Escolar Documentos

Profissional Documentos

Cultura Documentos

CHP 4

Enviado por

Czarina CasallaDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

CHP 4

Enviado por

Czarina CasallaDireitos autorais:

Formatos disponíveis

15

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 4: Gross Income

CHAPTER 4

GROSS INCOME

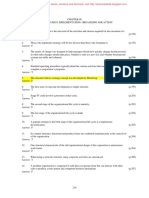

Problem 4 1 TRUE OR FALSE

1. True

2. True

3. True

4. False cost of living allowance is part of a taxable compensation income.

5. True

6. False Religious officers income is subject to income tax.

7. True

8. True

9. False , income of debtor = amount of debt settled

10. False transportation allowance pre-computed on a daily basis is not subject to tax.

11. False there is no income because the actual expenses is greater than the advances.

12. True

13. False, the rule on MCIT is being described.

14. True

15. True

Problem 4 2 TRUE OR FALSE

1. False tips are taxable because there is no law exempting it from income tax.

2. True

3. False Not income but a liability in compliance with the trading business rule.

4. False Under service business, advances from clients are to be reported as income.

Include as income because the advanced rental is without restriction.

5. True

6. True

7. False because estimated bad debts is not allowed to be deducted from gross business

income.

8. True

9. False Not an option to report, but required to report.

10. False the return of premium from insurance company is not taxable.

11. True

12. False income should be realized to be taxable.

13. True

14. False As a rule, income obtained illegally is taxable.

15. False As a rule, income received by error is reportable income.

16

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 4: Gross Income

Problem 4 3 TRUE OR FALSE

1. False This tax-exemption is granted only to public employees and applicable to

accumulated monetized vacation and sick leave credits.

2. False Only 13 th month pay is nontaxable within P30,000 ceiling.

3. True

4. False proceeds of life insurance due to death is nontaxable regardless of who is the

beneficiary.

5. False as a rule board and loading furnished by an employer is taxable, except when it

applies to employers benefit rule.

6. True

7. False not taxable income because the dividend received is still stock though different in

class.

8. True

9. True

10. True

11. False The rule of P10,000 and below applies to prizes not winnings.

12. False Only damages resulting from injuries is nontaxable.

13. True

14. False this rule applies to winnings. Prizes amounting to P10,000 and below is subject

to normal tax.

15. True

Problem 4 4 TRUE OR FALSE

1. True

2. True

3. False Income from profession

4. True

5. True

6. False Only those employees who can meet the requisites are exempt from income tax

even if the retirement plan is BIR approved.

7. True

8. False Not taxable.

9. False Overtime pay of MWE is nontaxable.

10. True

11. True

12. False Interest expense of a bank is treated as part of cost of service.

13. False Advance collection of rent income is taxable.

14. False All earnings of a resident Filipino citizen from all sources are taxable in the

Philippines.

17

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 4: Gross Income

15. False Subject to a normal tax of 30% because such interest income is a normal

operating income of the bank.

Problem 4 5

1. D

2. C

3. C

4. A

5. D

6. D

7. A

8. B

9. A

10. B

Problem 4 6

1. D

2. B

3. D

4. B

5. A

6. B

7. C

8. A

9. C

10. D

Problem 4 8

A

Net take home pay

Add: Withholding income tax

Total

Less: 13 th month pay

Gross reportable compensation

Problem 4 7

1. D

2. C

3. B

4. C

5. A

6. B

7. D

8. B

9. D

10. C

P180,000

30,000

P210,000

10,000

P200,000

Unused 10-day vacation leave is nontaxable if it is converted into cash (Rev. Regs. No. 10-2008;

BIR Ruling No. 93-34). In the above problem, the 10-day vacation leave was actually availed;

hence, taxable.

Problem 4 9

D

Salary (P370,000 + P50,000)

Per diem as a board of director

Taxable thirteenth month pay (P35,000 P5,000)

Gross taxable compensation income

P420,000

200,000

5,000

P625,000

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

18

Chapter 4: Gross Income

Problem 4 10

B

Salary

Overtime pay

13th month pay and other bonuses

Total compensation income

P150,000

30,000

15,000

P195,000

Problem 4 11

B

Salary

Tips

Cost and living allowance

Total taxable compensation income

P120,000

360,000

5,000

P485,000

Note: New BIR interpretation provides that the 13 th month pay and other benefits amounting to

P30,000 and below is not taxable. Since the 13 th month pay is only P10,000, the P20,000

achievement awards being part of de-minimis can be used as other benefits, to complete the

P30,000 nontaxable threshold.

Problem 4 12

Salary (P120,000 + P24,000)

Overtime pay

Payment of services (P4,000 + P30,000)

Present value of non-interest bearing notes (P30,000 x 0.909)

Reportable taxable income per ITR

P144,000

36,000

34,000

27,270

P241,270

In general, interest income is subject to final tax; hence not to be reported in the ITR.

Non-interest bearing note is to be reported at its discounted value when received. (Sec.

2.78.1, Rev. Reg. No. 2-98)

Problem 4 13

D

(First employment for 30 years received at the age of 50)

P500,000

Aside from the requirement that the plan should be reasonable, the Tax Code requires that the retiring employee should have been in the

service of the same employer for at least ten years and is not less than fifty years of age at the time of his retirement. The taxpayer should

not also have previously availed of the privilege under a retirement benefit plan for the same or another employer.)

Problem 4 14

B

First employment resigned

Problem 4 15

C

Gross compensation income (1,000 x P10)

P300,000

P10,000

19

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 4: Gross Income

Problem 4 16

Compensation income (P13 P12) x 10,000

Capital gain (P15 P13) x 10,000

Problem 4 17

Compensation

P 10,000

Capital gain

P 20,000

Compensation income (P25 P23) x 10,000

Capital gain (P30 P25) x 10,000

Compensation

P 20,000

Capital gain

P 50,000

Correction: The option was exercised and sold in year 200C when the market price was P30.

Problem 4 18

C

Regular compensation per month

Cancellation of indebtedness (P300,000 P275,000)

Total compensation income December 200B

Problem 4 19

B

Insurance premium beneficiary Sico

Problem 4 20

A

Basic compensation (P30,000 x 12)

Shares of stock (P100 x 100)

Stock option (P120 P80) x 100

Annual insurance premium (P4,000 x 50%)

Gross compensation

Problem 4 21

B

Cleaning of business equipment

Repair service of store

Total casual service income

Problem 4 22

C

Total purchases

Transportation cost on purchases

Unsold goods

Cost of goods sold

Problem 4 23

Inventory, beginning

Purchases

Purchase discounts

Purchase returns

P 50,000

25,000

P75,000

P5,000

P360,000

10,000

4,000

2,000

P376,000

P 1,000

3,000

P 4,000

P500,000

5,000

( 40,000)

P465,000

C

P 20,000

1,200,000

( 10,000)

( 40,000)

20

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 4: Gross Income

Transportation in

Inventory end

Cost of sale

Problem 4 24

5,000

( 50,000)

P1,125,000

C

Year 1

Inventory, beginning

Inventory, ending

Purchases

Freight in

Purchase discount

Cost of sales

(P50,000)

850,000

10,000

( 20,000)

P790,000

Problem 4 25

B

Sales

Sales returns

Net sales

Less: Cost of goods manufactured and sold

Purchases raw materials

Freight-in

Raw materials, ending inventory

Raw materials used

Direct labor

Factory overhead

Total manufacturing cost

Work-in-process, ending inventory

Finished goods, ending inventory

Gross business income

Problem 4 26

Advance payment

Additional collection

Office machine

Gross service income

Year 2

P 50,000

( 30,000)

900,000

15,000

( 25,000)

P910,000

P1,275,000

(

25,000)

P1,250,000

P 540,000

20,000

(

10,000)

P 550,000

400,000

200,000

P1,150,000

( 100,000)

( 50,000)

1,000,000

P 250,000

Problem 4 27

B

Professional fee, accounting services

Less: Direct costs of services:

Salaries of accounting staff

Accounting supplies

Gross business income for MCIT purposes*

P 2,000

8,000

3,000

P13,000

P500,000

P150,000

10,000

160,000

P340,000

Correction: The requirement should qualify that the gross business income is for MCIT

purposes.

Problem 4 28

B

Interest income from clients

P50,000,000

21

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 4: Gross Income

Trading gain

Less: Cost of services:

Lending and investments funds salaries

Interest expenses paid to depositors

Gross income for MCIT purposes

Problem 4 29

10,000,000

P3,000,000

2,000,000

5,000,000

P55,000,000

Interest income from clients

Gain on sale of capital assets

Rent income

Total

Less: Cost of services:

Salaries of bank employees assigned in

lending and investments of funds

Depreciation of computers and

teller machines used

Direct supplies used

Interest expense paid to depositors

Gross income for MCIT purposes

P10,000,000

5,000,000

2,000,000

P17,000,000

P3,700,000

600,000

200,000

1,500,000

6,000,000

P11,000,000

Problem 4 30

B

Service charges:

Originating from the Philippines

Collection abroad of collect messages originating in the Philippines

Gross income for Philippine Income Tax computation

P 150,000

60,000

P 210,000

Problem 4 31

B

Rent for year:

200A

200B

200C

200B Reportable income

P 80,000

480,000

40,000

P 600,000

Problem 4 32

1

.

Letter C

22

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 4: Gross Income

Advanced deposit

Monthly rental (P20,000 x 10 months)

Annual insurance premium to be paid by the lessee

(P6,000 x 10/12)

Portion of real estate tax to be paid by the lessee

(P3,000 x 10/12)

Rent income

P 40,000

200,000

5,000

2,500

P247,500

As a general rule, pre-collection of rental is taxable in full to the lessor when

received regardless of accounting method used.

2

.

Letter B

Monthly rental (P20,000 x 10 months)

Annual insurance premium to be paid by the lessee

(P6,000 x 10/12)

Portion of real estate tax to be paid by the lessee

(P3,000 x 10/12)

Rent income

Commission income (P2,000,000 x 5%)

Reportable taxable income

Problem 4 33

P200,000

5,000

2,500

P207,500

100,000

P307,500

Year 1 Outright method

Year 1 Spread-out method

Value of investment

Less: Accum. depreciation [(P240,500 - P560)/8 yrs] x 4.75 yrs

Book value, end of lease

Divided by remaining years of contract

Outright

P240,500

P240,500.00

142,464.37

P 98,035.63

4.7

5

P

20,639

9/12

P

15,479

Annual income from improvement

Multiplied by months in a year

Year 1 spread-out rent income on improvement

Problem 4 34

Outright

Spread-out

Spread-out

C

Outright

P180,000

Spread-out

P - 0 -

For spread out method, there is no reportable income from leasehold improvement for year 200B

because the said improvement was completed at the end of the year.

23

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 4: Gross Income

Problem 4 35

Cost of improvement

Less: Accumulated depreciation at the end of the lease (P300,000/6) x 4 years and 7 months

Book value at the end of the lease

Divided by number of years until the termination of lease contract = 4 years and 7 months

Annual additional income

Multiplied by number of years expired (from March 31, 200B to December 31, 200D)

Reported additional income from improvement

Book value of improvement at the time of pre-termination

Cost

P300,000

Less: Accum. depreciation at pre-termination (P300,000/6) x 2.75 years

137,500

Additional income in 200D from the pre-termination of contract

Problem 4 36

Interest income from

Interest income from

Interest income from

Total taxable interest

A

an investment in a 10-year bond

5-year time deposit in Philippine bank

expanded foreign currency deposit

income

P300,000

229,167

P 70,833

4.58

P 15,454

2.75

(P42,500)

162,500

P120,000

P 40,000

50,000

60,000

P150,000

Note: Technically speaking, the interest from 5-year time deposit in Philippine bank is taxable

because the period involved is not more than 5 years and the deposit is not BSP prescribed form.

Problem 4 37

D

Year 3 interest income of P4,461.20.

Problem 4 38

D

Royalty income as author (P100,000 x 10%)

Royalty income from franchising (P200,000 x 20%)

Royalty income from gold mine (P500,000 x 20%)

Total final tax

Problem 4 39

Gross royalties:

Copyright (P31,500/90%)

Patent (P20,000/80%)

Income tax final

Copyright (P35,000 x 10%)

Patent (P25,000 x 20%)

Income after tax

Problem 4 40

1

.

P 10,000

40,000

100,000

P150,000

Letter B

Royalties within derived from:

Copyright

P 35,000

Patent

P 25,000

( 3,500)

.

P 31,500

( 5,000)

P 20,000

24

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 4: Gross Income

Pain reliever invention (P100,000 x 20%)

Musical compositions (P200,000 x 10%)

Books (P500,000 x 10%)

Final tax on royalty income

2

.

P20,000

20,000

50,000

P90,000

Letter D

Royalties outside derived from:

Pain reliever invention

Musical compositions

Books

Royalty income subject to normal tax

P200,000

100,000

300,000

P600,000

In general, royalties derived from sources within the Philippines are subject to a final

tax of 20%, except royalties on books, other literary works and musical compositions

which shall be subject to a final tax of 10%. Royalties received by resident citizens from

sources outside the Philippines shall be subject to normal tax under Section 24 (A) of

the NIRC and by the domestic corporation under Section 27 (A) of the NIRC.

Problem 4 41

P500,000 - Dividends earned by a domestic corporation from a foreign corporation are taxable.

Problem 4 42

A

The dividend received by a domestic corporation from another domestic corporation is

nontaxable.

Problem 4 43

C

First prize in Talentadong Pinoy

2nd place in bicycle race

3rd place in chess tournament

Amount subject to normal tax

P10,000

6,000

15,000

P31,000

In general, prizes (reward for a contest) are subject to final tax of 20% except if the amount of the

prize is P10,000 or less which will be subject to normal tax. Winnings (reward that depends on

chance) are subject to 20% final tax regardless of amount. [Sec. 24 (B)(1), NIRC]

Problem 4 44

D

First prize raffle draw (P50,000 P1,000)

Gambling winnings

Beauty contest winnings

Taxable prizes and winnings

Problem 4 45

Income (loss)

P 49,000

300,000

100,000

P449,000

C

Year 1

P100,000

Year 2

(P 20,000)

Year 3

P 50,000

25

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 4: Gross Income

Less: NOLCO (P25,000 P20,000 P10,000)

Bad debts written off

Income (loss) before bad debts recovery

Bad debts recovery of previous year with tax benefit

Taxable income

25,000

P 75,000

.

P 75,000

10,000

(P 30,000)

25,000

(P 5,000)

5,000

5,000

P 40,000

8,000

P 48,000

Note: The tax benefit allowed in year 2 for the bad debts written off is only P5,000; hence, the

reportable bad debts recovery in year 3 should also be P5,000.

Problem 4 46

D

Year 1: No bad debt recovery

Year 2: Bad debt recovery

None

P 600

Problem 4 47

D

P5,000 local tax recovery.

Problem 4 48

C

Real property tax

Local taxes

Reportable income from tax refund

Problem 4 49

B

Unfair competition

Loss earnings

Moral damages for breach of contract

Exemplary damages for breach of contract

Interest on damages

Gross income from damage recoveries subject to tax

P 10,000

500

P 10,500

P400,000

100,000

150,000

50,000

10,000

P710,000

Actual damages are considered taxable income to the extent that such damages constitute a loss

of anticipated profits, and are non-taxable to the extent they represent a return of capital or

investment. However, moral and exemplary damages awarded as a result of a breach of contract

are subject to income tax, and, consequently, withholding tax. (BIR Ruling No. DA-489-2005

dated December 6, 2005)

Take note that the moral damages and exemplary damages awarded were not on account of

injuries or sickness.

Problem 4 50

C

Annuity received

Present value (P20,000 x 0.9091)

Interest income - Taxable annuity

P 20,000

18,182

P 1,818

Note: The present value factor of P1 for an effective interest rate of 10% is 0.9091.

Problem 4 51

Annuity received

D

P 5,880

26

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 4: Gross Income

Present value (P5,880 x 0.8928)

Interest income - Taxable annuity

5,250

630

Problem 4 52

B

Excess of withdrawable amount ($10,000 - $1,000)

Multiplied by exchange rate per 1 dollar

Reportable income received by error

$ 9,000

P 50

P450,000

Problem 4 53

C

Net increase in net asset

Less: Salary in a year (P5,000 x 12)

Illegally obtained income - taxable

P108,000

60,000

P 48,000

Correction: The increase in net worth should be P108,000.

Note: Income derived from illegal source is taxable even if the taxpayer is a MWE.

Problem 4 54

Gross income

P 425,000

In case of taxpayers engaged in the sale of service, gross income means gross receipts less

sales returns, allowances and discounts. [Sec. 27 (A) NIRC]

Problem 4 55

Salary

P300,000

Corporate shares received (1,000 shares x P100)

100,000

Cancellation of debt in lieu of service rendered

50,000

Profit sharing

40,000

Gross taxable compensation income

P490,000

Problem 4 56

Licensing fee

Registration fees of delivery trucks

Real estate tax

Community tax

Foreign income tax previously claimed as deduction

Reportable gross income on tax refunds

Problem 4 57

1. Gross income trading business (P500,000 P200,000)

Gross income warehouse (P200,000 P150,000)

Net capital gains (loss) on personal properties

Computer more than 1 year

(P10,000 P20,000) x 50%

Car more than 1 year (P100,000 P50,000) x 50%

Gross income subject to regular tax

2.

Unutilized portion of sale of residential house

(P1,000,000 P800,000) x 6%

P 30,000

4,000

5,000

3,000

80,000

P122,000

P300,000

50,000

(P5,000)

25,000

20,000

P370,000

P12,000

27

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 4: Gross Income

Problem 4 58

Salary (P25,000 + P302,000)

Income tax paid by the employer

Note receivable

Total compensation

Business gross income

Allowable expenses

Prepaid rent income

Bad debts recovered previously written- off (P38,000 x 60%)

Taxable income subject to tabular tax

P327,000

5,000

20,000

P352,000

P 400,000

( 250,000)

150,000

50,000

22,800

P574,800

Você também pode gostar

- CH 13Documento18 páginasCH 13Czarina CasallaAinda não há avaliações

- CH 11Documento15 páginasCH 11Czarina CasallaAinda não há avaliações

- CH 08Documento16 páginasCH 08Czarina CasallaAinda não há avaliações

- CH 10Documento15 páginasCH 10Czarina CasallaAinda não há avaliações

- CH 12Documento15 páginasCH 12Czarina CasallaAinda não há avaliações

- CH 14Documento16 páginasCH 14Czarina CasallaAinda não há avaliações

- CH 09Documento16 páginasCH 09Czarina CasallaAinda não há avaliações

- CH 07Documento16 páginasCH 07Czarina CasallaAinda não há avaliações

- CH 04Documento15 páginasCH 04Czarina CasallaAinda não há avaliações

- Ch01 PDFDocumento15 páginasCh01 PDFCzarina CasallaAinda não há avaliações

- CH 06Documento15 páginasCH 06Czarina CasallaAinda não há avaliações

- CH 02Documento16 páginasCH 02Czarina CasallaAinda não há avaliações

- CH 05Documento16 páginasCH 05Czarina CasallaAinda não há avaliações

- Chapt-14 Withholding TaxDocumento3 páginasChapt-14 Withholding Taxhumnarvios100% (2)

- Losses: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocumento4 páginasLosses: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersJane Manumpay50% (4)

- 01 Management, The Controller, & Cost AccountingDocumento4 páginas01 Management, The Controller, & Cost AccountingJay-ar PreAinda não há avaliações

- chp-13 TaxDocumento11 páginaschp-13 TaxJane Mae CruzAinda não há avaliações

- CHP 12Documento17 páginasCHP 12Czarina CasallaAinda não há avaliações

- CHP 6Documento44 páginasCHP 6Czarina CasallaAinda não há avaliações

- Income Taxes of Estates & Trusts: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocumento13 páginasIncome Taxes of Estates & Trusts: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersJane Mae CruzAinda não há avaliações

- Chapt 11+Income+Tax+ +individuals2013fDocumento13 páginasChapt 11+Income+Tax+ +individuals2013fiamjan_10180% (15)

- CHP 8Documento14 páginasCHP 8Czarina CasallaAinda não há avaliações

- Chapter 10Documento4 páginasChapter 10Judith Salome Basquinas0% (1)

- Chapt 7+Dealings+in+Prop2013fDocumento15 páginasChapt 7+Dealings+in+Prop2013fMay May100% (3)

- Chap 2 Tax Admin2013Documento10 páginasChap 2 Tax Admin2013Quennie Jane Siblos100% (1)

- Chap 1 Gen. Prin 2013Documento3 páginasChap 1 Gen. Prin 2013Quennie Jane Siblos100% (6)

- Chap 3 Concepts of Income2013Documento8 páginasChap 3 Concepts of Income2013Quennie Jane Siblos100% (1)

- Chap 5 Exclude From Gross Income2013Documento10 páginasChap 5 Exclude From Gross Income2013Quennie Jane Siblos100% (2)

- 2009 F-3 (B) Class NotesDocumento3 páginas2009 F-3 (B) Class Notesasadmir01Ainda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Merchant BankingDocumento43 páginasMerchant BankingAbhishek Sanghvi100% (1)

- ICICI Prudential Life Insurance CompanyDocumento6 páginasICICI Prudential Life Insurance CompanyRamandeep Singh ThindAinda não há avaliações

- Underwriting GuidelinesDocumento6 páginasUnderwriting GuidelinesHitkaran Singh RanawatAinda não há avaliações

- Corporate Guarantee and Bank GuaranteeDocumento1 páginaCorporate Guarantee and Bank GuaranteeChaitanya SharmaAinda não há avaliações

- Robert Kiyosaki 60 Menit Jadi KayaDocumento11 páginasRobert Kiyosaki 60 Menit Jadi KayaAnas ApriyadiAinda não há avaliações

- Oracle R12 Payables Interview QuestionsDocumento13 páginasOracle R12 Payables Interview QuestionsPrashanth KatikaneniAinda não há avaliações

- CB Team Product Presentation LatestDocumento31 páginasCB Team Product Presentation LatestFlaviu HotnogAinda não há avaliações

- MyTW Bill 475525918821 12 12 2022Documento1 páginaMyTW Bill 475525918821 12 12 2022lapenbAinda não há avaliações

- Avenir 022011monthlyreportDocumento2 páginasAvenir 022011monthlyreportchicku76Ainda não há avaliações

- Evolution of The Indian Banking IndustryDocumento7 páginasEvolution of The Indian Banking IndustryfasahmadAinda não há avaliações

- Leases Revised 5 30 20Documento144 páginasLeases Revised 5 30 20Jeasmine Andrea Diane PayumoAinda não há avaliações

- OPD Form IHealthcare-2Documento2 páginasOPD Form IHealthcare-2Masoom Kazmi100% (1)

- ZZZZDocumento109 páginasZZZZnikhils88Ainda não há avaliações

- Ketan Parekh ScamDocumento10 páginasKetan Parekh ScamTusharAinda não há avaliações

- Statement For Account No 60258865747 From 01/11/2019 To 31/01/2020Documento8 páginasStatement For Account No 60258865747 From 01/11/2019 To 31/01/2020Hargur BediAinda não há avaliações

- Cross Rates - August 23 2018Documento1 páginaCross Rates - August 23 2018Tiso Blackstar GroupAinda não há avaliações

- V Shankar Aiyar & Co. MumbaiDocumento18 páginasV Shankar Aiyar & Co. MumbaisuhaniAinda não há avaliações

- Allied Bank ReportDocumento53 páginasAllied Bank ReportAli HassanAinda não há avaliações

- Customer Satisfaction On Online Banking of EXIM Bank LTD.: BRAC UniversityDocumento42 páginasCustomer Satisfaction On Online Banking of EXIM Bank LTD.: BRAC UniversityRashel MahmudAinda não há avaliações

- Assured Returns.: Our PromiseDocumento12 páginasAssured Returns.: Our PromiseVinodkumar ShethAinda não há avaliações

- Certified Valuation Analyst-CVADocumento4 páginasCertified Valuation Analyst-CVAamyhashemAinda não há avaliações

- Lifecomm ProductDocumento9 páginasLifecomm Productphani100% (2)

- Franchise AccountingDocumento4 páginasFranchise AccountingJeric IsraelAinda não há avaliações

- Practice Sums-Journal Entries 1Documento2 páginasPractice Sums-Journal Entries 1Sanket SinghaiAinda não há avaliações

- Private Bank JobsDocumento7 páginasPrivate Bank JobsAbhj SaAinda não há avaliações

- The Global Debt Facility's Liens Against The Federal Reserve BanksDocumento18 páginasThe Global Debt Facility's Liens Against The Federal Reserve Bankskaren hudes100% (1)

- Attach File Bbs BBS 4 3-2 ProjectLoan N EquipmentLoanDocumento4 páginasAttach File Bbs BBS 4 3-2 ProjectLoan N EquipmentLoanRovita TriyambudiAinda não há avaliações

- Terms and Condition: 1. Sharing of Data With IBLDocumento3 páginasTerms and Condition: 1. Sharing of Data With IBLChannaAinda não há avaliações

- Negotiable Instrument Case DigestsDocumento47 páginasNegotiable Instrument Case DigestsJerick Bambi SadernasAinda não há avaliações

- 405b-Principles of AuditingDocumento21 páginas405b-Principles of AuditingSecurity Bank Personal LoansAinda não há avaliações