Escolar Documentos

Profissional Documentos

Cultura Documentos

Future CPAs - CPA Practical Experience Overview

Enviado por

fede1979arDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Future CPAs - CPA Practical Experience Overview

Enviado por

fede1979arDireitos autorais:

Formatos disponíveis

CPA Practical Experience

Requirements

What do I need to know?

CPA practical requirements are a critical component of the CPA

certification program. There are two routes to obtain your practical

experience requirements:

Pre-approved programs in which future CPAs gain relevant

experience in training positions pre-approved by the profession

Experience verification in which future CPAs demonstrate relevant

experience at an employer of choice

Future CPAs can gain experience through either route, or a combination

Previous and

International

Experience

Can my prior experience

count towards my

certification?

Yes, prior experience of a

minimum of three months

to a maximum of 12 months

may be recognized as qualifying

practical experience.

of both. There are five common requirements:

1. Qualifying Experience

Future CPAs must gain relevant paid employment that is progressively

challenging to develop as a professional accountant.

Both routes take a minimum of 30 months; this includes an allowance

of up to 20 weeks of time away from work (including vacation time).

The period of practical experience cannot begin until you have a CPA

mentor.

2. Appropriate Supervision

Your supervisor is responsible for either assigning you the required

experience in a pre-approved program, or within the experience

verification route, verifying that your experience is factually accurate

in your experience report.

Your supervisor does not need to be a designated accountant.

Does experience gained

outside of Canada

qualify?

Yes, if the experience satisfies

the practical experience

requirements, whether it is

gained domestically or

internationally, it may be

recognized.

Does my previous

experience expire?

Yes. To ensure experience

is relevant, all experience

must be gained in positions

that ended within the last

seven years.

3. Reporting & Self-Assessment

Once you register with your provincial/regional body, you will gain access to PERT.

The experience report details the duration of the experience, the type of experience being gained and

your assessment of this experience.

Your gained experience is self-assessed at least twice a year and discussed with your CPA mentor.

Reporting covers both technical competencies and enabling competencies.

4. CPA Mentorship

You will meet with your CPA mentor at least semi-annually to review your progress against set

required competencies.

5. Assessment by Profession

At key milestones, the experience report must be assessed by your provincial/regional body.

CPA PRACTICAL EXPERIENCE REQUIREMENTS |

STUDENTS/CANDIDATES

Two Models. One Standard.

Qualifying practical experience can be gained through two routes. Here's how they work.

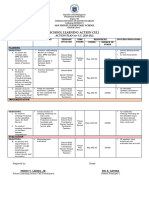

1) Pre-Approved Route

What does it mean for future CPAs?

Employers offering these programs have had them approved by the profession in advance. The

programs have been designed to provide future CPAs all the required experience within 30 months.

As a result, less documentation in PERT is required from future CPAs taking this path. Assessment by

the profession occurs when you complete the program.

0 MONTHS

Organization

appoints

pre-approved

program

leader(s)

Program

approved

by the

profession

START

18 MONTHS

>30 MONTHS

18-Month*

Admission Check

Hired to

pre-approved

route

(MANDATORY)

YES

YES

(MANDATORY)

Have you met

the CPA Practical

Experience

Requirements?

Have you

registered for the

CPA Professional

Education Program?

Program

structured to

ensure

competencies

can be

achieved

within 30

months

Final Assessment

C

O

M

P

L

E

T

E

NO

NO

Duration

stops until

requirements

met

Organization

identifies

role(s)

Meeting with CPA mentor throughout practical experience term

*This experience can be any combination of full-time, part-time or co-operation experience but no more than 12 months will be recognized as prior experience. If you are reporting experience as you

gain it, then you require a CPA mentor. If the experience is being reported as prior experience, capped at 12 months, then no mentor is required for the period of prior experience.

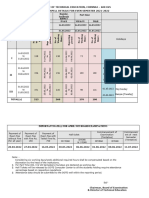

2) Experience Verification Route

What does it mean for future CPAs?

This flexible route allows future CPAs to demonstrate competence and have relevant experience

recognized, as it is gained, at an employer of choice.

Future CPAs complete detailed experience reports in PERT that are assessed by the profession at

key milestones. Supervisors review and attest to the accuracy of experience reports.

0 MONTHS

Results of

Assessment

3 MONTHS

OPTION A

3-Month

Assessment

(MANDATORY)

Register

and

profession

assesses

position

YES

Find a

position and

complete

initial check

Feedback on

Progression

(OPTIONAL)

12 MONTHS

12-Month

Assessment

(MANDATORY)

Have you

gained Level 1

proficiency

in at least 2

competency

sub-areas?

OPTION B

S

T

A

R

T

9 MONTHS

Does the position

provide experience

in at least one

competency area at

Level 1?

NO

18 MONTHS

YES

18-Month*

Admission Check

(MANDATORY)

Have you

registered for the

CPA Professional

Education Program?

NO

NO

Duration

stops until

requirements

met

Duration

stops until

requirements

met

>30 MONTHS

YES

Final Assessment

(MANDATORY)

YESYES

Have you met

the CPA Practical

Experience

Requirements?

NO

Meeting with CPA mentor throughout practical experience term

*This experience can be any combination of full-time, part-time or co-operation experience but no more than 12 months will be recognized as prior experience. If you are reporting experience as you

gain it, then you require a CPA mentor. If the experience is being reported as prior experience, capped at 12 months, then no mentor is required for the period of prior experience.

Contact your provincial or regional body for additional information

cpacanada.ca/PracticalExperience

C

O

M

P

L

E

T

E

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Judie A. Compas: With HonorsDocumento10 páginasJudie A. Compas: With HonorsGRACE VERIDIANOAinda não há avaliações

- Spotlight On First Reading 1 - Unit 3 - PPT - PPSXDocumento39 páginasSpotlight On First Reading 1 - Unit 3 - PPT - PPSXRicky CagasAinda não há avaliações

- G0002A - PP - Teaching Roles, Responsibilities, Relationships and BoundariesDocumento19 páginasG0002A - PP - Teaching Roles, Responsibilities, Relationships and BoundariesAshraf EL WardajiAinda não há avaliações

- Annual Prortion - 1Documento54 páginasAnnual Prortion - 1Vaishnav YadavAinda não há avaliações

- Piqc Diploma Registration FormDocumento2 páginasPiqc Diploma Registration Formrajaabid0% (1)

- ProQuestDocuments 2021-11-24Documento6 páginasProQuestDocuments 2021-11-24Accurate Technology LimitedAinda não há avaliações

- ĐỀ SỐ 7 NKDocumento6 páginasĐỀ SỐ 7 NKN.K Đức AnhAinda não há avaliações

- Answer Keys MathDocumento10 páginasAnswer Keys MathElner Dale Jann GarbidaAinda não há avaliações

- Ipe Form 1Documento2 páginasIpe Form 1KingAinda não há avaliações

- 2020 2021 Lac Action PlanDocumento2 páginas2020 2021 Lac Action PlanIsidro LaridaAinda não há avaliações

- Regulament Diplome FAI ArhInt 2017-18Documento14 páginasRegulament Diplome FAI ArhInt 2017-18ElizaAinda não há avaliações

- Brigada Eskwela Proposal 2022Documento3 páginasBrigada Eskwela Proposal 2022KATHLEEN JOY PABALAY100% (1)

- SpellDetails April 2022Documento2 páginasSpellDetails April 2022vijir15646Ainda não há avaliações

- Educational Planning and Curriculum DevelopmentDocumento3 páginasEducational Planning and Curriculum DevelopmentPevi VirtudazoAinda não há avaliações

- Global History Bilingual Glossary Haitian-Creole-EnglishDocumento27 páginasGlobal History Bilingual Glossary Haitian-Creole-Englishaehsgo2collegeAinda não há avaliações

- Vijayalaxmi Engineers & ContractorsDocumento2 páginasVijayalaxmi Engineers & ContractorsDivya DhumalAinda não há avaliações

- BSEd-SCI - 4-1 - Cabansag, Angelie - My Weekly JournalDocumento9 páginasBSEd-SCI - 4-1 - Cabansag, Angelie - My Weekly JournalGel CabansagAinda não há avaliações

- ASAN Freshers Meet 23Documento1 páginaASAN Freshers Meet 23rocky bhaiAinda não há avaliações

- Final Demonstration Teaching in Mathematics 9Documento4 páginasFinal Demonstration Teaching in Mathematics 9ERIX VALMADRIDAinda não há avaliações

- Tugas Mata Kuliah Model Pembelajaran Bahasa Kelas B Kelompok 2 - RevDocumento17 páginasTugas Mata Kuliah Model Pembelajaran Bahasa Kelas B Kelompok 2 - RevTri Wahyuni PurwaningsihAinda não há avaliações

- Approaches For Organizational Learning: A Literature Review: Dirk Basten and Thilo HaamannDocumento20 páginasApproaches For Organizational Learning: A Literature Review: Dirk Basten and Thilo HaamannAJAYSURYAA K S 2128204Ainda não há avaliações

- Lesson Plan MTB 3 in English DetailedDocumento8 páginasLesson Plan MTB 3 in English DetailedJennifer Talabucon-DiasnesAinda não há avaliações

- CRT & NRT LessonDocumento10 páginasCRT & NRT LessonShehari WimalarathneAinda não há avaliações

- Topper 8 110 2 14 English 2016 Solution Up201603181134 1458281042 1198Documento10 páginasTopper 8 110 2 14 English 2016 Solution Up201603181134 1458281042 1198sneha100% (1)

- Children Who Make Articulation ErrorsDocumento13 páginasChildren Who Make Articulation ErrorsAudrey RosaAinda não há avaliações

- Candidate Information FormDocumento6 páginasCandidate Information FormVenkatesh ghAinda não há avaliações

- Joyce Mutiso UpdatedDocumento3 páginasJoyce Mutiso UpdatedDirector MwangiAinda não há avaliações

- NAAC Revised Accreditation Framework - 2020: Criterion 01 "Curricular Aspects"Documento19 páginasNAAC Revised Accreditation Framework - 2020: Criterion 01 "Curricular Aspects"BasappaSarkarAinda não há avaliações

- Phase-XII Notification 2024 26022024Documento167 páginasPhase-XII Notification 2024 26022024s71397586Ainda não há avaliações

- Proposed Sample Timetable For Pilot F2F Key Stage 1 Kindergarten To Grade 3Documento22 páginasProposed Sample Timetable For Pilot F2F Key Stage 1 Kindergarten To Grade 3Edgardo De Mesa MalaitAinda não há avaliações