Escolar Documentos

Profissional Documentos

Cultura Documentos

Alibaba VIE Structure Notes

Enviado por

Yujia Jin0 notas0% acharam este documento útil (0 voto)

71 visualizações3 páginasAlibaba VIE structure

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoAlibaba VIE structure

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

71 visualizações3 páginasAlibaba VIE Structure Notes

Enviado por

Yujia JinAlibaba VIE structure

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 3

VIE variable interest entity

To achieve IPO, Chinese companies have 2 options either

onshore (A share) listing or offshore (red chip) listing. Most

companies use red chip listing because conditions lower and

faster. For red chip listing, two options straightforward

offshore listing structure or VIE structure.

First used by SINA in 2000. In china, FDI is not totally open to

foreign investors. Industries are classified into 4 categories

encouraged, permitted, restricted and prohibited. Vie

structure created to circumvent legal restrictions

More than 100 Chinese companies have adopted VIE structure

Alibaba, Tencent, Baidu, Sina, Tudou etc.

As indicated in the diagram above, foreign investors and PRC

individuals establish SPV1 in Cayman; then SPV1 sets up a whollyowned SPV2 in Hong Kong; and then SPV2 establishes the wholly

foreign-owned enterprise ("WFOE") in the PRC. The domestic

company usually is the one which owns licenses or approvals for the

business. However, due to restrictions on foreign investment, the

WFOE cannot obtain licenses or approvals from the PRC authorities

to operate in the desired industry. Through a set of contractual

arrangements among the WFOE, PRC individuals (usually PRC

individuals are the companies founders) and the domestic

company, the WFOE may be able to actually control the domestic

company as if it directly owned the equity interests in such domestic

company. Thus SPV1 may consolidate the financials of the domestic

company into the groups overall financial statements, which is

permitted and accepted by the US General Accepted Accounting

Principles.

In practice, the contractual arrangements include:

(i) the Consulting and Service Agreement entered into by and

between the WFOE and the domestic company, which provides that

the WFOE shall provide certain services (for example, the consulting

or strategic services and technical services) to the domestic

company for a fee, typically determined by the WFOE with the

intended result of shifting the domestic companys profits to the

WFOE;

(ii) the Asset License Agreement entered into by and between the

WFOE and the domestic company, under which the WFOE licenses

certain assets including intellectual properties to the WFOE for

royalty fees;

(iii) the Voting Rights Agreement or Proxy entered into by and

among the WFOE, PRC individuals and the domestic company, in

which the domestic companys shareholderPRC individuals

authorize the WFOE to exercise their shareholders rights in the

domestic company, including voting rights, inspection/information

rights, signing rights and election rights, etc.;

(iv) the Call Option Agreement entered into by and among the

WFOE, PRC individuals and the domestic company, in which PRC

individuals grant the WFOE an option to purchase all or a portion of

their equity interests in the domestic company at a lowest possible

price permitted by PRC law;

(v) the Equity Pledge Agreement entered into by and among the

WFOE, PRC individuals and the domestic company, through which

the PRC individuals pledge their equity interests in the domestic

company to the WFOE as a guarantee of the performance of their

and the domestic companys obligations under other agreements

among the three (3) parties in the VIE structure; and

(vi) the Loan Agreement entered into by and between the WFOE and

PRC individuals, in which the WFOE extends a loan to PRC

individuals to use for capitalization of the domestic company.

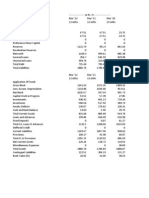

The cash flow goes like this: SPV1 will fund the SPV2. SPV2 will

make a capital contribution to the WFOE. The WFOE will extend a

loan to the PRC individuals, who will in turn establish and finance the

PRC domestic company. When the PRC domestic company makes a

profit, it will distribute a dividend to the PRC individuals. The PRC

individuals will make a repayment of the loan to the WFOE. The

WFOE will use the proceeds of the loan together with other funds to

be discussed below to make a dividend distribution offshore to

SPV2, which will in turn make a dividend distribution to SPV1. In

addition, through the contractual arrangements between the WFOE

and the PRC domestic company, the domestic company will also

make certain payments to the WFOE for provision of services. This

payment will be part of the dividend to be distributed by the WFOE

offshore, thus completing the chain of cash flow.

At the beginning, the VIE structure was used primarily for asset-light

companies, such as internet companies, advertising companies,

software companies, education companies and media companies,

etc. However, after several years development, the asset-heavy

companies also began to choose VIE structures for their financing or

offshore listing and the typical example was China Qinfa Group

Limited. Recently, the VIE structure has been increasingly used by

asset-heavy companies.

Alibaba files for US IPO!

Licenses to operate websites in China are held by VIEs 100%

owned by Chinese citizens. Basically licenses owned by Jack Ma and

not owned by main Alibaba company filing for IPO.

Você também pode gostar

- New EbclDocumento16 páginasNew EbclA0913KHUSHI RUNGTAAinda não há avaliações

- Growth of Venture CapitalDocumento24 páginasGrowth of Venture CapitalAshish MahendraAinda não há avaliações

- PR - SEBI Board MeetingDocumento4 páginasPR - SEBI Board MeetingShyam SunderAinda não há avaliações

- Risks and Regulations of Vie Structure 2014Documento4 páginasRisks and Regulations of Vie Structure 2014VickerCarryAinda não há avaliações

- BY Amarnath PoornimaDocumento30 páginasBY Amarnath PoornimaexistsasnitinAinda não há avaliações

- QFI Eligibility ConditionsDocumento12 páginasQFI Eligibility ConditionsalphajatinAinda não há avaliações

- FMR AssignmentDocumento8 páginasFMR AssignmentSiddharth PandeyAinda não há avaliações

- Special Purpose VehicleDocumento3 páginasSpecial Purpose VehicleAkarsh GuptaAinda não há avaliações

- Presentation On: Venture Capital & SebiDocumento14 páginasPresentation On: Venture Capital & Sebivineeta4604Ainda não há avaliações

- PWC ODI Reg. AnalysisDocumento5 páginasPWC ODI Reg. AnalysisVishwas SharmaAinda não há avaliações

- Fijas King Cincila Heena Lakshya Jeyaraj JituparnaDocumento30 páginasFijas King Cincila Heena Lakshya Jeyaraj JituparnaClarence PSAinda não há avaliações

- Venture Capital: Rahul Shah Roll:135 MFM3-BDocumento53 páginasVenture Capital: Rahul Shah Roll:135 MFM3-BParth MakwanaAinda não há avaliações

- Powerpoint Presentation: Movement of Funds and Investments Across BordersDocumento19 páginasPowerpoint Presentation: Movement of Funds and Investments Across BordersArjhay CruzAinda não há avaliações

- Chapter - 4. Protection of Investors in Primary Market (Ipos) Through Issue of Capital and Disclosure Requirements (Icdr)Documento25 páginasChapter - 4. Protection of Investors in Primary Market (Ipos) Through Issue of Capital and Disclosure Requirements (Icdr)Mukesh ManwaniAinda não há avaliações

- Venture CapitalDocumento60 páginasVenture CapitalAdii AdityaAinda não há avaliações

- Final Version Itfs Platform Circular 09 07 21 1 1 22072021110027Documento14 páginasFinal Version Itfs Platform Circular 09 07 21 1 1 22072021110027Manvi PareekAinda não há avaliações

- Venture CapitalDocumento23 páginasVenture CapitalpecmbaAinda não há avaliações

- Spec Com Case DigestsDocumento13 páginasSpec Com Case DigestsClaudine SumalinogAinda não há avaliações

- 外資投資問答集Documento15 páginas外資投資問答集hiAinda não há avaliações

- Terms and ConditionsDocumento8 páginasTerms and Conditionsarun_christianoAinda não há avaliações

- Offshore Derivation InstrumentDocumento2 páginasOffshore Derivation InstrumentChandan Kumar RoyAinda não há avaliações

- VC 131209235045 Phpapp02Documento45 páginasVC 131209235045 Phpapp02rachealllAinda não há avaliações

- Guide Listing Companies Initial Public Offerings PDFDocumento25 páginasGuide Listing Companies Initial Public Offerings PDFQamar KazmiAinda não há avaliações

- LAM - Role of Legal AwarenessDocumento4 páginasLAM - Role of Legal AwarenessShashank IyerAinda não há avaliações

- Venture CapitalDocumento45 páginasVenture CapitalGaurav BhawsarAinda não há avaliações

- Overview On InvITsDocumento4 páginasOverview On InvITssayliAinda não há avaliações

- Key SFO Definitions: Asset ManagementDocumento24 páginasKey SFO Definitions: Asset ManagementAndrew LeeAinda não há avaliações

- IPO ReportDocumento36 páginasIPO Reportrobinson_john2005Ainda não há avaliações

- Crowd-Sourced Equity Funding A Reality For Australian CompaniesDocumento8 páginasCrowd-Sourced Equity Funding A Reality For Australian CompaniessilvofAinda não há avaliações

- Odey Int'l FundDocumento48 páginasOdey Int'l FundcogitatorAinda não há avaliações

- Report of Chandrasekhar Committee On Venture CapitalDocumento43 páginasReport of Chandrasekhar Committee On Venture CapitalA SenthilkumarAinda não há avaliações

- Kinds of ProspectusDocumento6 páginasKinds of ProspectusIsraa ZaidiAinda não há avaliações

- Guide To Do B in VNDocumento32 páginasGuide To Do B in VNTruong Kim ChiAinda não há avaliações

- SPVDocumento7 páginasSPVkalpesh bhagne0% (1)

- Article Foreign Regulatory Environment AssessmentDocumento4 páginasArticle Foreign Regulatory Environment AssessmentAdarsh BhandariAinda não há avaliações

- Venture CapitalDocumento84 páginasVenture CapitalAshar RazaAinda não há avaliações

- Foreign CapitalDocumento15 páginasForeign Capitaldranita@yahoo.comAinda não há avaliações

- Manupatranw - Charting Paths - Private Placement Challenges in India's Equity Based Crowdfunding LandscapeDocumento5 páginasManupatranw - Charting Paths - Private Placement Challenges in India's Equity Based Crowdfunding LandscapeKARTIKEYA KOTHARIAinda não há avaliações

- Note On Public IssueDocumento9 páginasNote On Public IssueKrish KalraAinda não há avaliações

- Foreign Investor ProjectDocumento22 páginasForeign Investor ProjectwaghaAinda não há avaliações

- 01 IPO Process in Bangladesh Edited Raw FileDocumento23 páginas01 IPO Process in Bangladesh Edited Raw FileAndy DropshipperAinda não há avaliações

- NBFCsDocumento30 páginasNBFCsjeetAinda não há avaliações

- Company and LLPDocumento4 páginasCompany and LLPKampani SidhantAinda não há avaliações

- Overseas Direct InvestmentDocumento61 páginasOverseas Direct InvestmentSutonu BasuAinda não há avaliações

- Infra Debt FundDocumento3 páginasInfra Debt FundMana Bhanjan BeheraAinda não há avaliações

- Joint VentureDocumento13 páginasJoint VentureDeepa NairAinda não há avaliações

- Tg40 Cap FaqDocumento4 páginasTg40 Cap FaqInternational Business TimesAinda não há avaliações

- What Is A Lending Company?Documento5 páginasWhat Is A Lending Company?Lourdes EPAinda não há avaliações

- Comm Rev Case Digest Part IvDocumento4 páginasComm Rev Case Digest Part IvAlicia Jane NavarroAinda não há avaliações

- Foreign Currency Convertible Bonds FinalDocumento15 páginasForeign Currency Convertible Bonds FinalGautam JainAinda não há avaliações

- SEBI (Venture Capital Funds) RegulationsDocumento23 páginasSEBI (Venture Capital Funds) RegulationsDickench Das50% (2)

- Fipe ChinaDocumento13 páginasFipe ChinasuksukAinda não há avaliações

- Single Page MemoDocumento2 páginasSingle Page MemoSaleh RehmanAinda não há avaliações

- Special Investor's Resident Visa Program: Questions & AnswersDocumento6 páginasSpecial Investor's Resident Visa Program: Questions & AnswersChiechiee Louis Nival MijaresAinda não há avaliações

- Crowdfunding in 2014 (Understanding a New Asset Class)No EverandCrowdfunding in 2014 (Understanding a New Asset Class)Ainda não há avaliações

- Intellectual Property Securitization: Intellectual Property SecuritiesNo EverandIntellectual Property Securitization: Intellectual Property SecuritiesNota: 5 de 5 estrelas5/5 (1)

- Setting Up Wholly Foreign Owned Enterprises in ChinaNo EverandSetting Up Wholly Foreign Owned Enterprises in ChinaAinda não há avaliações

- Emerging Principles of International Competition LawDocumento466 páginasEmerging Principles of International Competition LawYujia JinAinda não há avaliações

- Listing and DisclosureDocumento59 páginasListing and DisclosureYujia JinAinda não há avaliações

- Introductory Lecture ACPDocumento1 páginaIntroductory Lecture ACPYujia JinAinda não há avaliações

- Jingle Bells With Decorations JulieDocumento2 páginasJingle Bells With Decorations JulieYujia JinAinda não há avaliações

- Notes On FoucaultDocumento14 páginasNotes On FoucaultYujia JinAinda não há avaliações

- Class 2Documento1 páginaClass 2Yujia JinAinda não há avaliações

- Global EconomyDocumento42 páginasGlobal EconomyYujia JinAinda não há avaliações

- European CitizenshipDocumento3 páginasEuropean CitizenshipYujia JinAinda não há avaliações

- Enron Scandal PresentationDocumento11 páginasEnron Scandal PresentationYujia JinAinda não há avaliações

- Micro and Macro Prudential RegulationDocumento15 páginasMicro and Macro Prudential RegulationYujia JinAinda não há avaliações

- Japan - Success, Problems and ImpactDocumento17 páginasJapan - Success, Problems and ImpactYujia JinAinda não há avaliações

- Nation Building and Ethnic Diversity in IndonesiaDocumento23 páginasNation Building and Ethnic Diversity in IndonesiaYujia Jin100% (1)

- Japan - Success, Problems and ImpactDocumento17 páginasJapan - Success, Problems and ImpactYujia JinAinda não há avaliações

- Politics ResearchDocumento10 páginasPolitics ResearchYujia JinAinda não há avaliações

- Introduction To Financial InclusionDocumento9 páginasIntroduction To Financial Inclusionmahaseth2008100% (1)

- Cash Flow Statement Examples As Per Direct Method: Report Name Sap Report T-CodeDocumento6 páginasCash Flow Statement Examples As Per Direct Method: Report Name Sap Report T-Codejainendra100% (1)

- Sample - Cash Flow Assumptions For ABC Manufacturing CompanyDocumento4 páginasSample - Cash Flow Assumptions For ABC Manufacturing CompanyCrystal LyneAinda não há avaliações

- In The Matter of Apricot Corp Blueberry Bank SA (2019) NHC 88Documento11 páginasIn The Matter of Apricot Corp Blueberry Bank SA (2019) NHC 88DhiyaAinda não há avaliações

- Proximate Cause in Negotiable Instruments Allied Banking Corp. vs. Lim Sio Wan (2008) FactsDocumento13 páginasProximate Cause in Negotiable Instruments Allied Banking Corp. vs. Lim Sio Wan (2008) FactsJimcris Posadas HermosadoAinda não há avaliações

- TVS Balance SheetDocumento6 páginasTVS Balance SheetNihal LamgeAinda não há avaliações

- Secured Transactions Outline JDDocumento176 páginasSecured Transactions Outline JDJesse Danoff92% (13)

- Comelec Resolution 9476 Campaign Finance LawDocumento26 páginasComelec Resolution 9476 Campaign Finance LawDustin BrownAinda não há avaliações

- Reserve Bank of IndiaDocumento11 páginasReserve Bank of Indiaprateek17000Ainda não há avaliações

- 7 Deductions ICAI SM + PCA + Past RTPs + Past Exam Questions WatermarkDocumento25 páginas7 Deductions ICAI SM + PCA + Past RTPs + Past Exam Questions WatermarkSavya SachiAinda não há avaliações

- Loan Repayment Amortization Schedule For Jeremy KarpelDocumento2 páginasLoan Repayment Amortization Schedule For Jeremy KarpelMichael AndersonAinda não há avaliações

- 16-15749 - All Docs PDFDocumento64 páginas16-15749 - All Docs PDFRecordTrac - City of OaklandAinda não há avaliações

- Awareness of MicrofinanceDocumento34 páginasAwareness of MicrofinanceDisha Tiwari100% (1)

- Social Entrepreneurship ManualDocumento54 páginasSocial Entrepreneurship ManualAndreea AcxinteAinda não há avaliações

- Draft Loan AgreementDocumento5 páginasDraft Loan Agreementlos dos ojosAinda não há avaliações

- Credit Management - A Conceptual FrameworkDocumento30 páginasCredit Management - A Conceptual Frameworkeknath200050% (2)

- Project Management For Construction - Financing of Constructed FacilitiesDocumento22 páginasProject Management For Construction - Financing of Constructed Facilitieskingston roseAinda não há avaliações

- Money Habits Cheat SheetDocumento9 páginasMoney Habits Cheat Sheetned100% (1)

- Acme Shoe Rubber vs. CA 260 SCRA 714Documento2 páginasAcme Shoe Rubber vs. CA 260 SCRA 714Darlyn BangsoyAinda não há avaliações

- "Debenture Trustee" - Position, Powers and Duties - It Is The LawDocumento13 páginas"Debenture Trustee" - Position, Powers and Duties - It Is The LawRohitSharmaAinda não há avaliações

- G.R. No. 197494Documento5 páginasG.R. No. 197494Sheraina GonzalesAinda não há avaliações

- Chapter Two The Role of Banks in Financing Small Scale Business in NigeriaDocumento12 páginasChapter Two The Role of Banks in Financing Small Scale Business in NigeriaSarah PearlAinda não há avaliações

- Ef3e Int Filetest 02bDocumento5 páginasEf3e Int Filetest 02bItsel Alfaro100% (3)

- Titman PPT CH18Documento79 páginasTitman PPT CH18IKA RAHMAWATIAinda não há avaliações

- ProductsDocumento7 páginasProductsDnyana RaghunathAinda não há avaliações

- Financial Institutions Management - Chap011Documento21 páginasFinancial Institutions Management - Chap011sk625218Ainda não há avaliações

- Smes' Survey of Gujranwala District: State Bank of PakistanDocumento44 páginasSmes' Survey of Gujranwala District: State Bank of PakistanMuhammad HamayunAinda não há avaliações

- Affidavit - MortgageDocumento2 páginasAffidavit - MortgagePeeJay ArvesuAinda não há avaliações

- Grand Central Phase II Sales Brochure 13 Nov 2020Documento179 páginasGrand Central Phase II Sales Brochure 13 Nov 2020KL YeungAinda não há avaliações

- DIP Financing Strategies For Distressed CompaniesDocumento9 páginasDIP Financing Strategies For Distressed CompaniesThiago CâmaraAinda não há avaliações