Escolar Documentos

Profissional Documentos

Cultura Documentos

Finance Formula Sheet and Notes

Enviado por

JaydenausDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Finance Formula Sheet and Notes

Enviado por

JaydenausDireitos autorais:

Formatos disponíveis

Formula Sheet (FS)

Shareholder Value and the cost of capital

Capital Budgeting:

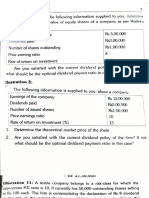

The dividend growth model (DGM) approach (Return on equity):

1

Prime cost rate:

effective life

Prime cost method: initial cost prime cost rate

Diminishing value rate: prime cost rate 2 (Note: you multiply this by the previous years depreciation)

Incremental Earnings before Interest and Taxes (EBIT) = Incremental Revenue Incremental Costs

Depreciation

Income Tax = EBIT Corporate Tax Rate

Incremental Earnings (Net income) = (Incremental Revenues Incremental Costs Depreciation) (1

Tax Rate)

Tax savings from depreciation = Depreciation expense Tax Rate

Net working Capital (NWC) = Current Assets Current Liabilities

= Cash + Inventory + Receivables Payables

Change in net working capital =

NPV CF0

t 1

CFt

1 r

Accounting Break-even:

e.g.

($

($

$ )

= Dividend Yield + Capital Gain Yield

Average annual return of a security:

Variability of returns

( )=

SD(R) = =

[(R1 ) + +(

( )

SD(R) = =

( )

E[ R] R f

) ]

Where: Cost of equity=

Cost of Debt=

)=

Cost of Preference Share=

Notation:

E = market value of equity = number outstanding shares times price per share

D = market value of debt = number outstanding bonds times bond price

+ +

(

= Cx

= 100%)

V E D V A

U

M&Ms Proposition I: L

M&Ms Proposition I (With tax shield): VL VU PV (Interest Tax Shield)

Value of interest tax shield:

++

) T= sample size (years)

Leveraged equity cost of capital:

Static trade-off theory:

Derivative Securities

+(

Where D/E = debt equity ratio

E[ R ]

Portfolio Expected Return (Weighted avg): ( ) =

(

Portfolio variance:

=

+

+2

,

Where:

( ) is the variance of returns for the portfolio.

1,2 is the correlation of returns for asset 1 and asset 2.

= the

proportion of funds invested in asset 1.

= the standard deviation of returns for asset 1.

Covariance:

Rf=Risk free rate of return

Coefficient of variation= CV

Correlation:

Weighted average cost of capital (WACC) =

Expected return: ( ) =

Where: pi=probability of state of economy, Ri=rate of return at state

Volatility = measure of risk, determined by variance and standard deviation

( )=

( ( )) Sum of (probability of ecnmc state-asset return in ecnmc state)^2

Sharpe ratio = S

+

2

Where: I = annual interest payment, PV = par or face value of the debenture, NP = net proceeds of the

issue = market price less costs, N = the number of years to maturity of the debenture

Financial Leverage and Capital Structure Policy

Where: P = share price at beginning of period,

t

P = share price at end of period ,

t+1

D = dividend received at end of period

t+1

Approximation of Yield to Maturity (return on debt R D):

Cost of debt = RD= Bond value

Risk and Return:

Weights

E/V = percent financed with equity

D/V = percent financed with debt

= 450

FC = Fixed costs, D = depreciation, P = Price per unit, v = cost per unit (wholesale price)

Cost of preference shares:

V = market value of the firm = D + E + P (

Gain/Loss = Salvage value [cost total depreciation]

The Security market line (SML) Approach:

=

+

(

)

Where: =equity beta, Rf = risk free rate, RM=Market rate of return, (RM-Rf)=market risk premium

)+

)+. . +

Lecture 6 - Capital Budgeting

The capital budgeting process

1. Forecasting projects revenues and cost (we will not be covering this)

2. Incremental Earnings the amount by which a firms earnings are expected to change as a results

of an investment decisions (convert earnings to cash flows).

3. Incremental Cash Flows the incremental cash flows for project evaluation consist of any and all

changes in the firms future cash flows that are a direct consequence of undertaking the project.

4. Stand-alone principle evaluation of a project based on the projects incremental cash flows.

Step 2 - Forecasting incremental Earnings

Incremental Revenue and Cost Estimates

The evaluation is on how the project will change the cash flows of the firm

Thus, focus is on incremental revenues and costs

Incremental Earnings before Interest and Taxes (EBIT) = Incremental Revenue Incremental Costs

Depreciation NOTE: EBITDA is before Depreciation and Amortization is factored

Step 2- Forecasting Incremental Earnings: Operating Expenses versus Capital Expenditures

Assets purchased entail a negative cash flow.

A depreciation expense is recorded each year over the accounting life of the asset.

Straight-Line (Prime cost) Depreciation total cost of asset/effective life

Note: shipping/delivery and installation costs are capitalised as part of the assets purchase price.

Depreciation is a non-cash expense of running a business.

Depreciation is the way that the cost of the asset is claimed over the economic life of the asset.

The only cash flow effect is the effect on the taxable income from claiming depreciation as a

deduction.

There are two methods of depreciation:

1. Prime cost method initial cost prime cost rate

2. Diminishing value method diminishing value rate previous years depreciation

Depreciation will affect amount of tax paid known as depreciation expense tax shield

Taxes

Marginal Corporate Tax Rate - The tax rate a firm will pay on an incremental dollar of pre-tax

income. Income Tax = EBIT Corporate Tax Rate

The Final Incremental Earnings Forecast [See Incremental Earnings (Net Income) on formula sheet]

Step 3 Cash Flow Estimation

Convert to FCF first and then conduct investment decision analysis such as NPV, IRR

In order to evaluate a capital budgeting decision, the firms available cash flows must be found out

The incremental effect of a project on firms available cash = incremental free cash flow (FCF).

Two important steps: 1. Add back depreciation 2. Consider changes in Net working capital

Step 3 - Converting the Earnings to Free Cash Flow: Step 1 - Add Back Depreciation

Depreciation expense in not a cash flow but taxable earnings = taxes, which are a cash flow

Add back depreciation to the incremental earnings to recognise the fact that we still have the cash

flow associated with it.

Depreciation cost is not a real cash cost but the government allows tax deduction for some kinds

of fixed cost (e.g., depreciation, interest expenses) e.g. 30% of each $ of depreciation

Depreciation tax savings = Depreciation Tax Rate

Step 3 - Converting the Earnings to Free Cash Flow: Step 2 Net Working Capital (NWC)

See Formula sheet for formula CACL = Net working capital

If positive, then additional working capital is needed expansion. If negative, WC is being cashed

out (contraction or increased efficiency).

At the end of the projects life, inventory will be liquidated, and accounts receivable and accounts

payable will be settled. Thus investment in NWC will be returned by the end of the projects life.

Other factor to consider that may affect incremental cash flows:

Sunk costs (no effect do not consider)

Opportunity costs (cash flows could be generated from an alternative use include)

Side effects (should be considered if project causes a change in profits and net cash flows)

- Cannibalisation, -ve externality, cash flows; synergic, +ve externality cash flows

Financing costs ( do not subtract interest expense or dividends do not consider)

Gain or loss on disposal (do consider gain results in excess depreciation)

Replacement projects (do consider operating costs=income=tax=cash flows)

Project Analysis and Evaluation

Scenario analysis ask what if questions. E.g. what if sales were 3000 units instead of 4000

Sensitivity analysis shows in NPV or IRR in response to a a variable (e.g. unit sales)

- Steeper sensitivity lines show greater risk. Small changes result in large changes in NPV.

- Weaknesses: shows no likelihood of the change, ignores relationships b/n variables

- Benefits: Identifies dangerous variables, gives break even information

Accounting break-even - The sales level that results in a zero net profit for the project (See FS).

Lecture 7- Risk and Return

Realised return is the total return that occurs over a particular time period.

Past returns from an investment in a given share can be worked out (See 1st formula on FS)

Average annual return is simply sum of annual returns/number of years

Variability of returns the bigger the variance, the greater actual returns tend to differ from avg.

Expected return [E(R)] accounts for the prob. of operating in a certain economic state (See FS)

Sharpe ratio (See FS) shows extra return for choosing asset with extra volatility/risk. higher=better

Coefficient of Variation compares volatility to amount of expected return. Lower = better tradeoff

Two asset portfolio is a weighted avg return depending on proportion of funds invested in each

Risk depends on individual share and relationship between their returns

-

Correlation: strength and direction of the linear relationship between two variables

Covariance: A measure of the degree to which returns on two risky assets move in tandem

Lecture 8: Shareholder value and the Cost of Capital

The cost of equity, RE , is the return required by equity investors given the risk of the cash flows

from the firm going to equity. 2 methods: Dividend Growth Model & Security Market Line approach

Dividend Growth Model (DGM) and Security Market Line (SML) formulas, see formula sheet

Preference shares dont have voting rights and receive fixed constant dividend ever period.

Can be valued as perpetuity (See FS)

The cost of debt is the required return on firms debtestimated by calculating YTM on exst. Debt

Yield to maturity (YTM) - return that an investor would receive if they held the debt until maturity.

It is the discount rate that makes the present value of all future payments equal to its market

price. YTM an be approximated using formula in formula sheet.

WACC is the average of a firms equity and debt costs of capital, weighted by the fractions of the

firms value that correspond to equity and debt, respectively.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- A Guide To Fund Management by Daniel BrobyDocumento315 páginasA Guide To Fund Management by Daniel BrobyPhuc Hien100% (2)

- Strategic Marketing NotesDocumento48 páginasStrategic Marketing NotesJaydenaus100% (1)

- VPCI Between Price VolumeDocumento5 páginasVPCI Between Price VolumelenovojiAinda não há avaliações

- Exercise 19-27 Return On Investment Residual Income EVA® (LO 19-1, 19-2, 19-3)Documento2 páginasExercise 19-27 Return On Investment Residual Income EVA® (LO 19-1, 19-2, 19-3)Chryshelle LontokAinda não há avaliações

- FINAN204-21A - Tutorial 8 QuestionsDocumento4 páginasFINAN204-21A - Tutorial 8 QuestionsDanae YangAinda não há avaliações

- Mural Artist Callout 2021Documento7 páginasMural Artist Callout 2021JaydenausAinda não há avaliações

- Instruments Exam NotesDocumento2 páginasInstruments Exam NotesJaydenausAinda não há avaliações

- Fiscal Policy NotesDocumento5 páginasFiscal Policy NotesJaydenausAinda não há avaliações

- Capstone Introductory Lesson NotesDocumento16 páginasCapstone Introductory Lesson NotesJaydenausAinda não há avaliações

- Module 1 - Financial Markets and InstitutionsDocumento25 páginasModule 1 - Financial Markets and InstitutionsJaydenausAinda não há avaliações

- Strategic Marketing GlossaryDocumento9 páginasStrategic Marketing GlossaryJaydenausAinda não há avaliações

- Capstone Introductory Lesson NotesDocumento16 páginasCapstone Introductory Lesson NotesJaydenausAinda não há avaliações

- SMP ChecklistDocumento4 páginasSMP ChecklistJaydenausAinda não há avaliações

- Singapore/Thailand Trip Information - Sample IteneraryDocumento5 páginasSingapore/Thailand Trip Information - Sample IteneraryJaydenausAinda não há avaliações

- Economics 2AB NotesDocumento11 páginasEconomics 2AB NotesJaydenausAinda não há avaliações

- Bangladesh Textile Industry AccordDocumento4 páginasBangladesh Textile Industry AccordJaydenausAinda não há avaliações

- Marketing Research - PopulationDocumento2 páginasMarketing Research - PopulationJaydenausAinda não há avaliações

- Handling JACFDocumento10 páginasHandling JACFJaydenausAinda não há avaliações

- Communication in BusinessDocumento6 páginasCommunication in BusinessJaydenausAinda não há avaliações

- FNCE2000 Chapter6 Valuing Shares & Bonds QuestionsDocumento3 páginasFNCE2000 Chapter6 Valuing Shares & Bonds QuestionsJaydenaus0% (1)

- Z For Zachariah - EpilogueDocumento3 páginasZ For Zachariah - EpilogueJaydenausAinda não há avaliações

- Rational Diet Basics: Caloric Intake, Macros, MealsDocumento3 páginasRational Diet Basics: Caloric Intake, Macros, MealsJaydenausAinda não há avaliações

- Assignment of SFM 02-Feb-2022Documento6 páginasAssignment of SFM 02-Feb-2022Sandhya MudaliarAinda não há avaliações

- Chapter Six: 6. Bond MarketsDocumento55 páginasChapter Six: 6. Bond MarketsNhatty WeroAinda não há avaliações

- Chapter 3Documento61 páginasChapter 3Lam Mai Đặng VũAinda não há avaliações

- Brookfield Asset Management - "Real Assets, The New Essential"Documento23 páginasBrookfield Asset Management - "Real Assets, The New Essential"Equicapita Income TrustAinda não há avaliações

- Security Analysis and Portfolio Management - Lesson 5 - Risk Management, Concept, Sources & Types of RiskDocumento4 páginasSecurity Analysis and Portfolio Management - Lesson 5 - Risk Management, Concept, Sources & Types of RiskEdwin HauwertAinda não há avaliações

- Financing Source - Debt ValuationDocumento56 páginasFinancing Source - Debt ValuationTacitus KilgoreAinda não há avaliações

- Real Estate GlossaryDocumento52 páginasReal Estate GlossaryJustine991Ainda não há avaliações

- MGT-214 Assignment on Factors Determining Dividend PolicyDocumento20 páginasMGT-214 Assignment on Factors Determining Dividend PolicyNayem Islam75% (4)

- VB6 Commands and FunctionsDocumento18 páginasVB6 Commands and FunctionsDumdum7Ainda não há avaliações

- 10 5923 J Ijfa 20180704 01Documento14 páginas10 5923 J Ijfa 20180704 01Sinta Dwi SampurnaAinda não há avaliações

- What Makes A MoatDocumento5 páginasWhat Makes A MoatMohammed ShakilAinda não há avaliações

- Capital Budgeting Methods ExplainedDocumento171 páginasCapital Budgeting Methods ExplainedSiddharth mehtaAinda não há avaliações

- Eva VS RoiDocumento12 páginasEva VS RoiSafwan BhikhaAinda não há avaliações

- Capm ApmDocumento6 páginasCapm ApmmedolinjacAinda não há avaliações

- Mas 2 - 1304 Financial Management: Capital BudgetingDocumento9 páginasMas 2 - 1304 Financial Management: Capital BudgetingVel JuneAinda não há avaliações

- Superior Performance Via Superior Price Forecasting Woody BrockDocumento24 páginasSuperior Performance Via Superior Price Forecasting Woody BrockVas RaAinda não há avaliações

- Incremental Analysis and Capital Budgeting: Learning ObjectivesDocumento74 páginasIncremental Analysis and Capital Budgeting: Learning ObjectivesHanifah OktarizaAinda não há avaliações

- Eva Unilever PDFDocumento13 páginasEva Unilever PDFRevathi TurlapatiAinda não há avaliações

- Black Book On Investment of Working WomenDocumento88 páginasBlack Book On Investment of Working WomenRizwan Shaikh 44100% (2)

- Multiple Choice Questions on Performance ManagementDocumento21 páginasMultiple Choice Questions on Performance Managementlalith kumarAinda não há avaliações

- FIN211 Financial Management Lecture Notes Text Reference: Chapter 1 Topic: Role of Financial ManagementDocumento8 páginasFIN211 Financial Management Lecture Notes Text Reference: Chapter 1 Topic: Role of Financial ManagementAnonymous y3E7iaAinda não há avaliações

- Ch20 Guan CM Aise TBDocumento35 páginasCh20 Guan CM Aise TBHero CourseAinda não há avaliações

- Lease Financing - Lessee and Lessor's AnalysisDocumento2 páginasLease Financing - Lessee and Lessor's AnalysisVidelSatan0% (1)

- Merits and Demerits of Investing in Different Financial SectorsDocumento11 páginasMerits and Demerits of Investing in Different Financial Sectorsgourav rathoreAinda não há avaliações

- GMBA Batch: November 2011 Corporate Finance 1 and 2 (18 HoursDocumento3 páginasGMBA Batch: November 2011 Corporate Finance 1 and 2 (18 HoursAbhishek JainAinda não há avaliações

- PM40 Risk Analysis andDocumento101 páginasPM40 Risk Analysis andprincessmuneebashahAinda não há avaliações