Escolar Documentos

Profissional Documentos

Cultura Documentos

TDS Certificate Details

Enviado por

Anonymous SMqp9rZuDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

TDS Certificate Details

Enviado por

Anonymous SMqp9rZuDireitos autorais:

Formatos disponíveis

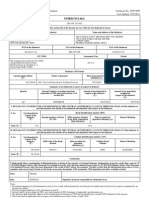

FORM NO.

16A

[See rule 31(1)(b)]

Certificate under section 203 of the Income-tax Act, 1961 for tax deducted at source

Certificate No.

Last updated on

Name and address of the Deductor

PAN of the Deductor

Name and address of the Deductee

TAN of the Deductor

CIT (TDS)

PAN of the Deductee

Assessment Year

Address

Period

From

To

City Pin code

Summary of payment

Sl. No.

Amount paid/credited

Nature of payment

Deductee Reference No.

provided by the

Deductor (if any)

Date of

payment/credit

(dd/mm/yyyy)

Total (Rs.)

Summary of tax deducted at source in respect of Deductee

Quarter

Receipt Numbers of original

quarterly statements of TDS

under sub-section (3) of section

200

Amount of tax

deducted in respect of

Deductee

Amount of tax

deposited/remitted in

respect of Deductee

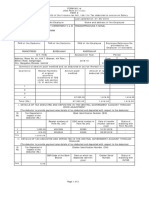

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN

THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJUSTMENT

(The deductor to provide payment wise details of tax deducted

and deposited with respect to the deductee)

Sl. No.

Tax deposited

in respect of the

deductee (Rs.)

Book Identification Number (BIN)

Receipt numbers of

Form No. 24G

DDO serial

number in Form

No. 24G

Date of Transfer

voucher

(dd/mm/yyyy)

Status of

Matching with

Form No.24G

Total (Rs.)

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN

THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment wise details of tax deducted

and deposited with respect to the deductee)

Sl. No.

Tax deposited

in respect of the

deductee (Rs.)

Challan Identification Number (CIN)

BSR Code of the

Bank Branch

Printed from www.incometaxindia.gov.in

Date on which tax

deposited

Challan Serial

Number

Status of

matching with

Page 1 of 2

(dd/mm/yyyy)

OLTAS

Total (Rs. )

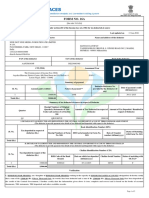

Verification

I,.., son/daughter of . working in the capacity of . (designation) do hereby certify that a

sum of Rs. .. [Rs. . (in words)] has been deducted and deposited to the credit of the Central

Government. I further certify that the information given above is true, complete and correct and is based on the

books of account, documents, TDS statements, TDS deposited and other available records.

Place

______________________________

(Signature of person responsible for deduction of tax)

Date

Designation:______________________________

Full Name: ______________________________

Notes:

1. Government deductors to fill information in item I if tax is paid without production of an income-tax challan and in item II if tax is

paid accompanied by an income-tax challan.

2. Non-Government deductors to fill information in item II.

3. The deductor shall furnish the address of the Commissioner of Income-tax (TDS) having jurisdiction as regards TDS statements of

the assessee.

4. In items I and II, in column for tax deposited in respect of deductee, furnish total amount of TDS, surcharge (if applicable) and

education cess (if applicable).;

Printed from www.incometaxindia.gov.in

Page 2 of 2

Você também pode gostar

- (See Rule 31 (1) (B) ) : Form No. 16ADocumento38 páginas(See Rule 31 (1) (B) ) : Form No. 16AsamAinda não há avaliações

- (See Rule 31 (1) (B) )Documento2 páginas(See Rule 31 (1) (B) )B RAinda não há avaliações

- "FORM NO.16B: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocumento1 página"FORM NO.16B: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceKKumar SantoshAinda não há avaliações

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocumento2 páginasForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAkshay DhawanAinda não há avaliações

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocumento2 páginasForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAnonymous glyBR9Ainda não há avaliações

- Form 16A TDS Certificate DetailsDocumento2 páginasForm 16A TDS Certificate DetailsKovidh GoyalAinda não há avaliações

- (See Rule 37D) : Cit (TDS) Address City Pin Code . .Documento2 páginas(See Rule 37D) : Cit (TDS) Address City Pin Code . .Akshay RuikarAinda não há avaliações

- New Tds CertificateDocumento1 páginaNew Tds Certificatechowdhary_akshayAinda não há avaliações

- Form27d Applicable From 01.04Documento2 páginasForm27d Applicable From 01.04sudhrengeAinda não há avaliações

- Form 16 ADocumento2 páginasForm 16 Asatyampandey7986659533Ainda não há avaliações

- Form 16 Excel FormatDocumento4 páginasForm 16 Excel FormatAUTHENTIC SURSEZAinda não há avaliações

- Itr 62 Form 16Documento4 páginasItr 62 Form 16Hardik ShahAinda não há avaliações

- Printed From WWW - Incometaxindia.gov - in Page 1 of 4Documento4 páginasPrinted From WWW - Incometaxindia.gov - in Page 1 of 4Thil ThilAinda não há avaliações

- Form16fy10 11Documento3 páginasForm16fy10 11atishroyAinda não há avaliações

- Form 16a New FormatDocumento2 páginasForm 16a New FormatJayAinda não há avaliações

- Form No. 16ADocumento1 páginaForm No. 16ASiyad AhammedAinda não há avaliações

- Law Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16Documento3 páginasLaw Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16api-247505461Ainda não há avaliações

- (See Rule 31 (1) (A) ) : Form No. 16Documento4 páginas(See Rule 31 (1) (A) ) : Form No. 16Ejaj HassanAinda não há avaliações

- Rlic App Ecommunication Pdfrecieptgenerator Mail PDF Files TDSC STMT 2011-12 q3 Ablpi5301a Form16a 2012-13 q3Documento2 páginasRlic App Ecommunication Pdfrecieptgenerator Mail PDF Files TDSC STMT 2011-12 q3 Ablpi5301a Form16a 2012-13 q3143688Ainda não há avaliações

- 15 CaDocumento8 páginas15 CadamanAinda não há avaliações

- Tax Applicable (Tick One) 2 8 1Documento7 páginasTax Applicable (Tick One) 2 8 1Gaurav BajajAinda não há avaliações

- Form 16Documento2 páginasForm 16Mithun KumarAinda não há avaliações

- (See Rule 31 (1) (A) ) : Form No. 16Documento8 páginas(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandeAinda não há avaliações

- Printed From: (I T R 6 2 1 6 A, 1) (1)Documento1 páginaPrinted From: (I T R 6 2 1 6 A, 1) (1)ManikdnathAinda não há avaliações

- Ahrpv0731f 2013-14Documento2 páginasAhrpv0731f 2013-14Shiva KumarAinda não há avaliações

- ITR62 Form 15 CADocumento5 páginasITR62 Form 15 CAMohit47Ainda não há avaliações

- Form ITR-VDocumento2 páginasForm ITR-VSumit ManglaniAinda não há avaliações

- Aaaco1111l Form16a 2011-12 Q3Documento1 páginaAaaco1111l Form16a 2011-12 Q3Pradnesh KulkarniAinda não há avaliações

- Form No.16A: Tax Information Network of Income Tax Department Certificate No.: GVVIPLDocumento2 páginasForm No.16A: Tax Information Network of Income Tax Department Certificate No.: GVVIPLcool_rdAinda não há avaliações

- Form 16 TDS CertificateDocumento3 páginasForm 16 TDS CertificateBijay TiwariAinda não há avaliações

- Turnover Form 2011Documento1 páginaTurnover Form 2011PikinisoAinda não há avaliações

- TdsDocumento4 páginasTdsSahil SheikhAinda não há avaliações

- Tanzania Revenue Authority Withholding Tax CertificateDocumento1 páginaTanzania Revenue Authority Withholding Tax CertificatePVL MwanzaAinda não há avaliações

- Indian Income Tax Return Verification FormDocumento1 páginaIndian Income Tax Return Verification FormSanjeev BansalAinda não há avaliações

- Form 16B TDS CertificateDocumento1 páginaForm 16B TDS CertificateSurendra Kumar BaaniyaAinda não há avaliações

- Form No.16: Part ADocumento3 páginasForm No.16: Part AYogesh DhekaleAinda não há avaliações

- Form 16 and Salary DetailsDocumento22 páginasForm 16 and Salary DetailsAjay Chowdary Ajay ChowdaryAinda não há avaliações

- Form 16 ADocumento2 páginasForm 16 AParminderSinghAinda não há avaliações

- ViewDocumento2 páginasViewVenkat JvsraoAinda não há avaliações

- FORM 16 TAX DEDUCTION CERTIFICATEDocumento3 páginasFORM 16 TAX DEDUCTION CERTIFICATEdugdugdugdugiAinda não há avaliações

- Anspg5953f 2018-19Documento3 páginasAnspg5953f 2018-19virajv1Ainda não há avaliações

- SARALDocumento1 páginaSARALchintamani100% (2)

- Astr 1Documento1 páginaAstr 1Ravi AroraAinda não há avaliações

- Kaushik Sarkar Form 16 DynProDocumento5 páginasKaushik Sarkar Form 16 DynProKaushik SarkarAinda não há avaliações

- Form 16Documento2 páginasForm 16SIVA100% (1)

- Pay TDS and TCS via Challan FormDocumento2 páginasPay TDS and TCS via Challan Formbrayan uyAinda não há avaliações

- (See Sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194NDocumento6 páginas(See Sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194NRavi PrakashAinda não há avaliações

- Form No 16Documento4 páginasForm No 16Md ZhidAinda não há avaliações

- FCT IRS Form G Organization Name PeriodDocumento2 páginasFCT IRS Form G Organization Name PeriodNwogboji EmmanuelAinda não há avaliações

- Oriental Bank of Commerce RTGS NEFT RTGS and DDDocumento2 páginasOriental Bank of Commerce RTGS NEFT RTGS and DDDasharath Patel67% (3)

- Mahila Samman Savings Certificate FormDocumento5 páginasMahila Samman Savings Certificate FormanuAinda não há avaliações

- Umesh C-Form16 - 2020-21Documento10 páginasUmesh C-Form16 - 2020-21Umesh CAinda não há avaliações

- Form-I TaxDocumento3 páginasForm-I TaxNGL VenturesAinda não há avaliações

- Form No. 24Q: (See Section 192 and Rule 31A)Documento3 páginasForm No. 24Q: (See Section 192 and Rule 31A)Sajith Malappurath SasidharanAinda não há avaliações

- FKMPS9021Q Q3 2016-17Documento2 páginasFKMPS9021Q Q3 2016-17Hannan SatopayAinda não há avaliações

- Bar Review Companion: Taxation: Anvil Law Books Series, #4No EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Ainda não há avaliações

- Middle East and North Africa Economic Developments and Prospects, October 2013: Investing in Turbolent TimesNo EverandMiddle East and North Africa Economic Developments and Prospects, October 2013: Investing in Turbolent TimesAinda não há avaliações

- Noting SkillsDocumento53 páginasNoting Skillsjao npgajwelAinda não há avaliações

- Emaan Bil Laah (Final Version)Documento52 páginasEmaan Bil Laah (Final Version)Farheen KhanumAinda não há avaliações

- Security Control TypesDocumento4 páginasSecurity Control Types3LIX 311100% (1)

- Licencing, FranchisingDocumento17 páginasLicencing, FranchisingRavi ParekhAinda não há avaliações

- Affidavit of ExplanationDocumento3 páginasAffidavit of ExplanationDolores PulisAinda não há avaliações

- REMEDIAL LAW BAR EXAMINATION QUESTIONSDocumento11 páginasREMEDIAL LAW BAR EXAMINATION QUESTIONSAubrey Caballero100% (1)

- Drying and Firing Shrinkages of Ceramic Whiteware Clays: Standard Test Method ForDocumento2 páginasDrying and Firing Shrinkages of Ceramic Whiteware Clays: Standard Test Method ForEliKax!Ainda não há avaliações

- CACIB - Research FAST FX Fair Value ModelDocumento5 páginasCACIB - Research FAST FX Fair Value ModelforexAinda não há avaliações

- TOT Power Control v. AppleDocumento28 páginasTOT Power Control v. AppleMikey CampbellAinda não há avaliações

- Bank Victoria International Tbk2019-03-11 - Annual-Report-2012Documento537 páginasBank Victoria International Tbk2019-03-11 - Annual-Report-2012sofyanAinda não há avaliações

- (30.html) : Read and Listen To Sentences Using The WordDocumento3 páginas(30.html) : Read and Listen To Sentences Using The Wordshah_aditAinda não há avaliações

- Abu Bakr GumiDocumento9 páginasAbu Bakr GumiajismandegarAinda não há avaliações

- 7 - Bukidnon Doctors' Hospital Inc. v. Metropolitan Bank & Trust Co.Documento12 páginas7 - Bukidnon Doctors' Hospital Inc. v. Metropolitan Bank & Trust Co.kaloy915Ainda não há avaliações

- Human Rights and Women S Legal & Constitutional Rights in IndiaDocumento28 páginasHuman Rights and Women S Legal & Constitutional Rights in IndiaAMARNATHAinda não há avaliações

- Entry of AppearanceDocumento3 páginasEntry of AppearanceConrad Briones100% (1)

- Hotel Sales Company Volume Guaranteed Rate LetterDocumento5 páginasHotel Sales Company Volume Guaranteed Rate LetterSimon EllyAinda não há avaliações

- Amezquita LetterDocumento2 páginasAmezquita LetterKeegan StephanAinda não há avaliações

- Code of Ethics With Irr 2Documento53 páginasCode of Ethics With Irr 2Kate Sarah GabasaAinda não há avaliações

- Services Institute of Medical Sciences Merit List Session 2014-2015Documento18 páginasServices Institute of Medical Sciences Merit List Session 2014-2015Shawn ParkerAinda não há avaliações

- Amalgamation of Banking CompaniesDocumento17 páginasAmalgamation of Banking CompaniesShivali Dubey67% (3)

- Dole Department Order No. 178-17: August 25, 2017 August 25, 2017Documento2 páginasDole Department Order No. 178-17: August 25, 2017 August 25, 2017John Michael CamposAinda não há avaliações

- Mrs. Shanta V. State of Andhra Pradesh and OrsDocumento12 páginasMrs. Shanta V. State of Andhra Pradesh and OrsOnindya MitraAinda não há avaliações

- Ebook PDF Business Law and The Regulation of Business 13th Edition by Richard A Mann PDFDocumento41 páginasEbook PDF Business Law and The Regulation of Business 13th Edition by Richard A Mann PDFmary.cardin71097% (36)

- Philracom Authority Uphold EIA Testing RacehorsesDocumento6 páginasPhilracom Authority Uphold EIA Testing RacehorsesAjpadateAinda não há avaliações

- Anchor Savings Bank Vs FurigayDocumento1 páginaAnchor Savings Bank Vs FurigayDannR.Reyes100% (1)

- MSDS Amonium OksalatDocumento5 páginasMSDS Amonium OksalatAdi Kurniawan EffendiAinda não há avaliações

- Pakistan Airport Passenger DataDocumento4 páginasPakistan Airport Passenger DataRajesh BhaskaranAinda não há avaliações

- Cricket RulesDocumento1 páginaCricket RulesSheetal AhujaAinda não há avaliações

- Big Data SecurityDocumento4 páginasBig Data SecurityIbrahim MezouarAinda não há avaliações

- Payment Transaction Report: Stanbic Bank Zimbabwe Limited, Company Registration No. 3387/89Documento2 páginasPayment Transaction Report: Stanbic Bank Zimbabwe Limited, Company Registration No. 3387/89Tadiwanashe ChikoworeAinda não há avaliações