Escolar Documentos

Profissional Documentos

Cultura Documentos

Research Retreat

Enviado por

Harshal BorgaonDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Research Retreat

Enviado por

Harshal BorgaonDireitos autorais:

Formatos disponíveis

RESEARCH RETREATMode refers to the method of interaction, such

21-22 May

2016

as email, telephone, text messaging, multimedia messaging, Internet, mobile

Electronic

- Customer

Relationship

Customer

Internet,

etc.

Timing refers

to both Management

the time andand

location

the interaction

Experience

Management

Using

Digital

Communications

An

Empirical

takes place. Data Exchange refers to the process by which the

customer

Study of Banking Sector in North Karnataka

information and marketer commercial information are shared between

marketer

and customer.

referC

to the value the customer expects to

xxx Harshal

Borgaon, Dr.Goals

Prashantha

obtain in return for engaging in the interaction and for sharing customer

information to trigger this action.

Introduction Title of Research , Research Questions, Hypothesis,

1.1.

Objectives

Methodology

This proposed research focuses on studying the ability of online

1.

Introduction:

There are four

reshaping

of business

technological

communities,

as a trends

channel

to serve the

as world

an interface

between

organization

advances

and

the

speed

and consumer and aid the organization in achieving its CRM goals. This

with be

which

new technologies

created

and copied,

the loss of

would

accomplished

through theare

following

research

objectivesgeographic advantage resulting

i. To identify the Customer Relationship Management (CRM) and Efrom globalization, the shake-up of traditionally stable industries as a

practicesand

in Public and Private Retail Banks in North Karnataka.

result ofCRM

deregulation

ii.

To

understand

thewant,

CRM when

and E-CRM

the rising power of the the

and customers

their ability awareness

to get whatofthey

they

in the public

and private

sector

Retailthe

banks

in North

want it,practices

from whomever

they want.

with this

in mind,

relationship

Karnataka.

experience

becomes on of the greatest competitive aspects for a

iii.

Explore

the use and application of internet measures in the

businesss

survival.

Themeasurement

buzzword of globalization

holds no meaning without the concept

of customer Experience.

of what

is being termed

as Digitization.

withof

theonline

internet

having

iv.

Develop

a model

to analyze Further,

the usage

consumer

built ancommunities

E-enterpriseforhas

brought the

intocomponents

vogue, thethat

use build

of emergent

identifying

consumer

internaltrustworthiness

and external

online

communities

within

companies,

or

for an organization.

between

and their

partners

or customers.

This,inalong

with the

v. Tocompanies

compare E-CRM

practices

with

CRM practices

the public

and

organizational willingness to take risks has created new opportunities for

private sector retail banks in North Karnataka.

companies in the domain of innovation, internet based collaboration and

co-operation. Innovation processes are continuous and appropriate human

1.2. Research Questions

capital is fast becoming a scarce resource.

Keeping capabilities

in view the coupled

researchwith

objectives

our researcher

find

Distinctive

institutional

excellencetries

nowto

spell

answers

following questions,

sourcestoofthe

competitive

advantage. Organizations are transforming from

1. What is thebureaucratic,

strategic intent functional,

of banks in North

Karnataka

in adoptingtoEhierarchical,

pyramid

structures

interconnected

subsystems, characterized by flexibility, employee

CRM practices?

empowerment,

and

or networked

People, knowledge

and

2. What are the netflat

benefits

of E-CRMstructures.

over the traditional

CRM?

capabilities

arethe

the feasibility

key organizational

assets. in terms of the business and

3. What are

issues involved

The

value

of

targeting

the

right

kind of customers has become so

implementation of E-CRM practices?

important that the entire success and failure of an organization depends

on customer

acquisition and retention. it is for this reason that technology

1.3. Hypothesis

has become

very

important

marketing

in the form

H1: E-CRM

has

benefits in

over

the traditional

CRM of CRM. to provide a

wholesome

understanding

in

about

customers,

data generation

H2: Bank customers have knowledge about effective

E-CRM

and data

analysis

is veryhave

important,

backed

appropriate

data mining,

H3: E-CRM

benefits

positive

effect with

on customer

satisfaction

organizations

can

reap

such

benefits.

H4: E-CRM has positive impact on measurement of customer

experience using online communities

Electronic - Customer Relationship Management and Customer Experience Management

Using Digital Communications An Empirical Study of Banking Sector in North Karnataka

H5: E-CRM competitive advantages have positive effect on customers

satisfaction in choosing the banks to do their financial and

business works.

Synopsis of Proposed Presentation to be made at Research Retreat May 2016 Page 1

Electronic - Customer Relationship Management and Customer Experience Management

Using Digital Communications An Empirical Study of Banking Sector in North Karnataka

2. Method of Study

Research data would be collected from both primary and secondary

sources. The quantitative data would be collected by administering

questionnaire to the respondents. Questionnaires would be administered by

meeting prospective respondents in their respective offices with prior

appointment. In addition to this, personal interviews would also be

conducted to understand the respondents attitudes towards E-CRM aspects

in public and private sector retail banks in Karnataka. It is intended to

conduct a field survey in the retail parts of North Karnataka which includes

Hubli-Dharwad, Belagavi, Bijapur, Bagalkot, Raichur, and Gulbarga.

Secondary data sources would also be used to collect the data for this

research study. Bulletins from banking staff colleges, which include RBI

publications and manuals, would be major sources of secondary data.

Various other sources like online and print journals and magazines, which

focus on the contemporary issues in the banking and CRM areas, would be

referred.

The data so collected would be analyzed by applying mathematical

and statistical tools such as correlation, covariance and Chi Square. The data

will be presented in tabular and graphical format. Software such as SPSS,

SAS, GAUSS, TSP, Mat lab, RATS available to do data analysis. It is intended

to use SPSS package and MS Spread sheet for data analysis purpose.

a. Geographical Area

It is intended to collect the required data from various geographical

location of North Karnataka in the form of field survey. The respondents

would be chosen from commercial part of north Karnataka which includes

cities like Hubli-Dharwad, Belagavi, Bijapur, Bagalkot, Raichur, and Gulbarga.

b. Sampling method

It is intended to collect the required data from Banks Manager and

customers of the retail banks in public and private sector located in 6

different cities of North Karnataka.

The research here would like to use Simple Random Sampling

method to conduct the field survey, a randomly selected sample from a

larger sample or population, giving all the individuals in the sample an equal

chance to be chosen. In a simple random sample, individuals are chosen at

random and not more than once to prevent a bias that would negatively

affect the validity of the result of the experiment, by using the following

Statistical formula to calculate the sample size for the survey,

Synopsis of Proposed Presentation to be made at Research Retreat May 2016 Page 2

Electronic - Customer Relationship Management and Customer Experience Management

Using Digital Communications An Empirical Study of Banking Sector in North Karnataka

z2 x p ( 1 - p )

e2

Sample Calculation =

z2 x p ( 1 - p )

1+ 2

e N

Where

Z = Z value (for 95% confidence level = 1.96)

p = percentage picking a choice, expressed as decimal (50% =

0.5)

e = confidence interval or margin of error (3%)

N = Population

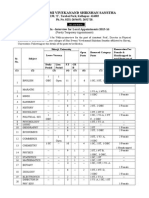

Population Size City wise

City

No. of Account Holders

No. of Respondents

Belgaum

432623

187

Bagalkot

217971

94

Bijapur

240521

104

Gulburga

504078

218

Raichur

211147

91

Dharwad-Hubli

860707

372

24,67,047

1067

Number of Customers of the Bank 24,67,047, which includes the

Savings Bank account holders with a minimum age of 18 and above in retail

banks in 6 different cities in North Karnataka and by using the above

statistical formula, the number of customers of the Bank to be interviewed

by the researcher is 1,067.

City

Belgaum

Bagalkot

Bijapur

Gulburga

Raichur

Dharwad-Hubli

No. of Bank Managers

No. of Respondents

90

67

21

16

48

36

43

32

34

25

134

100

370

275

Number of Bank Managers 370, the managers of the individual

nationalised public and/or private sector retail banks in 6 different cities in

North Karnataka and by using the above statistical formula, the number of

Bank Manager to be interviewed by the researcher is 275.

3. Data Collection

Page 3 Synopsis of Proposed Presentation to be made at Research Retreat May 2016

Electronic - Customer Relationship Management and Customer Experience Management

Using Digital Communications An Empirical Study of Banking Sector in North Karnataka

For the purpose of the study, data would be collected from

secondary and primary sources that would be analyzed using both

quantitative and qualitative methods.

a. Pilot study

For the proposed study it is planned to have a pilot study before

collecting the actual data where the researcher would want to evaluate

feasibility, time, cost, adverse events and effect size in an attempt to predict

an appropriate sample size and if needed improve the design.

4. Mode of Data Collection

For the proposed study it is intended to collect data from Primary

sources by conducting survey with the Banks Manager and the customers of

the retail banks in North Karnataka. It is also proposed to collect relevant

data from various secondary sources available.

Synopsis of Proposed Presentation to be made at Research Retreat May 2016 Page 4

Electronic - Customer Relationship Management and Customer Experience Management

Using Digital Communications An Empirical Study of Banking Sector in North Karnataka

Current Stage of Research Work (should include research undertaken

after confirmation of registration)

1. Thorough understanding of the topic chosen by visiting various

Universities libraries across North Karnataka viz., Karnataka

University, Dharwad; Visvesvaraya Technological University,

Belgaum; and Rani Channamma University, Belagavi.

2. Systematically collected and read articles related to the chosen

topic from various Peer-Reviewed Journals, Conference

Proceedings and E-Journals.

3. Identified various variables related to the chosen topic.

4. Currently drafting the Questionnaire for the pilot study.

Page 5 Synopsis of Proposed Presentation to be made at Research Retreat May 2016

Electronic - Customer Relationship Management and Customer Experience Management

Using Digital Communications An Empirical Study of Banking Sector in North Karnataka

Plan for the next one year

(Specific details of the research plan for the next one year)

1. Prepare Questionnaire in consultation with the Guide by 15th May 2016.

2. Conduct a Pilot Study in between 16th May 2016 till 16th June 2016.

3. Analyze the information collected during pilot study and run reliability

and validity test by 30th June 2016.

4. Based on the data collected during the pilot study present an article

and publish in reputed Journal.

5. Finalize the questionnaire in consultation with Guide by 10th July 2016.

6. Circulate the finalized questionnaire in respected selected sample

areas to be filled by Bank Managers and Customers of the Bank from

15th July 2016 till 30th January 2017.

7. Analysis the information collected during the final study in between 1 st

February 2017 till 30th April 2017.

8. Based on the data collected during the pilot study present an article

and publish in reputed Journal.

Conference at Which Papers Presented and Publications in Journals

Synopsis of Proposed Presentation to be made at Research Retreat May 2016 Page 6

Electronic - Customer Relationship Management and Customer Experience Management

Using Digital Communications An Empirical Study of Banking Sector in North Karnataka

(Details of papers presented and publications with journal details)

1. Paper Presented on Electronic CRM: Challenges and Opportunities in

Banking Industry at International Conference on Innovation in

Marketing, E-Commerce, Information Technology and Banking (IMEIB2016) conducted by Department of Management Studies, The Oxford

College of Engineering, Bengaluru on 7th April 2016

2. Published paper on Electronic CRM: Challenges and Opportunities in

Banking Industry in Annual Research Journal of Department of

Management Studies Bengaluru, IMEIB, Page No. 45 to 47, Volume 2,

April 2016, ISSN No. 0254-8755.

Page 7 Synopsis of Proposed Presentation to be made at Research Retreat May 2016

Você também pode gostar

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Case Study The Fall of QuestDocumento2 páginasCase Study The Fall of QuestHarshal BorgaonAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Advertisement Management AssignmentDocumento1 páginaAdvertisement Management AssignmentHarshal BorgaonAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Challenges of Rural Youth Today: IntruductionDocumento6 páginasChallenges of Rural Youth Today: IntruductionHarshal BorgaonAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Bargaining PolicyDocumento46 páginasBargaining PolicyHarshal BorgaonAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Advertisement ManagementDocumento6 páginasAdvertisement ManagementHarshal BorgaonAinda não há avaliações

- Case Study Leadership StylesDocumento2 páginasCase Study Leadership StylesHarshal BorgaonAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- MBA College Marketing PlanDocumento1 páginaMBA College Marketing PlanHarshal BorgaonAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Tally Accounting Package: Unit - 1Documento19 páginasTally Accounting Package: Unit - 1Harshal BorgaonAinda não há avaliações

- Form 8A ProcedureDocumento17 páginasForm 8A ProcedureGirish BhatAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Attention and ComprehensionDocumento22 páginasAttention and ComprehensionHarshal BorgaonAinda não há avaliações

- Consumer Perceived ValueDocumento1 páginaConsumer Perceived ValueHarshal BorgaonAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- GD TopicsDocumento6 páginasGD TopicsHarshal BorgaonAinda não há avaliações

- SSVS - Kolhapur-Sr College Adve. Local 015-016Documento2 páginasSSVS - Kolhapur-Sr College Adve. Local 015-016Harshal BorgaonAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Brand Management Question PaperDocumento1 páginaBrand Management Question PaperHarshal BorgaonAinda não há avaliações

- Attention and ComprehensionDocumento22 páginasAttention and ComprehensionHarshal BorgaonAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Advertising Management KUD SyllabusDocumento1 páginaAdvertising Management KUD SyllabusHarshal BorgaonAinda não há avaliações

- KellerDocumento23 páginasKellersaaigeeAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- KellerDocumento23 páginasKellersaaigeeAinda não há avaliações

- Rajashekhar ChimilagiDocumento79 páginasRajashekhar ChimilagiHarshal Borgaon100% (1)

- Brand Management QPDocumento1 páginaBrand Management QPHarshal BorgaonAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Advertisement Management AssignmentDocumento1 páginaAdvertisement Management AssignmentHarshal BorgaonAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Attitudes and ScalingDocumento61 páginasAttitudes and ScalingHarshal BorgaonAinda não há avaliações

- Advertising Management Assignments Sl. No. Assignment Submission DateDocumento1 páginaAdvertising Management Assignments Sl. No. Assignment Submission DateHarshal BorgaonAinda não há avaliações

- Brand Management QPDocumento1 páginaBrand Management QPHarshal BorgaonAinda não há avaliações

- Perceptions: "You Become What You Thinketh"Documento66 páginasPerceptions: "You Become What You Thinketh"Harshal BorgaonAinda não há avaliações

- Consumer Behaviour Seminar TopicsDocumento1 páginaConsumer Behaviour Seminar TopicsHarshal BorgaonAinda não há avaliações

- Consumer Perception: Consumer Behavior, Ninth EditionDocumento49 páginasConsumer Perception: Consumer Behavior, Ninth EditionHarshal BorgaonAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Keller 01Documento13 páginasKeller 01Umang AgarwalAinda não há avaliações

- SyllabusDocumento68 páginasSyllabusHarshal Borgaon100% (1)

- ValScope PRO 0909 WebDocumento2 páginasValScope PRO 0909 Webrujisak_m0% (1)

- Arduped PDFDocumento17 páginasArduped PDFPrakash Duraisamy100% (1)

- MODx DocParsers API Cheatsheet v1.0Documento1 páginaMODx DocParsers API Cheatsheet v1.0Thomas GrantAinda não há avaliações

- Water Towers Using GTSTRUDLDocumento1 páginaWater Towers Using GTSTRUDLKelly WhiteAinda não há avaliações

- MIMIX Reference PDFDocumento747 páginasMIMIX Reference PDFRahul JaiswalAinda não há avaliações

- Module18 dhcpV2Documento7 páginasModule18 dhcpV2killartnAinda não há avaliações

- HitFilm Express 2017 User GuideDocumento314 páginasHitFilm Express 2017 User GuideOpik Rozikin100% (2)

- Affiliate GuideDocumento5 páginasAffiliate GuidetvmAinda não há avaliações

- Pcad 2006 AsciiDocumento164 páginasPcad 2006 Asciimamanca1Ainda não há avaliações

- UiPath RPA Developer AcademyDocumento11 páginasUiPath RPA Developer AcademySatti CAinda não há avaliações

- Eee4024 Computer-Architecture-And-Organization TH 1.0 37 Eee4024Documento3 páginasEee4024 Computer-Architecture-And-Organization TH 1.0 37 Eee4024Anbarasan SubramaniyanAinda não há avaliações

- Siemens NX - GuidanceDocumento8 páginasSiemens NX - Guidancedjtj89100% (1)

- Stopping Criteria PDFDocumento4 páginasStopping Criteria PDFHarsha Chaitanya GoudAinda não há avaliações

- How To Recreate A Control File in Oracle DatabaseDocumento3 páginasHow To Recreate A Control File in Oracle Databasekamakom78100% (1)

- Handbook of Spectrum Monitoring 2011Documento678 páginasHandbook of Spectrum Monitoring 2011haripost100% (1)

- 10 Obscure Excel Tricks That Can Expedite Common ChoresDocumento8 páginas10 Obscure Excel Tricks That Can Expedite Common ChoresHamza IslamAinda não há avaliações

- MT6757 Android ScatterDocumento10 páginasMT6757 Android Scatteramir mamiAinda não há avaliações

- Queen Problem - Allegro 5Documento3 páginasQueen Problem - Allegro 5Alexandru Gabriel StoicaAinda não há avaliações

- RHEL6 DatasheetDocumento8 páginasRHEL6 DatasheetArmando Paredes JaraAinda não há avaliações

- 8086 Development ToolsDocumento7 páginas8086 Development ToolsJashuva Chukka0% (1)

- LectureNotes - 20170410-1 - Introduction To EHMIDocumento19 páginasLectureNotes - 20170410-1 - Introduction To EHMINam Vũ0% (1)

- Control of Nonconforming ProductDocumento11 páginasControl of Nonconforming ProductDutch CharmingAinda não há avaliações

- Sudha Ma Thy 2016Documento6 páginasSudha Ma Thy 2016vishek kumarAinda não há avaliações

- MSX Magazine No. 4 1986-01 Laser Magazine FRDocumento32 páginasMSX Magazine No. 4 1986-01 Laser Magazine FRkmyl75Ainda não há avaliações

- Process ControlDocumento24 páginasProcess ControlEr Shubham RaksheAinda não há avaliações

- Blockchain's Smart Contracts: Driving The Next Wave of Innovation Across Manufacturing Value ChainsDocumento10 páginasBlockchain's Smart Contracts: Driving The Next Wave of Innovation Across Manufacturing Value ChainsCognizant50% (2)

- Interbase Language Reference PDFDocumento292 páginasInterbase Language Reference PDFdanielbg817Ainda não há avaliações

- Core Java Amity TutDocumento5 páginasCore Java Amity TutRaghav GogiaAinda não há avaliações

- CN3421 Lecture Note 1 - IntroductionDocumento20 páginasCN3421 Lecture Note 1 - IntroductionKiang Teng LimAinda não há avaliações

- A Plus 220 1001 PDF Exam ObjectivesDocumento19 páginasA Plus 220 1001 PDF Exam Objectiveseraakash88Ainda não há avaliações