Escolar Documentos

Profissional Documentos

Cultura Documentos

RMC No 68-2015

Enviado por

Pedro BrugadaDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

RMC No 68-2015

Enviado por

Pedro BrugadaDireitos autorais:

Formatos disponíveis

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

Quezon City

August 1, 2015

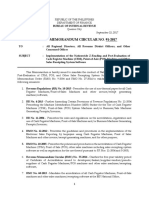

REVENUE MEMORANDUM CIRCULAR NO. 68-2015

SUBJECT

ACCREDITATION OF CASH REGISTER MACHINES / POINT-OFSALE MACHINES AND OTHER SALES MACHINES/RECEIPTING

SOFTWARE AT THE BIR NATIONAL OFFICE LEVEL

TO

All Internal Revenue Officials, Employees and Others Concerned

Pursuant to Section 237 of the National Internal Revenue Code of 1997

(NIRC), as amended, and in conformity with Revenue Memorandum Circular (RMC)

No. 30-2015, this Circular is hereby issued to mandate the accreditation of all Cash

Register Machines (CRM) / Point-of-Sale (POS) machines and other sales

machines/receipting software at the BIR National Office.

In line with this, the following policies and guidelines shall be observed:

1. All developers / distributors / dealers / supplier-vendors / pseudo-suppliers

who intend to sell / distribute / use CRM / POS / other sales machines /

receipting software shall secure accreditation from the BIR prior to selling /

distribution / use of the same.

Pseudo-suppliers shall refer to taxpayer-users of sales machines and/or sales

receipting system software who are either: (a) direct importers of CRM/POS

or other receipt/invoice-generating business machines; or (b) taxpayer-users

who develop their own sales receipting system software, for their own internal

use and/or for distribution to their branches/franchisees;

2. All new applications for accreditation of CRM/POS/other sales

machines/receipting software of developers / distributors / dealers / suppliervendors / pseudo-suppliers shall be processed at the BIR-National Office level

only, through the National Accreditation Board (NAB);

3. Only BIR-accredited CRM/POS/other sales machines/receipting software shall

be used by business taxpayers;

4. Accreditation shall be valid for five (5) years from the date of issuance of the

Certificate of Accreditation. The developer / dealer / supplier-vendor / pseudosupplier of CRMs / POSs / other sales machines / receipting software shall

apply for renewal of accreditation within sixty (60) days prior to the expiration

of the validity period;

Page 1 of 4

5. Taxpayer-users and/or resellers of CRM / POS / other sales machines /

receipting software acquired online or abroad (off-the-shelf), for use and/or resell in the Philippines, shall be treated as pseudo-suppliers; thus, they shall be

required to secure an accreditation from the NAB prior to use and/or re-selling

of the same;

6. Taxpayer-users of sales receipting system software or any similar software

acquired / subscribed via Cloud application service provider shall likewise

secure an accreditation, provided that the taxpayer-user shall allow a

provision for storage and backup of all required data including authorized

access(es) for BIR Revenue Officers which shall be locally available for audit

purposes.

Cloud refers to an internet-based computing where different services such as

servers, storage and applications are delivered to an organization to cater

specific business or non-business requirements;

7. The National Accreditation Board and the Technical Working Group are

hereby created and shall be composed of the following:

National Accreditation Board (NAB)

Head:

Assistant Commissioner, Client Support Service (CSS),

Operations Group (for Taxpayers under Revenue

District Offices (RDO)/Revenue Region (RR) Offices)

Assistant Commissioner, Large Taxpayer Service (LTS) (for

Large Taxpayers)

Co-head:

Assistant Commissioner, Information Systems Development &

Operations Service (ISDOS), Information Systems Group

Members:

A. Functional

Chief, LT-Audit Division/Large Taxpayers Division (LTD)

Makati and Cebu

Chief, Large Taxpayers Assistance Division (LTAD)/Excise LT

Regulatory Division (ELTRD)

Chief, Taxpayer Service Programs & Monitoring Division

(TSPMD) or Representative-CSS

Chief, Assessment Programs Division (APD) or RepresentativeAssessment Service

B. Technical

Head or Representative, National Office Data Center (NODC)

Chief or Representative, Security Management Division (SMD)

Chief or Representative, Network Management and Technical

Support Division (NMTSD)

Chief or Representative, IT Planning & Standards Division

(ITPSD)

Technical Working Group (TWG)

A. TWG Secretariat (ISG)

B. Section Chief or Representative from the following offices:

Page 2 of 4

TSPMD;

LT-Audit Division/LTD;

LTAD/ELTRD/LTD;

APD;

NODC; RDC

SMD;

8. All new applicants for accreditation of their CRM / POS / other sales machines

/ receipting software, or their designated Authorized Users, shall be required

to enroll at the BIRs Electronic Accreditation and Registration (eAccReg)

system, prior to the use of the same.

An authorized user is a duly designated responsible officer/employee with a

written authorization duly signed by the developer / distributor / dealer /

supplier-vendor / pseudo-supplier as indicated in the sworn statement;

9. To enroll in eAccReg, a duly signed Sworn Declaration (Annex A) together

with the complete documentary requirements as enumerated under Section

5.0 of Revenue Regulations No. 11-2004, shall be submitted by the developer

/ dealer / supplier-vendor / pseudo-supplier to the RDOs / LTAD / ELTRD /

LTDs having jurisdiction over the place of business of the said applicant;

10. Enrollment may be done before or after submission of the Sworn Declaration

and complete documentary requirements. The approval/activation of the

applicants Account Enrollment shall be upon receipt of the Sworn

Declaration and complete documentary requirements by the concerned RDO

/ LTAD / ELTRD / LTD. Account enrollment application shall be on a one (1)

authorized user per Taxpayer Identification Number (TIN) basis, or one

authorized user in behalf of multiple Branches, whichever is

applicable/convenient to the taxpayer.

Account enrollment is a web facility allowing users of eAccReg to create an

account including those with manually-issued Machine Identification Number

(MIN). It requires information to be provided to identify the taxpayer plus the

desired username and password;

11. The concerned RDO / LTAD / ELTRD / LTD shall ensure the completeness of

the required documents received which shall be collated in a docket and shall

be transmitted to the NAB, through the Secretariat Technical Working Group

(TWG) from the ISG, prior to inspection / evaluation;

12. The following shall be observed by the TWG in the actual conduct of the

inspection / evaluation:

A. Inspect the machine/software requiring the applicant to present an actual

systems demonstration of the system;

B. Determine if the machine is compliant with the conditions set forth

under Section 5.0 of RR No. 11-2004;

Page 3 of 4

C. Determine if the machine issues a receipt/invoice with complete data

requirements as provided in Section 5 of RR No. 10-2015; and

D. Use the Functional and Technical Evaluation/Appraisal Checklist of Sales

Machines and/or Sales Receipting System Software as provided in Annex

E of Revenue Memorandum Order (RMO) No. 10-2005.

13. The respective Heads of the NAB shall be responsible for the issuance of the

Certificate of Accreditation/Notice of Denial; and

14. The list of accredited CRM / POS / other sales machines / receipting software

shall be posted on the BIR website, including contact details of the developer

/ dealer / supplier-vendor / pseudo-supplier.

All internal revenue officials and employees are hereby enjoined to give this

Circular as wide a publicity as possible.

(Original Signed)

KIM S. JACINTO-HENARES

Commissioner of Internal Revenue

H2

.

LMB ______ NMA ______ LCG ______ EBQ ______ ARS ______ NSV ______ MLDR ______ CACR ______

SBM ______ MAG ______

JPP

______ ESM ______ MLH ______ PBG

______

Page 4 of 4

MAA ______

Você também pode gostar

- CRM POS GuidelinesDocumento7 páginasCRM POS GuidelinesRomer LesondatoAinda não há avaliações

- Flexible Work Agreement: Last Updated 4 July 2019Documento4 páginasFlexible Work Agreement: Last Updated 4 July 2019Muso OnleeAinda não há avaliações

- Sec Registration of Representative Office: Basic Requirements To HaveDocumento8 páginasSec Registration of Representative Office: Basic Requirements To HaveGabriel CarumbaAinda não há avaliações

- Maritime Industry Authority Advisory No 2017-17Documento3 páginasMaritime Industry Authority Advisory No 2017-17PortCalls100% (2)

- Annex A - Mission OrderDocumento1 páginaAnnex A - Mission OrderLeomar ContilloAinda não há avaliações

- Bir Ruling Da 086 08Documento5 páginasBir Ruling Da 086 08Orlando O. CalundanAinda não há avaliações

- Tax Update RR 18-2012Documento32 páginasTax Update RR 18-2012johamarz6245Ainda não há avaliações

- Used Vehicle Purchase and Sale ContractDocumento3 páginasUsed Vehicle Purchase and Sale ContractScribdTranslationsAinda não há avaliações

- PermittingHazardous PDFDocumento35 páginasPermittingHazardous PDFMike AdvinculaAinda não há avaliações

- 209890-2017-Opulent Landowners Inc. v. Commissioner of PDFDocumento29 páginas209890-2017-Opulent Landowners Inc. v. Commissioner of PDFJobar BuenaguaAinda não há avaliações

- Preliminary Advice of Loss FormDocumento1 páginaPreliminary Advice of Loss FormWai Leong Edward Low0% (1)

- Pool Reservation FormDocumento2 páginasPool Reservation Formadmin9696Ainda não há avaliações

- SecCert LGU Permits Application (Oct 6, 2020) RevDocumento1 páginaSecCert LGU Permits Application (Oct 6, 2020) RevArnel Kevin Jan BesaAinda não há avaliações

- Pea Applicationform PDFDocumento1 páginaPea Applicationform PDFChipAinda não há avaliações

- Procedure For Land AcquisitionDocumento25 páginasProcedure For Land AcquisitionRob ClosasAinda não há avaliações

- Revenue Audit Memorandum 1-98Documento5 páginasRevenue Audit Memorandum 1-98Nikos CabreraAinda não há avaliações

- Buyer's Request Form (BRF)Documento2 páginasBuyer's Request Form (BRF)LeytonDelaCruzAinda não há avaliações

- 2022MC SEC MC No. 9 S. of 2022 2023 Filing of Annual Financial Statements and General Information Sheet R 12-13-22Documento5 páginas2022MC SEC MC No. 9 S. of 2022 2023 Filing of Annual Financial Statements and General Information Sheet R 12-13-22jonely kantimAinda não há avaliações

- RMC No 5-2014 - Clarifying The Provisions of RR 1-2014Documento18 páginasRMC No 5-2014 - Clarifying The Provisions of RR 1-2014sj_adenipAinda não há avaliações

- Withholding Tax Remittance Return: Kawanihan NG Rentas InternasDocumento4 páginasWithholding Tax Remittance Return: Kawanihan NG Rentas InternasArlyn De Las AlasAinda não há avaliações

- Biodata Revised As of 11.5.18Documento1 páginaBiodata Revised As of 11.5.18Oceanspeed LogisticsAinda não há avaliações

- SD-SCD-QF01 Application For PS (FORM) - 19june2014Documento4 páginasSD-SCD-QF01 Application For PS (FORM) - 19june2014Mitch EspirituAinda não há avaliações

- Increase of Authorized Capital Stock: Additional Requirements Depending On The Kind of Payment On SubscriptionDocumento3 páginasIncrease of Authorized Capital Stock: Additional Requirements Depending On The Kind of Payment On SubscriptionsejinmaAinda não há avaliações

- Joint Affidavit of Two Disinterested PersonsDocumento2 páginasJoint Affidavit of Two Disinterested PersonsRodjard Pacete100% (1)

- Operations Order SBM NO. 2014-013Documento3 páginasOperations Order SBM NO. 2014-013Thelma Evangelista100% (1)

- Telecomuting AgreementDocumento2 páginasTelecomuting AgreementJPFAinda não há avaliações

- Mayor's Permit QC 2 - 2Documento2 páginasMayor's Permit QC 2 - 2Zachary YapAinda não há avaliações

- BIR Ruling No. 242-18 (Gift Certs.)Documento7 páginasBIR Ruling No. 242-18 (Gift Certs.)LizAinda não há avaliações

- Rmo 12 2013 List of Unused Expired Orssiscis Annex D Docxdocx PDF FreeDocumento2 páginasRmo 12 2013 List of Unused Expired Orssiscis Annex D Docxdocx PDF FreeShitake Mitsuki100% (1)

- Affidavit For Change of Color of Motor VehicleDocumento1 páginaAffidavit For Change of Color of Motor VehicleHR LegalAinda não há avaliações

- Appointment LetterDocumento3 páginasAppointment LetterOjhal RaiAinda não há avaliações

- Annex C-1 - Summary of System DescriptionDocumento4 páginasAnnex C-1 - Summary of System DescriptionChristian Albert HerreraAinda não há avaliações

- Alpha, Inc.: Articles of IncorporationDocumento5 páginasAlpha, Inc.: Articles of IncorporationgilbertmalcolmAinda não há avaliações

- Nino SawtDocumento2 páginasNino SawtCarolina VillenaAinda não há avaliações

- Trademark Application FormDocumento2 páginasTrademark Application FormlemmorepisacAinda não há avaliações

- Borres Realty & Development Corporation Borres Realty & Development CorporationDocumento12 páginasBorres Realty & Development Corporation Borres Realty & Development Corporation09303313316Ainda não há avaliações

- 6b Manila Trafffice and Parking BureauDocumento12 páginas6b Manila Trafffice and Parking BureauRobin de VegaAinda não há avaliações

- Orleyte Co. Philippine Branch v. City ofDocumento5 páginasOrleyte Co. Philippine Branch v. City ofChristian Edward CoronadoAinda não há avaliações

- AIRB Cover LetterDocumento1 páginaAIRB Cover Letterhazel sabinoAinda não há avaliações

- Certificate of No Pending Admin Case FormDocumento1 páginaCertificate of No Pending Admin Case FormXavier Henry ZamoraAinda não há avaliações

- AGENT Referral Agent Agreement-NEW LOGO (1) - SignedDocumento2 páginasAGENT Referral Agent Agreement-NEW LOGO (1) - SignedHerbertAinda não há avaliações

- Integrity PactDocumento7 páginasIntegrity PactHarpreet SinghAinda não há avaliações

- RFID Customer Request FormDocumento1 páginaRFID Customer Request FormSteven CastroAinda não há avaliações

- Promo Mechanics WedDocumento3 páginasPromo Mechanics WedRaizel OgreAinda não há avaliações

- Authorization For Credit Investigation and AppraisalDocumento1 páginaAuthorization For Credit Investigation and AppraisalMarvin CeledioAinda não há avaliações

- Undertaking Against Undue Influence BriberyDocumento2 páginasUndertaking Against Undue Influence BriberyjoyAinda não há avaliações

- Template NDA For ProposalsDocumento7 páginasTemplate NDA For ProposalsBenup GuragainAinda não há avaliações

- Document Checklist: Bizlink Enrollment FormDocumento2 páginasDocument Checklist: Bizlink Enrollment FormYourMakatiPad PropertiesAinda não há avaliações

- Waiver, Waiver and Quitclaim: Know All Men by These PresentsDocumento1 páginaWaiver, Waiver and Quitclaim: Know All Men by These PresentsChow GarciaAinda não há avaliações

- Renewal FAs FormDocumento2 páginasRenewal FAs FormMichelle GarciaAinda não há avaliações

- We Have Prepared A Template Below That You Can Have Printed, Filled Out, Signed and NotarizedDocumento2 páginasWe Have Prepared A Template Below That You Can Have Printed, Filled Out, Signed and NotarizedMcAsia Foodtrade Corp0% (1)

- RFID Customer Request FormDocumento1 páginaRFID Customer Request FormAnatalio ViadoyAinda não há avaliações

- 2022 - Escrow Secretary's CertificateDocumento1 página2022 - Escrow Secretary's CertificateAngela Pascual100% (1)

- Pro-Forma Application Letter For Enrollment in PEZA Electronic Zone Transfer System (EZTS)Documento2 páginasPro-Forma Application Letter For Enrollment in PEZA Electronic Zone Transfer System (EZTS)PortCallsAinda não há avaliações

- Rule 1020 New Establishment Registration (1) - 2Documento1 páginaRule 1020 New Establishment Registration (1) - 2Dustin NitroAinda não há avaliações

- POEA License ProcedureDocumento3 páginasPOEA License ProcedureDiana FernandezAinda não há avaliações

- Provisional Agenda For The 1299th Board of Regents MeetingDocumento16 páginasProvisional Agenda For The 1299th Board of Regents MeetingOffice of the Student Regent, University of the PhilippinesAinda não há avaliações

- Revenue Memorandum Order No. 15-2018: Bureau of Internal RevenueDocumento15 páginasRevenue Memorandum Order No. 15-2018: Bureau of Internal Revenuebayot limAinda não há avaliações

- 20005rmo 10-05Documento16 páginas20005rmo 10-05Cheng OlayvarAinda não há avaliações

- RMC No 91-17 Post Evaluation of CRM POSDocumento6 páginasRMC No 91-17 Post Evaluation of CRM POSGil Pino0% (1)

- Ak. Jain Dukki Torts - PDF - Tort - DamagesDocumento361 páginasAk. Jain Dukki Torts - PDF - Tort - Damagesdagarp08Ainda não há avaliações

- JurisDocumento19 páginasJurisJee JeeAinda não há avaliações

- Affinity (Medieval) : OriginsDocumento4 páginasAffinity (Medieval) : OriginsNatia SaginashviliAinda não há avaliações

- False Imprisonment and IIED Ch. 1Documento2 páginasFalse Imprisonment and IIED Ch. 1Litvin EstheticsAinda não há avaliações

- Yumol - Jr. - v. - Ferrer - Sr.Documento12 páginasYumol - Jr. - v. - Ferrer - Sr.Maegan Labor IAinda não há avaliações

- Public OfficerDocumento12 páginasPublic OfficerCatAinda não há avaliações

- Minimum Capital Requirement GhanaDocumento2 páginasMinimum Capital Requirement GhanaAndrew TandohAinda não há avaliações

- A Theoretical Study of The Constitutional Amendment Process of BangladeshDocumento58 páginasA Theoretical Study of The Constitutional Amendment Process of BangladeshMohammad Safirul HasanAinda não há avaliações

- Navarro v. SolidumDocumento6 páginasNavarro v. SolidumJackelyn GremioAinda não há avaliações

- Deloitte - Contingency PlanDocumento5 páginasDeloitte - Contingency PlanvaleriosoldaniAinda não há avaliações

- Fuji v. Espiritu - CaseDocumento21 páginasFuji v. Espiritu - CaseRobeh AtudAinda não há avaliações

- Philippines Commonly Used ObjectionsDocumento1 páginaPhilippines Commonly Used ObjectionsEllen DebutonAinda não há avaliações

- Case Study On Tata NanoDocumento12 páginasCase Study On Tata NanoChandel Manuj100% (1)

- Transpo Case Digests FinalsDocumento21 páginasTranspo Case Digests Finalsaags_06Ainda não há avaliações

- Certificate of Conformity: No. CLSAN 080567 0058 Rev. 00Documento2 páginasCertificate of Conformity: No. CLSAN 080567 0058 Rev. 00annamalaiAinda não há avaliações

- Clint Stillmore Operates A Private Investigating Agency Called Stillmore InvestigationsDocumento2 páginasClint Stillmore Operates A Private Investigating Agency Called Stillmore Investigationstrilocksp SinghAinda não há avaliações

- Top Ten IT FailuresDocumento1 páginaTop Ten IT Failuresjason_carter_33Ainda não há avaliações

- CIDB Contract FormDocumento36 páginasCIDB Contract FormF3008 Dalili Damia Binti AmranAinda não há avaliações

- Mindanao Pres Co. v. City Assessors G.R. No. L-17870Documento2 páginasMindanao Pres Co. v. City Assessors G.R. No. L-17870Liam LacayangaAinda não há avaliações

- Sanchez v. DemetriouDocumento15 páginasSanchez v. DemetriouChristopher Martin GunsatAinda não há avaliações

- Remedial Law Q and ADocumento17 páginasRemedial Law Q and Akonvan100% (2)

- Cybersecurity in Africa An AssessmentDocumento34 páginasCybersecurity in Africa An AssessmentTPK Studies & WorkAinda não há avaliações

- Instructions & Commentary For: Standard Form of Contract For Architect's ServicesDocumento65 páginasInstructions & Commentary For: Standard Form of Contract For Architect's ServicesliamdrbrownAinda não há avaliações

- Mohnish Pabrai - ChecklistDocumento1 páginaMohnish Pabrai - ChecklistCedric TiuAinda não há avaliações

- Skyline Software Systems, Inc. v. Keyhole, Inc Et Al - Document No. 74Documento3 páginasSkyline Software Systems, Inc. v. Keyhole, Inc Et Al - Document No. 74Justia.comAinda não há avaliações

- Ballard County, KY PVA: Parcel SummaryDocumento3 páginasBallard County, KY PVA: Parcel SummaryMaureen WoodsAinda não há avaliações

- Crisis After Suffering One of Its Sharpest RecessionsDocumento5 páginasCrisis After Suffering One of Its Sharpest RecessionsПавло Коханський0% (2)

- Solved Consider The Apple Computer Trade Example Given in Section 19 5 NowDocumento1 páginaSolved Consider The Apple Computer Trade Example Given in Section 19 5 NowM Bilal SaleemAinda não há avaliações

- Media and Information Literacy: Quarter 1 - Module 7Documento8 páginasMedia and Information Literacy: Quarter 1 - Module 7Louie RamosAinda não há avaliações

- Going Through Customs: Useful WordsDocumento1 páginaGoing Through Customs: Useful Wordslolita digiacomoAinda não há avaliações