Escolar Documentos

Profissional Documentos

Cultura Documentos

Fitch Affirms Indian Bank at BB+ Withdraws All Ratings

Enviado por

Subham MazumdarDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Fitch Affirms Indian Bank at BB+ Withdraws All Ratings

Enviado por

Subham MazumdarDireitos autorais:

Formatos disponíveis

Fitch affirms Indian Bank at BB+ Withdraws All Ratings

Fitch Ratings has today declared and

withdrawn the ratings of Indian Bank

for commercial reasons.

There has been no such material

change in Indian Bank's credit profile

since the previous rating actions on

5th July 2016. To acquire more

information on the rating drivers,

please visit Fitch Affirms 9 Indian

Banks' IDRs, Downgrades VRs of

IDBI, Canara, and Indian Bank Ratings Navigator.

Rating sensitivities are inapplicable

because the ratings have been withdrawn. Fitch has declared and withdrawn the following

ratings:

Long-Term Issuer Default Rating (IDR) at 'BB+'; Outlook Stable;

Viability Rating at 'bb+'

Short-Term IDR at 'B'

Support Rating Floor at 'BB+'

Support Rating at '3'

Meanwhile, Indian Bank share price was trading 5.47 per cent higher at Rs.216. It opened at

Rs.204.10 from a previous closing of Rs.204.80. As of 2:04 pm, the days high of the stock

stood at Rs.219.70 while the days low read at Rs.202.95.

Out of the Top 500 Shares, Indian Bank ranks among the Multibagger Shares, identified by the

Dynamic research analysts and market experts at the end of the month of June. The scrip can

be an awesome investment opportunity and can give the investor high returns. The

fundamentals and financials of the stock are very strong. Indian Bank has been deeply

analysed by Dynamic Levels analysts with the help of technical and fundamental research. It is

recorded that the stock is being traded in very high volumes. As observed, the bank multiplies

its earnings per share every year. The share has a great potential to grow in near future. For

information on the financials of the stock, please visit Indian Bank share price history.

www.dynamiclevels.com

Page 1

Disclaimer

The investment advice or guidance provided by way of recommendations, reports or other ways

are solely the personal views of the research team. Users are advised to use the data for the

purpose of information and rely on their own judgment while making investment decision.

Dynamic Equities Pvt. Ltd - SEBI Investment Advisory Reg. No.: INA300002022

Disclosure

Dynamic Equities Pvt. Ltd. is a member of NSE, BSE, MCX SX and a DP with NSDL & CDSL. It is also

engaged in Investment Advisory Services and Portfolio Management Services. Dynamic

Commodities Pvt. Ltd., associate company, is a member of MCX & NCDEX. We declare that our

activities were neither suspended nor we have defaulted with any stock exchange authority with

whom we are registered. SEBI, Exchanges and Depositories have conducted the routine inspection

and based on their observations have issued advise letters or levied minor penalty on for certain

operational deviations.

Answers to the Best of our knowledge and belief of Dynamic/ its Associates/ Research Analyst:

DYNAMIC/its Associates/ Research Analyst/ his Relative:

Do not have any financial interest / any actual/beneficial ownership in the subject

company.

Do not have any other material conflict of interest at the time of publication of the

research report

Have not received any compensation from the subject company in the past twelve months

Have not managed or co-managed public offering of securities for the subject company.

Have not received any compensation for brokerage services or any products / services or

any compensation or other benefits from the subject company, nor engaged in market

making activity for the subject company

Have not served as an officer, director or employee of the subject company

www.dynamiclevels.com

Page 2

Você também pode gostar

- A Passage To AfricaDocumento25 páginasA Passage To AfricaJames Reinz100% (2)

- IDirect BhartiAirtel QC Mar16Documento2 páginasIDirect BhartiAirtel QC Mar16arun_algoAinda não há avaliações

- Atul Bisht Research Project ReportDocumento71 páginasAtul Bisht Research Project ReportAtul BishtAinda não há avaliações

- MCN Drill AnswersDocumento12 páginasMCN Drill AnswersHerne Balberde100% (1)

- Monthly Call: Apollo TyresDocumento4 páginasMonthly Call: Apollo TyresRajasekhar Reddy AnekalluAinda não há avaliações

- Tech Edge - Sapphire FoodsDocumento8 páginasTech Edge - Sapphire FoodsSuraj BhasmeAinda não há avaliações

- SBI BlogDocumento3 páginasSBI BlogSubham MazumdarAinda não há avaliações

- Icici Prud IpoDocumento2 páginasIcici Prud IpoDynamic LevelsAinda não há avaliações

- VVD and Sons Private Limited: Rating AdvisoryDocumento6 páginasVVD and Sons Private Limited: Rating AdvisorySANJAY KHATRIAinda não há avaliações

- IDBI Hit Most in Road Sector Bad DebtDocumento2 páginasIDBI Hit Most in Road Sector Bad DebtSubham MazumdarAinda não há avaliações

- 2 Federal Bank - One Pager Result Update Jan 24Documento3 páginas2 Federal Bank - One Pager Result Update Jan 24raghavanseshu.seshathriAinda não há avaliações

- HDFC and Icici Bank Final ReportDocumento19 páginasHDFC and Icici Bank Final ReportSahib SinghAinda não há avaliações

- SBI Ranks 7thDocumento2 páginasSBI Ranks 7thDynamic LevelsAinda não há avaliações

- Are The Nbfcs Rejoicing A Possible Rbi Rate Cut?Documento2 páginasAre The Nbfcs Rejoicing A Possible Rbi Rate Cut?Dynamic LevelsAinda não há avaliações

- SBI Issues $500bn 5 Yr Bonds at 3.25 Per CentDocumento3 páginasSBI Issues $500bn 5 Yr Bonds at 3.25 Per CentChetan PanchamiaAinda não há avaliações

- Nuflower Foods and Nutrition Private Limited-RA3Documento9 páginasNuflower Foods and Nutrition Private Limited-RA3vinvle.aroraAinda não há avaliações

- Chapter-4Merchant Banking and Credit Rating-1Documento77 páginasChapter-4Merchant Banking and Credit Rating-1Gowtham SrinivasAinda não há avaliações

- State Bank of India (STABAN) : Stress Levels More Comfortable Than PeersDocumento2 páginasState Bank of India (STABAN) : Stress Levels More Comfortable Than PeersvijayAinda não há avaliações

- 12 Monthly CallDocumento4 páginas12 Monthly CallGauriGanAinda não há avaliações

- Monthly Call: Reliance CapitalDocumento5 páginasMonthly Call: Reliance CapitalxytiseAinda não há avaliações

- Credit Rating Agencies in IndiaDocumento23 páginasCredit Rating Agencies in Indiaanon_315460204Ainda não há avaliações

- Nifty Future Trading StrategyDocumento3 páginasNifty Future Trading StrategyJegadiswary ElangoAinda não há avaliações

- HDFC Bank Q1 Net Profit Up 20%, Bad Loans Jump 13%Documento2 páginasHDFC Bank Q1 Net Profit Up 20%, Bad Loans Jump 13%Subham MazumdarAinda não há avaliações

- India Ratings Assigns Kanchi Karpooram IND BB-' Outlook StableDocumento4 páginasIndia Ratings Assigns Kanchi Karpooram IND BB-' Outlook StableoceanapolloAinda não há avaliações

- SBI@ Your Door StepDocumento2 páginasSBI@ Your Door StepDynamic LevelsAinda não há avaliações

- SBI Securities Morning Update - 12-01-2023Documento6 páginasSBI Securities Morning Update - 12-01-2023deepaksinghbishtAinda não há avaliações

- Technical Stock Idea: Private Client GroupDocumento2 páginasTechnical Stock Idea: Private Client GroupkhaniyalalAinda não há avaliações

- Sundram Fasteners Share Price Makes New High Post Q1 ResultsDocumento2 páginasSundram Fasteners Share Price Makes New High Post Q1 ResultsSubham MazumdarAinda não há avaliações

- HMB Ispat Private Limited - AD - 05-Jul-2022Documento10 páginasHMB Ispat Private Limited - AD - 05-Jul-2022DHANJIT KUMAR SAHAinda não há avaliações

- Technical Stock Idea: Retail ResearchDocumento2 páginasTechnical Stock Idea: Retail ResearchumaganAinda não há avaliações

- Powerpack 240522Documento2 páginasPowerpack 240522sibabrata chatterjeeAinda não há avaliações

- Derivative Stock PickDocumento2 páginasDerivative Stock PickPrashantKumarAinda não há avaliações

- Technical Stock Idea: Private Client GroupDocumento2 páginasTechnical Stock Idea: Private Client GroupumaganAinda não há avaliações

- Credit Rating Agencies in India PDFDocumento23 páginasCredit Rating Agencies in India PDFKumar KishanAinda não há avaliações

- Stock SplitsDocumento4 páginasStock SplitsDynamic LevelsAinda não há avaliações

- Technical Stock Pick: Private Client GroupDocumento2 páginasTechnical Stock Pick: Private Client GroupViswanathan SundaresanAinda não há avaliações

- LC Sageone Select Stock Portfolio: A Long-Only Equity FundDocumento25 páginasLC Sageone Select Stock Portfolio: A Long-Only Equity FundsieausAinda não há avaliações

- Page Industries Share Price Reacts Positively To ResultDocumento2 páginasPage Industries Share Price Reacts Positively To ResultSubham MazumdarAinda não há avaliações

- Shiv Health Foods Llp-RU-12-06-2023Documento12 páginasShiv Health Foods Llp-RU-12-06-2023Rituraj solankiAinda não há avaliações

- Technical Stock Idea: Retail ResearchDocumento2 páginasTechnical Stock Idea: Retail ResearchjojoAinda não há avaliações

- Bhoomi Disk Family Sheds Stakes in GHCLDocumento4 páginasBhoomi Disk Family Sheds Stakes in GHCLSubham MazumdarAinda não há avaliações

- NSIC & ONICRA Performance and Credit Rating Scheme For Small Scale IndustriesDocumento4 páginasNSIC & ONICRA Performance and Credit Rating Scheme For Small Scale IndustriesKamlesh TripathiAinda não há avaliações

- IDirect RBIAction Dec21Documento4 páginasIDirect RBIAction Dec21PavankopAinda não há avaliações

- Asmitha Microfin LimitedDocumento10 páginasAsmitha Microfin LimitedshivamAinda não há avaliações

- Fundamental Analysis For Investment Decisions On Five Major BanksDocumento17 páginasFundamental Analysis For Investment Decisions On Five Major BanksShikha ShuklaAinda não há avaliações

- NSE Listed CompaniesDocumento3 páginasNSE Listed CompaniesDynamic LevelsAinda não há avaliações

- Retail Research: Indian Currency MarketDocumento3 páginasRetail Research: Indian Currency MarketumaganAinda não há avaliações

- Sapm 2 Total 90 PagesDocumento91 páginasSapm 2 Total 90 PagesPochender VajrojAinda não há avaliações

- Retail Research: Indian Currency MarketDocumento3 páginasRetail Research: Indian Currency MarketDinesh ChoudharyAinda não há avaliações

- Navi Abridged ProspectusDocumento38 páginasNavi Abridged ProspectusPrintronics Computer ServicesAinda não há avaliações

- Morning Tea - 9feb16Documento3 páginasMorning Tea - 9feb16Shailesh KhodkeAinda não há avaliações

- Credit RatingDocumento15 páginasCredit RatingKrishna Chandran PallippuramAinda não há avaliações

- Fund Raising Advisory: Service ProfileDocumento4 páginasFund Raising Advisory: Service ProfiledhananjaywalkeAinda não há avaliações

- Technical Pick: Weekly ChartDocumento2 páginasTechnical Pick: Weekly ChartGauriGanAinda não há avaliações

- Credit Rating Agency AbhinandanDocumento15 páginasCredit Rating Agency AbhinandanNaba DekaAinda não há avaliações

- Infosys Revenue To Hit A Snag On Its Sales AimDocumento3 páginasInfosys Revenue To Hit A Snag On Its Sales AimSubham MazumdarAinda não há avaliações

- Final Project Report On Au Fin. JaipurDocumento71 páginasFinal Project Report On Au Fin. Jaipurkapiljjn100% (1)

- Technical Stock Idea: Private Client GroupDocumento2 páginasTechnical Stock Idea: Private Client GroupumaganAinda não há avaliações

- Credit-Rating Tata ProjectsDocumento2 páginasCredit-Rating Tata ProjectsjagadeeshAinda não há avaliações

- Retail Research: Technical Stock IdeaDocumento2 páginasRetail Research: Technical Stock IdeaumaganAinda não há avaliações

- Technical Stock Idea: Private Client GroupDocumento2 páginasTechnical Stock Idea: Private Client GroupumaganAinda não há avaliações

- Stocks That Performing TodayDocumento3 páginasStocks That Performing TodaySubham MazumdarAinda não há avaliações

- DLF Expansion Was A Boon, The Size Now A Bane: Quarterly SalesDocumento2 páginasDLF Expansion Was A Boon, The Size Now A Bane: Quarterly SalesSubham MazumdarAinda não há avaliações

- Cement SectorDocumento4 páginasCement SectorSubham MazumdarAinda não há avaliações

- Spectrum AuctionDocumento3 páginasSpectrum AuctionSubham MazumdarAinda não há avaliações

- Eicher MotorsDocumento4 páginasEicher MotorsSubham MazumdarAinda não há avaliações

- Union Budget and Railway BudgetDocumento3 páginasUnion Budget and Railway BudgetSubham MazumdarAinda não há avaliações

- FEDs and IndiaDocumento3 páginasFEDs and IndiaSubham MazumdarAinda não há avaliações

- Call On Welspun IndiaDocumento3 páginasCall On Welspun IndiaSubham MazumdarAinda não há avaliações

- Ultratech-The Dark Horse of The RaceDocumento4 páginasUltratech-The Dark Horse of The RaceSubham MazumdarAinda não há avaliações

- Vakrangee LimitedDocumento3 páginasVakrangee LimitedSubham MazumdarAinda não há avaliações

- La Opala Share Price Zoomed 14% After Block DealDocumento3 páginasLa Opala Share Price Zoomed 14% After Block DealSubham MazumdarAinda não há avaliações

- The FED ApathyDocumento3 páginasThe FED ApathySubham MazumdarAinda não há avaliações

- Bhoomi Disk Family Sheds Stakes in GHCLDocumento4 páginasBhoomi Disk Family Sheds Stakes in GHCLSubham MazumdarAinda não há avaliações

- Dynamic Levels Morning Report 26th August 2016 UpDocumento5 páginasDynamic Levels Morning Report 26th August 2016 UpSubham MazumdarAinda não há avaliações

- Call On Cosmo Films PDFDocumento2 páginasCall On Cosmo Films PDFSubham MazumdarAinda não há avaliações

- Call On SSWLDocumento3 páginasCall On SSWLSubham MazumdarAinda não há avaliações

- IT Index RoseDocumento2 páginasIT Index RoseSubham MazumdarAinda não há avaliações

- Federal Reserves Economic SymposiumDocumento2 páginasFederal Reserves Economic SymposiumSubham MazumdarAinda não há avaliações

- Indo Count Share Price On The RiseDocumento2 páginasIndo Count Share Price On The RiseSubham MazumdarAinda não há avaliações

- Apcotex Share Price Zooming UpDocumento2 páginasApcotex Share Price Zooming UpSubham MazumdarAinda não há avaliações

- Call On HCL TechDocumento3 páginasCall On HCL TechSubham MazumdarAinda não há avaliações

- Hinduja GlobalDocumento2 páginasHinduja GlobalSubham MazumdarAinda não há avaliações

- RBL Bank Is All Set For Its IPO: Aim of The IPODocumento3 páginasRBL Bank Is All Set For Its IPO: Aim of The IPOSubham Mazumdar100% (1)

- SAIL Bets Big On India Revival by Implementing CapacityDocumento3 páginasSAIL Bets Big On India Revival by Implementing CapacitySubham MazumdarAinda não há avaliações

- Just Dial Q1 Was An Utter Failure Share Price Dips 3%: Market SynopsisDocumento3 páginasJust Dial Q1 Was An Utter Failure Share Price Dips 3%: Market SynopsisSubham MazumdarAinda não há avaliações

- BedDocumento17 páginasBedprasadum2321Ainda não há avaliações

- Eternal LifeDocumento9 páginasEternal LifeEcheverry MartínAinda não há avaliações

- Feline Neonatal IsoerythrolysisDocumento18 páginasFeline Neonatal IsoerythrolysisPaunas JoshiAinda não há avaliações

- Chhabra, D., Healy, R., & Sills, E. (2003) - Staged Authenticity and Heritage Tourism. Annals of Tourism Research, 30 (3), 702-719 PDFDocumento18 páginasChhabra, D., Healy, R., & Sills, E. (2003) - Staged Authenticity and Heritage Tourism. Annals of Tourism Research, 30 (3), 702-719 PDF余鸿潇Ainda não há avaliações

- Fansubbers The Case of The Czech Republic and PolandDocumento9 páginasFansubbers The Case of The Czech Republic and Polandmusafir24Ainda não há avaliações

- K9G8G08B0B SamsungDocumento43 páginasK9G8G08B0B SamsungThienAinda não há avaliações

- GRADE 1 To 12 Daily Lesson LOG: TLE6AG-Oc-3-1.3.3Documento7 páginasGRADE 1 To 12 Daily Lesson LOG: TLE6AG-Oc-3-1.3.3Roxanne Pia FlorentinoAinda não há avaliações

- Reported Speech StatementsDocumento1 páginaReported Speech StatementsEmilijus Bartasevic100% (1)

- Top 100 Questions On Modern India History PDFDocumento16 páginasTop 100 Questions On Modern India History PDFmohammed arsalan khan pathan100% (1)

- War Thesis StatementsDocumento8 páginasWar Thesis StatementsHelpPaperRochester100% (2)

- Research Paper 701Documento13 páginasResearch Paper 701api-655942045Ainda não há avaliações

- Hilti Product Technical GuideDocumento16 páginasHilti Product Technical Guidegabox707Ainda não há avaliações

- Finding Nemo 2Documento103 páginasFinding Nemo 2julianaAinda não há avaliações

- Aspects of The Language - Wintergirls Attached File 3Documento17 páginasAspects of The Language - Wintergirls Attached File 3api-207233303Ainda não há avaliações

- Strategic ManagementDocumento14 páginasStrategic ManagementvishakhaAinda não há avaliações

- The Importance of Logo DesignDocumento1 páginaThe Importance of Logo DesignDanielAinda não há avaliações

- Philosophy of Jnanadeva - As Gleaned From The Amrtanubhava (B.P. Bahirat - 296 PgsDocumento296 páginasPhilosophy of Jnanadeva - As Gleaned From The Amrtanubhava (B.P. Bahirat - 296 PgsJoão Rocha de LimaAinda não há avaliações

- Hce ReviewerDocumento270 páginasHce ReviewerRaquel MonsalveAinda não há avaliações

- Conrail Case QuestionsDocumento1 páginaConrail Case QuestionsPiraterija100% (1)

- Proper AdjectivesDocumento3 páginasProper AdjectivesRania Mohammed0% (2)

- CU 8. Johnsons Roy NeumanDocumento41 páginasCU 8. Johnsons Roy NeumanPatrick MatubayAinda não há avaliações

- Serological and Molecular DiagnosisDocumento9 páginasSerological and Molecular DiagnosisPAIRAT, Ella Joy M.Ainda não há avaliações

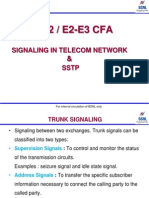

- Signalling in Telecom Network &SSTPDocumento39 páginasSignalling in Telecom Network &SSTPDilan TuderAinda não há avaliações

- Marketing PlanDocumento41 páginasMarketing PlanMark AbainzaAinda não há avaliações

- Spiritual Transcendence in Transhumanism PDFDocumento10 páginasSpiritual Transcendence in Transhumanism PDFZeljko SaricAinda não há avaliações

- Julie Jacko - Professor of Healthcare InformaticsDocumento1 páginaJulie Jacko - Professor of Healthcare InformaticsjuliejackoAinda não há avaliações

- Lead Workplace CommunicationDocumento55 páginasLead Workplace CommunicationAbu Huzheyfa Bin100% (1)