Escolar Documentos

Profissional Documentos

Cultura Documentos

Practice Midterm 1

Enviado por

stargearDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

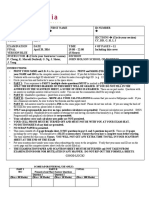

Practice Midterm 1

Enviado por

stargearDireitos autorais:

Formatos disponíveis

Test No.

First Midterm Examination

ACC3200

Instructions:

1 You must write your name on this sheet as well as the scantron sheet.

2 The answers to the multiple questions should be entered on the scantron sheet.

3 IMPORTANT: You MUST SHOW how you calculated your answers in the space provided below

for each question. If you fail to do so, you will NOT RECEIVE credit for the question even if you

show the correct answer on the scantron sheet.

The Baruch Honor Code is the standard of professional behavior on this exam. When you have

completed your exam, please read the following pledge and add your signature to indicate that you

have complied with the Honor Code.

I PLEDGE THAT I HAVE NEITHER GIVEN NOR RECEIVED ANY UNAUTHORIZED

ASSISTANCE ON THIS EXAM, AND THAT ANY VIOLATIONS OF THE HONOR CODE BY

OTHERS THAT I HAVE OBSERVED, OR OTHERWISE BECOME AWARE OF, WILL BE

REPORTED BY ME TO THE HONOR COUNCIL.

Name (Please print)

Last

Signature

You should hand in BOTH the scantron and this exam.

Page1of3

First

1 Which of the following statements is true?

A. Total variable costs remain constant as level of activity increases (in the relevant range).

B. Total fixed costs increase as the level of activity increases (in the relevant range).

C. It is impossible to determine whether variable and fixed costs will increase or decrease based on the level of

activity (within the relevant range).

D. Per unit variable cost increases as the level of activity increases (within the relevant range).

E. Per unit fixed cost decreases as the level of activity increases (within the relevant range).

2 Tallahassee Company is highly automated and uses a computer to control manufacturing operations. Tallahassee uses

a job-order costing system and applies manufacturing overhead (MOH) cost to products on the basis of computer

hours. The estimates below were used in preparing the predetermined OH rate at the beginning of the year:

Fixed MOH cost

Variable MOH per computer hour

Computer hours

$

$

1,275,000

3.00

85,000 hrs

During the year, a severe economic recession resulted in the cutting back production and the building of inventory in

the company's warehouse. The company's cost records revealed the following actual cost and operating data for the

year:

Computer-hours

Manufacturing overhead cost

Balances at year-end:

Work-in-process Inventory

Finished Goods Inventory

Costs of Good Sold

60,000

$1,350,000

$160,000

$1,040,000

$2,800,000

What is the predetermined overhead rate for the year ?

A.

$15.00 per hour

B.

$21.25 per hour

C.

$22.50 per hour

D.

$18.00 per hour

$15.88 per hour

E.

Page2of3

3 Bostons Dairy has just opened its main yogurt factory in upstate Massachusetts. This main factory can produce 3,500

boxes of yogurt monthly (each box contains twelve 6-oz cups). Due to overwhelming demand for the companys

product, Bostons Dairy has signed a contract to rent a new factory, which can produce up to 8,000 boxes per month.

The monthly total fixed costs are $40,000 in the main factory and $16,000 in the new factory. The variable

production cost of yogurt is $4.50 per box in the main factory. The variable production cost in the new factory is $6.0

per box as materials have to be redistributed from the main factory. The average selling price is $15, and the variable

selling expense is $1 per box, which is the same for all factories.

In addition, Bostons Dairy plans to pay its sales force $0.80 per box as added bonus for every box sold above the

break-even point. How many boxes does the company have to produce and sell in order to earn a net operating income

of $10,000 per month (round all decimal up to one box)?

A.

B.

C.

D.

E.

11,500

6,344

7,733

4,233

1,389

boxes

boxes

boxes

boxes

boxes

4 Olympia Companys variable expenses are 60% of sales. At a $600,000 sales level, the degree of operating leverage is

4. The company's chief executive officer has decided to purchase and install a new automated assembly line that will

increase the company's fixed expenses by 80% but will reduce variable expenses per unit of product by 40%.

Assuming that the sales level remains the same and the change will not affect the sales price, determine the new

degree of operating leverage after the new assembly is installed:

3.91

A.

4.00

B.

6.40

C.

D.

2.91

E. None of the above

5 Sacramento Corporation uses direct labor-hours in its predetermined overhead rate. At the beginning of the year, the

estimated direct labor-hours were 15,700 hours. At the end of the year, actual direct labor-hours for the year were

16,700 hours, the actual manufacturing overhead for the year was $352,960, and manufacturing overhead for the year

was overapplied by $27,800. The estimated manufacturing overhead at the beginning of the year used in the

predetermined overhead rate must have been:

A.

$

327,124

B.

$

357,960

C.

$

380,760

D.

$

347,960

E. None of the above

Page3of3

Você também pode gostar

- Quiz Job Order and CVPDocumento9 páginasQuiz Job Order and CVPLara Lewis AchillesAinda não há avaliações

- Cga-Canada Management Accounting Fundamentals (Ma1) Examination March 2014 Marks Time: 3 HoursDocumento18 páginasCga-Canada Management Accounting Fundamentals (Ma1) Examination March 2014 Marks Time: 3 HoursasAinda não há avaliações

- Cost Volume Profit Case Analysis: RequiredDocumento2 páginasCost Volume Profit Case Analysis: Requiredkenrose laguyoAinda não há avaliações

- STRAT ReviewerDocumento13 páginasSTRAT ReviewerCrisel SalomeoAinda não há avaliações

- P1 March 2011 For PublicationDocumento24 páginasP1 March 2011 For PublicationmavkaziAinda não há avaliações

- Sample ExamsDocumento11 páginasSample ExamsCai04Ainda não há avaliações

- 68 TermsDocumento7 páginas68 TermsakenemidAinda não há avaliações

- Exercise Chapter 4Documento7 páginasExercise Chapter 4truongvutramyAinda não há avaliações

- Final Exam Autumn 2011 v1Documento38 páginasFinal Exam Autumn 2011 v1peter kongAinda não há avaliações

- Final Practice ExamDocumento15 páginasFinal Practice ExamRaymond KeyesAinda não há avaliações

- A. Calculate The Break-Even Dollar Sales For The MonthDocumento25 páginasA. Calculate The Break-Even Dollar Sales For The MonthMohitAinda não há avaliações

- Managerial Accounting Practice Problems2 PDFDocumento9 páginasManagerial Accounting Practice Problems2 PDFFrank Lovett100% (1)

- HI5017 Progressive Tutorial Question Assignment T2 2020 PDFDocumento8 páginasHI5017 Progressive Tutorial Question Assignment T2 2020 PDFIkramAinda não há avaliações

- Chapter 2 Test Study Guide MSDocumento4 páginasChapter 2 Test Study Guide MSdestinyv07100% (1)

- ACC 349 - Week 5 - Final ExamDocumento16 páginasACC 349 - Week 5 - Final ExamShelly ElamAinda não há avaliações

- Final Exam - Practice FinalDocumento12 páginasFinal Exam - Practice FinalShi FrankAinda não há avaliações

- Assignment-1 MATH 371 (Fall 2018)Documento5 páginasAssignment-1 MATH 371 (Fall 2018)umar khanAinda não há avaliações

- ECG Company Sells Lightweight Tables. One Table Is Sold For $45. Variable and Fixed Expenses Data Is Given Below: Variable Expenses Per Unit: $18 Fixed Expenses Per Year: $540,000Documento2 páginasECG Company Sells Lightweight Tables. One Table Is Sold For $45. Variable and Fixed Expenses Data Is Given Below: Variable Expenses Per Unit: $18 Fixed Expenses Per Year: $540,000UMAIR AFZALAinda não há avaliações

- 52 Resource 7Documento4 páginas52 Resource 7gurudevgaytri0% (1)

- CVP AnalysisDocumento5 páginasCVP AnalysisAnne BacolodAinda não há avaliações

- Acc103 2Documento12 páginasAcc103 2Reina TrầnAinda não há avaliações

- BU330 Accounting For ManagerDocumento89 páginasBU330 Accounting For ManagerG JhaAinda não há avaliações

- ACC 115 - Chapter 21 Quiz - Cost Behavior and Cost-Volume-Profit AnalysisDocumento3 páginasACC 115 - Chapter 21 Quiz - Cost Behavior and Cost-Volume-Profit AnalysisJoyAinda não há avaliações

- CMAPart2 PDFDocumento53 páginasCMAPart2 PDFarslaan89Ainda não há avaliações

- Final Exam S1 2016 ACCT603Documento10 páginasFinal Exam S1 2016 ACCT603avtar0% (1)

- ExercisesDocumento6 páginasExercisesShreshtha VermaAinda não há avaliações

- P2 - Management Accounting - Decision ManagementDocumento24 páginasP2 - Management Accounting - Decision ManagementTapan BalaAinda não há avaliações

- Trắc NghiệmDocumento50 páginasTrắc NghiệmNGÂN CAO NGUYỄN HOÀNAinda não há avaliações

- Accounting Textbook Solutions - 23Documento19 páginasAccounting Textbook Solutions - 23acc-expertAinda não há avaliações

- Connect Accounting Homework AnswersDocumento6 páginasConnect Accounting Homework Answersewa96c3kAinda não há avaliações

- Practice Exam 1gdfgdfDocumento49 páginasPractice Exam 1gdfgdfredearth2929100% (1)

- Adms2510f FL95Documento9 páginasAdms2510f FL95rabeya26Ainda não há avaliações

- Management Science FinalDocumento8 páginasManagement Science FinalAAUMCLAinda não há avaliações

- CVP Analysis Exercise-OLDDocumento3 páginasCVP Analysis Exercise-OLDIftekhar Uddin M.D EisaAinda não há avaliações

- Long Test 2 Set BDocumento2 páginasLong Test 2 Set BMonica ReyesAinda não há avaliações

- Accounting and FinanceDocumento6 páginasAccounting and FinanceAisha KhanAinda não há avaliações

- Briefly Speaking IncDocumento21 páginasBriefly Speaking IncdavidAinda não há avaliações

- Chartered University College: Cat Paper 2Documento17 páginasChartered University College: Cat Paper 2Mohsena MunnaAinda não há avaliações

- QP March2012 p1Documento20 páginasQP March2012 p1Dhanushka Rajapaksha100% (1)

- P1 Sept 2013Documento20 páginasP1 Sept 2013Anu MauryaAinda não há avaliações

- Colorscope 1Documento6 páginasColorscope 1Oca Chan100% (2)

- 28 Comm 308 Final Exam (Winter 2016)Documento11 páginas28 Comm 308 Final Exam (Winter 2016)TejaAinda não há avaliações

- ACC 302second MidtermDocumento8 páginasACC 302second MidtermvirgofairiesAinda não há avaliações

- Mid ExamDocumento27 páginasMid ExamANH NGUYEN THI THUYAinda não há avaliações

- Brewer Chapter 6Documento8 páginasBrewer Chapter 6Sivakumar KanchirajuAinda não há avaliações

- Lecture-11 Relevant Costing LectureDocumento6 páginasLecture-11 Relevant Costing LectureNazmul-Hassan Sumon0% (2)

- Ce F5 002Documento28 páginasCe F5 002សារុន កែវវរលក្ខណ៍Ainda não há avaliações

- Extra Test 01 - KTQTDocumento4 páginasExtra Test 01 - KTQTcongnt92Ainda não há avaliações

- Accounting ReviewDocumento6 páginasAccounting ReviewkahedigeAinda não há avaliações

- Exam161 10Documento7 páginasExam161 10patelp4026Ainda não há avaliações

- Latihan UAS Manacc TUTORKU (Answered)Documento10 páginasLatihan UAS Manacc TUTORKU (Answered)Della BianchiAinda não há avaliações

- Assignment 3 MIS325Documento11 páginasAssignment 3 MIS325Adriana TotinoAinda não há avaliações

- Acc312 Platt Spr07 Exam1 Solution PostedDocumento13 páginasAcc312 Platt Spr07 Exam1 Solution Posted03322080738Ainda não há avaliações

- ACCT 7004 Exam F2022 TemplateDocumento17 páginasACCT 7004 Exam F2022 TemplateJesse DanielsAinda não há avaliações

- Chapter 05 1a EocDocumento9 páginasChapter 05 1a EocOmar CirunayAinda não há avaliações

- FINAN204-23A - Tutorial 3Documento19 páginasFINAN204-23A - Tutorial 3Xiaohan LuAinda não há avaliações

- Attempt-1: The Company's Accountant Used A Denominator of Budgeted Machine Hours For The Current Accounting PeriodDocumento18 páginasAttempt-1: The Company's Accountant Used A Denominator of Budgeted Machine Hours For The Current Accounting Periodpragadeeshwaran100% (2)

- ACG2071 Final Exam Chapter 6 To 8 Test 2 Recap Fall 14 NotesDocumento13 páginasACG2071 Final Exam Chapter 6 To 8 Test 2 Recap Fall 14 NotesEdny SaintfelixAinda não há avaliações

- Audit Case 2 - SkiDocumento2 páginasAudit Case 2 - SkistargearAinda não há avaliações

- Trueblood Case 2 PDFDocumento3 páginasTrueblood Case 2 PDFstargearAinda não há avaliações

- Audit Case 1 - Analytical ProceduresDocumento2 páginasAudit Case 1 - Analytical ProceduresstargearAinda não há avaliações

- Econ 4100 Syllabus Spring 2016 Baruch - 11 10 AMDocumento5 páginasEcon 4100 Syllabus Spring 2016 Baruch - 11 10 AMstargearAinda não há avaliações

- Syllabus SP 2016Documento8 páginasSyllabus SP 2016stargearAinda não há avaliações

- How To Use The Worksheet: BBA PathwaysDocumento3 páginasHow To Use The Worksheet: BBA PathwaysstargearAinda não há avaliações

- ©dr. Chula King All Rights ReservedDocumento3 páginas©dr. Chula King All Rights ReservedstargearAinda não há avaliações

- Syllabus Spring 2015Documento7 páginasSyllabus Spring 2015stargearAinda não há avaliações

- Principle - DISCIPLINE - Management DiaryDocumento8 páginasPrinciple - DISCIPLINE - Management Diaryharsh inaniAinda não há avaliações

- Week 1 LabDocumento3 páginasWeek 1 LabSara ThompsonAinda não há avaliações

- The Prudential Regulations of State Bank PakistanDocumento33 páginasThe Prudential Regulations of State Bank PakistanSaad Bin Mehmood88% (17)

- Brick Makers in FaisalabadDocumento27 páginasBrick Makers in FaisalabadMuhammad Shahid SaddiqueAinda não há avaliações

- People Should Abandon Cash and Use Plastic Cards OnlyDocumento10 páginasPeople Should Abandon Cash and Use Plastic Cards OnlygstgdtAinda não há avaliações

- Bba 312 FM Home Test Jan19 FTDocumento3 páginasBba 312 FM Home Test Jan19 FTDivine DanielAinda não há avaliações

- 651593285MyGov 5th September, 2023 & Agenda KenyaDocumento29 páginas651593285MyGov 5th September, 2023 & Agenda KenyaJudy KarugaAinda não há avaliações

- Axiata Group Berhad: 1HFY10 Net Profit More Than Doubles - 26/08/2010Documento5 páginasAxiata Group Berhad: 1HFY10 Net Profit More Than Doubles - 26/08/2010Rhb InvestAinda não há avaliações

- United Respublic of Tanzania Business Registrations and Licensing AgencyDocumento2 páginasUnited Respublic of Tanzania Business Registrations and Licensing AgencyGreen MakwareAinda não há avaliações

- Entrepreneurship-11 12 Q2 SLM WK2Documento6 páginasEntrepreneurship-11 12 Q2 SLM WK2MattAinda não há avaliações

- Essentials of Investments: Equity ValuationDocumento41 páginasEssentials of Investments: Equity ValuationAnthony OrtegaAinda não há avaliações

- Workman Define-Award 569 Od 2013Documento40 páginasWorkman Define-Award 569 Od 2013shazuarni ahmadAinda não há avaliações

- Singapore Property Weekly Issue 59Documento17 páginasSingapore Property Weekly Issue 59Propwise.sgAinda não há avaliações

- Joint Report by JP Morgan and Oliver Wyman Unlocking Economic Advantage With Blockchain A Guide For Asset ManagersDocumento24 páginasJoint Report by JP Morgan and Oliver Wyman Unlocking Economic Advantage With Blockchain A Guide For Asset ManagersJuan JesúsAinda não há avaliações

- MGT201 A Huge File For Quizzes 1140 PagesDocumento1.140 páginasMGT201 A Huge File For Quizzes 1140 PagesWaseem AliAinda não há avaliações

- Financial Statement Analysis Lenovo Final 1Documento18 páginasFinancial Statement Analysis Lenovo Final 1api-32197850550% (2)

- BCG Matrix and GE Nine Cells MatrixDocumento15 páginasBCG Matrix and GE Nine Cells MatrixBinodBasnet0% (1)

- Unfair Trade PracticesDocumento29 páginasUnfair Trade PracticesVasudha FulzeleAinda não há avaliações

- Evergreen Event Driven Marketing PDFDocumento2 páginasEvergreen Event Driven Marketing PDFEricAinda não há avaliações

- Canada Autos (DSC) (Panel)Documento15 páginasCanada Autos (DSC) (Panel)Frontyardservices Uganda limitedAinda não há avaliações

- Innovation and Leadership Values: Case Study CritiqueDocumento4 páginasInnovation and Leadership Values: Case Study CritiqueHanan SalmanAinda não há avaliações

- Soap Industry AnalysisDocumento6 páginasSoap Industry AnalysisbkaaljdaelvAinda não há avaliações

- Gr11 - Worksheet - Demand & SupplyDocumento2 páginasGr11 - Worksheet - Demand & Supplysnsmiddleschool2020Ainda não há avaliações

- Mbe AsDocumento2 páginasMbe AsSwati AroraAinda não há avaliações

- Supply Curve of LabourDocumento3 páginasSupply Curve of LabourTim InawsavAinda não há avaliações

- Relationship Manager 0Documento1 páginaRelationship Manager 0Tanvir AhmedAinda não há avaliações

- Labor Law Chapter-2Documento9 páginasLabor Law Chapter-2Toriqul IslamAinda não há avaliações

- SolutionsDocumento8 páginasSolutionsJavid BalakishiyevAinda não há avaliações

- Schumpeter's Theory of Economic Development - EconomicsDocumento24 páginasSchumpeter's Theory of Economic Development - EconomicsreggydevvyAinda não há avaliações

- Cash Basis Accounting Vs Accrual SystemDocumento3 páginasCash Basis Accounting Vs Accrual SystemAllen Jade PateñaAinda não há avaliações

- Getting to Yes: How to Negotiate Agreement Without Giving InNo EverandGetting to Yes: How to Negotiate Agreement Without Giving InNota: 4 de 5 estrelas4/5 (652)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!No EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Nota: 4.5 de 5 estrelas4.5/5 (14)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindNo EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindNota: 5 de 5 estrelas5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)No EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Nota: 4.5 de 5 estrelas4.5/5 (15)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineAinda não há avaliações

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookNo EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookNota: 5 de 5 estrelas5/5 (4)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesAinda não há avaliações

- Well Control for Completions and InterventionsNo EverandWell Control for Completions and InterventionsNota: 4 de 5 estrelas4/5 (10)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsAinda não há avaliações

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)No EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Nota: 4.5 de 5 estrelas4.5/5 (5)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)No EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Nota: 4 de 5 estrelas4/5 (33)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeNo EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeNota: 4 de 5 estrelas4/5 (21)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsNo EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsNota: 5 de 5 estrelas5/5 (1)

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyNo EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyAinda não há avaliações

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsNo EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsNota: 4 de 5 estrelas4/5 (7)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItNo EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItNota: 4.5 de 5 estrelas4.5/5 (14)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetNo EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetNota: 4.5 de 5 estrelas4.5/5 (14)

- Controllership: The Work of the Managerial AccountantNo EverandControllership: The Work of the Managerial AccountantAinda não há avaliações

- Contract Negotiation Handbook: Getting the Most Out of Commercial DealsNo EverandContract Negotiation Handbook: Getting the Most Out of Commercial DealsNota: 4.5 de 5 estrelas4.5/5 (2)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCNo EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCNota: 5 de 5 estrelas5/5 (1)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageNo EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageNota: 4.5 de 5 estrelas4.5/5 (109)