Escolar Documentos

Profissional Documentos

Cultura Documentos

National Casualty Company v. Repheka Persadi, 11th Cir. (2014)

Enviado por

Scribd Government DocsDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

National Casualty Company v. Repheka Persadi, 11th Cir. (2014)

Enviado por

Scribd Government DocsDireitos autorais:

Formatos disponíveis

Case: 14-11933

Date Filed: 11/07/2014

Page: 1 of 8

[DO NOT PUBLISH]

IN THE UNITED STATES COURT OF APPEALS

FOR THE ELEVENTH CIRCIT

____________________________

No. 14-11933

Non-Argument Calendar

_____________________________

D.C. Docket No. 1:13-cv-01381-TWT

NATIONAL CASUALTY COMPANY,

Plaintiff Appellee,

versus

MELANIE PICKENS,

Defendant,

REPHEKA PERSADI,

by and through her legal guardian, Frank Persadi,

Defendant Appellant.

____________________________

Appeal from the United States District Court

for the Northern District of Georgia

_____________________________

(November 7, 2014)

Case: 14-11933

Date Filed: 11/07/2014

Page: 2 of 8

Before TJOFLAT, WILSON and ROSENBAUM, Circuit Judges.

PER CURIAM:

We conclude for the reasons stated by the District Court in its Opinion and

Order of April 4, 2014 (which is attached as an Appendix), that National Casualty

Company did not have a duty to defend, and thus did not have a duty to indemnify,

Melanie Pickens in the state court action brought against her by Repheka Persadi.

The District Courts judgment in favor of National Casualty Company is

accordingly

AFFIRMED.

Case: 14-11933

Date Filed: 11/07/2014

Page: 3 of 8

APPENDIX

OPINION AND ORDER

The Plaintiff National Casualty Company is seeking a declaratory judgment

regarding its obligations to defend and indemnify the Defendant Melanie Pickens. It is

before the Court on the Plaintiffs Motion for Summary Judgment [Doc. 16]. For the

reasons set forth below, the Motion for Summary Judgment [Doc. 16] is

GRANTED.

I. Background

The Defendant Repheka Persadi was a student at Hopewell Middle School from

2004 to 2007. (PLs Statement of Facts 2.) Persadi has been diagnosed with Downs

syndrome and suffers from other medical ailments. (Id.) The Defendant Melanie

Pickens was her special education teacher. (Id.) On November 21, 2012, Persadi filed suit

against Pickens, asserting a section 1983 claim as well as various state law claims.

(Id. 1, 5, 6.) Persadi alleged that Pickens had committed multiple shocking and

offensive acts, such as:

i. Screaming at Repheka and the other children on a daily basis;

ii. Burping in the faces of Repheka and the other children;

iii. Shaking her breasts and pressing them in the faces of Repheka and other

children;

iv. Pressing her buttocks into the faces of Repheka and the other children and

passing gas;

v. Cursing at Repheka and the other children;

vi. Often using vulgarities in front of Repheka and the other children; and

1

Case: 14-11933

Date Filed: 11/07/2014

Page: 4 of 8

vii. Spraying Repheka with Lysol and putting her out in the hallway after

Repheka passed gas in class.

(Id. 3.) Persadi alleged that these acts were committed with deliberate indifference

toward the rights of [Persadi] and with specific intent to injure her. (Id. 4.)

During the time period within which these alleged acts took place, the Plaintiff

National Casualty Company was an insurer for the Professional Association of

Georgia Educators. (Id. 9.) By letter dated February 19, 2013, the Plaintiff informed

Pickens that it would defend Pickens in the underlying action, but subject to a

reservation of rights. (Id. 8.) The Plaintiff then filed the current action requesting a

declaratory judgment that it has no obligation to defend Pickens in the underlying suit,

or indemnify her for any judgment therein. Specifically, the Plaintiff argues that three

exclusions in the insurance contract relieve it from any liability: the intentional acts

exclusion, the criminal acts exclusion, and the sexual misconduct exclusion.

Pickens did not answer the Complaint and has not filed a response to the motion.

Persadi filed an affidavit in response, as well as a brief which argues that the criminal acts

exception does not apply. Pickens did not file a response.

II. Legal Standard

Summary judgment is appropriate only when the pleadings, dispositions and

affidavits submitted by the parties show that no genuine issue of material fact exists and

that the movant is entitled to judgment as a matter of law. FED. R. CIV. P. 56(c). The

2

Case: 14-11933

Date Filed: 11/07/2014

Page: 5 of 8

court should view the evidence and any inferences that may be drawn in the light most

favorable to the nonmovant. Adickes v. S.H. Kress & Co., 398 U.S. 144, 158-59 (1970).

The party seeking summary judgment must first identify grounds that show the absence

of a genuine issue of material fact. Celotex Corp. v. Catrett, 477 U.S. 317, 323-24

(1986). The burden then shifts to the nonmovant, who must go beyond the pleadings

and present affirmative evidence to show that a genuine issue of material fact does

exist. Anderson v. Liberty Lobby, Inc., 477 U.S. 242, 257 (1986). A mere scintilla of

evidence supporting the opposing partys position will not suffice; there must be a

sufficient showing that the jury could reasonably find for that party. Walker v.

Darbv, 911 F.2d 1573, 1577 (11th Cir. 1990).

III. Discussion

If there is no duty to defend, there is no duty to indemnify. See, e.g., Shafe v.

Am. States Ins. Co., 288 Ga. App. 315, 317 (2007) ([A]n insurer's duty to defend is

broader than its duty to indemnify.); Sikirica v. Nationwide Ins. Co., 416 F.3d 214,

225 (3d Cir. 2005) (Because the duty to defend is broader than the duty to indemnify,

there is no duty to indemnify if there is no duty to defend.). Thus, the Court will

begin by determining whether the Plaintiff has a duty to defend Pickens in the lawsuit

brought against her by Persadi.

An insurer's duty to defend turns on the language of the insurance contract and the

allegations of the complaint asserted against the insured. City of Atlanta v. St. Paul

Case: 14-11933

Date Filed: 11/07/2014

Page: 6 of 8

Fire & Marine Ins. Co., 231 Ga. App. 206, 207 (1998). In Georgia, insurance is a

matter of contract, and the parties to an insurance policy are bound by its plain and

unambiguous terms. Richards v. Hanover Ins. Co., 250 Ga. 613, 614 (1983). [A]n

insurance company is . . . free to insure against certain risks while excluding others.

Continental Cas. Co. v. H.S.I. Financial Services. Inc., 266 Ga. 260, 262 (1996).

Although the provisions of an insurance policy will be construed against the insurer

when a part is susceptible of two constructions . . .if the language is unambiguous and

but one reasonable construction is possible, the court will enforce the contract as

written. Sapp v. State Farm Fire & Cas. Co., 226 Ga. App. 200, 201 (1997) (internal

quotation marks omitted). To excuse the duty to defend the petition must

unambiguously exclude coverage under the policy . . . and thus, the duty to defend

exists if the claim potentially comes within the policy. Penn-Am. Ins. Co. v. Disabled

Am. Veterans. Inc., 268 Ga. 564, 565 (1997) (internal citations omitted).

Here, the intentional acts exclusion relieves the Plaintiff of liability for all of

the acts that form the basis of Persadis claims against Pickens. This exclusion reads:

The Company shall not be obligated to make any payment or defend any

lawsuit in connection with any CLAIM against the insured arising from: . . .

J. an intentional act by. . . the insured, whether or not any resulting damages are

intended or foreseeable, except for such damages resulting from corporal

punishment of any student administered by or at the direction of the insured.

(Schlueter Aff., Ex. 1) (emphasis added). The acts which gave rise to Persadis

lawsuit were deliberate. Even though Persadi also asserted a negligence claim against

Case: 14-11933

Date Filed: 11/07/2014

Page: 7 of 8

Pickens, this claim nonetheless arises from Pickens intentional acts. Cf. Continental

Cas. Co., 266 Ga. at 262 ([C]overage need not be provided even though negligence

was asserted as a concurrent cause of the harm . . . because the harm clearly arose out of

conduct that was within the scope of an insurance policy exclusionary clause.);

Rucker v. Columbia Nat. Ins. Co., 307 Ga. App. 444, 447-48 (2010) (Rucker argues

that Taylors act of not performing a background check on Phillips was a negligent act

. . . [b]ecause Taylor intended to forego conducting a background check . . . the policy

did not provide coverage for the claim asserted.). 1

In response, Persadi first argues that summary judgment ought to be denied

because discovery may reveal that Pickens acts were not intentional . . . even though

her actions may have been sufficiently reckless and conscience-shocking to amount to

a . . .substantive due process violation. (Jones Aff. 5.) This argument

misunderstands the clear text of the insurance contract. For coverage to be excluded,

Pickens had to have intended the acts, not the consequences. Indeed, the contract

makes clear that it is immaterial whether any resulting damage was intended or

foreseeable. (See Schlueter Aff., Ex. 1.) Persadi never alleged in her complaint against

Pickens or in her Response brief here that Pickens acts were non-volitional.

Neither Persadi nor Pickens try to argue that Pickens acts constituted

corporal punishment.

Case: 14-11933

Date Filed: 11/07/2014

Page: 8 of 8

Second, Persadi argues that the criminal acts exclusion does not apply because

Pickens was found to be immune from criminal liability. (Persadis Resp. to Mot. for

Summ. J., at 3.) Even if this were true, the intentional acts exclusion still relieves the

Plaintiff of any liability in connection with Persadis lawsuit. Thus, the Plaintiff does not

have a duty to defend Pickens in the lawsuit brought by Persadi. Consequently, the

Plaintiff also has no duty to indemnify Pickens for any liability that may arise from

Persadis lawsuit.

IV. Conclusion

For these reasons, the Court GRANTS the Plaintiff National Casualty

Companys Motion for Summary Judgment [Doc. 16].

Você também pode gostar

- An Inexplicable Deception: A State Corruption of JusticeNo EverandAn Inexplicable Deception: A State Corruption of JusticeAinda não há avaliações

- Filed: Patrick FisherDocumento20 páginasFiled: Patrick FisherScribd Government DocsAinda não há avaliações

- Sphinx International v. National Union Fire, 412 F.3d 1224, 11th Cir. (2005)Documento10 páginasSphinx International v. National Union Fire, 412 F.3d 1224, 11th Cir. (2005)Scribd Government DocsAinda não há avaliações

- Defendant's Opposition To Plaintiff's Motion To Dismiss Defendant's CounterclaimDocumento23 páginasDefendant's Opposition To Plaintiff's Motion To Dismiss Defendant's CounterclaimPatrik NoheAinda não há avaliações

- No. 97-1282, 140 F.3d 222, 3rd Cir. (1998)Documento11 páginasNo. 97-1282, 140 F.3d 222, 3rd Cir. (1998)Scribd Government DocsAinda não há avaliações

- Allstate Insurance Company v. Renuka Prasad, Hemraj Prasad Chandra Palat Toreshwar Nauth, 991 F.2d 669, 11th Cir. (1993)Documento5 páginasAllstate Insurance Company v. Renuka Prasad, Hemraj Prasad Chandra Palat Toreshwar Nauth, 991 F.2d 669, 11th Cir. (1993)Scribd Government DocsAinda não há avaliações

- Sidney A. Clark v. Donald Taylor, 710 F.2d 4, 1st Cir. (1983)Documento14 páginasSidney A. Clark v. Donald Taylor, 710 F.2d 4, 1st Cir. (1983)Scribd Government DocsAinda não há avaliações

- Triple M Financing v. Univ. Underwriters, 10th Cir. (2006)Documento5 páginasTriple M Financing v. Univ. Underwriters, 10th Cir. (2006)Scribd Government DocsAinda não há avaliações

- United States Court of Appeals, Third CircuitDocumento7 páginasUnited States Court of Appeals, Third CircuitScribd Government DocsAinda não há avaliações

- United States v. Bedford, 536 F.3d 1148, 10th Cir. (2008)Documento17 páginasUnited States v. Bedford, 536 F.3d 1148, 10th Cir. (2008)Scribd Government DocsAinda não há avaliações

- Fitzgerald v. Expressway Sewerage, 177 F.3d 71, 1st Cir. (1999)Documento6 páginasFitzgerald v. Expressway Sewerage, 177 F.3d 71, 1st Cir. (1999)Scribd Government DocsAinda não há avaliações

- USCOURTS TXSD 4 - 13 CV 01857 0Documento19 páginasUSCOURTS TXSD 4 - 13 CV 01857 0Pranjal KushwahaAinda não há avaliações

- Lawrence L. Penny, Plaintiff-Apellee/cross-Appellant v. Louis O. Giuffrida, Director Federal Emergency Management Agency Defendant-Appellant/cross-Appellee, 897 F.2d 1543, 10th Cir. (1990)Documento9 páginasLawrence L. Penny, Plaintiff-Apellee/cross-Appellant v. Louis O. Giuffrida, Director Federal Emergency Management Agency Defendant-Appellant/cross-Appellee, 897 F.2d 1543, 10th Cir. (1990)Scribd Government DocsAinda não há avaliações

- City of Delray v. Agricultural Ins., 85 F.3d 1527, 11th Cir. (1996)Documento16 páginasCity of Delray v. Agricultural Ins., 85 F.3d 1527, 11th Cir. (1996)Scribd Government DocsAinda não há avaliações

- Allstate Insurance Co. v. Victor Ginsberg, 351 F.3d 473, 11th Cir. (2003)Documento17 páginasAllstate Insurance Co. v. Victor Ginsberg, 351 F.3d 473, 11th Cir. (2003)Scribd Government DocsAinda não há avaliações

- American Surety Company of New York v. Harvey S. Gold and Earl O. Dearmore, 375 F.2d 523, 10th Cir. (1967)Documento8 páginasAmerican Surety Company of New York v. Harvey S. Gold and Earl O. Dearmore, 375 F.2d 523, 10th Cir. (1967)Scribd Government DocsAinda não há avaliações

- United States Court of Appeals, Eleventh CircuitDocumento10 páginasUnited States Court of Appeals, Eleventh CircuitScribd Government DocsAinda não há avaliações

- Ronald C. Denis v. State Farm Life Insurance Company, 11th Cir. (2016)Documento5 páginasRonald C. Denis v. State Farm Life Insurance Company, 11th Cir. (2016)Scribd Government DocsAinda não há avaliações

- 09-09-2016 ECF 92 Taitz V Johnson - OrDER Granting 74 Motion To DismissDocumento8 páginas09-09-2016 ECF 92 Taitz V Johnson - OrDER Granting 74 Motion To DismissJack RyanAinda não há avaliações

- United States v. Phillip P. Tomasetta, 429 F.2d 978, 1st Cir. (1970)Documento5 páginasUnited States v. Phillip P. Tomasetta, 429 F.2d 978, 1st Cir. (1970)Scribd Government DocsAinda não há avaliações

- Not PrecedentialDocumento10 páginasNot PrecedentialScribd Government DocsAinda não há avaliações

- Westport Ins Co v. Lydia S Ulrich Test, 4th Cir. (2002)Documento8 páginasWestport Ins Co v. Lydia S Ulrich Test, 4th Cir. (2002)Scribd Government DocsAinda não há avaliações

- Federal Judge Dismisses Claim by Marybeth PazarasDocumento12 páginasFederal Judge Dismisses Claim by Marybeth PazarasNia TowneAinda não há avaliações

- Fidelity and Deposit Company of Maryland v. First Western Bank Robert Prevost, 978 F.2d 714, 1st Cir. (1992)Documento5 páginasFidelity and Deposit Company of Maryland v. First Western Bank Robert Prevost, 978 F.2d 714, 1st Cir. (1992)Scribd Government DocsAinda não há avaliações

- Herman M. Wolf v. Preferred Risk Life Insurance Co., 728 F.2d 1304, 10th Cir. (1984)Documento5 páginasHerman M. Wolf v. Preferred Risk Life Insurance Co., 728 F.2d 1304, 10th Cir. (1984)Scribd Government DocsAinda não há avaliações

- Robert Colton v. John B. Swain, and Third-Party v. Pacific Indemnity Co., A Corporation, Third-Party, 527 F.2d 296, 3rd Cir. (1975)Documento12 páginasRobert Colton v. John B. Swain, and Third-Party v. Pacific Indemnity Co., A Corporation, Third-Party, 527 F.2d 296, 3rd Cir. (1975)Scribd Government DocsAinda não há avaliações

- Restor-A-Dent Dental Laboratories, Inc. v. Certified Alloy Products, Inc., Unigard Mutual Insurance Company, Intervener-Appellant, 725 F.2d 871, 2d Cir. (1984)Documento10 páginasRestor-A-Dent Dental Laboratories, Inc. v. Certified Alloy Products, Inc., Unigard Mutual Insurance Company, Intervener-Appellant, 725 F.2d 871, 2d Cir. (1984)Scribd Government DocsAinda não há avaliações

- United States Court of Appeals, Third CircuitDocumento13 páginasUnited States Court of Appeals, Third CircuitScribd Government DocsAinda não há avaliações

- Harrington Response To Motion To Strike Affirmative DefensesDocumento19 páginasHarrington Response To Motion To Strike Affirmative DefensesRob Harrington100% (1)

- United States Court of Appeals, Third CircuitDocumento12 páginasUnited States Court of Appeals, Third CircuitScribd Government DocsAinda não há avaliações

- Brooklyn Law School v. The Aetna Casualty and Surety Company and Aetna Life & Casualty, Defendants, 849 F.2d 788, 2d Cir. (1988)Documento4 páginasBrooklyn Law School v. The Aetna Casualty and Surety Company and Aetna Life & Casualty, Defendants, 849 F.2d 788, 2d Cir. (1988)Scribd Government DocsAinda não há avaliações

- Not PrecedentialDocumento4 páginasNot PrecedentialScribd Government DocsAinda não há avaliações

- Eduardo Flores v. DeVry University, Inc., 11th Cir. (2014)Documento5 páginasEduardo Flores v. DeVry University, Inc., 11th Cir. (2014)Scribd Government DocsAinda não há avaliações

- Publish United States Court of Appeals Tenth Circuit: FiledDocumento23 páginasPublish United States Court of Appeals Tenth Circuit: FiledScribd Government DocsAinda não há avaliações

- National Casualty Co v. First State Insuranc, 430 F.3d 492, 1st Cir. (2005)Documento10 páginasNational Casualty Co v. First State Insuranc, 430 F.3d 492, 1st Cir. (2005)Scribd Government DocsAinda não há avaliações

- Global Naps, Inc. v. Federal Insurance, 336 F.3d 59, 1st Cir. (2003)Documento10 páginasGlobal Naps, Inc. v. Federal Insurance, 336 F.3d 59, 1st Cir. (2003)Scribd Government DocsAinda não há avaliações

- United States Court of Appeals, Tenth CircuitDocumento7 páginasUnited States Court of Appeals, Tenth CircuitScribd Government DocsAinda não há avaliações

- Allstate Insurance Company v. The 65 Security Plan, Lindemuth, Michael, 879 F.2d 90, 3rd Cir. (1989)Documento6 páginasAllstate Insurance Company v. The 65 Security Plan, Lindemuth, Michael, 879 F.2d 90, 3rd Cir. (1989)Scribd Government DocsAinda não há avaliações

- Lawd-1 - 2019-cv-01173-00014 Response by USIC PDFDocumento7 páginasLawd-1 - 2019-cv-01173-00014 Response by USIC PDFLaw of Self DefenseAinda não há avaliações

- United States District Court Southern District of Indiana Indianapolis DivisionDocumento11 páginasUnited States District Court Southern District of Indiana Indianapolis DivisionRenee CookAinda não há avaliações

- United States Court of Appeals, Ninth CircuitDocumento7 páginasUnited States Court of Appeals, Ninth CircuitScribd Government DocsAinda não há avaliações

- Adrienne Dilworth v. Metropolitan Life Insurance Company, 418 F.3d 345, 3rd Cir. (2005)Documento12 páginasAdrienne Dilworth v. Metropolitan Life Insurance Company, 418 F.3d 345, 3rd Cir. (2005)Scribd Government DocsAinda não há avaliações

- United States Court of Appeals, Third CircuitDocumento8 páginasUnited States Court of Appeals, Third CircuitScribd Government DocsAinda não há avaliações

- Response To Plaintiff's Motion To Compel PDFDocumento7 páginasResponse To Plaintiff's Motion To Compel PDFYou'reInBadHandsAinda não há avaliações

- Dennis Wiley, As Next of Friend, Parent, and Guardian of Trilby Wiley Dennis Wiley Elaine Wiley, His Wife v. State Farm Fire & Casualty Co. Floyd Wiley, JR, 995 F.2d 457, 3rd Cir. (1993)Documento18 páginasDennis Wiley, As Next of Friend, Parent, and Guardian of Trilby Wiley Dennis Wiley Elaine Wiley, His Wife v. State Farm Fire & Casualty Co. Floyd Wiley, JR, 995 F.2d 457, 3rd Cir. (1993)Scribd Government DocsAinda não há avaliações

- Doe V Austin Doc 30 Defendants Motion in ResponseDocumento17 páginasDoe V Austin Doc 30 Defendants Motion in ResponseDavid FoleyAinda não há avaliações

- United States Court of Appeals Third CircuitDocumento9 páginasUnited States Court of Appeals Third CircuitScribd Government DocsAinda não há avaliações

- Ronald N. Ashley v. City of Jackson, Mississippi, 464 U.S. 900 (1983)Documento5 páginasRonald N. Ashley v. City of Jackson, Mississippi, 464 U.S. 900 (1983)Scribd Government DocsAinda não há avaliações

- Pinkey White v. United States Fidelity and Guaranty Company, 356 F.2d 746, 1st Cir. (1966)Documento4 páginasPinkey White v. United States Fidelity and Guaranty Company, 356 F.2d 746, 1st Cir. (1966)Scribd Government DocsAinda não há avaliações

- United States Court of Appeals, First CircuitDocumento6 páginasUnited States Court of Appeals, First CircuitScribd Government DocsAinda não há avaliações

- Charles A. McKinsey v. Sentry Insurance, A Mutual Company, 986 F.2d 401, 10th Cir. (1993)Documento9 páginasCharles A. McKinsey v. Sentry Insurance, A Mutual Company, 986 F.2d 401, 10th Cir. (1993)Scribd Government DocsAinda não há avaliações

- Winnacunnet Coop v. National Union Fire, 84 F.3d 32, 1st Cir. (1996)Documento10 páginasWinnacunnet Coop v. National Union Fire, 84 F.3d 32, 1st Cir. (1996)Scribd Government DocsAinda não há avaliações

- Gratton Earl Moore v. United States, 432 F.2d 730, 3rd Cir. (1970)Documento16 páginasGratton Earl Moore v. United States, 432 F.2d 730, 3rd Cir. (1970)Scribd Government DocsAinda não há avaliações

- United States v. Frost, 10th Cir. (2009)Documento9 páginasUnited States v. Frost, 10th Cir. (2009)Scribd Government DocsAinda não há avaliações

- United States v. Robert Lee Green, A/K/A Hope, 636 F.2d 925, 4th Cir. (1980)Documento12 páginasUnited States v. Robert Lee Green, A/K/A Hope, 636 F.2d 925, 4th Cir. (1980)Scribd Government DocsAinda não há avaliações

- Sample Motion2QuashDocumento7 páginasSample Motion2QuashTodd Wetzelberger100% (2)

- Higinio Aponte v. American Surety Company of New York, Etc., 276 F.2d 678, 1st Cir. (1960)Documento4 páginasHiginio Aponte v. American Surety Company of New York, Etc., 276 F.2d 678, 1st Cir. (1960)Scribd Government DocsAinda não há avaliações

- United States v. Glen M. Stoddart, 574 F.2d 1050, 10th Cir. (1978)Documento5 páginasUnited States v. Glen M. Stoddart, 574 F.2d 1050, 10th Cir. (1978)Scribd Government DocsAinda não há avaliações

- United States v. Gary S. Stevens, 909 F.2d 431, 11th Cir. (1990)Documento8 páginasUnited States v. Gary S. Stevens, 909 F.2d 431, 11th Cir. (1990)Scribd Government DocsAinda não há avaliações

- United States Court of Appeals, Tenth CircuitDocumento4 páginasUnited States Court of Appeals, Tenth CircuitScribd Government DocsAinda não há avaliações

- United States v. Garcia-Damian, 10th Cir. (2017)Documento9 páginasUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- United States v. Kieffer, 10th Cir. (2017)Documento20 páginasUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Documento22 páginasConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- Apodaca v. Raemisch, 10th Cir. (2017)Documento15 páginasApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- United States v. Olden, 10th Cir. (2017)Documento4 páginasUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Documento100 páginasHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Documento21 páginasCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- Payn v. Kelley, 10th Cir. (2017)Documento8 páginasPayn v. Kelley, 10th Cir. (2017)Scribd Government Docs50% (2)

- Coyle v. Jackson, 10th Cir. (2017)Documento7 páginasCoyle v. Jackson, 10th Cir. (2017)Scribd Government Docs100% (1)

- Greene v. Tennessee Board, 10th Cir. (2017)Documento2 páginasGreene v. Tennessee Board, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- Wilson v. Dowling, 10th Cir. (2017)Documento5 páginasWilson v. Dowling, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- Brown v. Shoe, 10th Cir. (2017)Documento6 páginasBrown v. Shoe, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- Publish United States Court of Appeals For The Tenth CircuitDocumento10 páginasPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsAinda não há avaliações

- Pecha v. Lake, 10th Cir. (2017)Documento25 páginasPecha v. Lake, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- Publish United States Court of Appeals For The Tenth CircuitDocumento14 páginasPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- Publish United States Court of Appeals For The Tenth CircuitDocumento24 páginasPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsAinda não há avaliações

- United States v. Voog, 10th Cir. (2017)Documento5 páginasUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- United States v. Roberson, 10th Cir. (2017)Documento50 páginasUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- United States v. Kearn, 10th Cir. (2017)Documento25 páginasUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- Webb v. Allbaugh, 10th Cir. (2017)Documento18 páginasWebb v. Allbaugh, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Documento9 páginasNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- United States v. Windom, 10th Cir. (2017)Documento25 páginasUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- United States v. Kundo, 10th Cir. (2017)Documento7 páginasUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- Northglenn Gunther Toody's v. HQ8-10410-10450, 10th Cir. (2017)Documento10 páginasNorthglenn Gunther Toody's v. HQ8-10410-10450, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- United States v. Henderson, 10th Cir. (2017)Documento2 páginasUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- Pledger v. Russell, 10th Cir. (2017)Documento5 páginasPledger v. Russell, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- United States v. Muhtorov, 10th Cir. (2017)Documento15 páginasUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- United States v. Magnan, 10th Cir. (2017)Documento27 páginasUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- Publish United States Court of Appeals For The Tenth CircuitDocumento17 páginasPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsAinda não há avaliações

- United States v. Magnan, 10th Cir. (2017)Documento4 páginasUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- Criminal Law Book 1-2Documento198 páginasCriminal Law Book 1-2JV Regnin100% (1)

- Poblete Construction v. SSCDocumento1 páginaPoblete Construction v. SSCLoreen DanaoAinda não há avaliações

- wk6 VDA. DE AVILES Vs CAdocxDocumento4 páginaswk6 VDA. DE AVILES Vs CAdocxjoshAinda não há avaliações

- BIE2001: Law of Land Development Tutorial Week 1: Introduction To Land Administration System in Malaysia Lecturer: Dr. Hasniyati HamzahDocumento16 páginasBIE2001: Law of Land Development Tutorial Week 1: Introduction To Land Administration System in Malaysia Lecturer: Dr. Hasniyati HamzahSin YeeAinda não há avaliações

- USA vs. Roger StoneDocumento38 páginasUSA vs. Roger StoneAndy BeltAinda não há avaliações

- Ca2 ReviewerDocumento5 páginasCa2 ReviewerRAIZZA MAE BARZAAinda não há avaliações

- Angeles City v. Angeles City Electric CorporationDocumento2 páginasAngeles City v. Angeles City Electric CorporationCharlotte Francis Marie AmbasAinda não há avaliações

- Abakada Vs Purisima CaseDocumento1 páginaAbakada Vs Purisima CasemarwantahsinAinda não há avaliações

- Mactan Workers Union v. AboitizDocumento1 páginaMactan Workers Union v. AboitizNap GonzalesAinda não há avaliações

- NLRC jurisdiction over employee termination disputesDocumento2 páginasNLRC jurisdiction over employee termination disputesHeart NuqueAinda não há avaliações

- People v. SanidadDocumento3 páginasPeople v. SanidadSophiaFrancescaEspinosaAinda não há avaliações

- (PC) Thomas v. Madera County Department of Corrections Et Al - Document No. 7Documento4 páginas(PC) Thomas v. Madera County Department of Corrections Et Al - Document No. 7Justia.comAinda não há avaliações

- Richard R. Kreimer v. Bureau of Police for the Town of Morristown, Jay White, Former Chief of Police, Morristown J. Rota, D. McKim D. Widdas, D. Bowerbank, R. Gibbons, Kevin Mulholland, Police Officers, Morristown, David Manahan, Former Mayor of Morristown, Norman Bloch, Mayor of Morristown, Terrence J. Reidy, Morristown Business Administrator, Edward A. Taratko, Morris Township Business Administrator, Barbara Harris, Mayor of Morris Township, Joint Free Public Library of Morristown and Morris Township: The Library Board of Trustees, Elaine Weil, President of the Trustees, Barbara Rice, Library Director, B. Riesenfeld, Elaine Kissil, Donna Cole, Cathy Prince, Ann McDade Lois Demsky, Library Employees, All Individually and in Their Official Capacities, Capt. Walter Gensch. The Joint Free Public Library of Morristown and Morris Township Defendant-Third Party v. Travelers Insurance Company, and Travelers Indemnity Company, Third Party the Joint Free Public Library of Morristown and MorrisDocumento44 páginasRichard R. Kreimer v. Bureau of Police for the Town of Morristown, Jay White, Former Chief of Police, Morristown J. Rota, D. McKim D. Widdas, D. Bowerbank, R. Gibbons, Kevin Mulholland, Police Officers, Morristown, David Manahan, Former Mayor of Morristown, Norman Bloch, Mayor of Morristown, Terrence J. Reidy, Morristown Business Administrator, Edward A. Taratko, Morris Township Business Administrator, Barbara Harris, Mayor of Morris Township, Joint Free Public Library of Morristown and Morris Township: The Library Board of Trustees, Elaine Weil, President of the Trustees, Barbara Rice, Library Director, B. Riesenfeld, Elaine Kissil, Donna Cole, Cathy Prince, Ann McDade Lois Demsky, Library Employees, All Individually and in Their Official Capacities, Capt. Walter Gensch. The Joint Free Public Library of Morristown and Morris Township Defendant-Third Party v. Travelers Insurance Company, and Travelers Indemnity Company, Third Party the Joint Free Public Library of Morristown and MorrisScribd Government DocsAinda não há avaliações

- Raineri v. Hillsborough, 19 F.3d 1427, 1st Cir. (1994)Documento4 páginasRaineri v. Hillsborough, 19 F.3d 1427, 1st Cir. (1994)Scribd Government DocsAinda não há avaliações

- For Filing - Petition For Special Action Beaver Et Al V Ducey - FINALDocumento73 páginasFor Filing - Petition For Special Action Beaver Et Al V Ducey - FINALDanny Shapiro100% (1)

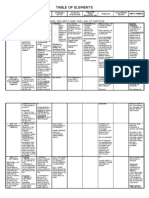

- CRIM2 Table of ElementsDocumento40 páginasCRIM2 Table of Elementssaintkarri100% (9)

- Jessie Earl Purvis v. James Crosby, 451 F.3d 734, 11th Cir. (2006)Documento13 páginasJessie Earl Purvis v. James Crosby, 451 F.3d 734, 11th Cir. (2006)Scribd Government DocsAinda não há avaliações

- Complaint - Leakey v. Setai Group and Jason TurnerDocumento9 páginasComplaint - Leakey v. Setai Group and Jason TurnerpospislawAinda não há avaliações

- Cerilla vs. LezamaDocumento2 páginasCerilla vs. LezamaFranchesca RevelloAinda não há avaliações

- Kilayko DigestDocumento2 páginasKilayko DigestCarol JacintoAinda não há avaliações

- Ortiz V ComelecDocumento2 páginasOrtiz V ComelecLuz Celine CabadingAinda não há avaliações

- City of Edgerton OrdinancesDocumento636 páginasCity of Edgerton OrdinancesCity of Edgerton100% (2)

- C2. Matibag vs. BenipayoDocumento2 páginasC2. Matibag vs. BenipayoAlit Dela CruzAinda não há avaliações

- RA ELECTRONICSTECH MANILA Oct2017 JG PDFDocumento110 páginasRA ELECTRONICSTECH MANILA Oct2017 JG PDFPhilBoardResultsAinda não há avaliações

- Appeal Against Conviction in Double Murder CaseDocumento19 páginasAppeal Against Conviction in Double Murder CaseManpreet Kaur MakhanAinda não há avaliações

- Petitioner RespondentDocumento8 páginasPetitioner RespondentEmAinda não há avaliações

- Rep Vs Tan DigestDocumento1 páginaRep Vs Tan DigestApril Joy Matudio Rabang - Baylosis100% (2)

- Ortega, Et Al. vs. CA, Et Al., 245 SCRA 529: VITUG, J.: G.R. No. 109248. July 3, 1995Documento3 páginasOrtega, Et Al. vs. CA, Et Al., 245 SCRA 529: VITUG, J.: G.R. No. 109248. July 3, 1995Marites regaliaAinda não há avaliações

- Crybaby Ryan Boylston Legal Threat ResponseDocumento3 páginasCrybaby Ryan Boylston Legal Threat Responsestephen6dibertAinda não há avaliações

- RescissionNotice Fin Charge COMPLAINTDocumento23 páginasRescissionNotice Fin Charge COMPLAINTLoanClosingAuditors100% (1)