Escolar Documentos

Profissional Documentos

Cultura Documentos

MS 1 How Pro Table Is The Indian Stock Market PDF

Enviado por

Palwasha MalikTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

MS 1 How Pro Table Is The Indian Stock Market PDF

Enviado por

Palwasha MalikDireitos autorais:

Formatos disponíveis

Pacic-Basin Finance Journal 30 (2014) 4461

Contents lists available at ScienceDirect

Pacic-Basin Finance Journal

journal homepage: www.elsevier.com/locate/pacfin

How protable is the Indian stock market?

Paresh Kumar Narayan a,, Huson Ali Ahmed a,

Susan Sunila Sharma a, Prabheesh K.P. b

a

b

Financial Econometrics Group, School of Accounting, Economics and Finance, Deakin University, Australia

Department of Liberal Arts, Indian Institute of Technology, Hyderabad, India

a r t i c l e

i n f o

Article history:

Received 17 September 2013

Accepted 4 July 2014

Available online 11 July 2014

JEL classication:

G11

G12

G14

G17

a b s t r a c t

In this paper, using a range of technical trading and momentum

trading strategies, we show that the Indian stock market is protable.

We nd robust evidence that investing in some sectors is relatively

more protable than investing in others. We show that sectoral

heterogeneity with respect to protability is a result of the gradual

diffusion of information from the market to the sectors. Specically,

we show that while the market predicts returns of sectors, the

magnitude of predictability varies with sectors. Our results are robust

to a range of trading strategies.

2014 Elsevier B.V. All rights reserved.

Keywords:

Momentum

Technical trading

Prots

Sectors

Stock market

India

Predictability

1. Introduction

The growth of the Indian stock market over the last decade has been impressive, particularly in terms

of market capitalization, number of listed companies, and turnover rate. Market capitalization as a

percentage of GDP of the National Stock Exchange (NSE), for instance, increased from 35% in 2001 to 85%

in 2011. Similarly, the number of companies listed on the NSE more than doubled over the corresponding

period, from 720 to 1552. Likewise, the turnover on the Indian stock market increased from US$621 billion

Corresponding author at: School of Accounting, Economics and Finance, Faculty of Business and Law, Deakin University, 221 Burwood

Highway, Burwood, Victoria 3125, Australia. Tel.: +61 3 9244 6180; fax: +61 3 9244 6034.

E-mail addresses: paresh.narayan@deakin.edu.au (P.K. Narayan)., huson.aliahmed@deakin.edu.au (H.A. Ahmed).,

s.sharma@deakin.edu.au (S.S. Sharma)., Prabheesh@iith.ac.in (P. K.P.).

http://dx.doi.org/10.1016/j.pacn.2014.07.001

0927-538X/ 2014 Elsevier B.V. All rights reserved.

P.K. Narayan et al. / Pacic-Basin Finance Journal 30 (2014) 4461

45

in 2010 to US$1056 billion in 2011. For all its impressive growth, India achieved a global rank of 7th in

terms of market capitalization, 10th in terms of total value traded, and 22nd in terms of turnover ratio, as

of December 2010 (NSE, 2011).

The impressive growth of the Indian stock market has attracted research on the efciency (or

otherwise) of the market. There are a number of studies that examine the efciency of the Indian stock

market (see, inter alia, Dicle et al., 2010; Kumar et al., 2011; Majumder, 2013; Mishra et al., 2011; Narayan

et al., 2014a,b; and Narayan and Ahmed, in press). There are two ways in which this literature can be taken

forward. First, these studies do not provide an economic signicance analysis with respect to market

efciency or inefciency. Therefore, it is unclear how protable the Indian stock market is. Second, if an

investor wants to invest in the Indian stock market, which sectors should she invest in? This question

remains unanswered in these studies.1

Therefore, from this growing literature on the Indian stock market, there are clearly four things which

are relatively less understood. These are:

1. The Indian stock market may be protable but do prots vary from sector-to-sector?

2. Can investors use different trading strategies to make prots from the Indian stock market? If yes, how

much do the prots vary from sector-to-sector as trading strategies change?

3. Short-selling is a feature of the Indian market; therefore, what effect does short-selling has on sectoral

prots?

4. The most recent global nancial crisis has affected stock markets globally; therefore, has the crisis

affected sectoral prots on the Indian stock market?

To the best of our knowledge, none of these questions has been answered in the literature. Our study

provides the rst attempt at addressing each of these questions. Our approach is as follows. We utilise a

range of technical trading rules and momentum trading rules to identify winners and losers and form

returns for momentum and zero-cost portfolios. We also consider ranking stocks based on moving average

rules and then undertaking long and short positions. Taking long and short positions based on a ranking of

sectors allows an investor to diversify risk and consider a portfolio of sectors in her trading strategy. More

details on our approach are provided in the next section.

2. Approach

2.1. Moving average ranking-based trading strategy

In this section, we consider trading strategies based on moving average rules. The moving average

technical trading rules are popular trading strategies, particularly in the foreign exchange market (see, for

instance, Lee and Mathur, 1996a,b, and Szakmary and Mathur, 1997) and commodity markets (see

Narayan et al., 2013; Narayan et al., 2014b). We begin as follows:

1. We compute the monthly long-run (LR) and short-run (SR) moving averages (MA) using identied

intervals for LR and SR.

2. Using (SRLR) moving average for respective intervals, we rank each of the six sectors, from best (rank

1) to worst (rank 6). The highest positive difference between SRMA and LRMA is assigned a rank of 1,

and the lowest difference between SRMA and LRMA is ranked last.

3. We initiate long positions in high ranked sector(s) and short the sector with the lowest rank. In this

way, we are able to devise three trading strategies (excluding the nave investor strategy), as will be

discussed soon.

4. When we do not allow for short-selling, we simply do not short but allow for cash positions.

1

There is another branch of this literature (Chang et al., 2004), which typically employs simple technical trading rules, such as the

moving average and the trading range break rules. These studies generally nd some evidence of protability. Similarly,

Gunasekarage and Power (2001) and Narayan et al. (2014a) nd evidence that the Indian stock market is protable, although these

studies use different approaches compared to what we do in this paper.

46

P.K. Narayan et al. / Pacic-Basin Finance Journal 30 (2014) 4461

Following the Lee and Mathur (1996a,b) and the Okunev and White (2003) studies, we dene the

short-run moving average (MASR) and the long-run moving average (MALR) at time t as:

SR

Rt j1MASR

j;t1

j

LR

Rt i1MAi;t1

MA j;t

LR

MAi;t

where j and i are prior months of sectoral returns. The SRMA values range from 1 to 12 months, while the LRMA

values range from 2 to 36 months. In all combinations of short-run and long-run moving average trading rules,

j b i. Just to demonstrate how these trading rule combinations are implemented, consider the sectoral position

LR

SR

LR

SR

LR

based on a SRMA of 1 month. We compute this as MASR

1t MA2,t, MA1,t MA3,t, , MA1,t MA36,t. Similarly,

SR

SR

LR

SR

LR

using a 2-month short-term moving average MA2,t, MA2,t MA3,t, , MA2,t MA36,t, we determine the

investment positions. At the end of each month, for each individual moving average combination, the six sectors

are ranked on a scale of 1 (best-performing) to 6 (worst-performing). This ranking is based on the return-based

momentum indicator, which is simply the difference in return between the SR and LR moving averages. The

Table 1

A summary of trading rules and trading strategies.

Each month, from January 2001 through December 2012, each sector is ranked from one to six based on the difference between the

short-run MA and long-run MA of prior returns, using MA combinations for each strategy under the respective scenarios. Using the

differences between the short-run and long-run MA, we take a long position in the most attractive sector (rank 1) and a short

position in the least attractive sector (rank 6) in the case of short-selling, or simply take a cash position in the case of no short-selling.

The short-run MA parameter ranges from 1 month to 12 months, while the long-run MA parameter runs from 2 months to

36 months.

Strategy

MA rules (in number of months)

Panel A: scenario I: with 100% short-selling allowed

Two

[1,2][12,36]

Three

[1,2][12,36]

Four

[1,2][12,36]

Panel B: scenario II: short-selling not allowed

One: naive strategy

[1,2][12,36]

Two

[1,2][12,36]

Three

[1,2][12,36]

Four

[1,2][12,36]

Panel C: scenario III: trading strategies based on limited short-selling

Two

[1,2][12,36]

Three

[1,2][12,36]

Four

[1,2][12,36]

Long and short positions

Long position: rank 1 (100%)

Cash position: rank 2,3,4,5 (0%)

Short position: rank 6 (100%)

Long position: rank 1 (50%)

Long position: rank 2,3 (25%)

Cash position: rank 4,5 (0%)

Short position: rank 6 (100%)

Long position: rank 1 (70%)

Long position: rank 2 (30%)

Cash position: rank 3 (0%)

Short position: rank 4 (100%)

Invest equally across 6 sectors

Long position: rank 1 (100%)

Take no position: rank 2,3,4,5,6 (0%)

Long position: rank 1 (50%)

Long position: rank 2,3 (25% each)

Take no position: rank 4,5,6 (0%)

Long position: rank 1 (70%)

Long position: rank (30%)

Long position: rank 1 (100%)

Long position: rank 2 (76%)

Take no position: rank 2,3,4,5, (0%)

Short position: rank 6 (76%)

Long position: rank 1 (76%)

Long position: rank 2,3,4,5 (25% each)

Short position: rank 6 (76%)

Long position: rank 1 (70%)

Long position: rank 2 (30%)

Long position: rank 3,4 (38% each)

Short Position: rank 6 (76%)

P.K. Narayan et al. / Pacic-Basin Finance Journal 30 (2014) 4461

47

sector that has the largest return difference (MASR MALR), earns a rank of 1, the sector with the second largest

return difference earns a rank of 2, while the sector with the least return difference is the worst-performing and,

thus, earns a rank of 6. We place weights on each of the short-run/long-run combinations and positions are taken

and held for a month, based on the respective strategy. The rankings are revised each month and new positions

are taken if rankings do indeed change.

We propose four different strategies to examine the efciency and protability of the sectors in the

Indian market. A summary of the trading strategies is provided in Table 1.

Strategy I: This strategy assumes a nave investor who invests equally in all six sectors, irrespective of

the sectors' rankings.

Strategy II: This strategy invests 100% in the highest ranked sector and shorts the lowest ranked sector in

the case of short-selling, but takes cash positions in the case of no short-selling. This strategy,

thus, provides opportunities to make arbitrage prots from taking two opposite positions.

Strategy III: This strategy invests in the top-3 ranked sectors. An investor with this strategy invests 50% in

the sector ranked one, and 25% each in the sectors ranked two and three. The investor will

short the worst-ranked sector in the case of short-selling and take cash positions in the case

of no short-selling. This strategy, therefore, allows an investor to build a portfolio of sectors

which also diversies risks.

Strategy IV: This strategy allows an investor to invest 70% in the highest ranked sector and 30% in the

second-highest ranked sector. The investor continues to short the weakest ranked sector in

the case of short-selling, and takes cash positions in the case of no short-selling.

In all these strategies, where we allow for short-selling, our approach proceeds as follows. First, we

allow for 100% short-selling. Then, in a robustness test of protability, we allow for a short-selling of 76%

based on our estimate of the magnitude of short-selling in the Indian market.

2.2. Technical trading based rules

In this section, we discuss three specic technical trading rules that we utilise to generate buy and sell

signals.2 These are the moving average rule, momentum trading rule, and a lter-based trading rule.

Essentially, we generate prots using these buy and sell signals from each of these three trading rules and

take the average of these prots to make a judgement on the protability of sectors.

The short-run (j) moving average values range from one to three months, while the long-run (i) moving

average values range from nine to 12 months. In all combinations of short-run and long-run moving average

trading rules, j b i. These combinations are as follows: (SRMA1-LRMA9), (SRMA1-LRMA12); (SRMA2-LRMA9),

(SRMA2-LRMA12); and (SRMA3-LRMA9), (SRMA3-LRMA12). From these rules, we generate a buy signal,

denoted by a value of 1 in a particular month t, if SRMA1 N LRMA9, while a sell signal is generated if

SRMA1 b LRMA9. These buy and sell signals are generated for all six combinations of SR and LR moving averages.

Based on these signals, each month, we simultaneously long in the winner (that is, when SRMA N LRMA) and

short in the loser.

We also use momentum trading rules to generate buy and sell signals. With momentum trading rules,

we use two periods (m = 9, 12). Trading signals are generated based on whether or not the current stock

price is higher than the price m months ago: if it is, a buy signal is generated (with a value of 1);

otherwise, a sell signal (with a value of 0) is generated. Based on this rule, we simultaneously long in

winner and short in losers within an industry/sector.

Finally, we use a lter of 10% price threshold as a trading rule. If current return is 10% higher than

average return a buy signal is generated or else the signal is to sell. Accordingly, a long position in winner

and short position in loser stocks are taken.

Every time we take positions, we keep the investment for 1-month, 3-month and 6-month holding

periods. Using these three trading rules, we form average time-series prots for winner, loser, momentum

(winner loser) and zero-cost (winner + loser) portfolios. For each of these portfolios, we compute

2

See Neely et al. (2013) for an example of using technical indicators to predict equity risk premium.

48

P.K. Narayan et al. / Pacic-Basin Finance Journal 30 (2014) 4461

mean monthly average returns and standard deviation, which is what we report in Tables presented in the

next section.

3. Data and results

3.1. Data

Our data set comes from the National Stock Exchange (NSE) of India. We use the monthly S&P CNX

Nifty, the index of the NSE, which is comprised of 50 stocks from 24 sectors of the Indian economy; for a

nice recent discussion on the Indian stock market, see Narayan et al. (2014a,b). We use only six sectors in

our analysis. We choose these six sectors because they are the only sectors for which data are available

from January 2001 to December 2012. For the rest of the sectors, data start much later, which is not helpful

for our empirical design. This sample size, constrained by the start date is noted in Narayan et al. (2014b).

The main implication here is that at the sector-level there is no historical time-series data for India that

goes beyond 2000; therefore, we, like the empirical literature, utilise what is available. Because our

approach requires a common start date and needs to have as long a time-series as possible, we end up

with only six sectors. These sectors together constitute approximately 60% of total market capitalization,

led by the banking sector (15.3%), energy sector (11.1%), and the FMCG sector (10.2%). The sectoral indices

are as follows:

1. CNX Bank Index: this index is comprised of the 12 most liquid and biggest capitalized Indian banking

stocks.

2. CNX MNC Index: this index is comprised of 15 listed companies in which foreign shareholding is over

50% and/or the management control is vested in the foreign company.

3. CNX IT Index: this index is comprised of 20 Information Technology (IT) stocks, such as IT-related

activities, in particular, IT Infrastructure, IT Education and Software Training, Telecommunication

Services and Networking Infrastructure, Software Development, Hardware Manufacturers, Vending,

and Support and Maintenance.

4. CNX FMCG Index: this index is comprised of 15 stocks from the Fast Moving Consumer Goods industry

(FMCG).

5. CNX Pharmaceutical Index: this is the index of the Pharmaceuticals sector and is comprised of 10

stocks.

6. CNX Energy Index: this is the index of Petroleum, Gas and Power and is comprised of 10 stocks.

A brief discussion of the data is in order here. We report descriptive statistics on returns in Table 2. This

table reports descriptive statistics relating to market (CNX Nifty) and sectoral returns. Returns are

computed as (Pt/Pt 1 1) * 100, where Pt is the price index. Mean returns, standard deviation,

skewness, and kurtosis statistics' are reported. These statistics are based on monthly data for the period

January 2001 to December 2012. The descriptive statistics of the data suggest that monthly market returns

Table 2

Descriptive Statistics.

This table reports the descriptive statistics relating to market (CNX Nifty) and sectoral returns. Returns are computed as (Pt/Pt 1 1) * 100,

where P is the price index. Mean returns, standard deviation, skewness, and kurtosis statistics are reported. We also report the coefcient from

the AR(1) model of returns and IT t-statistic in the parenthesis (see Column III). *** and * denote statistical signicance at the 10% and 1% levels,

respectively.

S&P CNX Nifty

Banking

IT

FMCG

Pharmaceutical

Energy

MNC

Mean

AR(1)

1.2554

2.0732

0.1647

1.3337

1.4228

1.6408

1.1504

0.3516***

0.3021***

0.2221***

0.2343***

0.3193***

0.2972***

0.3333***

(4.4445)

(0.3753)

(2.6948)

(2.8501)

(0.0001)

(3.7316)

(0.0001)

JB_Q-stat

(24)

Std. dev.

Skewness

Kurtosis

36.183* (0.053)

34.713* (0.073)

34.2* (0.081)

20.47 (0.670)

34.099* (0.083)

31.494 (0.140)

34.32* (0.079)

6.3394

8.3150

11.6485

5.0056

5.4157

7.0763

5.6119

0.4282

0.1257

3.2839

0.4906

0.5877

0.0413

0.4685

4.4843

4.0234

26.2201

3.4735

4.4917

4.5763

4.3218

P.K. Narayan et al. / Pacic-Basin Finance Journal 30 (2014) 4461

49

over the sample period were 1.26% and four sectors (banking, pharmaceutical, FMCG, and energy) had

average returns in excess of market returns. The monthly sectoral returns are in the 0.162.07% range. The

standard deviation reveals that the IT sector is most volatile; it is almost twice as volatile as the market.

The rest of the sectors are less volatile. In fact, three of the six sectors (FMCG, pharmaceutical, and MNC)

are less volatile than the market. Like mean returns, volatility also varies sector-by-sector. All sectors have

a negative skewness except for the banking sector returns. The IT sector returns are the most negatively

skewed. A similar picture emerges when reading the kurtosis statistics, suggesting that the return

distributions are all leptokurtic and more so for the IT sector. Clearly, then, sectoral return behaviour is

different and the IT sector stands in sharp contrast to others.

3.2. Results from momentum-based trading strategies

3.2.1. Results without short-selling

The main ndings on the performance of each of the trading strategies for each of the six sectors are

reported in Table 3. Results in panel A are based on a strategy whereby the investor is assumed to be nave

and, therefore, invests equally in all six sectors, irrespective of their ranking. We call this strategy I. In

panel B, we have an investor who invests 100% in the rst-ranked sector and has no interest in investing in

the other sectors. We call this strategy II. Panel C contains results from a strategy which invests 50% in the

rst-ranked sector and 25% each in the sectors ranked two and three, leaving the rest of the

worst-performing sectors in cash positions. We call this strategy III. The fourth panel consists of returns

from a strategy that invests 70% and 30% in sectors ranked one and two, respectively. Again, as in previous

strategies, the investor leaves the rest of the sectors in cash positions. We call this strategy IV.

Table 3

Performance of long and short strategies with short-sell restriction (short-selling not allowed).

This table reports monthly mean returns without short-selling. The row with Prob N 0 denotes the percentage to total months in

which prots from a given strategy exceeds zero. The row with Prob N market represents the percentage of total months in which

prots from a given strategy exceeds the market return. Here, we use the S&P CNX Nifty as a benchmark for the market. The paired

t-test indicates whether or not the return from each of the strategies is signicantly greater than the market return. *** and **

represent statistical signicance at the 1%, 5% and 10% levels, respectively.

Banking

Energy

IT

MNC

FMCG

Pharmaceutical

Panel A: strategy I

Mean rets %

Std. dev.

Prob. N 0 (%)

Prob. N market (%)

Paired t-test

0.303**

1.459

57.273

34.545

1.931

0.164

1.107

61.818

30.909

2.211

0.175

1.150

58.182

33.636

2.187

0.225**

0.971

61.818

31.818

2.109

0.294***

0.852

68.182

35.255

1.989

0.217**

0.904

60.000

32.727

2.2128

Panel B: strategy II

Mean rets %

Std. dev.

Prob. N 0 (%)

Prob. N market (%)

Paired t-test

0.286

2.871

9.091

34.545

1.903

0.628**

2.873

8.182

37.273

1.23

0.815**

3.617

20.000

40.909

0.85

0.373**

1.929

3.636

35.455

1.735

0.587***

2.168

20.000

44.545

1.342

0.215

2.536

6.364

33.636

2.661

Panel C: strategy III

Mean rets %

Std. dev.

Prob. N 0 (%)

Prob. N market (%)

Paired t-test

0.297

1.971

27.27

36.36

1.942

0.379**

1.701

21.82

33.64

1.745

0.418**

2.095

33.64

38.18

1.640

0.377***

1.291

35.45

31.82

1.783

0.447***

1.447

46.36

37.27

1.633

0.010

1.408

26.36

31.82

2.461

Panel D: strategy IV

Mean rets %

Std. dev.

Prob. N 0 (%)

Prob. N market (%)

Paired t-test

0.283

2.225

20.00

35.45

1.887

0.531***

2.192

14.55

35.45

1.462

0.618**

2.696

30.00

39.09

1.27

0.390***

1.481

16.36

32.73

1.772

0.556***

1.730

34.55

37.27

1.456

0.129

1.845

12.73

30.91

2.656

50

P.K. Narayan et al. / Pacic-Basin Finance Journal 30 (2014) 4461

Evidence obtained from strategy I, where a nave investor invests equally across all six sectors, suggests

that economic prots are statistically insignicant in energy and IT sectors only. Monthly prots for the

remaining four sectors are in the [0.22, 0.30] percentage range. When we look at the evidence from

strategy II, in all sectors, except banking and pharmaceutical, prots are statistically different from zero. In

other words, prots are statistically signicant at the 10% level or better for energy, IT, MNC, and FMCG

sectors. However, the magnitude of prots varies from sector-to-sector. It is the IT sector which gives

investors the most prots with a monthly average return of 0.815%, while the pharmaceutical sector gives

investors the least prot with a monthly average loss of 0.215%. When we collect evidence from strategies

III and IV, we discover protability results consistent with strategy II in terms of the most protable and

least protable sectors. The most protable sector consistently appears to be IT while the least protable

sector is pharmaceutical. When we consider all sectors as one portfolio, the monthly returns from

strategies I to IV fall in the [1.4%, 2.5%] range.

The main implication of our ndings here is that prots across the three strategies, excluding a strategy

that assumes a nave investor, are generally consistent on two fronts: rst, prots are statistically signicant at

the 10% level or better for four of the six sectors, although prots are clearly sector-dependentthat is, the

magnitude of prots is different in different sectors. Second, the IT sector consistently out-performs the other

sectors, while the pharmaceutical sector produces the lowest prots. On the whole, then, the protable

sectors are IT, energy, FMCG, and MNC.

There are other interesting features of our results which are worth highlighting. Generally, we notice

that with higher prots come higher risk. An interesting trend here is that as investors move from a

strategy where they take a long position in the most attractive sector (strategy II) to taking long positions

in more than one sector (strategies III and IV) as part of investment diversication, a decline in risk is

experienced. The standard deviation for the IT sector, for instance, declines from 3.6 in the case of strategy

II to 2.1 and 2.7, respectively, in the case of strategies III and IV. When we consider the performance of the

other ve sectors, we notice a similar trend in that there is a decline in the standard deviation as an

investor moves from strategy II to strategy IV. The implication here is that a strategy (such as our strategy

III), that allows an investor to take a long position in multiple sectors, leads to diversication of risk

although the prots are smaller from such a strategy compared to strategies II and IV.

For each of the strategies, we report some additional statistics to gauge the performance of the

strategies. In particular, we report the probability that mean returns are greater than zero and greater than

the market (Nifty) return. Ignoring the nave investor (Strategy I), we notice that in strategy III, where we

allow an investor to diversify risk by taking long positions in the top-3 sectors, the probability that returns

are greater than zero is highest for all sectors. For example, with strategy III, 34% of the time IT sector

returns are greater than zero. Moreover, when we compare sectoral returns with the market return, we

nd that all three strategies (strategies II, III, and IV) reveal that for the IT, FMCG, and banking sectors, over

35% of the time returns exceed the market return. Finally, the paired t-test reveals that for most sectors

returns from each strategy are statistically signicant relative to the market, mostly at the 10% level of

signicance.

3.2.2. Results with short-selling

3.2.2.1. Background. Short-selling is the practice of selling shares that the seller does not own at the time of

trading. In India, the Securities and Exchange Board of India (SEBI), the regulator of the Indian capital

market, denes a short sale as selling of the shares without having the physical possession of the shares

unless it is either for squaring-up of an earlier purchase in the same settlement of the same stock

exchange, or against the pending deliveries from the same stock exchange pertaining to previous

settlements (SEBI, 1996). There are various phases associated with short-selling activities in the Indian

market. First, in the 1990s, only retail investors were allowed to short-sell. The Badla system and the

weekly settlement system were in place Weekly settlement with T + 5 days ensured that investors made

payments and took delivery of securities within ve days after the day of the transaction. The Badla

system, by comparison, was useful when investors preferred to postpone the settlement of a transaction

from one settlement period to another. Both these systems governing short-selling activities were

instrumental in increasing the volume of trading, which was responsible for high stock price volatility.

This needed a response; the SEBI temporarily banned short-selling in 1998 and 2001. Second, a more

P.K. Narayan et al. / Pacic-Basin Finance Journal 30 (2014) 4461

51

stringent measure was taken by SEBI, who abolished the Badla system on 2 July, 2001. In fact, the Badla

system was replaced by a rolling settlement system, with T + 3 days settlement system. Third, from 1

April, 2003, the Indian stock market moved to the T + 2 rolling settlement system. Therefore, the

payment and delivery of securities had to be completed within two days after the day of the transaction

(Pathak, 2008).

Fourth, in 2007, the SEBI allowed all classes of investors, including institutional investors, to short-sell

in the Indian stock market. However, naked short-selling was not permitted; all investors are required to

mandatorily honour their obligation of delivering the securities at the time of settlement. Similarly, in

2007, the SEBI introduced a fully-edged Securities Lending and Borrowing Scheme (SLBS) for the

effective transaction of short-selling. Through this scheme, investors can borrow and lend securities

through approved intermediaries (SEBI, 2010). The SLBS is applicable in the cash market.

Table 4 shows the details of settlement of trade in the cash segment of NSE, such as the traded quantity,

deliverable quantity, and the percentage of deliverable quantity to traded quantity for the period 2001

2002 to 20102011. This table reveals that the total traded quantity of shares is high during the stock

market boom period (20032007). However, the delivered quantity of shares is much low compared to

the traded quantity. During 20002011, the average delivered shares was around 24% of total traded

quantity. This implies that the remaining 76% of trading is for speculative purposes for day trading. The

day trade can be either short-selling of securities or long-buying of securities, those who buy (long) will

square their long position or those who sell (short) will cover their short sales before market close.

Accordingly, for every short sale there will be a corresponding long (buy). Since there is limited

availability of data on short-selling in the Indian stock market, we use the above non-delivered quantity of

sharesthat is, 76%as a proxy for the size of short selling.3

3.2.2.2. Findings. In Table 5, we report the results of sectoral protability by simply assuming a short-selling

of 100%, which is close to what we estimate short-selling to be on the Indian stock market. The results are

reported for only those three strategies where an investor is able to take long and short positions by

forming an arbitrage portfolio with zero investment. The key ndings from the short-selling based trading

across three different strategies can be summarised as follows:

The IT sector is the most protable. The monthly average prots are in the 0.651.1% range.

The pharmaceutical sector is the least protable with prots/loss in the 0.37 to 0.02% range.

In terms of sectoral protability, all three strategies produce very consistent results. However, in terms

of risk, we notice a reduction when an investor moves from strategy II to a relatively more diversied

strategy. Consider the IT sector, for example. The standard deviation declines from 4.77% with strategy II

to 2.56% with strategy III.

Prots in the four protable sectors are much higher when short-selling is allowed compared to prots

obtained from strategies that do not allow for short-selling. Taking the evidence from strategy III, IT

prots are almost 172% higher under short-selling compared to a case of no short-selling. The second

largest gain in prots from short-selling is achieved by the energy sector (80%), followed by the FMCG

sector (40%). The smallest increase in prots with short-selling is experienced by the MNC sector whose

prots increase only by 4.5%.

When all sectors are considered as a portfolio, the portfolio returns from Strategies II to IV fall in the

[1.98%, 3.69%] range.

3.2.3. Results in the pre-crisis and crisis periods

Several studies (see, inter alia, Longstaff, 2010) have shown that the performance of stock markets has

been negatively affected by the 2007 global nancial crisis. This literature has analysed the stock markets

from different perspectives. We re-estimate sectoral prots by splitting the sample into a pre-crisis period

(30 August 2002 to 31 March 2007) and a period including the crisis (1 April 2007 to 31 December 2012).

3

While it is true that the magnitude of short-selling is unknown, the impact of short-selling on the Indian market has been of

interest. In a recent study, for instance, Giannikos and Gousgounis (2012) nd that during the period of short-sale ban (20012007)

the equity market was overpriced compared to the futures market. They argue that the main source of overpricing was opinion

dispersion. They further document that overpricing declined when the short-selling ban was lifted.

52

P.K. Narayan et al. / Pacic-Basin Finance Journal 30 (2014) 4461

Table 4

Settlement in cash segment of NSE.

This table shows the details of settlement of trade in the cash segment of NSE, such as the traded quantity, deliverable quantity, and

the percentage of deliverable quantity to traded quantity for the period 20002001 to 20102011.

Source: SEBI Bullen (various months).

Year

Traded quantity

(lakh)

Deliverable quantity

(lakh)

% of delivered quantity to traded quantity

20012002

20022003

20032004

20042005

20052006

20062007

20072008

20082009

20092010

20102011

Average

274,695

365,403

704,537

787,996

818,438

850,510

148,123

141,893

220,588

181,091

59,299

82,353

175,546

202,276

227,239

239,070

367,970

275,270

47,481

49,737

21.59

16.5

24.92

25.67

27.76

28.11

24.84

21.59

21.86

27.47

23.6

The results for the pre-crisis period are reported in Table 6, while results from the crisis period are

reported in Table 7.

These results are interesting and reveal the following. First, in the pre-crisis period, there is mixed

evidence on protability. For example, while strategy III reveals protability for ve out of six sectors

(with the exception of the pharmaceutical sector), strategies II and IV reveal protability for only energy

and FMCG, and MNC and FMCG sectors, respectively. Compare this with the crisis period: strategies II, III

and IV consistently suggest that energy and IT are the only protable sectors. Second, the FMCG and IT

sectors remain the most protable in pre-crisis and crisis periods, respectively. Third, two sectors, namely,

MNC and FMCG, which were protable in the pre-crisis period become unprotable in the crisis period.

Table 5

Performance of long and short strategies with short-selling allowed (100%).

This table reports monthly mean returns based on short-selling. The row with Prob N 0 denotes the percentage to total months in

which prots from a given strategy exceeds zero. The row with Prob N market represents the percentage of total months in which

prots from a given strategy exceeds the market return. Here, we use the S&P CNX Nifty as a benchmark for the market. The paired

t-test indicates whether or not the return from each of the strategies is signicantly greater than the market return. ***, ** and *

represent statistical signicance at the 1%, 5% and 10% levels, respectively.

Banking

Energy

IT

MNC

FMCG

Pharmaceutical

Panel A: strategy II

Mean rets %

Std. dev.

Prob. N 0 (%)

Prob. N market (%)

Paired t-test

0.125

5.764

19.09

35.45

1.763

0.822**

4.167

14.55

35.45

0.824

0.889**

4.770

35.45

41.82

0.687

0.398*

2.194

4.55

34.55

1.692

0.433**

3.092

27.27

44.55

1.532

0.365

2.901

10.00

32.73

2.868

Panel B: strategy III

Mean rets %

Std. dev.

Prob. N 0 (%)

Prob. N market (%)

Paired t-test

0.823***

2.299

48.79

37.27

0.952

0.684***

2.061

34.55

33.64

1.208

1.138***

2.562

60.91

41.82

0.403

0.394***

1.296

38.18

30.91

1.779

0.630***

1.630

57.27

39.09

1.332

0.017

1.503

31.82

32.73

2.868

Panel C: strategy IV

Mean rets %

Std. dev.

Prob. N 0 (%)

Prob. N market (%)

Paired t-test

0.165

5.527

30.00

36.36

1.786

0.686**

3.710

20.00

34.55

1.045

0.645*

4.144

45.45

40.00

1.69

0.326*

1.572

16.36

32.73

1.853

0.402**

2.793

41.82

38.18

1.594

0.240

2.355

17.27

30.91

2.74

P.K. Narayan et al. / Pacic-Basin Finance Journal 30 (2014) 4461

53

Table 6

Performance of long and short strategies with short-selling allowed (100%): Pre-crisis period.

This table reports monthly mean returns from short-selling over the pre-crisis period. The row with Prob N 0 denotes the

percentage to total months in which prots from a given strategy exceeds zero. The row with Prob N market represents the

percentage of total months in which prots from a given strategy exceeds the market return. Here, we use the S&P CNX Nifty as a

benchmark for the market. The paired t-test indicates whether or not the return from each of the strategies is signicantly greater

than the market return. ***, ** and * denote statistical signicance at the 10%, 5%, and 1% levels, respectively.

Banking

Energy

IT

MNC

FMCG

Pharmaceutical

Panel A: strategy II

Mean rets %

Std. dev.

Prob. N 0 (%)

Prob. N market (%)

Paired t-test

0.125

5.286

19.149

27.660

1.871

0.970*

3.585

12.766

29.787

0.778

0.159

4.358

31.915

29.787

1.489

0.600

2.627

6.383

27.660

1.673

0.992*

3.691

31.915

38.298

1.151

0.017

1.785

8.511

23.404

2.242

Panel B: strategy III

Mean rets %

Std. dev.

Prob. N 0 (%)

Prob. N Market (%)

Paired t-test

0.644***

2.093

19.149

36.170

1.154

0.850***

1.692

12.766

23.404

1.259

1.146***

2.858

31.915

34.043

0.857

0.594***

1.557

6.383

23.404

1.763

1.321***

1.758

31.915

31.915

0.926

0.272

0.923

8.511

25.532

2.209

Panel C: strategy IV

Mean rets %

Std. dev.

Prob. N 0 (%)

Prob. N market (%)

Paired t-test

0.167

5.527

25.532

34.043

1.867

0.351

3.710

19.149

27.660

1.194

0.125

4.144

46.809

27.660

1.687

0.517**

1.572

19.149

25.532

1.869

0.939*

2.793

46.809

27.660

1.265

0.222

2.355

14.894

23.404

2.209

Table 7

Performance of long and short strategies with short-selling allowed (100%): Crisis period.

This table reports mean monthly returns from short-selling over the crisis period. The row with Prob N 0 denotes the percentage to

total months in which prots from a given strategy exceeds zero. The row with Prob N market represents the percentage of total

months in which prots from a given strategy exceeds the market return. Here, we use the S&P CNX Nifty as a benchmark for the

market. The paired t-test indicates whether or not the return from each of the strategies is signicantly greater than the market

return. ***, ** and * represent statistical signicance at the 1%, 5% and 10% levels, respectively.

Banking

Panel A: strategy II

Mean rets %

Std. dev.

Prob. N 0 (%)

Prob. N market (%)

Paired t-test

0.017

6.110

19.048

41.270

0.776

Panel B: strategy III

Mean rets %

Std. dev.

Prob. N 0 (%)

Prob. N market (%)

Paired t-test

0.989***

2.431

50.794

38.095

0.049

Panel C: strategy IV

Mean rets %

Std. dev.

Prob. N 0 (%)

Prob. N market (%)

Paired t-test

0.121

5.986

34.921

37.089

0.034

Energy

IT

MNC

FMCG

Pharmaceutical

1.070*

4.533

15.873

39.683

0.389

1.327**

5.019

38.095

50.794

0.375

0.250

1.850

3.175

39.683

0.781

0.036

2.562

23.810

49.206

1.020

0.626

3.453

11.111

39.683

1.776

0.739**

2.290

36.508

41.270

0.502

1.145***

2.362

60.317

47.619

0.213

0.248

1.072

34.921

36.508

0.831

0.144

1.347

47.619

44.444

0.717

0.161

1.781

30.159

38.095

1.197

0.984***

4.454

46.032

49.206

0.465

0.192

1.420

14.286

38.095

0.157

0.035

2.357

38.095

46.032

0.176

0.547

2.677

19.048

36.508

0.291

0.901***

4.062

22.222

41.270

0.551

54

P.K. Narayan et al. / Pacic-Basin Finance Journal 30 (2014) 4461

3.2.4. A robustness test

One aspect of our empirical analysis which remains unclear is that related to short-selling. The amount

of short-selling allowed on the Indian stock market is not made public. Therefore, in this paper, we

estimate it to be around 76%. This analysis on short-selling is, itself, a contribution to the literature. We

then allowed for short-selling of 100% in our empirical analysis, as reported in the previous section. We

want to test how prots will change if we reduce the amount of short-selling to something like 76%, which

is closest to what we believe is allowed on the Indian stock market. We do this and report the results in

Table 8.

The main ndings can be summarised as follows:

1. Like with 100% short-selling, four of the six sectoral prots are statistically signicant.

2. Like with 100% short-selling, the ranking of sectors does not change much, except that in two of the

three strategies, the energy sector becomes more protable than the IT sector.

3. Compared with 100% short-selling, there are only very marginal changes in the magnitude of prots for

some sectors, but not all. In three of the four protable sectors, prots are higher with 100%

short-selling compared to when short-selling is restricted to 76%.

3.3. Results from technical trading rule-based strategies

The results from technical trading prots based on the moving average, momentum and lter rules,

averaged across strategies and over time, are presented in Table 9. Two results are of particular relevance.

First, we notice that unlike the rank-based trading strategy prots, here returns from all six sectors are

protable; that is, they are statistically different from zero at the 1% level. This result holds regardless of

the month of holding period. Over the six-month holding period, for example, we notice that both

momentum prots (that is, winner minus loser prots) and the zero-cost portfolio prots (winner plus

loser prots) are maximised for the banking sector followed by the energy sector. Second, the magnitude

of prots is higher in all sectors compared to a rank-based momentum trading strategy as reported earlier.

Table 8

Performance of long and short strategies with limited short-selling allowed (maximum of 76% short-selling).

This table reports mean monthly returns from limited short-selling. The row with Prob N 0 denotes the percentage to total months

in which prots from a given strategy exceeds zero. The row with Prob N market represents the percentage of total months in

which prots from a given strategy exceeds the market return. Here, we use the S&P CNX Nifty as a benchmark for the market. The

paired t-test indicates whether or not the return from each of the strategies is signicantly greater than the market return. ***, ** and

* represent statistical signicance at the 1%, 5% and 10% levels, respectively.

Banking

Energy

IT

MNC

FMCG

Pharmaceutical

Panel A: strategy II

Mean rets %

Std. dev.

Prob. N 0 (%)

Prob. N Market (%)

Paired t-test

0.251

4.863

31.818

35.455

1.579

0.735**

3.680

17.273

37.273

0.970

0.852*

4.580

45.455

42.727

0.742

0.370*

2.048

13.636

34.545

1.729

0.579**

2.779

40.909

45.455

1.314

0.294

2.817

17.273

34.545

2.740

Panel B: strategy III

Mean rets %

Std. dev.

Prob. N 0 (%)

Prob. N Market (%)

Paired t-test

0.320

4.711

53.240

39.091

1.558

0.723**

3.379

56.364

33.636

1.008

0.705*

3.836

58.256

40.000

1.058

0.462**

2.032

60.000

32.165

1.569

0.586***

2.542

67.273

41.818

1.329

0.104

2.525

58.182

32.145

1.015

Panel C: strategy IV

Mean rets %

Std. dev.

Prob. N 0 (%)

Prob. N Market (%)

Paired t-test

0.443

4.926

54.545

38.182

1.297

0.727**

3.538

55.455

32.727

1.095

0.677*

3.901

59.091

40.909

1.064

0.524**

2.473

60.000

32.727

1.448

0.645**

2.671

66.364

40.000

1.226

0.294

2.728

58.182

31.818

1.805

P.K. Narayan et al. / Pacic-Basin Finance Journal 30 (2014) 4461

55

Table 9

Average prots from technical trading rules.

This table reports average prots obtained from three different technical trading rules; namely, moving average (MA), momentum, and

lter rules. The MA rule is based on short-term MA and long-term MA of 1, 2, and 3 months, and 9 and 12 months, respectively. The

momentum rule generates a buy signal whenever current stock price is higher than or equal to m months ago, where we set m = 9 and

12, and a sell signal is generated whenever the current price is less than price m months ago. Finally, the lter rule generates a buy signal

whenever current return is greater than or equal to 110% of the average return based on tm, where we set m equals to 12.

Conversely, a sell signal is generated whenever current return is less than the 110% of average return based on tm. For individual stocks

in each of the six sectors, we identify winners and losers based on these buy and sell signals. We equally invest in winners in period t

and short in losers. Therefore, the momentum (mom) returns are simply returns of winners minus returns of losers and the portfolio

return is simply the returns of winners plus returns of losers. The corresponding standard deviation of momentum and portfolio returns

for each sector and for each holding periodthat is, for 1-month, 3-month, and 6-monthare also reported. ***, ** and * represent

statistical signicance at the 1%, 5% and 10% levels, respectively.

1-Month

Mom.

3-Month

6-Month

Portfolio

Mom.

Portfolio

Banking

Return

SD

2.341***

8.433

1.807***

7.405

2.491***

5.991

3.271*

5.003

2.569***

4.433

3.613***

3.529

Energy

Return

SD

1.773**

7.058

1.691***

6.283

1.979*

5.107

2.498***

4.423

2.087***

4.105

2.981***

3.31

FMCG

Return

SD

1.522***

5.114

1.574***

4.506

1.575***

3.471

2.124***

2.842

1.606***

2.698

2.290***

2.048

1.302*

7.77

0.863

7.53

2.404***

6.036

1.045*

5.848

3.398***

4.665

IT

Return

SD

0.334

11.26

MNC

Return

SD

1.303***

5.792

1.331***

5.112

1.409***

4.181

2.172***

3.42

1.498***

3.349

2.434***

2.638

Pharmaceutical

Return

SD

1.477***

5.537

1.075***

4.549

1.586***

3.863

1.897***

3.224

1.655***

2.884

2.010***

2.461

For each stock in a sector, winners and losers are identied from buy and sell signals generated using

the three technical trading rules explained earlier. As before, the buy and sell signals are generated every

month and prots are averaged (across the three technical trading strategies) every month, generating a

time-series of winner minus loser and zero-cost portfolios. This is to say that portfolios are re-balanced

every month. The momentum returns are computed as the difference between returns of winners and

losers whereas the portfolio return is computed as the sum of returns of winners and losers. The gures

reported in Panel A of Table 10 are these time-series averages and their standard deviation. All prots are

statistically different from zero at (at least) the 10% level of signicance.

Next we follow Jegadeesh and Titman (1993) and estimate prots based on buying winners and selling

losers. The idea is simple and proceeds as follows. Based on the geometric mean of returns sectors are

ranked from 1 to 6. Sectors ranked 1 and 2 are taken as winner sectors while the loser sectors are those

ranked 5 and 6. The strategy then is to invest equally in winner sectors and short equally in loser sectors,

holding the portfolios for 1-month, 3-month, and 6-month horizons. Portfolios are rebalanced every

month and momentum and zero-cost portfolio returns are computed. These results are reported in

panel B.

This is what we nd. First, with respect to individual stock momentum, we nd that: (a) average returns

from both winner minus losers and zero-cost portfolios offer positive and statistically signicant (at least at

the 5% level of signicance) returns in all sectors; and (b) prots, in terms of magnitude, increase with the

portfolio holding period. Second, when portfolios are held for three and six months, zero-cost portfolio

returns are maximised for the IT sector, followed by banking and MNC sectors. Moreover, at the 6-month

56

P.K. Narayan et al. / Pacic-Basin Finance Journal 30 (2014) 4461

Table 10

Individual stock momentum by industry and industry momentum.

This table reports two sets of results organised into Panels A and B. In panel A, we have individual stock momentum return and

portfolio return and their standard deviations for 1-month, 3-month and 6-month holding periods. Using technical trading rules, buy

and sell signals are generated and winner and loser stocks are identied. Based on these winner and loser stocks, momentum (MP)

and zero-cost portfolios (ZCP) are generated. Panel B has the corresponding industry momentum and portfolio returns and their

standard deviations. Instead of ranking stocks, here we rank the six sectors. Sectors are ranked using the geometric average and

those ranked 1 and 2 are taken as winner sectors while the loser sectors are those ranked 5 and 6. The strategy then is investment

equally in winner sectors and shorting equally in loser sectors and holding the portfolios for 1-month, 3-month, and 6-month

horizons. Mom^ is risk-adjusted momentum returns following the proposal of Barroso and Santa-Clara (2013), which is simply a

target volatility (which is a constant and we set this to the sample standard deviation) multiplied by the actual momentum returns

over time normalised by a time-varying volatility, which we proxy using a rolling-window of six months. *** represent statistical

signicance at the 1%, 5% and 10% levels, respectively.

Panel A: individual stock momentum

1-Month

3-Month

6-Month

Banking

Return

SD

MP

Mom^

ZCP

3.392***

13.4150

3.7367***

11.1022

2.754***

11.3650

MP

Mom^

ZCP

MP

3.499***

8.7190

Mom^

ZCP

4.6709***

10.4182

4.381***

7.2420

Mom^

ZCP

MP

3.668***

6.5610

Mom^

Portfolio

6.7656***

10.0251

4.774***

5.5300

Mom^

ZCP

Energy

Return

SD

2.243***

11.8510

2.4928***

9.3465

1.684***

9.9900

MP

2.259***

6.8630

2.5613***

6.9064

2.872***

5.8580

MP

2.364***

5.2660

4.0199***

8.1776

3.280***

4.4170

FMCG

MP

Return

SD

2.166***

8.5630

Mom^

3.2973***

5.6463

ZCP

2.107***

7.6250

MP

2.209***

5.0160

Mom^

3.2844***

5.5595

ZCP

2.848***

4.2460

MP

2.302***

3.8420

Mom^

5.0557***

7.4907

ZCP

3.076***

3.1410

IT

Return

SD

MP

Mom^

ZCP

MP

Mom^

ZCP

MP

Mom^

ZCP

2.326***

15.2980

2.8890***

10.5348

2.668***

12.7600

2.968***

10.9770

4.1617***

11.9279

4.397***

9.0150

3.784***

10.7660

5.0551***

18.1241

5.744***

9.3280

MP

Mom^

ZCP

MP

Mom^

ZCP

MP

Mom^

ZCP

5.5097***

11.2295

3.523***

6.1630

Mom^

ZCP

MNC

Return

SD

2.472***

11.2170

3.9820***

8.9614

2.328***

9.5780

2.706***

7.3350

3.020***

6.2610

6.4161***

9.4742

4.073***

5.3640

Pharmaceutical

MP

Return

SD

2.462***

10.7040

Mom^

2.9173***

6.8730

ZCP

2.094***

9.1650

MP

2.596***

6.7720

3.6675***

6.5431

3.183***

5.8570

MP

2.842***

5.5040

Mom^

6.2759***

7.8865

ZCP

3.662***

4.8240

Panel B: industry momentum

1-month

MP

Return

SD

2.972***

12.3240

3-month

ZCP

2.568***

5.4860

MP

5.723***

11.4670

6-month

ZCP

0.4100

2.3580

MP

1.615***

0.4490

ZCP

2.055***

0.4490

holding period average returns from both winner minus loser and zero-cost portfolios are again maximised

for the IT sector, followed by the banking sector. Third, at the industry-level, average returns of all winners

minus loser portfolios are positive and statistically signicant at the 1% level. By comparison, the zero-cost

portfolio only offers positive and signicant monthly average returns in 1-month and 6-month holding

periods.

P.K. Narayan et al. / Pacic-Basin Finance Journal 30 (2014) 4461

57

240

200

160

120

%

80

40

0

-40

2003 2004

2005

2006

2007

2008

2009

2010

2011

2012

Year

12 M

3M

1M

6M

24 M

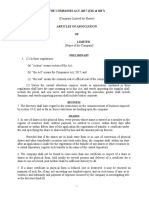

Fig. 1. A time-series plot of average cumulative momentum prots. This gure plots the cumulative average momentum prots.

These prots are average over time (December 2003 to December 2012) for the six sectors for 1-month, 3-month, 6-month,

2-month, and 24-month horizons.

In addition, just to compare the performance over different holding periods, we plot in Fig. 1, average

(across sectors) cumulative momentum prots for 1-month, 3-month, 6-month, 12-month, and 24-month

horizons. We observe a clear pattern; that is, momentum prots for holding periods 1-month to 12-month

are fairly consistent but prots at the 24-month horizon are substantially different, and suggest a weaker

momentum.

On the whole, there are two clear messages from these individual and industry-based portfolio returns.

The rst point is about whether or not an investor should devise a trading strategy based on stocks or

sectors. There is mixed evidence on this. Consider the 1-month holding period rst. At the industry-level,

the momentum portfolio and the zero-cost portfolio offer investors an average return of 2.97% and 2.57%,

respectively, which are in excess of the corresponding sectoral average returns, except in the case of the

banking sector. Therefore, at a short holding period of 1-month it seems economically signicant for an

investor to trade on winner and loser sectors/industry as opposed to winner and loser stocks unless of

course the investor is only keen in investing in the banking sector. At the 3-month horizon, by

comparison, the momentum portfolio of the industry beats the average returns from winner minus loser

stocks in each sector, but the average industry zero-cost portfolio makes a loss of 0.41% per month

whereas all zero-cost sectoral portfolios make a statistically signicant prot. The second point relates to

the longest holding periodthe 6-month portfolio; here, both winner minus loser and zero-cost

portfolios of the industry offer less prots than corresponding prots from sectoral portfolios. Therefore,

where short horizon portfolios favour sectors over the industry as a whole, long horizon portfolios offer

the complete opposite implication for investors.

Following Barroso and Santa-Clara (2013), we also compute risk-adjusted momentum returns (Mom*),

which is simply a target volatility (which we take as the standard deviation over the analysis period)

multiplied by the actual momentum returns over time normalised by a time-varying volatility, which we

proxy using a rolling-window of six months. We generally observe that prots from both momentum and

zero-cost portfolios are less than the risk-adjusted prots; however, the results are robust in the sense that

average returns from both portfolios are positive and statistically different from zero.

In Table 11, we return to our average prots obtained from the three technical trading rules. All stocks

are collected and sorted on the basis of size (market capitalisation), book-to-market, and liquidity

(number of transactions). We do this in order to test the robustness of our industry-based results reported

in panel B of Table 10, motivated by empirical results presented in Moskowitz and Grinblatt (1999),

amongst others. Under each of these three control measures, quartiles of stocks are created. For example,

for size-based stocks, the rst quantile includes the largest 25% of stocks while quantile four includes the

smallest 25% of stocks in our sample. When performance is controlled by book-to-market ratio, the rst

58

P.K. Narayan et al. / Pacic-Basin Finance Journal 30 (2014) 4461

Table 11

Prots sorted on size, book-to-market, and liquidity.

This table reports prots that are controlled for size (Panel A), book-to-market (Panel B) and liquidity (Panel C). Using combinations

of the three technical trading rules, the performance of portfolios were categorised by size (market capitalisation), book-to-market,

and liquidity (number of transactions). Quartiles are formed under each of the three control variables. For example, for size, the rst

quantile includes the largest 25% of stocks while quantile four includes the smallest 25% of stocks in our sample. When performance

is controlled by book-to-market ratio, the rst quartile includes the 25% of stocks which have the highest book-to-market ratio while

the fourth quantile includes the 25% of stocks with the lowest book-to-market ratio. Finally, when performance is judged on the

basis of liquidity, quartile one includes the 25% of most liquid stocks while the 25% of stocks with the least liquidity (that is, the 25%

most illiquid stocks) are in quantile four. For each quantile under each control measure, we identify winners and losers based on buy

and sell signals identied using technical trading rules. We equally invest in winners in period t and short in losers. From this

investment strategy, a time-series of momentum returns are computed (returns of winners minus returns of losers) and a

time-series of portfolio return is also computed (returns of winners plus returns of losers). This table reports the average of these

returns. The corresponding standard deviation of momentum and portfolio returns for each quartile for each holding periodthat is,

for 1-month, 3-month, and 6-monthare also reported. *** and ** represent statistical signicance at the 1%, 5% and 10% levels,

respectively.

1-Month

Panel A: size-based

Quantile 1

Return

SD

Quantile 2

Return

SD

Quantile 3

Return

SD

Quantile 4

Return

SD

3-Month

6-Month

Momentum

2.241***

10.299

Momentum

2.667***

11.781

Momentum

3.169***

12.410

Momentum

2.616***

13.582

Portfolio

1.896***

8.871

Portfolio

2.240***

9.885

Portfolio

2.882***

10.844

Portfolio

2.550***

11.525

Momentum

2.276***

6.091

Momentum

2.858***

6.949

Momentum

3.471

8.569

Momentum

2.917***

9.078

Portfolio

2.940***

5.133

Portfolio

3.526***

5.889

Portfolio

4.193

7.540

Portfolio

3.941***

7.561

Momentum

2.355***

4.534

Momentum

3.102**

1.803

Momentum

3.898***

7.409

Momentum

3.399***

8.373

Portfolio

3.228***

3.726

Portfolio

4.022***

5.820

Portfolio

4.884***

6.574

Portfolio

4.795***

7.174

Panel B: book-to-market-based

Quantile 1

Momentum

Return

1.885***

SD

10.378

Quantile 2

Momentum

Return

2.922***

SD

11.856

Quantile 3

Momentum

Return

2.655***

SD

11.867

Quantile 4

Momentum

Return

3.015

SD

13.802

Portfolio

1.927***

8.691

Portfolio

2.634***

10.211

Portfolio

2.271***

10.184

Portfolio

2.965

11.860

Momentum

2.051***

6.485

Momentum

3.094***

7.747

Momentum

2.885***

7.389

Momentum

3.303

8.893

Portfolio

2.944***

5.198

Portfolio

3.905***

6.572

Portfolio

3.551***

6.496

Portfolio

4.336

7.661

Momentum

2.258***

5.267

Momentum

3.354***

6.270

Momentum

3.172***

6.580

Momentum

3.776***

7.841

Portfolio

3.445***

4.286

Portfolio

4.387***

5.420

Portfolio

4.158***

5.694

Portfolio

5.054***

6.776

Panel C: liquidity-based

Quantile 1

Momentum

Return

2.651***

SD

11.640

Quantile 2

Momentum

Return

2.390***

SD

12.715

Quantile 3

Momentum

Return

2.780***

SD

12.205

Quantile 4

Momentum

Return

2.768***

SD

11.430

Portfolio

2.286***

9.955

Portfolio

2.125***

10.603

Portfolio

2.656***

10.492

Portfolio

2.641***

10.006

Momentum

2.786***

7.251

Momentum

2.514***

7.419

Momentum

3.059***

8.171

Momentum

3.052***

7.780

Portfolio

3.586***

6.131

Portfolio

3.416***

6.215

Portfolio

3.906***

6.979

Portfolio

3.850***

6.730

Momentum

2.978***

5.625

Momentum

2.733***

6.278

Momentum

3.436***

6.935

Momentum

3.513***

7.289

Portfolio

4.051***

4.689

Portfolio

3.950***

5.196

Portfolio

4.527***

5.997

Portfolio

4.564***

6.476

quantile includes the 25% of stocks which have the highest book-to-market ratio while the fourth quantile

includes the 25% of stocks with the lowest book-to-market ratio.

Finally, when performance is judged on the basis of liquidity, quantile one includes the 25% most

liquid stocks while the 25% of stocks with the least liquidity (that is, the 25% most illiquid stocks) are in

P.K. Narayan et al. / Pacic-Basin Finance Journal 30 (2014) 4461

59

quantile four. For each quantile under each control measure, we identify winners and losers based on buy

and sell signals, identied using technical trading rules. We equally invest in winners in period t and

short in losers. From this investment strategy, a time-series of momentum returns is computed (returns

of winners minus returns of losers) and a time-series of portfolio returns is also computed (returns of

winners plus returns of losers).

There are two main ndings here. First, prots are positive and statistically signicant regardless of

how stocks are sorted. Therefore, that the Indian stock market is protable holds across a range of widely

used control measures. Second, the most highly liquid stocks (25% of the most liquid stocks) on the Indian

market offer the highest average returns from both the winner minus loser portfolio and the zero-cost

portfolio. This is true regardless of the holding period.

The nal part of our analysis is with regard to the difference in protability results which we obtain. Two

aspects of the Indian stock market have become clear. First, the market is protable. A range of different

strategies tend to offer investors statistically signicant monthly returns. Second, when we estimate prots by

sector, we observe that while most strategies support sectoral protability to hold for all six sectors, prots

tend to be sector-specic. This heterogeneity in sectoral prots is not surprising but is rather expected. This

type of sector-specic results can best be explained by the information diffusion hypothesis, proposed by

Hong et al. (2007), and empirically tested by Westerlund and Narayan (2014a), who show that different types

of nancial ratios predict returns of some sectors more successfully than others. Moreover, Hong et al. (2007)

test whether industry portfolios predict movements in stock markets. They nd that 14 out of 34 industries

can predict movements in stock markets, suggesting support for the information diffusion hypothesis. More

specially, they claim, on the evidence of this predictability, that the stock market reacts with a delay to

information contained in industry returns. Motivated by these ndings, we test whether market returns

predict sectoral returns on the Indian stock market. Essentially, our time-series predictive regression model

has the following form:

SRt MRt1 t

where SR is the sectoral stock return and MR is the market return lagged one period over time t which is

monthly from January 2001 to December 2012. The returns are computed as the natural log difference of

market price and stock price indices. The null hypothesis is that the market return does not predict

sectoral stock returns. To test for the null hypothesis, we estimate the model using the generalised least

squares estimator proposed by Westerlund and Narayan (2012, 2014b). The two main features relevant

for our predictive regression model are: (a) predictor endogeneity; and (b) heteroskedasticity. Both these

issues characterise predictive regression models where high frequency data are used and where returns

appear on both sides of the regression model. The results, reported in Table 12, are as follows. First, our

Table 12

Results on sectoral return predictability.

This table reports three ndings. Column 2 contains the FGLS test examining the null hypothesis that market return predicts sectoral

returns for India. Six sectors, namely, banking, energy, FMCG, IT, MNC, and pharmaceutical, are considered. The coefcient on beta

and the FGLS t-test statistic of Westerlund and Narayan (2012, 2014) are reported in parenthesis. Column 3 is about whether market

return for each of the six sectors is endogenous in our proposed predictive regression model. To test for endogeneity, the residuals

from the proposed predictive regression model are regressed on residuals obtained from the rst-order autoregressive model of

market returns. The slope coefcient is reported together in parenthesis with the t-test statistic examining the null hypothesis that

the slope coefcient is zero. The nal column reports the null hypothesis of no ARCH effects in market returns and in sectoral returns.

*** denotes statistical signicance at the 1% level.

Predictability test: = 0

Endogeneity test

Heteroskedasticity test (p-value)

Market returns

Sectoral returns

0.486***

0.281***

0.126**

0.869***

0.269***

0.264***

1.166***

0.920***

0.514***

1.714***

0.779***

0.669***

0.000

0.000

0.000

0.000

0.000

0.000

0.000

0.000

0.000

0.000

0.000

0.000

Sectors

Banking

Energy

FMCG

IT

MNC

Pharmaceutical

(4.894)

(3.186)

(1.941)

(3.323)

(3.772)

(3.880)

(20.115)

(20.928)

(11.290)

(5.825)

(22.364)

(13.991)

60

P.K. Narayan et al. / Pacic-Basin Finance Journal 30 (2014) 4461

predictor variablemarket returnsis endogenous. This endogeneity is present in all sectoral predictive

regression models. Second, the ARCH-LM test on ltered returns based on an autoregressive model with

12 lags, suggests that the null hypothesis of no heteroskedasticity can be strongly rejected at the 1% level

for both the market returns and all the sectoral returns. Third, the null hypothesis of no predictability is

rejected strongly at the 1% level for all six sectors and the coefcient on predictability is in the range of

0.264 (pharmaceutical sector) and 0.869 (IT sector). This nding suggests that the sectoral returns react to

market returns with different speeds. For example, a 1% increase in market returns predicts a 0.869%

increase in the IT sector's returns but the effect of the market is almost four times smaller on the returns of

the pharmaceutical sector. This is suggestive of a gradual diffusion of information from the market to its

sectors.

4. Concluding remarks

In this paper we examine whether, using a range of trading strategies, investors can make prots from

the Indian stock market. Our contributions are three-fold. First, unlike the extant literature, we examine

protability at the sector-level; yet, we do not ignore the market. We employ a range of trading strategies,

allowing an investor to take long and short positions, and consistently nd that the IT sector is the most

protable. Second, a controversial issue about which not much public information is available relates to

the magnitude of short-selling. We provide an analysis and estimate the magnitude of short-selling on the

Indian market.

Third, we undertake a range of robustness tests, including identifying winners and losers from technical

trading rules and past performance, controlling for industry size, book-to-market, and liquidity factors, and

generating risk-adjusted momentum and zero-cost portfolio prots. All results point to the protability of the

Indian stock market. Importantly, we discover that some sectors are relatively more protable than others.

We show that this sector-specic protability is due to information diffusionthat is, the market returns,

while they do predict all six sectoral returns, the magnitude of predictability varies from sector-to-sector. So,

in our analysis, the source of information diffusion is not only the evidence that market returns predict stock

returns but also that the speed of predictability is different for different sectors.

There are two main implications emerging from our study. Both relate to prospects for future studies. First,

we believe that future studies, not only on the Indian stock market but on stock markets in general, should

show respect to sectoral heterogeneity in any hypothesis testing that involves sectors of a market. Second, in

light of lack of concrete information on short-selling in the Indian stock exchange, our estimate of the degree

of short-selling is merely a prediction. We emphasise on this point strongly, for we hope future studies will

improve upon our prediction error (if any), and, in doing so, our study sets the motivation for future research

on this subject. We are most excited about these future research outcomes.

References

Barroso, P., and Santa-Clara, P., (2013) Momentum has its moments, Unpublished Manuscript.

Chang, E.J., Lima, E.J.A., Tabak, B.M., 2004. Testing for predictability in emerging equity markets. Emerg. Mark. Rev. 5, 295316.

Dicle, M.F., Beyhan, A., Yao, L.J., 2010. Market efciency and international diversication: evidence from India. Int. Rev. Econ. Financ.