Escolar Documentos

Profissional Documentos

Cultura Documentos

3-4 Trusts

Enviado por

oddsey0713Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

3-4 Trusts

Enviado por

oddsey0713Direitos autorais:

Formatos disponíveis

3.

4 Trusts

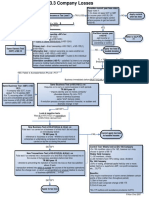

To whom the net income will be taxed depends on which beneficiary

has present entitlement or whether they are under legal disability

Nondiscretionary

Trust?

TRUSTS

NO

Discretionary

Trust?

YES

Indefeasible?

Interest that cannot be

brought to an end.

- Harmer v FCT

no

indefeasible interest

PRESENTLY

ENTITLED? (PE)

According to:

- FCT v Whiting

- Taylor v FCT

Vested?

Cloth with legal rights.

Vested in possession

right of present

enjoy (Gartside v IRC)

Vested in interest

right of future enjoy

YES

Deemed Present Entitlement? (DPE)

Did trustee exercise discretion in your

favour s101

YES

YES

Minors:

Tax-free

0-$416

417-1308

66%

>1307

45%

Legally disabled?

(LD)

- Minor (<18)

NO

-bankrupt

-unsound mind?

$1,325 tax-free when

combined with low-income

rebate of $600 s159N

Interest in possession?

There must be an immediate fixed right

of present or future enjoyments (but for

legal disability or not Taylor v FCT)

NO

YES

Resident?

YES

s97(1)

NLD + PE

Benef pay tax at

benef marg rate

NO

s98(2)

Trustee pay tax at

benef marg rate

Streaming of Dist TR92/13

Only allowed if:

1) Trust deed does not req mixing of income

2) Trustee accts for each type of income

3) Dist clearly reflected in trustees dist resolution

Other info

-Tax credits are according to beneficiaries dist, imputation

credits is dependent on trusts election

-Trust income retains character

-Company beneficiary receiving dividend will incur credit to

their franking acct

-Foreign income dist to non-resident is not assessable s98(4)

-Interest income to non-resident is not assessable s128D,

only subject to withholding tax of 10% s128B

-Franked dividends non-res not AI and no w/holding tax

s128D

-Unfranked dividends w/holding for non-res

Resident natural

person and not a

trustee?

YES

Legally disabled?

- Minor (<18)

-bankrupt

-unsound mind?

Resident?

NO

YES

s98(1)

LD + PE

trustee pay tax at

benef marg rate

NO

NO

s99/s99A

No one PE

- trustee pays tax at penal

rate (45% + 1.5%

YES

medicare levy)

No

s98(1), (3), (4)

Tax trustee

Does beneficiary

have vested and

indefeasible

interest?

s95A(2)

s97(1)

NLD + PE

Benef pay tax at

benef marg rate

NO

YES

s98(1), (3), (4)

Tax trustee

TAX LOSS or NET

INCOME? s95

TAX LOSS - calc assuming resident

individual

s97(1)

Benef pay tax

s98(1)

Trustee taxed

NET INCOME

Retained in the trust. Carried

forward to subsequent years.

Doherty v FCT

How do you calculate AI?

trust law income

- Income

(distributable income/profit)

tax law income

- Net Income

Accessing PY tax loss

-need to satisfy tests

according to trust type over

the test period CLP 94

Calculate proportionate share of income

and apply this percentage to net income

- Zeta Force Pty Ltd v FCT (authority for

net income > income)

Income injection test

CLP95

Family Trusts CLP 95

AI = [proportionate share of DI / DI] x NI

CGT Implications

A1 s104-10

-Transfer of property to trustee

-Declaration of trust in respect of asset

E1

- Further assets transferred to trustee

E2

E5 s104-75 (trustee makes

-Trust transfers to beneficiary

CG if MV > CB, CG passes to beneficiary s104-75(3))

Division 128: Deceased

-Deceased assets not assessed under CGT rules s128-10

-Main residence: acq @ MV at death

-Pre-CGT: acq @ MV @ death

-Post-CGT acq @ cost base

CGT event E4 s104-70

-CG/CB adj on non-assessable dist from unit/fixed trusts

1) Accting Y - taxable Y < CB of units

reduce CB by difference (AY-TY)

2) Accting Y - taxable Y > CB of units

CG on difference (CB vs AY-TY)

Ken Choi 2007

Você também pode gostar

- 1-4 Deductions FlowchartDocumento2 páginas1-4 Deductions Flowchartoddsey0713Ainda não há avaliações

- 1-8 GST - GST Payable or ITC AvalDocumento2 páginas1-8 GST - GST Payable or ITC Avaloddsey0713Ainda não há avaliações

- 1-5 Trading StockDocumento1 página1-5 Trading Stockoddsey0713Ainda não há avaliações

- 1-3 Assessable IncomeDocumento2 páginas1-3 Assessable Incomeoddsey0713Ainda não há avaliações

- Restrictions on franking creditsDocumento1 páginaRestrictions on franking creditsoddsey0713Ainda não há avaliações

- Does FBT Apply?: Div 13 ExclusionsDocumento1 páginaDoes FBT Apply?: Div 13 Exclusionsoddsey0713Ainda não há avaliações

- 3 5 PartnershipsDocumento1 página3 5 Partnershipsoddsey0713Ainda não há avaliações

- 2-3 Capital AllowancesDocumento1 página2-3 Capital Allowancesoddsey0713Ainda não há avaliações

- 3-3 Company LossesDocumento1 página3-3 Company Lossesoddsey0713Ainda não há avaliações

- 4-3 Part IVA General AntiAvoidanceDocumento1 página4-3 Part IVA General AntiAvoidanceoddsey0713Ainda não há avaliações

- 3-3 Div 7A Deemed Divs - VLDocumento1 página3-3 Div 7A Deemed Divs - VLoddsey0713Ainda não há avaliações

- 2-4,5 Capital WorksDocumento1 página2-4,5 Capital Worksoddsey0713Ainda não há avaliações

- T6 Chapter 5 Solutions To The Essential ActivitiesDocumento12 páginasT6 Chapter 5 Solutions To The Essential Activitiesoddsey0713Ainda não há avaliações

- Creating Effective Ads PPT 4 MGMTDocumento22 páginasCreating Effective Ads PPT 4 MGMToddsey0713Ainda não há avaliações

- Executing-The-Creative Design Elements and Layout Styles With ADS As ExamplesDocumento47 páginasExecuting-The-Creative Design Elements and Layout Styles With ADS As Examplesoddsey0713Ainda não há avaliações

- 2006 Planning EvalDocumento33 páginas2006 Planning EvalSanjay SahooAinda não há avaliações

- Case Summaries 1 193Documento54 páginasCase Summaries 1 193oddsey0713100% (1)

- T5 Chapters 4 and 8 Solutions To The Essential ActivitiesDocumento18 páginasT5 Chapters 4 and 8 Solutions To The Essential Activitiesoddsey0713Ainda não há avaliações

- T8 Chapters 9 and 7 Solutions To The Essential ActivitiesDocumento12 páginasT8 Chapters 9 and 7 Solutions To The Essential Activitiesoddsey0713Ainda não há avaliações

- T7 Chapter 6 Solutions To The Essential ActivitiesDocumento26 páginasT7 Chapter 6 Solutions To The Essential Activitiesoddsey0713Ainda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Non-Traditional Machining: Unit - 1Documento48 páginasNon-Traditional Machining: Unit - 1bunty231Ainda não há avaliações

- Sheikh Zayed Grand Mosque - Largest in UAEDocumento2 páginasSheikh Zayed Grand Mosque - Largest in UAEKyla SordillaAinda não há avaliações

- Ethical and Social Dimensions of Science and TechnologyDocumento26 páginasEthical and Social Dimensions of Science and TechnologyKlester Kim Sauro ZitaAinda não há avaliações

- Family Nursing Care PlanDocumento2 páginasFamily Nursing Care PlanSophia Ella OnanAinda não há avaliações

- Unit 6 ( CONSTRUCTION OF THE FLEXIBLE PAVEMENT )Documento19 páginasUnit 6 ( CONSTRUCTION OF THE FLEXIBLE PAVEMENT )Zara Nabilah87% (15)

- Watson Studio - IBM CloudDocumento2 páginasWatson Studio - IBM CloudPurvaAinda não há avaliações

- Service ManualDocumento14 páginasService ManualOlegAinda não há avaliações

- MCQ InflationDocumento6 páginasMCQ Inflationashsalvi100% (4)

- Natural Frequency of Axially Functionally Graded, Tapered Cantilever Beamswith Tip Masses MahmoudDocumento9 páginasNatural Frequency of Axially Functionally Graded, Tapered Cantilever Beamswith Tip Masses MahmoudDrm AmmAinda não há avaliações

- Orgin of Life and Organic EvolutionDocumento74 páginasOrgin of Life and Organic Evolutionasha.s.k100% (5)

- Architecture Vernacular TermsDocumento3 páginasArchitecture Vernacular TermsJustine Marie RoperoAinda não há avaliações

- User'S Manual: 1 - Installation 2 - Technical SpecificationsDocumento8 páginasUser'S Manual: 1 - Installation 2 - Technical SpecificationsGopal HegdeAinda não há avaliações

- (Macmillan Studies in Marketing Management) Frank Jefkins BSC (Econ), BA (Hons), MCAM, FIPR, MInstM, MAIE, ABC (Auth.) - Public Relations For Marketing Management-Palgrave Macmillan UK (1983)Documento193 páginas(Macmillan Studies in Marketing Management) Frank Jefkins BSC (Econ), BA (Hons), MCAM, FIPR, MInstM, MAIE, ABC (Auth.) - Public Relations For Marketing Management-Palgrave Macmillan UK (1983)Subhasis DasAinda não há avaliações

- Contract Management Software BenefitsDocumento9 páginasContract Management Software BenefitsYashas JaiswalAinda não há avaliações

- Small-Scale Fisheries Co-op ConstitutionDocumento37 páginasSmall-Scale Fisheries Co-op ConstitutionCalyn MusondaAinda não há avaliações

- Bildiri Sunum - 02Documento12 páginasBildiri Sunum - 02Orhan Veli KazancıAinda não há avaliações

- Case Study Series by Afterschoool - The Great Hotels of BikanerDocumento24 páginasCase Study Series by Afterschoool - The Great Hotels of BikanerKNOWLEDGE CREATORSAinda não há avaliações

- Sbi Home Loan InfoDocumento4 páginasSbi Home Loan InfoBhargavaSharmaAinda não há avaliações

- Computer Assisted Language LearningDocumento9 páginasComputer Assisted Language Learningapi-342801766Ainda não há avaliações

- Boosting BARMM Infrastructure for Socio-Economic GrowthDocumento46 páginasBoosting BARMM Infrastructure for Socio-Economic GrowthEduardo LongakitAinda não há avaliações

- Praveen Verma Auto CAD IntershipDocumento15 páginasPraveen Verma Auto CAD IntershipPraveen vermaAinda não há avaliações

- Sample COBOL ProgramsDocumento35 páginasSample COBOL Programsrahul tejAinda não há avaliações

- DIRECTORS1Documento28 páginasDIRECTORS1Ekta ChaudharyAinda não há avaliações

- Dialysis PowerpointDocumento10 páginasDialysis Powerpointapi-266328774Ainda não há avaliações

- Index and Sections Guide for Medical DocumentDocumento54 páginasIndex and Sections Guide for Medical DocumentCarlos AndrésAinda não há avaliações

- Voyager en DLRDocumento2 páginasVoyager en DLRlizxcanoAinda não há avaliações

- Application Sheet: Series CW SeriesDocumento2 páginasApplication Sheet: Series CW SerieskamalAinda não há avaliações

- Fa2prob3 1Documento3 páginasFa2prob3 1jayAinda não há avaliações

- Physics Chapter on Motion and Force EquationsDocumento2 páginasPhysics Chapter on Motion and Force EquationsMalikXufyanAinda não há avaliações

- L10: Factors that Affect a Pendulum's PeriodDocumento9 páginasL10: Factors that Affect a Pendulum's PeriodHeide CarrionAinda não há avaliações