Escolar Documentos

Profissional Documentos

Cultura Documentos

Stock Valuation

Enviado por

Ahmed Raza MirDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Stock Valuation

Enviado por

Ahmed Raza MirDireitos autorais:

Formatos disponíveis

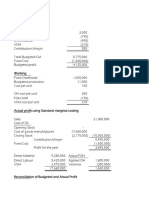

Prepared by: Muhammad Umar Munir

Share Valuation

IMPORTANT FORMULAE:

Dividend discount

model:

(Gordon model)

Components of expected

return:

P0

DIV0 (1 g )

E1 (1 b)

DIV1

OR P0

OR P0

rg

rg

rg

DIV1

g

P0

r Dividend yield Growth rate (Capital gain yield )

Growth rate:

g ROE retention ratio OR g

GROWTH RATE:

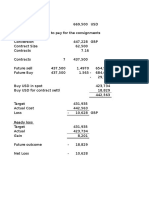

Following are the data related to Jax Ltd:

YEAR 1992 1993 1994 1995 1996

EPS

2.00 2.16 2.33 2.52 2.72

Calculate growth rate.

1997

2.94

1998

3.18

1999

3.43

n 1

EPS n

1

EPS 0

2000

3.70

2001

4.00

GROWTH RATE:

YEAR

1

2

DIVIDENDS 1.0700 1.1449

Calculate expected growth rate.

3

1.2250

BASICS:

1. DPS CALCULATION:

MegaCity Ltd has just paid dividend of Rs.1.5 per share. The dividend is expected to grow

5% for next three years and 10% thereafter for ever. Calculate expected dividends for next

five years.

2. CONSTANT GROWTH VALUATION:

Thomas Brothers is expected to pay dividend per share of 50 paisa next year. Dividend is

expected to grow at a constant rate of 7%. Calculate price of a share assuming require rate of

return is 15%.

[Answer: Rs.6.25]

3. CONSTANT GROWTH VALUATION:

Share of Haris Ltd is selling for Rs.20 per share. The stock has just paid a dividend of Rs.1

per share. This dividend is expected to grow at a constant rate of 10%. Calculate the

expected price of the stock after a year and required return on the stock.

[Answer: Rs.22, and 15.5%]

4. PREFERRED STOCK VALUATION:

FeeNest Ltd has preferred stock outstanding which pays dividend of Rs.5 per share. The

required rate of return on this stock is 8.33%. Calculate the price of preferred stock.

[Answer: Rs.60]

5. SUPERNORMAL GROWTH VALUATION:

A company currently pays a dividend of rupees two per share. It is estimated that the

companys dividend will grow at the rate of twenty percent for the next two years, and

thereafter at the rate of seven percent for ever. The company stock has a required rate of

twelve point three percent. At what price would you like to purchase the stock?

[Answer: Rs.50.5]

6. GROWTH RATE:

Current market price of X Ltds share is Rs.80. the stock is expected to have a year end

dividend per share of Rs.4/-. Required rate of return is 14%. Calculate the constant growth

rate.

-1-

Prepared by: Muhammad Umar Munir

Share Valuation

[Answer: 9%]

7. DECLINING RATE:

UNZ Ltd is facing considerable financial difficulties. As a result, the earnings and dividends

are falling at a constant annual rate of 5%. If required rate of return is 15% and current

dividend is Rs.5, calculate the market price of the share.

[Answer: Rs.23.75]

CONSTANT GROWTH VALUATION GORDON MODEL:

1. Rachel Gill is considering buying stock of MCT which is expected to pay an annual dividend

of Rs.5.877 next year. Dividends are expected to grow at 5.90% forever. Rachel Gill

proposes to hold the stock for the next couple of years and then sell it at fair market price. If

the required return is 13.37%, what should Rachel Gill pay for the stock?

[Answer: Rs.78.6747]

2. Wang Corp is expected to pay a dividend of Rs.1.068 next quarter. Dividends are expected

to grow at an annual growth rate of 5.50% compounded every quarter forever. If investors

require an annual return of 14.36% compounded every quarter on Wang Corp's stock, what

should the price of the stock be?

[Answer: Rs.48.2167]

3. Analysts' forecasts indicate that John Beere will pay a dividend of Rs.5.628 next year. You

expect the dividends to grow at 5.20% forever. What should you pay for the stock if you plan

to hold it for 6 years and then sell it at fair market price? Assume that the required rate of

return is 14.25%?

[Answer: Rs.62.18785]

GROWTH RATE:

1. SuperCard's stock has experienced a steady growth in its annual dividend. The last dividend

paid was Rs.4.95 per share. If shares of SuperCard are currently selling for Rs.50.09, and

the required rate of return on the stock is 16.19%, estimate the growth in dividends

experienced by SuperCard? This is also the capital gains yield on the stock.

[Answer: 5.74%]

2. Earth Mover has just paid a dividend of Rs.5.55. Investors require a return of 16.93% from

Earth Mover's stock. What constant growth rate in dividends (capital gains yield) would be

required for Earth Mover's stock to sell for Rs.49.73?

[Answer: 5.1905%]

3. Stock in IBP is selling for Rs.57.90 per share. IBP just paid a dividend of Rs.4.60 per share,

and the required return on similar stocks is 12.36%. Assuming that IBP's dividends will grow

at a constant rate in the future. Estimate the growth rate.

[Answer: 4.09%]

4. Micromedia have experienced a steady growth in its annual dividend. The next dividend is

expected to be Rs.5.500 per share. If shares of Micromedia are currently selling for

Rs.75.76, and the required rate of return on the stock is 12.03%, estimate the rate of growth

in dividends experienced by Micromedia? This is also the capital gains yield on the stock.

[Answer: 4.77%]

5. SS Publishing is expected to pay a dividend of Rs.4.677 next year. Investors require an

annual return of 16.06% from SS Publishing's stock. What constant growth rate in dividends

(capital gains yield) would be required for SS Publishing's stock to sell for Rs.38.56?

[Answer: 3.93%]

TEST YOUR SKILLS:

1. Analysts' forecasts indicate that World Travel will pay a quarterly dividend of Rs.0.864 next

period. They expect dividends to grow at an annual rate of growth of 4.76% compounded

every quarter forever. What should the price of World Travel's stock be if investors require an

annual return of 17.64% compounded quarterly?

2. Zachery Gomez plans to buy United Food stock that just paid a dividend of Rs.4.50. The

dividend is expected to grow at 9.62% for the next 2 years. At that point in time Zachery

Gomez proposes to sell the stock for Rs.61.03. If the required return on United Food's stock

is 14.57%, at what price should United Food's stock be selling today?

-2-

Você também pode gostar

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)Ainda não há avaliações

- Investment Analysis & Portfolio Management: Equity ValuationDocumento5 páginasInvestment Analysis & Portfolio Management: Equity ValuationNitesh Kirar100% (1)

- Accounting and Finance for Business Strategic PlanningNo EverandAccounting and Finance for Business Strategic PlanningAinda não há avaliações

- FM-Imp QuestionsDocumento2 páginasFM-Imp QuestionsPau GajjarAinda não há avaliações

- Exercise 1Documento2 páginasExercise 1Ketan AhirAinda não há avaliações

- Valuation Equity Shares Less Than 40 CharactersDocumento13 páginasValuation Equity Shares Less Than 40 CharactersSaraf Kushal100% (2)

- Problems SAPMDocumento4 páginasProblems SAPMSneha Swamy100% (1)

- Tutorial 7Documento5 páginasTutorial 7Jian Zhi TehAinda não há avaliações

- Financial Management Dividend ModelsDocumento10 páginasFinancial Management Dividend ModelsSavya Sachi50% (2)

- Advance Financial Management - Stocks Valuation Self Test ProblemDocumento2 páginasAdvance Financial Management - Stocks Valuation Self Test ProblemWaqar AhmadAinda não há avaliações

- Special Issues in Corporate FinanceDocumento6 páginasSpecial Issues in Corporate FinanceMD Hafizul Islam HafizAinda não há avaliações

- Sumit KishoreDocumento24 páginasSumit KishoreSumitAinda não há avaliações

- FM 2012 WorksheetDocumento9 páginasFM 2012 WorksheetBeing ShonuAinda não há avaliações

- Share Valuation Exercises - Session 8Documento1 páginaShare Valuation Exercises - Session 8Bhavana Lekshmidev Amrita Vishwa VidhyapeedamAinda não há avaliações

- Stock valuation problems using dividend discount modelDocumento1 páginaStock valuation problems using dividend discount modelJosine JonesAinda não há avaliações

- Quiz 4Documento1 páginaQuiz 4Hanny chandraAinda não há avaliações

- Stock Return and ValuationDocumento9 páginasStock Return and Valuationchinmay manjrekarAinda não há avaliações

- Financial Management 2E: Rajiv Srivastava - Dr. Anil MisraDocumento5 páginasFinancial Management 2E: Rajiv Srivastava - Dr. Anil MisraAnkit AgarwalAinda não há avaliações

- Assignment Questions SapmDocumento2 páginasAssignment Questions SapmKeerthini SadashivaAinda não há avaliações

- Tutorial 3Documento3 páginasTutorial 3Thuận Nguyễn Thị KimAinda não há avaliações

- Assignment # 6Documento9 páginasAssignment # 6Ahtsham Ilyas RajputAinda não há avaliações

- Tutorial StocksDocumento3 páginasTutorial StocksNguyên KhôiAinda não há avaliações

- Mergers & Acquisitions Qs on EPS, P/E, Exchange RatiosDocumento4 páginasMergers & Acquisitions Qs on EPS, P/E, Exchange RatiosRiya GargAinda não há avaliações

- Security Analysis and Valuation Blue Red Ink (1) - WatermarkDocumento22 páginasSecurity Analysis and Valuation Blue Red Ink (1) - WatermarkKishan RajyaguruAinda não há avaliações

- STOCK VALUATION TUTORIALDocumento3 páginasSTOCK VALUATION TUTORIALSen Siew Ling0% (1)

- Tutorial 3 For FM-IDocumento5 páginasTutorial 3 For FM-IarishthegreatAinda não há avaliações

- 01 Security Valuation - EquityDocumento11 páginas01 Security Valuation - Equitysoumyaduke700Ainda não há avaliações

- NajeebRehman 1505 14145 1/AFN ExamplesDocumento47 páginasNajeebRehman 1505 14145 1/AFN ExamplesQazi JunaidAinda não há avaliações

- Practice Problems 6Documento2 páginasPractice Problems 6zidan92Ainda não há avaliações

- BWFF2043 A201 Tutorial Topic 3Documento4 páginasBWFF2043 A201 Tutorial Topic 3Nur WahidaAinda não há avaliações

- Lesson 3 Module 3Documento2 páginasLesson 3 Module 3MukeshKumarAinda não há avaliações

- Share Bond ValuationDocumento2 páginasShare Bond ValuationRanganathchowdaryAinda não há avaliações

- Exercises On Stock ValuationDocumento3 páginasExercises On Stock ValuationFatin FathihahAinda não há avaliações

- TVM problems and solutionsDocumento2 páginasTVM problems and solutionsnitesh jainAinda não há avaliações

- Problems On Bond and Equity ValuationDocumento3 páginasProblems On Bond and Equity ValuationVishnu PrasannaAinda não há avaliações

- List of Favourite SFM Examination QuestionsDocumento12 páginasList of Favourite SFM Examination QuestionsAnkit RastogiAinda não há avaliações

- Tutorial Stocks - S2 - 2019.20Documento3 páginasTutorial Stocks - S2 - 2019.20Leo ChristAinda não há avaliações

- Business Finance Assignment EnaaDocumento4 páginasBusiness Finance Assignment EnaaEna Bandyopadhyay100% (1)

- Exercise-Stock ValuationDocumento2 páginasExercise-Stock Valuationchasnaa lidzamalihaAinda não há avaliações

- PM Quiz 6Documento7 páginasPM Quiz 6Daniyal NasirAinda não há avaliações

- 2 Stock ValuationDocumento9 páginas2 Stock Valuationmichaelbarbosa0265Ainda não há avaliações

- Cost of Capital - TaskDocumento15 páginasCost of Capital - TaskAmritesh MishraAinda não há avaliações

- Assignment 2 - Stock ValuationDocumento1 páginaAssignment 2 - Stock ValuationMary Yvonne AresAinda não há avaliações

- SFM MaterialDocumento106 páginasSFM MaterialAlok67% (3)

- Year DividendDocumento2 páginasYear DividendHimanshu SharmaAinda não há avaliações

- SFM Module 4Documento2 páginasSFM Module 4riddhisanghviAinda não há avaliações

- Dividend DecisionsDocumento3 páginasDividend DecisionsRatnadeep MitraAinda não há avaliações

- Corporate Finance Current Papers of Final Term PDFDocumento35 páginasCorporate Finance Current Papers of Final Term PDFZahid UsmanAinda não há avaliações

- Economic NumericalDocumento26 páginasEconomic NumericalSantosh ThapaAinda não há avaliações

- TVM Tutorial SolnDocumento3 páginasTVM Tutorial SolnPoornika AwasthiAinda não há avaliações

- Tutorial StocksDocumento3 páginasTutorial StocksViễn QuyênAinda não há avaliações

- Muqaddas Zulfiqar 30101 (B F)Documento9 páginasMuqaddas Zulfiqar 30101 (B F)Muqaddas ZulfiqarAinda não há avaliações

- Chapter 6 - ExercisesDocumento2 páginasChapter 6 - ExercisesNguyen Hoang Tram AnhAinda não há avaliações

- Cost of CapitalDocumento166 páginasCost of Capitalmruga_12350% (2)

- Dividend Policy: Kiran ThapaDocumento21 páginasDividend Policy: Kiran ThapaRajesh ShresthaAinda não há avaliações

- Basic Stock ValuationDocumento9 páginasBasic Stock Valuationdalila123a50% (2)

- d15 Hybrid f9 Q PDFDocumento8 páginasd15 Hybrid f9 Q PDFhelenxiaochingAinda não há avaliações

- Stock Market Today Tips - Book Profit On The Stock CMCDocumento21 páginasStock Market Today Tips - Book Profit On The Stock CMCNarnolia Securities LimitedAinda não há avaliações

- SFM Test 3 Ques1652597579Documento3 páginasSFM Test 3 Ques1652597579Nakul GoyalAinda não há avaliações

- Class Activity - Stock ValuationDocumento2 páginasClass Activity - Stock ValuationKHIZAR SAQIBAinda não há avaliações

- As Nov Dec 2017Documento5 páginasAs Nov Dec 2017Ahmed Raza MirAinda não há avaliações

- 289214169 عمرو اور سلیمانی خزانہ PDFDocumento235 páginas289214169 عمرو اور سلیمانی خزانہ PDFAhmed Raza MirAinda não há avaliações

- IFRS 10 Consolidated Financial IFRS 11 Joint Arrangements and IFRS 13 Fair ValueDocumento24 páginasIFRS 10 Consolidated Financial IFRS 11 Joint Arrangements and IFRS 13 Fair ValueAhmed Raza MirAinda não há avaliações

- Advanced Accounting and Financial ReportingDocumento6 páginasAdvanced Accounting and Financial ReportingAhmed Raza MirAinda não há avaliações

- E Voting Guide (ICAP - Overseas Members)Documento10 páginasE Voting Guide (ICAP - Overseas Members)Ahmed Raza MirAinda não há avaliações

- p4 Summary BookDocumento35 páginasp4 Summary BookAhmed Raza MirAinda não há avaliações

- NPV-IRR NewDocumento39 páginasNPV-IRR NewAhmed Raza MirAinda não há avaliações

- Ifrs11 Joint ArrangementsDocumento1 páginaIfrs11 Joint ArrangementsAhmed Raza MirAinda não há avaliações

- Ifrs11 Joint Arrangements PDFDocumento15 páginasIfrs11 Joint Arrangements PDFAhmed Raza MirAinda não há avaliações

- Ifrs11 Joint Arrangements PDFDocumento15 páginasIfrs11 Joint Arrangements PDFAhmed Raza MirAinda não há avaliações

- Practical Guide Ifrs10 and 12Documento33 páginasPractical Guide Ifrs10 and 12Ahmed Raza MirAinda não há avaliações

- FR 2 QuizDocumento14 páginasFR 2 QuizAhmed Raza MirAinda não há avaliações

- Grant Thornton Ifrs 10 Financial StatementsDocumento104 páginasGrant Thornton Ifrs 10 Financial StatementsAhmed Raza MirAinda não há avaliações

- Lecture4 Inv f06 604-InventoryDocumento63 páginasLecture4 Inv f06 604-InventoryRandy CavaleraAinda não há avaliações

- Financial AccountingDocumento42 páginasFinancial AccountingAhmed Raza MirAinda não há avaliações

- FAC2602 - Generally Accepted Accounting Stds Valuation of Financial InstrumentsDocumento32 páginasFAC2602 - Generally Accepted Accounting Stds Valuation of Financial InstrumentsAhmed Raza MirAinda não há avaliações

- Aik Aur OptionDocumento35 páginasAik Aur OptionAhmed Raza MirAinda não há avaliações

- Q6 Costing Today PaperDocumento2 páginasQ6 Costing Today PaperAhmed Raza MirAinda não há avaliações

- AssertionsDocumento2 páginasAssertionsAhmed Raza MirAinda não há avaliações

- PracticeDocumento6 páginasPracticeAhmed Raza MirAinda não há avaliações

- WaccDocumento44 páginasWaccAhmed Raza MirAinda não há avaliações

- Share-Based Payment: IFRS Standard 2Documento42 páginasShare-Based Payment: IFRS Standard 2Teja JurakAinda não há avaliações

- Corporate Dividend Policy InsightsDocumento7 páginasCorporate Dividend Policy InsightsAhmed Raza MirAinda não há avaliações

- Section e - QuestionsDocumento4 páginasSection e - QuestionsAhmed Raza MirAinda não há avaliações

- Section F - AnswersDocumento9 páginasSection F - AnswersAhmed Raza MirAinda não há avaliações

- Section F - QuestionsDocumento2 páginasSection F - QuestionsAhmed Raza MirAinda não há avaliações

- Solution: Part (A)Documento12 páginasSolution: Part (A)Ahmed Raza MirAinda não há avaliações

- PC EDocumento24 páginasPC EAhmed Raza MirAinda não há avaliações

- Solution: Part (A)Documento12 páginasSolution: Part (A)Ahmed Raza MirAinda não há avaliações

- Dominion MotorsDocumento9 páginasDominion MotorsAnimesh BanerjeeAinda não há avaliações

- Inventory Management, JIT, and Backflush Costing Key ConceptsDocumento57 páginasInventory Management, JIT, and Backflush Costing Key ConceptsnikkaaaAinda não há avaliações

- Macroeconomics Canadian 8th Edition Sayre Solutions Manual 1Documento9 páginasMacroeconomics Canadian 8th Edition Sayre Solutions Manual 1tyrone100% (52)

- WK 9 Elementary Treatment of Fiscal PolicyDocumento52 páginasWK 9 Elementary Treatment of Fiscal PolicyGODSTIME EGBO JOSEPHAinda não há avaliações

- UntitledDocumento6 páginasUntitledKunal NakumAinda não há avaliações

- SCM Chapter 14Documento21 páginasSCM Chapter 14Urmi Mehta100% (1)

- IFM Course Plan 2017Documento8 páginasIFM Course Plan 2017Eby Johnson C.Ainda não há avaliações

- CAGE Analysis and SWOT Help illy Prioritize International MarketsDocumento3 páginasCAGE Analysis and SWOT Help illy Prioritize International MarketsLaura Mercado50% (4)

- Marketing Analytics For Data-Rich Environments: Michel Wedel & P.K. KannanDocumento25 páginasMarketing Analytics For Data-Rich Environments: Michel Wedel & P.K. KannanAbhinandan ChatterjeeAinda não há avaliações

- Fundamental Analysis 12Documento5 páginasFundamental Analysis 12Pranay KolarkarAinda não há avaliações

- MBA-101 Internal and External EnvironmentDocumento19 páginasMBA-101 Internal and External EnvironmentinasapAinda não há avaliações

- Project IdentificationDocumento7 páginasProject Identificationsimmi33Ainda não há avaliações

- BITF19A024 - Economics - Supply PracticeDocumento6 páginasBITF19A024 - Economics - Supply PracticeAhmad NuttAinda não há avaliações

- Ecocomy at WarDocumento40 páginasEcocomy at Wargion trisaptoAinda não há avaliações

- 13 Costs ProductionDocumento54 páginas13 Costs ProductionAtif RaoAinda não há avaliações

- Small Business in Kenya PDFDocumento7 páginasSmall Business in Kenya PDFSenelwa Anaya100% (1)

- Plant Design and Economics Lect 1Documento46 páginasPlant Design and Economics Lect 1Negese TeklearegayAinda não há avaliações

- Micro & Macro EconomicsDocumento8 páginasMicro & Macro Economicsadnantariq_2004100% (1)

- Euroconstruct Country Report PDFDocumento2 páginasEuroconstruct Country Report PDFLauraAinda não há avaliações

- Dainik Jagran and Hindustan TimesDocumento7 páginasDainik Jagran and Hindustan TimesAnubhav SharmaAinda não há avaliações

- Marketing Plan (Handout)Documento16 páginasMarketing Plan (Handout)Grachel Gabrielle Enriquez67% (33)

- CAPE Economics SyllabusDocumento69 páginasCAPE Economics SyllabusDana Ali75% (4)

- Cost Behavior HandoutsDocumento4 páginasCost Behavior Handoutsjamhel25Ainda não há avaliações

- J.C. Laugee, DanoneDocumento10 páginasJ.C. Laugee, DanoneHynek BuresAinda não há avaliações

- Case Chapter 8Documento11 páginasCase Chapter 8jeremyAinda não há avaliações

- Interdependence and Gains From TradeDocumento5 páginasInterdependence and Gains From TradeDolphAinda não há avaliações

- M.A. EconomicsDocumento23 páginasM.A. EconomicsV.R RameswarAinda não há avaliações

- Dev of Petchem in ECERDocumento528 páginasDev of Petchem in ECERAnonymous E3sSdt851XAinda não há avaliações

- CaiaDocumento2 páginasCaiaOsiris316Ainda não há avaliações

- Law of Equi Marginal Utility - Powerpoint PresentationDocumento12 páginasLaw of Equi Marginal Utility - Powerpoint Presentationharshal misalAinda não há avaliações

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNo EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNota: 4.5 de 5 estrelas4.5/5 (14)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)No EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Nota: 4.5 de 5 estrelas4.5/5 (4)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassAinda não há avaliações

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000No EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Nota: 4.5 de 5 estrelas4.5/5 (86)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistNo EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistNota: 4.5 de 5 estrelas4.5/5 (73)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsAinda não há avaliações

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanNo EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanNota: 4.5 de 5 estrelas4.5/5 (79)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialAinda não há avaliações

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesNo EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesNota: 4.5 de 5 estrelas4.5/5 (30)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsAinda não há avaliações

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisNo EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisNota: 5 de 5 estrelas5/5 (6)

- Value: The Four Cornerstones of Corporate FinanceNo EverandValue: The Four Cornerstones of Corporate FinanceNota: 4.5 de 5 estrelas4.5/5 (18)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNo EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorAinda não há avaliações

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantNo EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantNota: 4 de 5 estrelas4/5 (104)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthNo EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthAinda não há avaliações

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityNo EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityNota: 4.5 de 5 estrelas4.5/5 (4)

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouNo EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouNota: 5 de 5 estrelas5/5 (5)

- Finance Basics (HBR 20-Minute Manager Series)No EverandFinance Basics (HBR 20-Minute Manager Series)Nota: 4.5 de 5 estrelas4.5/5 (32)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNota: 4.5 de 5 estrelas4.5/5 (32)

- Joy of Agility: How to Solve Problems and Succeed SoonerNo EverandJoy of Agility: How to Solve Problems and Succeed SoonerNota: 4 de 5 estrelas4/5 (1)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingNo EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingNota: 4.5 de 5 estrelas4.5/5 (17)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNo EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNota: 3.5 de 5 estrelas3.5/5 (8)

- The Best Team Wins: The New Science of High PerformanceNo EverandThe Best Team Wins: The New Science of High PerformanceAinda não há avaliações