Escolar Documentos

Profissional Documentos

Cultura Documentos

AC05

Enviado por

shreyas_devangaDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

AC05

Enviado por

shreyas_devangaDireitos autorais:

Formatos disponíveis

UNIT 5 COMPLETING THE ACCOUNTING CYCLE

Free Quick Notes books

Free Business Textbooks

provide help for accounting,

Library covers many subjects. I. ACCOUNTING STATEMENTS economics, statistics, and

basic mathematics.

Quick Clean Laundry Service

Balance Sheet

September 30, 1991 Now that Financial Statements have been made, amounts

temporarily stored in expense, revenue, and the withdrawals

ASSETS accounts may be moved to the equity account. A new account

Current Assets: entitled Income Summary will be used to calculate income

Cash $117 which will then be moved to Owner's Equity.

Accounts Receivable 35

Prepaid Advertising 40

Laundry Supplies 5

Plant and Equipment:

Laundry Equipment $48

Less Accumulated ---1.

Depreciation -fl

Total Assets $244 Quick Clean Laundry Service

Income Statement

LIABILITIES For the Month Ended Sept. 30, 1991

Current Liabilities:

Accounts Payable $ 30 Revenue:

Salaries Payable 10 Laundry Revenue $190

Unearned Laundry Revenue ---1..Q.

Total Current Liabilities $ 50 Operating Expenses:

Washer/Dryer Expense $75

OWNER'S EQUITY Telephone Expense 10

Advertising Expense 10

Capital Sept.1 $150 Laundry Supply Expense 20

Income $64 Depreciation Expense 1

Withdrawals -2.Q. ~ SalariesExpense 1.Q.

Capital Sept. 30 ~ Total Operating Expenses ~

Total Liabilities + Net Income $ 64

Owner's Equity $244

II. CLOSING PROCESS LOGIC III. CLOSING JOURNAL ENTRIES

DR. CR.

Step 1 Reduce Expenses to zero Sept. 30 Income Summary 126

Step 2 Reduce Revenues to zero Washer/Dryer Expense 75

Step 3 Reduce Income Summary to zero Telephone Expense 10

Step 4 Reduce Withdrawals to zero Advertising Expense 10

Laundry Supply Expense 20

Owner 1 s Equity Depreciation Expense 1

(4) 20 Bal. 150 Salaries Expense 10

I

(3) 64

Sept. 30 Laundry Revenue 190

Income Summary 190

Withdrawals

Income Summary Sept. 30 Income Summary 64

Bal. 20 I (4) 20

Capital, Darin Jones 64

(1)126

(3) 64

I (2) 190

~es Revenue Sept. 30 Capital,Darin Jones 20

20

Bal. 126 I (1) 126 (2)190 IBal. 190 Withdrawals, Darin Jones

IV. POST-CLOSING TRIAL BALANCE

Quick Clean Laundry Service

Our 28 Free Internet Libraries

Post-Closing Trial Balance have academic and career

September30, 1991

materials for students,

Cash $117 teachers, and professional.

Accounts Receivable 35

Prepaid Advertising 40

Laundry Supplies 5 Note: The closing of all ex-

Laundry Equipment 48 pense and revenue accounts

Accumulated Depreciation, results in a Post-Closing

Laundry Equipment $ 1 Trial Balance consisting of

Accounts Payable 30 only Balance Sheet accounts.

Salaries Payable 10

Unearned Laundry Revenue 10

Capital, Darin Jones ~ Business Software Library

$245 $245

has free accounting, math

24

and statistics software.

v. REVERSmG ENTRIES

Adjusting entries sometimes require a unique nonroutine entry early in the next cycle to complete a particular

transaction. The September 30th payroll adjustment of $10 to Salaries Expense and Salaries Payable associated

with the $15 weekly payroll is an example. A unique entry must be made on the October 2nd payday to complete

the payroll. Reversing the September 30 adjustment on October 1 will allow the regular payroll entry on October 2

to complete the payroll. Regardless of the alternative chosen, $10 is charged to Salaries Expense in September,

$5 in October, and the salary liability has been brought to zero.

Paying Salaries- No Reversing

Entry Paying SalarJ.es - ReversingEntry

DR. CR.

DR. CR.

Sept. 30 SalariesExpense 10 Sept. 30 Salaries Expense 10

Salaries Payable 10 Salaries Payable 10

Oct. 2 SalariesExpense 5 Oct. 1 Salaries Payable 10

SalariesPayable 10 Salaries Expense 10

Cash 15 Oct. 2 Salaries Expense 15

Cash 15

VI. CORRECTING ENTRIES

Erasing is never allowed. A line may be drawn through journal entry errors discovered before

posting. After posting, errors must be corrected with journal entries. If a $5 purchase of Laundry

Supplies had been posted to Laundry Equipment, the following Correcting Entry would be necessary:

DR. CR.

Oct. 5 Laundry Supplies 5

Laundry Equipment 5

VII. THE THIRTEEN ACCOUNTING STEPS

1. Journal Entries 4. Adjusting Entries 9. Closing Entries 12. Reversing

2. Post to Ledger 5. Post to Ledger 7. Income Statement 10. Post to Ledger Entries

3. Trial Balance 6. Adjusted Trial 8. Balance Sheet 11. Post-Closing Trial 13. Correcting

Balance Balance Entries

VIII. OWNER I S EQUITY VS. STOCKHOLDERS I EQUITY

Sole proprietorships and partnerships account for Owner's Equity in essentially the same manner, only the number

of capital and withdrawal accounts differ. Corporations, on the other hand, replace the capital account with contributed

capital (stock) accounts, use dividends to distribute equity to owners, and accumulated undistributed profits in the

Retained Earnings account. September's equity transactions for Quick Clean contrasting a sole proprietorship with

a corporation appear below. Also contrasted are the equity sections of the Balance Sheet.

STARTING A BUSINESS

DR. CR. DR. CR.

Cash 150 Cash 150

150 Comnon Stock 150

Capital,Darin Jones

Issued 150 shares of

$1 par Common Stock.

RECORDING EARNINGS

Income SUI!UTlary 64 Income SUI!UTlary 64

64 Retained Earnings 64

Capital, Darin Jones

DISTlUBUTING EARNINGS

Withdrawals,Darin Jones 20 Retained Earnings 20

Cash 20 Dividend Payable 20

Declared a 13 1/3<::per

20 share stock dividend.

Capital,Darin Jones 20

Withdrawals,Darin Jones 20 Dividend Payable

Cash 20

EQUITY SECTION OF BALANCE SHEET

OWner's Equity Stockholders

I Equity

Darin Jones, Capital,September1, 1992 $150 Comnon Stock, $1 par 150 shares

Net Income $ 64 authorized and outstanding $150

Withdrawals 2Q. --M Retained Earnings -H

Total Stockholders' Equity S194

Capital,September30 S194

Software Tutorial Internet Library Our Professional Development Resources Center

has material to help with many 25

has material to enhance your career.

popular software programs.

Você também pode gostar

- AC06Documento2 páginasAC06shreyas_devangaAinda não há avaliações

- AC04Documento2 páginasAC04shreyas_devangaAinda não há avaliações

- AC02Documento2 páginasAC02shreyas_devangaAinda não há avaliações

- Acu 1Documento2 páginasAcu 1Ahmad Hussein Enayat (Muhsin)Ainda não há avaliações

- AC07Documento2 páginasAC07shreyas_devangaAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- 1572 - Anantha Narayanan FFS CalculationDocumento1 página1572 - Anantha Narayanan FFS CalculationAnantha NarayananAinda não há avaliações

- Ubicomp PracticalDocumento27 páginasUbicomp Practicalvikrant sharmaAinda não há avaliações

- OB and Attendance PolicyDocumento2 páginasOB and Attendance PolicyAshna MeiAinda não há avaliações

- 3) Uses and Gratification: 1) The Hypodermic Needle ModelDocumento5 páginas3) Uses and Gratification: 1) The Hypodermic Needle ModelMarikaMcCambridgeAinda não há avaliações

- Employee of The Month.Documento2 páginasEmployee of The Month.munyekiAinda não há avaliações

- Leather PuppetryDocumento8 páginasLeather PuppetryAnushree BhattacharyaAinda não há avaliações

- Ode To The West WindDocumento4 páginasOde To The West WindCharis Mae DimaculanganAinda não há avaliações

- Localization On ECG: Myocardial Ischemia / Injury / InfarctionDocumento56 páginasLocalization On ECG: Myocardial Ischemia / Injury / InfarctionduratulfahliaAinda não há avaliações

- Sheetal PatilDocumento4 páginasSheetal PatilsheetalAinda não há avaliações

- Developpments in OTC MarketsDocumento80 páginasDeveloppments in OTC MarketsRexTradeAinda não há avaliações

- Energy Production From Speed BreakerDocumento44 páginasEnergy Production From Speed BreakerMuhammad Bilal67% (3)

- EPMS System Guide For Subcontractor - V1 2Documento13 páginasEPMS System Guide For Subcontractor - V1 2AdouaneNassim100% (2)

- Level of Organisation of Protein StructureDocumento18 páginasLevel of Organisation of Protein Structureyinghui94Ainda não há avaliações

- MEMORANDUM OF AGREEMENT DraftsDocumento3 páginasMEMORANDUM OF AGREEMENT DraftsRichard Colunga80% (5)

- HangersSupportsReferenceDataGuide PDFDocumento57 páginasHangersSupportsReferenceDataGuide PDFIndra RosadiAinda não há avaliações

- 1KHW001492de Tuning of ETL600 TX RF Filter E5TXDocumento7 páginas1KHW001492de Tuning of ETL600 TX RF Filter E5TXSalvador FayssalAinda não há avaliações

- HDO OpeationsDocumento28 páginasHDO OpeationsAtif NadeemAinda não há avaliações

- Quotation - 1Documento4 páginasQuotation - 1haszirul ameerAinda não há avaliações

- Equilibrium of A Rigid BodyDocumento30 páginasEquilibrium of A Rigid BodyChristine Torrepenida RasimoAinda não há avaliações

- The Future of FinanceDocumento30 páginasThe Future of FinanceRenuka SharmaAinda não há avaliações

- Bagian AwalDocumento17 páginasBagian AwalCitra Monalisa LaoliAinda não há avaliações

- Parrot Mk6100 Userguide Zone1Documento100 páginasParrot Mk6100 Userguide Zone1Maria MartinAinda não há avaliações

- Docket - CDB Batu GajahDocumento1 páginaDocket - CDB Batu Gajahfatin rabiatul adawiyahAinda não há avaliações

- (Problem Books in Mathematics) Antonio Caminha Muniz Neto - An Excursion Through Elementary Mathematics, Volume III - Discrete Mathematics and Polynomial Algebra (2018, Springer)Documento647 páginas(Problem Books in Mathematics) Antonio Caminha Muniz Neto - An Excursion Through Elementary Mathematics, Volume III - Discrete Mathematics and Polynomial Algebra (2018, Springer)Anonymous iH6noeaX7100% (2)

- Collecting, Analyzing, & Feeding Back DiagnosticDocumento12 páginasCollecting, Analyzing, & Feeding Back DiagnosticCaroline Mariae TuquibAinda não há avaliações

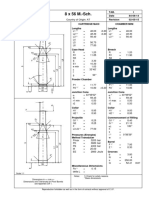

- 8 X 56 M.-SCH.: Country of Origin: ATDocumento1 página8 X 56 M.-SCH.: Country of Origin: ATMohammed SirelkhatimAinda não há avaliações

- Canon I-SENSYS MF411dw Parts CatalogDocumento79 páginasCanon I-SENSYS MF411dw Parts Catalogmarian100% (1)

- Sage TutorialDocumento115 páginasSage TutorialChhakuli GiriAinda não há avaliações

- API RP 7C-11F Installation, Maintenance and Operation of Internal Combustion Engines.Documento3 páginasAPI RP 7C-11F Installation, Maintenance and Operation of Internal Combustion Engines.Rashid Ghani100% (1)

- Chapter1 Intro To Basic FinanceDocumento28 páginasChapter1 Intro To Basic FinanceRazel GopezAinda não há avaliações