Escolar Documentos

Profissional Documentos

Cultura Documentos

Jacob Sincoff, Inc. v. Commissioner of Internal Revenue, 209 F.2d 569, 2d Cir. (1953)

Enviado por

Scribd Government DocsDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Jacob Sincoff, Inc. v. Commissioner of Internal Revenue, 209 F.2d 569, 2d Cir. (1953)

Enviado por

Scribd Government DocsDireitos autorais:

Formatos disponíveis

209 F.

2d 569

JACOB SINCOFF, Inc.

v.

COMMISSIONER OF INTERNAL REVENUE.

No. 126.

Docket 22842.

United States Court of Appeals Second Circuit.

Argued December 16, 1953.

Decided December 31, 1953.

J. H. Landman, New York City (Nathan B. Kogan, New York City, of

counsel), for petitioner.

H. Brian Holland, Ellis N. Slack, Robert N. Anderson and James Q.

Riordan, Washington, D. C., for respondent.

Before CLARK, FRANK and HINCKS, Circuit Judges.

FRANK, Circuit Judge.

The facts are stated in the Findings and Opinion of the Tax Court, reported in

20 T.C. 288. With reference to the liability under 102, I.R.C. 26 U.S. C.A.

102, taxpayer had the burden of overcoming the effect not only of the

Commissioner's determination but also the additional burden created by 102

(c).1 On the basis of the Tax Court's findings, which are amply supported by

the evidence, taxpayer did not meet those requirements. Especially, as a

considerable part of the evidence consisted of oral testimony of witnesses seen

and heard by Judge Murdock, we cannot upset his findings, and we accept his

logically inferred legal conclusion.

We agree with the decision, and Judge Murdock's reasoning, that the margin

contract with the broker did not constitute indebtedness within I.R.C. 719(a)

(1), 26 U.S.C.A. 719(a) (1) and 35.719a of Regulation 112. We need only add

that we think the decision not at odds with Brewster Shirt Corp. v.

Commissioner, 2 Cir., 159 F.2d 227, 229. For there, in holding that a factoring

agreement constituted a "mortgage" within 719(a) (1), we said that to hold

otherwise would be "to subject Factoring Agreements to burdensome excess

profits taxes", and added: "Factoring Agreements are common enough but are

frequently entered into by persons of only moderate financial strength who

cannot obtain the money they need from commercial banks and must borrow at

higher cost from institutions having greater freedom in the risks they may take

when making loans. We cannot suppose that it was the intention of Congress to

subject security given under Factoring Agreements to a form of taxation which

would in effect discriminate against those arrangements in favor of secured

bank loans, especially when borrowers from Factors are a class frequently least

able to bear the burden." Obviously, such a rationale has no application to a

margin transaction with a broker.

3

Affirmed.

Notes:

1

Section 102(c) reads: "The fact that the earnings or profits of a corporation are

permitted to accumulate beyond the reasonable needs of the business shall be

determinative of the purpose to avoid surtax upon shareholders unless the

corporation by the clear preponderance of the evidence shall prove to the

contrary."

See also 102(b) which reads: "The fact that any corporation is a mere holding

or investment company shall be prima facie evidence of a purpose to avoid

surtax upon shareholders."

Você também pode gostar

- Pledger v. Russell, 10th Cir. (2017)Documento5 páginasPledger v. Russell, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- United States v. Garcia-Damian, 10th Cir. (2017)Documento9 páginasUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- Financial Analysis of Yahoo IncDocumento28 páginasFinancial Analysis of Yahoo IncSrinu GattuAinda não há avaliações

- Demolition Agenda: How Trump Tried to Dismantle American Government, and What Biden Needs to Do to Save ItNo EverandDemolition Agenda: How Trump Tried to Dismantle American Government, and What Biden Needs to Do to Save ItAinda não há avaliações

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Documento21 páginasCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- Bob Jessop - Fordism and Post-FordismDocumento22 páginasBob Jessop - Fordism and Post-Fordismqrs-ltd100% (1)

- Principles and Applications of Economics: Marc Lieberman, Robert E. Hall PDFDocumento93 páginasPrinciples and Applications of Economics: Marc Lieberman, Robert E. Hall PDFcompe100% (2)

- Publish United States Court of Appeals For The Tenth CircuitDocumento10 páginasPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsAinda não há avaliações

- HP Final... GRP 04Documento6 páginasHP Final... GRP 04Sowjanya Reddy PalagiriAinda não há avaliações

- Theories ExerciseDocumento1 páginaTheories ExerciseZeneah MangaliagAinda não há avaliações

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Documento22 páginasConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- Sison V AnchetaDocumento3 páginasSison V AnchetaRyan Vic AbadayanAinda não há avaliações

- Financial Performance Analysis SIP ProjectDocumento66 páginasFinancial Performance Analysis SIP Projectchhita mani soren100% (1)

- Lecture Notes On Philippines BudgetingDocumento9 páginasLecture Notes On Philippines Budgetingzkkoech92% (12)

- Mondelez ReportDocumento8 páginasMondelez ReportSrivathsanVaradan100% (1)

- PAS 2 InventoriesDocumento3 páginasPAS 2 InventoriesLary Lou Ventura100% (4)

- Commissioner v. Glenshaw Glass CoDocumento5 páginasCommissioner v. Glenshaw Glass CojAinda não há avaliações

- Ernest W. Brown, Inc. v. Commissioner of Internal Revenue, 258 F.2d 829, 2d Cir. (1958)Documento2 páginasErnest W. Brown, Inc. v. Commissioner of Internal Revenue, 258 F.2d 829, 2d Cir. (1958)Scribd Government DocsAinda não há avaliações

- General American Investors Co., Inc. v. Commissioner of Internal Revenue, 211 F.2d 522, 2d Cir. (1954)Documento4 páginasGeneral American Investors Co., Inc. v. Commissioner of Internal Revenue, 211 F.2d 522, 2d Cir. (1954)Scribd Government DocsAinda não há avaliações

- Redondo Construction v. Banco Exterior, 11 F.3d 3, 1st Cir. (1993)Documento5 páginasRedondo Construction v. Banco Exterior, 11 F.3d 3, 1st Cir. (1993)Scribd Government DocsAinda não há avaliações

- Waterman's Estate v. Commissioner of Internal Revenue, 195 F.2d 244, 2d Cir. (1952)Documento5 páginasWaterman's Estate v. Commissioner of Internal Revenue, 195 F.2d 244, 2d Cir. (1952)Scribd Government DocsAinda não há avaliações

- United States v. John C. Bruswitz and Edward C. Koenke, 219 F.2d 59, 2d Cir. (1955)Documento5 páginasUnited States v. John C. Bruswitz and Edward C. Koenke, 219 F.2d 59, 2d Cir. (1955)Scribd Government DocsAinda não há avaliações

- United States Court of Appeals Third CircuitDocumento5 páginasUnited States Court of Appeals Third CircuitScribd Government DocsAinda não há avaliações

- C. Ludwig Baumann & Co. v. Marcelle, Collector of Internal Revenue, 203 F.2d 459, 2d Cir. (1953)Documento5 páginasC. Ludwig Baumann & Co. v. Marcelle, Collector of Internal Revenue, 203 F.2d 459, 2d Cir. (1953)Scribd Government DocsAinda não há avaliações

- Geo. M. Still, Inc. v. Commissioner of Internal Revenue, 218 F.2d 639, 2d Cir. (1955)Documento2 páginasGeo. M. Still, Inc. v. Commissioner of Internal Revenue, 218 F.2d 639, 2d Cir. (1955)Scribd Government DocsAinda não há avaliações

- United States Court of Appeals, Third CircuitDocumento7 páginasUnited States Court of Appeals, Third CircuitScribd Government DocsAinda não há avaliações

- Ambassador Apartments, Inc. v. Commissioner of Internal Revenue, Louis Litoff and Rose Litoff v. Commissioner of Internal Revenue, 406 F.2d 288, 2d Cir. (1969)Documento3 páginasAmbassador Apartments, Inc. v. Commissioner of Internal Revenue, Louis Litoff and Rose Litoff v. Commissioner of Internal Revenue, 406 F.2d 288, 2d Cir. (1969)Scribd Government DocsAinda não há avaliações

- Commissioner of Internal Revenue v. Adam, Meldrum & Anderson Co., Inc, 215 F.2d 163, 2d Cir. (1954)Documento4 páginasCommissioner of Internal Revenue v. Adam, Meldrum & Anderson Co., Inc, 215 F.2d 163, 2d Cir. (1954)Scribd Government DocsAinda não há avaliações

- In The Matter of AMERICAN METAL PRODUCTS CO., Inc., Bankrupt. Arthur B. Weiss, Trustee-Appellant, Walter E. Heller Co., Inc., AppelleeDocumento6 páginasIn The Matter of AMERICAN METAL PRODUCTS CO., Inc., Bankrupt. Arthur B. Weiss, Trustee-Appellant, Walter E. Heller Co., Inc., AppelleeScribd Government DocsAinda não há avaliações

- Commissioner of Internal Revenue v. Glenshaw Glass Co. Commissioner of Internal Revenue v. William Goldman Theatres, IncDocumento8 páginasCommissioner of Internal Revenue v. Glenshaw Glass Co. Commissioner of Internal Revenue v. William Goldman Theatres, IncScribd Government DocsAinda não há avaliações

- United States Court of Appeals, Second Circuit.: No. 759. Docket 34693Documento4 páginasUnited States Court of Appeals, Second Circuit.: No. 759. Docket 34693Scribd Government DocsAinda não há avaliações

- Waynesboro Knitting Company v. Commissioner of Internal Revenue, 225 F.2d 477, 3rd Cir. (1955)Documento6 páginasWaynesboro Knitting Company v. Commissioner of Internal Revenue, 225 F.2d 477, 3rd Cir. (1955)Scribd Government DocsAinda não há avaliações

- Hanover Bank v. Commissioner, 369 U.S. 672 (1962)Documento13 páginasHanover Bank v. Commissioner, 369 U.S. 672 (1962)Scribd Government DocsAinda não há avaliações

- John M. Wiseman v. United States, 371 F.2d 816, 1st Cir. (1967)Documento3 páginasJohn M. Wiseman v. United States, 371 F.2d 816, 1st Cir. (1967)Scribd Government DocsAinda não há avaliações

- Commissioner of Internal Revenue v. George J. Schaefer, 240 F.2d 381, 2d Cir. (1957)Documento5 páginasCommissioner of Internal Revenue v. George J. Schaefer, 240 F.2d 381, 2d Cir. (1957)Scribd Government DocsAinda não há avaliações

- Plymouth Savings Bank v. United States Internal Revenue Service and Massachusetts Department of Revenue, 187 F.3d 203, 1st Cir. (1999)Documento9 páginasPlymouth Savings Bank v. United States Internal Revenue Service and Massachusetts Department of Revenue, 187 F.3d 203, 1st Cir. (1999)Scribd Government DocsAinda não há avaliações

- Business Development Corporation of Georgia, Inc. v. Hartford Fire Insurance Company, 747 F.2d 628, 11th Cir. (1984)Documento7 páginasBusiness Development Corporation of Georgia, Inc. v. Hartford Fire Insurance Company, 747 F.2d 628, 11th Cir. (1984)Scribd Government DocsAinda não há avaliações

- In Re Randall Clark Burns and Deborah A. Burns, Debtors. Citizens National Bank v. Randall Clark Burns, 894 F.2d 361, 10th Cir. (1990)Documento4 páginasIn Re Randall Clark Burns and Deborah A. Burns, Debtors. Citizens National Bank v. Randall Clark Burns, 894 F.2d 361, 10th Cir. (1990)Scribd Government DocsAinda não há avaliações

- Central Bank v. United States, 345 U.S. 639 (1953)Documento7 páginasCentral Bank v. United States, 345 U.S. 639 (1953)Scribd Government DocsAinda não há avaliações

- IRS v. Cousins, 209 F.3d 38, 1st Cir. (2000)Documento6 páginasIRS v. Cousins, 209 F.3d 38, 1st Cir. (2000)Scribd Government DocsAinda não há avaliações

- United States Court of Appeals, Third CircuitDocumento6 páginasUnited States Court of Appeals, Third CircuitScribd Government DocsAinda não há avaliações

- United States V Kirby LumberDocumento31 páginasUnited States V Kirby LumberKTAinda não há avaliações

- Key Research For Stars Motion To Vacate Judgment2Documento937 páginasKey Research For Stars Motion To Vacate Judgment2MelAinda não há avaliações

- Giles E. Bullock and Katherine D. Bullock v. Dana Latham, Commissioner of Internal Revenue, and E. C. Coyle, JR., District Director of Internal Revenue, 306 F.2d 45, 2d Cir. (1962)Documento6 páginasGiles E. Bullock and Katherine D. Bullock v. Dana Latham, Commissioner of Internal Revenue, and E. C. Coyle, JR., District Director of Internal Revenue, 306 F.2d 45, 2d Cir. (1962)Scribd Government DocsAinda não há avaliações

- United States Court of Appeals, Tenth CircuitDocumento5 páginasUnited States Court of Appeals, Tenth CircuitScribd Government DocsAinda não há avaliações

- Desvi, Inc., On Behalf of Itself and All Others Similarly Situated v. Continental Insurance Company, 968 F.2d 307, 3rd Cir. (1992)Documento4 páginasDesvi, Inc., On Behalf of Itself and All Others Similarly Situated v. Continental Insurance Company, 968 F.2d 307, 3rd Cir. (1992)Scribd Government DocsAinda não há avaliações

- Guaranty Trust Co. of New York v. United States, 192 F.2d 164, 2d Cir. (1951)Documento3 páginasGuaranty Trust Co. of New York v. United States, 192 F.2d 164, 2d Cir. (1951)Scribd Government DocsAinda não há avaliações

- The Motel Company v. The Commissioner of Internal Revenue, 340 F.2d 445, 2d Cir. (1965)Documento6 páginasThe Motel Company v. The Commissioner of Internal Revenue, 340 F.2d 445, 2d Cir. (1965)Scribd Government DocsAinda não há avaliações

- General Artists Corp. v. Commissioner of Internal Revenue, 205 F.2d 360, 2d Cir. (1953)Documento3 páginasGeneral Artists Corp. v. Commissioner of Internal Revenue, 205 F.2d 360, 2d Cir. (1953)Scribd Government DocsAinda não há avaliações

- The First National Bank of Birmingham v. W. E. Daniel, 239 F.2d 801, 1st Cir. (1956)Documento6 páginasThe First National Bank of Birmingham v. W. E. Daniel, 239 F.2d 801, 1st Cir. (1956)Scribd Government DocsAinda não há avaliações

- W. E. Daniel and E. A. Dillard v. The First National Bank of Birmingham, 228 F.2d 803, 1st Cir. (1956)Documento5 páginasW. E. Daniel and E. A. Dillard v. The First National Bank of Birmingham, 228 F.2d 803, 1st Cir. (1956)Scribd Government DocsAinda não há avaliações

- N. C. Freed Company, Inc., and International Roofing Corp. v. Board of Governors of The Federal Reserve System and Federal Trade Commission, 473 F.2d 1210, 2d Cir. (1973)Documento11 páginasN. C. Freed Company, Inc., and International Roofing Corp. v. Board of Governors of The Federal Reserve System and Federal Trade Commission, 473 F.2d 1210, 2d Cir. (1973)Scribd Government Docs100% (1)

- City Bank Farmers Trust Co. v. Helvering, 313 U.S. 121 (1941)Documento3 páginasCity Bank Farmers Trust Co. v. Helvering, 313 U.S. 121 (1941)Scribd Government DocsAinda não há avaliações

- American Dispenser Co., Inc. v. Commissioner of Internal Revenue, 396 F.2d 137, 2d Cir. (1968)Documento3 páginasAmerican Dispenser Co., Inc. v. Commissioner of Internal Revenue, 396 F.2d 137, 2d Cir. (1968)Scribd Government DocsAinda não há avaliações

- The L. B. Foster Company v. United States, 248 F.2d 389, 3rd Cir. (1957)Documento7 páginasThe L. B. Foster Company v. United States, 248 F.2d 389, 3rd Cir. (1957)Scribd Government DocsAinda não há avaliações

- United States Court of Appeals, Fourth CircuitDocumento4 páginasUnited States Court of Appeals, Fourth CircuitScribd Government DocsAinda não há avaliações

- Rushton v. State Bank of South, 164 F.3d 1338, 10th Cir. (1999)Documento11 páginasRushton v. State Bank of South, 164 F.3d 1338, 10th Cir. (1999)Scribd Government DocsAinda não há avaliações

- J. J. Dix, Inc. v. Commissioner of Internal Revenue, Estate of Jacob J. Dix, Deceased v. Commissioner of Internal Revenue, 223 F.2d 436, 2d Cir. (1955)Documento4 páginasJ. J. Dix, Inc. v. Commissioner of Internal Revenue, Estate of Jacob J. Dix, Deceased v. Commissioner of Internal Revenue, 223 F.2d 436, 2d Cir. (1955)Scribd Government DocsAinda não há avaliações

- In The Matter of Middle Atlantic Stud Welding Co., Bankrupt. Appeal of Tru-Fit Screw Products Corp, 503 F.2d 1133, 3rd Cir. (1974)Documento6 páginasIn The Matter of Middle Atlantic Stud Welding Co., Bankrupt. Appeal of Tru-Fit Screw Products Corp, 503 F.2d 1133, 3rd Cir. (1974)Scribd Government DocsAinda não há avaliações

- Nisqually Indian Tribe v. City of Centralia v. U.S. Dept. of Energy, Third-Party-Defendants v. Cullen & Cullen, 19 F.3d 28, 3rd Cir. (1994)Documento4 páginasNisqually Indian Tribe v. City of Centralia v. U.S. Dept. of Energy, Third-Party-Defendants v. Cullen & Cullen, 19 F.3d 28, 3rd Cir. (1994)Scribd Government DocsAinda não há avaliações

- United States v. G. E. Hall and Christine B. Hall, G. E. Hall and Christine B. Hall, Cross-Appellants v. United States of America, Cross-Appellee, 307 F.2d 238, 10th Cir. (1962)Documento7 páginasUnited States v. G. E. Hall and Christine B. Hall, G. E. Hall and Christine B. Hall, Cross-Appellants v. United States of America, Cross-Appellee, 307 F.2d 238, 10th Cir. (1962)Scribd Government DocsAinda não há avaliações

- N. Louis Stone v. Commissioner of Internal Revenue, 360 F.2d 737, 1st Cir. (1966)Documento6 páginasN. Louis Stone v. Commissioner of Internal Revenue, 360 F.2d 737, 1st Cir. (1966)Scribd Government DocsAinda não há avaliações

- Louie E. Nalley v. Patsy D. Nalley, Joyce F. Blanton v. Patsy D. Nalley, 53 F.3d 649, 4th Cir. (1995)Documento8 páginasLouie E. Nalley v. Patsy D. Nalley, Joyce F. Blanton v. Patsy D. Nalley, 53 F.3d 649, 4th Cir. (1995)Scribd Government DocsAinda não há avaliações

- Lillie B. Cowan, Counter-Defendant v. Miles Rich Chrysler-Plymouth, Counter-Claimant, 885 F.2d 801, 11th Cir. (1989)Documento5 páginasLillie B. Cowan, Counter-Defendant v. Miles Rich Chrysler-Plymouth, Counter-Claimant, 885 F.2d 801, 11th Cir. (1989)Scribd Government DocsAinda não há avaliações

- Standard MacHinery Co. v. Duncan Shaw Corp., 208 F.2d 61, 1st Cir. (1953)Documento6 páginasStandard MacHinery Co. v. Duncan Shaw Corp., 208 F.2d 61, 1st Cir. (1953)Scribd Government DocsAinda não há avaliações

- Benjamin A. Stratmore and Helen Stratmore v. United States, 420 F.2d 461, 3rd Cir. (1970)Documento17 páginasBenjamin A. Stratmore and Helen Stratmore v. United States, 420 F.2d 461, 3rd Cir. (1970)Scribd Government DocsAinda não há avaliações

- United States Court of Appeals Third CircuitDocumento5 páginasUnited States Court of Appeals Third CircuitScribd Government DocsAinda não há avaliações

- Filed: Patrick FisherDocumento12 páginasFiled: Patrick FisherScribd Government DocsAinda não há avaliações

- United States Court of Appeals, Tenth CircuitDocumento7 páginasUnited States Court of Appeals, Tenth CircuitScribd Government DocsAinda não há avaliações

- Capitol Indemnity v. Superior Management, 4th Cir. (2002)Documento7 páginasCapitol Indemnity v. Superior Management, 4th Cir. (2002)Scribd Government DocsAinda não há avaliações

- American-La France-Foamite Corporation v. Commissioner of Internal Revenue, 284 F.2d 723, 2d Cir. (1960)Documento5 páginasAmerican-La France-Foamite Corporation v. Commissioner of Internal Revenue, 284 F.2d 723, 2d Cir. (1960)Scribd Government DocsAinda não há avaliações

- Luis and Margaret Vega, Individually and On Behalf of Others Similarly Situated v. First Federal Savings & Loan Association of Detroit, 622 F.2d 918, 1st Cir. (1980)Documento13 páginasLuis and Margaret Vega, Individually and On Behalf of Others Similarly Situated v. First Federal Savings & Loan Association of Detroit, 622 F.2d 918, 1st Cir. (1980)Scribd Government DocsAinda não há avaliações

- Resolution Trust Corporation in Its Capacity As Receiver For Bell Federal Savings Bank v. John L. Daddona, SR., Judy Daddona and Daniel Culnen, 9 F.3d 312, 3rd Cir. (1993)Documento14 páginasResolution Trust Corporation in Its Capacity As Receiver For Bell Federal Savings Bank v. John L. Daddona, SR., Judy Daddona and Daniel Culnen, 9 F.3d 312, 3rd Cir. (1993)Scribd Government DocsAinda não há avaliações

- First Heritage National Bank v. Luke Keith and Margaret Keith, 902 F.2d 33, 1st Cir. (1990)Documento7 páginasFirst Heritage National Bank v. Luke Keith and Margaret Keith, 902 F.2d 33, 1st Cir. (1990)Scribd Government DocsAinda não há avaliações

- Niles-Bement-Pond Co. v. Fitzpatrick, 213 F.2d 305, 2d Cir. (1954)Documento12 páginasNiles-Bement-Pond Co. v. Fitzpatrick, 213 F.2d 305, 2d Cir. (1954)Scribd Government DocsAinda não há avaliações

- Coyle v. Jackson, 10th Cir. (2017)Documento7 páginasCoyle v. Jackson, 10th Cir. (2017)Scribd Government Docs100% (1)

- Payn v. Kelley, 10th Cir. (2017)Documento8 páginasPayn v. Kelley, 10th Cir. (2017)Scribd Government Docs50% (2)

- United States v. Kieffer, 10th Cir. (2017)Documento20 páginasUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- United States v. Olden, 10th Cir. (2017)Documento4 páginasUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- Greene v. Tennessee Board, 10th Cir. (2017)Documento2 páginasGreene v. Tennessee Board, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- Brown v. Shoe, 10th Cir. (2017)Documento6 páginasBrown v. Shoe, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- Wilson v. Dowling, 10th Cir. (2017)Documento5 páginasWilson v. Dowling, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Documento100 páginasHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- United States v. Kearn, 10th Cir. (2017)Documento25 páginasUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- Publish United States Court of Appeals For The Tenth CircuitDocumento24 páginasPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsAinda não há avaliações

- Publish United States Court of Appeals For The Tenth CircuitDocumento14 páginasPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- Pecha v. Lake, 10th Cir. (2017)Documento25 páginasPecha v. Lake, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- Apodaca v. Raemisch, 10th Cir. (2017)Documento15 páginasApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- United States v. Voog, 10th Cir. (2017)Documento5 páginasUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- United States v. Roberson, 10th Cir. (2017)Documento50 páginasUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- Northglenn Gunther Toody's v. HQ8-10410-10450, 10th Cir. (2017)Documento10 páginasNorthglenn Gunther Toody's v. HQ8-10410-10450, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- United States v. Windom, 10th Cir. (2017)Documento25 páginasUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- Webb v. Allbaugh, 10th Cir. (2017)Documento18 páginasWebb v. Allbaugh, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Documento9 páginasNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- United States v. Muhtorov, 10th Cir. (2017)Documento15 páginasUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- United States v. Magnan, 10th Cir. (2017)Documento27 páginasUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- United States v. Henderson, 10th Cir. (2017)Documento2 páginasUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- Publish United States Court of Appeals For The Tenth CircuitDocumento17 páginasPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsAinda não há avaliações

- United States v. Magnan, 10th Cir. (2017)Documento4 páginasUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

- United States v. Kundo, 10th Cir. (2017)Documento7 páginasUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsAinda não há avaliações

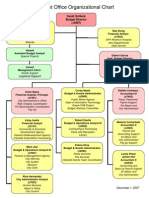

- Oakland City Budget Office Org Chart Dec 2007Documento1 páginaOakland City Budget Office Org Chart Dec 2007oaklocAinda não há avaliações

- 648 Sula Vineyards B Sustainable GrowthDocumento20 páginas648 Sula Vineyards B Sustainable GrowthRahul RahatalAinda não há avaliações

- Thesis BBS 4th Year Profitability Analysis of NEA Rashi FINALEDocumento47 páginasThesis BBS 4th Year Profitability Analysis of NEA Rashi FINALERashi Goyal100% (1)

- Optimal Taxation Lecture (34 - 37) Topics: NPTEL-Economics-Public EconomicsDocumento7 páginasOptimal Taxation Lecture (34 - 37) Topics: NPTEL-Economics-Public EconomicsAnonymous H8AZMsAinda não há avaliações

- Hilton 13e SM Ch07Documento72 páginasHilton 13e SM Ch07tttAinda não há avaliações

- Theories of Financial ManagementDocumento5 páginasTheories of Financial ManagementZehraAbdulAzizAinda não há avaliações

- 2022 ICTSI Balance Sheet Income Statement - pg.53Documento1 página2022 ICTSI Balance Sheet Income Statement - pg.53loveartxoxo.commissionAinda não há avaliações

- Financial Statement Analysis: - FocusDocumento12 páginasFinancial Statement Analysis: - FocuspfeAinda não há avaliações

- Wateen Telecom 19-04-10Documento3 páginasWateen Telecom 19-04-10Muhammad BilalAinda não há avaliações

- Accounting II FinalDocumento6 páginasAccounting II FinalPak KhAinda não há avaliações

- Accounting For General Long-Term Liabilities and Debt ServiceDocumento50 páginasAccounting For General Long-Term Liabilities and Debt Serviceመስቀል ኃይላችን ነውAinda não há avaliações

- Contract of LeaseDocumento2 páginasContract of Leaseric releAinda não há avaliações

- VAT 100 PrintDocumento3 páginasVAT 100 PrintSwamy HNAinda não há avaliações

- 53.income Tax Compliance Check ListDocumento5 páginas53.income Tax Compliance Check ListmercatuzAinda não há avaliações

- Teresita Buenaflor ShoesDocumento13 páginasTeresita Buenaflor ShoesThe Phoebie JhemAinda não há avaliações

- MCQs On Taxation LawDocumento18 páginasMCQs On Taxation LawAli Asghar RindAinda não há avaliações

- 5 6145300324501422422 PDFDocumento3 páginas5 6145300324501422422 PDFBeverly MindoroAinda não há avaliações

- Prulife Vs CirDocumento12 páginasPrulife Vs CirERWINLAV2000Ainda não há avaliações

- Far110full 140911091633 Phpapp02Documento56 páginasFar110full 140911091633 Phpapp02Is FarezAinda não há avaliações