Escolar Documentos

Profissional Documentos

Cultura Documentos

Basel Disclouser Chaitra2070

Enviado por

Krishna Bahadur ThapaDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Basel Disclouser Chaitra2070

Enviado por

Krishna Bahadur ThapaDireitos autorais:

Formatos disponíveis

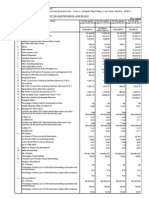

Disclosure under Capital Adequacy Framework 2007

As at Chaitra end 2070 of the Fiscal Year 2070/071 (Mid April of 2014)

Rs. in '000'

1 Capital structure and capital adequacy

Core Capital (Tier I)

a Paid up equity Share Cpaital

b Proposed Bonus Equity Shares

c

Irredeemable Non-cumulative preference shares

d Share Premium

e Statutory Gereral Reserves

f

Retained Earnings

g Un-audited current year cumulative profit

h Capital Redemption Reserve

i

Capital Adjustment Reserve

j

Dividend Equalization Reserve

k

Special Reserve

l

Defered Tax Reserve

m Capital Reserve (created for loan waived as per Nepal Govt. Direction)

n Other Free Reserves

Total Core Capital

Amount

3,965,524

90,552

1,820,705

(6,617,604)

384,038

380,383

7,486

22,246

93,520

259,736

6,063

412,647

Supplementary Capital (Tier II)

a Cumulative and/or Redeemable Preference Share

b Subordinated Term Debt

c

Hybrid Capital Instruments

d General loan loss provision

e Investment Adjustment Reserve

f

Assets Revaluation Reserve

g Exchange Equalization Reserve

h Other Reserves

Total Supplementary Capital

Amount

446,624

17,594

84,449

548,667

Details of Subordinated Term Debt:

Not Applicable

Deduction from Capital

The Bank holds net Investment in shares and debentures amounting to Rs. 82,727 thousand.

Total Capital Fund

Particulars

Core Capital (Tier 1) (after deduction of qualifing amount)

Supplementary Capital (Tier 2)

Total Capital Fund*

Amount

329,920

329,920

659,841

*Since Tier 2 Capital is greater than Tier 1 Capital, Tier 2 Capital up to the amount of Tier 1 Capital is considered for calculating Total Capital Fund.

Capital Adequacy Ratio:

0.88%

2 Risk weighted exposures for Credit, Market and Operational Risk

Risk Weighted Exposures

Risk Weighted Exposure for Credit Risk

Risk Weighted Exposure for Operational Risk

Risk Weighted Exposure for Market Risk

Total Risk Weighted Exposures

Supervisor's adjustment (addition)

1 % of Net Interest Income on market risk (due to poor assets-liabilities management)

3 % of Gross Income on Operational risk (due to weak operational risk management)

4 % of Risk Weighted Exposure (Supervisor's addition due to poor risk management)

Total Risk Weighted Exposures (after supervisor's adjustment)

Amount

65,590,074

4,092,204

1,409,409

71,091,687

25,254

945,640

2,843,667

74,906,248

Risk weighted exposures under each 11 categories of Credit Risk

S. N.

1

2

3

4

5

6

7

8

9

10

11

Categories

Claims on Government and Central Bank

Claims on Other Financial Entities

Claims on Banks

Claims on Domestic Corporates and Securities Firms

Claims on Regulatory Retail Portfolio

Claims secured by residential properties

Claims Secured by Commercial real estate

Past due claims

High Risk claims

Other Assets

Off Balance Sheet Items

Total

Risk Weighted

Exposure

1,161,990

3,704,473

48,637,023

8,563,017

3,523,572

65,590,074

Amount of Non Performing Assets (both Gross and Net)

Particulars

Bass B (Restructured)

Substandard

Doubtful

Bad

Total

Gross

72,313

242,320

139,140

1,604,162

2,057,935

Amount

Provision

9,039

60,580

69,570

1,604,162

1,743,351

Net

63,274

181,740

69,570

314,584

NPA Ratios

5.33%

0.86%

Gross NPA to Gross Advances

Net NPA to Net Advances

Movement in Non Performing Assets

Particulars

Non Performing Assets (Rs. in 000')

Non Performing Assets (%)

This Quarter

Previous Quarter Changes %

2,057,935

2,268,176

-10.22%

5.33%

5.83%

-0.50%

Write off of Loans and Interest Suspense in the Quarter

Particulars

Amount

Write off Loans

Write off of Interest Suspense

Movement in Loan Loss Provision and Interest Suspense:

Particulars

Loan Loss Provision

Interest Suspense

This Quarter

Previous Quarter

2,189,975

2,273,594

3,659,326

3,788,158

Details of Additional Loan Loss Provision

None

Segregation of Investment Portfolio

Particulars

Held for Trading

Held to Maturity

Available for sale

Total

Amount

19,681,275

82,727

19,764,002

Changes %

-3.8%

-3.4%

Você também pode gostar

- Unit-2, Regulations of Depository InstitutionsDocumento6 páginasUnit-2, Regulations of Depository InstitutionsUmesh LagejuAinda não há avaliações

- Unaudited Financial Results (Quarterly) : As at Third Quarter of The Financial Year 2070/71 (13/04/2014)Documento2 páginasUnaudited Financial Results (Quarterly) : As at Third Quarter of The Financial Year 2070/71 (13/04/2014)nayanghimireAinda não há avaliações

- Axis Bank ValuvationDocumento26 páginasAxis Bank ValuvationGermiya K JoseAinda não há avaliações

- BPI: Q1 Balance SheetDocumento1 páginaBPI: Q1 Balance SheetBusinessWorldAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Balance Sheet of Oil and Natural Gas CorporationDocumento7 páginasBalance Sheet of Oil and Natural Gas CorporationPradipna LodhAinda não há avaliações

- Earnings PresentationDocumento23 páginasEarnings PresentationBVMF_RIAinda não há avaliações

- Fourth Quarter 2008 Earnings Review: January 16, 2009Documento35 páginasFourth Quarter 2008 Earnings Review: January 16, 2009Mark ReinhardtAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Suggested Answers Intermediate Examination - Spring 2012: Realization AccountDocumento7 páginasSuggested Answers Intermediate Examination - Spring 2012: Realization AccountAhmed Raza MirAinda não há avaliações

- Capitec Interim2004Documento1 páginaCapitec Interim2004naeemrencapAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Wayne County Financial ReportDocumento31 páginasWayne County Financial ReportWDET 101.9 FMAinda não há avaliações

- F7 June 2013 BPP Answers - LowresDocumento16 páginasF7 June 2013 BPP Answers - Lowreskumassa kenya100% (1)

- Chapter 16 MGT of Equity CapitalDocumento29 páginasChapter 16 MGT of Equity CapitalRafiur Rahman100% (1)

- APQ3FY12Documento19 páginasAPQ3FY12Abhigupta24Ainda não há avaliações

- SEx 9Documento24 páginasSEx 9Amir Madani100% (1)

- Financial Performance of Dhaka BankDocumento6 páginasFinancial Performance of Dhaka Bankdiu_diptoAinda não há avaliações

- Pyrogenesis Canada Inc.: Financial StatementsDocumento43 páginasPyrogenesis Canada Inc.: Financial StatementsJing SunAinda não há avaliações

- 3may2011 e-1Q11ResultsDocumento13 páginas3may2011 e-1Q11ResultsByond ReAinda não há avaliações

- 6.4.3. Applying The CAMEL Framework: PublicationsDocumento5 páginas6.4.3. Applying The CAMEL Framework: PublicationsAnjali KatarukaAinda não há avaliações

- Annaly Investor PresentationDocumento22 páginasAnnaly Investor PresentationFelix PopescuAinda não há avaliações

- Earnings PresentationDocumento18 páginasEarnings PresentationBVMF_RIAinda não há avaliações

- BM&F Bovespa 3Q08 Earnings Conference Call November 12Documento32 páginasBM&F Bovespa 3Q08 Earnings Conference Call November 12BVMF_RIAinda não há avaliações

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Documento18 páginasSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoAinda não há avaliações

- Solution Financial Management Strategy May 2008Documento7 páginasSolution Financial Management Strategy May 2008samuel_dwumfourAinda não há avaliações

- Bil Quarter 2 ResultsDocumento2 páginasBil Quarter 2 Resultspvenkatesh19779434Ainda não há avaliações

- 2005 Q1 Supplement US GAAPDocumento22 páginas2005 Q1 Supplement US GAAPflatronl1752sAinda não há avaliações

- f9 2010 June QDocumento8 páginasf9 2010 June QAbid SiddiquiAinda não há avaliações

- Form NO. Description: Disclosures - LIFE INSURANCE COMPANIES-web-siteDocumento72 páginasForm NO. Description: Disclosures - LIFE INSURANCE COMPANIES-web-siteVenkata ChalamAinda não há avaliações

- F1 May 2011 AnswersDocumento11 páginasF1 May 2011 AnswersmavkaziAinda não há avaliações

- Financial Statement AnalysisDocumento18 páginasFinancial Statement AnalysisSaema JessyAinda não há avaliações

- Authorization For Issuance of Stock RightsDocumento6 páginasAuthorization For Issuance of Stock Rightsaccounting probAinda não há avaliações

- CHAPTER 7 - Notes - Part 1 Assignment (Aljean C. Duran)Documento3 páginasCHAPTER 7 - Notes - Part 1 Assignment (Aljean C. Duran)Aljean Castro DuranAinda não há avaliações

- WSJ Jpmfiling0510Documento191 páginasWSJ Jpmfiling0510Reza Abusaidi100% (1)

- of Revised Schdule Vi1Documento43 páginasof Revised Schdule Vi1Jay RoyAinda não há avaliações

- W1 AssignmentDocumento3 páginasW1 AssignmentHoang NguyenAinda não há avaliações

- Particulars: Financial Statements Scope ObjectiveDocumento40 páginasParticulars: Financial Statements Scope ObjectiveKm Brly FanoAinda não há avaliações

- Boeing: I. Market InformationDocumento20 páginasBoeing: I. Market InformationJames ParkAinda não há avaliações

- Financialmanagementofbanks 151021134204 Lva1 App6892Documento41 páginasFinancialmanagementofbanks 151021134204 Lva1 App6892ManavAgarwalAinda não há avaliações

- p2hkg 2011 Jun ADocumento12 páginasp2hkg 2011 Jun AMusaku MukumbwaAinda não há avaliações

- Assign 1 - Sem II 12-13Documento8 páginasAssign 1 - Sem II 12-13Anisha ShafikhaAinda não há avaliações

- Basel IiiDocumento3 páginasBasel Iiianandsnd0074Ainda não há avaliações

- BAC Q4 2013 PresentationDocumento25 páginasBAC Q4 2013 PresentationZerohedgeAinda não há avaliações

- Earnings Update Q4FY15 (Company Update)Documento45 páginasEarnings Update Q4FY15 (Company Update)Shyam SunderAinda não há avaliações

- Financial Results For Sept 30, 2015 (Standalone) (Result)Documento2 páginasFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Ravi 786Documento23 páginasRavi 786Tatiana HarrisAinda não há avaliações

- 1financial Statements and Financial Statement AnalysisDocumento24 páginas1financial Statements and Financial Statement AnalysisBenson NjorogeAinda não há avaliações

- Chapter 3 Presentation of Financial StatementsDocumento24 páginasChapter 3 Presentation of Financial StatementsLEE WEI LONGAinda não há avaliações

- 3q 2014 Data Pack of Said CompanyDocumento19 páginas3q 2014 Data Pack of Said CompanynewsreaderfreemailAinda não há avaliações

- JPM Mortgage WarningsDocumento21 páginasJPM Mortgage WarningsZerohedgeAinda não há avaliações

- Fixed Income Investor Review: John Gerspach Eric AboafDocumento43 páginasFixed Income Investor Review: John Gerspach Eric AboafAhsan AliAinda não há avaliações

- Financial Results For The Quarter Ended 30 June 2012Documento2 páginasFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaAinda não há avaliações

- WFC Financial OverviewDocumento25 páginasWFC Financial Overviewbmichaud758Ainda não há avaliações

- Unaudited Financial Results For The Quarter/Half Year Ended 30th September, 2014Documento4 páginasUnaudited Financial Results For The Quarter/Half Year Ended 30th September, 2014Dhruba DebnathAinda não há avaliações

- Financial Results For June 30, 2015 (Standalone) (Result)Documento5 páginasFinancial Results For June 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Userfiles Financial 6fDocumento2 páginasUserfiles Financial 6fTejaswini SkumarAinda não há avaliações

- F2 Sept 2014 Examiners AnswersDocumento15 páginasF2 Sept 2014 Examiners AnswersFahadAinda não há avaliações

- Wiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo EverandWiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsAinda não há avaliações

- Report On Information TechnologyDocumento9 páginasReport On Information TechnologyKrishna Bahadur ThapaAinda não há avaliações

- Deposit Collection at BOKDocumento34 páginasDeposit Collection at BOKKrishna Bahadur ThapaAinda não há avaliações

- Bread & Bakery Products: 2002 Market ReportDocumento95 páginasBread & Bakery Products: 2002 Market ReportKrishna Bahadur ThapaAinda não há avaliações

- Role of Central Bank in ForexDocumento5 páginasRole of Central Bank in ForexKrishna Bahadur Thapa100% (2)

- Djezzy Perd Énormément D'abonnés !Documento83 páginasDjezzy Perd Énormément D'abonnés !Anonymous uKab5aIwrAinda não há avaliações

- ACC 311 - Week2 - 2-1 MyAccountingLab Homework - Chapter 4Documento18 páginasACC 311 - Week2 - 2-1 MyAccountingLab Homework - Chapter 4Lilian LAinda não há avaliações

- QLV đầu tư vàngDocumento18 páginasQLV đầu tư vàngSơnNamAinda não há avaliações

- Overheads L3 UpdatedDocumento28 páginasOverheads L3 Updatedviony catelinaAinda não há avaliações

- CH 08Documento24 páginasCH 08Jenny Ann ManaladAinda não há avaliações

- Chapter 4 Multiple Choice-ComputationalDocumento11 páginasChapter 4 Multiple Choice-Computationalmusic niAinda não há avaliações

- W 4-5 Cost and ManagementDocumento12 páginasW 4-5 Cost and ManagementMelvinAinda não há avaliações

- Retail Pro POS v8, v9, Prism Ecommerce IntegrationDocumento19 páginasRetail Pro POS v8, v9, Prism Ecommerce IntegrationAvnish SaxenaAinda não há avaliações

- Unit 2 Topic 1 TemplateDocumento5 páginasUnit 2 Topic 1 TemplateDev KhatriAinda não há avaliações

- Case Study of Capital BudgetingDocumento38 páginasCase Study of Capital BudgetingZara Urooj100% (1)

- Development of Business PlanDocumento20 páginasDevelopment of Business PlanSuzannePadernaAinda não há avaliações

- Assignment 3 HBS Case 1 ValuationDocumento15 páginasAssignment 3 HBS Case 1 ValuationqrpiotrAinda não há avaliações

- Literature Review On Accounting StandardsDocumento8 páginasLiterature Review On Accounting Standardsafmzywxfelvqoj100% (1)

- Target Market FMCG Industry: Submitted By:-Manish GoelDocumento34 páginasTarget Market FMCG Industry: Submitted By:-Manish Goelmanish1895Ainda não há avaliações

- Supply Chain Management: Strategy, Planning, and Operation: Seventh Edition, Global EditionDocumento39 páginasSupply Chain Management: Strategy, Planning, and Operation: Seventh Edition, Global Editionasim100% (1)

- Compare and Contrast The Industrial Organisation Approach To The ResourceDocumento3 páginasCompare and Contrast The Industrial Organisation Approach To The ResourceMarvin AlleyneAinda não há avaliações

- Past ExamDocumento11 páginasPast Exammohamed.shaban2533Ainda não há avaliações

- Analisis Efisiensi Perbankan. (Dicha Nur Wendha) 85Documento13 páginasAnalisis Efisiensi Perbankan. (Dicha Nur Wendha) 85Ika SwastiAinda não há avaliações

- Internal Scanning, Organizational AnalysisDocumento42 páginasInternal Scanning, Organizational AnalysisMohamed SalahAinda não há avaliações

- Resume Quadri Sakirat Kofoworola Quadri 03 - 31 - 2022 12 - 26 - 31 AMDocumento2 páginasResume Quadri Sakirat Kofoworola Quadri 03 - 31 - 2022 12 - 26 - 31 AMOmobolanle AdetutuAinda não há avaliações

- Unit 1 BeDocumento13 páginasUnit 1 BeSalome KhriamAinda não há avaliações

- Accounting For Managers 1Documento43 páginasAccounting For Managers 1nivedita_h424040% (1)

- MBA Finance Project On Retail Banking With Special Reference To YES BANKDocumento111 páginasMBA Finance Project On Retail Banking With Special Reference To YES BANKChandramauli Mishra100% (1)

- Overcoming The Fear of The UnknownDocumento5 páginasOvercoming The Fear of The UnknownBharat SahniAinda não há avaliações

- ch15 MRPDocumento37 páginasch15 MRPNaseeb Ullah TareenAinda não há avaliações

- Maria HernandezDocumento6 páginasMaria Hernandezchtbox1039Ainda não há avaliações

- Phillips PLL 6e Chap07Documento58 páginasPhillips PLL 6e Chap07snsahaAinda não há avaliações

- Course: Mathematics For Finance Ind Vidual Assignment I For Distance Students Mark AllotedDocumento2 páginasCourse: Mathematics For Finance Ind Vidual Assignment I For Distance Students Mark AllotedArafo BilicsanAinda não há avaliações

- Chika Njoku JacksonDocumento138 páginasChika Njoku JacksonMax KerkAinda não há avaliações

- EOQ-POQ Workshop (New Generation 2)Documento3 páginasEOQ-POQ Workshop (New Generation 2)vanesa salazar cardenasAinda não há avaliações