Escolar Documentos

Profissional Documentos

Cultura Documentos

Taxation Trends in The European Union - 2012 29

Enviado por

Dimitris ArgyriouTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Taxation Trends in The European Union - 2012 29

Enviado por

Dimitris ArgyriouDireitos autorais:

Formatos disponíveis

Part I

Overall tax revenue

Box 1.3:

VAT revenue ratio

The VAT revenue ratio consists of actual VAT revenues collected (VATrev) divided by the product of the VAT standard rate

(VATrate) and net final consumption, i.e. final consumption expenditure (P3) minus VAT receipts:

O

v

e

r

a

l

l

VAT revenue ratio =

VATrev

.

VATrate ( P3 VATrev )

A low value of the ratio suggests that exemptions, reduced rates, or tax evasion have a significant impact.

The VAT revenues collected are reported in Table 7 of Annex A and the VAT standard rates are provided in Table 1.1 of the

general part of this report. The final consumption expenditure (P3) includes the household final consumption expenditure

(private consumption), non-profit institutions serving households (NPISH) final consumption expenditure and general

government final consumption expenditure (general government consumption). Total final consumption expenditure data can be

downloaded from Eurostat [nama_fcs_c].

t

a

x

r

e

v

e

n

u

e

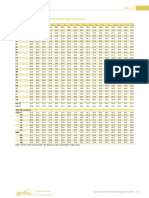

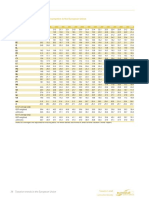

Table 1.1: VAT rates in the Member States

2000-2012, in %

Member State

BE

BG

CZ

DK

DE

EE

IE

EL

ES

FR

IT

CY

LV

LT

LU

HU

MT

NL

AT

PL

PT

RO

SI

SK

FI

SE

UK

EU-27

Note:

VAT rate

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

Reduced

Standard

2000

21

6/12

20

22

5

25

16

7

18

5

21

12.5

18

8

16

7

19.6

5.5

20

10

10

5

18

18

5

15

6/12

25

0/12

15

5

17.5

6

20

10

22

7

17

5/12

19

19

8

23

10

22

8/17

25

6/12

17.5

5

19.2

(4.2)

(4)

(4)

(2.1)

(4)

(3)

(3)

2001

21

6/12

20

22

5

25

16

7

18

5

20

12.5

18

8

16

7

19.6

5.5

20

10

10

5

18

18

5/9

15

6/12

25

0/12

15

5

19

6

20

10

22

7

17

5/12

19

19

8

23

10

22

8/17

25

6/12

17.5

5

19.3

(4.3)

(4)

(4)

(2.1)

(4)

(3)

(3)

2002

21

6/12

20

22

5

25

16

7

18

5

21

12.5

18

8

16

7

19.6

5.5

20

10

13

5

18

18

5/9

15

6/12

25

0/12

15

5

19

6

20

10

22

7

19

5/12

19

20

8.5

23

10

22

8/17

25

6/12

17.5

5

19.5

(4)

(4)

(2.1)

(4)

(3)

(3)

(4.3)

(4)

(4)

(2.1)

(4)

(3)

(3)

2004

21

6/12

20

19

5

25

16

7

18

5

21

13.5

18

8

16

7

19.6

5.5

20

10

15

5

18

5

18

5/9

15

6/12

25

5/15

18

5

19

6

20

10

22

7

19

5/12

19

9

20

8.5

19

22

8/17

25

6/12

17.5

5

19.4

(4.4)

(4)

(4)

(2.1)

(4)

(3)

(3)

2005

21

6/12

20

19

5

25

16

7

18

5

21

13.5

19

9

16

7

19.6

5.5

20

10

15

5

18

5

18

5/9

15

6/12

25

5/15

18

5

19

6

20

10

22

7

21

5/12

19

9

20

8.5

19

22

8/17

25

6/12

17.5

5

19.6

(4.8)

(4.5)

(4)

(2.1)

(4)

(3)

(3)

2006

21

6/12

20

19

5

25

16

7

18

5

21

13.5

19

9

16

7

19.6

5.5

20

10

15

5/8

18

5

18

5/9

15

6/12

20

5/15

18

5

19

6

20

10

22

7

21

5/12

19

9

20

8.5

19

22

8/17

25

6/12

17.5

5

19.4

(4.8)

(4.5)

(4)

(2.1)

(4)

(3)

(3)

2007

21

6/12

20

7

19

5

25

19

7

18

5

21

13.5

19

9

16

7

19.6

5.5

20

10

15

5/8

18

5

18

5/9

15

6/12

20

5

18

5

19

6

20

10

22

7

21

5/12

19

9

20

8.5

19

10

22

8/17

25

6/12

17.5

5

19.5

(4.8)

(4.5)

(4)

(2.1)

(4)

(3)

(3)

2008

21

6/12

20

7

19

9

25

19

7

18

5

21

13.5

19

9

16

7

19.6

5.5

20

10

15

5/8

18

5

18

5/9

15

6/12

20

5

18

5

19

6

20

10

22

7

20

5/12

19

9

20

8.5

19

10

22

8/17

25

6/12

17.5

5

19.4

(4.8)

(4.5)

(4)

(2.1)

(4)

(3)

(3)

2009

21

6/12

20

7

19

9

25

19

7

20

9

21.5

13.5

19

9

16

7

19.6

5.5

20

10

15

5/8

21

10

19

5/9

15

6/12

25

5/18

18

5

19.0

6

20

10

22

7

20

5/12

19

5/9

20

8.5

19

10

22

8/17

25

6/12

15

5

19.8

(4.8)

(4.5)

(4)

(2.1)

(4)

(3)

(3)

2010

21

6/12

20

7

20

10

25

19

7

20

9

21

13.5

23

5.5/11

18

8

19.6

5.5

20

10

15

5/8

21

10

21

5/9

15

6/12

25

5/18

18

5

19

6

20

10

22

7

21

6/13

24

5/9

20

8.5

19

6/10

23

9/13

25

6/12

17.5

5

20.4

(4.8)

(4)

(2.1)

(4)

(3)

(3)

2011

21

6/12

20

9

20

10

25

19

7

20

9

21

13.5

23

6.5/13

18

8

19.6

5.5

20

10

15

5/8

22

12

21

5/9

15

6/12

25

5/18

18

5/7

19

6

20

10

23

5/8

23

6/13

24

5/9

20

8.5

20

10

23

9/13

25

6/12

20.0

5

20.7

(4.8)

(4)

(2.1)

(4)

(3)

2012

21

6/12

20

9

20

14

25

19

7

20

9

23

13.5/9

23

6.5/13

18

8

19.6

5.5/7

21

10

17

5/8

22

12

21

5/9

15

6/12

27

5/18

18

5/7

19

6

20

10

23

5/8

23

6/13

24

5/9

20

8.5

20

10

23

9/13

25

6/12

20.0

5

21.0

(4.8)

(4)

(2.1)

(4)

(3)

If two VAT rates were applicable during a year the one being in force for more than six months or introduced on 1 July is indicated in the table. Super reduced rates

(below 5 %) are shown in brackets. IT: Standard rate was increased in September 2011; CY: Standard rate was increased in March 2012; FI: Reduced 17 % rate

was decreased to 12 % on 1.10.2009. Standard rate as well as reduced rates were increased by one percentage point on 1.7.2010.

Source: Commission services

28

(4.3)

2003

21

6/12

20

22

5

25

16

7

18

5

21

13.5

18

8

16

7

19.6

5.5

20

10

15

5

18

9

18

5/9

15

6/12

25

0/12

15

5

19

6

20

10

22

7

19

5/12

19

20

8.5

20

14

22

8/17

25

6/12

17.5

5

19.5

Taxation trends in the European Union

Você também pode gostar

- Policy On Representation AllowanceDocumento10 páginasPolicy On Representation AllowanceCeline Pascual-Ramos100% (1)

- MInutes GuidelinesDocumento5 páginasMInutes GuidelinesGideonEmmanuelAinda não há avaliações

- Financial Aspect - Feasibility StudyDocumento33 páginasFinancial Aspect - Feasibility StudyAgayatak Sa Manen55% (20)

- PLP Government Accounting Mid-Term ExamDocumento4 páginasPLP Government Accounting Mid-Term ExamApril Manjares100% (2)

- Financial Training Manual For NGO's in NamibiaDocumento76 páginasFinancial Training Manual For NGO's in NamibiaAndré Le Roux100% (1)

- SITXFIN009 Student Assessment Task 1 (1) PreetDocumento13 páginasSITXFIN009 Student Assessment Task 1 (1) PreetSmile Reacts100% (1)

- ASIA TRUST DEVELOPMENT BANK, INC Vs CIRDocumento2 páginasASIA TRUST DEVELOPMENT BANK, INC Vs CIRPaolo NazarenoAinda não há avaliações

- Taxation Trends in The European Union - 2012 90Documento1 páginaTaxation Trends in The European Union - 2012 90d05registerAinda não há avaliações

- Taxation Trends in The European Union - 2012 21Documento1 páginaTaxation Trends in The European Union - 2012 21d05registerAinda não há avaliações

- Taxation Trends in The European Union - 2012 28Documento1 páginaTaxation Trends in The European Union - 2012 28Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 20Documento1 páginaTaxation Trends in The European Union - 2012 20d05registerAinda não há avaliações

- Taxation Trends in The European Union - 2012 16Documento1 páginaTaxation Trends in The European Union - 2012 16d05registerAinda não há avaliações

- The Use of Cyclically Adjusted Balances at Banco de PortugalDocumento11 páginasThe Use of Cyclically Adjusted Balances at Banco de PortugalAlessandro BianchessiAinda não há avaliações

- Taxation Trends in The European Union - 2012 91Documento1 páginaTaxation Trends in The European Union - 2012 91d05registerAinda não há avaliações

- Taxation Trends in The European Union - 2011 - Booklet 29Documento1 páginaTaxation Trends in The European Union - 2011 - Booklet 29Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union: Focus On The Crisis: The Main Impacts On EU Tax SystemsDocumento44 páginasTaxation Trends in The European Union: Focus On The Crisis: The Main Impacts On EU Tax SystemsAnonymousAinda não há avaliações

- Inceu Adrian & Zai Paul & Mara Ramona - Indirect Taxes in European UnionDocumento9 páginasInceu Adrian & Zai Paul & Mara Ramona - Indirect Taxes in European UnionAlex MariusAinda não há avaliações

- Taxation Trends in EU in 2010Documento42 páginasTaxation Trends in EU in 2010Tatiana TurcanAinda não há avaliações

- Taxation Trends in The European Union - 2012 25Documento1 páginaTaxation Trends in The European Union - 2012 25Dimitris ArgyriouAinda não há avaliações

- Ecfin Country Focus: Decomposing Total Tax Revenues in GermanyDocumento8 páginasEcfin Country Focus: Decomposing Total Tax Revenues in GermanyJhony SebanAinda não há avaliações

- Taxation Trends in The European Union - 2012 82Documento1 páginaTaxation Trends in The European Union - 2012 82d05registerAinda não há avaliações

- Euro Area and EU28 Government Deficit at 3.0% and 3.3% of GDP RespectivelyDocumento16 páginasEuro Area and EU28 Government Deficit at 3.0% and 3.3% of GDP RespectivelyDonald KellyAinda não há avaliações

- Taxation Trends in The European Union - 2012 41Documento1 páginaTaxation Trends in The European Union - 2012 41Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 59Documento1 páginaTaxation Trends in The European Union - 2012 59d05registerAinda não há avaliações

- Taxation Trends in The European Union - 2012 33Documento1 páginaTaxation Trends in The European Union - 2012 33Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 66Documento1 páginaTaxation Trends in The European Union - 2012 66d05registerAinda não há avaliações

- Taxation Trends in The European Union - 2012 70Documento1 páginaTaxation Trends in The European Union - 2012 70d05registerAinda não há avaliações

- Codul Fiscal (In Limba Engleza)Documento65 páginasCodul Fiscal (In Limba Engleza)Cristina CiobanuAinda não há avaliações

- Taxation Trends in The European Union - 2012 86Documento1 páginaTaxation Trends in The European Union - 2012 86d05registerAinda não há avaliações

- Taxation Trends in The European Union - 2012 39Documento1 páginaTaxation Trends in The European Union - 2012 39Dimitris ArgyriouAinda não há avaliações

- The French Economy Exits Recession But Remains Fragile: Economic ResearchDocumento14 páginasThe French Economy Exits Recession But Remains Fragile: Economic Researchapi-227433089Ainda não há avaliações

- Taxation Trends in The European Union - 2012 74Documento1 páginaTaxation Trends in The European Union - 2012 74d05registerAinda não há avaliações

- The Economy of FranceDocumento18 páginasThe Economy of Francejames killerAinda não há avaliações

- 01 S&D - Closing The European Tax Gap 2Documento1 página01 S&D - Closing The European Tax Gap 2Dimitris ArgyriouAinda não há avaliações

- Faculty - Economic and ManagementDocumento5 páginasFaculty - Economic and ManagementBaraawo BaraawoAinda não há avaliações

- The Influence of The Economic Crisis On The Underground Economy in Germany and The Other OECD-countries in 2010: A (Further) Increase. by Friedrich SchneiderDocumento10 páginasThe Influence of The Economic Crisis On The Underground Economy in Germany and The Other OECD-countries in 2010: A (Further) Increase. by Friedrich SchneiderLeSoirAinda não há avaliações

- Taxation Trends in The European Union - 2012 40Documento1 páginaTaxation Trends in The European Union - 2012 40Dimitris ArgyriouAinda não há avaliações

- Indicators For GERMANY: France Ational Tatistical ATADocumento25 páginasIndicators For GERMANY: France Ational Tatistical ATASatNam SiNgh TethiAinda não há avaliações

- Dynamic Tax Analysis Group 18Documento10 páginasDynamic Tax Analysis Group 18Prakhar GuptaAinda não há avaliações

- Hourly Labour Costs Ranged From 3.8 To 40.3 Across The EU Member States in 2014Documento4 páginasHourly Labour Costs Ranged From 3.8 To 40.3 Across The EU Member States in 2014Turcan Ciprian SebastianAinda não há avaliações

- Ahorro en UEDocumento7 páginasAhorro en UEelenaAinda não há avaliações

- Ireland: Developments in The Member StatesDocumento4 páginasIreland: Developments in The Member StatesBogdan PetreAinda não há avaliações

- The Effect of The VAT Rate Change On Aggregate Consumption and Economic GrowthDocumento31 páginasThe Effect of The VAT Rate Change On Aggregate Consumption and Economic GrowthCristina IonescuAinda não há avaliações

- Taxation Trends Report 2020.enDocumento308 páginasTaxation Trends Report 2020.enviktor's VibesAinda não há avaliações

- Taxation Trends in The European Union - 2012 159Documento1 páginaTaxation Trends in The European Union - 2012 159d05registerAinda não há avaliações

- Budget+2011 ENDocumento24 páginasBudget+2011 ENMiro YakimovAinda não há avaliações

- Taxation Trends in The European Union - 2011 - Booklet 13Documento1 páginaTaxation Trends in The European Union - 2011 - Booklet 13Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 164Documento1 páginaTaxation Trends in The European Union - 2012 164d05registerAinda não há avaliações

- Taxation Trends in The European Union - 2012 38Documento1 páginaTaxation Trends in The European Union - 2012 38Dimitris ArgyriouAinda não há avaliações

- Do Smes Face A Higher Tax Burden? Evidence From Belgian Tax Return DataDocumento19 páginasDo Smes Face A Higher Tax Burden? Evidence From Belgian Tax Return DataPilar RiveraAinda não há avaliações

- 1.1tax Burden Eu 2016Documento12 páginas1.1tax Burden Eu 2016vapevyAinda não há avaliações

- Taxation Trends in The European Union - 2012 122Documento1 páginaTaxation Trends in The European Union - 2012 122d05registerAinda não há avaliações

- Germany Tax StructureDocumento14 páginasGermany Tax StructurechadnuttasophonAinda não há avaliações

- It 2013-11-15 SWD enDocumento10 páginasIt 2013-11-15 SWD enSpiros StathakisAinda não há avaliações

- Euro Area and EU27 Government Deficit at 4.1% and 4.5% of GDP RespectivelyDocumento16 páginasEuro Area and EU27 Government Deficit at 4.1% and 4.5% of GDP RespectivelyRaluca MarciucAinda não há avaliações

- Quarterly Sector Accounts - Households: Statistics ExplainedDocumento4 páginasQuarterly Sector Accounts - Households: Statistics ExplainedLucian SalaAinda não há avaliações

- Taxation Trends in The European Union - 2012 48Documento1 páginaTaxation Trends in The European Union - 2012 48d05registerAinda não há avaliações

- Swd2012 Portugal enDocumento24 páginasSwd2012 Portugal enrui_cavaleiroAinda não há avaliações

- Economy of FranceDocumento7 páginasEconomy of Francesyed_murshedAinda não há avaliações

- Annual Growth in Labour Costs Up To 1.4% in Euro Area and To 1.2% in EU28Documento5 páginasAnnual Growth in Labour Costs Up To 1.4% in Euro Area and To 1.2% in EU28pathanfor786Ainda não há avaliações

- EcoNote18 Solde Courant de La France enDocumento8 páginasEcoNote18 Solde Courant de La France enPracheth ReddyAinda não há avaliações

- Info NoteDocumento2 páginasInfo NotePolitics.ieAinda não há avaliações

- Taxation Trends in The European Union - 2012 107Documento1 páginaTaxation Trends in The European Union - 2012 107d05registerAinda não há avaliações

- Hellenic Republic Public Debt Bulletin: June 2015Documento5 páginasHellenic Republic Public Debt Bulletin: June 2015Anonymous svLu6IAinda não há avaliações

- 2.fiscal ConsolidationDocumento4 páginas2.fiscal ConsolidationimwrongAinda não há avaliações

- EIB Investment Report 2021/2022 - Key findings: Recovery as a springboard for changeNo EverandEIB Investment Report 2021/2022 - Key findings: Recovery as a springboard for changeAinda não há avaliações

- Taxation Trends in The European Union - 2012 42Documento1 páginaTaxation Trends in The European Union - 2012 42Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 40Documento1 páginaTaxation Trends in The European Union - 2012 40Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 44Documento1 páginaTaxation Trends in The European Union - 2012 44Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 38Documento1 páginaTaxation Trends in The European Union - 2012 38Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 41Documento1 páginaTaxation Trends in The European Union - 2012 41Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 34Documento1 páginaTaxation Trends in The European Union - 2012 34Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 37Documento1 páginaTaxation Trends in The European Union - 2012 37Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 31Documento1 páginaTaxation Trends in The European Union - 2012 31Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 33Documento1 páginaTaxation Trends in The European Union - 2012 33Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 39Documento1 páginaTaxation Trends in The European Union - 2012 39Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 35Documento1 páginaTaxation Trends in The European Union - 2012 35Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2011 - Booklet 37Documento1 páginaTaxation Trends in The European Union - 2011 - Booklet 37Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 10Documento1 páginaTaxation Trends in The European Union - 2012 10Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 27Documento1 páginaTaxation Trends in The European Union - 2012 27Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 30Documento1 páginaTaxation Trends in The European Union - 2012 30Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 26Documento1 páginaTaxation Trends in The European Union - 2012 26Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 24Documento1 páginaTaxation Trends in The European Union - 2012 24Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 25Documento1 páginaTaxation Trends in The European Union - 2012 25Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 8Documento1 páginaTaxation Trends in The European Union - 2012 8Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 5Documento1 páginaTaxation Trends in The European Union - 2012 5Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 3Documento1 páginaTaxation Trends in The European Union - 2012 3Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2011 - Booklet 29Documento1 páginaTaxation Trends in The European Union - 2011 - Booklet 29Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2011 - Booklet 36Documento1 páginaTaxation Trends in The European Union - 2011 - Booklet 36Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2011 - Booklet 34Documento1 páginaTaxation Trends in The European Union - 2011 - Booklet 34Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2011 - Booklet 35Documento1 páginaTaxation Trends in The European Union - 2011 - Booklet 35Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2011 - Booklet 31Documento1 páginaTaxation Trends in The European Union - 2011 - Booklet 31Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2011 - Booklet 33Documento1 páginaTaxation Trends in The European Union - 2011 - Booklet 33Dimitris ArgyriouAinda não há avaliações

- Local Budget Circular No. 148 Dated Dec 232022Documento6 páginasLocal Budget Circular No. 148 Dated Dec 232022lebron JamesAinda não há avaliações

- COA Cir 94-013, 12-13-94Documento4 páginasCOA Cir 94-013, 12-13-94Misc EllaneousAinda não há avaliações

- ALBA Inc. Letter To Punong Barangays RA No. 9184 March 22 24 2023 PDFDocumento1 páginaALBA Inc. Letter To Punong Barangays RA No. 9184 March 22 24 2023 PDFApril AgustinAinda não há avaliações

- Assessment of Local Fiscal PerformanceDocumento2 páginasAssessment of Local Fiscal PerformanceKei SenpaiAinda não há avaliações

- AssignmentDocumento4 páginasAssignmentrvkrd4k69jAinda não há avaliações

- Nsu Act202 Project (Budgeting)Documento15 páginasNsu Act202 Project (Budgeting)Noman100% (1)

- P - Public Investment Management HandbookDocumento86 páginasP - Public Investment Management HandbookTanny LunaAinda não há avaliações

- Management Control SystemsDocumento42 páginasManagement Control SystemsManjunath HSAinda não há avaliações

- Assessment of Government Budgetary Control Procedures and Utilization (In Case of Hawassa University)Documento20 páginasAssessment of Government Budgetary Control Procedures and Utilization (In Case of Hawassa University)samuel debebeAinda não há avaliações

- Chapter 8 Savings and Invest (New)Documento20 páginasChapter 8 Savings and Invest (New)Laiba KhanAinda não há avaliações

- Covered Lives SummaryDocumento8 páginasCovered Lives Summarygaurav_johnAinda não há avaliações

- Cost II FInal ExamDocumento4 páginasCost II FInal ExamAbaas AhmedAinda não há avaliações

- Disinvestment Objectives: 9 Objectives of Disinvestment in IndiaDocumento4 páginasDisinvestment Objectives: 9 Objectives of Disinvestment in IndiakanishkAinda não há avaliações

- Accounting Controls and Bureaucratic Strategies in Municipal GovernmentDocumento24 páginasAccounting Controls and Bureaucratic Strategies in Municipal GovernmentRian LiraldoAinda não há avaliações

- Test BankDocumento15 páginasTest BankBWB DONALDAinda não há avaliações

- BLGF Memorandum Re Change Request Forms (CRFS) For The FY 2022 SGLG AssessmentDocumento6 páginasBLGF Memorandum Re Change Request Forms (CRFS) For The FY 2022 SGLG AssessmentMTO San Antonio, ZambalesAinda não há avaliações

- PPSAS 1 & PPSAS 33-Presentation of FS and First Time Adoption of Accrual - For AGIADocumento72 páginasPPSAS 1 & PPSAS 33-Presentation of FS and First Time Adoption of Accrual - For AGIALyka Mae Palarca Irang100% (1)

- Financial Management: Short-Term Financial PlanningDocumento23 páginasFinancial Management: Short-Term Financial PlanningRao786Ainda não há avaliações

- Income Taxation BsaDocumento11 páginasIncome Taxation BsaCrizel SerranoAinda não há avaliações

- Public Debt and The ConstitutionDocumento6 páginasPublic Debt and The Constitutionrenushi100% (1)

- Xii GB Ui3 QBDocumento16 páginasXii GB Ui3 QBMishti GhoshAinda não há avaliações

- Ldip 2024-2026Documento92 páginasLdip 2024-2026Josephine Templa-JamolodAinda não há avaliações

- Cost Solutions Past PapersDocumento22 páginasCost Solutions Past Paperstheateeq100% (1)