Escolar Documentos

Profissional Documentos

Cultura Documentos

Variance Reporting Methods

Enviado por

msTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Variance Reporting Methods

Enviado por

msDireitos autorais:

Formatos disponíveis

Chapter 6: Variance Reporting

CHAPTER 6: VARIANCE REPORTING

Objectives

The objectives are

Create an over/(under) variance column definition

Define a report that displays favorable/(unfavorable) variances

Introduction

Reporting on variances either actual versus budget, this year versus last year

is a common financial reporting format. Two methods are generally used when

you are reporting on variances.

In the simpler method, one of the two amounts being compared is deducted from

the other. No allowance is made for the type of accounts being reported. For

example, if actual minus budget results in a positive umber, then regardless of the

account type (revenue or expense) the variance is said to be positive. This type of

variance is known as over/ (under) variances in the upcoming exercises.

In the second method of variance reporting, known as favorable/(unfavorable),

the type of account is also taken into consideration. For example, in revenue

accounts, if actual results are higher than those budget the variance is displayed

as favorable. However, if actual expenses are higher than budget, then that

variance is displayed as unfavorable.

The key to the second method is the XCR print control used exclusively in

calculated variance columns. When XCR matches up with a C in the normal

balance f a row, it reverses the sign of the variance calculation result. Therefore,

Cs are also place on total rows that related to accounts display a C such as Net

Sales or Net Income.

Over/(Under) Variances

Although not as common a variance display as favorable/(unfavorable), the

over/(under) method is a straightforward method for comparing he difference in

two amounts.

Over/(Under) Column Definition

The following steps define the process for create a current period, actual versus

budget report.

6-1

Chapter 6: Review Plus

1. In the status bar, double-click GLMF. In the Companies dialog, scroll

down until USMF is displayed in the list. Click on USMF and select Set

As Default.

2. On the File menu, point to New, then click Column Definition.

3. In column A, Column Type, double-click and select DESC (Row

Descriptions). The default column width of 30 characters can be updated

as you want, however, the changes only display in the generated report.

4. Repeat Step 2 in columns B and C, selecting the FD column type.

5. In column C, double-click the Book Code/Attribute Category, and

select FY2012.

6. In column D, select CALC column type.

7. In the Formula field, type B-C.

8. Type the following descriptions into the Header 2 row:

a. Column B Actual

b. Column C Budget

c. Column D Over/(Under)

9. Save the column definition with the name Actual Budget Over Under.

FIGURE 6.1 ACTUAL BUDGET OVER UNDER COLUMN DEFINITION

Open a Report Definition

The over/under column design is associated with the summary income statement

row definition in the following steps.

1.

2.

3.

4.

5.

6-2

Click the Report Definitions button on the navigation pane.

Double-click Summary Income Statement with CBR.

On the File menu, click the Save As menu item.

Type the name Summary Income Statement Over Under.

Click OK.

Chapter 6: Variance Reporting

Generate Report

To generate the report, follow these steps:

1. Click the Company drop-down arrow and select USMF.

2. Click the Column drop-down arrow and select Actual Budget Over

Under.

3. Click on the Settings tab and select the Other formatting option,

Display negative numbers in red. Clear the Display rows with no

amounts option.

4. Update the Spaces between columns to 1.

5. Save the report definition and then click Generate Report.

Notice that the complete report displays all negative values in red, while the

over/under column reports the difference of actuals results, minus budget

expectations.

FIGURE 6.2 ACTUAL BUDGET OVER UNDER REPORT

6-3

Chapter 6: Review Plus

Favorable/(Unfavorable) Variances

The column design for favorable/(unfavorable) reporting is similar to the

over/under design, with two primary differences: the calculation formula is

reversed and the XCR print control is activated.

FIGURE 6.3 ACTUAL BUDGET FAVORABLE UNFAVORABLE REPORT

Favorable/(Unfavorable) Column Definition

The over/under column design is used as a starting template for the

favorable/unfavorable design that is created in the following steps.

1.

2.

3.

4.

5.

6.

Click the Column Definitions button on the navigation pane.

Double click Actual Budget Over Under.

On the File menu, click the Save As menu item.

Type the name Actual Budget Favorable Unfavorable.

Click OK.

Double-click column D, Header 1 and in the Column header text, type

Favorable/. Click the Format options down arrow and select None.

Click OK.

7. Click in Header 2 and update the text to read (Unfavorable).

8. In the Formula field, type C-B. In this method of variance reporting,

the basis for comparison comes first in the formula.

9. Double-click the Print Control field, select XCR, and then click OK.

6-4

Chapter 6: Variance Reporting

10. Save the column definition.

FIGURE 6.4 ACTUAL BUDGET FAVORABLE UNFAVORABLE COLUMN DEFINITION

How XCR Works

When the XCR print control is included in a calculation column type, the basic

variance formula of actual minus budget or budget minus actual is expanded to

consider the type of account being reporting on. The account type is determined

by the placement of Cs in the Normal Balance field of the row definition.

1. Click the Row Definitions button on the navigation pane.

2. Double-click Summary Income Statement

Cs are placed on rows that link to the financial data source to flip the balance of

the account for presentation in the report. If a C is present, XCR reverse the sign

of the result of the variance calculation. Totals do not require a C in non-variance

reporting; however, a C is required to correctly calculate the variance on totals

that will display a credit balance if account presentation had not been flipped.

View the Report

A new report definition is created based on the over/under report design.

1.

2.

3.

4.

Click the Report Definitions button on the navigation pane.

Double-click Summary Income Statement Over Under

On the File menu, click the Save As menu item.

Update the name to read Summary Income Statement Favorable. Click

OK.

6-5

Chapter 6: Review Plus

5. Click the Column drop-down arrow and select Actual Budget Favorable

Unfavorable.

Save the report definition and then click Generate Report. The

completed report displays.

Modify to include variance percentages

In addition to dollar variances, you can add a percentage variance column to the

favorable/unfavorable design.

1. Return to Report Designer and then click the Open column definition

icon.

2. In column E, select the CALC column type.

3. Type the formula D/C.

4. Double-click column D, Header 1. Update the column header text to

read Favorable/(Unfavorable).

5. Select the Box format option and Spread from D to E. Click OK.

6. Click column D, Header 2 and press the Delete key. Type a currency

symbol $. Click column E, Header 2and type a percent sign %.

7. Double-click column E, Format/Currency Override. Select

Percentage. Click Ok.

8. Save the changes to the column definition.

FIGURE 6.5 UPDATED ACTUAL BUDGET FAVORABLE UNFAVORABLE COLUMN DEFINITION

Re-generate a report

Return to the report definition to generate the revised design.

1. Click the Open Report Definition icon.

2. Click Generate Report. The generated report displays.

6-6

Chapter 6: Variance Reporting

Summary

Variance reports are designed when users want to display the difference between

two columns of results. The two methods of designing variance reports are:

over/(under) and favorable/(unfavorable). When using the

favorable/(unfavorable) method, the print control XCR is applied in combination

with the C normal balance code in the row definition to present the correct sign

on the variance. Variances can be presented in dollar or percentage formats.

6-7

Chapter 6: Review Plus

Quick Interaction: Lessons Learned

Take a moment and write down three key points you have learned from this

chapter

1.

2.

3.

6-8

Você também pode gostar

- Reporte de Costos KSB1 - Cost Report Job Aid PDFDocumento14 páginasReporte de Costos KSB1 - Cost Report Job Aid PDFRoberto MartínezAinda não há avaliações

- Budget User Interface (BUI) : North America Surface Trans User GuideDocumento11 páginasBudget User Interface (BUI) : North America Surface Trans User GuideAlfonso Estuardo BejaranoAinda não há avaliações

- General Ledger Tasks and Budgeting GuideDocumento8 páginasGeneral Ledger Tasks and Budgeting GuideamrAinda não há avaliações

- Indian Financial Statement Excel Audit SoftwareDocumento115 páginasIndian Financial Statement Excel Audit SoftwareRamesh Radhakrishnaraja100% (2)

- BCS Campus Training Manual Updated 9-14Documento13 páginasBCS Campus Training Manual Updated 9-14Moaaz AtifAinda não há avaliações

- FSG - PNL Training ManualDocumento11 páginasFSG - PNL Training ManualmshadabalamAinda não há avaliações

- Cost Center Wise RPTDocumento15 páginasCost Center Wise RPTVaidyanathan IyerAinda não há avaliações

- Inancial Statement Analysis by Using Report Painter: Step 1: Transaction Code FGI4 (Create Form)Documento10 páginasInancial Statement Analysis by Using Report Painter: Step 1: Transaction Code FGI4 (Create Form)jacktocoke_664924439Ainda não há avaliações

- SAP BW Walkthrough: Finance ReportsDocumento8 páginasSAP BW Walkthrough: Finance ReportsashokamruthAinda não há avaliações

- GL Faq3Documento5 páginasGL Faq3Katie RuizAinda não há avaliações

- How to Pre-Post a Budget Transfer in BCSDocumento10 páginasHow to Pre-Post a Budget Transfer in BCSAlok VermaAinda não há avaliações

- General Ledger End User Training ManualDocumento47 páginasGeneral Ledger End User Training Manualsudheer1112Ainda não há avaliações

- FSG Manual for Financial Statement GenerationDocumento40 páginasFSG Manual for Financial Statement GenerationOgwuche Oche SimonAinda não há avaliações

- Financial Reporting with Report PainterDocumento20 páginasFinancial Reporting with Report PainterFrancoSuperAinda não há avaliações

- Chapter 4: Using Dimensions: ObjectivesDocumento9 páginasChapter 4: Using Dimensions: ObjectivesmsAinda não há avaliações

- Management Reporter and Cash FlowsDocumento9 páginasManagement Reporter and Cash Flowspjanssen2306Ainda não há avaliações

- Vertex42 Money Manager 2.1: INSTRUCTIONS - For Excel 2010 or LaterDocumento28 páginasVertex42 Money Manager 2.1: INSTRUCTIONS - For Excel 2010 or LaterDistika Adhi PratamaAinda não há avaliações

- Vertex42 Money Manager 2.0: INSTRUCTIONS - For Excel 2010 or LaterDocumento26 páginasVertex42 Money Manager 2.0: INSTRUCTIONS - For Excel 2010 or LaterNikkiAinda não há avaliações

- 15 General Ledger Journals Create and Post A General Journal PDFDocumento5 páginas15 General Ledger Journals Create and Post A General Journal PDFmoon heizAinda não há avaliações

- FIN.1.1.1. - (General Ledger Setup - Chart of Accounts) : Direct Aid COA Coding Will Be 8 Digits As Follows: XXXXXXXXDocumento12 páginasFIN.1.1.1. - (General Ledger Setup - Chart of Accounts) : Direct Aid COA Coding Will Be 8 Digits As Follows: XXXXXXXXIslam SultanAinda não há avaliações

- Money ManagerDocumento24 páginasMoney Managercal_123Ainda não há avaliações

- Vertex42 Money Manager 2.1: INSTRUCTIONS - For Excel 2010 or LaterDocumento29 páginasVertex42 Money Manager 2.1: INSTRUCTIONS - For Excel 2010 or LaterMohamed AfsalAinda não há avaliações

- Vertex42 Money Manager 2.1: INSTRUCTIONS - For Excel 2010 or LaterDocumento30 páginasVertex42 Money Manager 2.1: INSTRUCTIONS - For Excel 2010 or LatereleldevAinda não há avaliações

- Oracle RevaluationDocumento16 páginasOracle RevaluationVinita BhatiaAinda não há avaliações

- General Journal On Dynamic NavisionDocumento38 páginasGeneral Journal On Dynamic NavisionChetan SungsamAinda não há avaliações

- Modifying Qbs ReportsDocumento19 páginasModifying Qbs ReportsSudtana Rattanadilok Na PhuketAinda não há avaliações

- Module 3: General Journals Module Overview: ObjectivesDocumento38 páginasModule 3: General Journals Module Overview: ObjectivesManishAinda não há avaliações

- 3 - Financials - 1 - Manage The COA - DemosDocumento6 páginas3 - Financials - 1 - Manage The COA - DemosMónica CacheuxAinda não há avaliações

- How To Define ReportsDocumento5 páginasHow To Define ReportsiqbalAinda não há avaliações

- Short Guide Drill Down FM A VCR 01 ReportDocumento8 páginasShort Guide Drill Down FM A VCR 01 Reportanilr008Ainda não há avaliações

- Sensitivity Analysis and Scenario Planning in Capital BudgetingDocumento10 páginasSensitivity Analysis and Scenario Planning in Capital BudgetingAlexandre Cameron BorgesAinda não há avaliações

- Paul BudgetDocumento30 páginasPaul BudgetHoney Mae LimAinda não há avaliações

- Crystal Report Cross TabDocumento13 páginasCrystal Report Cross Tabiqbal85Ainda não há avaliações

- DAY-Financial ReportDocumento29 páginasDAY-Financial ReportNnisa YakinAinda não há avaliações

- Advanced General Ledger Reporting and Optional ChartfieldsDocumento11 páginasAdvanced General Ledger Reporting and Optional ChartfieldsVijaya GaliAinda não há avaliações

- FI-SD Integration Account DeterminationDocumento13 páginasFI-SD Integration Account DeterminationchonchalAinda não há avaliações

- Break Even Chart-Meaning-Advantages and TypesDocumento12 páginasBreak Even Chart-Meaning-Advantages and TypesrlwersalAinda não há avaliações

- S - ALR - 87099918 Cost Planning - DepreciationDocumento4 páginasS - ALR - 87099918 Cost Planning - DepreciationZakir Chowdhury100% (1)

- Money Manager 2 TraducidoDocumento29 páginasMoney Manager 2 Traducidoismael.alex4Ainda não há avaliações

- Money Manager 2Documento29 páginasMoney Manager 2jshhss787Ainda não há avaliações

- Finance GL ConceptsDocumento77 páginasFinance GL ConceptsDanish MajidAinda não há avaliações

- CreateReportLibrarySAPDocumento43 páginasCreateReportLibrarySAPPranshu Rastogi100% (1)

- Proof of Concept 1 Fi Na Ncials: Fusion Financial ReportingDocumento43 páginasProof of Concept 1 Fi Na Ncials: Fusion Financial ReportingKv kAinda não há avaliações

- Money Manager 2022Documento29 páginasMoney Manager 2022Yohan LimAinda não há avaliações

- Crystal Reports: Charting On Print-Time FormulasDocumento7 páginasCrystal Reports: Charting On Print-Time FormulasLucas Corrêa PachecoAinda não há avaliações

- Access 2007 ReportsDocumento14 páginasAccess 2007 ReportsMary PaulatAinda não há avaliações

- Report Manager and FSG Setup and GuidDocumento15 páginasReport Manager and FSG Setup and GuidzahidrafibhattiAinda não há avaliações

- SAP FI ReportsDocumento51 páginasSAP FI ReportsSuryaAinda não há avaliações

- AP Aging Report InstructionsDocumento18 páginasAP Aging Report InstructionsBhupendra KumarAinda não há avaliações

- How Do I Use My Dashboard?: Outstanding RevenueDocumento131 páginasHow Do I Use My Dashboard?: Outstanding RevenueShuaib RahujoAinda não há avaliações

- Automatic Account DeterminationDocumento13 páginasAutomatic Account DeterminationPraveen KumarAinda não há avaliações

- Ax and MR CurrencyDocumento22 páginasAx and MR CurrencywennchunAinda não há avaliações

- 2.02 - NOTES: 6311 Accounting I Summer 2010, Version 2Documento18 páginas2.02 - NOTES: 6311 Accounting I Summer 2010, Version 2api-262218593Ainda não há avaliações

- Developing Key Performance Indicators in TableauDocumento10 páginasDeveloping Key Performance Indicators in TableauRamesh KumarAinda não há avaliações

- Chart of Accounts ExplainedDocumento15 páginasChart of Accounts Explainedcarmel andreAinda não há avaliações

- PeopleSoft GL PointsDocumento14 páginasPeopleSoft GL PointsVenkateswara Rao Balla100% (1)

- Excel for Auditors: Audit Spreadsheets Using Excel 97 through Excel 2007No EverandExcel for Auditors: Audit Spreadsheets Using Excel 97 through Excel 2007Ainda não há avaliações

- Collins EngDocumento163 páginasCollins EngmsAinda não há avaliações

- 02 - Introduction To POS - OverviewDocumento8 páginas02 - Introduction To POS - OverviewmsAinda não há avaliações

- Ax2012 Enus Int 03Documento12 páginasAx2012 Enus Int 03msAinda não há avaliações

- Module 10: Pos Themes Module Overview: ObjectivesDocumento8 páginasModule 10: Pos Themes Module Overview: ObjectivesmsAinda não há avaliações

- Ax2012 Enus Si DisclDocumento2 páginasAx2012 Enus Si DisclmsAinda não há avaliações

- 07 Localization InformationDocumento8 páginas07 Localization InformationmsAinda não há avaliações

- Module 4: Pos Framework Module Overview: ObjectivesDocumento12 páginasModule 4: Pos Framework Module Overview: ObjectivesmsAinda não há avaliações

- Ax2012 Enus Me 02Documento52 páginasAx2012 Enus Me 02msAinda não há avaliações

- 11 User-Interface Extensibility Sample and How ToDocumento6 páginas11 User-Interface Extensibility Sample and How TomsAinda não há avaliações

- 09 - Logon Extensibility - Sample and How - ToDocumento8 páginas09 - Logon Extensibility - Sample and How - TomsAinda não há avaliações

- 02 - Introduction To POS - OverviewDocumento8 páginas02 - Introduction To POS - OverviewmsAinda não há avaliações

- Ax2012 Enus Retail TocDocumento2 páginasAx2012 Enus Retail TocmsAinda não há avaliações

- 08 - Extensibility Best PracticesDocumento8 páginas08 - Extensibility Best PracticesmsAinda não há avaliações

- 03 - POS Extensibility Technical OverviewDocumento8 páginas03 - POS Extensibility Technical OverviewmsAinda não há avaliações

- 05 - Development Environment RequirementsDocumento4 páginas05 - Development Environment RequirementsmsAinda não há avaliações

- Ax2012 Enus HRM TocDocumento6 páginasAx2012 Enus HRM TocmsAinda não há avaliações

- Ax2012 Enus Py TocDocumento4 páginasAx2012 Enus Py TocSrini VasanAinda não há avaliações

- 07 - Configuration of Database InstancesDocumento4 páginas07 - Configuration of Database InstancesmsAinda não há avaliações

- Ax2012 Enus WMSR2 TocDocumento4 páginasAx2012 Enus WMSR2 TocmsAinda não há avaliações

- Ax2012 Enus SQL TocDocumento4 páginasAx2012 Enus SQL TocmsAinda não há avaliações

- Ax2012 Enus Retail TocDocumento4 páginasAx2012 Enus Retail TocmsAinda não há avaliações

- Microsoft Dynamics Ax 2012 R2 For Retail in Brick and Mortar Stores-Development and Customization Course ObjectivesDocumento2 páginasMicrosoft Dynamics Ax 2012 R2 For Retail in Brick and Mortar Stores-Development and Customization Course ObjectivesmsAinda não há avaliações

- 06 Technical BackgroundDocumento2 páginas06 Technical BackgroundmsAinda não há avaliações

- Ax2012 Enus Retail TocDocumento4 páginasAx2012 Enus Retail TocmsAinda não há avaliações

- MB6 869Documento27 páginasMB6 869rudhra02Ainda não há avaliações

- MB2 868Documento27 páginasMB2 868msAinda não há avaliações

- MB3 861Documento26 páginasMB3 861msAinda não há avaliações

- MB3 862Documento24 páginasMB3 862msAinda não há avaliações

- Microsoft EXAM MB6-870: Microsoft Dynamics AX 2012 Trade and LogisticsDocumento25 páginasMicrosoft EXAM MB6-870: Microsoft Dynamics AX 2012 Trade and Logisticsrudhra02Ainda não há avaliações

- Microsoft EXAM MB6-870: Microsoft Dynamics AX 2012 Trade and LogisticsDocumento25 páginasMicrosoft EXAM MB6-870: Microsoft Dynamics AX 2012 Trade and Logisticsrudhra02Ainda não há avaliações

- HSS S6a LatestDocumento182 páginasHSS S6a Latestkk lAinda não há avaliações

- Logistics AssignmentDocumento15 páginasLogistics AssignmentYashasvi ParsaiAinda não há avaliações

- 8 Edsa Shangri-La Hotel Vs BF CorpDocumento21 páginas8 Edsa Shangri-La Hotel Vs BF CorpKyla Ellen CalelaoAinda não há avaliações

- Lecture 4 The Seven Years' War, 1756-1763Documento3 páginasLecture 4 The Seven Years' War, 1756-1763Aek FeghoulAinda não há avaliações

- Ex For Speech About The ObesityDocumento3 páginasEx For Speech About The ObesityJenniferjenniferlalalaAinda não há avaliações

- Coursebook Chapter 15 AnswersDocumento3 páginasCoursebook Chapter 15 AnswersAhmed Zeeshan80% (10)

- List of applicants for admission to Non-UT Pool categoryDocumento102 páginasList of applicants for admission to Non-UT Pool categoryvishalAinda não há avaliações

- Lecture-1 An Introduction To Indian PhilosophyDocumento14 páginasLecture-1 An Introduction To Indian PhilosophySravan Kumar Reddy100% (1)

- Elements of Consideration: Consideration: Usually Defined As The Value Given in Return ForDocumento8 páginasElements of Consideration: Consideration: Usually Defined As The Value Given in Return ForAngelicaAinda não há avaliações

- Literary Structure and Theology in The Book of RuthDocumento8 páginasLiterary Structure and Theology in The Book of RuthDavid SalazarAinda não há avaliações

- 2014 10 A Few Good Men Playbill PDFDocumento8 páginas2014 10 A Few Good Men Playbill PDFhasrat natrajAinda não há avaliações

- Networking and TESOL career goalsDocumento2 páginasNetworking and TESOL career goalsSadiki FltaAinda não há avaliações

- Build - Companion - HarrimiDocumento3 páginasBuild - Companion - HarrimiandrechapettaAinda não há avaliações

- Practice 4Documento5 páginasPractice 4Nguyễn Tuấn ĐịnhAinda não há avaliações

- Delhi Public School Mid-Term Exam for Class 5 Students Covering English, Math, ScienceDocumento20 páginasDelhi Public School Mid-Term Exam for Class 5 Students Covering English, Math, ScienceFaaz MohammadAinda não há avaliações

- ULI Europe Reshaping Retail - Final PDFDocumento30 páginasULI Europe Reshaping Retail - Final PDFFong KhAinda não há avaliações

- IGNOU Hall Ticket December 2018 Term End ExamDocumento1 páginaIGNOU Hall Ticket December 2018 Term End ExamZishaan KhanAinda não há avaliações

- How To Have A BEAUTIFUL MIND Edward de BDocumento159 páginasHow To Have A BEAUTIFUL MIND Edward de BTsaqofy Segaf100% (1)

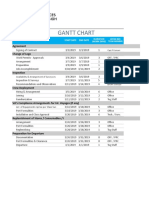

- Gantt Chart TemplateDocumento3 páginasGantt Chart TemplateAamir SirohiAinda não há avaliações

- Human Resources ManagementDocumento18 páginasHuman Resources ManagementztrinhAinda não há avaliações

- When The Rule of Law PrevailsDocumento3 páginasWhen The Rule of Law PrevailsMarianne SasingAinda não há avaliações

- CH8 OligopolyModelsDocumento37 páginasCH8 OligopolyModelsJeffrey LaoAinda não há avaliações

- Omoluabi Perspectives To Value and Chara PDFDocumento11 páginasOmoluabi Perspectives To Value and Chara PDFJuan Daniel Botero JaramilloAinda não há avaliações

- University of ST Andrews 2009 ArticleDocumento156 páginasUniversity of ST Andrews 2009 ArticleAlexandra SelejanAinda não há avaliações

- Find Offshore JobsDocumento2 páginasFind Offshore JobsWidianto Eka PramanaAinda não há avaliações

- Family Law Study Material for LL.B. and BA.LL.B. CoursesDocumento134 páginasFamily Law Study Material for LL.B. and BA.LL.B. CoursesDigambar DesaleAinda não há avaliações

- DH 0526Documento12 páginasDH 0526The Delphos HeraldAinda não há avaliações

- The Seven ValleysDocumento17 páginasThe Seven ValleyswarnerAinda não há avaliações

- Risk Register 2012Documento2 páginasRisk Register 2012Abid SiddIquiAinda não há avaliações

- History Project: (For Ist Semester)Documento27 páginasHistory Project: (For Ist Semester)Jp YadavAinda não há avaliações