Escolar Documentos

Profissional Documentos

Cultura Documentos

Quiz Razones Financieras

Enviado por

Alex BritoDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Quiz Razones Financieras

Enviado por

Alex BritoDireitos autorais:

Formatos disponíveis

Name: __________________________________________

Date: _______________

Quiz name: Raz Fin Liq oper apal

1.

Which of the following is least likely a limitation of financial ratios?

A

Data on comparable firms are difficult to acquire.

Determining the target or comparison value for a ratio requires judgment.

Different accounting treatments require the analyst to adjust the data before comparing ratios.

2.

An analyst who is interested in a company's long-term solvency would most likely examine the:

A

Return on total capital.

defensive interval ratio.

fixed charge coverage ratio.

RGB, Inc.'s purchases during the year were $ 1 00,000. The balance sheet shows an average accounts

payable balance of $ 12,000. RGB's payables payment period is closest to:

3.

A

37 days.

44 days.

52 days.

RGB, Inc. has a gross profit of $45,000 on sales of $ 150,000. The balance sheet shows average total

assets of $75,000 with an average inventory balance of $ 1 5,000. RGB's total asset turnover and

inventory turnover are closest to: Asset turnover Inventory turnover

4.

A

7.00 times 2.00 times

2.00 times 7.00 times

0.50 times 0.33 times

If RGB, Inc. has annual sales of $ 1 00,000, average accounts payable of $30,000, and average

accounts receivable of $25,000, RGB's receivables turnover and average collection period are closest

to:

Receivables turnover Average collection period

5.

A

2. 1 times 174 days

3.3 times 1 1 1 days

4.0 times 9 1 days

A company's current ratio is 1.9. If some of the accounts payable are paid off from the cash account,

the:

6.

A

numerator would decrease by a greater percentage than the denominator, resulting in a lower

current ratio.

denominator would decrease by a greater percentage than the numerator, resulting in a higher

current ratio.

numerator and denominator would decrease proportionally, leaving the current ratio unchanged.

7.

A company's quick ratio is 1.2. If inventory were purchased for cash, the:

A

numerator would decrease more than the denominator, resulting in a lower quick ratio.

Page 1 of 2

denominator would decrease more than the numerator, resulting in a higher current ratio.

numerator and denominator would decrease proportionally, leaving the current ratio unchanged.

All other things held constant, which of the following transactions will increase a firm's current ratio

if the ratio is greater than one?

8.

A

Accounts receivable are collected and the funds received are deposited in the firm's cash account.

Fixed assets are purchased from the cash account.

Accounts payable are paid with funds from the cash account.

RGB, Inc.'s receivable turnover is ten times, the inventory turnover is five times, and the payables

turnover is nine times. RGB's cash conversion cycle is closest to:

9.

A

69 days.

104 days.

150 days.

RG B, Inc.'s income statement shows sales of $ 1 ,000, cost of goods sold of $400, pre-interest

operating expense of $300, and interest expense of $ 1 00. RGB's interest coverage ratio is closest to:

10.

A

2 times.

3 times.

4 times.

Page 2 of 2

Você também pode gostar

- Macroeconomics in An Open EconomyDocumento6 páginasMacroeconomics in An Open EconomyTusiime Wa Kachope SamsonAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- CaseDocumento2 páginasCaseAman Dheer KapoorAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

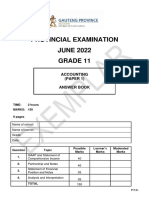

- Gr11 ACC P1 (ENG) June 2022 Answer BookDocumento9 páginasGr11 ACC P1 (ENG) June 2022 Answer BooklemogangAinda não há avaliações

- Dilla University: Department of EconomicsDocumento40 páginasDilla University: Department of EconomicsOromay Elias100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- MIM Group 6 Case StudyDocumento8 páginasMIM Group 6 Case Studyritesh singhAinda não há avaliações

- International Business: Seventeenth Edition, Global EditionDocumento12 páginasInternational Business: Seventeenth Edition, Global EditionAhmad Khaled DahnounAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- SWOT Analysis For Pizza HutDocumento3 páginasSWOT Analysis For Pizza HutPratiwi SusantiAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Arkansas Business Rankings: Wealthiest Arkansas Families.Documento64 páginasArkansas Business Rankings: Wealthiest Arkansas Families.gamypoet3380Ainda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Last Assignment BWCS by Bilal AkbarDocumento102 páginasLast Assignment BWCS by Bilal AkbarBrainiac MubeenAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Sketcher Business AnalysisDocumento25 páginasSketcher Business AnalysisAK JRAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- I HousingDocumento8 páginasI Housingamahle NeneAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- DD309Documento23 páginasDD309James CookeAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Aschalew Adane: Submitted To: Dr. Gondar, EthiopiaDocumento17 páginasAschalew Adane: Submitted To: Dr. Gondar, EthiopiaAhmed Bashir HassanAinda não há avaliações

- B2B MarketingDocumento17 páginasB2B Marketingvc8446526703Ainda não há avaliações

- Indian Railways - GSTDocumento30 páginasIndian Railways - GSTghanghas_ankitAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Entrep Handout Wk2Documento5 páginasEntrep Handout Wk2julialynsantos008Ainda não há avaliações

- Afrm Exam NotesDocumento8 páginasAfrm Exam NotesSoumiya MuthurajaAinda não há avaliações

- Chapter 1: Ten Principles of Microeconomics: Economy Households and EconomiesDocumento3 páginasChapter 1: Ten Principles of Microeconomics: Economy Households and EconomiesManel KricheneAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- 301 303 305 307 309 - QB 2019 - Bba V-Done-1Documento145 páginas301 303 305 307 309 - QB 2019 - Bba V-Done-1Parveen SiwachAinda não há avaliações

- FINANCIAL REPORTING II .... Anthony EduahDocumento294 páginasFINANCIAL REPORTING II .... Anthony EduahAnita SmithAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- My WorkDocumento47 páginasMy Workmuzo213Ainda não há avaliações

- 34 - Neha Sabharwal - Panacea BiotechDocumento10 páginas34 - Neha Sabharwal - Panacea Biotechrajat_singlaAinda não há avaliações

- Microeconomics Intuitive Approach Calculus 2nd Edition Thomas Nechyba Test BankDocumento24 páginasMicroeconomics Intuitive Approach Calculus 2nd Edition Thomas Nechyba Test BankIanSpencerjndex100% (35)

- Bdo PresentationDocumento28 páginasBdo PresentationTen Balestramon100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Problems On Redemption of Pref SharesDocumento7 páginasProblems On Redemption of Pref SharesYashitha CaverammaAinda não há avaliações

- Accounting - Chapter 12 - Nike Financial AnalysisDocumento18 páginasAccounting - Chapter 12 - Nike Financial AnalysisMT - 07LJ - Lougheed MS (1486)Ainda não há avaliações

- Engineering Economics: ST ND RD TH THDocumento4 páginasEngineering Economics: ST ND RD TH THniteshAinda não há avaliações

- FOREX Part1Documento1 páginaFOREX Part1lender kent alicanteAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento2 páginasStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceVeeresh ShettarAinda não há avaliações

- Eshopbox Pricing For Your BusinessDocumento19 páginasEshopbox Pricing For Your Businesspavan kumar tAinda não há avaliações