Escolar Documentos

Profissional Documentos

Cultura Documentos

Budget Charticle ONLINE

Enviado por

patrickkerkstraDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Budget Charticle ONLINE

Enviado por

patrickkerkstraDireitos autorais:

Formatos disponíveis

Deconstructing Philadelphia’s Budget Crisis

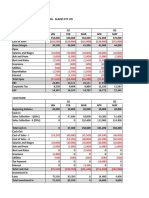

For 18 months, Philadelphia has veered from one 3. The Crisis Arrives

budget crisis to the next. Yawning deficits are filled Combined, high pension costs and a weak tax base left Philadelphia particularly vulnerable to a recession.

In 2008, tax collections sagged and the city pension fund was battered by the stock market collapse. Mayor Nutter

through spending cuts and tax hikes, only to be found himself a cumulative $2.1 billion short for the years 2009-2013, according to Inquirer calculations.

replaced with new budget gaps months later. Between past budgets and his current proposal, here’s how Nutter has closed that gap:

How did the city get here? How has City Hall Figures are in millions.

dealt with these crises? And how likely is it that Spending reductions: 44 percent Fee increases, tax hikes: 56 percent

Philadelphia will find itself in a similar bind $577.7 $403.6 $228.7 $484.9 $324.0 $192.5

in the years to come? — Patrick Kerkstra

Net spending Spending cuts Delayed Sales-tax hike Garbage Soda

reductions transferred to tax cuts fee tax

pension payments

1. A Long Time Coming NOTE: Figures do not add up to $2.1 billion because end of the five-year fund balance is higher than the beginning fund balance. Other fees $15.0

The crisis is rooted in decades-old problems, such as Philadelphia’s Mix of reductions and increases could change depending on what City Council does with the current budget.

declining population and high poverty rate. These factors of a weak

tax base make it difficult for the city to collect enough revenue to run

a government without high and uncompetitive tax rates. 4. Is Recovery Ahead?

The city projects tax collections will pick up slowly as the economy recovers. And for the first time in six

Philadelphia Population Philadelphia Poverty Rate decades, Philadelphia gained in population last year. Poverty, though, remains a stubborn and likely

Percentage of total population long-lasting challenge for the city. The pension payments are not going away, either. Philadelphia arguably

1950 living below the poverty line. remains just as vulnerable to the next recession as it was to the last one.

2,071,605 24.3%

2.0 2009 22.2%

(estimate) 20.2% 19.8% 16.8%

1,547,297 20% The state granted 16.4%

16.2%

1.5

15.1%

Philadelphia

2000 a partial deferral 15.8% 15.7%

15 15.7% 15.5%

1,517,550 of its pension 15.4%

1.0 15.2%

payments for 15.6% 15.5%

10 15.5% 15.4%

2010 and 2011, 15.2%

to be paid 15.0%

0.5 5 14.6%

in 2013 14.5%

and 2014. 14.0%

0 0

’50 ’60 ’70 ’80 ’90 ’00 ’09 ’70 ’80 ’90 ’00 ’08

General Fund Pension and Pension Bond Obligation, 2011-2030

Story slug SE1BUDGET04

An estimated $14 billion will be spent on city pensions 12.9% Hermes slug SE1BUDGET04-A

$885.2

2. The City’s Pension Fund 11.7% 11.7% 12.4% during the next 20 years.

Balloon

Mac slug city budget charticle

Then there are fast-growing employee pension $800 million Payment Location HOT ART/graphics server

expenses. The high costs are partly due to in 2029

contracts favorable to unions, but politicians A final $200

Artist tierno 2866

share in the blame. They lacked the 11.0% million payment Pub date April 4, 2010

foresight to make needed investments 600

in the pension fund, a failing that the 10.1%

on the city’s

pension

Section B

Nutter administration is paying for 9.3%

9.4% obligation Assigning Editor Busby

now. Each year, mandatory pension

payments consume a bigger 400

bond is due

in 2029,

Size 65p3 x 71 lines

chunk of the city’s budget. From 2012 onward, employee pension payments giving the

will exceed the total cost of the city Police Department. city some Verification

Percentage of 200 pension

General Fund Spent 6.7% 6.6% payment Copy editor

Actual Projected relief approval

on Pensions 7.1%

in 2030.

6.5% 0

’11 ’13 ’15 ’17 ’19 ’21 ’23 ’25 ’27 ’29

ABOUT THIS ANALYSIS

The Inquirer developed

this analysis with assistance 5 PERCENT

from the staff of the Pennsylvania

Intergovernmental Cooperation

Authority, a state agency that

oversees the city’s budgeting. 2001-2005 2006-2010 2011-2015 2016-2020 2021-2025 2026-2030

SOURCES: City of Philadelphia;

U.S. Census Bureau. Research and analysis: PATRICK KERKSTRA / Staff Writer Graphic: JOHN TIERNO / Staff Artist

Você também pode gostar

- 2011 Prelim City Budget FinalDocumento53 páginas2011 Prelim City Budget FinalDaniel StraussAinda não há avaliações

- Is "Tax Day" Too Burdensome For The Rich?Documento2 páginasIs "Tax Day" Too Burdensome For The Rich?api-26190997Ainda não há avaliações

- Peran Pajak dalam Pemulihan Ekonomi NasionalDocumento16 páginasPeran Pajak dalam Pemulihan Ekonomi NasionalAngga AnugrawanAinda não há avaliações

- Interim Union Budget 2024-25 Note - 0Documento3 páginasInterim Union Budget 2024-25 Note - 030091998skumarAinda não há avaliações

- State and Federal SpendingDocumento25 páginasState and Federal SpendingNational Press FoundationAinda não há avaliações

- JFC 1Q21 earnings dragged by one-off tax adjustment below estimatesDocumento10 páginasJFC 1Q21 earnings dragged by one-off tax adjustment below estimatesJajahinaAinda não há avaliações

- Interest Rates: Yield Curve Flattening Yield Curve FlatteningDocumento2 páginasInterest Rates: Yield Curve Flattening Yield Curve FlatteningNishtha KaushikAinda não há avaliações

- Chasing Fiscal ResponsibilityDocumento18 páginasChasing Fiscal ResponsibilityNathan BenefieldAinda não há avaliações

- Greene County FY2025 Citizens Guide FINAL CMSDocumento10 páginasGreene County FY2025 Citizens Guide FINAL CMSnewsAinda não há avaliações

- Advanced Taxation (Acfn 622) Semester 1, 2012Documento12 páginasAdvanced Taxation (Acfn 622) Semester 1, 2012yebegashet100% (1)

- Current Tax ReceiptsDocumento1 páginaCurrent Tax ReceiptsHeidi BillodeauAinda não há avaliações

- From The Desk of Business Head and CIO - January 2019: Mr. Prateek AgrawalDocumento4 páginasFrom The Desk of Business Head and CIO - January 2019: Mr. Prateek AgrawalAshwin HasyagarAinda não há avaliações

- TCS Financial Results: Quarter III FY 2021-22Documento25 páginasTCS Financial Results: Quarter III FY 2021-22Arindam MukhopadhyayAinda não há avaliações

- PersonalIncome December 2008Documento1 páginaPersonalIncome December 2008International Business TimesAinda não há avaliações

- MARYLAND BUDGET HIGHLIGHTS FY 2018Documento152 páginasMARYLAND BUDGET HIGHLIGHTS FY 2018srikrishna natesanAinda não há avaliações

- Budget, Revenues, and Cash Position Update: FY 2010 Potential Problem: Deficit SpendingDocumento23 páginasBudget, Revenues, and Cash Position Update: FY 2010 Potential Problem: Deficit SpendingRichardAinda não há avaliações

- 2020 Q 3 ReleaseDocumento4 páginas2020 Q 3 ReleasentAinda não há avaliações

- ALP OLI CY: Manish Sahewala, 23 Ruchika Gilada, 34 Kishore Babu, 14 Sec: C PG-09-11/T2Documento23 páginasALP OLI CY: Manish Sahewala, 23 Ruchika Gilada, 34 Kishore Babu, 14 Sec: C PG-09-11/T2sahewalaAinda não há avaliações

- 2009-08-06 Saxo Bank Research Note - US Q2 GDPDocumento8 páginas2009-08-06 Saxo Bank Research Note - US Q2 GDPTrading Floor100% (2)

- Bridgewater ReportDocumento12 páginasBridgewater Reportw_fibAinda não há avaliações

- 1 - FINANCE - ACS2021-FSD-FIN-0025 - 2022 Budget Tabling Presentation - ENDocumento25 páginas1 - FINANCE - ACS2021-FSD-FIN-0025 - 2022 Budget Tabling Presentation - ENJon WillingAinda não há avaliações

- Ceo Letter To Shareholders 2017 PDFDocumento46 páginasCeo Letter To Shareholders 2017 PDFOnoraroisgotti420Ainda não há avaliações

- Jamie Dimon's CEO Letter To Shareholders 2017Documento46 páginasJamie Dimon's CEO Letter To Shareholders 2017CNBC.com100% (1)

- Dimon LetterDocumento46 páginasDimon LetterHeisenbergAinda não há avaliações

- Holding Period, Taxes, and Required Performance: September 22, 2013Documento11 páginasHolding Period, Taxes, and Required Performance: September 22, 2013RamasamyShenbagarajAinda não há avaliações

- Ultimate Financial ModelDocumento33 páginasUltimate Financial ModelTulay Farra100% (1)

- NBP Funds Take On Federal Budget FY2021 PDFDocumento11 páginasNBP Funds Take On Federal Budget FY2021 PDFWaleed AnsariAinda não há avaliações

- 2011 Prelim City Budget FinalDocumento53 páginas2011 Prelim City Budget FinalEarlynoftenAinda não há avaliações

- 160811ID Tax Revenues SlippingDocumento3 páginas160811ID Tax Revenues SlippingDaniel Pandapotan MarpaungAinda não há avaliações

- Banking & Financial Awareness Digest March 2019Documento10 páginasBanking & Financial Awareness Digest March 2019Manish KumarAinda não há avaliações

- Overview of Fiscal Structure of PakistanDocumento51 páginasOverview of Fiscal Structure of Pakistanhasan shayanAinda não há avaliações

- Then & NowDocumento20 páginasThen & NowYoite MiharuAinda não há avaliações

- Understanding Poverty Through Dimensions and MeasuresDocumento41 páginasUnderstanding Poverty Through Dimensions and MeasuresダニエルAinda não há avaliações

- 2010-11 Budget Dev Parameters PresentationDocumento33 páginas2010-11 Budget Dev Parameters PresentationBrendan WalshAinda não há avaliações

- Pakistan Economy Fiscal Deficit Jumps 84% YoY in 1QFY23Documento3 páginasPakistan Economy Fiscal Deficit Jumps 84% YoY in 1QFY23Krrish LaraieAinda não há avaliações

- Measuring Progressivity in Canadas Tax SystemDocumento10 páginasMeasuring Progressivity in Canadas Tax SystemAbid faisal AhmedAinda não há avaliações

- Household Characteristics, Irish Inflation and The Cost of LivingDocumento8 páginasHousehold Characteristics, Irish Inflation and The Cost of LivinggabrielAinda não há avaliações

- Should We Worry About American Debt?: Part V: Economics GroupDocumento6 páginasShould We Worry About American Debt?: Part V: Economics GroupPhileas FoggAinda não há avaliações

- Social Security and The BudgetDocumento6 páginasSocial Security and The BudgetCommittee For a Responsible Federal BudgetAinda não há avaliações

- India Market Strategy: FY23 Budget: The Struggle To Spend ProductivelyDocumento34 páginasIndia Market Strategy: FY23 Budget: The Struggle To Spend ProductivelyVi KiAinda não há avaliações

- Global Mid-Year Forecast: JUNE 2021Documento20 páginasGlobal Mid-Year Forecast: JUNE 2021Daiany Costa100% (1)

- MacroeconomicSituationReport2ndFY2021 22 PDFDocumento24 páginasMacroeconomicSituationReport2ndFY2021 22 PDFsha ve3Ainda não há avaliações

- The California State Budget and Revenue Volatility: Fiscal Health in A Deficit ContextDocumento16 páginasThe California State Budget and Revenue Volatility: Fiscal Health in A Deficit ContextHoover InstitutionAinda não há avaliações

- 2020 Q 4 ReleaseDocumento18 páginas2020 Q 4 ReleasentAinda não há avaliações

- CIC's 1Q21 Earnings Decline 16% Y/y, Below Estimates: Concepcion Industrial CorporationDocumento8 páginasCIC's 1Q21 Earnings Decline 16% Y/y, Below Estimates: Concepcion Industrial CorporationJajahinaAinda não há avaliações

- 1Q21 Earnings Rose 43%, Beating Estimates On Lower-Than-Expected OpexDocumento7 páginas1Q21 Earnings Rose 43%, Beating Estimates On Lower-Than-Expected OpexJajahinaAinda não há avaliações

- MODULE 3 UNIT 2 TRAIN SUPPLEMENTAL READING 1 Aki - Policy - Brief - Volume - Xii - No. - 4 - 2019Documento6 páginasMODULE 3 UNIT 2 TRAIN SUPPLEMENTAL READING 1 Aki - Policy - Brief - Volume - Xii - No. - 4 - 2019Isabella AlfonsoAinda não há avaliações

- Ks Whopays FactsheetDocumento2 páginasKs Whopays FactsheetbrentwistromAinda não há avaliações

- 4Q23 Mastercard Earnings ReleaseDocumento15 páginas4Q23 Mastercard Earnings ReleaseFashina RashidatAinda não há avaliações

- Economics Group: Weekly Economic & Financial CommentaryDocumento9 páginasEconomics Group: Weekly Economic & Financial Commentaryjws_listAinda não há avaliações

- 4th Quarter 2020 Earnings Conference Call: February 4, 2021Documento23 páginas4th Quarter 2020 Earnings Conference Call: February 4, 2021bmuguruAinda não há avaliações

- BOP & IIP - Q1 20 PublicationDocumento6 páginasBOP & IIP - Q1 20 PublicationAnonymous UpWci5Ainda não há avaliações

- Monthly Chartbook 6 Jan 23Documento53 páginasMonthly Chartbook 6 Jan 23avinash sharmaAinda não há avaliações

- Union Budget FY2024Documento15 páginasUnion Budget FY2024Sathiyamoorthy RethinamAinda não há avaliações

- MF Working Paper: Increasing Public Sector Revenue in The Philippines: Equity and Efficiency ConsiderationsDocumento15 páginasMF Working Paper: Increasing Public Sector Revenue in The Philippines: Equity and Efficiency ConsiderationsMoses VillagonzaloAinda não há avaliações

- Will Credit Help The U.S. Consumer in H2-2014?: Economics GroupDocumento6 páginasWill Credit Help The U.S. Consumer in H2-2014?: Economics Groupchatuuuu123Ainda não há avaliações

- Chile's Public Finances in The Context of The Pandemic July 2021Documento24 páginasChile's Public Finances in The Context of The Pandemic July 2021Ian Carrasco TufinoAinda não há avaliações

- The Fast Plan for Tax Reform: A Fair, Accountable, and Simple Tax Plan to Chop Away the Federal Tax ThicketNo EverandThe Fast Plan for Tax Reform: A Fair, Accountable, and Simple Tax Plan to Chop Away the Federal Tax ThicketAinda não há avaliações

- LAC Poverty and Labor Brief, February 2014: Social Gains in the Balance - A Fiscal Policy Challenge for Latin America and the CaribbeanNo EverandLAC Poverty and Labor Brief, February 2014: Social Gains in the Balance - A Fiscal Policy Challenge for Latin America and the CaribbeanAinda não há avaliações

- Middle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsNo EverandMiddle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsAinda não há avaliações

- May 20 2010 Budget LetterDocumento2 páginasMay 20 2010 Budget LetterpatrickkerkstraAinda não há avaliações

- DC 33 Gets Behind Soda TaxDocumento1 páginaDC 33 Gets Behind Soda TaxpatrickkerkstraAinda não há avaliações

- Letter To The MayorDocumento2 páginasLetter To The MayorpatrickkerkstraAinda não há avaliações

- Parking Authority AuditDocumento41 páginasParking Authority Auditpatrickkerkstra100% (2)

- STC Philly SSB Tax Survey ToplineDocumento6 páginasSTC Philly SSB Tax Survey ToplinepatrickkerkstraAinda não há avaliações

- Pending Requests To AdministrationDocumento52 páginasPending Requests To Administrationpatrickkerkstra100% (2)

- Vote To Kill BRT 4 9 10Documento3 páginasVote To Kill BRT 4 9 10patrickkerkstraAinda não há avaliações

- Pending Requests To AdministrationDocumento104 páginasPending Requests To AdministrationpatrickkerkstraAinda não há avaliações

- Pending Requests To AdministrationDocumento186 páginasPending Requests To AdministrationpatrickkerkstraAinda não há avaliações

- Philadelphia 2009-2010 Budget in BriefDocumento82 páginasPhiladelphia 2009-2010 Budget in BriefpatrickkerkstraAinda não há avaliações

- Philadelphia 5-Year PlanDocumento56 páginasPhiladelphia 5-Year PlanpatrickkerkstraAinda não há avaliações

- Needless Jobs: Why Six Elected City Positions Should DieDocumento60 páginasNeedless Jobs: Why Six Elected City Positions Should Diepatrickkerkstra100% (3)

- Deco404 Public Finance Hindi PDFDocumento404 páginasDeco404 Public Finance Hindi PDFRaju Chouhan RajAinda não há avaliações

- MCQ Banking, Finance and Economy TestDocumento7 páginasMCQ Banking, Finance and Economy Testarun xornorAinda não há avaliações

- GPPB Reso 27-2012Documento3 páginasGPPB Reso 27-2012Ax Scribd100% (1)

- Project Report Goods and Service Tax in IndiaDocumento6 páginasProject Report Goods and Service Tax in IndiaAmit AgiwalAinda não há avaliações

- Global Transition of HR Practices During COVID-19Documento5 páginasGlobal Transition of HR Practices During COVID-19Md. Saifullah TariqueAinda não há avaliações

- Unit 3Documento23 páginasUnit 3Nigussie BerhanuAinda não há avaliações

- SAP Global Implementation Conceptual-Design-Of-Finance and ControllingDocumento172 páginasSAP Global Implementation Conceptual-Design-Of-Finance and Controllingprakhar31Ainda não há avaliações

- Hybrid Agreement Business Project Management ReportDocumento45 páginasHybrid Agreement Business Project Management Reportandrei4i2005Ainda não há avaliações

- Credit Card Response Rates and ProfitsDocumento6 páginasCredit Card Response Rates and ProfitskkiiiddAinda não há avaliações

- Business Plan 1. Executive SummaryDocumento2 páginasBusiness Plan 1. Executive SummaryBeckieAinda não há avaliações

- Bank Mandiri ProfileDocumento2 páginasBank Mandiri ProfileTee's O-RamaAinda não há avaliações

- Maximizing Advantages of China JV for HCFDocumento10 páginasMaximizing Advantages of China JV for HCFLing PeNnyAinda não há avaliações

- Issue of SharesDocumento53 páginasIssue of SharesKanishk GoyalAinda não há avaliações

- CBSE Class 12 Economics Sample Paper (For 2014)Documento19 páginasCBSE Class 12 Economics Sample Paper (For 2014)cbsesamplepaperAinda não há avaliações

- CMA Case Study Blades PTY LTDDocumento6 páginasCMA Case Study Blades PTY LTDMuhamad ArdiansyahAinda não há avaliações

- Asli Pracheen Ravan Samhita PDFDocumento2 páginasAsli Pracheen Ravan Samhita PDFgirish SharmaAinda não há avaliações

- CVP - Quiz 1Documento7 páginasCVP - Quiz 1Jane ValenciaAinda não há avaliações

- Dianne FeinsteinDocumento5 páginasDianne Feinsteinapi-311780148Ainda não há avaliações

- TaxDocumento18 páginasTaxPatrickBeronaAinda não há avaliações

- Opinion - Mary Mcculley V US Bank Homeowner WinsDocumento28 páginasOpinion - Mary Mcculley V US Bank Homeowner WinsmcculleymaryAinda não há avaliações

- Direction Ranking Blood RelationDocumento23 páginasDirection Ranking Blood RelationdjAinda não há avaliações

- Analysis On The Proposed Property Tax AssessmentDocumento32 páginasAnalysis On The Proposed Property Tax AssessmentAB AgostoAinda não há avaliações

- Rentberry Whitepaper enDocumento59 páginasRentberry Whitepaper enKen Sidharta0% (1)

- Blank - Nota SiasatanDocumento41 páginasBlank - Nota SiasatanprinceofkedahAinda não há avaliações

- I 1065Documento55 páginasI 1065Monique ScottAinda não há avaliações

- Chapter 12 Solutions ManualDocumento82 páginasChapter 12 Solutions ManualbearfoodAinda não há avaliações

- International Financial Management Chapter 6 - Government Influence On Exchang RateDocumento54 páginasInternational Financial Management Chapter 6 - Government Influence On Exchang RateAmelya Husen100% (2)

- Tutorial - Week12.starting A BusinessDocumento4 páginasTutorial - Week12.starting A BusinessAnonymous LDvhURRXmAinda não há avaliações

- Ch.3 Size of BusinessDocumento5 páginasCh.3 Size of BusinessRosina KaneAinda não há avaliações