Escolar Documentos

Profissional Documentos

Cultura Documentos

Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)

Enviado por

Shyam SunderDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)

Enviado por

Shyam SunderDireitos autorais:

Formatos disponíveis

I

*a

*.4(

.-*

STORE

4e*

one

. **

,..,.

January 22,2016

Scrip Code - 532679

BSE Limited

Phiroze Jeejeebhoy Towers,

Dalal Street.

MUMBAI - 4OO OOI

STOREONE

National Stock Exchange of India Limited,

'Exchange Plaza'

Bandra-Kurla Complex,

Bandra (East)

MUMBAI _ 4OO 05 ]

Re: A

Iof

udi

ended December 31,2015

Dear Sir,

Pursuant to Regulation 33 of the Securities and Exchange

Board of India (Listing

obligations and Disclosure Requirements) Regulations

(,Listing

Regulations,), we

,201i

enclose hereto, for your information and record, the

unaudited standalone financial

results of Store one Retail India Limited (the Company)

for the quarter and nine months

ended December 31,2015, duly approved by the goaid

of Direciors of the Company at

its meeting held today i.e. January 22,2016.

Further in terms of Regulation 33(3)(b) of the Listing Regulations,

we wish to inform you

that the Company has opted for submitting standal-one"financial

results for the currenr

financial year.

We also submit herewith a Limited Review Report dated Januar y

22,2016, issued by the

Statutory Auditors of

company, on the standalone financial results of the company

the

for the said period, which was duly placed before the Board at

the aforesaid meetins.

Thanking you,

Yours truly,

For Store One

Vikas l(fi-andelwal

Encl : as above

Store One Retail India Limited

-:,,?:.ffi"S:";,'^;i1?5:i"',:',?'fl?,tlk"'"1!?fly19"1ffi:i^::',"""&-;Tfl3'rii3#ffi':?:,f'::,:::'66811r'

CIN: L52 l9ODL2OO5PLC l8 | 536 | Website: www.storeone.in I E-mail: helpdesk@indiabulls.com

(,1424t

"

STORE ONE RETAIL

INDIA LIMITED

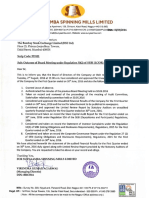

Unaudited Standalone Financial Results

for the quarter and nine months ended December 37'2075

Statement of Unaudited l(esults f or the quarter and nlne montns enoeo uecemDer

DATl'r I

1,

Particulars

30-Sep-15

31-Dec-1-4

31-Dec-15

31-Dec-14

31'Mar-15

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

(Audited)

7,941.31

3.581.31

3,760.20

15,1r3.6r

gg11 96

13,436.83

3,581.31

3,760.20

15,113.61

9,9L1..96

13,436.83

7.51

14.88

22.03

41.33

52.15

524.87

919.78

1.,268.42

lncome from Operations

(,\

NTot

erlec /Income from Onerations (Net of taxes)

7,941.3't

Iotal Income from Operations (net)

2

Expenses

5.54

(a) Purchase of stock-in-trade

(b) Employee benefits exPense

(c) Depreciation and

/'1\ f'\narafino

Rr

amortisation expense

Total expenses

3

P..fit

f."-

Op"t"tions before Other Income, Fit utt .ottt & E*."Pt

"

profit from ordinary Activities before Finance Costs and Exceptiona]ltentlgl1]

Finance costs

@ies

331.81

185.59

5JO.ZJ

350.51

332.L9

1,055.22

919.95

2,434.18

L0,673.64

6,295.84

8,273.89

6,330.46

3,124.07

3,090.02

!2,677.17

7,781,.99

1,610.85

457.30

670.18

10,5L4.24

a a)) qQ

after Finance Costs but b"fory

5.14

5.1,6

309.02

920.28

5,659.67

nther eYnenses

f,*.:gtioryljtem

(5-5)

1.,61,6.01,

462.84

675.32

10

11

12

13

t4

15

Profit from Ordinary Activities before tax (7-8)

fax expense

Net Profit from Ordinary Activities after tax (9-10)

44)

44

L4.96

2,457.40

) 1rq

97

/-/ .oJ

20.43

2,1,50.40

aqn

))

279.1,4

309.89

210.00

828.18

365.56

623.91

L,336.87

1,52.95

465.32

r,629.22

7,784.84

2,326.31

1,336.87

152.95

465.32

L,629.22

'1,,784.84

2,326.31

1,336.87

752.95

465.32

r,629.22

1,784.84

2,324.32

7,336.87

L52.95

465.32

1,629.22

7,784.84

2,324.32

2,760.00

2,760.00

2,760.00

2,760.00

2,760.00

297.35

297.35

297.35

297.35

297.35

8

9

Year ended

Nine months ended

Quarter ended

31-Dec-15

1.99

Extraordinary items (net of tax expense of Rs'Nil)

Net Profit for the period /year (17-12\

Paid-up Equity Share Capital (Face value of Rs.10 Perjlarg)

euid np Preference Share Capital (Face value of Rs.10 per share)

2,760.00

297.35

16

17

@beforeExtraordinaryitems(FaceValueofRs.10perEquityShare)

"(EPS for tlrc quarter and nine months are not annualised)

-Basic (Amount in Rs.)

-Diluted (Amount in Rs.)

(b)

4.84*

0.55*

L.69*

5.90*

6.57*

8.40

4.84*

0.55*

1.68*

5.90*

r).Jo'

8.40

4.84*

0.55*

L.69*

5.90*

6.57*

8.40

0.55*

1.68*

5.90*

6.56*

8.40

Eamings per share (EPS) after Extraordinary items (Face Value of Rs. 10 per Equity Share)

*(EPS

annunlised)

t'or the quarter and nine months are not

-Basic (Amount in Rs.)

18

4.84*

-Diluted (Amount in Rs.)

Items exceeding 10% of Total Expenditure

-- Property management and assets

-- Labour Charges

-- Travelling and ConveYance

maintenance exPenses

WP

'q)

77

418.07

402.80

660.56

106.98

1.,642.1,2

344.13

a la

5,817.89

3,739.73

L,202.77

908.s3

4,266.\4

1 tqA qR

L,125.1.6

11.95

328.01

?'^ '7o/*'!-s."'-

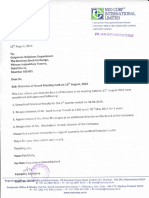

Notes to the Finan ial

R$ultt:

a)The6mncija1rsu1t!ofst@oneRetailIndiaLimited(,sIoREoNE.,"thecmPany'')6as[a[dalonentityfo|thequarberandnirfmtlsndedDeembg31,2015h

comit1eatirsmetinghetdmJ6nuar2z2016andapPMedbytheBGrdofDi!edo6(,theboard)atit'neetin8heldonJanuar2z2016''Ihesresultshavebe{3ubjtdtoalibdrdew

bv the Statutorv Auditom of the Conrpanv.

During the curent quarter, the Comp6rry hd invesbed into

a wholy oMed subsidiary

b)

(AS - 14 Sgmt Repoting as sP.ifed undd sctim 133 of

F Conpany,, priMry bGins sgMt is !efcbed based on prin ipar b6irss activities @ied on by it. As pe AccNnting Standard

c)

'mt:

' co.pjo

bsines

e$nent-' i Megemat and Ms,intetun e s@ic6

in

two

iepottable

(s

the

cmpaiy

opdates

2014

amended),

*a with Rdt of rhe c@panie6 (Acoutr) Rules,

,

and

"t Renting Seffic6

Equip@nt

ed

in one gegraphicrr segmat i.e, within India. Other bcineaes have

tFn sh()m uds

unalocated

(Rupees in lakhs)

Segment Results

Nine months ended

Quarter ended

Particulars

Segrnent Revenue

Management and Maintenance Services

Equipment Renting Services

30-Sep-15

31-Dec-14

31-Dec-15

31-Dec-14

31-Mar-15

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

(Audited)

6,242.72

1.,774.85

2,115.73

9,830.57

1,,623.42

1,,673.19

1,,436.15

4,931,.11

3,748.75

208.32

351,.93

570.06

737.3L

9,977.96

13,436.83

75.17

Unallocated

Year ended

31-Dec-15

IJJ.Z/

7,369.73

c,

e,)a 7a

7,94L.37

3,581.31

3,760.20

15,773.6L

7,947.31

3,581.31

3,760.20

15,113.61

9,977.96

13,436.83

5,272.00

351.41,

112.1,6

5,817.85

1,,1,47.94

1,375.28

401.03

570.76

350.62

AqaA)

720.06

1,366.87

69.63

115.39

170.56

298.46

465.52

586.46

Total

5,742.66

7,037.56

633.34

7,569.93

2,333.52

3,328.61

(i) Less: Interest

137.76

(4,268.03)

48.77

316.86

(766.1.0)

(119.25

(s,623.8s)

7,336.87

752.95

465.32

L,629.22

Total

Less: Inter Segment Revenue

lncome from Operations

Segment Results

Profit before Tax and Interest

Management and Maintenance Services

Equipment Renting Services

Unallocated

(ii\ Add/[ess): Other Unallocable Income/(Expenditure) net off Unallocable (Expenditure)/Income

Iotal Profit Before Tax

Capital Employed (Segment Assets - Segment Liabilities)

Management and Maintenance Services

Equipment Renting Services

I Inallocated

Iotal

d)

118.51

174.45

L,727.72

12,398.99

13,854.45

1,5,176.98

5,185.34

L,94L.68

(1,,704.76)

77,307.44

15,970.58

1.5,199.94

(276.89)

(276.8e)

1'?gRgg

(CIN: L52190DL2005PLC181536)

Pia fohnson

Place: Mumbai

Date : 22lanuary

2076

Whole Time Director

2,326.31

1,727.72

5,838.84

1,5,176.98

11,,759.62

(1.,704.76

(1,891.15

15,199.94

15,707.37

6f'w

d/

7,784.84

5,185.34

For and on behalf of the Board of Directors

/'n ,/#*,

109.83

(8e2.47)

17,307.44

Figures for the prior period/year have been regrouped and/or reclassified wherever considered necessary.

Registered Office: M-62 &.63, First Floor, Connaught Place, New Delhi-110001

49.81

(4e8.87)

\7il

)g)

"*\

K---2

Agarw

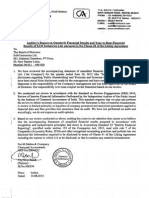

al Pral+ash & Co.

- 110001

508, Indra Prakash, 21, Barakhamba Road, New Delhi

:

OtL-435t6377

Fax

Phones : 2373O880 /

E-mail : Pagarwal0286@gmail'com

CHARTERED ACCOUNTANTS

The Board of Directors

Store One Retaillndia Limited

we

Results of

Unaudited standalone Financial

of

Statement

have reviewed the accompanying

StoreoneRetai||ndiaLimited(,,theCompany.,)fortheQuarterandNineMonthsperiodended

of Directors'

December31.,2015(,'thestatement,,)'This,statementistheresponsibilityoftheCompany,s

e".;a of Directors / committee of Board

approved nv *,"

Management and has been

based on our review'

a report on the Statement

Our responsibility is to issue

by the Independent

WeconductedourreviewoftheStatementinaccordancewiththeStandardonReview

l,Reuirw

rinoncial Information Performed

Engagement (sRE)

of tnterim

24;,

Auditoroftherntity;issuedbytheInstituteofCharteredAccountantsofIndia.Thisstandard

to inquiries of company

requiresthatwep|anandperformtr.'er"uie*toobtainmoderateassuranceastowhetherthe

A review is rimited primarily

misstatement.

statement is free of materiar

not express an audit

personne|andana|ytica|proceduresapp|iedtofinancialdataandthusprovides|essassurance

and accordingly' we do

,ro'i

."

performed

not

have

than an audit. we

opinion.

causes us

to our attention that

above, nothing has come

stated

as

conducted

Accounting

Based on our review

p'epar"d in accordance with the

st.t...ni,

accompanying

7 of the

to believe that the

Act' 2013' read with Rule

the'Companies

of

fEg

i..tion

practices and poricies in India'

Standards specifieiunO.,

recognised ...oun,ing

Rures, 20r,4 and other

(Accounts)

33 of the sEBl

companies

disclosed in tlrms of clause

;

;

require-d

information

has not discrosed the

(ListingobligationsandDisclosu,."n.qui,"ments)Regu|ations,20l.5includingthemannerin

misstatement'

or that it contains any material

which it is to be disclosed'

FOR AGARWAL PRAKASH

& CO'

CHARTERED ACCOUNTANTS

PARTNER

MembershiP No':097848

Place: MUMBAI

Date:

22ndJanuarY,20L6

Você também pode gostar

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosAinda não há avaliações

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosAinda não há avaliações

- TTR RRL: LimitedDocumento5 páginasTTR RRL: LimitedShyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Documento8 páginasAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento6 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento8 páginasStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Documento12 páginasStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento6 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento15 páginasStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results For March 31, 2016 (Result)Documento5 páginasStandalone Financial Results For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento5 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Pdfnews PDFDocumento5 páginasPdfnews PDFMurthy KarumuriAinda não há avaliações

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento8 páginasStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results For December 31, 2015 (Result)Documento3 páginasFinancial Results For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results For June 30, 2016 (Result)Documento2 páginasStandalone & Consolidated Financial Results For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento8 páginasStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento6 páginasStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results For June 30, 2016 (Result)Documento2 páginasStandalone & Consolidated Financial Results For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Consolidated Financial StatementsDocumento78 páginasConsolidated Financial StatementsAbid HussainAinda não há avaliações

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento6 páginasStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 páginasStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento6 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Documento4 páginasAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- AIL Share Holding As of Sep 30, 2010Documento1 páginaAIL Share Holding As of Sep 30, 2010Prateek DhingraAinda não há avaliações

- Standalone Financial Results For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Highlights: Hinopak Motors LimitedDocumento6 páginasFinancial Highlights: Hinopak Motors LimitedAli ButtAinda não há avaliações

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Documento9 páginasStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- HPCL Audited Results31Mar2013Documento1 páginaHPCL Audited Results31Mar2013Pranav DesaiAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Pak Elektron Limited: Condensed Interim FinancialDocumento16 páginasPak Elektron Limited: Condensed Interim FinancialImran ArshadAinda não há avaliações

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento9 páginasStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Auditors Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Auditors Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento7 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Documento7 páginasStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Axis Bank: Regd. Office: Trishul', 3 Floor, Opp. Samartheshwar Temple, Law Garden, Ellisbridge, Ahmedabad - 380 006Documento3 páginasAxis Bank: Regd. Office: Trishul', 3 Floor, Opp. Samartheshwar Temple, Law Garden, Ellisbridge, Ahmedabad - 380 006alayprajapatiAinda não há avaliações

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento6 páginasStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- JUL'Sep'12 Jul-Sep'11 Rupees RupeesDocumento8 páginasJUL'Sep'12 Jul-Sep'11 Rupees RupeesMansoor AliAinda não há avaliações

- PDF Processed With Cutepdf Evaluation EditionDocumento3 páginasPDF Processed With Cutepdf Evaluation EditionShyam SunderAinda não há avaliações

- Standalone Financial Results For September 30, 2016 (Result)Documento3 páginasStandalone Financial Results For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results For March 31, 2016 (Result)Documento11 páginasStandalone Financial Results For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Transcript of The Investors / Analysts Con Call (Company Update)Documento15 páginasTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderAinda não há avaliações

- Investor Presentation For December 31, 2016 (Company Update)Documento27 páginasInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Bexar County - 166th District Court: Plaintiff'S Original PetitionDocumento12 páginasBexar County - 166th District Court: Plaintiff'S Original PetitionFares SabawiAinda não há avaliações

- Police Log October 1, 2016Documento10 páginasPolice Log October 1, 2016MansfieldMAPoliceAinda não há avaliações

- India Delhi NCR Office Marketbeat Q1 2023 Ver2Documento2 páginasIndia Delhi NCR Office Marketbeat Q1 2023 Ver2jaiat22Ainda não há avaliações

- Police Patrol Is One of The Most Important Tasks eDocumento4 páginasPolice Patrol Is One of The Most Important Tasks emary magadiaAinda não há avaliações

- Flow Chart For Installation of Rooftop Solar PV System Under Net Metering ArrangementDocumento1 páginaFlow Chart For Installation of Rooftop Solar PV System Under Net Metering Arrangementjai parkashAinda não há avaliações

- Smarten Price List1.6Documento1 páginaSmarten Price List1.6Kuldeep Khokhar InsanAinda não há avaliações

- Behold-We-Turn-To-The-Gentiles-Acts-13-46-Aspects-Preceding-The-First-Missionary-Journey-Of-The-Holy-Apostle-Paul - Content File PDFDocumento11 páginasBehold-We-Turn-To-The-Gentiles-Acts-13-46-Aspects-Preceding-The-First-Missionary-Journey-Of-The-Holy-Apostle-Paul - Content File PDFIonutAinda não há avaliações

- Reviews: Avg Antivirus For Mac: A Good Free OptionDocumento5 páginasReviews: Avg Antivirus For Mac: A Good Free OptionTaaTa JimenezzAinda não há avaliações

- Quality Control Review Guide For Single Audits - Final (Dec 2016)Documento27 páginasQuality Control Review Guide For Single Audits - Final (Dec 2016)HBL AFGHANISTANAinda não há avaliações

- Cimpor 2009 Annual ReportDocumento296 páginasCimpor 2009 Annual Reportrlshipgx1314Ainda não há avaliações

- Midterm VBF 2015 - Full Report - Eng PDFDocumento352 páginasMidterm VBF 2015 - Full Report - Eng PDFngocbephamAinda não há avaliações

- Wright PDFDocumento21 páginasWright PDFmipalosaAinda não há avaliações

- Article On Hindu Undivided Family PDFDocumento14 páginasArticle On Hindu Undivided Family PDFprashantkhatanaAinda não há avaliações

- Liberalism and The American Natural Law TraditionDocumento73 páginasLiberalism and The American Natural Law TraditionPiguet Jean-GabrielAinda não há avaliações

- Drug MulesDocumento1 páginaDrug MulesApril Ann Diwa AbadillaAinda não há avaliações

- Offences Against ChildDocumento29 páginasOffences Against Child20225 SALONEE SHARMAAinda não há avaliações

- Tinkle Digest MalaVikaDocumento17 páginasTinkle Digest MalaVikaHarika Bandaru0% (1)

- Shoemart 1Documento10 páginasShoemart 1api-26570979Ainda não há avaliações

- 2021 Fourth Quarter Non-Life Industry ReportDocumento62 páginas2021 Fourth Quarter Non-Life Industry ReportPropensity MuyamboAinda não há avaliações

- 2014 15 PDFDocumento117 páginas2014 15 PDFAvichal BhaniramkaAinda não há avaliações

- E. San Juan Jr. - U.S. Imperialism and Revolution in The Philippines (2007)Documento296 páginasE. San Juan Jr. - U.S. Imperialism and Revolution in The Philippines (2007)Omar V. TolosaAinda não há avaliações

- America The Story of Us Episode 3 Westward WorksheetDocumento1 páginaAmerica The Story of Us Episode 3 Westward WorksheetHugh Fox III100% (1)

- Xat Application Form 2021Documento3 páginasXat Application Form 2021Charlie GoyalAinda não há avaliações

- Republic Vs MangotaraDocumento38 páginasRepublic Vs Mangotaramimisabayton0% (1)

- Taveras Co Decides at The Beginning of 2008 To AdoptDocumento1 páginaTaveras Co Decides at The Beginning of 2008 To AdoptM Bilal SaleemAinda não há avaliações

- Offer LetterDocumento10 páginasOffer LetterAtul SharmaAinda não há avaliações

- Waqf NotesDocumento7 páginasWaqf NotesKunalKumarAinda não há avaliações

- Owler - Havells Competitors, Revenue and Employees - Owler Company ProfileDocumento6 páginasOwler - Havells Competitors, Revenue and Employees - Owler Company ProfileAbhishek KumarAinda não há avaliações

- APO Country Paper - S Ky - FinalDocumento17 páginasAPO Country Paper - S Ky - FinalS Ky NBCAinda não há avaliações

- The Three Stages of PreservationDocumento2 páginasThe Three Stages of PreservationQazi Saad100% (2)