Escolar Documentos

Profissional Documentos

Cultura Documentos

Gerbang Nusajaya DTZ Report

Enviado por

stormleeDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Gerbang Nusajaya DTZ Report

Enviado por

stormleeDireitos autorais:

Formatos disponíveis

Market Assessment of

Gerbang Nusajaya and

Iskandar Puteri.

COMPLETED BY DTZ CONSULTING AND

RESEARCH MALAYSIA AND SINGAPORE

Gerbang Nusajaya will spearhead the

next wave of growth in Iskandar Malaysia

Prepared for : UEM Sunrise Berhad

30th April 2015

Gerbang Nusajaya is set to be a major commercial hub, making

Nusajaya the engine of growth in Iskandar Malaysia.

Potential for 257,000 jobs to be created by catalytic developments in

Gerbang Nusajaya.

Future population growth will drive housing demand.

Concerns on oversupply and demand slowdown in Iskandar Malaysia

are of a short-term nature, unlikely to impede the progress of

Gerbang Nusajaya.

Contacts:

Saleha Yusoff

Director, Consulting &

Research

+ 603 2161 7228 ext 302

saleha_yusoff@dtz.com.my

Brian Koh

Executive Director,

Investment/Consulting &

Research

+ 603 2161 7228 ext 300

brian_koh@dtz.com.my

Choon Fah Ong

Chief Operating Officer

Regional Head (SEA),

Consulting & Research

+ 65 6293 3228

choonfah.ong@dtz.com

Strong fundamentals and opportunities

Iskandar Malaysia (IM), particularly Nusajaya, continues to benefit from

various committed investments and planned catalytic developments. Its

value proposition is increasingly attractive to Singapore.

Short-term concerns on oversupply and demand slowdown in Iskandar

Malaysia are actually driven by large scale launches of residential units in

Flagship A (Johor Bahru city centre), especially those launched by Chinese

developers. These are less threatening for Gerbang Nusajaya due to its

location and immediate connectivity to Singapore, served by the

Malaysia-Singapore Second Link.

With the presence of key catalytic developments ranging from tourism

and leisure, healthcare and wellness, education, creative to business and

industrial sectors in place to stimulate job creation and economic

activities, Gerbang Nusajaya is poised to generate strong population

growth that will drive housing demand.

DTZ Nawawi Tie Leung Property Consultants Sdn Bhd

Suite 34.01, Level 34, Menara Citibank

165 Jalan Ampang

50450 Kuala Lumpur

DTZ Debenham Tie Leung (SEA) Pte Ltd

100 Beach Road

#35-00 Shaw Tower

Singapore 189702

Market Assessment on Nusajaya and Gerbang Nusajaya

DTZ Consulting & Research

Malaysia and Singapore

Huge potential lies ahead

DTZ believes that the 4,551-acre Gerbang Nusajaya, which has been

comprehensively master-planned by UEM Sunrise, will ensure long-term

sustainable growth and become a successful business hub in its own right.

With various planned catalytic developments, coupled with its ability to

capitalise on the proposed High-Speed Rail (HSR) station which is likely to

be located in Gerbang Nusajaya, it is capable of creating up to 257,000

jobs, resulting in rapid population growth and housing demand in

Nusajaya. Its developments will drive the commercial success of Nusajaya

from its strategic location between Malaysia and Singapore.

30th April 2015

www.dtz.com

2

Market Assessment on Nusajaya and Gerbang Nusajaya

DTZ Consulting & Research

Malaysia and Singapore

Johor and Iskandar Malaysia outperforms the nation

Higher GDP growth

Figure 1: GDP Index

Johors economy has outperformed the nation

since 2009. On an average basis, Johors GDP

amounted to 9% of the Malaysias annual GDP

during 2005 2013.

140

Johor

Index (2009 : 100)

130

Iskandar Malaysia, being the destination of 11%

of approved investments in Malaysia,

contributed about 70% of Johors GDP. Highvalue jobs have been created, as evidenced by

its GDP per capita, which is 7% higher than the

national level.

120

Malaysia

110

100

90

80

Lower unemployment rate

2009

2010

Malaysia

The labour market also performed better, with

an unemployment rate of just 2.6% in 2014,

lower than the 2.9% recorded at the national

level. This can be partly attributed by a number

of pioneer projects in Iskandar Malaysia, which

have commenced their operations. Based on

census data, there is no shortage of labour

supply as more young people are entering the

workforce. Official census conducted in 2010

revealed that 42% of the Johor population aged

between 25 to 54 years old. It is projected that

this ratio will increase to 44% by 2030.

2011

2012

2013

Johor

Source: Department of Statistics Malaysia,

IRDA, DTZ Consulting & Research, 2015

Figure 2: Unemployment Rate

4.0%

Malaysia: 2.9%

3.5%

3.0%

2.5%

2.0%

Johor: 2.6%

1.5%

Given the continuous job creation in Iskandar

Malaysia, coupled with the increasing

workforce, the unemployment rate is expected

to remain low, going forward.

1.0%

0.5%

0.0%

Malaysia

Johor

Source: Department of Statistics Malaysia, 2014

30th April 2015

www.dtz.com

3

Market Assessment on Nusajaya and Gerbang Nusajaya

DTZ Consulting & Research

Malaysia and Singapore

Singapore continues to complement Malaysias growth, including Iskandar

Malaysia

Iskandar Malaysias value proposition is

increasingly attractive

Opportunities for land-intensive

businesses

Singapore leads foreign investment in Iskandar

Malaysia, with a cumulative committed

investments totalled RM 12.1 billion during

2006 2014. Both the governments of

Singapore and Malaysia recognise the immense

benefit of twinning economic activities between

Iskandar Malaysia and Singapore. Bilateral cooperation has deepened in recent years,

evident from the setting up of the MalaysiaSingapore Joint Ministerial Committee of

Iskandar Malaysia (JMCIM) in 2013. This has

helped to facilitate the development of several

catalytic projects in Iskandar Malaysia, e.g. the

High-Speed Rail (HSR) and Rapid Transit System

(RTS).

Since it is increasingly challenging for landintensive industrial operations to find suitable

land plots in Singapore, the vast availability of

land and lower land cost in neighbouring

locations, such as Nusajaya, will continue to

attract land-intensive industries from Singapore

to relocate. For office-based activities, Nusajaya

offers opportunities for companies to further

reduce their operational costs as major

Business Process Outsourcing (BPO) and Shared

Services Centre (SSC) locations.

Spillover effect from Singapore

Cooling measures introduced by the Singapore

Government have encouraged outward real

estate investments, partly generating demand

for residential units in Iskandar Malaysia, as

transaction costs are significantly higher for

buyers of Singapore residential properties. The

Iskandar Malaysia residential market will also

benefit from the potential spillover effect of

population growth in Singapore, which is

projected to reach 6.9 million by 2030.

Potential for business relocation

Recent developments in Singapore have

encouraged companies to venture into Iskandar

Malaysia. Rising business costs and tightened

foreign worker policies present challenges for

companies operating in the island-state.

Besides, the government, via International

Enterprise (IE) Singapore, has rolled out various

incentives and programs with the aim of helping

Small and Medium Enterprises (SMEs) to grow

overseas and stay competitive. Moreover, the

Economic Development Board (EDB) is

encouraging land-intensive activities to be

located in neighbouring countries, although it is

also targeting companies to site their high-value

and headquarter operations in Singapore.

The proximity of Iskandar Malaysia offers

complementary locational advantage with

Singapore. It is an attractive proposition for

companies looking to invest in the region, as

they can position and develop their value chain

across both Singapore and Iskandar Malaysia.

With comprehensive infrastructure and

established labour pool, there is potential for

Nusajaya to attract companies from Singapore,

either to set up part of their operations, or for

complete relocation in the long term.

30th April 2015

www.dtz.com

4

Market Assessment on Nusajaya and Gerbang Nusajaya

DTZ Consulting & Research

Malaysia and Singapore

Spearheading the next wave of growth

Figure 3: Job Creation in Gerbang Nusajaya

Gerbang Nusajaya is set to be the major

commercial hub in Iskandar Malaysia

300

257.1

250

'000 jobs

With key projects such as Nusajaya Tech Park,

FASTrack Iskandar and Gateway CBD, Gerbang

Nusajaya is well positioned as the major

commercial hub in Iskandar Malaysia, making

Nusajaya the engine of growth due to its

immediate connectivity from the MalaysiaSingapore Second Link and the proposed HighSpeed Rail station. Given the catalytic

investments in education, manufacturing,

healthcare, tourism, creative art and

entertainment, job creation and population

growth will trend towards Nusajaya.

200

164.2

150

177.8

82.1

100

50

116.7

2.5

58.3

2015

2020

without HSR

2025

2030

with HSR

Source: DTZ Consulting & Research, 2015

Increasing population and tourist arrivals

will spur leisure and retail sectors

According to UEM Sunrise, Gerbang Nusajaya

will create 213,000 high-skilled jobs. This is in

line with our base case scenario which

estimates a minimum creation of 177,800 jobs.

However, there is an upside potential as it is

able to capitalise on the proposed High-Speed

Rail. If Gerbang Nusajaya is chosen as the

location of the High-Speed Rail station, more

commercial activities can be expected and this

in turn will support the creation of more job

opportunities. With more business activities,

the potential for a more intensive usage of land

is positive and this could give rise to a higher

potential of 257,000 jobs.

Tourist arrivals in Johor will continue to rise,

driven by leisure projects, as well as high-value

business sectors and industries, which attract

business travellers. According to the Ministry of

Tourism, Johor hosted 5.77 million of hotel

guests in 2013, 46% higher than in 2012. With

an assumed growth of 5% per annum, the

number of tourist arrivals is set to reach 13.23

million in 2030, giving rise to demand for an

additional 14,000 hotel rooms.

The increase in tourist arrivals, coupled with the

population growth, will spur the retail sector. In

order to cater to the rise in demand, an

additional 9.6 million square feet of retail

spaces, or approximately 15 new malls will be

required.

Future population growth to drive housing

demand in Nusajaya

About 30% of Iskandar Malaysia population will

be based in Nusajaya. With the presence of

High-Speed Rail, the number of households in

Nusajaya will be 14% higher than the base case

scenario, widening the residential demand from

57,600 units to over 85,000 units.

Gerbang Nusajaya is well positioned to cater for

such growth given its proximity to Singapore

and various catalytic developments in Nusajaya.

30th April 2015

www.dtz.com

5

Market Assessment on Nusajaya and Gerbang Nusajaya

DTZ Consulting & Research

Malaysia and Singapore

Figure 4: Projected commercial-related jobs in Gerbang Nusajaya

Potential supply of 65.69 million sq ft of commercial space

70

159,058

Employment - Commercial

160,000

60

140,000

Supporting 159,058 commercial-related jobs

120,000

50

95,635

100,000

80,000

79,779

48,068

60,000

500

30

20

48,068

40,000

20,000

40

Million sq ft

180,000

10

24,284

2015

2020

2025

2030

Commercial NLA (million sq ft) with HSR (RHS)

Commercial NLA (million sq ft) without HSR (RHS)

Employment - Commercial without HSR (LHS)

Employment - Commercial with HSR (LHS)

Source: DTZ Consulting and Research, January 2015.

Figure 5: Housing Demand in Nusajaya

250,000

223,087

195,339

200,000

85,362 units

150,000

100,000

7,760 units per annum

50,000

0

Nusajaya : No. of Housing Units

Nusajaya : No. of Households without HSR

Nusajaya : No. of Households with HSR

Source: DTZ Consulting and Research, January 2015.

30th April 2015

www.dtz.com

6

Market Assessment on Nusajaya and Gerbang Nusajaya

DTZ Consulting & Research

Malaysia and Singapore

Figure 6: Projected Population Growth in Iskandar Malaysia

Source: IRDA, DTZ Consulting and Research, January 2015.

Perceived downside risk of Iskandar Malaysia property market the perspective

from Gerbang Nusajaya

parcels in Johor Bahru city centre will have at

least 20,000 high-rise residential units.

The roots of perception

The state of Iskandar Malaysia property market

has been widely perceived as worsening

following the emergence of Chinese developers

who flooded the market with large-scale

launches of high-rise residential units located in

strategic sea-front areas in downtown Johor

Bahru. Their projects, coupled with those

launched by Malaysian developers, have

stiffened the market competition. Our

estimates revealed that these sea-front land

The aggressive move of foreign developers, plus

new cooling measures such as the revised RM 1

million floor price for foreign buyers, and

stringent lending conditions have exerted

pressures on Malaysian developers, resulting

amendments in their development strategies.

DTZ understands that some have lowered their

sale targets and are now becoming more

realistic than during the peak time of Iskandar

Malaysia.

30th April 2015

www.dtz.com

7

Market Assessment on Nusajaya and Gerbang Nusajaya

DTZ Consulting & Research

Malaysia and Singapore

Less threatening for Gerbang Nusajaya

Huge supply of high-rise residential units in

Johor Bahru city centre

From the perspective of Gerbang Nusajaya, the

issue of oversupply of residential properties and

demand slowdown is less threatening due to

two reasons, namely the long term nature of

township development, and the key catalyst

projects that will generate the necessary

demand for commercial properties. Its location,

being at the western corridor of the Iskandar

Malaysia, coupled with the size of the land

which spans over 4,000 acres, offers untapped

opportunities to create synergies. This is

something which many developers, with their

limited land parcels in the much-focused Johor

Bahru city centre and Medini, are unable to

achieve. Although Medini is also situated within

the same flagship, it is developed by many

different developers; whereas Gerbang

Nusajaya is master-planned by a single entity.

This allows UEM Sunrise to create its own

demand drivers for the residential and

commercial components at its own pace.

DTZ noted that the concerns on the issue of

oversupply and the slowdown in demand are

actually driven by recent developments in the

residential sector in Johor Bahru city centre.

While the recent measures introduced by the

Government may have dampened the demand,

most of the high-rise residential projects tend

to target the same group of buyer, namely the

investors. Our site visit revealed that landed

projects, which are mostly located outside the

Johor Bahru city centre, have achieved good

take-up. Beside investors, these landed

residential projects also attract existing

homeowners who are keen to upgrade their

lifestyle. Demand for commercial properties is

positive as it will benefit from the spillover

effects of various committed investments. Also,

high-grade gated and guarded industrial units

with large built-up are highly sought.

Figure 6: Incoming and Planned Supply of

Residential Units in Iskandar Malaysia

A trending-upward demand is expected, given

their existing projects such as Nusajaya Tech

Park and FASTrack Iskandar which will create

high-income jobs. For instance, it is estimated

that the annual salary of an electrician working

at FASTrack Iskandar would be 3.5 times higher

than the national average. This is positive for

Gerbang Nusajaya as workers are able to afford

a better lifestyle. Moreover, the proposed

Gerbang Nusajaya High-Speed Rail station will

create positive spillover effects.

Nusajaya

26%

185,886 units

Rest of

Iskandar

Malaysia

74%

Source: NAPIC, DTZ Consulting and Research,

January 2015.

30th April 2015

www.dtz.com

8

Market Assessment on Nusajaya and Gerbang Nusajaya

DTZ Consulting & Research

Malaysia and Singapore

Conclusion

long-term sustainable growth and become a

successful business hub in its own right. It is the

new catalyst that will spearhead the next wave

of growth in Iskandar Malaysia.

The Nusajaya of tomorrow will be totally

different from today. DTZ believes that Gerbang

Nusajaya, which has been comprehensively

master-planned by UEM Sunrise, will ensure

30th April 2015

www.dtz.com

9

Market Assessment on Nusajaya and Gerbang Nusajaya

DTZ Consulting & Research

Malaysia and Singapore

Business Contacts

Business Space/Occupier Services

Yasmine Mohd Zamirdin

Associate Director

Phone: +60 (0)3 2161 7228 ext 288

Email: yasmine_zamirdin@dtz.com.my

Investment Advisory

Sr Low Han Hoe

Senior Manager

Phone: +60 (0)3 2161 7228 ext 278

Email: hanhoe_low@dtz.com.my

Consulting & Research

Brian Koh

Executive Director

Phone: +60 (0)3 2161 7228 ext 300

Email: brian_koh@dtz.com.my

Consulting & Research

Saleha Yusoff

Director

Phone: +60 (0)3 2161 7228 ext 302

Email: saleha_yusoff@dtz.com.my

Property Management

T.Subramaniam

Director

Phone: +60 (0)3 2161 7228 ext 310

Email: subra@dtz.com.my

Residential

Eddy Wong

Managing Director

Phone: +60 (0)3 2161 7228 ext 380

Email: eddy_wong@dtz.com.my

Residential

Chong Yen Yee

Associate Director

Phone: +60 (0)3 2161 7228 ext 381

Email: yenyee_chong@dtz.com.my

Retail

Ungku Suseelawati Ungku Omar

Executive Director

Phone: +60 (0)3 2161 7228 ext 330

Email: suseela@dtz.com.my

Retail

Wong Suet Pink

Associate Director

Phone: +60 (0)3 2161 7228 ext 338

Email: suetpink_wong@dtz.com.my

Valuation

Sr Daniel Ma Jen Yi

Director

Phone: +60 (0)3 2161 7228 ext 222

Email: daniel_ma@dtz.com.my

Valuation

Hanafi Abd Rahman

Manager

Phone: +60 (0)3 2161 7228 ext 225

Email: hanafi_rahman@dtz.com.my

Disclaimer

This report should not be relied upon as a basis for entering into transactions without seeking specific,

qualified, professional advice. Whilst facts have been rigorously checked, DTZ can take no responsibility

for any damage or loss suffered as a result of any inadvertent inaccuracy within this report. Information

contained herein should not, in whole or part, be published, reproduced or referred to without prior

approval. Any such reproduction should be credited to DTZ.

30th April 2015

www.dtz.com

10

gerbangnusajaya.com

Você também pode gostar

- Gerbang Nusajaya DTZ Report PDFDocumento12 páginasGerbang Nusajaya DTZ Report PDFQina NursakinaAinda não há avaliações

- Invest Malaysia: An Immersive EconomyDocumento4 páginasInvest Malaysia: An Immersive EconomyTimes MediaAinda não há avaliações

- Real Estate Foresight: Iskandar: A Place For Work, Play and LivingDocumento7 páginasReal Estate Foresight: Iskandar: A Place For Work, Play and LivingKelvin SumAinda não há avaliações

- Excelco Equipment - Attracting Young Talent in SingaporeDocumento14 páginasExcelco Equipment - Attracting Young Talent in SingaporeAishah HarunAinda não há avaliações

- IskandarMalaysia FullDocumento28 páginasIskandarMalaysia FullYew Toh TatAinda não há avaliações

- Focus On Negri Sembilan - 14 September 2014Documento24 páginasFocus On Negri Sembilan - 14 September 2014Times MediaAinda não há avaliações

- Ass Bdoe4103Documento10 páginasAss Bdoe4103azam mustafaAinda não há avaliações

- Gerbang Nusajaya E-BrochureDocumento2 páginasGerbang Nusajaya E-BrochurepavitravadivelooAinda não há avaliações

- 2013Documento127 páginas2013Sor VictorAinda não há avaliações

- Medini Iskandar MalaysiaDocumento50 páginasMedini Iskandar Malaysiaapi-246317055Ainda não há avaliações

- LolDocumento16 páginasLolhanafiezsqiAinda não há avaliações

- SGCI - Technical Proposal 291216Documento22 páginasSGCI - Technical Proposal 291216Anonymous UUw70xirbl100% (1)

- SG - Salary - Guide - 2022 - 23 v5Documento63 páginasSG - Salary - Guide - 2022 - 23 v5andrewsolisjrAinda não há avaliações

- 11th Malaysia Plan Six Strategic Thrusts in Moving Towards Vision 2020 - Astro AwaniDocumento9 páginas11th Malaysia Plan Six Strategic Thrusts in Moving Towards Vision 2020 - Astro AwaniZati TyAinda não há avaliações

- Final Keynote Address Johor Business and Investment Forum - YAB Menteri Besar JohorDocumento12 páginasFinal Keynote Address Johor Business and Investment Forum - YAB Menteri Besar JohorAngel YakAinda não há avaliações

- Proposal Storyboard - Updated Cut: IIB Marketing Video For External Viewing Date: 01 March 2023Documento4 páginasProposal Storyboard - Updated Cut: IIB Marketing Video For External Viewing Date: 01 March 2023Iskandar RazakAinda não há avaliações

- Johor Property - 17 October 2015Documento24 páginasJohor Property - 17 October 2015Times MediaAinda não há avaliações

- Property Quotient Jan12 (v1.2)Documento13 páginasProperty Quotient Jan12 (v1.2)Hazrul IzwanAinda não há avaliações

- Attracting Foreign Investments: List of 2009 Project AnnouncementsDocumento1 páginaAttracting Foreign Investments: List of 2009 Project Announcementssanch123Ainda não há avaliações

- CDP II Final Draft - OkDocumento29 páginasCDP II Final Draft - OkJiaChyi PungAinda não há avaliações

- Sustainable Urban City of KajangDocumento40 páginasSustainable Urban City of KajangHamzah AliAinda não há avaliações

- KL-SG High Speed Rail: Riding The HSR RevivalDocumento44 páginasKL-SG High Speed Rail: Riding The HSR Revival@yuan100% (1)

- China in Malaysia: State-Business Relations and the New Order of Investment FlowsNo EverandChina in Malaysia: State-Business Relations and the New Order of Investment FlowsAinda não há avaliações

- ICT Blueprint 2020 Iskandar MalaysiaDocumento31 páginasICT Blueprint 2020 Iskandar MalaysiaAminudin SulaimanAinda não há avaliações

- ETP2013 ENG Full VersionDocumento352 páginasETP2013 ENG Full VersionMuhd Afiq Syazwan100% (1)

- Mag Issue137 PDFDocumento141 páginasMag Issue137 PDFShafiq Nezat100% (1)

- Kuala Lumpur, Malaysia: Launchpad To Southeast Asia: An Investment GuideDocumento0 páginaKuala Lumpur, Malaysia: Launchpad To Southeast Asia: An Investment GuideNicholas AngAinda não há avaliações

- 11 June MainDocumento1 página11 June Mainapi-256645033Ainda não há avaliações

- Montessori School Standardize Feasibility ReportDocumento41 páginasMontessori School Standardize Feasibility ReportGhulam Mustafa75% (4)

- 3 Important of ETP To Malaysian EconomyDocumento12 páginas3 Important of ETP To Malaysian EconomySyamim AisyahAinda não há avaliações

- Case 2: Doing Business in SingaporeDocumento5 páginasCase 2: Doing Business in SingaporeHera AsuncionAinda não há avaliações

- Iskandar Malaysia Property Market May 2015Documento15 páginasIskandar Malaysia Property Market May 2015Mks AsarAinda não há avaliações

- FIN 346 Securities MarketDocumento7 páginasFIN 346 Securities Marketmirah.azizan28Ainda não há avaliações

- Global Technology Hub Blueprint PDFDocumento110 páginasGlobal Technology Hub Blueprint PDFNia Zainorin100% (1)

- Brain Drain: Propensity To Leave by Malaysian Professionals: Junaimah Jauhar and Yusliza Mohd YusoffDocumento4 páginasBrain Drain: Propensity To Leave by Malaysian Professionals: Junaimah Jauhar and Yusliza Mohd YusoffSylvaen WswAinda não há avaliações

- Medini Iskandar Special ReportDocumento12 páginasMedini Iskandar Special ReportIskandar RazakAinda não há avaliações

- Contoh Press RilisDocumento3 páginasContoh Press RilisHamdan Sobri AndhikaAinda não há avaliações

- Sson Market UPDATE 2015: Malaysia's Shared Services IndustryDocumento7 páginasSson Market UPDATE 2015: Malaysia's Shared Services IndustrysoloAinda não há avaliações

- Cbct2203 (MSC)Documento10 páginasCbct2203 (MSC)Mohd Sufikar MechingAinda não há avaliações

- Myforesight - Malaysia's Shipbuilding IndustryDocumento58 páginasMyforesight - Malaysia's Shipbuilding IndustryRushdi RahimAinda não há avaliações

- Mah Sing Annual Report 2013Documento221 páginasMah Sing Annual Report 2013ETDWAinda não há avaliações

- Nivesh: GlobalDocumento60 páginasNivesh: GlobalSaumy ShuklaAinda não há avaliações

- DocumewntDocumento73 páginasDocumewntSaumy ShuklaAinda não há avaliações

- DocumDocumento73 páginasDocumSaumy ShuklaAinda não há avaliações

- Publishedpapaer 2Documento12 páginasPublishedpapaer 2Worth ItAinda não há avaliações

- Pre-Feasibility Study Prime Minister's Small Business Loan SchemeDocumento20 páginasPre-Feasibility Study Prime Minister's Small Business Loan SchemeMian Adi Chaudhry100% (1)

- Astaka Holdings To Develop New Headquarters of Johor Bahru's City Council, MBJB, Heralding New Era of Transformation of Southern CityDocumento4 páginasAstaka Holdings To Develop New Headquarters of Johor Bahru's City Council, MBJB, Heralding New Era of Transformation of Southern CityWeR1 Consultants Pte LtdAinda não há avaliações

- Individual Assignment 2 - Issues and Ethics in FinanceDocumento8 páginasIndividual Assignment 2 - Issues and Ethics in FinanceRahimah YusofAinda não há avaliações

- WTWPMR2015Documento76 páginasWTWPMR2015HaZr AfiszAinda não há avaliações

- Astaka Holdings Awards Construction Contract For MBJB's New Headquarters in Johor Bahru's New Administrative and Commercial HubDocumento3 páginasAstaka Holdings Awards Construction Contract For MBJB's New Headquarters in Johor Bahru's New Administrative and Commercial HubWeR1 Consultants Pte LtdAinda não há avaliações

- Foreign Labour in Malaysia Selected Works PDFDocumento176 páginasForeign Labour in Malaysia Selected Works PDFNurul FarahAinda não há avaliações

- Business Plan 1Documento23 páginasBusiness Plan 1Malimi Mwami100% (1)

- Pt. Global Investasindo Indonesia: Success, Safe and ComfortableDocumento23 páginasPt. Global Investasindo Indonesia: Success, Safe and Comfortableilhamrabbani8Ainda não há avaliações

- A Competitive Advantage Strategy Based On Innovative Culture andDocumento8 páginasA Competitive Advantage Strategy Based On Innovative Culture andhibo gaacuurAinda não há avaliações

- KN AR12 The Khazanah ReportDocumento138 páginasKN AR12 The Khazanah Reportirmreza68Ainda não há avaliações

- Malaysia Needs To Intensify Investment in Human Capital - The Edge MarketsDocumento6 páginasMalaysia Needs To Intensify Investment in Human Capital - The Edge MarketssuemeAinda não há avaliações

- Human Capital Development in South Asia: Achievements, Prospects, and Policy ChallengesNo EverandHuman Capital Development in South Asia: Achievements, Prospects, and Policy ChallengesAinda não há avaliações

- Innovative Strategies in Higher Education for Accelerated Human Resource Development in South AsiaNo EverandInnovative Strategies in Higher Education for Accelerated Human Resource Development in South AsiaAinda não há avaliações

- TODAY Tourism & Business Magazine, Volume 23, April, 2016No EverandTODAY Tourism & Business Magazine, Volume 23, April, 2016Ainda não há avaliações

- Incubating Indonesia’s Young Entrepreneurs:: Recommendations for Improving Development ProgramsNo EverandIncubating Indonesia’s Young Entrepreneurs:: Recommendations for Improving Development ProgramsAinda não há avaliações

- Astaka Holdings Limited Annual Report 2019Documento143 páginasAstaka Holdings Limited Annual Report 2019WeR1 Consultants Pte LtdAinda não há avaliações

- History of Singapore-Johore RailwayDocumento20 páginasHistory of Singapore-Johore RailwayNur Filzahruz Mohamad SahAinda não há avaliações

- Malacca Strait Sailing GuideDocumento2 páginasMalacca Strait Sailing GuideIya IyalahAinda não há avaliações

- IPDN 14 NOV 2019 Malindo Border Governance ARA PDFDocumento11 páginasIPDN 14 NOV 2019 Malindo Border Governance ARA PDFAbdulrahim AnuarAinda não há avaliações

- HCDocumento20 páginasHCZira ArizAinda não há avaliações

- AirlinesDocumento28 páginasAirlinesSandraPriya Medusa MurugiahAinda não há avaliações

- Resume AbangDocumento4 páginasResume Abanglysa dexignAinda não há avaliações

- CV. Muhammad Bin SurpadiDocumento6 páginasCV. Muhammad Bin SurpadiShaiful Annuar50% (2)

- Last Updated 20 January 2014: List of Approved Local Medical PractitionersDocumento67 páginasLast Updated 20 January 2014: List of Approved Local Medical PractitionersahfohAinda não há avaliações

- Contact Information: Nurul Amira Edora Binti JamaludinDocumento1 páginaContact Information: Nurul Amira Edora Binti JamaludinNurul Amira EdoraAinda não há avaliações

- Corporate Social ResponsibilityDocumento10 páginasCorporate Social ResponsibilityNurulAdellaAinda não há avaliações

- Johor Branches: Tasek Maju GroupDocumento6 páginasJohor Branches: Tasek Maju GroupPuspita LerianaAinda não há avaliações

- Laporan Dcs JB 20092021Documento4 páginasLaporan Dcs JB 20092021Leena LetchumananAinda não há avaliações

- Contamination in Pasir Gudang Area, Peninsular Malaysia: What Can We Learn From Kim Kim River Chemical Waste Contamination?Documento4 páginasContamination in Pasir Gudang Area, Peninsular Malaysia: What Can We Learn From Kim Kim River Chemical Waste Contamination?Leow Chee Seng100% (1)

- Southern PropertyDocumento24 páginasSouthern PropertyTimes MediaAinda não há avaliações

- 2017 Briefing Checklist SchoolSupportWorkshop 25.01.2017Documento9 páginas2017 Briefing Checklist SchoolSupportWorkshop 25.01.2017Michelle DuncanAinda não há avaliações

- Ajiya AR2018 PDFDocumento172 páginasAjiya AR2018 PDFPhoo Wint ZawAinda não há avaliações

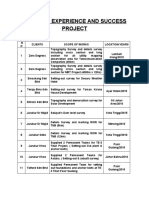

- Company Experience and Success ProjectDocumento4 páginasCompany Experience and Success ProjectSaiful IzuanAinda não há avaliações

- Mohd Khalis HalimDocumento5 páginasMohd Khalis HalimnurliyanaAinda não há avaliações

- Senarai Gudang Berlesen Awam GbaDocumento30 páginasSenarai Gudang Berlesen Awam GbaAsia IT-ComponentAinda não há avaliações

- Store LocatorDocumento56 páginasStore LocatorHasmitthaAinda não há avaliações

- Senarai Frekuensi, Stesen Radio Di MalaysiaDocumento2 páginasSenarai Frekuensi, Stesen Radio Di MalaysiaNaz IsaAinda não há avaliações

- Result OMK 2017 Individu Bongsu PDFDocumento1 páginaResult OMK 2017 Individu Bongsu PDFAizad ZulqarnaenAinda não há avaliações

- FUJI OIL Group Palm Oil Mill List (June 2021-December 2021)Documento17 páginasFUJI OIL Group Palm Oil Mill List (June 2021-December 2021)rezaAinda não há avaliações

- 2.1 3rd Party Cost (Agency) - Crane BargeDocumento1 página2.1 3rd Party Cost (Agency) - Crane BargewanmohdsaifulfadlyAinda não há avaliações

- Redone NCDocumento9 páginasRedone NCSaw HJAinda não há avaliações

- JB Sentral Bus Terminal - Land Transport GuruDocumento4 páginasJB Sentral Bus Terminal - Land Transport GuruJeff TeeAinda não há avaliações

- Final Results Best Campers 2021 ..Documento20 páginasFinal Results Best Campers 2021 ..MawaddahAinda não há avaliações

- Colonial Powers, Nation-States and Kerajaan in Maritime Southeast Asia: Structures, Legalities and PerceptionsDocumento14 páginasColonial Powers, Nation-States and Kerajaan in Maritime Southeast Asia: Structures, Legalities and Perceptionsanjangandak2932Ainda não há avaliações

- Aja Aja Fighting Trial Questions 2023 v2-1Documento28 páginasAja Aja Fighting Trial Questions 2023 v2-1WONG SZE WEI KPM-GuruAinda não há avaliações