Escolar Documentos

Profissional Documentos

Cultura Documentos

Pac Rep RRF 2005

Enviado por

L. A. PatersonTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Pac Rep RRF 2005

Enviado por

L. A. PatersonDireitos autorais:

Formatos disponíveis

.

'

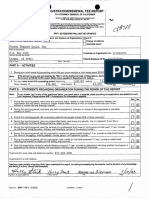

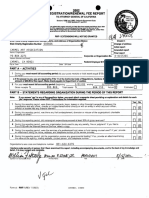

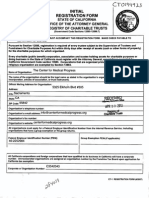

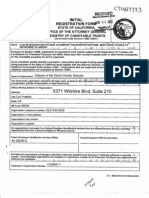

ANNUAL

REGISTRATION RENEWAL FEE REPORT

TO ATTORNEY GENERAL OF CALIFORNIA

IN

MAIL TO:

Registry of Charitable Trusts

P.O. Box 903447

Sacramento, CA 94203-4470

Telephone: (916) 445-2021

Sections 12586 and 12587, California Government Code

11 Cal. Code Regs. sections 301-307, 311 and 312

Failure to submit this report annually no later than four months and fifteen days after the

end of the organization's accounting period may result In the loss of tax exemption and

the assessment of a minimum tax of ~800. plus interest. andlor fines or filing penalties

as defined in Government Code Section 12586.1. IRS extensions will be honored.

WEBSITE ADDRESS:

http://ag.ca.gov/charities/

State Charity Registration Number

Pacific

Name

Check if:

Change of address

DAmended report

...

10--"'---'\---'_

...;5;;...;1;;;..1;;;....;..3..;;;8

Re

of Organization

ANNUAL REGISTRATION RENEWAL FEE SCHEDULE (11 Cal. Code Regs. sections 301-307, 311and 312)

Make Check Payable to Attorney General's Registry of Charitable Trusts

Gross Annual Revenue

Fee

Less than $25,000

Between $25,000 and $100,000

Fee

Gross Annual Revenue

$50

$75

Between $100,001and $250,000

Between $250,001 and $1 million

$25

Gross Annual Revenue

Fee

Between $1,000,001 and $10 million

Between $10,000,001 and $50 million

Greater than

$150

$225

PART A - ACTIVITIES

1/01/05

For your most recent full accounting period (beginning

Gross annual revenue

PART B - STATEMENTS

Note:

1 , 251 , 318 .

REGARDING

ending

Total assets

ORGANIZATION

12 / 31 / 0 5 ) list:

1,318,144.

DURING THE PERIOD OF THIS REPORT

If you answer 'yes' to any of the questions below, you must attach a separate sheet providing an explanation and details for each

'yes' response. Please review RRF-1 instructions for information required.

During this reporting period, were there any contracts, loans, leases or other financial transactions between the

organization and any officer, director or trustee thereof either directly or with an entity in which any such officer,

director or trustee had

financial interest?

period, was there any theft, embezzlement,

diversion

or misuse of the organization's

charitable

Duri

During this reporting period, were any organization funds used to pay any penalty,

Form 4720 with the Internal Revenue S

attach a

.

During this reporting period, were the services of a commercial fundraiser

purposes used? If 'yes,' provide an attachment listing the name, address,

service

i

During this reporting

the

of the

Duri

indi

Does the organization conduct a vehicle donation program? If 'yes,' provide an attachment indicating whether

the program is operated by the charity or whether the organiZation contracts with a commercial fundraiser for

charitable

.

enditures

fine or judgment?

this reporting period, did the organization

the number of raffles and the

nr.'n",rAn an audited

hold a raffle for charitable

occurred.

financial

statement

If you filed a

or fundraising counsel for charitable

and telephone number of the

period, did the organization receive any governmental funding?

rnaili

address contact

and

number.

Organization's

revenues?

exceed 50% of

purposes?

in accordance

If so, provide an attachment

If 'yes,' provide

with generally

listing

an attachment

accepted

accounting

e-mail address

I declare under penalty of perjury that I have examined this report, including accompanying documents, and to the best of my knowledge

and bel , it is true, correct and complete.

,

b ,ff',

CAVA9801L

08116/05

RRF'

(3.0/

"

DEC 0 7 2006

Attorney General's

Registry of Charitable Trusts

Você também pode gostar

- FTG RRF 2005Documento2 páginasFTG RRF 2005L. A. PatersonAinda não há avaliações

- Pac Rep RRF 2007Documento1 páginaPac Rep RRF 2007L. A. PatersonAinda não há avaliações

- Pac Rep RRF 2002Documento2 páginasPac Rep RRF 2002L. A. PatersonAinda não há avaliações

- Pac Rep RRF 2003Documento2 páginasPac Rep RRF 2003L. A. PatersonAinda não há avaliações

- FTG RRF 2003Documento2 páginasFTG RRF 2003L. A. PatersonAinda não há avaliações

- Caa RRF 2004Documento2 páginasCaa RRF 2004L. A. PatersonAinda não há avaliações

- Caa RRF 2012Documento1 páginaCaa RRF 2012L. A. PatersonAinda não há avaliações

- FTG RRF 2004Documento2 páginasFTG RRF 2004L. A. PatersonAinda não há avaliações

- FTG RRF 2006Documento1 páginaFTG RRF 2006L. A. PatersonAinda não há avaliações

- Pac Rep RRF 2006Documento1 páginaPac Rep RRF 2006L. A. PatersonAinda não há avaliações

- FTG RRF 2007Documento1 páginaFTG RRF 2007L. A. PatersonAinda não há avaliações

- SCC RRF 2010Documento2 páginasSCC RRF 2010L. A. PatersonAinda não há avaliações

- SCC RRF 2011Documento2 páginasSCC RRF 2011L. A. PatersonAinda não há avaliações

- FTG RRF 2001Documento2 páginasFTG RRF 2001L. A. PatersonAinda não há avaliações

- FTG RRF 2012Documento1 páginaFTG RRF 2012L. A. PatersonAinda não há avaliações

- FTG RRF 2002Documento2 páginasFTG RRF 2002L. A. PatersonAinda não há avaliações

- Pacrep RRF 2014Documento1 páginaPacrep RRF 2014L. A. PatersonAinda não há avaliações

- C SBTT (: Annual Registration Renewal Fee Report To Attorney General of CaliforniaDocumento1 páginaC SBTT (: Annual Registration Renewal Fee Report To Attorney General of CaliforniaL. A. PatersonAinda não há avaliações

- Caa RRF 2010Documento1 páginaCaa RRF 2010L. A. PatersonAinda não há avaliações

- FTG RRF 2009Documento1 páginaFTG RRF 2009L. A. PatersonAinda não há avaliações

- Caa RRF 2001Documento2 páginasCaa RRF 2001L. A. PatersonAinda não há avaliações

- Annual Registration Renewal Fee Report To Attorney General of CaliforniaDocumento1 páginaAnnual Registration Renewal Fee Report To Attorney General of CaliforniaagbufzbfAinda não há avaliações

- Istration/Renewal Fee Retort: JEL EL JEL JEL JEL JEL JEL JELDocumento1 páginaIstration/Renewal Fee Retort: JEL EL JEL JEL JEL JEL JEL JELL. A. PatersonAinda não há avaliações

- Pac Rep RRF 2009Documento2 páginasPac Rep RRF 2009L. A. PatersonAinda não há avaliações

- SCC RRF 2005Documento3 páginasSCC RRF 2005L. A. PatersonAinda não há avaliações

- Fomtnp RRF 2015Documento2 páginasFomtnp RRF 2015L. A. PatersonAinda não há avaliações

- Fomtnp RRF 2013Documento2 páginasFomtnp RRF 2013L. A. PatersonAinda não há avaliações

- SCC RRF 2004Documento3 páginasSCC RRF 2004L. A. PatersonAinda não há avaliações

- Caa RRF 2014Documento1 páginaCaa RRF 2014L. A. PatersonAinda não há avaliações

- FTG RRF 2013Documento1 páginaFTG RRF 2013L. A. PatersonAinda não há avaliações

- SCC RRF 2009Documento2 páginasSCC RRF 2009L. A. PatersonAinda não há avaliações

- Carmel Art Association PO BOX 2271 CARMEL, CA 93 921: Registration/Renewal Fee ReportDocumento1 páginaCarmel Art Association PO BOX 2271 CARMEL, CA 93 921: Registration/Renewal Fee ReportL. A. PatersonAinda não há avaliações

- FTG RRF 2000Documento1 páginaFTG RRF 2000L. A. PatersonAinda não há avaliações

- 2014 2015 Annual Registration Renewal Form RRF 1Documento2 páginas2014 2015 Annual Registration Renewal Form RRF 1Nyi Lwin HtetAinda não há avaliações

- Pac Rep RRF 2004Documento4 páginasPac Rep RRF 2004L. A. PatersonAinda não há avaliações

- Breast Cancer Survivors FoundationDocumento48 páginasBreast Cancer Survivors FoundationthereadingshelfAinda não há avaliações

- Center For Medical Progress California RegistrationDocumento10 páginasCenter For Medical Progress California RegistrationelicliftonAinda não há avaliações

- CWCS Founding DocumentsDocumento98 páginasCWCS Founding DocumentsWilliamsburg GreenpointAinda não há avaliações

- Clinton Foundation Revised Filing 2013Documento108 páginasClinton Foundation Revised Filing 2013Daily Caller News FoundationAinda não há avaliações

- Reporting Requirements For Charities and Not For Profit OrganizationsDocumento15 páginasReporting Requirements For Charities and Not For Profit OrganizationsRay Brooks100% (1)

- Oakland Community Land Trust - Founding Documents 1999Documento75 páginasOakland Community Land Trust - Founding Documents 1999auweia1Ainda não há avaliações

- Ag990 AnnualreportDocumento2 páginasAg990 AnnualreportDaniel_Johnson_1322Ainda não há avaliações

- Form CRI 200 Short Form Registration Verification Statement PDFDocumento5 páginasForm CRI 200 Short Form Registration Verification Statement PDFWen' George BeyAinda não há avaliações

- Period Covered Filing DeadlineDocumento10 páginasPeriod Covered Filing DeadlineHaftari HarmiAinda não há avaliações

- Public Health Council Annual Registration Renewal Fee Report To Attorney General of CaliforniaDocumento1 páginaPublic Health Council Annual Registration Renewal Fee Report To Attorney General of CaliforniaWAKESHEEP Marie RNAinda não há avaliações

- Request For Copy of Personal Income or Fiduciary Tax ReturnDocumento2 páginasRequest For Copy of Personal Income or Fiduciary Tax ReturnAsjsjsjsAinda não há avaliações

- Engagement Letter - The LabDocumento3 páginasEngagement Letter - The LabBaldovino VenturesAinda não há avaliações

- Ent Retention RequirementsDocumento22 páginasEnt Retention RequirementsDez ZaAinda não há avaliações

- Checklist For Starting A Kentucky NonprofitDocumento19 páginasChecklist For Starting A Kentucky NonprofitNancy Slonneger HancockAinda não há avaliações

- Ir524 PDFDocumento2 páginasIr524 PDFTiffany Morris0% (1)

- Onondaga County Legislator Timothy Burtis Financial Disclosure 2015Documento3 páginasOnondaga County Legislator Timothy Burtis Financial Disclosure 2015Michelle BreidenbachAinda não há avaliações

- Accounting 170Documento14 páginasAccounting 170cynthia reyesAinda não há avaliações

- CWCS AG RegistrationDocumento2 páginasCWCS AG RegistrationWilliamsburg GreenpointAinda não há avaliações

- RESPA Letter To GreentreeDocumento19 páginasRESPA Letter To GreentreeMark R.Ainda não há avaliações

- Engagement Letter For Business Bookkeeping and Tax PrepartionDocumento2 páginasEngagement Letter For Business Bookkeeping and Tax PrepartionPinky Daisies100% (1)

- Kurt Miller FinancialDocumento28 páginasKurt Miller FinancialThe Valley IndyAinda não há avaliações

- 10000002219Documento50 páginas10000002219Chapter 11 DocketsAinda não há avaliações

- rrf1 FormDocumento5 páginasrrf1 Formsalman_fbAinda não há avaliações

- Councilmember Announcements 12-03-18Documento1 páginaCouncilmember Announcements 12-03-18L. A. PatersonAinda não há avaliações

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocumento2 páginasCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonAinda não há avaliações

- Agenda City Council Special Meeting 12-03-18Documento3 páginasAgenda City Council Special Meeting 12-03-18L. A. PatersonAinda não há avaliações

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocumento2 páginasCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonAinda não há avaliações

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocumento5 páginasCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonAinda não há avaliações

- City of Carmel-By-The-Sea City Council AgendaDocumento5 páginasCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonAinda não há avaliações

- Appointments FORA 12-03-18Documento2 páginasAppointments FORA 12-03-18L. A. PatersonAinda não há avaliações

- Proclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18Documento2 páginasProclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18L. A. PatersonAinda não há avaliações

- MPRWA Agenda Packet 11-08-18Documento18 páginasMPRWA Agenda Packet 11-08-18L. A. PatersonAinda não há avaliações

- Appointments Monterey-Salinas Transit Board 12-03-18Documento2 páginasAppointments Monterey-Salinas Transit Board 12-03-18L. A. PatersonAinda não há avaliações

- Minutes City Council Special Meeting November 5, 2018 12-03-18Documento1 páginaMinutes City Council Special Meeting November 5, 2018 12-03-18L. A. PatersonAinda não há avaliações

- Agenda City Council 03-21-18Documento2 páginasAgenda City Council 03-21-18L. A. PatersonAinda não há avaliações

- Minutes Mprwa September 27, 2018Documento2 páginasMinutes Mprwa September 27, 2018L. A. PatersonAinda não há avaliações

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocumento4 páginasCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonAinda não há avaliações

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocumento3 páginasCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonAinda não há avaliações

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocumento2 páginasCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonAinda não há avaliações

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocumento5 páginasCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonAinda não há avaliações

- Monthly Reports September 2018 11-05-18Documento55 páginasMonthly Reports September 2018 11-05-18L. A. PatersonAinda não há avaliações

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocumento4 páginasCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonAinda não há avaliações

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocumento8 páginasCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonAinda não há avaliações

- Destruction of Certain Records 11-05-18Documento41 páginasDestruction of Certain Records 11-05-18L. A. PatersonAinda não há avaliações

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocumento4 páginasCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonAinda não há avaliações

- Special Meeting Minutes October 1, 2018 11-05-18Documento1 páginaSpecial Meeting Minutes October 1, 2018 11-05-18L. A. PatersonAinda não há avaliações

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocumento30 páginasCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonAinda não há avaliações

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocumento7 páginasCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonAinda não há avaliações

- MPRWA Agenda Packet 10-25-18Documento6 páginasMPRWA Agenda Packet 10-25-18L. A. PatersonAinda não há avaliações

- MPRWA Agenda Closed Session 10-25-18Documento1 páginaMPRWA Agenda Closed Session 10-25-18L. A. PatersonAinda não há avaliações

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocumento4 páginasCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonAinda não há avaliações

- Monthly Reports August 10-02-18Documento48 páginasMonthly Reports August 10-02-18L. A. PatersonAinda não há avaliações

- City Council Agenda 10-02-18Documento3 páginasCity Council Agenda 10-02-18L. A. PatersonAinda não há avaliações

- PNB Vs CADocumento1 páginaPNB Vs CARonabeth Bermudez CabañasAinda não há avaliações

- Membership in CompanyDocumento14 páginasMembership in CompanyXahra MirAinda não há avaliações

- Business Contacts Bulletin - May Sri LankaDocumento19 páginasBusiness Contacts Bulletin - May Sri LankaDurban Chamber of Commerce and IndustryAinda não há avaliações

- Yum BrandDocumento48 páginasYum BrandIbu HamidAinda não há avaliações

- Tax ReconDocumento12 páginasTax ReconArah Monica Dela TorreAinda não há avaliações

- KKN Kompania Di Gas I Petroli PDFDocumento2 páginasKKN Kompania Di Gas I Petroli PDFAnonymous 6NTlFCaAinda não há avaliações

- PUBCORP (Midterms Reviewer)Documento55 páginasPUBCORP (Midterms Reviewer)Mikey GoAinda não há avaliações

- Southwest Radical New Flight PlanDocumento11 páginasSouthwest Radical New Flight PlanjycheahAinda não há avaliações

- Cost of Capital1Documento33 páginasCost of Capital1Mark Levi CorpuzAinda não há avaliações

- CIBIL Report UnderstandingDocumento3 páginasCIBIL Report UnderstandingSujan NaikAinda não há avaliações

- RESEARCH PAPER - Growth Strategy of Mercedes BenzDocumento8 páginasRESEARCH PAPER - Growth Strategy of Mercedes Benzsanjana rao100% (1)

- NFIFWI - Circular Details - Print PreviewDocumento2 páginasNFIFWI - Circular Details - Print PreviewVijay KumarAinda não há avaliações

- Problem 1Documento2 páginasProblem 1Shaira BugayongAinda não há avaliações

- Senior Analyst 03.11Documento1 páginaSenior Analyst 03.11Nasim AkhtarAinda não há avaliações

- Research CaseDocumento3 páginasResearch Casenotes.mcpu100% (1)

- PolicySchedule 22140031190160379064 161948448Documento2 páginasPolicySchedule 22140031190160379064 161948448amitAinda não há avaliações

- August - September 2008 Issue 95Documento116 páginasAugust - September 2008 Issue 95cf34Ainda não há avaliações

- Case Analysis (AT&T Final) AnwerDocumento13 páginasCase Analysis (AT&T Final) AnwerAmmar KhanAinda não há avaliações

- Partnership, Agency & TrustDocumento34 páginasPartnership, Agency & TrustJohn Baja Gapol100% (2)

- Executive Summary: Organization StudyDocumento61 páginasExecutive Summary: Organization StudyImamjafar SiddiqAinda não há avaliações

- Chicago GSB EXP11 - Introduction To ConsultingDocumento51 páginasChicago GSB EXP11 - Introduction To ConsultingRafael CunhaAinda não há avaliações

- SearchFundPrimer August2010Documento94 páginasSearchFundPrimer August2010Hao ShiAinda não há avaliações

- Director Sales Industrial Management in NYC Resume Thomas HillDocumento2 páginasDirector Sales Industrial Management in NYC Resume Thomas HillThomasHill2Ainda não há avaliações

- EstateDocumento8 páginasEstateJessica Pama EstandarteAinda não há avaliações

- 33 Secrets of Super SuccessDocumento48 páginas33 Secrets of Super SuccessCarmen Ezcurra Rodriguez-Pastor0% (1)

- Kashif PTCL Final ReportDocumento167 páginasKashif PTCL Final Reportkashif ali0% (1)

- Certificate of Contribution: Optum Global Solutions (Philippines), Inc. Under Unitedhealth Group ("Company")Documento1 páginaCertificate of Contribution: Optum Global Solutions (Philippines), Inc. Under Unitedhealth Group ("Company")Grey Del PilarAinda não há avaliações

- Corporate Behavioural Finance Chap06Documento14 páginasCorporate Behavioural Finance Chap06zeeshanshanAinda não há avaliações

- District Sales ManagerDocumento2 páginasDistrict Sales Managerapi-77760664Ainda não há avaliações

- Commissioner of Internal Revenue vs. McGeorge Food Industries, Inc.Documento7 páginasCommissioner of Internal Revenue vs. McGeorge Food Industries, Inc.Jonjon BeeAinda não há avaliações