Escolar Documentos

Profissional Documentos

Cultura Documentos

Article CP & Rajaram 02

Enviado por

Paramasivan ArivalanDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Article CP & Rajaram 02

Enviado por

Paramasivan ArivalanDireitos autorais:

Formatos disponíveis

KIJECBM/JUL-SEP15/VOL-2/ISS-3/A4

ISSN:2348-4969

IMPACT FACTOR (2015) - 3.9581

KAAV INTERNATIONAL JOURNAL OF ECONOMICS,COMMERCE &

BUSINESS MANAGEMENT

DEATH CLAIM UNDER MICRO INSURANCE PORTFOLIO

Dr. C. Param

Assistant

S.Raj

Ph.D Resea

Periyar EVR Coll

Tiruch

Abstract

Insurance is needed to everyon

different segments and p

insurance companies and

as Janata Personal Acc

insuranc

offered b

low pric

transacti

death cla

are available in

red by all registered life

nt of the population such

cy, Cattle or live stock

micro insurance policies

Micro insurance being a

s mainly on keeping the

scuss the overview of micro insurance

Key Wo

d group category, policy holder

Introdu

P

death benefit shall be payable as Death due to any

reason o

remium policies Sum Assured on Death shall be

payable which is defined as high as 10 times of annualised premium or 105 per cent of all the

premium paid as on date of death or sum assured on maturity or absolute amount assured to be

paid on death where absolute amount assured to be paid on death is sum assured. The premiums

mentioned above exclude taxes and extra premium, if any, for single premium policies. sum

assured on death shall be payable which is defined as higher as 125 per cent of single premium

excluding the taxes and extra premium, if any or absolute amount assured to be paid on death

where absolute amount assured to be paid on death is sum assured. If Death is due to accident, an

additional sum equal to sum assured shall also be payable. With this aspect this paper consists of

Copyright 2015 Published by kaav publications. All rights reserved

38

www.kaavpublications.org

KIJECBM/JUL-SEP15/VOL-2/ISS-3/A4

ISSN:2348-4969

IMPACT FACTOR (2015) - 3.9581

individual and group category of death claim, duration wise settlement of death claim of micro

insurance in India.

Literature Review

Kirti Singh and Vijay Kumar Gangal (2011) noted that Micro insurance is of supreme

importance for protecting poor lives against accidents, threats and other types of risks. This paper

highlights the importance of micro insurance for the upliftment of rural poor focuses on the

initiatives taken by private and public insurance companies in the growth of rural India and also

helps to understand how micro insurance is helpful in alleviation of poverty.

Amrutha Varshini and Suresh B.H (2013)

a tool for the

countrys poor people to protect themselves fro

ancial risks and

provide optimism to policy holders, helping

gencies. Microinsurance is considered as an integral output of

poor from being

further impoverished as a result of adverse ev

s, there will be

increasingly higher standards for quality produc

Premasis Mukherjee (2012) in his art

will soon cease

to be influenced by the rural and socia

he insurers have

innovated products and distribution bey

t business in the

low income segment. However, the reg

es of the sector.

Group based policies, alternative micro

ovations have to

be brought under the reg

rate the growth of micro

insurance in India.

Shweta Mathar (2010)

ro insurance in India and

challeng

She opined that policy

induced

low income people who

form a s

social security.

Ramalsk

d that there is awareness about micro

insuranc

who played a major role in creating

awarene

icro insurance policy. The period of

awarene

lationship between the socio-economic

factors a

e products of life insurance corporation

of India.

Parvath

experimented a lot with micro insurance and sector is

still driv

insurance provider, seeks government subsidies and

donor fu

ial viability in preference to designing market led,

sustainable schemes. Policy induced and institutional innovations are promoting insurance

among the low income people who form a sizable sector of the population and who are mostly

without any social security cover.

Statement of problem

In a country where less than 3 per cent of the population has access to insurance, and

where upwards of 35 million people fall below the poverty line each year because of a single

health event in the family, it is slowly being accepted that micro health insurance units that

offer benefit packages and require pre-payment create a rudimentary insurance among

Copyright 2015 Published by kaav publications. All rights reserved

39

www.kaavpublications.org

KIJECBM/JUL-SEP15/VOL-2/ISS-3/A4

ISSN:2348-4969

IMPACT FACTOR (2015) - 3.9581

marginalized and underserved segments of the population in India. Micro insurance units

represent a high hope for extension of health insurance coverage among the poor. India is a

world leader in the development of this form of low-cost health insurance, but most micro

insurance units in India and elsewhere are managed independently, usually without the skills

required to properly assume the actuarial and organizational consequences of underwriting risks

of their members. Death claims under the micro insurance portfolio is an important aspect of the

effectiveness of insurance. Hence, there is a need to understand the death claim product wise,

Category wise and company wise which help to measure the performance of micro insurance

institutions in the country.

Objective

To evaluate the death claim Micro insura

Methodology

The present paper is quantitative in na

collected form the report of IRDA, website of i

arranged according to its needs and ana

Death claim term policy

For Death Claim if the life as

arises. If the death has taken place with

it is called an early death

death claim. In case of th

the claim amount becom

nominee

intimatio

death, ca

death cl

within t

different

or prem

treated a

hich have been

d data have been

the death claim

mencement of the policy,

, it is called a non early

he duration of the policy,

f Life Insurance 108 the

st relative shall send an

fact of death, the date of

er. Insurer deals with the

he policy. If the policyholder has died

.e., acceptance of risk which may be

s been dated back it is treated as early

r 2 years of the commencement, it is

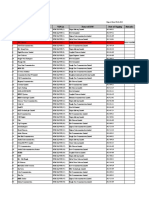

Table No: 1

surance Portfolio- Individual Category

Particul

Total

Claims pending at 1.28

start of year

Claims

49.82

intimated/booked

Claims paid

42.46

Claims repudiated

8.64

Claims pending at 0.00

ntage

LIC

Percentage

53.33

1.12

46.66

Industry

Total

2.4

3.94

1189.05

95.97

1238.87

3.49

39.18

0

1174.12

13.41

2.64

96.50

60.81

100

1216.58

22.05

2.64

Copyright 2015 Published by kaav publications. All rights reserved

40

www.kaavpublications.org

KIJECBM/JUL-SEP15/VOL-2/ISS-3/A4

ISSN:2348-4969

IMPACT FACTOR (2015) - 3.9581

end of year

Rs.(Lakhs)

Source: Handbook on Indian Insurance Statistics2010-11

Table No 1 indicates the amount of benefit paid micro insurance portfolio with respect to

individual category. As regards claims pending at start of year, total death claim pending

amounted to Rs.2.4 lakhs of which, 1.28 lakhs were by private sectors and Rs.1.12 lakhs by LIC.

Majority of the death Claim (53.33 percentage) pending belong to private sector micro insurance

in the year 2010-11.

As regards claims intimated and booked, a total of Rs. 1238.87 Lakhs claims were intimated and

booked as total of which, 49.82 were Lakhs by

Lakhs by LIC.

Majority of the claims intimated and booked (9

micro insurance

in the year 2010-11

As regards claims paid, a total of Rs.1216.58

ch 42.46 Lakhs

were by private sectors and Rs.1174.12 Lakhs

m paid belong to

LIC micro insurance in the year 2010-11

As regards claims repudiated, a total of Rs.22.0

d of which, 8.64

Lakhs were by Private sector and Rs

aims repudiated

(13.41) belong to LIC micro insurance

As regards claims pending at the end o

is Rs.2.64lakhs

by LIC. Majority of death claim are pen

Death Claims un

Particulars

P

T

Claims

start of y

Claims

intimate

Claims p

Claims r

Claims

end of y

Source:

ividual Category

entage

Industry

Total

12

7686

44

95.34

71.42

100

7598

84

16

istics2010-11

Table n

claim policies under micro insurance portfolio with

respect t

As regards claims pending at start of year, total number of death claim policies was 12 of which

7 policies were by private sectors and 5 policies by LIC. Majority of the policies (58.33

percentage) belong to private sectors micro insurance in the year 2010-11

As regards claims intimated or booked out of 7686 policies 371 policies were by private sectors

and 7315 policies by LIC. Majority of the policies (95.17 percentage) belong to LIC .Micro

insurance in the year 2010-11

As regards claims paid out of 7598 policies 354 policies were by private sectors and 7244

policies by LIC. Majority of the policies (95.34 percentage) belong to LIC micro insurance in the

year 2010-11

Copyright 2015 Published by kaav publications. All rights reserved

41

www.kaavpublications.org

KIJECBM/JUL-SEP15/VOL-2/ISS-3/A4

ISSN:2348-4969

IMPACT FACTOR (2015) - 3.9581

As regards claims repudiated out of a total of 84 policies. 24 policies were by private sectors and

60 policies by LIC. Majority of the policies (71.42 percentage) belong to LIC micro insurance in

the year 2010-11

As regards claims pending at the end of the year, there was a total of 16 death claim policies.

Majority of the death claim policies (100 percentage) belong to LIC micro insurance in the year

2010-11

Table No: 3

Death claims under Micro Insurance Portfolio Group Category

Rs.(Lakhs)

Particulars

Private

Total

1096.48

Percentag

Industry

Total

20703.03

Claims

5.29

intimated/booked

Claims paid

1028.07

4.98

Claims repudiated

42.9

100

Claims pending at 26.29

15 94

end of year

Source: Handbook on Indian Insurance

20635.69

42.9

164.86

Table no: 3 indicates the amount of be

group category.

As regards claims intima

private sectors and Rs.1

(94.70 percentage) belon

As rega

private s

belong t

As rega

sectors.

As regar

private s

(84.05 p

s. 1096.48 lakhs was by

ms intimated and booked

. 1028.07 lakhs was by

paid (95.01 percentage)

lakhs, Rs. 42.9 lakhs was by private

) belong to private sectors

worth lakhs claims were pending with

with LIC. Majority of the death claim

ear 2010-11

Table No: 4

ce Number of Life Policies Group Category

ntage LIC

Percentage Industry

Total

0.81

487

99.18

491

4495

8.93

45819

91.06

50314

4285

128

86

8.52

100

20.14

45965

0

341

91.47

0

79.85

50250

128

427

D

Particul

Claims pending start

of year

Claims

intimated/booked

Claims paid

Claims repudiated

Claim pending end

of year

o with respect to

Copyright 2015 Published by kaav publications. All rights reserved

42

www.kaavpublications.org

KIJECBM/JUL-SEP15/VOL-2/ISS-3/A4

ISSN:2348-4969

IMPACT FACTOR (2015) - 3.9581

Source: Handbook on Indian Insurance Statistics2010-11

Table No:4 indicates the number of lives policies under micro insurance port folio with respect

to group category.

As regards claims pending at the start of the year out of the life policies 4791, 4 policies are at

private sectors and 487 number of life policies at LIC. Majority of the death claims life policies

(99.18) pending belong to LIC micro insurance in the year 2010-11

As regards claims intimated and booked out of 50314 numbers of life policies, 4495 policies

were by private sectors and 45819 policies by LIC. Majority of the number of policies (91.06

percentage) belong to LIC micro insurance in th

As regards claims paid out of 50250 life policie

vate sectors and

45965 policies by LIC. Majority of the polici

) belong to LIC

micro insurance in the year 2010-11

As regards claims repudiated out of 128 life

private sectors.

Majority of the claims repudiated (100 percenta

cro insurance in

the year 2010-11

As regards claims pending at the end

ere with private

sectors and 341 with LIC. Majority

g to LIC micro

insurance in the year 2010-11

Duration of Settlement

As per the regul

insurer i

i d

clarifica

settling

complete

) Regulations, 2002 the

all documents including

y can set a practice of

ation, the insurer has to

the written intimation of claim.

urance Individual Category

Rs.(Lakhs)

Particul

Within 1

1173.62

Within 1

0.50

Within 3

0.00

Within 6-12 Months 0.00

0

0.00

More than 12 Months 0.00

0

0.00

TotalClaims Settled 365.32

23.73

1174.12

Source: Handbook on Indian Insurance Statistics2010-11

Percentage Industry

Total

76.37

1536.64

18.58

2.69

0

0.11

0

0.00

0

0.00

76.26

1539.44

Table no: 5 Duration wise settlement of micro insurance during the year 2010-11 was as follows

Copyright 2015 Published by kaav publications. All rights reserved

43

www.kaavpublications.org

KIJECBM/JUL-SEP15/VOL-2/ISS-3/A4

ISSN:2348-4969

IMPACT FACTOR (2015) - 3.9581

There was a sum of Rs.1536.64 lakhs within a month as duration for settlement of claim of

which, Rs.363.02 lakhs were by private sectors and Rs.1173.62 lakhs by LIC. A maximum

(76.37 percentage) settlement claim within a month was by LIC during the year 2010-11

There was a sum of Rs.2.69 lakhs within one to three months as duration for settlement of claim

of which, Rs.2.19 lakhs was by private sectors and Rs.0.50 lakhs by LIC. A maximum (18.58

percentage) settlement claim within one to three month was by LIC during the year 2010-11

There was a sum of Rs.0.11 lakhs within three to six months as duration for settlement of claim

of which, Rs.0.11 lakhs was by private sectors and a maximum (100 percentage) settlement

claim was done within a month by LIC during the year 2010-11

Table

Duration wise settlement of clai

Particulars

Private

Percentage

Total

Within 1 Month

7242

6.11

Within 1-3 Months

2

3.50

Within 3 -6 Months

0

0

Within 6-12 Months

2

66

Total Claims Settled 7244

39

Source: Handbook on Indian Insurance

Table no: 6 Duration w

2010-11 was as follows

There were 118456 polic

policies

settleme

There w

policies

settleme

There w

13 polic

to six mo

y

e Industry

Total

118456

57

13

3

18527

policies during the year

of claim of which, 7242

mum (93.88 percentage)

11

ment of claim of which, 2

IC. A maximum (96.49 percentage)

he year 2010-11

ation for settlement of claim of which,

settlement claim was done within three

Conclus

I

nd time consist financial services with unique nature

of featur

varies from one year to unlimited time particularly in

micro insurance. Therefore maturity period and claim of the policy will be a major role in

designing the insurance products by insurance companies. Death claim is one of the major parts

of the insurance products. In a normal death claim, that is if the life assured has died after two

years of the commencement of risk, the insurer, on being intimated about the death of the

policyholder, calls for the age proof, if not earlier admitted, the original policy document and

proof of death. The proof of death can be a certificate from the municipal authorities under

which cremation has taken place or other local body like death registry. Hence, the present

article concludes that the death claim of micro insurance products in the country is playing a key

Copyright 2015 Published by kaav publications. All rights reserved

44

www.kaavpublications.org

KIJECBM/JUL-SEP15/VOL-2/ISS-3/A4

ISSN:2348-4969

IMPACT FACTOR (2015) - 3.9581

role in deciding the insurance business. Claim pending leads to inefficiency of the insurance

company which fails to settle their claim in a time specified; less claim settlement periods show

the efficiency of insurance companies.

Reference

Amrutha varshini.V and Suresh.B.H (2013) penetration of micro insurance study.Global

research analysis.

Hemant Bhargava ED Micro insurance affordable insurance the Micro way

IRDA (2005), Insurance regulatory and development authority obligations of insurers to rural

social sector.

Kalyanasundaram.M.K, Micro insurance

nges, the Indian

Banker Vol.VIII No.8

Kirtisingh and vijaykumargangal(2011)

iftment of rural

india. Excel international journal of multidiscip

pp.131-145

Parvathi.G (2012), Mciro insurance

of Research in

Mamagement, Economic and Commerce vol.2 p

Premasis Mukherjee (2010), Trends of micro ins

e.net

Ramalskshmi and Ramalingam

Micro Insurance

with special reference to LIC of India v

Shweeta Mathur (2010), Micr

er power vol.2.

pp.17-19

IRDA Annual Report 2010-201

Handbook on Ind

Website

www.thinkchange

w

w

w

h

Copyright 2015 Published by kaav publications. All rights reserved

45

www.kaavpublications.org

Você também pode gostar

- Article CP & Rajaram 04Documento6 páginasArticle CP & Rajaram 04Paramasivan ArivalanAinda não há avaliações

- HUDocumento1 páginaHUParamasivan ArivalanAinda não há avaliações

- June 2016 1465467227 49Documento1 páginaJune 2016 1465467227 49Paramasivan ArivalanAinda não há avaliações

- An Overview of Demographic Profile of Prisoners in India PDFDocumento10 páginasAn Overview of Demographic Profile of Prisoners in India PDFParamasivan ArivalanAinda não há avaliações

- The Companies Bill 2012Documento7 páginasThe Companies Bill 2012Raju ShawAinda não há avaliações

- Ascshedulapplication PDFDocumento1 páginaAscshedulapplication PDFParamasivan ArivalanAinda não há avaliações

- Economic Violence Against Dalit Entrepreneurs in Tamil Nadu PDFDocumento12 páginasEconomic Violence Against Dalit Entrepreneurs in Tamil Nadu PDFParamasivan ArivalanAinda não há avaliações

- Constitutional Validity of UGC NormsDocumento30 páginasConstitutional Validity of UGC NormsLive LawAinda não há avaliações

- Export DocumentationDocumento11 páginasExport DocumentationRaja SekharAinda não há avaliações

- One Page Bio DataDocumento1 páginaOne Page Bio DataParamasivan ArivalanAinda não há avaliações

- GO - M.com EqualentDocumento2 páginasGO - M.com EqualentParamasivan ArivalanAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- 10-Wireless Network SecurityDocumento33 páginas10-Wireless Network SecurityNam BuiAinda não há avaliações

- SCM-310-Final Project (MHC) PDFDocumento22 páginasSCM-310-Final Project (MHC) PDFMahmudul HasanAinda não há avaliações

- List of Required International Shipping Documents The Different TypesDocumento6 páginasList of Required International Shipping Documents The Different Typesa_rogall7926Ainda não há avaliações

- Lesson 9 Cdi 4 PPT Traffic LightsDocumento21 páginasLesson 9 Cdi 4 PPT Traffic LightsGlady Mae LadesmaAinda não há avaliações

- Hybrid Modern Resume Template BlackDocumento4 páginasHybrid Modern Resume Template BlackSOFYAN HELMI PURBAAinda não há avaliações

- GFSI 2023 General ConditionsDocumento3 páginasGFSI 2023 General ConditionsJohnson ojofuAinda não há avaliações

- Gmail - Accenture Location DetailsDocumento3 páginasGmail - Accenture Location Detailsrithuik1598Ainda não há avaliações

- Introduction To E-CommerceDocumento3 páginasIntroduction To E-CommerceMartin MulwaAinda não há avaliações

- Types of Computer Networks: PAN, LAN, MAN and WANDocumento15 páginasTypes of Computer Networks: PAN, LAN, MAN and WANDeva T NAinda não há avaliações

- Wage TypeDocumento4 páginasWage TypeFareha RiazAinda não há avaliações

- Quick Reference Guide: Release 2.1 - January 2016 - COMPUNEL & Sons B.VDocumento19 páginasQuick Reference Guide: Release 2.1 - January 2016 - COMPUNEL & Sons B.VMuhammad AkramAinda não há avaliações

- Troubleshoot WLAN IssuesDocumento4 páginasTroubleshoot WLAN IssuesIvan Herrera CoronaAinda não há avaliações

- AuditingDocumento10 páginasAuditingRameez Abbasi100% (1)

- VSP IGW Allocation ReportDocumento18 páginasVSP IGW Allocation ReportJamil SakerAinda não há avaliações

- Bank Statement 2015 AugDocumento4 páginasBank Statement 2015 AugKaykay HendersonAinda não há avaliações

- BMMS 09 CognitiveRadioNetworks Part1Documento56 páginasBMMS 09 CognitiveRadioNetworks Part1fsAinda não há avaliações

- Topics in Preliminary for Highway and Railroad EngineeringDocumento15 páginasTopics in Preliminary for Highway and Railroad EngineeringRodin James GabrilloAinda não há avaliações

- Web Based and Online Application For Capstone and Thesis ProjectDocumento2 páginasWeb Based and Online Application For Capstone and Thesis ProjectEmil Tamayo0% (2)

- Abdul Razak.A S/O Moosa 632 (733) 12, POST MANGALPADY Uppala KasargodDocumento10 páginasAbdul Razak.A S/O Moosa 632 (733) 12, POST MANGALPADY Uppala Kasargodabdul razzakAinda não há avaliações

- Financial Analysis of SBI Bank PROJECT (MANSI)Documento110 páginasFinancial Analysis of SBI Bank PROJECT (MANSI)manan88% (8)

- EximwireDocumento10 páginasEximwireHanh ThongAinda não há avaliações

- Comparing Life Insurance Services of Public & Private SectorsDocumento22 páginasComparing Life Insurance Services of Public & Private SectorsHola GamerAinda não há avaliações

- Chapter+4+ +Audit+of+Receivables+ (Part+1)Documento10 páginasChapter+4+ +Audit+of+Receivables+ (Part+1)Dan MorettoAinda não há avaliações

- Your Guide to PNR Creation, Fares, Ticketing & GST EntriesDocumento13 páginasYour Guide to PNR Creation, Fares, Ticketing & GST EntriesMittal Travel Agency Rail TJKAinda não há avaliações

- AO 2016-0032 QS of Medical PositionsDocumento12 páginasAO 2016-0032 QS of Medical PositionsTotoDodongGus100% (10)

- Quotation: Navin Infrasolutions Pvt. LTD - SatnaDocumento2 páginasQuotation: Navin Infrasolutions Pvt. LTD - SatnaBalraj BawaAinda não há avaliações

- Home Helpers Home Care - Google SearchDocumento1 páginaHome Helpers Home Care - Google Searchrudy.upshawAinda não há avaliações

- EnglishDocumento20 páginasEnglishTimothy SheltonAinda não há avaliações

- Fundamentals of Accountancy, Business and Management 2: Quarter 2 - Module Week 1Documento9 páginasFundamentals of Accountancy, Business and Management 2: Quarter 2 - Module Week 1Joana Jean SuymanAinda não há avaliações

- A2 Form Indian BankDocumento2 páginasA2 Form Indian BankVoletiram Babu100% (2)