Escolar Documentos

Profissional Documentos

Cultura Documentos

Agrifood and Agricultural Social Network

Enviado por

Josephoclark0 notas0% acharam este documento útil (0 voto)

23 visualizações16 páginasWelcome to ZONEAGRO.The fisrt and innovative Agri-Food & Agricultural Social Network with a B2B Marketplace.

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoWelcome to ZONEAGRO.The fisrt and innovative Agri-Food & Agricultural Social Network with a B2B Marketplace.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

23 visualizações16 páginasAgrifood and Agricultural Social Network

Enviado por

JosephoclarkWelcome to ZONEAGRO.The fisrt and innovative Agri-Food & Agricultural Social Network with a B2B Marketplace.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 16

AGRIFOOD AND

AGRICULTURAL

SOCIAL

NETWORK

PUTTING RESOURCES INTO

AGRICULTURAL STOCKS TEMPORARY TREND OR INTELLIGENT

INVESTMENT?

The revelation of agribusiness has assumed a key part

in driving human development. All the more along

for more information contact: Zoneagro.com Phone: 00 33 432 85 01 73

these lines, horticulture has prompted incredible

advances in science and human improvement.

Furthermore, in the present time of globalization, the

importance of farming can't be thought little of. A few

pros trust that putting resources into rural stocks

ensures a larger number of profits than putting

resources into different items, for example, gold and

valuable metals. Exchanging horticultural stocks

includes purchasing and offering the supplies of

organizations partaking in the cultivating business.

Here are a few reasons why you ought to consider

putting resources into horticultural stocks:

Preeminent, the interest for nourishment to bolster

the steadily developing world populace will

dependably increment. The present world populace is

drawing nearer 7 billion. These individuals will require

sustenance to eat. This implies numerous

organizations will come up to deliver satisfactory

sustenance to manage this populace. In this way,

putting resources into horticultural stocks will

dependably prompt benefits.

It is evaluated that the world expends a normal of

3,000 bushels of grain product consistently. This figure

is around two times what we expended back in the

1970s. On the off chance that the present pattern

proceeds with, it is assessed that this figure will

dramatically increase throughout the following two

decades. This shows the measure of weight on the

worldwide sustenance supply system is gigantic, and

this ought to give you a justifiable reason motivation

to put resources into rural today.

Next, putting resources into rural stocks gives a

decent mix between social work and business. In the

event that you put resources into farming, you will be

prodding the nation's monetary development and

making employments for other individuals. Especially,

this would prompt better personal satisfaction for

those in the country ranges. Thusly, it is a win-win

circumstance for everybody; and all the more along

these lines, you are improving someone else's life site

details here http://www.zoneagro.com.

A few businesspersons don't care for tossing their

cash in agrarian stocks since they think it is an unsafe

parkway of venture. Much the same as whatever other

kind of venture, farming stocks have their own

dangers and advantages. In any case, its dangers can

without much of a stretch be surmounted in the event

that you figure out how to oversee them. Also, the

upsides of putting resources into the rural division far

exceed its detriments.

To this end, it is clear that putting resources into rural

stocks is the approach on the off chance that you are

a keen financial specialist. Other than procuring you

great returns, you will be doing your part in kicking

out appetite from the world. Putting resources into the

horticultural part is the certain approach, begin today!

Agribusiness Investment - A Must Read Article

Finding the best agribusiness speculation can be

dubious for the unpracticed speculator with practically

no learning of the area, however there are obviously a

wide range of alternatives accessible including

farming venture reserves, direct agrarian area

venture, and buying values in rural organizations. In

this article I will go some approach to researching the

diverse alternatives, the dangers they present to

financial specialists, the mechanics of how every kind

of agribusiness speculation functions, and the profits

that are as of now being accomplished.

Firstly we will take a gander at the pertinence of

agribusiness speculation for the current monetary

atmosphere, and whether this specific part hints at us

the having the capacity to produce development and

salary.

The Current Economic Climate

The worldwide economy is still in a condition of

turmoil, and the UK specifically is curtailing open

spending to lessen an unmanageable national

obligation, the populace is developing, and

quantitative facilitating is prone to lead us into a time

of amplified swelling. Likewise, the absence of

financial deceivability implies that it is difficult to

esteem resources, for example, stocks, and loan fees

being so low implies that our money stores are not

producing any substantial pay to talk about.

So what does this mean for speculators? It implies

that we have to purchase resources that have a

positive connection with expansion i.e. they go up in

quality speedier than the rate of swelling, these

benefits should likewise create a salary to supplant

the wage we have lost from money, lastly any

advantage that we buy should likewise have a solid

and quantifiable reputation.

It is clear that farming venture, particularly putting

resources into agrarian area, shows the qualities of

development, pay, a positive relationship with

expansion, is anything but difficult to esteem, and has

an unmistakable and apparent reputation to

investigate, and all things considered horticulture

speculation ticks the majority of the applicable boxes

to conceivably turn into the perfect resource class for

speculators today.

Farming Investment Fundamentals

The basics supporting farming venture are quite

simple to quantify; as the worldwide populace

develops we require more nourishment, to deliver

more sustenance we require more agrarian area as

this is the asset that gives the greater part of the

grain and oats that we eat, and the majority of the

space to brush the domesticated animals that end up

on our plate. So we are managing an exceptionally

fundamental inquiry of supply and request, if request

increments and supply can't keep up, the estimation

of the hidden resource expands, so we should take a

gander at a portion of the key markers of supply and

interest for agribusiness venture.

For seven of the most recent eight years we have

expended more grain than we have created,

conveying the worldwide store down to basic levels.

Since 1961 the measure of rural area per individual

has dropped by half (0.42 hectares for every

individual down to 0.21 hectares for every individual

in 2007).

The worldwide populace is required to develop by 9

billion by 2050.

Most research organizations and specialists trust that

we should build the measure of farming area by half

to backing that development, basically a gainful field

the extent of more prominent London should be found

each week.

In the most recent ten years for all intents and

purposes no more land has been gotten tied up with

creation as environmental change, corruption and

advancement and a large group of different

components imply that there is next to zero all the

more new land we could use to cultivate.

The basic resource that delivers our sustenance, the

area, will turn out to be more important as more

individuals interest nourishment.

Agrarian area esteem rise when the sustenance it

produces can be sold at a higher cost, making owning

farmland more gainful, and nourishment costs are at a

40 year low, leaving space for around 400% value

swelling. Truth be told a bushel of wheat expense

around $27 in the mid-seventies and now costs just

$3.

Farmland in the UK has ascended in quality by 20%

from June 2009 to June 2010, and 13% in 2010 alone

as indicated by the Knight Frank Farmland Index.

So the essentials supporting horticulture venture are

sound and unmistakably exhibit a decent picture for

potential speculation. In any case, would we be able

to ingest value expansion? Well there are a heap of

studies that let us know obviously that as a populace,

we assimilate increments in nourishment costs very

nearly 100%, and penance spending in different

ranges, so yes, we can.

Strategies for Agriculture Investment

Agribusiness Investment Funds

There are numerous sorts of agribusiness speculation

assets to browse, most put resources into cultivating

organizations, other simply in arable area, and others

by stock in horticultural administrations organizations.

Most horticulture speculation assets are indicating

astounding development, and the way that they are

purchasing has expanded the level of interest in the

business sector thusly their insignificant nearness is

adding to capital development. Provincial specialists

Savills as of late remarked on the way that they have

admittance to 7 billion in capital from asset to buy

cultivates, that is sufficient cash-flow to buy six times

the measure of farmland that will be publicized in the

UK this year, truth be told, by Frank there has been

30% less farmland promoted for this present year

from last, and purchaser enquiries have expanded by

9%.

To discuss hazard for a minute, the danger included

with this asset based venture methodology is that you

give over control to an asset supervisor who will

spend your cash for you and procure resources that he

or she accepts are significant. Additionally, in the

event that one asset performs seriously, that for the

most part has a thump on impact for other

agribusiness speculation stores as trust in this specific

procedure takes a hot, you can accordingly lose

esteem through no shortcoming of your own. You

likewise need to pay an asset administration charge,

eating into your benefits.

Regarding the profits one can anticipate from an

asset, this differs uncontrollably however most

venture yearly returns of around 10%, in spite of the

fact that this will change contingent upon an entire

host of elements including the asset administration,

speculation methodology, and general economic

situations.

Purchasing Shares in Agricultural Companies as an

Agriculture Investment

Another choice for picked considering capitalizing on

horticulture venture is to buy offers in an agrarian

business, be that a cultivating business, or an

administrations business, the choices to consider

differ uncontrollably and cautious thought must be

embraced to pick a suitable business sector (LSE,

NASDAQ and so forth), and afterward a suitable

organization in which to contribute. The matter of

picking shares stays, as I would see it, a vocation best

left to those with the time, experience and assets to

painstakingly explore the organization, its

administration, and it product offering, and just those

organization showing sound essentials ought to be

added to a portfolio.

The danger here is as with any value based venture, a

down-swing in the business sector can bring about a

decent organization to lose worth and subsequently

influence the abundance of the speculator negatively.

We have all seen as of late how a bear business sector

can cut down gainful organizations and the entire

reason of agribusiness speculation is to stay away

from money related markets and include a component

of non-connection to a portfolio, guaranteeing the

financial specialist claims an advantage that is

unaffected by unpredictable securities exchanges.

Você também pode gostar

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Occlusal Appliance TherapyDocumento14 páginasOcclusal Appliance TherapyNam BuiAinda não há avaliações

- OphthalmoplegiaDocumento5 páginasOphthalmoplegiaPatricia Feliani SitohangAinda não há avaliações

- Janssen Vaccine Phase3 Against Coronavirus (Covid-19)Documento184 páginasJanssen Vaccine Phase3 Against Coronavirus (Covid-19)UzletiszemAinda não há avaliações

- 00516-CLIA-Newsletter Jan 06Documento4 páginas00516-CLIA-Newsletter Jan 06losangelesAinda não há avaliações

- Bee Keeping-KVK MorenaDocumento6 páginasBee Keeping-KVK MorenaAsh1Scribd100% (1)

- Little Ann and Other Poems by Ann Taylor and Jane TaylorDocumento41 páginasLittle Ann and Other Poems by Ann Taylor and Jane Tayloralexa alexaAinda não há avaliações

- TFU-Risk Assessment RA-11 - Use of Grooving & Threading MachinesDocumento1 páginaTFU-Risk Assessment RA-11 - Use of Grooving & Threading Machinesarshin wildanAinda não há avaliações

- Estrogen Dominance-The Silent Epidemic by DR Michael LamDocumento39 páginasEstrogen Dominance-The Silent Epidemic by DR Michael Lamsmtdrkd75% (4)

- Presentation On "Insurance Sector": Submitted By: Faraz Shaikh Roll No: 9 Mba MarketingDocumento16 páginasPresentation On "Insurance Sector": Submitted By: Faraz Shaikh Roll No: 9 Mba MarketingFakhruddin DholkawalaAinda não há avaliações

- Vocab PDFDocumento29 páginasVocab PDFShahab SaqibAinda não há avaliações

- WEEK 7-8: Health 9 Module 4Documento8 páginasWEEK 7-8: Health 9 Module 4Heidee BasasAinda não há avaliações

- House of Candy PresentationDocumento42 páginasHouse of Candy PresentationRohit JaroudiyaAinda não há avaliações

- Insulating Oil TestingDocumento6 páginasInsulating Oil TestingnasrunAinda não há avaliações

- Clinical Features, Evaluation, and Diagnosis of Sepsis in Term and Late Preterm Infants - UpToDateDocumento42 páginasClinical Features, Evaluation, and Diagnosis of Sepsis in Term and Late Preterm Infants - UpToDatedocjime9004Ainda não há avaliações

- Tinongcop ES-Teachers-Output - Day 1Documento3 páginasTinongcop ES-Teachers-Output - Day 1cherybe santiagoAinda não há avaliações

- Five Characteristics of Authentic LeadershipDocumento2 páginasFive Characteristics of Authentic LeadershipArnel Billy LimAinda não há avaliações

- Intimacy and Healthy Affective Maturaity - Fa-Winter09bDocumento9 páginasIntimacy and Healthy Affective Maturaity - Fa-Winter09bCarlos GiraldoAinda não há avaliações

- Food Safety PosterDocumento1 páginaFood Safety PosterMP CariappaAinda não há avaliações

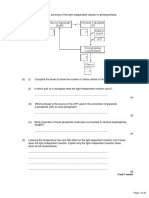

- Photosynthesis PastPaper QuestionsDocumento24 páginasPhotosynthesis PastPaper QuestionsEva SugarAinda não há avaliações

- Om Deutz 1013 PDFDocumento104 páginasOm Deutz 1013 PDFEbrahim Sabouri100% (1)

- Intraocular Pressure and Aqueous Humor DynamicsDocumento36 páginasIntraocular Pressure and Aqueous Humor DynamicsIntan EkarulitaAinda não há avaliações

- Dual Laminate Piping HandbookDocumento46 páginasDual Laminate Piping HandbookA.Subin DasAinda não há avaliações

- R. Nishanth K. VigneswaranDocumento20 páginasR. Nishanth K. VigneswaranAbishaTeslinAinda não há avaliações

- Design and Details of Elevated Steel Tank PDFDocumento10 páginasDesign and Details of Elevated Steel Tank PDFandysupaAinda não há avaliações

- Work of Asha Bhavan Centre - A Nonprofit Indian Organisation For Persons With DisabilityDocumento10 páginasWork of Asha Bhavan Centre - A Nonprofit Indian Organisation For Persons With DisabilityAsha Bhavan CentreAinda não há avaliações

- CHAPTER 8 f4 KSSMDocumento19 páginasCHAPTER 8 f4 KSSMEtty Saad0% (1)

- Injection Analyzer Electronic Unit enDocumento67 páginasInjection Analyzer Electronic Unit enmayralizbethbustosAinda não há avaliações

- 15 UrinalysisDocumento9 páginas15 UrinalysisJaney Ceniza تAinda não há avaliações

- DTC P1602 Deterioration of Battery: DescriptionDocumento5 páginasDTC P1602 Deterioration of Battery: DescriptionEdy SudarsonoAinda não há avaliações

- Topic 7: Respiration, Muscles and The Internal Environment Chapter 7B: Muscles, Movement and The HeartDocumento4 páginasTopic 7: Respiration, Muscles and The Internal Environment Chapter 7B: Muscles, Movement and The HeartsalmaAinda não há avaliações