Escolar Documentos

Profissional Documentos

Cultura Documentos

Taxation Trends in The European Union - 2012 39

Enviado por

Dimitris Argyriou0 notas0% acharam este documento útil (0 voto)

14 visualizações1 páginap39

Título original

Taxation Trends in the European Union - 2012 39

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentop39

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

14 visualizações1 páginaTaxation Trends in The European Union - 2012 39

Enviado por

Dimitris Argyrioup39

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 1

Part I

Overall tax revenue

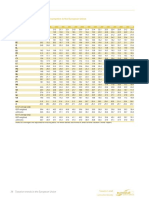

points of GDP. A broadly similar trend is visible also in

other related indicators such as revenue from taxes on

capital and business income taxes. The ITR on

capital (20) shows a stronger decline for 2010, 1.1

points in the EU-25 average, and this level remains

broadly in line with the 2002 one (see Graph 1.16).

O

v

e

r

a

l

l

Various factors could explain this development. First,

the ITR on capital has historically been sensitive to the

business cycle: the EU-25 ITR on capital reached a

peak between 1999 and 2000, then declined, and picked

up again, in line with the business cycle. Inevitably, the

effects of the recession affected the ITR already in

2009 and 2010.

t

a

x

Graph 1.16: Implicit tax rate on capital

1995-2010, in % (arithmetic average - adjusted for missing data

31

r

e

v

e

n

u

e

30

29

28

27

26

25

Stabilisation in effective tax rates at the

current end

Effective tax rates complement statutory tax rates by

additional charges on investment and by elements of

the tax base in order to evaluate the effective tax

burden incurred. The methodology used for the

calculation of EATRs is explained in ZEW report by

Devereux et al. (2008) and follows the methodology set

out by Devereux and Griffith (1999, 2003).

For the EU-27, the average EATR in 2011 is 21.3 %,

but this overall average hides considerable dispersion

in the EATR levels across the individual Member

States (see Table 86 in Annex A). The EATR is the

lowest in Bulgaria (8.9 %), Cyprus (10.6 %) and Latvia

(12.6 %), and the highest in France (32.8 %), Malta

(32.2 %) and Spain (31.9 %). All NMS-12 Member

States, except Malta, have effective tax rates below

20 % (16.4 % on average); all EU-15 Member States,

except the Netherlands and Ireland, levy taxes at 23 %

and higher (25 % on average).

24

23

22

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

EU-25

EA-17

Source: Commission services

In addition, the strong cuts in the CIT statutory rate

translate in lower revenues. However, it seems likely

that the measures to broaden the corporate tax base,

which have frequently accompanied the statutory rate

cuts, have been playing an important role in sustaining

the ITRs; and a series of measures taken at EU level to

limit harmful tax competition may too have had an

impact. Normally, both factors fade out with time:

cyclical effects depend largely on the existence of

carry-over provisions for losses incurred in previous

years and on capital gains, and base broadening has its

limits, explaining the decline in the last years. One

imponderable, however, is the possibility, that,

stimulated by the steep fall in corporate tax rates, which

in some countries are now well below the top PIT rate,

growing incorporatisation has been boosting CIT

revenues at the expense of the personal income tax.

Over the last decade, a significant downward trend in

the effective corporate tax levels can be observed on

the EU level. Over the same time period, the

differential in effective tax levels between the EU-15

Member States and the NMS-12 Member States

increased due to intensified tax cuts in the later after

EU accession. The fall in EATRs over the last decade

largely followed the decrease of the CIT rate with a

drop in 2008 more pronounced for the former than for

the latter probably due to the numerous tax measures,

other than rate cuts supporting the business that many

governments introduced at the outbreak of the

crisis (21). However, the latest data show a stabilisation.

Graph 1.17: Corporate Income Tax rates and Average

Effective Taxation indicators,

EU-27, 1995-2012, in %

36%

34%

32%

30%

28%

Table 79 in Annex A presents the development of the

ITR on capital for all the Member States and years

available, showing a broad downward trend similar to

that of the rates.

26%

24%

22%

20%

1995

1996

1997

1998

1999

2000

2001

EU-27 average top statutory CIT rates

(20) The ITR on capital is the ratio between taxes on capital and aggregate capital

and savings income. Specifically it includes taxes levied on the income earned

from savings and investments by households and corporations and taxes,

related to stocks of capital stemming from savings and investment in previous

periods. The denominator of the capital ITR is an approximation of world-wide

capital and business income of residents for domestic tax purposes.

2002

2003

2004

2005

2006

2007

2008

2009

2010

EU-27 EATR - Taxation of the non-financial sector

Source: Commission services

(21) For detailed list of measures see European Commission (2010b)

38

Taxation trends in the European Union

2011

2012

Você também pode gostar

- Taxation Trends in The European Union - 2012 33Documento1 páginaTaxation Trends in The European Union - 2012 33Dimitris ArgyriouAinda não há avaliações

- Global Tax Revolution: The Rise of Tax Competition and the Battle to Defend ItNo EverandGlobal Tax Revolution: The Rise of Tax Competition and the Battle to Defend ItAinda não há avaliações

- Taxation Trends in The European Union - 2012 20Documento1 páginaTaxation Trends in The European Union - 2012 20d05registerAinda não há avaliações

- EIB Investment Survey 2022 - European Union overviewNo EverandEIB Investment Survey 2022 - European Union overviewAinda não há avaliações

- Ireland: Developments in The Member StatesDocumento4 páginasIreland: Developments in The Member StatesBogdan PetreAinda não há avaliações

- Taxation Trends in The European Union - 2012 86Documento1 páginaTaxation Trends in The European Union - 2012 86d05registerAinda não há avaliações

- Taxation Trends in The European Union - 2012 41Documento1 páginaTaxation Trends in The European Union - 2012 41Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 28Documento1 páginaTaxation Trends in The European Union - 2012 28Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 21Documento1 páginaTaxation Trends in The European Union - 2012 21d05registerAinda não há avaliações

- Taxation Trends in The European Union - 2012 38Documento1 páginaTaxation Trends in The European Union - 2012 38Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 107Documento1 páginaTaxation Trends in The European Union - 2012 107d05registerAinda não há avaliações

- Taxation Trends in The European Union - 2012 162Documento1 páginaTaxation Trends in The European Union - 2012 162d05registerAinda não há avaliações

- Taxation Trends in The European Union - 2012 70Documento1 páginaTaxation Trends in The European Union - 2012 70d05registerAinda não há avaliações

- Ecfin Country Focus: Decomposing Total Tax Revenues in GermanyDocumento8 páginasEcfin Country Focus: Decomposing Total Tax Revenues in GermanyJhony SebanAinda não há avaliações

- Taxation Trends in EU in 2010Documento42 páginasTaxation Trends in EU in 2010Tatiana TurcanAinda não há avaliações

- Taxation Trends in The European Union - 2012 74Documento1 páginaTaxation Trends in The European Union - 2012 74d05registerAinda não há avaliações

- Taxation Trends in The European Union - 2012 37Documento1 páginaTaxation Trends in The European Union - 2012 37Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 30Documento1 páginaTaxation Trends in The European Union - 2012 30Dimitris ArgyriouAinda não há avaliações

- GE 3 May 2012 - Andrea ManzittiDocumento23 páginasGE 3 May 2012 - Andrea ManzittiMeadsieAinda não há avaliações

- Taxation Trends in The European Union - 2011 - Booklet 13Documento1 páginaTaxation Trends in The European Union - 2011 - Booklet 13Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 156Documento1 páginaTaxation Trends in The European Union - 2012 156d05registerAinda não há avaliações

- Two Pillars OECDDocumento10 páginasTwo Pillars OECDmalejandrabv87Ainda não há avaliações

- Taxation Trends in The European Union - 2012 40Documento1 páginaTaxation Trends in The European Union - 2012 40Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 59Documento1 páginaTaxation Trends in The European Union - 2012 59d05registerAinda não há avaliações

- Taxation Trends in The European Union - 2012 90Documento1 páginaTaxation Trends in The European Union - 2012 90d05registerAinda não há avaliações

- Alia, Tax Rates. Because They Are Determined Directly Through A Political Process, Rates Provide ADocumento14 páginasAlia, Tax Rates. Because They Are Determined Directly Through A Political Process, Rates Provide AGandhi Jenny Rakeshkumar BD20029Ainda não há avaliações

- Taxation Trends in The European Union: Focus On The Crisis: The Main Impacts On EU Tax SystemsDocumento44 páginasTaxation Trends in The European Union: Focus On The Crisis: The Main Impacts On EU Tax SystemsAnonymousAinda não há avaliações

- Taxation Trends in The European Union - 2012 155Documento1 páginaTaxation Trends in The European Union - 2012 155d05registerAinda não há avaliações

- Taxation Trends in The European Union - 2012 64Documento1 páginaTaxation Trends in The European Union - 2012 64d05registerAinda não há avaliações

- What Changes Are Needed To Have A Serious Political Union in EuropeDocumento6 páginasWhat Changes Are Needed To Have A Serious Political Union in EuropeFranco PerottoAinda não há avaliações

- Taxation Trends in The European Union - 2012 31Documento1 páginaTaxation Trends in The European Union - 2012 31Dimitris ArgyriouAinda não há avaliações

- 2012-03-19 Greece Is Changing Updated Mar 2012Documento64 páginas2012-03-19 Greece Is Changing Updated Mar 2012guiguichardAinda não há avaliações

- Taxation Trends in The European Union - 2012 159Documento1 páginaTaxation Trends in The European Union - 2012 159d05registerAinda não há avaliações

- Taxation Trends in The European Union - 2012 122Documento1 páginaTaxation Trends in The European Union - 2012 122d05registerAinda não há avaliações

- Do Smes Face A Higher Tax Burden? Evidence From Belgian Tax Return DataDocumento19 páginasDo Smes Face A Higher Tax Burden? Evidence From Belgian Tax Return DataPilar RiveraAinda não há avaliações

- Faculty - Economic and ManagementDocumento5 páginasFaculty - Economic and ManagementBaraawo BaraawoAinda não há avaliações

- UK Tax SystemDocumento13 páginasUK Tax SystemMuhammad Sajid Saeed100% (1)

- Goverment at a glance OECD 2011 Κυβέρνηση με μια ματιά ΟΟΣΑ 2011 ΕλλάδαDocumento4 páginasGoverment at a glance OECD 2011 Κυβέρνηση με μια ματιά ΟΟΣΑ 2011 ΕλλάδαconstantinosAinda não há avaliações

- 01 IMF - Taxing Immovable Property - 2013 21Documento1 página01 IMF - Taxing Immovable Property - 2013 21Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 91Documento1 páginaTaxation Trends in The European Union - 2012 91d05registerAinda não há avaliações

- Taxation Trends in The European Union - 2012 66Documento1 páginaTaxation Trends in The European Union - 2012 66d05registerAinda não há avaliações

- Tax Burden UKDocumento13 páginasTax Burden UKArturas GumuliauskasAinda não há avaliações

- Eurof05 SchratzenstallerDocumento39 páginasEurof05 SchratzenstallerE. S.Ainda não há avaliações

- Taxation Trends in The European Union - 2012 82Documento1 páginaTaxation Trends in The European Union - 2012 82d05registerAinda não há avaliações

- Taxation Trends in The European Union - 2011 - Booklet 29Documento1 páginaTaxation Trends in The European Union - 2011 - Booklet 29Dimitris ArgyriouAinda não há avaliações

- Inceu Adrian & Zai Paul & Mara Ramona - Indirect Taxes in European UnionDocumento9 páginasInceu Adrian & Zai Paul & Mara Ramona - Indirect Taxes in European UnionAlex MariusAinda não há avaliações

- Salvador Barrios 2020Documento18 páginasSalvador Barrios 2020Arnoldus ApriyanoAinda não há avaliações

- Economia Subterana in Europa PDFDocumento112 páginasEconomia Subterana in Europa PDFFlorin Marius PopaAinda não há avaliações

- Adv Tax Assignment 1Documento8 páginasAdv Tax Assignment 1Hussain ImranAinda não há avaliações

- Cr2015 Belgium enDocumento89 páginasCr2015 Belgium enIlias MansouriAinda não há avaliações

- Public FinnceDocumento57 páginasPublic FinnceJim MathilakathuAinda não há avaliações

- VAT Romania 1aprilDocumento2 páginasVAT Romania 1aprilMaria Gabriela PopaAinda não há avaliações

- Ates (2020)Documento23 páginasAtes (2020)nita_andriyani030413Ainda não há avaliações

- Ahorro en UEDocumento7 páginasAhorro en UEelenaAinda não há avaliações

- Value Added TaxationDocumento55 páginasValue Added TaxationDeeti SahaAinda não há avaliações

- Taxation Trends in The European Union - 2012 151Documento1 páginaTaxation Trends in The European Union - 2012 151d05registerAinda não há avaliações

- United States: Annual Percentage ChangeDocumento2 páginasUnited States: Annual Percentage Changecinderkatt16Ainda não há avaliações

- Taxation Trends in The European Union - 2012 102Documento1 páginaTaxation Trends in The European Union - 2012 102d05registerAinda não há avaliações

- Tax and British Business Making The Case PDFDocumento24 páginasTax and British Business Making The Case PDFNawsher21Ainda não há avaliações

- Taxation Trends in The European Union - 2012 38Documento1 páginaTaxation Trends in The European Union - 2012 38Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 42Documento1 páginaTaxation Trends in The European Union - 2012 42Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 44Documento1 páginaTaxation Trends in The European Union - 2012 44Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 40Documento1 páginaTaxation Trends in The European Union - 2012 40Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 34Documento1 páginaTaxation Trends in The European Union - 2012 34Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 35Documento1 páginaTaxation Trends in The European Union - 2012 35Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 25Documento1 páginaTaxation Trends in The European Union - 2012 25Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 37Documento1 páginaTaxation Trends in The European Union - 2012 37Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 31Documento1 páginaTaxation Trends in The European Union - 2012 31Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 30Documento1 páginaTaxation Trends in The European Union - 2012 30Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 29Documento1 páginaTaxation Trends in The European Union - 2012 29Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 27Documento1 páginaTaxation Trends in The European Union - 2012 27Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 28Documento1 páginaTaxation Trends in The European Union - 2012 28Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 24Documento1 páginaTaxation Trends in The European Union - 2012 24Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 26Documento1 páginaTaxation Trends in The European Union - 2012 26Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 3Documento1 páginaTaxation Trends in The European Union - 2012 3Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 10Documento1 páginaTaxation Trends in The European Union - 2012 10Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2011 - Booklet 34Documento1 páginaTaxation Trends in The European Union - 2011 - Booklet 34Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2011 - Booklet 31Documento1 páginaTaxation Trends in The European Union - 2011 - Booklet 31Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2011 - Booklet 37Documento1 páginaTaxation Trends in The European Union - 2011 - Booklet 37Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 8Documento1 páginaTaxation Trends in The European Union - 2012 8Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2012 5Documento1 páginaTaxation Trends in The European Union - 2012 5Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2011 - Booklet 33Documento1 páginaTaxation Trends in The European Union - 2011 - Booklet 33Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2011 - Booklet 35Documento1 páginaTaxation Trends in The European Union - 2011 - Booklet 35Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2011 - Booklet 29Documento1 páginaTaxation Trends in The European Union - 2011 - Booklet 29Dimitris ArgyriouAinda não há avaliações

- Taxation Trends in The European Union - 2011 - Booklet 36Documento1 páginaTaxation Trends in The European Union - 2011 - Booklet 36Dimitris ArgyriouAinda não há avaliações

- Group 4 Amazon 45k01.1Documento73 páginasGroup 4 Amazon 45k01.1Đỗ Hiếu ThuậnAinda não há avaliações

- Term Paper Edit Swizel and VernonDocumento10 páginasTerm Paper Edit Swizel and VernonswizelAinda não há avaliações

- ENTREPRENEURSHIP Module IVDocumento9 páginasENTREPRENEURSHIP Module IVElaine RiotocAinda não há avaliações

- Franchise BrochureDocumento3 páginasFranchise BrochurePari SavlaAinda não há avaliações

- Chapter 2 - Management EnvironmentDocumento47 páginasChapter 2 - Management EnvironmentLe Thuy TrangAinda não há avaliações

- PMBOK (Project Management Body of Knowledge)Documento8 páginasPMBOK (Project Management Body of Knowledge)Hari Purwadi0% (1)

- E. Sharath Babu, Founder & CEO, Food King: Entrepreneurs Non-Tech EntrepreneursDocumento3 páginasE. Sharath Babu, Founder & CEO, Food King: Entrepreneurs Non-Tech Entrepreneurssundar666Ainda não há avaliações

- Enron Company Reaction PaperDocumento7 páginasEnron Company Reaction PaperJames Lorenz FelizarteAinda não há avaliações

- Module 1. Math InvestmentDocumento43 páginasModule 1. Math InvestmentManuel FranciscoAinda não há avaliações

- Business Strategy of SbiDocumento23 páginasBusiness Strategy of Sbichitra_sweetgirl100% (1)

- India's Economy and Society: Sunil Mani Chidambaran G. Iyer EditorsDocumento439 páginasIndia's Economy and Society: Sunil Mani Chidambaran G. Iyer EditorsАнастасия ТукноваAinda não há avaliações

- Manpower, Consultant and HR Companies of UAEDocumento5 páginasManpower, Consultant and HR Companies of UAENaeem Uddin95% (20)

- SCM AgreementDocumento6 páginasSCM AgreementankitaprakashsinghAinda não há avaliações

- ABC Practice Problems Answer KeyDocumento10 páginasABC Practice Problems Answer KeyKemberly AribanAinda não há avaliações

- Apple Inc StrategyDocumento4 páginasApple Inc Strategyvaibhav_gupta20110% (1)

- Impots DifferesDocumento174 páginasImpots DifferesomarlhAinda não há avaliações

- Managerial RemunerationDocumento18 páginasManagerial RemunerationIshita GoyalAinda não há avaliações

- Partnership CE W Control Ans PDFDocumento10 páginasPartnership CE W Control Ans PDFRedAinda não há avaliações

- Backflush Accounting FM May06 p43-44Documento2 páginasBackflush Accounting FM May06 p43-44khengmaiAinda não há avaliações

- Engg Eco Unit 2 D&SDocumento129 páginasEngg Eco Unit 2 D&SSindhu PAinda não há avaliações

- Estate Planning & Administration OutlineDocumento9 páginasEstate Planning & Administration OutlineSean Robertson100% (1)

- Strategic Management 2Documento46 páginasStrategic Management 2Ritz Talent HubAinda não há avaliações

- The Journal Jan-Mar 2018Documento100 páginasThe Journal Jan-Mar 2018Paul BanerjeeAinda não há avaliações

- Architect / Contract Administrator's Instruction: Estimated Revised Contract PriceDocumento6 páginasArchitect / Contract Administrator's Instruction: Estimated Revised Contract PriceAfiya PatersonAinda não há avaliações

- Tarif Customs Clearance Di SurabayaDocumento2 páginasTarif Customs Clearance Di SurabayaAlvinBurhaniAinda não há avaliações

- Tourist Attraction and The Uniqueness of Resources On Tourist Destination in West Java, IndonesiaDocumento17 páginasTourist Attraction and The Uniqueness of Resources On Tourist Destination in West Java, IndonesiaAina ZainuddinAinda não há avaliações

- Quantitative Strategic Planning Matrix (QSPM) For AirasiaDocumento4 páginasQuantitative Strategic Planning Matrix (QSPM) For AirasiamaliklduAinda não há avaliações

- John Menard KeynesDocumento3 páginasJohn Menard KeynesSanthoshTelu100% (1)

- Econ Notes From 25Documento5 páginasEcon Notes From 25Ayisa YaoAinda não há avaliações

- Case Study AnalysisDocumento4 páginasCase Study AnalysisZohaib Ahmed JamilAinda não há avaliações

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProNo EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProNota: 4.5 de 5 estrelas4.5/5 (43)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyAinda não há avaliações

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesAinda não há avaliações

- Tax Savvy for Small Business: A Complete Tax Strategy GuideNo EverandTax Savvy for Small Business: A Complete Tax Strategy GuideNota: 5 de 5 estrelas5/5 (1)

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessNo EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessAinda não há avaliações

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesNo EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesNota: 4 de 5 estrelas4/5 (9)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCNo EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCNota: 4 de 5 estrelas4/5 (5)

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionNo EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionAinda não há avaliações

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsAinda não há avaliações

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyNo EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyNota: 4 de 5 estrelas4/5 (52)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessNo EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessNota: 5 de 5 estrelas5/5 (5)

- Public Finance: Legal Aspects: Collective monographNo EverandPublic Finance: Legal Aspects: Collective monographAinda não há avaliações

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationAinda não há avaliações

- Beat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012No EverandBeat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012Ainda não há avaliações

- Estrategias de Impuestos: Cómo Ser Más Inteligente Que El Sistema Y La IRS Cómo Un Inversionista: Al Incrementar Tu Ingreso Y Reduciendo Tus Impuestos Al Invertir Inteligentemente Volumen CompletoNo EverandEstrategias de Impuestos: Cómo Ser Más Inteligente Que El Sistema Y La IRS Cómo Un Inversionista: Al Incrementar Tu Ingreso Y Reduciendo Tus Impuestos Al Invertir Inteligentemente Volumen CompletoAinda não há avaliações

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthNo EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthAinda não há avaliações

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipAinda não há avaliações

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)No EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Nota: 4.5 de 5 estrelas4.5/5 (43)

- The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesNo EverandThe Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesAinda não há avaliações

- S Corporation ESOP Traps for the UnwaryNo EverandS Corporation ESOP Traps for the UnwaryAinda não há avaliações

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsNo EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsNota: 3.5 de 5 estrelas3.5/5 (9)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionNo EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionNota: 5 de 5 estrelas5/5 (27)

![The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS Penalties](https://imgv2-1-f.scribdassets.com/img/audiobook_square_badge/711600370/198x198/d63cb6648d/1712039797?v=1)