Escolar Documentos

Profissional Documentos

Cultura Documentos

Bankers Admit Cost of Funds Has Come Down by 50-60 Bps But Transmission Hasn't Been More Than 20-30 Bps

Enviado por

Abhinav Gupta0 notas0% acharam este documento útil (0 voto)

10 visualizações1 páginaoki

Título original

20160608a_006101001

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentooki

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

10 visualizações1 páginaBankers Admit Cost of Funds Has Come Down by 50-60 Bps But Transmission Hasn't Been More Than 20-30 Bps

Enviado por

Abhinav Guptaoki

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 1

>

RBI TO REVIEW MCLR REGIME

Bankers admit cost of funds has come down by 50-60 bps but transmission hasnt been more than 20-30 bps

NUPUR ANAND

Mumbai, 7 June

wo months after the start of the

marginal cost of funds-based

lending rate (MCLR), the new

benchmark to which the pricing

of loans is linked, the Reserve

Bank of India (RBI) is looking at reviewing

this regime.

We will shortly review the operations of

MCLR framework to iron out any issues It

is early days yet, it has been in place only

for a month. We have to see how it transmits

into lending rates. There is an MCLR

and banks have to add a spread to it and

we have to see how that moves. So, I think

it is going to take a little while before

we can assess fully whether it has

the effect intended, RBI Governor

Raghuram Rajan said.

This comes at a time when bankers

admit that while the cost of funds under the

new rate regime has come down by almost

50-60 basis points (bps) as compared to

the earlier base rates, the transmission

to end-consumers hasnt been more than

20-30 bps.

Marie Diron, senior vice-president,

Sovereign Risk Group, Moodys said the

transmission of the monetary policy will

depend on progress in the clean-up of

bank balance sheets.

This is because lenders can add a spread

component over and above the MCLR,

depending on the customers risk profile

and other considerations. After adding

this spread, the real effect of transmission

gets limited.

In turn, this end ups undermining the

whole idea behind MCLR, which was aimed

at a faster and better transmission.

Since 2015, the regulator has

reduced the key lending rate by 125 bps

(till December when the MCLR guidelines

were introduced) but banks had brought

down their base rates by only 50-60 bps

at that time. As a result, RBI introduced

the MCLR regime, which came into

effect on April 1. It was based

on marginal cost of funds instead

of the average cost of funds to

ensure that the rate cuts were passed

on quickly.

Another factor, apart from the spread

component, that has led to a slower

transmission is the lack of credit demand

that continues to hover in single digits.

In general, I think there is a paucity to

credit demand from the usual sources

which is why banks are not in a great

hurry to reduce rates either. They seem

to be suggesting that they will not be

attractive (to) a whole lot of new credit

Reserve Bank of India Governor Raghuram Rajan (second from right) with Deputy Governors (from left) S S Mundra, Urjit Patel and H R Khan after

PHOTO: KAMLESH PEDNEKAR

the second bi-monthly monetary policy 2016-17 press conference in Mumbai on Tuesday

HDFC Bank cuts 2-year

MCLR; BOB hikes for 1 year

Private sector lender HDFC Bank has

reduced its marginal cost of funds-based

lending rate (MCLR) the benchmark

to price loans by five basis points for

one-month bucket to 8.95 per cent and

9.25 per cent for the two-year bucket.

Public sector lender Bank of Baroda

hiked MCLR for one year by 10 basis

points to 9.4 per cent.

ABHIJIT LELE

if they reduce rates, so why not stay

with the existing borrowers and

so on, Rajan said.

As the difference between the

credit and the deposit growth widens

MCLR RATES OF SELECT BANKS

Bank name

Old

base

SBI

Axis Bank

Bank of Baroda

PNB

Canara Bank

HDFC Bank

9.30

9.50

9.65

9.60

9.65

9.30

MCLR

over-night

8.90

8.95

9.15

9.15

8.80

8.90

(Figures in %)

One

month

Two

month

Six

month

9.00

9.05

9.20

9.20

9.10

8.95

9.05

9.25

9.30

9.30

9.20

9.05

9.10

9.30

9.35

9.35

9.25

9.10

One

year

9.15

9.35

9.40

9.40

9.35

9.15

Source: Banks

further, with deposit growth outpacing

the former, banks will probably

become more inclined to deploying the

funds into lending instead of just

parking these in government securities.

However, instead of waiting to see

how the new lending rate regime takes

shape, the regulator will soon be taking

stock of the situation and if needed may

bring about changes.

Você também pode gostar

- HOW BANKS DECIDE INTEREST RATES (Autosaved) (Autosaved)Documento30 páginasHOW BANKS DECIDE INTEREST RATES (Autosaved) (Autosaved)anuragAinda não há avaliações

- Weekly Progress & Evaluation Test 26: D. 2 & 3 OnlyDocumento3 páginasWeekly Progress & Evaluation Test 26: D. 2 & 3 OnlyAbhinav GuptaAinda não há avaliações

- ANSWERS To CDCS Question BankDocumento5 páginasANSWERS To CDCS Question BankAbhinav GuptaAinda não há avaliações

- 1 Working CapitalDocumento63 páginas1 Working CapitalDeepika Mittal50% (2)

- Weekly Progress & Evaluation Test 22: D. None of The AboveDocumento2 páginasWeekly Progress & Evaluation Test 22: D. None of The AboveAbhinav GuptaAinda não há avaliações

- LIBF Level 4 Certificate For Documentary Credit Specialists (CDCS)Documento10 páginasLIBF Level 4 Certificate For Documentary Credit Specialists (CDCS)Abhinav GuptaAinda não há avaliações

- KartikDocumento29 páginasKartikChandan SinghAinda não há avaliações

- KAMM Notes Taxation Bar 2021Documento115 páginasKAMM Notes Taxation Bar 2021Bai MonadinAinda não há avaliações

- Bill Ackman Value Investing Congress 100112Documento103 páginasBill Ackman Value Investing Congress 100112abc_dAinda não há avaliações

- Chapter 17 Capital Structure-TestbankDocumento12 páginasChapter 17 Capital Structure-TestbankLâm Thanh Huyền NguyễnAinda não há avaliações

- CDCS Question BankDocumento5 páginasCDCS Question BankAbhinav GuptaAinda não há avaliações

- MR - Abhinav Gupta: Page 1 of 2 M-8113103Documento2 páginasMR - Abhinav Gupta: Page 1 of 2 M-8113103Abhinav Gupta100% (1)

- Regional Rural Banks of India: Evolution, Performance and ManagementNo EverandRegional Rural Banks of India: Evolution, Performance and ManagementAinda não há avaliações

- RBI ImpactDocumento2 páginasRBI ImpactSiddharth RoyAinda não há avaliações

- SBI Cuts Deposit Rates SharplyDocumento2 páginasSBI Cuts Deposit Rates SharplynareshAinda não há avaliações

- Introduction of The IndustryDocumento7 páginasIntroduction of The IndustryNaveen SharmaAinda não há avaliações

- Financial Express Mumbai 01 August 2012 6Documento1 páginaFinancial Express Mumbai 01 August 2012 6bhaskardoley30385215Ainda não há avaliações

- Non-Performing Assets To Double in Two Years: ICRADocumento1 páginaNon-Performing Assets To Double in Two Years: ICRAseanmor111Ainda não há avaliações

- Assignment 3Documento5 páginasAssignment 3SuprityAinda não há avaliações

- What Is A CRR RateDocumento8 páginasWhat Is A CRR Ratesunilkumart7Ainda não há avaliações

- HDFC CASE STUDY Part 2Documento53 páginasHDFC CASE STUDY Part 2sourav khandelwalAinda não há avaliações

- Sbi Rates On Educational LoansDocumento1 páginaSbi Rates On Educational LoansrockyrrAinda não há avaliações

- Module B-Risk Management PDFDocumento5 páginasModule B-Risk Management PDFAshutosh GuptaAinda não há avaliações

- Marginal Cost of Funds Based Lending Rate (MCLR) - ArthapediaDocumento3 páginasMarginal Cost of Funds Based Lending Rate (MCLR) - ArthapediasoumyajitroyAinda não há avaliações

- AnubhavbaseratepptDocumento12 páginasAnubhavbaseratepptChandan SinghAinda não há avaliações

- What Is Base RateDocumento2 páginasWhat Is Base RateJyothsna PolimatiAinda não há avaliações

- SBI Will Slash RatesDocumento2 páginasSBI Will Slash RatesChetan PanchamiaAinda não há avaliações

- Malaysia Central Bank To Start New Retail Loan Pricing System in 2015Documento8 páginasMalaysia Central Bank To Start New Retail Loan Pricing System in 2015snurazaniAinda não há avaliações

- Article On Sbi RatesDocumento1 páginaArticle On Sbi RatesGIMPIRAWALAinda não há avaliações

- Credit VidyaDocumento2 páginasCredit VidyaRajesh NaiduAinda não há avaliações

- Repo Rate & Reverse Repo Rate InfoDocumento2 páginasRepo Rate & Reverse Repo Rate InfoGauravAinda não há avaliações

- Monthly BeePedia January 2021Documento134 páginasMonthly BeePedia January 2021Anish AnishAinda não há avaliações

- Business Standard-The M&M-RBL Bank Saga by Tamal BandyopadhyayDocumento1 páginaBusiness Standard-The M&M-RBL Bank Saga by Tamal BandyopadhyayGarima ChaudhryAinda não há avaliações

- Banking Case StudyDocumento9 páginasBanking Case Studyainesh_mukherjeeAinda não há avaliações

- Times: Rajan Resists Govt Pressure On RatesDocumento1 páginaTimes: Rajan Resists Govt Pressure On RatesVibhor AggarwalAinda não há avaliações

- Submitted By:-Sugandh Kr. Choudhary. R1813-B41 10805900Documento15 páginasSubmitted By:-Sugandh Kr. Choudhary. R1813-B41 10805900Sugandh Kr ChoudharyAinda não há avaliações

- Repo Rate NotesDocumento7 páginasRepo Rate NotesAmol DhumalAinda não há avaliações

- Risk Management 2Documento5 páginasRisk Management 2Prakash AnandAinda não há avaliações

- Interest Rates Need To Be Reduced - PPTX RBI STEPDocumento6 páginasInterest Rates Need To Be Reduced - PPTX RBI STEPIshpreet Singh BaggaAinda não há avaliações

- How Practical RBI Governor Raghuram Rajan's Radical Ideas Are - Business TodayDocumento7 páginasHow Practical RBI Governor Raghuram Rajan's Radical Ideas Are - Business TodayShankey GuptaAinda não há avaliações

- Indian Bank Base Rate:An Overview: Munich Personal Repec ArchiveDocumento11 páginasIndian Bank Base Rate:An Overview: Munich Personal Repec ArchiveAnup Kumar RayAinda não há avaliações

- News of The Week 2Documento17 páginasNews of The Week 2mehtarahul999Ainda não há avaliações

- Banks May Be Given Incentive To Extend Loans in Backward Areas: RBI Dy Guv MK JainDocumento4 páginasBanks May Be Given Incentive To Extend Loans in Backward Areas: RBI Dy Guv MK JainKARTHIK RAinda não há avaliações

- RbiDocumento6 páginasRbiAnjali RaiAinda não há avaliações

- Base Rate Vs BPLRDocumento2 páginasBase Rate Vs BPLRDebasish DeyAinda não há avaliações

- Rajan Vs Subbarao - Aditya KhannaDocumento3 páginasRajan Vs Subbarao - Aditya KhannaadiAinda não há avaliações

- Base Rate: Gyaan@ FinstreetDocumento8 páginasBase Rate: Gyaan@ Finstreetgautam_hariharanAinda não há avaliações

- Entrepreneurship Managementt200813Documento7 páginasEntrepreneurship Managementt200813Arpita SrivastavaAinda não há avaliações

- Orner Ffice: Business Outlook Steady Internal Accruals To Support Growth MomentumDocumento8 páginasOrner Ffice: Business Outlook Steady Internal Accruals To Support Growth Momentum0003tzAinda não há avaliações

- CRR Cut Not The Only WayDocumento2 páginasCRR Cut Not The Only WaySaam AjayAinda não há avaliações

- Corporate Governance Response PaperDocumento4 páginasCorporate Governance Response PaperBhumiAinda não há avaliações

- Monetary PolicyDocumento9 páginasMonetary Policytulasi nandamuriAinda não há avaliações

- Mob NpaDocumento2 páginasMob NpaAishwaryaAinda não há avaliações

- A New Rate, Called The Base Rate, Must Be Used To Price All LendingDocumento3 páginasA New Rate, Called The Base Rate, Must Be Used To Price All LendingSangram PandaAinda não há avaliações

- Article On Monetary PolicyDocumento3 páginasArticle On Monetary PolicyMahi YadavAinda não há avaliações

- IIBF Vision February 2015Documento8 páginasIIBF Vision February 2015NitinKumarAinda não há avaliações

- RBI Announces New Rules For Calculating Base Rate - Print View - LivemintDocumento1 páginaRBI Announces New Rules For Calculating Base Rate - Print View - LivemintPramod kAinda não há avaliações

- BankingDocumento2 páginasBankingingeniousashuAinda não há avaliações

- Subbarao Puts Onus On Govt: Slash in CRR May Be RBI's Curtain-Raiser To Rate CutsDocumento3 páginasSubbarao Puts Onus On Govt: Slash in CRR May Be RBI's Curtain-Raiser To Rate CutsfinscholarAinda não há avaliações

- Banks' Npas Could Rise On Account of Slowing Economy: Pmeac: Rbi Issues Fresh Measures To Bail Out Banks, Mkts To RallyDocumento4 páginasBanks' Npas Could Rise On Account of Slowing Economy: Pmeac: Rbi Issues Fresh Measures To Bail Out Banks, Mkts To Rallygeethark12Ainda não há avaliações

- Bank RecentDocumento3 páginasBank RecentaadianviAinda não há avaliações

- @@@gaining From Falling RatesDocumento18 páginas@@@gaining From Falling RatesDebashis NandiAinda não há avaliações

- Beepedia Monthly Current Affairs (Beepedia) December 2022Documento116 páginasBeepedia Monthly Current Affairs (Beepedia) December 2022Sovan KumarAinda não há avaliações

- Repo RateDocumento5 páginasRepo RateSweta SinghAinda não há avaliações

- Assignment of Buisness Enviroment MGT 511: TOPIC: Changes in Monetary Policy On Banking Sector or IndustryDocumento9 páginasAssignment of Buisness Enviroment MGT 511: TOPIC: Changes in Monetary Policy On Banking Sector or IndustryRohit VermaAinda não há avaliações

- RBI's Third Quarter Review-Shift in Monetary Policy 2009-10 Stance-VRK100-29012010Documento7 páginasRBI's Third Quarter Review-Shift in Monetary Policy 2009-10 Stance-VRK100-29012010RamaKrishna Vadlamudi, CFAAinda não há avaliações

- IDirect RBIActions Dec15Documento5 páginasIDirect RBIActions Dec15umaganAinda não há avaliações

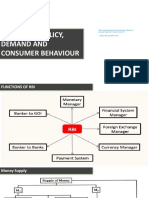

- Monetary Policy, Demand and Consumer Behaviour: Alculator/repo-Rate-Vs-Bank-Rate - HTML - Repo Rate and Bank RatreDocumento23 páginasMonetary Policy, Demand and Consumer Behaviour: Alculator/repo-Rate-Vs-Bank-Rate - HTML - Repo Rate and Bank RatreBhavya NarangAinda não há avaliações

- BanksDocumento2 páginasBanksShubham NarayanAinda não há avaliações

- Banks Have Ability To Withstand Stress: Also ReadDocumento22 páginasBanks Have Ability To Withstand Stress: Also Readpriya2210Ainda não há avaliações

- Annexure 13Documento2 páginasAnnexure 13Abhinav GuptaAinda não há avaliações

- Driving Trade and Export Growth: Time Zone: India Standard Time (IST)Documento6 páginasDriving Trade and Export Growth: Time Zone: India Standard Time (IST)Abhinav GuptaAinda não há avaliações

- Factoring NotesDocumento1 páginaFactoring NotesAbhinav GuptaAinda não há avaliações

- Business StandardDocumento11 páginasBusiness StandardAbhinav GuptaAinda não há avaliações

- Statement - 4 Net Loss (-) of Loss Making Cpses (Cognate Group Wise)Documento4 páginasStatement - 4 Net Loss (-) of Loss Making Cpses (Cognate Group Wise)Abhinav GuptaAinda não há avaliações

- Weekly Progress & Evaluation Test 19: Cdcs Exam 2019 (April Intake) Preparation ProgramDocumento1 páginaWeekly Progress & Evaluation Test 19: Cdcs Exam 2019 (April Intake) Preparation ProgramAbhinav GuptaAinda não há avaliações

- JD Kotak Banking and Financial Group Capital MarketDocumento1 páginaJD Kotak Banking and Financial Group Capital MarketAbhinav GuptaAinda não há avaliações

- Can Ajay Singh Turn Spicejet Around?: Spicejet'S Shrinking NumbersDocumento1 páginaCan Ajay Singh Turn Spicejet Around?: Spicejet'S Shrinking NumbersAbhinav GuptaAinda não há avaliações

- Unfair Trade Practices by Real Estate Firms: Consumer ProtectionDocumento1 páginaUnfair Trade Practices by Real Estate Firms: Consumer ProtectionAbhinav GuptaAinda não há avaliações

- An 011101002Documento1 páginaAn 011101002Abhinav GuptaAinda não há avaliações

- US Internal Revenue Service: Irb98-02Documento44 páginasUS Internal Revenue Service: Irb98-02IRSAinda não há avaliações

- Video Production Quote TemplateDocumento2 páginasVideo Production Quote TemplateJosé Carlos Godinez VasquezAinda não há avaliações

- Mahindra & Mahindra Acquires SSanYongDocumento11 páginasMahindra & Mahindra Acquires SSanYongShivam BajajAinda não há avaliações

- 0450 m18 in 22Documento4 páginas0450 m18 in 22yoshAinda não há avaliações

- Bpi FormatDocumento3 páginasBpi FormatJoanne JaenAinda não há avaliações

- HRMM GuidenceDocumento6 páginasHRMM GuidencenadliesaAinda não há avaliações

- AFS SolutionsDocumento19 páginasAFS SolutionsRolivhuwaAinda não há avaliações

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Documento1 páginaTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)raviAinda não há avaliações

- Pledge-Contract Act: Simar MakkarDocumento8 páginasPledge-Contract Act: Simar MakkarPearl LalwaniAinda não há avaliações

- Transfer Pricing II: Rajan Baa 3257Documento15 páginasTransfer Pricing II: Rajan Baa 3257Rajan BaaAinda não há avaliações

- Tr3ndy Jon's Trading StrategiesDocumento3 páginasTr3ndy Jon's Trading Strategieshotdog10Ainda não há avaliações

- In The United States Bankruptcy Court For The District of Delaware in Re:) Chapter 11 Pacific Energy Resources LTD., Et Al.,') Case No. 09-10785 (KJC) ) (Jointly Administered) Debtor.)Documento67 páginasIn The United States Bankruptcy Court For The District of Delaware in Re:) Chapter 11 Pacific Energy Resources LTD., Et Al.,') Case No. 09-10785 (KJC) ) (Jointly Administered) Debtor.)Chapter 11 DocketsAinda não há avaliações

- Delegation of Financial Rules 2006 AmendedDocumento360 páginasDelegation of Financial Rules 2006 AmendedHumayoun Ahmad Farooqi100% (1)

- CH 13Documento31 páginasCH 13Natasha GraciaAinda não há avaliações

- South Asia TechDocumento6 páginasSouth Asia TechA M FaisalAinda não há avaliações

- Insurance For Specific EventsDocumento1 páginaInsurance For Specific Eventsihsan nawawiAinda não há avaliações

- Key Facts Missold IVA Legal PartnerDocumento1 páginaKey Facts Missold IVA Legal PartnerAnthony RobertsAinda não há avaliações

- SG ITAD Ruling No. 019-03Documento4 páginasSG ITAD Ruling No. 019-03Paul Angelo TombocAinda não há avaliações

- Pre Test No. 1.2 HobaDocumento2 páginasPre Test No. 1.2 HobaJean TatsadoAinda não há avaliações

- 92611902-KrugmanMacro SM Ch19 PDFDocumento6 páginas92611902-KrugmanMacro SM Ch19 PDFAlejandro Fernandez RodriguezAinda não há avaliações

- Dear Sir/Madam, My Full Name Is Abdullahi Yusuf Moalim NurDocumento1 páginaDear Sir/Madam, My Full Name Is Abdullahi Yusuf Moalim Nurmucaashaq ibnu maxamedAinda não há avaliações

- CH 01 - QS 1-17-18 Ac 3-4Documento14 páginasCH 01 - QS 1-17-18 Ac 3-4Sharmi laAinda não há avaliações

- Master Circular MSME - RBIDocumento32 páginasMaster Circular MSME - RBIMadan MohanAinda não há avaliações

- Miga Professionals Program PDFDocumento2 páginasMiga Professionals Program PDFPaul Ivan Beppe a Yombo Paul IvanAinda não há avaliações

- Z003800101201740141305080572 448187Documento51 páginasZ003800101201740141305080572 448187Dian AnitaAinda não há avaliações

- New BIT Structure For 081 AboveDocumento17 páginasNew BIT Structure For 081 Aboveعلي برادةAinda não há avaliações