Escolar Documentos

Profissional Documentos

Cultura Documentos

LUFC Accounts

Enviado por

Adam ParkerDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

LUFC Accounts

Enviado por

Adam ParkerDireitos autorais:

Formatos disponíveis

COMPANY REGISTRATION NUMBER 06233875

LEEDS UNITED FOOTBALL CLUB LIMITED

FINANCIAL STATEMENTS

FOR THE YEAR ENDED

30 JUNE 2015

A28

A51G208B*

24/02/2016 ;

COMPANIES HOUSE

#230

LEEDS UNITED FOOTBALL CLUB LIMITED

FINANCIAL STATEMENTS

YEAR ENDED 30 JUNE 2015

CONTENTS

PAGE

Officers and professional advisers

Strategic report

Directors' report

Statement of directors' responsibilities

Independent auditor's report to the shareholders

Profit and loss account

Balance sheet

Cash flow statement

Notes to the financial statements

LEEDS UNITED FOOTBALL CLUB LIMITED

OFFICERS AND PROFESSIONAL ADVISERS

THE BOARD OF DIRECTORS

M Cellino

Ercole Cellino

Edoardo Cellino

DArty

5 Patel

J Patel

G Caboni

REGISTERED OFFICE

Elland Road

Leeds

LS11 OES

AUDITOR

Gibson Booth

Chartered Accountants

6 Statutory Auditor

New Court

Abbey Road North

Shepley

Huddersfield

HD8 BBJ

BANKERS

Barclays Bank pic

69 Albion Street

Leeds

LS1 5AA

SOLICITORS

Chadwick Lawrence

8-16 Dock Street

Leeds

LS101LX

Ward Hadaway

Wellington Street

Leeds

LS1 4DL

-1 -

LEEDS UNITED FOOTBALL CLUB LIMITED

STRATEGIC REPORT

YEAR ENDED 30 JUNE 2015

REVIEW OF BUSINESS ACTIVITIES

The summer months leading up to the start of the 2014/15 season saw substantial changes both on and off the pitch. A cultural

change under the ownership of Massimo Cellino saw a sporting director, Nicola Salerno, appointed to take charge of the club's

recruitment and 15 new players were drafted in - eleven permanent signings and four loan deals.

Italian football was the main source of the incomings, with the likes of Giuseppe Bellusci and Souleymane Doukara

commanding substantial fees to join from Catania, Highly-rated Brazil Under-20s international Adryan was among those who

arrived on loan, while striker Billy Sharp was the household name which the fans craved.

David Hockaday replaced Brian McDe/mott as the club's new head coach in June but departed Elland Road after just two wins

from his opening six games. Expectations for the season remained high despite a mixed start, and further changes were to

come as Darko Milanic was drafted in from Austrian side Sturm Graz to take charge following Neil Redfeam's productive

caretaker spell. However, six games without a win saw Milanic's contract terminated and Redfeam took charge on a permanent

basis. By this point, however, we were looking down the table rather than up and a worrying run of results over the Christmas

period saw the team slip towards the relegation zone. January brought a turn in fortunes and improved results soon made our

league standing a lot healthier as we went on to secure our Championship status.

Further reinforcements were made in the January transfer window, with Sol Bamba and Granddi Ngoyi both arriving on loan

from Palermo, while Edgar Cani joined from Catania for the remainder of the season.

pCM \AeT<V

The major positives on the footballing side came through our exciting homegrown talent, particularly the emergence of eventual

Young Player of the Year Lewis Cook in his breakthrough season. 2014/15 saw Alex Mowatt, another Academy graduate,

vf establish himself as a key figure as he went on to claim the Player of the Year award, while Charlie Taylor also cemented his

place in the side. Sam Byram continued to impress, scoring three times and attracting Premier League interest along the way,

" o^c v

and it was the season which saw Kalvin Phillips make the step up for his first-team debut.

*" fS

In financial terms the 2014/15 season saw the company make enormous strides towards stability Whilst there was a 3.55%

decrease in turnover from 25.3m to 24.4m we can attribute this almost entirely to the decline in merchandising income.

However, gate receipts increased slightly from 8.6m to 8.8m and following a period of restructuring the salary costs reduced

from 22.4m to 20.2m, a decrease of 9.8%.

"r^r^

I am very pleased to announce a 91% reduction of post tax losses for the financial year. In monetary terms, the 2014/15 result

of 2,012,342 loss represented a saving of 20,874,122 on the 2013/14 season. Of course, player trading made a major

contribution to the year on year savings with Ross McCormack departing in early July 2014 but this was necessary for the long

term benefit of the club.

The Board has worked tirelessly to strengthen the balance sheet with an additional 14,500,000 Ordinary Shares issued. The

balance sheet showed a surplus of 1,009,875 as at the 30 June 2015, an improvement on the 30 June 2014 deficit figure of

13,477,783.

FUTURE DEVELOPMENTS

The strategic review that commenced in April 2014 continues into the 2014/15 season. Following lengthy discussions the Club

took the decision to buy back all catering operations from Compass Contract Services (UK) Limited in order to widen the income

base and to take a more long term approach to financial stability. On 3 July 2015 all catering operations at Elland Road returned

in house and a programme of renovation to the hospitality areas has commenced in the West Stand and will continue until all

areas have been comprehensively modernised.

1

The club will continue to make sensible and cost effective changes to the playing squad to ensure that the burden of salary

costs remains manageable. However, whilst cost management is considered crucial we recognise the importance of investing in

the club's home, Elland Road. All areas of the business have benefited from a conservative capital improvement scheme with V

updates made to the retail shop, new 3G edging and lighting systems to the Elland Road pitch. Match day hospitality has

benefited from refurbishment of the private boxes and office areas have been modernised to exacting standards. Further

programmes will continue as and when our finances allow it.

I have openly voiced my opinion on the increased number of League games that are shown on live TV and will continue to work

~^\to ensure that the club is treated fairly, shown no more or no less than every other team within our League. It is my intention to

work to safeguard the future of Leeds United.

Signed on behalf of the directors

Approved by the directors on 2.fe>/.!.'./..!.

i ////Hi

/// /n

J / / // /]/ /

MCELtfNO P"SL/ V / / /

Director

/ jfd^iI (1

\

/N

( VA^/""

"

"^

ujV^

LEEDS UNITED FOOTBALL CLUB LIMITED

DIRECTORS' REPORT

YEAR ENDED 30 JUNE 2015

The directors present their report and the financial statements of the company for the year ended 30 June 201 5.

RESULTS AND DIVIDENDS

The loss for the year amounted to E2, 01 2, 342. The directors have not recommended a dividend.

FINANCIAL INSTRUMENTS

The company's financial instalments comprise of borrowings such as secured and unsecured loans and advanced receipts in

respect of the ordinary activities of the club, cash and liquid resources, finance leases and various other items such as trade

debtors and trade creditors that also arise directly from its operations.

FINANCIAL RISK MANAGEMENT AND EXPOSURE TO RISK

In order to minimise financial risk the directors of the company have taken the decision not to engage in trades of a speculative

nature. At the year end the company had no foreign currency exposure. Other risks and uncertainties may arise dependent on

the performance of the football team.

CASH FLOW

The company continues to ensure that cash flows are closely monitored on a daily basis and reviews its overall financial

requirements on an annual basis. This policy will be maintained for the foreseeable future.

DIRECTORS

The directors who served the company during the year were as follows;

'

A M Cellino

. Ercole Cellino

*EdoardoCe,,in,

!ppat,' 'i

A Umbers served as a director from 1 January 2015 until 12 October 2015.

G Caboni was appointed as a director on 21 January 2015.

M Cellino resigned as a director on 21 January 201 5 and was re-appointed on 6 May 2015.

DISABLED EMPLOYEES

Applications for employment by disabled persons are always fully considered. In event of members of staff becoming disabled,

every opportunity is made to ensure their employment with the company continues and that appropriate training is arranged. It is

the policy of the company that the training, career development and promotion of disabled persons should, as far as possible.

be identical to that of other employees.

EMPLOYEE INVOLVEMENT

The company's employment policies are designed to attract, retain and motivate the best people. The company involves

employees at all levels of the organisation through a broad base of regular communication, meetings and briefing sessions to

understand current performance and communicate future developments.

AUDITOR

Gibson Booth are deemed to be re-appointed under section 487(2) of the Companies Act 2006.

Each of the persons who is a director at the date of approval of this report confirm that:

so far as each director is aware, there is no relevant audit information of which the company's auditor is unaware; and

each director has taken all steps that they ought to have taken as a director to make themself aware of any relevant audit

information and to establish that the company's auditor is aware of that information.

Registered office:

Elland Road

Leeds

LS11 OES

Signed on behalf of

Approved by the directors on

-3-

LEEDS UNITED FOOTBALL CLUB LIMITED

STATEMENT OF DIRECTORS' RESPONSIBILITIES

YEAR ENDED 30 JUNE 2015

The directors are responsible for preparing the Strategic Report, Directors' Report and the financial statements in accordance

with applicable law and regulations.

Company law requires the directors to prepare financial statements for each financial year. Under that law the directors have

elected to prepare the financial statements in accordance with United Kingdom Generally Accepted Accounting Practice (United

Kingdom Accounting Standards and applicable law). Under company law the directors must not approve the financial

statements unless they are satisfied that they give a true and fair view of the state of affairs of the company and of the profit or

loss of the company for that year.

In preparing these financial statements, the directors are required to:

select suitable accounting policies and then apply them consistently;

make judgements and accounting estimates that are reasonable and prudent;

state whether applicable UK Accounting Standards have been followed, subject to any material departures disclosed and

explained in the financial statements;

prepare the financial statements on the going concern basis unless it is inappropriate to presume that the company will

continue in business.

The directors are responsible for keeping adequate accounting records that are sufficient to show and explain the company's

transactions and disclose with reasonable accuracy at any time the financial position of the company and enable them to ensure

that the financial statements comply with the Companies Act 2006. They are also responsible for safeguarding the assets of the

company and hence for taking reasonable steps for the prevention and detection of fraud and other irregularities.

-4-

LEEDS UNITED FOOTBALL CLUB LIMITED

INDEPENDENT AUDITOR'S REPORT TO THE SHAREHOLDERS OF LEEDS UNITED FOOTBALL CLUB

LIMITED

YEAR ENDED 30 JUNE 2015

We have audited the financial statements of Leeds United Football Club Limited for the year ended 30 June 201 5 which

comprise the Profit and Loss Account, Balance Sheet, Cash Flow Statement and the related notes. The financial reporting

framework that has been applied in their preparation is applicable law and United Kingdom Accounting Standards (United

Kingdom Generally Accepted Accounting Practice).

This report is made solely to the company's shareholders, as a body, in accordance with Chapter 3 of Part 16 of the Companies

Act 2006. Our audit work has been undertaken so that we might state to the company's shareholders those matters we are

required to state to them in an auditor's report and for no other purpose. To the fullest extent permitted by law, we do not accept

or assume responsibility to anyone other than the company and the company's shareholders as a body, for our audit work, for

this report, or for the opinions we have formed.

RESPECTIVE RESPONSIBILITIES OF DIRECTORS AND AUDITOR

As explained more fully in the Directors' Responsibilities Statement set out on page 4, the directors are responsible for the

preparation of the financial statements and for being satisfied that they give a true and fair view. Our responsibility is to audit

and express an opinion on the financial statements in accordance with applicable law and International Standards on Auditing

(UK and Ireland). Those standards require us to comply with the Auditing Practices Board's (APB's) Ethical Standards for

Auditors.

SCOPE OF THE AUDIT OF THE FINANCIAL STATEMENTS

A description of the scope of an audit of financial

www.frc.org.uk/apb/scope/private.cfm.

statements

is

provided on

the

FRC's

website

at.

OPINION ON FINANCIAL STATEMENTS

In our opinion the financial statements:

give a true and fair view of the state of the company's affairs as at 30 June 201 5 and of its loss for the year then ended;

have been properly prepared in accordance with United Kingdom Generally Accepted Accounting Practice; and

have been prepared in accordance with the requirements of the Companies Act 2006.

OPINION ON OTHER MATTER PRESCRIBED BY THE COMPANIES ACT 2006

In our opinion the information given in the Strategic Report and Directors' Report for the financial year for which the financial

statements are prepared is consistent with the financial statements.

MATTERS ON WHICH WE ARE REQUIRED TO REPORT BY EXCEPTION

We have nothing to report in respect of the following matters where the Companies Act 2006 requires us to report to you if, in

our opinion:

adequate accounting records have not been kept, or returns adequate for our audit have not been received from

branches not visited by us; or

the financial statements are not in agreement with the accounting records and returns; or

certain disclosures of directors' remuneration specified by law are not made; or

we have not received all the information and explanations we require for our audit.

New Court

Abbey Road North

Shepley

Huddersfield

HD8 8BJ

ALISTAIR RUSSELL FCA (Senior

Statutory Auditor)

For and on behalf of

GIBSON BOOTH

Chartered Accountants

& Statutory Auditor

-5-

LEEDS UNITED FOOTBALL CLUB LIMITED

PROFIT AND LOSS ACCOUNT

YEAR ENDED 30 JUNE 2015

2015

24,418,955

2014

25,290,530

Cost of sales

(3,937,295)

(6,224,396)*^^^

GROSS PROFIT

20,481,660

19,066,134

(33,324,254)

201,918

(37,212,169)

304,471

(12,640.676)

(17.841,564)

jT) 9,815,148

(392,510)

813,186

(2,066,860)

Note

2

TURNOVER

Administrative expenses

Other operating income

OPERATING LOSS

Profit/(loss) on disposal of players' registrations

Interest payable and similar charges

LOSS ON ORDINARY ACTIVITIES BEFORE TAXATION

(2,012,342)

Tax on loss on ordinary activities

LOSS FOR THE FINANCIAL YEAR

(2,585,530)

(2,012,342)

(22,886,464)

All of the activities of the company are classed as continuing.

The company has no recognised gains or losses other than the results for the

year as set out above.

feo^

The notes on pages 9 to 19 form part of these financial statements.

-6-

(20,300,934)

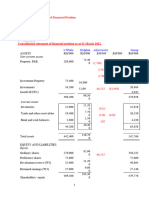

LEEDS UNITED FOOTBALL CLUB LIMITED

BALANCE SHEET

30 JUNE 2015

2015

Note

FIXED ASSETS

Intangible assets

Tangible assets

8

9

CURRENT ASSETS

Stocks

Debtors due within one year

Debtors due after one year

Cash at bank

10

11

11

CREDITORS: Amounts falling due within one year

12

NET CURRENT ASSETS

TOTAL ASSETS LESS CURRENT LIABILITIES

CREDITORS: Amounts falling due after more than one year

13

20

21

21

SHAREHOLDERS' FUNDS/(DEFICIT)

21

These accounts

d by the directors and authorised for issue i

7,891,935

11,412,700

20,505,412

19,304,635

646,015

8,536,446

4,022,701

10,937,672

637,982

8,836,720

12,113,047

24,342,834

(19,797,406)

21,587,749

(18,734,657)

4,545,428

2,853,092

25,050,840

22,157,727

(24,040,965)

19,000,000

6,000,000

(23,990,125)

1,009,875

istrafion Number: 06233875

The notes on pages 9 to 19 form part of these financial statements.

-7-

(35,635,510)

(13,477,783)

4,500,000

4,000,000

(21,977,783)

(13,477,783)

.Z.t?/.!..'.././P., and are signed on their behalf by:

M Cellii

Direct

Compai

9,876,418

10,628,994

1,009,875

CAPITAL AND RESERVES

Called-up equity share capital

Share premium account

Profit and loss account

2014

LEEDS UNITED FOOTBALL CLUB LIMITED

CASH FLOW STATEMENT

YEAR ENDED 30 JUNE 2015

2015

Note

22

NET CASH OUTFLOW FROM OPERATING ACTIVITIES

(7,538,344)

(45,465)

(65,882)

(496,884)

(63.774)

(111,347)

(560,658)

(6,143,390)

(563,804)

10,459,676

(2,302,432)

(666,141)

174,750

3,752,482

(2,793,823)

(6,435,622)

(10,892,825)

8,000,000

2,000,000

4,000,000

4,000,000

75,437

10,967,560

NET CASH OUTFLOW FROM RETURNS ON INVESTMENTS AND SERVICING OF

FINANCE

NET CASH INFLOW/(OUTFLOW) FROM CAPITAL EXPENDITURE

CASH OUTFLOW BEFORE FINANCING

FINANCING

Issue of equity share capital

Share premium on issue of equity share capital

Movement on short-term borrowings

New long-term loans from group undertakings

Repayment of long-term loans from group undertakings

New long-term loans from related parties

Repayment of long-term loans from related parties

Capital element of finance leases

(10,076,757)

RETURNS ON INVESTMENTS AND SERVICING OF FINANCE

Interest paid

Interest element of finance leases

CAPITAL EXPENDITURE

Payments to acquire intangible fixed assets

Payments to acquire tangible fixed assets

Receipts from sale of fixed assets

2014

(325,446)

NET CASH INFLOW FROM FINANCING

(DECREASE)/INCREASE IN CASH

23

(4,274,581)

(139.726)

5,374,581

(1,572,000)

(98,595)

5,260,247

22,746,983

(1,175,375)

11,854,158

The notes on pages 9 to 19 form part of these financial statements.

-8-

LEEDS UNITED FOOTBALL CLUB LIMITED

NOTES TO THE FINANCIAL STATEMENTS

YEAR ENDED 30 JUNE 2015

1.

ACCOUNTING POLICIES

Basis of accounting

The financial statements have been prepared under the historical cost convention and in accordance with applicable

accounting standards.

At 30 June 2015 the company had net assets of 1,009,875 (2014 13,477,783 net liabilities) and net current assets after

deducting debtors due after more than one year of 522,727 (2014: 2,853,092). The directors have prepared and

reviewed forecasts and, as part of their assessment of the going concern status of the company, they have received

written confirmation from both Mr Massimo Cellino and other group companies stating that amounts payable will not be

called in for a period of no less than twelve months from approval of the financial statements. As a result, the directors

consider that it is appropriate to prepare the accounts on the going concern basis.

Turnover

Turnover represents income receivable from football and related commercial activities, exclusive of VAT. Gate receipts

and other match day revenue are recognised as the games are played. The club also receives central distributions from

the Football League and a solidarity payment from the Premier League that are beyond the direct control of the officers of

the club. These distributions are recognised evenly over the course of the financial year.

Revenue derived from season tickets is credited to income in the period to which it relates. Amounts received in advance

are credited to deferred income in the balance sheet.

Sponsorship, advertising and similar commercial income is recognised over the duration of the respective contracts.

Amounts received in advance are credited to deferred income in the balance sheet.

Facility fees received for live coverage or highlights are taken when earned.

Intangible fixed assets - goodwill

Goodwill relating to the football club is being amortised in equal instalments over 50 years based on the longevity of the

club and the strength of the brand, all other goodwill is amortised over a 20 year period. Goodwill is reviewed annually to

ensure that it is not impaired.

Intangible fixed assets - player registrations

In line with FRS 10: Goodwill and intangible assets, the costs associated with the acquisition of players' registrations are

capitalised as intangible fixed assets and amortised, in equal annual instalments, over the period of the respective

players' contract. The transfer fee levy refund received during the year is credited against additions to intangible assets.

Players' registrations are written down for impairment when the carrying amount exceeds the amount recoverable

through use or sale.

Intangible fixed assets - trademarks

Trademarks are being amortised in equal annual instalments over 10 years.

Tangible fixed assets

Depreciation is calculated so as to write off the cost of an asset, less its estimated residual value, over the useful

economic life of that asset as follows:

Alterations and improvements

Fixtures and fittings

Leasehold land and buildings

2 - 2 0 years straight line

1-20 years straight line

0 - 3 4 years straight line

Assets under the course of construction are not depreciated until they are brought into productive use.

Stocks

Stocks, which comprise goods for resale, are stated at the lower of cost and net realisable value.

Leases

Assets under finance leases and hire purchase contracts are capitalised at their fair value on the inception of the lease

and depreciated over their estimated useful life. Finance charges are allocated evenly over the period of the lease in

proportion to the capital amount outstanding.

Operating lease rentals are charged to profit and loss in equal amounts over the term of the lease.

-9-

LEEDS UNITED FOOTBALL CLUB LIMITED

NOTES TO THE FINANCIAL STATEMENTS

YEAR ENDED 30 JUNE 2015

1.

ACCOUNTING POLICIES (continued)

Pension costs

For defined contribution schemes the pension cost charged in the year represents contributions payable by the group to

various pension schemes. For defined benefit schemes the expected cost of providing pensions, as calculated

periodically by professionally qualified actuaries, is charged to the profit and loss account so as to spread the cost over

the service lives of employees in such a way that the pension cost is a substantially level percentage of current and

expected future pensionable payroll.

Deferred taxation

Deferred tax is provided in full on timing differences which result in an obligation at the balance sheet date to pay more

tax, or a right to pay less tax, at a future date, at rates expected to apply when they crystallise based on current tax rates

and law. Timing differences arise from the inclusion of items of income and expenditure in tax computations in periods

different from those in which they are included in the financial statements. Deferred tax is not provided on timing

differences arising from the revaluation of fixed assets where there is no commitment to sell the asset, or on unremitted

earnings of subsidiaries and associates where there is no commitment to remit there earnings. Deferred tax assets are

recognised to the extent that it is regarded as more likely than not that they will be recovered. Deferred tax assets and

liabilities are not discounted.

Foreign currencies

Assets and liabilities in foreign currencies are translated into sterling at the rates of exchange ruling at the balance sheet

date. Transactions in foreign currencies are Iranslated into sterling at the rate of exchange ruling at the date of the

transaction. Exchange differences are taken into account in arriving at the operating profit.

Signing-on fees

Signing-on fees represent a normal part of the employment cost of the player and as such are to be charged to the profit

and loss account over the term of the contract, except in the circumstances of a player disposal. In that case, any

remaining signing-on fees due are allocated in full against the profit on disposal of players' registrations in the year in

which the player disposal is made.

2.

TURNOVER

All relates to the principal activity of operating a professional football club and arises from activities within the UK.

Gate receipts

Television and broadcasting income

Merchandising income

Central distributions

Other commercial revenue

10-

2015

8,761,296

270,400

4,656,646

4,098,500

6,632,113

2014

8,561,702

406,750

5,513,681

4,127,800

6,680,597

24,418,955

25,290,530

LEEDS UNITED FOOTBALL CLUB LIMITED

NOTES TO THE FINANCIAL STATEMENTS

YEAR ENDED 30 JUNE 2015

3.

OPERATING LOSS

Operating loss is stated after charging/(crediting):

Amortisation of intangible assets

Impairment of intangible fixed assets

Depreciation of owned fixed assets

Depreciation of assets held under finance lease agreements

Loss/(Profit) on disposal of fixed assets

Operating lease costs:

- Plant and equipment

- Other

Net profit on foreign currency translation

Impairment of Yorkshire Radio Limited inter-company debtor

Auditor's remuneration - audit of the financial statements

Auditor's remuneration - other fees

2015

3,160,653

353,727

1,277,723

69,000

2014

786

2,949,634

770,372

1,299,878

92,000

(5,549)

1,983,583

(181,910)

11,950

19,500

27,617

8,000

1,945,914

(120,057)

154,070

19.500

12,750

2014

19,500

19,500

13,885

5,330

5,000

3,402

1,000

2015

Auditor's remuneration - audit of the financial statements

Auditor's remuneration - other fees:

- Taxation services

- Corporate finance services

- Interim review

- Secretarial work

27,617

4.

11,750

12,750

PARTICULARS OF EMPLOYEES

The average number of staff employed by the company during the financial year amounted to:

2015

No

Players

Apprentices

Football team management"itxc

Management/administration ''Oo '

Casual match day staff

2014

No

44

52

12

12

69

351

382

496

564

19

12

107

The aggregate payroll costs of the above were:

2015

Wages and salaries - Ocv

Social security costs

Other pension costs

Included in wages and salaries are redundancy and ex-gratia p

11.

2014

17,781,412

2,039,694

26,633

20,117,561

2,192,700

59,845

19,847,739

22,370,106

of 1,173.591 (2014: 1,158,622).

LEEDS UNITED FOOTBALL CLUB LIMITED

NOTES TO THE FINANCIAL STATEMENTS

YEAR ENDED 30 JUNE 2015

5.

DIRECTORS' REMUNERATION

The directors' aggregate remuneration in respect of qualifying services were:

Aggregate remuneration

Pension contributions

2015

16,667

2014

514,397

7,500

16,667

.s fvc^r^

Or-O*^ ^ ^^Ss Vs^^-T=

521,897

OrAsA

^

* "V

Remuneration of highest paid director:

e-ost

f>c ^ cA>r<*<

\>-r ?Sc

^pf^^uL

*

2015

t ^A^,

Aggregate remuneration (excluding pension ^^

contributions) Vs*^

2014

394,043

16,667

None of the directors were accruing benefits under a defined contribution pension scheme (2014: one).

6.

INTEREST PAYABLE AND SIMILAR CHARGES

Finance charges

Interest on other loans

<^vvVX^

GjPr\5

65,882

(879,068)

2014

63,774

2,003,086

(813,186)

2,066,860

During the year, the loans from GFH Capital Limited were restated, and interest of 914,369 previously accrued was

reversed.

7.

TAXATION ON ORDINARY ACTIVITIES

(a) Analysis of charge in the year

2015

2014

Total current tax

Deferred tax:

Origination and reversal of timing differences

Losses

2,585,530

(b) Factors affecting current tax charge

The tax assessed on the loss on ordinary activities for the year is higher than the standard rate of corporation tax in the

UK of 20.75% (2014 - 22.50%).

2015

Loss on ordinary activities before taxation

Loss on ordinary activities by rate of tax

Expenses not deductible for tax purposes

Depreciation in excess of capital allowances

Intercompany write offs

Short term timing differences and losses not utilised

2014

(2,012,342)

(20,300,934)

(417,561)

10,531

(4,567,710)

173,368

186,993

220,037

850,474

34,666

3,509,202

Total current tax (note 7(a))

(c) Factors that may affect future tax charges

The company has losses of approximately 68 million (2014: 64 million) to carry forward against future profits.

,'v-

-12-

LEEDS UNITED FOOTBALL CLUB LIMITED

NOTES TO THE FINANCIAL STATEMENTS

YEAR ENDED 30 JUNE 2015

8.

INTANGIBLE FIXED ASSETS

Player

registrations

Goodwill

Trademarks

COST

AtUuly2014

Additions

Disposals

5,984,321

10,398

6,605,070

6,143,390

(3,094,497)

12,600,419

6,143,390

(3,094,497)

At 30 June 201 5

5,984,321

10,398

9,654,593

15,649,312

AMORTISATION

At 1 July 201 4

Charge for the year

Impairment for the year

On disposals

815,276

119,955

4,506

1,040

3,888,702

3,039,658

353,727

(2,449,970)

4,708,484

3,160,653

353,727

(2,449,970)

At 30 June 201 5

935,231

5,546

4,832,117

5,772,894

NET BOOK VALUE

At 30 June 2015

5,049,090

4,852

4,822,476

9,876,418

At 30 June 201 4

5,169,045

5,892

2,716.998

7,891,935

Total

Following a review of the playing squad at the year end and the subsequent release of several players the Directors have

taken the decision to impair the value of several members of the First Team squad. A total of 353,727 (2014: 770,372)

has been charged to the profit and loss in respect of this impairment.

9.

TANGIBLE FIXED ASSETS

Leasehold land

and buildings

Alterations and

improvements

Fixtures and

fittings

Total

COST

At 1 July 2014

Additions

Disposals

2,150,654

36,012

12,057,196

290,786

3,812,729

237,006

(1,966)

18,020,579

563,804

(1,966)

At 30 June 2015

2,186,666

12,347,982

4,047,769

18,582.417

DEPRECIATION

At 1 July 2014

Charge for the year

On disposals

217,026

116,649

3,638,780

869,747

2,752,073

360,327

(1.179)

6,607,879

1,346,723

(1,179)

At 30 June 2015

333,675

4,508,527

3,111,221

7,953,423

NET BOOK VALUE

At 30 June 2015

1,852,991

7,839,455

936,548

10,628.994

At 30 June 2014

1,933,628

8,418,416

1,060,656

11,412,700

The company has an option to acquire land adjacent to Lowfields Road from Leeds City Council that would be required to

complete the East Stand Development for which planning consent is in place. The option will expire on 31 October 2016.

The directors have reviewed the net book value of both the tangible and intangible fixed assets and are satisfied that they

are not impaired other than as described in note 8.

13-

LEEDS UNITED FOOTBALL CLUB LIMITED

NOTES TO THE FINANCIAL STATEMENTS

YEAR ENDED 30 JUNE 2015

9.

TANGIBLE FIXED ASSETS (continued)

Finance lease agreements

Included within the net book value of 10,628,994 is 172,000 (2014 - 381,000) relating to assets held under finance

lease agreements. The depreciation charged to the financial statements in the year in respect of such assets amounted

to 69,000 (2014-92,000).

10.

STOCKS

Goods held for resale

11.

DEBTORS

Trade debtors

Amounts owed by group undertakings

Transfer fee debtors-**^

Other debtors

Prepayments and accrued income , C^0iS^VjV-f ^>

2015

2,824,307

4 4,022,701

Cfi

902,001

^

245,528

f^4,564,610

2014

2,687,019

4,228,250

202,950

298,801

1,419,700

8,836,720

The debtors above include the following amounts falling due after more than one year:

2014

Amounts owed by group undertakings

12.

CREDITORS: Amounts falling due within one year

2015

dboVv-;

Transfer fee creditors

Of

4ocv-s ferS

Amounts owed to related parties

Trade creditors

Amounts owed to group undertakings

Taxation and social security

t^jogCS 4- ^ ^

Finance lease agreements

Other creditors

Accruals and deferred income

2,247,294

1,000,000

4,332,939

802,166-V

920,273

86,916

439,616

9,968,202

19,797,406

2014

1,197,658

222,984

4,319,891

688,600

1,860,946

156,239

356,445

9,931,894

18,734,657

-V.C.E

' .-..

Included in accruals and deferred income is 4,969,132 (2014: 7,059,000) representing advance payment of tickets and

sponsorship that would only become a liability of the company should it fail to fulfill all of its fixtures for future seasons.

Included in accruals and deferred income is an advance payment of 900,000 (2014: 1,300,000) which is secured by a

fixed and floating charge over all the company's assets.

Obligations under finance leases are secured on the related assets

As at 30 June 2015 there was a convertible loan due to Sport Capital Limited totalling 160,479 (2014: 147,984). A

conversion notice had not been issued as at 30 June 2015.

-14-

LEEDS UNITED FOOTBALL CLUB LIMITED

NOTES TO THE FINANCIAL STATEMENTS

YEAR ENDED 30 JUNE 2015

13.

CREDITORS: Amounts falling due after more than one year

2015

Amounts owed to group undertakings

Finance lease agreements

Transfer fee creditors

Pension (note 16)

Amounts owed to related parties

Accruals and deferred income

2014

4,142,114

62,597

2,880,802

405,452

16,000,000'

550,000

10,967,560

133,000

129,000

317,000

22,188,950

1,900,000

24,040,965

35,635,510

Obligations under finance leases are secured on the related assets.

14.

CREDITORS - CAPITAL INSTRUMENTS

Creditors include finance capital which is due for repayment as follows:

2015

Amounts repayable:

In more than one year but not more than two years

In more than two years but not more than five years

In more than five years

2014

1,000,000

3,000,000

12,000,000

2,000,000

8,500,000

16,000,000

10,500,000

Amounts owed to related parties represent shareholder loans from GFH Capital Limited of which 3,500,000 is repayable

in annual instalments from June 2016 to June 2019. In the event that the club becomes a member of the FA Premier

League prior to 2019, the remaining 13,500,000 will be repayable. If the club does not become a member of the FA

Premier League, the remaining balance is repayable in annual instalments from June 2019 to June 2032. The loans are

unsecured and interest free.

15.

COMMITMENTS UNDER FINANCE LEASE AGREEMENTS

Future commitments under finance lease agreements are as follows:

2015

2014

Amounts payable within 1 year

Amounts payable between 2 to 5 years

128,794

100,990

214,999

203,426

Less interest and finance charges relating to future periods

229,784

(80,271)

418,425

(129,186)

149,513

289,239

86,916

62,597

156,239

133,000

149,513

289,239

Finance lease agreements are analysed as follows:

Current obligations

Non-current obligations

-15-

LEEDS UNITED FOOTBALL CLUB LIMITED

NOTES TO THE FINANCIAL STATEMENTS

YEAR ENDED 30 JUNE 2015

16.

PENSIONS

Defined contribution schemes

Certain professional footballing staff are members of the Football League Players Retirement Income Scheme, a

non-contributory defined contribution scheme. In addition the company operates a defined contribution scheme open to

all other employees. Costs of all defi ned contribution schemes, totalling 26,633 (2014: 48,000), have been charged to

the profit and loss account in the year.

Defined benefit scheme

Certain other professional footballing staff are members of the Football League Limited Pension and Life Assurance

Scheme ("FLLPLAS"), a defined benefit scheme. Under FRS 17: Retirement Benefits, the FLLPLAS would be treated as

a defined benefit multi-employer scheme. The assets of the scheme are held separately from those of the company,

being invested with insurance companies. Sufficient information is not available for full FRS 17 disclosure.

Following a review of the Minimum Funding Requirement ("MFR") of the FLLPLAS, accrual of benefits of the final salary

section of the scheme was suspended as at 31 August 1999. In light of the exceptional circumstances affecting the

scheme, the trustees of the scheme commissioned an independent actuary's report on the MFR position and a

substantial deficit was identified. Under the Pensions Act 1985, participating employers will be required to contribute to

the deficiency. The latest actuarial valuation of the scheme was carried out as at 31 August 2014 and resulted in a

charge to the profit and loss account of 172,946 The allocation of the deficit under this valuation is repayable at 6,465

per month effective from 1 September 2015.

17.

COMMITMENTS UNDER OPERATING LEASES

At 30 June 2015 the company had annual commitments under non-cancellable operating leases as set out below.

2015

Land and

buildings

Operating leases which expire:

Within 1 year

Within 2 to 5 years

After more than 5 years - L\\CXM\

^\Vonp M^'

18.

35,090

1 ,994,798

2,029,888

Other Items

84,410

4,614

89,024

2014

Land and

buildings

Other Items

35,000

1,943.000

56,000

4,000

4,000

1,978,000

64,000

CONTINGENCIES

In the event of the club becoming a member of the FA Premier League before the 2017/18 Season a liability of

4,750,000 (2014: 4,750,000) will become payable to the liquidator of Leeds United Association Football Club Limited

under the provision of the sale agreement entered into on 4 May 2007.

Under the terms of the financial provisions relating to transfer of player registrations, future payments of up to 1,197,620

(2014: 1,062,000) may be payable dependent on the club's promotion to the FA Premier League and/or players

appearances for the club. Promotion to the FA Premier League may also incur bonuses payable of 8,321,284 (2014:

6,170,000) conditional on the performance of both players and football management throughout the 2015/16 season.

At the year end there were a number of legal claims and various claims from H M Revenue and Customs outstanding

against the company. These claims are being challenged by the directors and so there is significant uncertainty over their

outcome. For this reason no provision has been included in the balance sheet.

LEEDS UNITED FOOTBALL CLUB LIMITED

NOTES TO THE FINANCIAL STATEMENTS

YEAR ENDED 30 JUNE 2015

19.

RELATED PARTY TRANSACTIONS

Transactions with fellow subsidiaries of Eleonora Sport Limited

Yorkshire Radio Limited was advanced 11,950 (2014: 154,070) by Leeds United Football Club Limited. The year end

trading balance arising from this transaction was 1 1 ,950 (2014: 154,070) Yorkshire Radio Limited was dissolved on 20

October 2015 and so the directors of Leeds United Football Club Limited have taken the decision to fully impair the year

end balance.

Leeds United Media Limited advanced 113.566 (2014: 219,568) to Leeds United Football Club Limited. The year end

balance due to Leeds United Media Limited was 802,166 (2014: 688,600).

Leeds United Centenary Pavilion Limited charged 250,000 (2014: 250,000) to Leeds United Football Club Limited and

was advanced 2,950 (2014: nil) by Leeds United Football Club Limited. The year end balance due from Leeds United

Centenary Pavilion Limited was 1,837,600 (2014: 2,085,650).

Leeds City Holdings Limited was charged 42,500 (2014: 13,309,600) by Leeds United Football Club Limited. The year

end balance due from Leeds City Holdings Limited was 2,185,100 (2014: 2,142,600).

Transactions with shareholders

On 6 February 2014 the balances of 11,272,399 due to Brendale Holdings Limited and 2,012,807 due to Berrydale

Seventh Sport Holdings Limited were assigned to GFH Capital Limited. During the year, interest was charged on these

loans totalling Enil (2014: 1,506,201). Also the balance due to Envest Limited of 1,708,231 was assigned to GFH

Capital Limited. During the period interest of Enil (2014: 25,245) was charged on this loan. Envest Limited was a related

party due to its connection to Mr S S Nooruddin, a former director. During the year a repayment of 3,000,000 was made

to GFH Capital Limited. Interest of 914,369 previously accrued was deducted from this loan during the year as it is no

longer payable. At 30 June 2015 the remaining balance on this loan due to GFH Capital Limited was 17,000,000 (2014:

20,914,369) At the year end interest of Enil (2014: 319,623) had accrued on this balance

The company repaid 281,357 (2014: 8,428,192 advanced) to Eleonora Sport Limited, the immediate parent company.

During the year 6,500,000 (2014: Enil) of debt was converted into 6,500,000 1 ordinary shares. At 30 June 2015 the

balance due to Eleonora Sport Limited was 1,646,834 (2014: 8,428,192).

The company repaid 44.089 (2014: 2,539,369 advanced) to Eleonora Immobiliaire SpA. At the year end the balance

due to Eleonora Immobiliaire SpA was 2,495,280 (2014: 2,539,369) Eleonora Immobiliaire SpA is related by virtue of

its shareholding in Eleonora Sport Limited.

.

Transactions with other related parties

The company made payments totalling 1.311,183 (2014: Enil) to Mr Massimo Cellino, a director and received advances

of 31,034 (2014: 1,274,581). At 30 June 2015 a balance of 5,568 (2014: Enil), included in other debtors, was due from

Mr Cellino and a balance of Enil (2014: 1,274,581), included in amounts due to related parties, was due to Mr Cellino.

The maximum overdraft balance during the year was 36,602 The loan is unsecured, interest free and repayable on

demand.

The company was charged 32,809 (2014: Enil) by Oakwell Capital Limited for services provided prior to Mr Andrew

Umbers being appointed a director. At 30 June 2015 the balance due to Oakwell Capital Limited was 10,261 (2014:

Enil). Oakwell Capital Limited is a related party by virtue of the common Directorship of Mr Andrew Umbers.

20.

SHARE CAPITAL

Allotted, called up and fully paid:

Ordinary shares of 1 each

2015

No

19,000,000

19,000,000

2014

No

4,500,000

4,500,000

On 27 May 2015 a debt of 6,500,000 was converted to share capital by the issue of 6,500,000 1 Ordinary Shares at 1

per share. A further 3.000,000 1 Ordinary Shares were also issued on 27 May 2015 at 1.67 per share for cash

consideration. On 12 June 2015 a further 5,000,000 1 Ordinary Shares were issued at 1 per share for cash

consideration.

ZSA

-17-

cx

LEEDS UNITED FOOTBALL CLUB LIMITED

NOTES TO THE FINANCIAL STATEMENTS

YEAR ENDED 30 JUNE 2015

21.

RECONCILIATION OF SHAREHOLDERS' FUNDS AND MOVEMENT ON

RESERVES

Balance brought forward

Loss for the year

Other movements

New equity share capital

subscribed

22.

23.

Share capital

500,000

Share premium

account

Profit and loss Total share-holders'

account

funds

908,681

1,408,681

(22,886,464)

(22,886,464)

4,000,000

4,000,000

4,500,000

-

4,000,000

(21,977,783)

(2,012,342)

8,000,000

Balance brought forward

Loss for the year

Other movements

New equity share capital

subscribed

14,500,000

2,000,000

16,500,000

Balance carried forward

19.000,000

6,000,000

(23,990,125)

1,009,875

(13,477,783)

(2,012,342)

RECONCILIATION OF OPERATING LOSS TO

NET CASH OUTFLOW FROM OPERATING ACTIVITIES

Operating loss

Amortisation and impairment

Depreciation

Loss/(Profit) on disposal of fixed assets

(lncrease)/decrease in stocks

Increase in debtors

Increase in creditors

2015

(12,640,676)

3,514,380

1,346,723

786

(208,033)

(3,722,427)

1,632,490

2014

(17,841,564)

3,720,006

1,391,878

(5,549)

804,070

(2,650,860)

7,043,675

Net cash outflow from operating activities

(10,076,757)

(7,538,344)

RECONCILIATION OF NET CASH FLOW TO MOVEMENT IN NET DEBT

2015

(1,175,375)

(Decrease)/increase in cash in the period

2014

11,854,158

Movement in short-term borrowings

Net cash outflow from/(inflow) from long-term loans from group undertakings

Cash outflow in respect of finance leases

Cash outflow from/(inflow) from long-term loans from related parties

4,274,581

(10,967,560)

98,595

(3,802,581)

Change in net debt resulting from cash flows

Other non-cash changes in net debt

3,564,378

7,637,353

(2,892,825)

(16,814,369)

Movement in net debt in the period

Net debt at 1 July 2014

11,201,731

(21,555,686)

(19,707,194)

(1,848,492)

Net debt at 30 June 2015

(10,353,955)

(21,555,686)

-18-

(75,437)

325,446

139,726

LEEDS UNITED FOOTBALL CLUB LIMITED

NOTES TO THE FINANCIAL STATEMENTS

YEAR ENDED 30 JUNE 2015

24.

ANALYSIS OF CHANGES IN NET DEBT

At

1 Jul 2014

Cash flows

Net cash:

Cash in hand and at bank

12,113,047

(1,175,375)

Debt:

Debt due with 1 year

Debt due after 1 year

Finance lease agreements

(222,984)

(33,156,510)

(289,239)

4,600,027

139,726

(33,668,733)

(21,555,686)

Net debt

Other changes

At

30 Jun2015

10,937,672

(777,016)

8,414,369

(1,000,000)

(20,142,114)

(149,513)

4,739,753

7,637,353

(21,291,627)

3,564,378

7,637,353

(10,353,955)

Other changes in net debt relate to the conversion of 6,500,000 debt into share capital (see note 20) and the reversal of

914,369 loan interest previously accrued (see note 19).

25.

POST BALANCE SHEET EVENTS

On 3 July 2015 the company terminated its contract with Compass Services (UK) Ltd to provide catering services. The

company was required to repay 900,000 of monies received in advance to Compass Services (UK) Ltd in addition to an

exit fee of 125,000.

^fl- \o f^c.

26.

ULTIMATE CONTROLLING PARTY

Trust Sporting 2006, a trust registered in Italy, is the ultimate controlling party and Eleonora Sport Limited is the

immediate parent company.

off

Você também pode gostar

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Finacial Analysis of Nagpur Nagrik Sahakari Bank 100Documento77 páginasFinacial Analysis of Nagpur Nagrik Sahakari Bank 100Shriya MehrotraAinda não há avaliações

- BusCom Intercompany SalesDocumento18 páginasBusCom Intercompany SalesCarmela BautistaAinda não há avaliações

- Accounting For Business Combination - AssessmentsDocumento114 páginasAccounting For Business Combination - AssessmentsArn KylaAinda não há avaliações

- Valuation of GoodwillDocumento16 páginasValuation of GoodwillManas Maheshwari100% (1)

- Ind AS 105Documento16 páginasInd AS 105JyotiAinda não há avaliações

- Tutorial 4 Consolidated FS I (CBS) (A)Documento10 páginasTutorial 4 Consolidated FS I (CBS) (A)fooyy8Ainda não há avaliações

- On January 1 2013 Lessard Acquired 80 of The Share PDFDocumento1 páginaOn January 1 2013 Lessard Acquired 80 of The Share PDFhassan taimourAinda não há avaliações

- Partnership DissolutionDocumento9 páginasPartnership DissolutionKyla DizonAinda não há avaliações

- Ford Motor Company-Issuer-Jp Morgan Trustee-Trust IndentureDocumento49 páginasFord Motor Company-Issuer-Jp Morgan Trustee-Trust IndentureAlex G Stoll100% (1)

- Macbj20 4Documento14 páginasMacbj20 4AryanAinda não há avaliações

- A Project Report ON Trend Analysis of L.G. ElectronicsDocumento26 páginasA Project Report ON Trend Analysis of L.G. ElectronicsRajendra NikamAinda não há avaliações

- Australian Financial Accounting 7Th Edition Deegan Test Bank Full Chapter PDFDocumento67 páginasAustralian Financial Accounting 7Th Edition Deegan Test Bank Full Chapter PDFsarahpalmerotpdkjcwfq100% (13)

- Roadmap - Business Combinations - DeloitteDocumento286 páginasRoadmap - Business Combinations - DeloitteAlycia SkousenAinda não há avaliações

- Impairment of Assets: Cconceptual Framework and Reporting StandardDocumento4 páginasImpairment of Assets: Cconceptual Framework and Reporting StandardMeg sharkAinda não há avaliações

- I-Theories: Intangibles & Other AssetsDocumento19 páginasI-Theories: Intangibles & Other Assetsaccounting filesAinda não há avaliações

- P5 Syl2012 Set1Documento25 páginasP5 Syl2012 Set1Muhammed Nuz-hadAinda não há avaliações

- Accounting For Business Combinations FinalDocumento66 páginasAccounting For Business Combinations FinalLisa PorjeoAinda não há avaliações

- Consolidated Retained Earnings, January 1, 20x4Documento12 páginasConsolidated Retained Earnings, January 1, 20x4Lala FordAinda não há avaliações

- Fair Value Accounting, Financial Economics and The Transformation of ReliabilityDocumento15 páginasFair Value Accounting, Financial Economics and The Transformation of ReliabilityThe SalsaAinda não há avaliações

- MCR MCQDocumento28 páginasMCR MCQPritesh Ranjan SahooAinda não há avaliações

- p1 & AP - IntangiblesDocumento13 páginasp1 & AP - IntangiblesJolina Mancera100% (3)

- Example 8: Appendix - Answers To Examples and End-Of-Chapter QuestionsDocumento8 páginasExample 8: Appendix - Answers To Examples and End-Of-Chapter QuestionsDewan Mahid Raza ChowdhuryAinda não há avaliações

- Afar 08Documento14 páginasAfar 08RENZEL MAGBITANGAinda não há avaliações

- Xii Accountancy Study Mati.Documento75 páginasXii Accountancy Study Mati.Maruko ChanAinda não há avaliações

- Saint Hood Convent School Assignment Ch.3 (Change in Profit Sharing Ratio Among The Existing Partners)Documento3 páginasSaint Hood Convent School Assignment Ch.3 (Change in Profit Sharing Ratio Among The Existing Partners)Abhishek SharmaAinda não há avaliações

- Jurnal Eliminasi Dan Penyesuaian P5.1Documento7 páginasJurnal Eliminasi Dan Penyesuaian P5.1Rizqi Shofia Az ZahraAinda não há avaliações

- Slides Higgins 11e CH 1Documento18 páginasSlides Higgins 11e CH 1Huy NguyễnAinda não há avaliações

- Int. Acctg. 3 - Valix2019 - Chapter 3Documento12 páginasInt. Acctg. 3 - Valix2019 - Chapter 3Toni Rose Hernandez Lualhati100% (1)

- Q.1 What Is Meant by Reconstitution of Partnership Firm?: New Ratio 11:7:6Documento24 páginasQ.1 What Is Meant by Reconstitution of Partnership Firm?: New Ratio 11:7:6SUSHANTAinda não há avaliações