Escolar Documentos

Profissional Documentos

Cultura Documentos

Xfdgsfzfgdrfesdc

Enviado por

babylovelylovelyTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Xfdgsfzfgdrfesdc

Enviado por

babylovelylovelyDireitos autorais:

Formatos disponíveis

Financial Intermediation Financial

Crisis & Bank Runs

2013-2014

Learning Outcomes (Chapter 2)

2

FINANCIAL INTERMEDIATION

FINANCIAL CRISIS & BANK RUNS

Clearly recognise the problems created by

liquidity transformation

Thoroughly analyse well-established

principles of the theory of bank runs

Fully describe and critically analyse the

system of international regulation of bank

capital adequacy with minimum guidance

List and carefully analyse the arguments in

favour of, and against, banking regulation

2013 Lillibeth Ortiz

Contents

Question

A.

B.

C.

D.

E.

F.

2007-2009 Financial Crisis

Bank Runs

Deposit Contract

Possible Solutions

Summary

Past Year Exam Questions, Essential

Readings

A. Financial Crisis: Background

5

What went wrong?

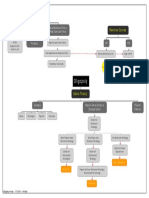

A. Financial Crisis: Why? How?

6

Housing market boom

Deregulation

of housing markets

Americans

spending more than they

produce

Asian savings redeployed in Americas

shopping spree

Financing from

capital markets: mortgage

backed securities & CDOs

Economic

Global

boom, lower interest rates

capital flows

Easier access

to financing home

Sub-prime mortgagers

Over-spending

Over-leveraged

FIs

had borrowed heavily to support

mortgage portfolios

Declining value losses banks collapse

Source: Fortune, By Colin Barr, September 26, 2008

Lillibeth Ortiz

Financial Intermediation Financial

Crisis & Bank Runs

2013-2014

A. Financial Crisis: Beginning of the

Collapse

A. Financial Crisis

8

Home prices plummeted in 2006-07

Mortgage

delinquencies rose

Forelosure filings increased 93 percent from

July 2006 to July 2007

Securitized mortgages led to large financial

losses

The increase in default rates led to:

Large

losses and uncertainty

reluctance to lend to each other

Banks

Higher interbank

interest rates

ST borrowing

Difficulty rolling over

Liquidity

Subprime mortgages

crisis

Countrywide

Financial bailed out and

eventually taken over by Bank of America

Source: Saunders & Cornett, Financial Institutions Management, 2011

A. Financial Crisis: Significant failures

and events

Bear Stearns funds filed for bankruptcy

by J.P. Morgan Chase

Fed moved beyond lending only to

Depository Institutions

A. Financial Crisis

By mid-March 2009, DJIA fell 53.8 percent in

less than 1 years

Record home foreclosures

Unemployment in excess of 10 percent

Acquired

Government seizure of Fannie Mae and

Freddie Mac

Lehman Brothers failure

Crisis spread worldwide

Source: Saunders & Cornett, Financial Institutions Management, 2011

in 45 in default in late 2008

Source: Saunders & Cornett, Financial Institutions Management, 2011

Dow Jones Industrial Average from

Oct 2006-Oct 2009

A. Financial Crisis

11

AIG bailout

Citigroup needed government support

Chrysler and GM declared bankruptcy in

2009

Goldman Sachs and Morgan Stanley

Only

Source: Yahoo finance

Lillibeth Ortiz

survivors of the major firms

Source: Saunders & Cornett, Financial Institutions Management, 2011

Financial Intermediation Financial

Crisis & Bank Runs

2013-2014

A. Financial Crisis: Rescue Plan

B. Liquidity Insurance Recall

14

Federal Reserve and other central banks

infused $180 billion

$700 billion Troubled Asset Relief Program

(TARP)

$827 billion stimulus program

American

2009

The service of improving liquidity through

offering of secondary securities which have

superior liquidity attributes compared to

primary securities is called ________

_____________

Banks

issue deposits that are cashable on

demand while its assets are illiquid

Deposits insure against random shocks to

investors preferences for the timing of

consumption

Recovery and Reinvestment Act of

Source: Saunders & Cornett, Financial Institutions Management, 2011

Question

C. Bank Run

15

16

What happens when too many depositors

withdraw at the same time?

C. Example: Bank Run on Northern

Rock

17

Lillibeth Ortiz

Depositors panic and withdraw

immediately, including even those who

would prefer to leave their deposits in if they

were not concerned about the bank failing.

Other Examples

18

Source: BBC News, 17 Sep 2007

A bank run is when a large number of

depositors decide to withdraw their funds

for reasons other than _____________________

Mortgage lending Northern Rock

lends a large amount for

mortgages, and finances this with

money from banks and savers

Savings Northern Rock receives a

relatively small amount of money

from savers

Money markets Have stopped

lending money to Northern Rock

due to the crisis in the US subprime mortgage market

Bank of England Steps into the

breach to give Northern Rock an

emergency loan

Bank run expert: Cyprus' plan was 'absurd By Stephen

Gandel, March 19, 2013

http://finance.fortune.cnn.com/2013/03/19/cyprus-bankrun/

The slow bank run that could still doom Europe, By Brad

Plumer on September 20, 2012, Washington Post

http://www.washingtonpost.com/blogs/ezraklein/wp/2012/09/20/the-slow-bank-run-that-could-stilldoom-europe/

Run on Vietnam's biggest bank highlights threat to economy,

By Ian MacKinnon, 27 Aug 2012, The Telegraph

http://www.telegraph.co.uk/finance/newsbysector/banks

andfinance/9501953/Run-on-Vietnams-biggest-bankhighlights-threat-to-economy.html

Financial Intermediation Financial

Crisis & Bank Runs

Question

19

2013-2014

Exercise:

think-pairshare

C. Bank Run

20

Why do bank runs happen?

Bank

runs can arise due to:

A bank run on an ______________ bank is not

necessarily a bad thing

Disciplines

the performance of managers &

owners

Acts as an incentive for banks to maintain

liquidity

If depositors do not distinguish between

good and bad banks, they withdraw all

funds

A bank attempting to meet demands will incur

large losses

C. Illustration: Bank Run

C. Bank Run

22

Impact

Consultancy

& Training Pte

Ltd

Assets

Liabilities

Hong Kong man arrested over bank

run rumors

23

A bank run can in itself lead to default by a

bank that is not (pre-run) insolvent.

Bank runs cause

because it can make healthy banks fail,

causing the recall of loans and the

termination of productive investment.

Bank panic: systemic or contagious bank

run.

Another Example

24

HONG KONG - Hong Kong police have

arrested a man for allegedly spreading

rumors on the Internet about a bank run

amid anxiety in the Chinese territory about

the U.S. financial crisis, police said Sunday.

Police officers noticed Friday that the 34year-old man left a message on an Internet

discussion forum saying a run would occur

on a local bank and urging people to

withdraw their deposits...

Latvian bank run sparked by Twitter rumors,

Dec 12, 2011, By Bobbie Johnson,

Gigaom.com

http://gigaom.com/2011/12/12/latvian-bank-

run-sparked-by-twitter-rumors/

Source: AP, 09/28/2008

Lillibeth Ortiz

Financial Intermediation Financial

Crisis & Bank Runs

2013-2014

C. Bank Run

True or False?

25

26

Bank runs make intermediation more costly:

Depositors

need to monitor banks more

closely.

need to maintain more reserves for

liquidity.

Banks

Bank contagion has serious economic

consequences

A run on a bank is not necessarily a bad

occurrence.

A contagious run, or bank panic, differs

from a run on a bank in that a contagious

run involves loss of faith in the entire banking

system as opposed to just one bank.

Supply

of credit

supply

Social welfare effects

Money

Question

D. Nature of the Deposit Contract

27

28

What other factor encourages bank runs?

Diamond & Dybvig (1983):

Deposits have a feature called

Exercise:

think-pairshare

Illustration

29

Would you run or stay?

A RUNS

A STAYS

B RUNS

0.5 , 0.5

0,1

SSC means that banks must serve customers

wishing to withdraw funds on a first-comefirst-serve basis.

Banks must deal with customers sequentially

before knowing how many of their

customers will ultimately wish to withdraw

funds.

D. Nature of the Deposit Contract

30

B STAYS

1,0

1.2 , 1.2

There is a greater pay-off when the

depositor arrives sooner, than later, to

redeem deposit since deposits are:

Debt

claims

Redeemable

on demand

to likely default on the last

redemption

Subject

How does the structure of deposit contracts

contribute to bank runs?

Lillibeth Ortiz

This means that the depositors place in line

matters i.e., SSC rewards those who arrive first to

withdraw their funds and thus

Financial Intermediation Financial

Crisis & Bank Runs

2013-2014

True or False?

31

Question

32

Demand deposits pose a liquidity risk for FIs

because they are repayable upon

demand.

Abnormally large and unexpected deposit

withdrawals can occur because of

concerns by depositors about a banks

solvency relative to other banks.

E. Possible Ways to Reduce Bank

Runs

33

How do we prevent bank runs?

E. Possible Solutions

34

Suspension of convertibility

Deposit insurance

the devices traditionally used to stop or

Central bank lending

prevent bank runs:

Capital adequacy

Securitization (addresses problems with SSC)

Suspension

Demand

E. Possible Solution: Suspension of

convertibility

35

Diamond & Dybvig (1983) model analyses

of convertibility

deposit insurance

E. Possible Solution: Deposit

Insurance

36

Banks can suspend convertibility of deposits

to cash

Not

allow more than a certain fraction of

deposits to be withdrawn

Must be done at the proper time

Suspension is unpopular

Lillibeth Ortiz

A promise to pay the amount promised by

the bank no matter how many depositors

withdraw

Removes incentive to participate in bank

run because deposits are safe

Works similarly to a central bank serving as

lender of last resort

Financial Intermediation Financial

Crisis & Bank Runs

2013-2014

E. Possible Solution: Deposit

Insurance

37

Singapore says to guarantee all

bank deposits

38

Best for government to provide deposit

insurance

Government

has taxation authority, can levy

charges on bank, can provide a guarantee

against large losses without holding reserves

to back up their promise. (Diamond, 2007)

The city-state joins other global and Asian

governments such as Australia and New Zealand

that have given a blanket guarantee on all bank

deposits amid a crisis of confidence in the global

financial markets.

Source: Reuters, 16 Oct 2008, Reporting by Saeed Azhar and Koh Gui Qing;

Editing by Kevin Lim)

MAS has set aside S$20b facility to

protect depositors in Singapore

Singapore Deposit Insurance

39

Singapore will guarantee all local and foreign

currency deposits in banks, finance companies and

investment banks operating in the city-state ....

The guarantee will be backed by S$150 billion

($101.4 billion) of government reserves and will

remain in place until Dec 31, 2010...

40

http://www.sdic.org.sg/

E. Possible Solution: Central bank

lending

41

25 July 2012, Channel News Asia

SINGAPORE: The Monetary Authority of Singapore

has set aside a liquidity facility of up to S$20 billion

to protect depositors in Singapore.

MAS said it has entered into an agreement on

February 9 this year with the Singapore Deposit

Insurance Corporation Limited (SDIC) to provide the

contingent liquidity facility.

The facility can be tapped on "in the event a

deposit insurance scheme fails and liquidity is

needed for compensation payments to insured

depositors".

HK bank run hits Singapore, spurs

US$500M infusion

42

Discount window lending

Lender

of last resort facility

Another source of financing for banks

instead of selling illiquid assets at a loss

Lillibeth Ortiz

Hundreds of nervous customers swarmed

Bank of East Asia offices in Singapore and

Hong Kong Thursday, the second day of

Asia's first major bank run since the global

financial crisis erupted last year.

Hong Kong's de facto central bank,

meanwhile, responded by injecting US$500

million into the market as a way of shoring

up the territory's banking system.

Source: 25 Sept 2008, The Associated Press

Financial Intermediation Financial

Crisis & Bank Runs

2013-2014

True or False?

43

F. Recap

44

In the event of a bank run, depositor claims

on the bank are satisfied on a pro rata

basis.

Deposit insurance is the only deterrent to

bank runs, contagious runs, and bank

panics.

Diamonds summary (2007):

An important function of banks is to create

liquidity i.e., offer deposits that are more liquid

than the assets that they hold

Banks

issue demand deposits that allow depositors to

withdraw at any time.

Banks make loans that cannot be sold quickly at a

high price.

F. Recap

45

Thus, there is a mismatch of liquidity: a banks

liabilities are more liquid than its assets

G. Past Year Exam Questions

46

This liquidity mismatch has caused problems for

banks when too many depositors attempt to

withdraw at once (a bank run)

Deposits have a feature called Sequential Service

Constraint which encourages bank runs

Banks have followed policies to stop runs, and

governments have instituted deposit insurance to

prevent runs

G. Past Year Exam Questions

47

Explain the relevance of the Diamond and

Dybvig (1983) model to liquidity insurance

and bank runs.(2011-Zone A, 2010-Zone B,

and 2009-Zone B)

Critically analyse the general arguments for

and against banking regulation, and with

particular reference to the role of the

deposit contract. (2009, Zone A)

G. Essential Reading & Sources

48

To what extent is the possibility of a bank

run an inevitable consequence of the

liquidity and maturity transformation

activities of banks? (2008, Zone A)

Explain the nature of liquidity risk, and

discuss the insights from the theory of bank

runs. (2008, Zone B)

Lillibeth Ortiz

Matthews & Thompson (2008) - Chapter 12.

Saunders & Cornett (2008) - Chapter 1,

pp.10 15; Chapter 17, pp.507-10

Bhattacharya & Thakor pp.250; Sections 4

&5

Você também pode gostar

- Singapore Standard On AuditingDocumento19 páginasSingapore Standard On AuditingbabylovelylovelyAinda não há avaliações

- Singapore Standard On AuditingDocumento7 páginasSingapore Standard On AuditingbabylovelylovelyAinda não há avaliações

- This Paper Is Not To Be Removed From The Examination HallsDocumento3 páginasThis Paper Is Not To Be Removed From The Examination HallsbabylovelylovelyAinda não há avaliações

- Singapore Standard On AuditingDocumento29 páginasSingapore Standard On AuditingbabylovelylovelyAinda não há avaliações

- Singapore Standard On AuditingDocumento18 páginasSingapore Standard On AuditingbabylovelylovelyAinda não há avaliações

- Singapore Standard On AuditingDocumento28 páginasSingapore Standard On AuditingbabylovelylovelyAinda não há avaliações

- Singapore Standard On AuditingDocumento14 páginasSingapore Standard On AuditingbabylovelylovelyAinda não há avaliações

- Singapore Standard On AuditingDocumento14 páginasSingapore Standard On AuditingbabylovelylovelyAinda não há avaliações

- Singapore Standard On AuditingDocumento19 páginasSingapore Standard On AuditingbabylovelylovelyAinda não há avaliações

- Singapore Standard On Auditing: Conforming AmendmentsDocumento9 páginasSingapore Standard On Auditing: Conforming AmendmentsbabylovelylovelyAinda não há avaliações

- Singapore Standard On AuditingDocumento10 páginasSingapore Standard On AuditingbabylovelylovelyAinda não há avaliações

- Singapore Standard On AuditingDocumento14 páginasSingapore Standard On AuditingbabylovelylovelyAinda não há avaliações

- Singapore Standard On AuditingDocumento16 páginasSingapore Standard On AuditingbabylovelylovelyAinda não há avaliações

- FGDFGDFDFSDFMHJFDKHDFDocumento10 páginasFGDFGDFDFSDFMHJFDKHDFbabylovelylovelyAinda não há avaliações

- Singapore Standard On AuditingDocumento21 páginasSingapore Standard On AuditingbabylovelylovelyAinda não há avaliações

- Singapore Standard On AuditingDocumento12 páginasSingapore Standard On AuditingbabylovelylovelyAinda não há avaliações

- Singapore Standard On AuditingDocumento20 páginasSingapore Standard On AuditingbabylovelylovelyAinda não há avaliações

- Singapore Standard On AuditingDocumento11 páginasSingapore Standard On AuditingbabylovelylovelyAinda não há avaliações

- HFHGFHGHDGSFDHDGGFGDocumento17 páginasHFHGFHGHDGSFDHDGGFGbabylovelylovelyAinda não há avaliações

- HFHGFHGHDGSFDHDGGFGDocumento31 páginasHFHGFHGHDGSFDHDGGFGbabylovelylovelyAinda não há avaliações

- Consequences of Accounting Harmonization: IFRS Adoption and Cross-Border ContagionDocumento48 páginasConsequences of Accounting Harmonization: IFRS Adoption and Cross-Border ContagionbabylovelylovelyAinda não há avaliações

- HFHGFHGHDGSFDHDGGFGDocumento31 páginasHFHGFHGHDGSFDHDGGFGbabylovelylovelyAinda não há avaliações

- Oligopoly: Characteristics Revenue CurvesDocumento1 páginaOligopoly: Characteristics Revenue CurvesbabylovelylovelyAinda não há avaliações

- Regulatory Framework - Seminar SolutionsDocumento3 páginasRegulatory Framework - Seminar SolutionsbabylovelylovelyAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- BFS Property Listing For Posting As of 02.01.2019 Public FinalDocumento11 páginasBFS Property Listing For Posting As of 02.01.2019 Public FinalNicole Paola Liva TalingtingAinda não há avaliações

- Project 3 FinalDocumento11 páginasProject 3 Finalapi-261340346Ainda não há avaliações

- Debt Elimination Discharge Set Off, Law, TruthDocumento5 páginasDebt Elimination Discharge Set Off, Law, TruthLandiBrown100% (7)

- Too Big To Fail Guided Notes 57Documento2 páginasToo Big To Fail Guided Notes 57api-305090576Ainda não há avaliações

- The Global Financial Crisis: Module 3 Housing and MortgagesDocumento30 páginasThe Global Financial Crisis: Module 3 Housing and MortgagesAlanAinda não há avaliações

- Apresentação Mauricio BenvenuttiDocumento51 páginasApresentação Mauricio BenvenuttiKim ReisAinda não há avaliações

- Bfs Property Listing For Posting As of 10.01.2018 PublicDocumento10 páginasBfs Property Listing For Posting As of 10.01.2018 PublicCedric Recato DyAinda não há avaliações

- Lehman Brothers Annual Report 2007Documento124 páginasLehman Brothers Annual Report 2007highfinance94% (16)

- Financial Crisis and Its Effect On BanksDocumento5 páginasFinancial Crisis and Its Effect On BanksTejo SajjaAinda não há avaliações

- US Market Projections: 1 Month USD LIBOR Forward Curve 3 Month USD LIBOR Forward Curve Daily SOFR Forward CurveDocumento76 páginasUS Market Projections: 1 Month USD LIBOR Forward Curve 3 Month USD LIBOR Forward Curve Daily SOFR Forward CurveAvi GoodsteinAinda não há avaliações

- Bfs Property Listing For Posting As of December 15 2016 Public Version CompressedDocumento20 páginasBfs Property Listing For Posting As of December 15 2016 Public Version Compressedxandie_sacroAinda não há avaliações

- Reinforcing Causal LoopDocumento1 páginaReinforcing Causal LoopMark Billy EspinosaAinda não há avaliações

- The 2007Documento3 páginasThe 2007Jeremy Bustamante100% (1)

- Us Foreclosure Lists March 2019Documento113 páginasUs Foreclosure Lists March 2019Virginia HolmesAinda não há avaliações

- Euro Crisis For Dummies PDFDocumento2 páginasEuro Crisis For Dummies PDFLauraAinda não há avaliações

- Financial CrisisDocumento25 páginasFinancial Crisisnuwan tharakaAinda não há avaliações

- New Deal Alphabet Soup WorksheetDocumento3 páginasNew Deal Alphabet Soup Worksheetapi-348656364100% (1)

- Chronicle of World Financial Crisis 2007-2008Documento4 páginasChronicle of World Financial Crisis 2007-2008Md. Azim Ferdous100% (1)

- Euro Crisis Summary PDFDocumento2 páginasEuro Crisis Summary PDFJustinAinda não há avaliações

- Economics - Case AnalysisDocumento3 páginasEconomics - Case Analysiscstellou22Ainda não há avaliações

- All The Devils Are HereDocumento1 páginaAll The Devils Are Heresudhanshur0% (3)

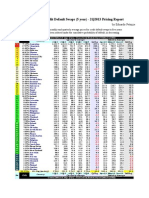

- Sovereign Credit Default Swaps (5 Year) - 2Q2013 Pricing ReportDocumento1 páginaSovereign Credit Default Swaps (5 Year) - 2Q2013 Pricing ReportEduardo PetazzeAinda não há avaliações

- The Wall Street Crash of 1929Documento11 páginasThe Wall Street Crash of 1929Ramona AlinaAinda não há avaliações

- What Is A 'Financial Crisis?'Documento3 páginasWhat Is A 'Financial Crisis?'Abdul Ahad SheikhAinda não há avaliações

- Fool's Gold-Gillian TettDocumento14 páginasFool's Gold-Gillian TettAnkit KhandelwalAinda não há avaliações

- Combating The Judicial Foreclosure Slaughterhouse Aug 4th 530pm West Palm Beach FL Monthly Happy HourDocumento1 páginaCombating The Judicial Foreclosure Slaughterhouse Aug 4th 530pm West Palm Beach FL Monthly Happy HourForeclosure FraudAinda não há avaliações

- Bfs Foreclosed Properties Listing As of 2017-04-12 PublicDocumento14 páginasBfs Foreclosed Properties Listing As of 2017-04-12 PublicCianPanganibanAinda não há avaliações

- Global Financial Crisis-TgDocumento4 páginasGlobal Financial Crisis-TgCharlesAinda não há avaliações

- Political Economy, Vol. 108 No. 1, 1-33: Daftar PustakaDocumento3 páginasPolitical Economy, Vol. 108 No. 1, 1-33: Daftar PustakaRian SopianAinda não há avaliações

- The Great Depression Scavenger HuntDocumento2 páginasThe Great Depression Scavenger Huntvickiajones60% (5)