.97

12.62

12.97

12.62

12.97

Nil

Nil

Disposed during the Quarter

Remaining Unresolved at the end of Quarter

Nil

Nil

The Company is operating in single segment vide Finance & Investments, segmental Report for the Quarter as per AS-17 of ICAI is not applicable for the Quarter.

Above resultes were reviewed by Audit Committee taken on record in Board Meeting held on 14th November, 2014.

Provision for Taxation will be made at the end of the Financial Year.

The Statutory Auditors of the Company have carried out "Limited Review" of the above Financial Results.

Place : Kolkata

Date : 14th November, 2014.

For Dynamic Portfolio Management & Services Limited

S/dRavi Kr. Newatia

Managing Director

Dynamic Portfolio Management & Services Ltd.

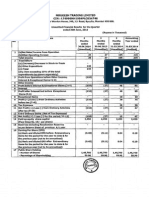

Statement of Assets & Liabilities

Rs. in Lacs

Particulars

A

EQUITY & LIABILITIES

1 Shareholders' Fund

(a) Share Capital

(b) Reserves and Surplus

(c) Money Received against Share Warrants

Sub-Total - Share Holders Fund

2 Share Capital Money (Pending Allotment

3 Minority Interest*

As At

30th Sept 2014

31st March

2014

Un-Audited

Audited

1,161.29

(6.57)

1,154.72

-

1,161.29

(7.36)

1,153.93

-

4 Non Current Liabilities

(a) Long Term Borrowings

(b) Deferred Tax Liabilities (Net)

(c) Other Long Term Liabilities

(d) Long Term Provisions

Sub-Total - Long Term Liabilities

3.35

0.22

10.56

14.13

8.28

0.13

6.80

15.21

5 Current Liabilities

(a) Short Term Borrowings

(b) Trade Payables

(c) Other Current Liabilities

(d) Short Term Provisions

27.85

9.37

4.13

0.14

1.95

Sub-Total - Current Liabilities

37.22

6.22

TOTAL EQUITY & LIABILITIES

1,206.07

1,175.36

6.54

911.71

-

6.76

120.00

874.53

-

918.25

1,001.29

149.21

13.54

9.45

115.56

0.06

287.82

1,206.07

94.76

57.13

22.19

174.07

1,175.36

ASSETS

1 Non-Current Assets

(a) Fixed Assets

(b) Goodwill on Consolidation*

(c) Non-Current Investments

(d) Deferred Tax Assets (Net)

(e) Long Term Loans & Advances

(f) Other Non-Current Assets

Sub-Total - Non Current Assets

2 Current Assets

(a) Current Investments

(b) Inventories

(c) Trade Receivables

(d) Cash & Cash Equivalents

(e) Short Term Loans & Advances

(f) Other Current Assets

Sub-Total - Current Assets

TOTAL - ASSETS

Você também pode gostar

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento7 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento5 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Documento3 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Absl Fy 2015Documento20 páginasAbsl Fy 2015junkyAinda não há avaliações

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Documento7 páginasStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review For June 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Documento4 páginasFinancial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento2 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Documento3 páginasFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento6 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocumento6 páginasOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderAinda não há avaliações

- JUSTDIAL Mutual Fund HoldingsDocumento2 páginasJUSTDIAL Mutual Fund HoldingsShyam SunderAinda não há avaliações

- Mutual Fund Holdings in DHFLDocumento7 páginasMutual Fund Holdings in DHFLShyam SunderAinda não há avaliações

- HINDUNILVR: Hindustan Unilever LimitedDocumento1 páginaHINDUNILVR: Hindustan Unilever LimitedShyam SunderAinda não há avaliações

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocumento2 páginasSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderAinda não há avaliações

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocumento5 páginasExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderAinda não há avaliações

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Documento1 páginaPR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderAinda não há avaliações

- Financial Results For Mar 31, 2014 (Result)Documento2 páginasFinancial Results For Mar 31, 2014 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results For March 31, 2016 (Result)Documento11 páginasStandalone Financial Results For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocumento2 páginasSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderAinda não há avaliações

- Financial Results For June 30, 2014 (Audited) (Result)Documento3 páginasFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results For September 30, 2013 (Result)Documento2 páginasFinancial Results For September 30, 2013 (Result)Shyam SunderAinda não há avaliações

- Financial Results For Dec 31, 2013 (Result)Documento4 páginasFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For September 30, 2016 (Result)Documento3 páginasStandalone Financial Results For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results For June 30, 2013 (Audited) (Result)Documento2 páginasFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results For June 30, 2016 (Result)Documento2 páginasStandalone Financial Results For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- PDF Processed With Cutepdf Evaluation EditionDocumento3 páginasPDF Processed With Cutepdf Evaluation EditionShyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Transcript of The Investors / Analysts Con Call (Company Update)Documento15 páginasTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderAinda não há avaliações

- Investor Presentation For December 31, 2016 (Company Update)Documento27 páginasInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Audit Evidence - Unit TwoDocumento28 páginasAudit Evidence - Unit TwoKananelo MOSENAAinda não há avaliações

- CFAP 6 AARS Summer 2023Documento4 páginasCFAP 6 AARS Summer 2023hassanlatif803Ainda não há avaliações

- Pengaruh Karakteristik Komite Audit, Karakteristik Perusahaan Dan Kompensasi Dewan Terhadap Komite Manajemen RisikoDocumento14 páginasPengaruh Karakteristik Komite Audit, Karakteristik Perusahaan Dan Kompensasi Dewan Terhadap Komite Manajemen RisikoJalu RisqiyonoAinda não há avaliações

- Full Multiple Choice For StudentsDocumento80 páginasFull Multiple Choice For StudentsĐỗ LinhAinda não há avaliações

- The Corporate Director's Guide ESG OversightDocumento19 páginasThe Corporate Director's Guide ESG OversightJenny Ling Lee Mei A16A0237Ainda não há avaliações

- 2023 AUDITING 202 Course OutlineDocumento9 páginas2023 AUDITING 202 Course OutlineAlbertoAinda não há avaliações

- Control Activities: Work Control Inventory Control Cost Control Quality ControlDocumento16 páginasControl Activities: Work Control Inventory Control Cost Control Quality ControlSuleman Tariq100% (1)

- Journal Entry Requirements: Accounting Services Guide Journal EntriesDocumento6 páginasJournal Entry Requirements: Accounting Services Guide Journal EntriesSudershan ThaibaAinda não há avaliações

- The Perceived Effect of Psychological Pricing To The Profitability of Franchise Food Carts in SM City BaguioDocumento2 páginasThe Perceived Effect of Psychological Pricing To The Profitability of Franchise Food Carts in SM City BaguioKathrine CruzAinda não há avaliações

- CKRS-BMMS MM 007 Shift Management Manual 01-00Documento56 páginasCKRS-BMMS MM 007 Shift Management Manual 01-00ailslia100% (1)

- Information Technology Risk and Controls 2nd EdditionDocumento36 páginasInformation Technology Risk and Controls 2nd EdditionMudassar UmarAinda não há avaliações

- Glossary AdsDocumento271 páginasGlossary AdsRodrigo JefecitoAinda não há avaliações

- Hotel AdministrationDocumento23 páginasHotel AdministrationUnis BautistaAinda não há avaliações

- Levine Smume7 Bonus Ch08Documento11 páginasLevine Smume7 Bonus Ch08Kiran SoniAinda não há avaliações

- Use of Secondary Tracking Segment in Oracle FinancialsDocumento3 páginasUse of Secondary Tracking Segment in Oracle FinancialsMoh'd AdamAinda não há avaliações

- Full Faa PDFDocumento392 páginasFull Faa PDFSham Sul100% (2)

- Risk Management Policy 1. Preamble:: Rail Vikas Nigam LTD (RVNL)Documento8 páginasRisk Management Policy 1. Preamble:: Rail Vikas Nigam LTD (RVNL)RVNLPKG6B VBL-GTLMAinda não há avaliações

- Audit of Investments: Investment PurposeDocumento11 páginasAudit of Investments: Investment PurposeTracy Miranda BognotAinda não há avaliações

- Module 2 Strategic Tax ManagementDocumento33 páginasModule 2 Strategic Tax ManagementAsh Padilla100% (1)

- (FDNACCT) Individual Online Research of Users and Business OrganizationsDocumento15 páginas(FDNACCT) Individual Online Research of Users and Business OrganizationsIrish Benette MartinezAinda não há avaliações

- New Delhi,: (I) The Total Income of Such Fund or Institution or Trust or University or Other Educational Institution orDocumento24 páginasNew Delhi,: (I) The Total Income of Such Fund or Institution or Trust or University or Other Educational Institution orCA.Shreehari KutsaAinda não há avaliações

- Synthesis On Capital BudgetingDocumento2 páginasSynthesis On Capital BudgetingRu MartinAinda não há avaliações

- Project Proposal On Cost AuditDocumento14 páginasProject Proposal On Cost AuditOnno Rokom Shuvo80% (5)

- Addverb Technologies Private LimitedDocumento60 páginasAddverb Technologies Private LimitedananyaagnihotriAinda não há avaliações

- June 1988 - June 1997 Maths Paper 2Documento38 páginasJune 1988 - June 1997 Maths Paper 2Jerilee SoCute Watts0% (1)

- Concept of ERS in SAP MMDocumento11 páginasConcept of ERS in SAP MMl s kumarAinda não há avaliações

- Covering Letter & CVDocumento5 páginasCovering Letter & CVMilindAinda não há avaliações

- LESSONS LEARNED The Costs and Benefits of The Earned ValueDocumento14 páginasLESSONS LEARNED The Costs and Benefits of The Earned Valuehh00216100% (1)

- SUCC102Documento264 páginasSUCC102joy100% (1)