Escolar Documentos

Profissional Documentos

Cultura Documentos

Digests Balane

Enviado por

Cathy Gacutan0 notas0% acharam este documento útil (0 voto)

35 visualizações8 páginasThe respondents asserted their ownership over a certain parcel of land against the petitioners Nora B. Calalang-Parulan and Elvira B.Calalang. Pedro Calalang committed fraud in such application by claiming sole and exclusive ownership over the land since 1935. The respondents assailed the validity of the sale of the land on two grounds.

Descrição original:

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoThe respondents asserted their ownership over a certain parcel of land against the petitioners Nora B. Calalang-Parulan and Elvira B.Calalang. Pedro Calalang committed fraud in such application by claiming sole and exclusive ownership over the land since 1935. The respondents assailed the validity of the sale of the land on two grounds.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

35 visualizações8 páginasDigests Balane

Enviado por

Cathy GacutanThe respondents asserted their ownership over a certain parcel of land against the petitioners Nora B. Calalang-Parulan and Elvira B.Calalang. Pedro Calalang committed fraud in such application by claiming sole and exclusive ownership over the land since 1935. The respondents assailed the validity of the sale of the land on two grounds.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 8

Calalang v Calalang-Garcia

Complaint4 for Annulment of Sale and Reconveyance of

Property filed with the RTC of Malolos, Bulacan on June 10,

1991, the respondents Rosario Calalang-Garcia, Leonora

Calalang-Sabile, and Carlito S. Calalang asserted their

ownership over a certain parcel of land against the petitioners

Nora B. Calalang-Parulan and Elvira B. Calalang.

According to the respondents, their father, Pedro Calalang

contracted two marriages during his lifetime. The first

marriage was with their mother Encarnacion Silverio. During

the subsistence of this marriage, their parents acquired the

above-mentioned parcel of land from their maternal

grandmother Francisca Silverio. Despite enjoying continuous

possession of the land, however, their parents failed to register

the same. On June 7, 1942, the first marriage was dissolved

with the death of Encarnacion Silverio.

Pedro Calalang entered into a second marriage with Elvira B.

Calalang who then gave birth to Nora B. Calalang-Parulan and

Rolando Calalang. According to the respondents, it was only

during this time that Pedro Calalang filed an application for free

patent over the parcel of land with the Bureau of Lands. Pedro

Calalang committed fraud in such application by claiming sole

and exclusive ownership over the land since 1935 and

concealing the fact that he had three children with his first

spouse.

Pedro Calalang sold the said parcel of land to Nora B. CalalangParulan

respondents assailed the validity of TCT No. 283321 on two

grounds. First, the respondents argued that the sale of the land

was void because Pedro Calalang failed to obtain the consent

of the respondents who were co-owners of the same. As

compulsory heirs upon the death of Encarnacion Silverio, the

respondents claimed that they acquired successional rights

over the land. Thus, in alienating the land without their

consent, Pedro Calalang allegedly deprived them of their pro

indiviso share in the property. Second, the respondents

claimed that the sale was absolutely simulated as Nora B.

Calalang-Parulan did not have the capacity to pay for the

consideration stated in the Deed of Sale.

whether Pedro Calalang was the exclusive owner of the

disputed property prior to its transfer to his daughter Nora B.

Calalang-Parulan.

records are bereft of any concrete proof to show that the

subject property indeed belonged to respondents maternal

grandparents. The evidence respondents adduced merely

consisted of testimonial evidence such as the declaration of

Rosario Calalang-Garcia that they have been staying on the

property as far as she can remember and that the property was

acquired by her parents through purchase from her maternal

grandparents. However, she was unable to produce any

document to evidence the said sale, nor was she able to

present any documentary evidence such as the tax declaration

issued in the name of either of her parents. Moreover, we note

that the free patent was issued solely in the name of Pedro

Calalang and that it was issued more than 30 years after the

death of Encarnacion and the dissolution of the conjugal

partnership of gains of the first marriage. Thus, we cannot

subscribe to respondents submission that the subject property

originally belonged to the parents of Encarnacion and was

acquired by Pedro Calalang and Encarnacion.

We likewise cannot sustain the argument of the petitioners that

the disputed property belongs to the conjugal partnership of

the second marriage of Pedro Calalang with Elvira B. Calalang

on the ground that the title was issued in the name of Pedro

Calalang, married to Elvira Berba [Calalang]. merely describes

the civil status and identifies the spouse of the registered

owner Pedro Calalang. Evidently, this does not mean that the

property is conjugal.

in his application for free patent,16 applicant Pedro Calalang

averred that the land was first occupied and cultivated by him

since 1935 and that he had planted mango trees, coconut

plants, caimito trees, banana plants and seasonal crops and

built his house on the subject lot. But he applied for free

patent only in 1974 and was issued a free patent while already

married to Elvira B. Calalang. Thus, having possessed the

subject land in the manner and for the period required by law

after the dissolution of the first marriage and before the second

marriage, the subject property ipso jure became private

property and formed part of Pedro Calalangs exclusive

property.17 It was therefore excluded from the conjugal

partnership of gains of the second marriage.

only upon the death of Pedro Calalang on December 27, 1989

that his heirs acquired their respective inheritances, entitling

them to their pro indiviso shares to his whole estate. At the

time of the sale of the disputed property, the rights to the

succession were not yet bestowed upon the heirs of Pedro

Calalang. And absent clear and convincing evidence that the

sale was fraudulent or not duly supported by valuable

consideration (in effect an inofficious donation inter vivos), the

respondents have no right to question the sale

Art 886

Spouses Joaquin v CA

Defendant spouses Leonardo Joaquin and Feliciana Landrito are

the parents of plaintiffs Consolacion, Nora, Emma and

Natividad as well as of defendants Fidel, Tomas, Artemio,

Clarita, Felicitas, Fe, and Gavino, all surnamed JOAQUIN. The

married Joaquin children are joined in this action by their

respective spouses.

Sought to be declared null and void ab initio are certain deeds

of sale of real property executed by defendant parents

Leonardo Joaquin and Feliciana Landrito in favor of their codefendant children and the corresponding certificates of title

issued in their names

plaintiffs-appellants, like their defendant brothers and sisters,

are compulsory heirs of defendant spouses, Leonardo Joaquin

and Feliciana Landrito, who are their parents. However, their

right to the properties of their defendant parents, as

compulsory heirs, is merely inchoate and vests only upon the

latters death. While still alive, defendant parents are free to

dispose of their properties, provided that such dispositions are

not made in fraud of creditors.

Plaintiffs-appellants are definitely not parties to the deeds of

sale in question. Neither do they claim to be creditors of their

defendant parents. Consequently, they cannot be considered

as real parties in interest to assail the validity of said deeds

either for gross inadequacy or lack of consideration or for

failure to express the true intent of the parties. Hence not

parties to the alleged deed of sale and are not principally or

subsidiarily bound thereby; hence, they have no legal capacity

to challenge their validity.

Manonongsong v Estimo

Allegedly, AgatonaGuevarra (Guevarra) inherited a property from

Justina Navarro, which is now under possession of the heirs of

Guevarra. Guevarra had six children, one of them is Vicente Lopez,

the father of petitioner Milagros Lopez Manongsong

(Manongsong). The respondents, the Jumaquio sisters and

Leoncia Lopez claimed that the property was actually sold to them

by Justina Navarro prior to her death. The respondents presented

deed of sale dated October 11, 1957. Milagros and

CarlitoManongsong (petitioners) filed a Complaint on June 19,

1992 praying for the partition and award to them of an area

equivalent to one-fifth (1/5), by right of representation. The RTC

ruled that the conveyance made by Justina Navarro is subject to

nullity because the property conveyed had a conjugal character

and that AgatonaGuevarra as her compulsory heir should have the

legal right to participate with the distribution of the estate under

question to the exclusion of others. The Deed of Sale did not at all

provide for the reserved legitime or the heirs, and, therefore it has

no force and effect against AgatonaGuevarra and should be

declared a nullity ab initio.

partnership; unless it be proved that it pertains exclusively to the

husband or to the wife. The presumption under Article 160 of the

Civil Code applies only when there is proof that the property was

acquired during the marriage. Proof of acquisition during the

marriage is an essential condition for the operation of the

presumption in favor of the conjugal partnership. There was no

evidence presented to establish that Navarro acquired the Property

during her marriage.

Bartolome v SSS

John Colcol was employed as electrician by Scanmar Maritime

Services, Inc. He was enrolled under the governments Employees

Compensation Program (ECP). He died due to an accident while on

board the vessel. John was, at the time of his death, childless and

unmarried. Thus, petitioner Bernardina P. Bartolome, Johns

biological mother and, allegedly, sole remaining beneficiary, filed a

claim for death benefits.

SSS denied the claim on the ground that Bernardina was

no longer considered as the parent of John since the latter was

legally adopted by Cornelio Colcol. As such, it is Cornelio who

qualifies as Johns primary beneficiary, not petitioner.

According to the records, Cornelio died during Johns

minority.

Whether or not the rights of the compulsory heirs were impaired by

the alleged sale of the property by Justina. - NO

As opposed to a disposition inter vivos by lucrative or gratuitous

title, a valid sale for valuable consideration does not diminish the

estate of the seller. When the disposition is for valuable

consideration, there is no diminution of the estate but merely a

substitution of values, that is, the property sold is replaced by the

equivalent monetary consideration. The Property was sold in 1957

for P250.00.

trial courts conclusion that the Property was conjugal, hence the

sale is void ab initio was not based on evidence, but rather on a

misapprehension of Article 160 of the Civil Code, which provides:

All property of the marriage is presumed to belong to the conjugal

Whether or not Bernardina is considered as a legal beneficiary of

John. Yes

The Court held that Cornelios adoption of John, without more, does

not deprive petitioner of the right to receive the benefits stemming

from Johns death as a dependent parent given Cornelios untimely

demise during Johns minority. Since the parent by adoption

already died, then the death benefits under the Employees

Compensation Program shall accrue solely to herein petitioner,

Johns sole remaining beneficiary.

Art 854

Reyes v. Barretto-Datu

Bibiano Barretto was married to Maria Gerardo. When Bibiano

Barretto died he left his share in a will to Salud Barretto and Lucia

Milagros Barretto and a small portion as legacies to his two sisters

Rosa Barretto and Felisa Barretto and his nephew and nieces. The

usufruct of a fishpond was reserved for his widow, Maria Gerardo.

Maria Gerardo, as administratrix prepared a project of partition. It

was approved and the estate was distributed and the shares

delivered.

Later on, Maria Gerardo died. Upon her death, it was discovered

that she executed two wills, in the first, she instituted Salud and

Milagros, both surnamed Barretto, as her heirs; and, in the second,

she revoked the same and left all her properties in favor of

Milagros Barretto alone. The later will was allowed and the first

rejected. In rejecting the first will presented by Tirso Reyes, as

guardian of the children of Salud Barretto, the LC held that Salud

was not the daughter of the decedent Maria Gerardo by her

husband Bibiano Barretto. This ruling was appealed to the SC,

which affirmed the same.

Having thus lost this fight for a share in the estate of Maria

Gerardo, as a legitimate heir of Maria Gerardo, plaintiff now falls

back upon the remnant of the estate of the deceased Bibiano

Barretto, which was given in usufruct to his widow Maria Gerardo.

Hence, this action for the recovery of one-half portion, thereof.

This action afforded the defendant an opportunity to set up her

right of ownership, not only of the fishpond under litigation, but of

all the other properties willed and delivered to Salud Barretto, for

being a spurious heir, and not entitled to any share in the estate of

Bibiano Barretto, thereby directly attacking the validity, not only of

the project of partition, but of the decision of the court based

thereon as well.

W/N the partition from which Salud acquired the fishpond is void ab

initio and Salud did not acquire valid title to it.

NO. Salud Barretto admittedly had been instituted heir in the late

Bibiano Barrettos last will and testament together with defendant

Milagros; hence, the partition had between them could not be one

such had with a party who was believed to be an heir without really

being one, and was not null and void. The legal precept (Article

1081) does not speak of children, or descendants, but of heirs

(without distinction between forced, voluntary or intestate ones),

and the fact that Salud happened not to be a daughter of the

testator does not preclude her being one of the heirs expressly

named in his testament; for Bibiano Barretto was at liberty to

assign the free portion of his estate to whomsoever he chose.

While the share () assigned to Salud impinged on the legitime of

Milagros, Salud did not for that reason cease to be a testamentary

heir of Bibiano Barretto.

Nor does the fact that Milagros was allotted in her fathers will a

share smaller than her legitime invalidate the institution of Salud

as heir, since there was here no preterition, or total ommission of a

forced heir.

Aznar v Duncan

Christensen died testate. The will was admitted to probate. The

court declared that Helen Garcia was a natural child of the

deceased. The Court of First Instance equally divided the properties

of the estate of Christensen between Lucy Duncan (whom testator

expressly recognized in his will as his daughter) and Helen Garcia.

In the order, the CFI held that Helen Garcia was preterited in the

will thus, the institution of Lucy Duncan as heir was annulled and

the properties passed to both of them as if the deceased died

intestate.

Whether the estate, after deducting the legacies, should be equally

divided or whether the inheritance of Lucy as instituted heir should

be merely reduced to the extent necessary to cover the legitime of

Helen Garcia, equivalent to of the entire estate.

The inheritance of Lucy should be merely reduced to cover the

legitime of Helen Garcia.

Christensen refused to acknowledge Helen Garcia as his natural

daughter and limited her share to a legacy of P3,600.00. When a

testator leaves to a forced heir a legacy worth less than the

legitime, but without referring to the legatee as an heir or even as

a relative, and willed the rest of the estate to other persons, the

heir could not ask that the institution of the heirs be annulled

entirely, but only that the legitime be completed.

Nuguid v Nuguid

Acain v CA

JLT Agro v Balasang

Você também pode gostar

- Random Notes From Omnibus Election CodeDocumento26 páginasRandom Notes From Omnibus Election CodeCathy GacutanAinda não há avaliações

- CONTRACT AGREEMENT SampleDocumento2 páginasCONTRACT AGREEMENT SampleCathy GacutanAinda não há avaliações

- PROCESSES Civ ProDocumento2 páginasPROCESSES Civ ProCathy GacutanAinda não há avaliações

- Appreciation of BallotsDocumento3 páginasAppreciation of BallotsAngelaAinda não há avaliações

- Ra 9184Documento24 páginasRa 9184Anonymous Q0KzFR2i0% (1)

- Special Power of AttorneyDocumento2 páginasSpecial Power of AttorneyCathy Gacutan100% (1)

- RevisedIRR RA9184Documento299 páginasRevisedIRR RA9184Francis Jr CastroAinda não há avaliações

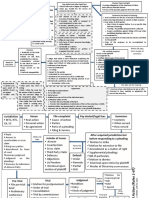

- Civil Procedure Flowchart PDFDocumento24 páginasCivil Procedure Flowchart PDFJeffreyReyes100% (3)

- Board Resolution SampleDocumento3 páginasBoard Resolution SampleCathy Gacutan100% (2)

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocumento20 páginasBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledCathy GacutanAinda não há avaliações

- DigestsDocumento3 páginasDigestsCathy GacutanAinda não há avaliações

- Efficient Use of Paper Rule A.M. No. 11-9-4-SCDocumento3 páginasEfficient Use of Paper Rule A.M. No. 11-9-4-SCRodney Atibula100% (3)

- Summary of Election RemediesDocumento5 páginasSummary of Election RemediesCathy GacutanAinda não há avaliações

- Consti Review Midterm DoctrinesDocumento27 páginasConsti Review Midterm DoctrinesCathy GacutanAinda não há avaliações

- Association of Customs Brokers, Inc. v. Municipal BoardDocumento2 páginasAssociation of Customs Brokers, Inc. v. Municipal BoardCathy GacutanAinda não há avaliações

- RA 6713 - Code of Conduct and Ethical Standard For Public Officials and EmployeesDocumento12 páginasRA 6713 - Code of Conduct and Ethical Standard For Public Officials and EmployeesCrislene Cruz83% (12)

- Estate Settlement GuidelinesDocumento4 páginasEstate Settlement GuidelinesOfel TactacAinda não há avaliações

- L - M G.R. No. 231658 4 July 2017: Agman V EdialdeaDocumento22 páginasL - M G.R. No. 231658 4 July 2017: Agman V EdialdeaCathy GacutanAinda não há avaliações

- RevisedIRR RA9184 2016 AnnexHDocumento31 páginasRevisedIRR RA9184 2016 AnnexHArvin Torres GuintoAinda não há avaliações

- Extrajudicial Settlement of Estate With Absolute Sale1Documento3 páginasExtrajudicial Settlement of Estate With Absolute Sale1bro smartAinda não há avaliações

- SyllabusDocumento5 páginasSyllabusCathy GacutanAinda não há avaliações

- RA 1379 - Forfeiture in Favor of The State Any Property Unlawfully Acquired EtcDocumento4 páginasRA 1379 - Forfeiture in Favor of The State Any Property Unlawfully Acquired EtcCrislene CruzAinda não há avaliações

- RA 1379 - Forfeiture in Favor of The State Any Property Unlawfully Acquired EtcDocumento4 páginasRA 1379 - Forfeiture in Favor of The State Any Property Unlawfully Acquired EtcCrislene CruzAinda não há avaliações

- Legality of The Use of ForceDocumento1 páginaLegality of The Use of ForceCathy GacutanAinda não há avaliações

- Rule 16 1.heirs of Loreto Maramag V.maramag, G.R. No. 181132, June 5, 2009Documento4 páginasRule 16 1.heirs of Loreto Maramag V.maramag, G.R. No. 181132, June 5, 2009Cathy GacutanAinda não há avaliações

- RevisedIRR RA9184Documento299 páginasRevisedIRR RA9184Francis Jr CastroAinda não há avaliações

- Valley Golf V Vda de CaramDocumento2 páginasValley Golf V Vda de CaramCathy GacutanAinda não há avaliações

- Summary of Election RemediesDocumento5 páginasSummary of Election RemediesCathy GacutanAinda não há avaliações

- PNP Law (Ra 6975)Documento29 páginasPNP Law (Ra 6975)Miming KokoyAinda não há avaliações

- Special Power of AttorneyDocumento2 páginasSpecial Power of AttorneyCathy Gacutan100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- 2019 Haplogroup SDocumento109 páginas2019 Haplogroup SKlaus MarklAinda não há avaliações

- The Family PowerPointDocumento13 páginasThe Family PowerPointMr. Daniel ArieAinda não há avaliações

- Table of Legitimes PDFDocumento1 páginaTable of Legitimes PDFJay-r TumamakAinda não há avaliações

- Family Law Ii - MCQDocumento2 páginasFamily Law Ii - MCQRupeshPandyaAinda não há avaliações

- Texas Small Estate Affidavit FormDocumento7 páginasTexas Small Estate Affidavit FormlexscholarAinda não há avaliações

- 9 Chewa Wedding Traditions You Must Know About! - Malawi WeddingDocumento1 página9 Chewa Wedding Traditions You Must Know About! - Malawi WeddingThe Bad HairAinda não há avaliações

- Essay About FamilyDocumento8 páginasEssay About FamilyNica Galapia LlanoAinda não há avaliações

- Unit 2Documento47 páginasUnit 2Shiva VermaAinda não há avaliações

- Fao 4296 2022 Paper Book PDFDocumento31 páginasFao 4296 2022 Paper Book PDFPaper SwitchAinda não há avaliações

- Balanay v. MartinezDocumento8 páginasBalanay v. MartinezJenAinda não há avaliações

- Level 1 Unit 3 HandoutDocumento9 páginasLevel 1 Unit 3 HandoutAllanValenciiaAinda não há avaliações

- PVL2602 - Tut201 - Exam DetailsDocumento27 páginasPVL2602 - Tut201 - Exam DetailsMercy MercyAinda não há avaliações

- DowryDocumento13 páginasDowrysparsh Gupta100% (2)

- Family Health History AmaDocumento5 páginasFamily Health History AmaFransiscus Braveno RapaAinda não há avaliações

- Guardianship Under Muslim Family LawDocumento44 páginasGuardianship Under Muslim Family LawTaiyabaAinda não há avaliações

- THE SPECIAL MARRIAGE ACtDocumento7 páginasTHE SPECIAL MARRIAGE ACtArsh DeepAinda não há avaliações

- Module Author: Charles C. Onda, MD, CpaDocumento12 páginasModule Author: Charles C. Onda, MD, CpaCSJAinda não há avaliações

- African Marriage Forms and Health Implica-TionsDocumento43 páginasAfrican Marriage Forms and Health Implica-TionsTheophilus BaidooAinda não há avaliações

- Pavithra Birth CertificateDocumento1 páginaPavithra Birth CertificateG ElumalaiAinda não há avaliações

- Hindu Succession Act, 1956Documento25 páginasHindu Succession Act, 1956anandcnlu83% (6)

- Essay 2 - Two Types of FamiliesDocumento3 páginasEssay 2 - Two Types of Familieskhanhngoc89Ainda não há avaliações

- 2019 Haplogroup HDocumento182 páginas2019 Haplogroup HKlaus MarklAinda não há avaliações

- Pickstock PDFDocumento56 páginasPickstock PDFSeinsu ManAinda não há avaliações

- PFR List of CasesDocumento21 páginasPFR List of Casesgabbieseguiran100% (1)

- Kinship, Marriage, and The HouseholdDocumento10 páginasKinship, Marriage, and The HouseholdALYANA CASSANDRA MARTINAinda não há avaliações

- Family Law 1, 4th Sem-1Documento20 páginasFamily Law 1, 4th Sem-1NoufalAinda não há avaliações

- Systematic Kinship TerminologiesDocumento5 páginasSystematic Kinship TerminologiesHugoBotelloAinda não há avaliações

- UntitledDocumento41 páginasUntitledDion AdalaAinda não há avaliações

- A Study On The Challenges Faced by Single Parent On Teenager Care Laveena D'Mello, Dr. B. M. Govindaraju & Dr. Meena MonteiroDocumento6 páginasA Study On The Challenges Faced by Single Parent On Teenager Care Laveena D'Mello, Dr. B. M. Govindaraju & Dr. Meena MonteiroDane EdwardsAinda não há avaliações

- Blood Relations-4Documento24 páginasBlood Relations-4ChandraAinda não há avaliações