Escolar Documentos

Profissional Documentos

Cultura Documentos

The Audit Risk Model

Enviado por

Shane LimDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

The Audit Risk Model

Enviado por

Shane LimDireitos autorais:

Formatos disponíveis

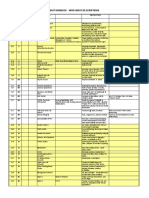

THE AUDIT RISK MODEL

Make it your friend

What is it?

In plain English

Affected by

Planned Detection Risk =

Measure of the risk that audit

evidence for a segment will

fail to detect material

misstatements, should they

exist.

Audit Risk /

Measure of how

willing the auditor

is to accept that

the financial

statements may be

materially

Determines amount of

misstated after an

evidence auditor plans to

unqualified

accumulate.

opinion is issued.

Risk that the evidence you

Risk that the

gather wont pick up on a

auditor is willing

significant misstatement. If

to accept of

you are willing to accept a

wrongly giving a

high planned detection risk, it clean opinion.

means that you accept the

risk that a significant

misstatement wont be

detected and hence less

evidence is required.

Changes to any other audit

The number of

risk model factors.

external users

relying on the

F/Ss, and the

extent of their

reliance (eg: how

widely disbursed

(Inherent Risk X

Measure of auditors

assessment of the

likelihood of a material

misstatement occurring,

before considering the

effectiveness of internal

controls.

Control Risk)

Measure of the auditors

assessment of the likelihood

that misstatements

exceeding a tolerable

amount in a segment will

not be prevented or

detected.

Risk of a significant

misstatement just

considering the nature of

the clients business.

Risk of controls failing to

catch a significant

misstatement (ie: the

controls fail)

Nature of the clients

business (remember my

telecom example)

Impacted by the strength of

the control environment,

and the control systems.

The nature and strength of

their information systems

(if weak, this creates a

The effectiveness of the

internal controls (how well

are they working

Relationships

The amount of evidence

required varies inversely with

the acceptable planned

detection risk to the auditor.

If the auditor is willing to

accept a greater risk that

his/her testing will fail to

detect a material

misstatement, then less

evidence is required.

However, if they are not

is the

organizations

ownership; is it

going public?)

greater risk of error).

throughout the fiscal year).

Management integrity (see

a common theme???)

Likelihood the

client will have

financial problems

after the audit

(look at their

liquidity position).

What drives management

(for example are they

compensated on a bonus

scheme driven solely by

profits?)

To what degree does the

auditor plan to rely on

them? Controls may work

very well, but if it is more

efficient to just do

substantive testing and not

rely on them, then control

risk may just be assessed as

high.

Integrity of

management (the

less integrity

management has,

the lower audit

risk the auditor

will be willing to

accept).

As the auditors

desired audit risk

decreases, the

amount of

assurance required

increases, and

more evidence

must be gathered.

Basically the

less the auditor is

Past audit results (have

you noted systematic

errors in the past?)

Complexity of accounting

(how many related parties

do they have, and do they

have complicated

accounting policies?)

Inherent risk impacts the

amount of evidence the

auditor must accumulate

(ie: the higher the inherent

risk, the more evidence is

required and hence the

lower planned detection

risk the auditor can

accept).

It also impacts where the

Generally, the higher your

control risk (the higher the

likelihood of your controls

failing), the greater the

amount of evidence the

auditor must accumulate.

Also, if controls cannot be

relied upon, this evidence

will have to come in the

form of more substantive

testing/ tests of details.

willing to accept such a risk, willing to accept a

they must gather more

wrong opinion,

evidence and do more testing. the more

assurance they

The higher the inherent risk,

need, and the

the lower the acceptable level more evidence

of planned detection risk.

required.

auditor focuses his or her

attention in testing

obviously, more testing

will be performed on areas

of higher risk).

Basically, the greater the

natural chance of a material

error (holding controls

constant), the less the

detection risk that can be

accepted by the auditor (and

hence the more evidence that

must be gathered).

Assessed for

Similarly, if control risk

increases (your controls have

a greater risk of failing) , but

inherent risk doesnt change,

the less planned detection

risk the auditor will be

willing to accept (and hence

more evidence required).

Will vary by transaction

related audit objective, for

each transaction cycle.

The financial

statements as a

whole. Rarely

varies by cycle or

account.

Each transaction cycle,

account, and audit

objective (remember the

telecom example, with

respect to revenues).

Each transaction related

audit objective, for each

transaction cycle.

Você também pode gostar

- Fraud Risk MDocumento11 páginasFraud Risk MEka Septariana PuspaAinda não há avaliações

- Control Monitoring and TestingDocumento15 páginasControl Monitoring and TestingTejendrasinh GohilAinda não há avaliações

- Intelligent Assurance Smart Controls PDFDocumento31 páginasIntelligent Assurance Smart Controls PDFChristen CastilloAinda não há avaliações

- Control Testing Vs Substantive by CPA MADHAV BHANDARIDocumento59 páginasControl Testing Vs Substantive by CPA MADHAV BHANDARIMacmilan Trevor JamuAinda não há avaliações

- Compliance Test Program: State Accounting OfficeDocumento10 páginasCompliance Test Program: State Accounting OfficeChristen CastilloAinda não há avaliações

- Hardening by Auditing: A Handbook for Measurably and Immediately Improving the Security Management of Any OrganizationNo EverandHardening by Auditing: A Handbook for Measurably and Immediately Improving the Security Management of Any OrganizationAinda não há avaliações

- Who Owns Fraud GreatDocumento7 páginasWho Owns Fraud GreatgigitoAinda não há avaliações

- Risk Assessment Form: 25 Paddington Green London W2 1NBDocumento2 páginasRisk Assessment Form: 25 Paddington Green London W2 1NBJulio AlvesAinda não há avaliações

- 2023 Annual Plan Risk ManagementDocumento60 páginas2023 Annual Plan Risk ManagementCatherineAinda não há avaliações

- Internal Controls 101Documento25 páginasInternal Controls 101Arcee Orcullo100% (1)

- Business Process Audit Guides IT ManagementDocumento25 páginasBusiness Process Audit Guides IT ManagementJulio CubiasAinda não há avaliações

- Audit RisksDocumento21 páginasAudit RisksMohanraj100% (1)

- Risk ID Risk Level Description of Risk Function 1Documento12 páginasRisk ID Risk Level Description of Risk Function 1preeti singh100% (1)

- Key Internal ControlDocumento5 páginasKey Internal ControlBarkah Wahyu PrasetyoAinda não há avaliações

- Internal Audit Risk Base DavaniDocumento15 páginasInternal Audit Risk Base DavaniHossein Davani100% (1)

- Internal Financial Controls WIRC 24062017Documento141 páginasInternal Financial Controls WIRC 24062017Ayush KishanAinda não há avaliações

- Entity Level ControlsDocumento11 páginasEntity Level ControlsEmmanuel DonAinda não há avaliações

- SOX Compliance Checklist Deloitte - ChecklistCompleteDocumento7 páginasSOX Compliance Checklist Deloitte - ChecklistCompletetosin.ekujumiAinda não há avaliações

- Test of ControlDocumento54 páginasTest of ControlK59 Vo Doan Hoang Anh100% (1)

- The Biggest Internal Audit Challenges in The Next Five YearsDocumento3 páginasThe Biggest Internal Audit Challenges in The Next Five YearsBagusAinda não há avaliações

- Controls in Ordering & PurchasingDocumento32 páginasControls in Ordering & PurchasingGrazel CalubAinda não há avaliações

- RiskandControls101 PDFDocumento11 páginasRiskandControls101 PDFliamAinda não há avaliações

- Impact and Likelihood ScalesDocumento3 páginasImpact and Likelihood ScalesRhea SimoneAinda não há avaliações

- Asia Pacific FraudDocumento32 páginasAsia Pacific FraudCici'cuit Thia-HattoriAinda não há avaliações

- Niche PartitioningDocumento3 páginasNiche PartitioningKhang LqAinda não há avaliações

- Internal Control Over Financial ReportingDocumento24 páginasInternal Control Over Financial ReportingPei Wang100% (1)

- Chapter 3 Internal Control ConsiderationDocumento22 páginasChapter 3 Internal Control Considerationconsulivy100% (1)

- Internal Control ConceptsDocumento14 páginasInternal Control Conceptsmaleenda100% (1)

- ISA Audit Guide 2010-01Documento243 páginasISA Audit Guide 2010-01Victor JacintoAinda não há avaliações

- DLTSoul DrinkersDocumento7 páginasDLTSoul DrinkersIgnacio Burón García100% (1)

- Internal Control System For Small Business To Reduce Risk of Fraud Tran LoanDocumento96 páginasInternal Control System For Small Business To Reduce Risk of Fraud Tran LoanLeo CerenoAinda não há avaliações

- Simplified Sample Entity Level Control Matrices ImpDocumento7 páginasSimplified Sample Entity Level Control Matrices ImpAqeelAhmadAinda não há avaliações

- Assessment of Audit RiskDocumento9 páginasAssessment of Audit RiskAli KhanAinda não há avaliações

- PgcIA - Scope, Process and Tools - ICAI Sep 05, 2014Documento56 páginasPgcIA - Scope, Process and Tools - ICAI Sep 05, 2014Aayushi AroraAinda não há avaliações

- GRC Reference Architecture - The GRC Enterprise Application CoreDocumento5 páginasGRC Reference Architecture - The GRC Enterprise Application CoreAdriano SaadAinda não há avaliações

- Risk Management Strategy A Complete Guide - 2019 EditionNo EverandRisk Management Strategy A Complete Guide - 2019 EditionAinda não há avaliações

- Internal Control Assessment PDFDocumento9 páginasInternal Control Assessment PDFRomlan D.Ainda não há avaliações

- Shs Core Subjects MelcsDocumento63 páginasShs Core Subjects MelcsRoldan Merjudio100% (1)

- Insulation Resistance TestDocumento7 páginasInsulation Resistance Testcarlos vidalAinda não há avaliações

- Internal Audit Manual NewDocumento26 páginasInternal Audit Manual NewhtakrouriAinda não há avaliações

- International Law of The Sea: 1.1. What Is It?Documento21 páginasInternational Law of The Sea: 1.1. What Is It?Clark Kenntt50% (2)

- Chapter 4: Revenue CycleDocumento12 páginasChapter 4: Revenue CycleCyrene CruzAinda não há avaliações

- OHS Policies and Guidelines (TESDA CSS NC2 COC1)Documento1 páginaOHS Policies and Guidelines (TESDA CSS NC2 COC1)Anonymous fvY2BzPQVx100% (2)

- Internal Control Over Financial Reporting - Guidance For Smaller Public CompaniesDocumento16 páginasInternal Control Over Financial Reporting - Guidance For Smaller Public CompaniesvivicabAinda não há avaliações

- Risk Management Toolkit - SummaryDocumento12 páginasRisk Management Toolkit - SummaryGerel GerleeAinda não há avaliações

- Draft RCM - ExpensesDocumento9 páginasDraft RCM - ExpensesAbhishek Agrawal100% (1)

- Expansion Joint Treatment Materials and TechniquesDocumento15 páginasExpansion Joint Treatment Materials and TechniquesMAHAK GUPTAAinda não há avaliações

- Purchasing Payables ControlDocumento9 páginasPurchasing Payables ControljenjenheartsdanAinda não há avaliações

- Risk Appetite And Risk Tolerance A Complete Guide - 2020 EditionNo EverandRisk Appetite And Risk Tolerance A Complete Guide - 2020 EditionAinda não há avaliações

- 03 - FoAM Form-02 - Fraud Risk Assessment TemplateDocumento3 páginas03 - FoAM Form-02 - Fraud Risk Assessment Templatenonavi lazoAinda não há avaliações

- Audit ProgramDocumento4 páginasAudit ProgramZoha KhaliqAinda não há avaliações

- Internal ControlDocumento14 páginasInternal ControlHemangAinda não há avaliações

- Information and Communication Audit Work ProgramDocumento4 páginasInformation and Communication Audit Work ProgramLawrence MaretlwaAinda não há avaliações

- Segregation of Duties Questionnaire - Accounts ReceivableDocumento3 páginasSegregation of Duties Questionnaire - Accounts ReceivableIrwansyah IweAinda não há avaliações

- Co NT Rol S: en Ts Erv IceDocumento35 páginasCo NT Rol S: en Ts Erv IceZesorith Thunder100% (1)

- Audit Universe and Risk Assessment ToolDocumento10 páginasAudit Universe and Risk Assessment ToolAsis KoiralaAinda não há avaliações

- Segregation of Duties ChecklistDocumento4 páginasSegregation of Duties ChecklistVijay SamuelAinda não há avaliações

- Alcatraz Corp. 2011 Balance Sheet, Income Statement, and Financial RatiosDocumento16 páginasAlcatraz Corp. 2011 Balance Sheet, Income Statement, and Financial RatiosRaul Dolo Quinones100% (1)

- Access To Programs and Data Audit Work ProgramDocumento2 páginasAccess To Programs and Data Audit Work ProgrammohamedciaAinda não há avaliações

- In Depth Guide To Public Company AuditingDocumento20 páginasIn Depth Guide To Public Company AuditingAhmed Rasool BaigAinda não há avaliações

- SOX Compliance: Don't Fight What Can Help YouDocumento22 páginasSOX Compliance: Don't Fight What Can Help YouAmu Dha100% (1)

- Cases of FraudDocumento198 páginasCases of FraudLia LeeAinda não há avaliações

- Sarbanes-Oxley (SOX) Project Approach MemoDocumento8 páginasSarbanes-Oxley (SOX) Project Approach MemoManna MahadiAinda não há avaliações

- ICP 8 Risk Management and Internal ControlsDocumento21 páginasICP 8 Risk Management and Internal Controlsjloganteng5673Ainda não há avaliações

- Third Party Vendors A Complete Guide - 2020 EditionNo EverandThird Party Vendors A Complete Guide - 2020 EditionAinda não há avaliações

- 2d3d Opal Card Vending Machine ManualDocumento40 páginas2d3d Opal Card Vending Machine ManualbsimonopalAinda não há avaliações

- Chapter Six: Capital Allocation To Risky AssetsDocumento26 páginasChapter Six: Capital Allocation To Risky AssetsjimmmmAinda não há avaliações

- Đề Thi Thử Sở Bình PhướcDocumento7 páginasĐề Thi Thử Sở Bình Phướcbinh caoAinda não há avaliações

- Systems ClassDocumento53 páginasSystems ClassBhetariya PareshAinda não há avaliações

- Particulate Contamination in Aviation Fuels by Laboratory FiltrationDocumento11 páginasParticulate Contamination in Aviation Fuels by Laboratory FiltrationMuhammad KhairuddinAinda não há avaliações

- Latex WikibookDocumento313 páginasLatex Wikibookraul_apAinda não há avaliações

- Modelacion Fisicomatematica Del Transporte de Metales PesadosDocumento11 páginasModelacion Fisicomatematica Del Transporte de Metales PesadosdiegoAinda não há avaliações

- Katie Nelson PDFDocumento3 páginasKatie Nelson PDFKatie NAinda não há avaliações

- Latka March2020 DigitalDocumento68 páginasLatka March2020 DigitalDan100% (2)

- ECO Report 03Documento96 páginasECO Report 03ahmedshah512Ainda não há avaliações

- 660 Inventions That Changed Our WorldDocumento5 páginas660 Inventions That Changed Our WorldKoby RamosAinda não há avaliações

- AN-029Wired Locker Access Control ENDocumento13 páginasAN-029Wired Locker Access Control ENpetar petrovicAinda não há avaliações

- JURNALfidyaDocumento20 páginasJURNALfidyaIrma NasridaAinda não há avaliações

- Philadelphia University Faculty of Engineering and Technology Department of Mechanical EngineeringDocumento8 páginasPhiladelphia University Faculty of Engineering and Technology Department of Mechanical EngineeringTamer JafarAinda não há avaliações

- Training Program for Newly Recruited AEEsDocumento7 páginasTraining Program for Newly Recruited AEEsakstrmec23Ainda não há avaliações

- Order Details for Order #10105Documento2 páginasOrder Details for Order #10105Mohamed HarbAinda não há avaliações

- Valve Type Trim Type CF XTDocumento1 páginaValve Type Trim Type CF XTAye KyweAinda não há avaliações

- Viking Tech ARG03FTC2551 - C217943Documento8 páginasViking Tech ARG03FTC2551 - C217943ALIRIO SOLANOAinda não há avaliações

- Katalog - Bengkel Print Indonesia PDFDocumento32 páginasKatalog - Bengkel Print Indonesia PDFJoko WaringinAinda não há avaliações

- Prediction On Miss Mamta Banerjee Honorable CM of West Bengal Much Much Before Result and Election by Indranil RayDocumento24 páginasPrediction On Miss Mamta Banerjee Honorable CM of West Bengal Much Much Before Result and Election by Indranil RayIndranil RayAinda não há avaliações

- ZEISS CALYPSO 2021 Flyer Action Software Options ENDocumento2 páginasZEISS CALYPSO 2021 Flyer Action Software Options ENnaveensirAinda não há avaliações

- Children's Film in The Digital Age - Essays On Audience, Adaptation and Consumer Culture (PDFDrive)Documento211 páginasChildren's Film in The Digital Age - Essays On Audience, Adaptation and Consumer Culture (PDFDrive)Basia KowalskaAinda não há avaliações