Escolar Documentos

Profissional Documentos

Cultura Documentos

Some Puzzling Features of India S Recent GDP Numbers 0

Enviado por

Raj MundaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Some Puzzling Features of India S Recent GDP Numbers 0

Enviado por

Raj MundaDireitos autorais:

Formatos disponíveis

ECONOMIC NOTES

EPW Research Foundation

Some Puzzling Features

of Indias Recent GDP Numbers

J Dennis Rajakumar, S L Shetty

An analysis of the end-November

2015 data release of the Central

Statistics Office raises some

issues that must be kept in mind

while discussing the state of

Indias economy. If past trends

are anything to go by, economic

growth in 201516 will not

improve in the last quarter

as some seem to hope. The

movements in the GDP deflators

and the very odd behaviour of a

gradual decline in the investment

rate together indicate that

growth in 201516 will not end

as earlier forecast.

he Central Statistics Office (CSO)

released the second quarter estimates of 201516 on 30 November

2015 (CSO 2015b), which has certain interesting and even intriguing features. The

object of this note is to decipher the various

dimensions of quarterly, half-yearly and

annual growth rates of gross value added

(GVA) at basic prices, gross domestic

product (GDP) at market prices, and in

their respective implied deflators. Using

these estimates for GVA at basic prices and

GDP at market prices, we provide an assessment of the likely influence of indirect

taxes on the growth rate, even if negligible.

Our review of these numbers also extends

to a few more areas: (i) a comparison of

the behaviour of GDP deflators with the

behaviour of wholesale and consumer

prices; (ii) a closer look at the deflators

employed to estimate private final consumption expenditures (PFCE) in real

terms, a key component of GDP at market

prices; and, finally, (iii) the dichotomous

nature of trends of the investment rate

and GDP growth rate.

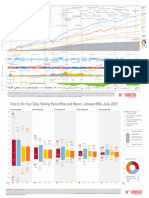

Odd Seasonal Growth Trends

J Dennis Rajakumar (dennisraja@epwrf.in) is

Director and S L Shetty (slshetty@epwrf.in) is

Advisor, EPW Research Foundation, Mumbai.

Economic & Political Weekly

EPW

january 9, 2016

Second, while the sharp increases in

growth rates are observed in quarterly

and half-yearly periods as well, certain

distinct seasonal patterns are observed,

especially in quarterly growth rates at

current prices (Figure 1, p 80). The quarterly data follow a zigzag pattern in practically every year with the second quarter

growth, in general, being the peak and

the fourth quarter growth, the trough.

There is thus a jump in the growth rate

from the first quarter to the second or at

times from the second to the third, and

then it declines in the next quarter. Following these quarterly trends, the halfyearly growth rates on a year-on-year

(y-o-y) basis, whether at constant or current prices, show that the first half

(AprilSeptember) of all years experiences higher growth compared to the

second half (OctoberMarch). These

seasonal trends are partly reflective of

the flows of agricultural output, though

the difference between kharif and rabi

output has narrowed over the years, the

second quarter is when GDP growth

peaks, and not the third quarter.

Indirect Tax Collection Effect

The third set of revelations in these data

concerns the distinction between GVA at

basic prices and GDP at market prices.

Until the NAS New Series, the CSO used

to measure the economys growth in terms

of the changes in real GDP at factor cost.

The sum of GVA originating from various

economic activities such as agriculture,

mining, quarrying, manufacturing and so

In Table 1 and Table 2 (p 80), we have

mapped growth rates in GVA at basic prices

and GDP at market prices, Table 1: Growth Rate of GVA at Basic Prices

(y-o-y Basis, in %)

Year

Quarter-wise

Half-yearly Full Year

respectively, in quarterly, Variable

Q1

Q2

Q3

Q4

H1

H2

half-yearly and annual peri- At constant price 201213 5.0 6.2 4.4 4.1 5.6 4.3 4.9

ods for all the years from

201314

7.2 7.5 6.6 5.3

7.4 6.0 6.6

201213 onwards as availa201415

7.4 8.4 6.8 6.1

7.9 6.5 7.2

201516

7.1 7.4

7.2

ble in the National Accounts

Statistics (NAS) New Series. At current price 201213 13.0 14.7 12.3 11.7 13.9 12.0 12.9

201314 12.8 14.7 15.0 10.6 13.8 12.8 13.2

A few features stand out.

201415 14.0 13.4 8.2 6.0 13.7

7.1 10.2

First, the annual growth

201516

7.1 5.2

6.2

rates of both GVA at basic

Deflator

201213

7.6 8.0 7.6 7.2

7.8

7.4 7.6

prices and GDP at market

201314

5.3 6.7 7.9 5.0

6.0

6.4 6.2

prices show sharp increases,

201415

6.1 4.5 1.3 -0.1

5.3 0.6 2.9

the former from 4.9% in

201516

0.1 -2.0

-1.0

201213 to 7.2% in 201415 Q1 relates to AprilJune; Q2 to JulySeptember, Q3 to OctoberDecember and

to January and March.

and the latter from 5.1% to Q4

H1 relates to AprilSeptember and H2 to October to March.

Source: Based on data extracted from EPWRF India Time Series.

7.3% over the same years.

vol li no 2

79

ECONOMIC NOTES

EPW Research Foundation

Figure1: Quarterly Growth Rate of GDP at Market Price

(at Current Prices, in %)

Figure 2: Movement in Price Indices

(Index value)

140

16

201314

14

130

GDP deflator

CPI

12

120

201213

10

201415

110

WPI

8

100

6

4

201516

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

Q1

Q2

Q3

on used to constitute GDP at factor cost.

After adjusting for net indirect taxes

(that is, indirect taxes minus subsidies),

CSO used to arrive at GDP at market

price. In the NAS new series, CSO introduced a new intermediate concept of

GVA at basic prices, which is GDP at factor cost adjusted for net production taxes

(indirect taxes on production minus subsidies on production).1 Further, by adding

net indirect taxes on products (indirect

tax on products minus subsidies on

products) to GVA at basic price, CSO

arrived at GDP at market prices. After

introducing these changes, the CSO discontinued the practice of providing GDP

at factor cost by economic activities.

Instead, it now gives GVA at basic prices

and GDP at market prices. The CSO also

continues to provide GDP at market price

as per the older expenditure method.

In the above estimates, there are two

sets of results. The first one concerns

somewhat higher growth shown by GDP

at market prices than the growth rate

shown by GVA at basic prices. This excess

growth by the market price GDP, though

meagre, is entirely attributable to the

gradual acceleration in the growth of

indirect taxes net of subsidies. At constant

prices, the basic price GVA growth rates of

Table 2: Growth Rate of GDP at Market Price

Variable

Year

Q1

At constant price 201213

201314

201415

201516

At current price 201213

201314

201415

201516

Deflator

201213

201314

201415

201516

4.5

7.0

6.7

7.0

12.5

12.7

13.4

8.8

7.6

5.3

6.3

1.7

Note and Source: Same as Table 1.

80

Quarter-wise

Q2

Q3

6.3

7.5

8.4

7.4

14.8

14.7

13.6

6.0

8.0

6.7

4.7

-1.3

Q4

5.0

6.4

6.6

4.7

6.7

7.5

13.0

14.8

8.1

12.3

12.2

7.7

7.6

7.9

1.5

7.3

5.1

0.2

Q4

2011-12

4.9%, 6.6% and 7.2% in three successive

years of 201213 to 201415 are uniformly

followed by higher growth rates, though

minuscule, of 5.1%, 6.9% and 7.3%,

respectively. This is arithmetically possible only if there was some accelerated

growth in indirect taxes net of subsidies.

The second revealing result concerns

the higher growth recorded in the first

half as compared with the second half of

each year. Such a phenomenon of differences in growth in the two halves of

each year is noticed in both GVA at basic

prices and GDP at market prices. But,

interestingly, the difference in growth

between the two halves narrows down

in the series on GDP at market prices as

compared with the half-yearly growth

rate differences in the series on GVA at

basic prices. This narrowing of the difference is again attributable to indirect

tax collections. In a recent study by Rajakumar and Krishnaswamy (2015), it has

been shown that indirect tax buoyancies

are higher in the second half of a year

than in the first half.

GDP Deflators and Price Indices

In Figure 2, we have presented the movements in three price indicesthe GDP

deflator, Wholesale Price Index (WPI)

(y-o-y Basis, in %) (200405=100) and ConHalf Yearly Full Year sumer Price Index (CPI,

H1

H2

combined) (2012=100)

5.4 4.8

5.1

with each one indexed to

7.3 6.6 6.9

the first quarter of 201112.

7.5

7.0

7.3

The divergence of these

7.2

indices are more pro13.6 12.6 13.1

13.7 13.5 13.6

nounced in recent times.

13.5

7.9 10.5

As is well known, GDP

7.4

deflators are a conglom7.8

7.4

7.6

erate based on individual

6.0 6.5 6.3

deflators used for final

5.5 0.8 3.0

goods

consisting of con0.2

sumption goods, capital

2012-13

2013-14

2014-15

2015-16

goods, and services; they sometimes

cover output value indices, or WPI or CPI

themselves. While WPI is based on

wholesale price quotations, it covers

only commodities such as basic, intermediate and final goods. The CPI has

market prices as the reference point, but

its basket comprises consumption items

of goods as well as services. Given these

structural differences in the coverage of

these indices and their weighing diagrams, some differences may be noticed

in the economy-wide inflation rate based

on these three different indices.

We have worked out percentage

changes, y-o-y basis, in these price indices

(Table 3). Throughout, the CPI-based

inflation rate has remained higher than

the others. The inflation rate based on

the GDP deflator had been lower than

that based on CPI, but higher than that

Table 3: Percentage Change in Price Indices

(y-o-y Basis, in %)

Year

Quarter

GDP

WPI

CPI

Brent Oil

Deflator (200405=100) (2012=100) Prices

201213 Q1

Q2

Q3

Q4

201314 Q1

Q2

Q3

Q4

201415 Q1

Q2

Q3

Q4

201516 Q1

Q2

Q3$

7.6

8.0

7.6

7.3

5.3

6.7

7.9

5.1

6.3

4.7

1.5

0.2

1.7

-1.3

7.5

7.9

7.3

6.7

4.8

6.6

7.1

5.4

5.8

3.9

0.3

-1.8

-2.3

-4.5

-2.9

9.9

10.0

9.8

9.9

8.8

10.1

10.6

8.2

7.9

6.7

4.1

5.3

5.1

3.9

5.2

-7.6

-3.3

0.6

-5.1

-5.4

0.6

-0.8

-3.8

6.9

-7.7

-50.2

-43.8

-50.7

-39.3

$ relates to average of October and November.

Correlation Coefficient (Q1201213 to Q2201516).

GDP Deflator

1

WPI (200405=100) 0.984

CPI (2012=100)

0.956

Brent Oil Prices

0.926

0.984

1

0.941

0.950

0.956

0.941

1

0.851

0.926

0.950

0.851

1

Source: Brent Oil Prices is based on data extracted from

http://tonto.eia.gov/.

Others are based on data extracted from EPWRF India Time

Series.

january 9, 2016

vol li no 2

EPW

Economic & Political Weekly

ECONOMIC NOTES

EPW Research Foundation

based on WPI. Reflecting its conglomerate nature, the GDP deflator always lies

between the WPI and CPI. Differences in

the inflation rate based on these three

different indices showed wide divergence during the last three quarters for

which data are available. The WPI inflation rate has been negative consistently

during the last three quarters going

from -1.8% to -4.5%, whereas CPI inflation rates have remained positive and

showed a marginal fall from 5.3% in the

fourth quarter of 201415 to 3.9% in the

second quarter of the current fiscal. But

the GDP deflator had moved up in the

first quarter of the current fiscal and

then fell to -1.3% in the second quarter.

Given the countrys overwhelming

dependence on imports of crude oil and

petroleum products, the WPI inflation

rate has remained low with declining

international oil prices, more so since the

third quarter of 201415.2 The average

daily crude oil prices that prevailed during OctoberNovember 2015 are 39.3%

less than what prevailed during the same

period the previous year.

In Table 3, we have also appended the

correlation coefficient (r) between the

rates of change in various deflators and

also in crude oil prices for the period from

first quarter of 201213 to second quarter

of 201516. The GDP deflator variations

have a close association with those of

WPI (r=0.984). The inflation rate based on

WPI is also closely associated with rate

of change in crude oil prices (r=0.950).

This suggests that the sharp decline in

oil prices in the third quarter of the

current year would have a favourable

impact on WPI as a whole.3

Deflators and PFCE

The deflators analysed above relate to

output deflators used to estimate GDP in

real terms. When the CSO arrives at GDP

following the expenditure method, it is

done at market prices. The two sets of

GDP estimatesone by the production

method and the other by the expenditure methoddo not generally tally

and produce discrepancies, which get

reflected in the consolidated accounts of

the nation built in the NAS. Those discrepancies arise essentially because of

the differences in deflators used to

Economic & Political Weekly

EPW

january 9, 2016

arrive at GDP numbers. On the expenditure side of GDP, at a preponderant share

of 57.5%, the PFCE becomes the most

crucial (Table 4), and the deflators used

in its estimation are sure to influence

the overall expenditure side estimation

of GDP at constant price. Hence, we have

taken a close look at the PFCE deflators

used by CSO.

Q1

Quarter-wise

Q2

Q3

As % of GDP at market price

201112 59.6 55.6

59.5

Full

Year

55.9

57.6

57.6

57.7

201213 58.5 57.9

60.2

55.1

58.2

57.6

57.9

201314 58.8 56.9

59.1

55.3

57.9

57.2

57.5

201415 58.5 56.2

57.8

55.5

57.4

56.6

57.0

201516 58.7 55.9

Growth rate (y-o-y basis, in %)

201213 2.5 10.8

6.2

201314 7.7

CPI combined

(Base=2012)

7.0

6.0

5.0

4.0

3.0

Implicit deflator

of PFCE

2.0

Q1

Half-yearly

H1

H2

Q4

(in %)

8.0

1.0

Table 4: Trends in PFCE at Constant Price

Year

Figure 3: Rate of Change (y-o-y) in CPI and

Implicit Deflator of PFCE

57.3

3.2

6.4

4.7

5.5

5.6

4.6

7.0

6.7

5.8

6.2

201415 6.2

7.1

4.2

7.9

6.6

6.0

6.3

201516 7.4

6.8

7.1

Note and Source: Same as Table 1.

To begin with, we have worked out

relative shares of each component of PFCE

corresponding to CPI items (Table 5).

Expenditure on food and non-alcoholic

beverages tend to dominate the entire

basket of PFCE, followed by transport

and gross rentals for housing. These

three items together account for a little

over half of total PFCE. Financial servicesrelated items, such as insurance and other

than insurance together, constitute the

remaining 4.6% of total PFCE.

Looking at various subgroups of CPI

and PFCE items, a near correspondence

between these two is noticed, except

for financial services. Thus, PFCE items

Q2

Q3

201415

2014-15

Q4

Q1

Q2

201516

2015-16

matching with subgroups of CPI account

for about 95% of total PFCE (Table 5).

However, a lack of correspondence is

seen when we compare, in the same

table, the CPI weights and relative

shares of PFCE items in total.

As CPI captures prices prevailing in

market transactions, the CPI-based inflation rate may be expected to have a close

approximation to changes in the implicit

deflator of PFCE. In fact, difference between implicit deflator of PFCE and CPIbased inflation rate used to be meagre at

about 0.6% in the first two quarters of

201415. Since then, such differences

have widened to about 2.5% during the

last three quarters (Figure 3). This may

be ascribed to the method of deflation

followed for various product items of

PFCE, many of which depend upon the

implicit deflator of gross value of output

or volume (Annexure 1, p 82).

It may be reiterated that households

spend money as per the price prevailing

in the market, and hence, CPI captures

market prices better. Moreover, given

the close matching of items included

Table 5: Matching of Items of CPI and PFCE

CPI Items and Weights

Sub-group Description

Code

1

2

3

4

Identical PFCE as per NAS

Weights

Food and beverages

45.86

Paan, tobacco and intoxicants 2.38

Clothing and footwear

6.53

Housing

10.07

5

Fuel and light

6.1.01 Household goods

and services

6.1.02 Health

6.1.03 Transport and communication

6.1.04 Recreation and amusement

6.1.05 Education

6.1.06 Personal care and effects

7

All Groups

6.84

3.8

5.89

8.59

1.68

4.46

3.89

100.0

Sl no*

Item Name

1

2

3

4.1+ 4.2

Share in Total

(201112)

Food and non-alcoholic beverages

Alcoholic beverages, tobacco and narcotics

Clothing and footwear

Gross rentals for housing (11.0) + Water supply and

miscellaneous services relating to the dwelling (0.3)

4.3

Electricity, gas and other fuel

5+ 12.5

Furnishing, household equipment and routine

household maintenance (3.6) + other services nec (9.3)

6

Health

7+8

Transport (14.9) + Communication (1.9)

9+11

Recreation and culture (1.1) + Restaurants and hotels (2.3)

10

Education

12.1+12.2 Personal care (1.2) + Personal effects nec (0.6)

All

29.17

3.09

6.99

11.36

3.71

12.84

3.54

16.80

3.38

2.68

1.84

95.40

* As per NAS publication.

Source: Based on data extracted from EPWRF India Time Series.

vol li no 2

81

ECONOMIC NOTES

EPW Research Foundation

under both CPI and PFCE, the change in

the implicit PFCE deflator may be

expected to move in tandem with

changes in CPI. If we then consider the

implicit deflator based on CPI for PFCE,

the resultant real GDP growth estimated

on the expenditure side would be different. To be more specific, the implicit

deflator of PCFE during the last four

quarters has fallen more than the CPI

and so the magnitude of growth of GDP

at market prices in these quarters, if

based on CPI, would be lower in real

terms than what has been currently

estimated.

Growth and Investment Dichotomy

Yet another distinct feature noticed in

the new NAS series is the persistent

decline in capital formation rates alongside acceleration in real GDP growth.

This issue has been highlighted (Rajakumar, Sawant and Shetty 2015) including by raising the larger question of the

misgivings regarding the possibilities of

the higher incremental capitaloutput

ratios in the face of high interest rates

and severe infrastructural bottlenecks.

The gross fixed capital formation (GFCF)

and gross capital formation (GCF), as

percentages of GDP, have persistently

fallen even in the latest half-year of

201516. The first half-year estimates

have fallen from the peak of 40.5% in

first half of 201112 to 33.4% in first

half of 201516 in GCF rates and from

34.8% to 29.9% in GFCF rates during the

same period. The annual estimates of

GCF rates have slipped from 38.9% to

33.1% between 201112 and 201415 and

Table 6: Investment Rate (as % of GDP at Market

Price, at Constant Price)

Year

Q1

Quarter-wise

Q2

Q3

Q4

Half-yearly

H1

H2

Gross Fixed Capital Formation

201112 34.7 35.0

32.4 32.7 34.8

201213 31.2 32.0

31.1 33.3 31.6

201314 29.8 31.7

30.8 30.7 30.7

201415 30.4 30.3

29.6 29.7 30.3

201516 29.8 30.1

29.9

Gross Capital Formation

(Includes Gross Fixed CF and changes in stock)

201112 40.3 40.7

37.2 37.8 40.5

201213 36.4 37.3

36.0 37.9 36.8

201314 32.9 34.7

33.5 33.7 33.8

201415 33.7 33.3

32.3 33.1 33.5

201516 33.2 33.6

33.4

Note and Source: Same as Table 1.

82

Full

Year

32.6 33.6

32.2 31.9

30.8 30.7

29.7 30.0

those of GFCF rates from 33.6% to 30%

(Table 6). This is the period when real

GDP growth rates have accelerated.

Summary and Implications

The analysis presented reveals that the

real growth rate has accelerated over

the years from 201213. A seasonality

factor has been noticed, with growth

invariably at a peak in the second quarter

and a trough in the fourth quarter.

Growth performance during the first

half of every year has been better than

the second half. The GDP deflator is

closely associated with WPI, which has

persistently been in the negative zone,

largely due to declines in international

oil prices. It was observed that the

real PFCE, a dominant component of

GDP at market prices, is subject to deflators of a mixed method. As PFCE reflects

household spending at market prices, if

CPI is used alternatively as deflator for

PFCE, the real growth of GDP at market

prices on the expenditure side would be

different. While the investment rate is

falling, the growth rate in real terms is

acceleratinga very odd phenomenon

in macroeconomic terms. More importantly, the nominal growth of GDP has

stood at 7.4% during the first half of the

current year, which appears abysmally

low compared to the expected 11.5%

of nominal growth for the full year in

the Union Budget 201516. The second

half of the current fiscal year will not be

any better, if the past trend holds good.

As WPI, and therefore the GDP deflator,

shows a preponderant influence of

international oil prices on which the

country has no control, the trailing

nominal growth is thus too alarming,

leaving no scope for complacency.

References

Central Statistics Office (2015a): Changes in

Methodology and Data Sources in the New

Series of National Accounts Base Year 201112,

Ministry of Statistics and Programme Implementation, New Delhi.

(2015b): Quarterly Estimates of Gross Domestic

Product for the Second Quarter (JulySeptember) of 201516, Press Note, 30 November.

Rajakumar, J Dennis and R Krishnaswamy (2015):

Surge in Union Government Revenues:

Indirect Tax Collection Leads Growth, Economic & Political Weekly, Vol 50, No 50,

12 December.

Rajakumar, J Dennis, Vijayata B Sawant and Anita

B Shetty (2015): New Estimates of Saving and

Capital Formation: Larger Numbers in a

Declining Trend, Economic & Political Weekly,

Vol 50, No 12, 21 March.

Annexure 1: Deflation Method Followed for PFCE

Group/Product Items

Sl no Name of the Group/Products

Method of Deflation

Primary goods

Base year prices (mostly

retail)

Manufactured products

CPI

Other products

CPI

Services:

Housing, water supply and

miscellaneous services

relating to dwelling

GVO at 201112 prices

Health services

CPI

Purchase of transport

Implicit price indices of GVO

services and maintenance of

personal transport equipment

Communication

Implicit price indices of GVO

Recreational and cultural

services

Implicit price indices of GVO

Education

Implicit price indices of GVO

Hotels and restaurants

Implicit price indices of GVO

Other miscellaneous services

Implicit price indices of GVO

Electricity, gas and other fuel:

Electricity

Production taxes are levies on factors of

productionland, labour or capital, irrespective of the volume of production like land

revenue. These taxes are in contrast to product

taxes which are wholly indirect levies imposed

per unit of products (CSO 2015a).

This is based on y-o-y change in the quarterly

average of the widely-used Europe Brent spot

price of crude oil (dollars per barrel, free-onboard basis).

WPI-based inflation rate in October and

November 2015 was in the order of -3.81% and

-1.99%, respectively. Index of WPI of fuel and

power (weight 14.9%) fell by (-)16.3% in October and (-)11.1% in November 2015; and of

Base year estimates are

moved forward using

consumption of electricity

Gas

Base year estimates are

moved forward using

consumption of gas

Kerosene

Base year estimates are

moved forward using

consumption of kerosene

Firewood

Base year estimates are

moved forward using

output of firewood at

201112 prices

Charcoal

Base year estimates are

moved forward using

production of charcoal

Gobar gas

Implicit price index of

production of gobar gas

Dung fuel, coke and

other fuel

Ratios of output to PFCE

have been used on the value

of output at constant prices

Notes

37.5 38.9

37.0 36.9

33.6 33.7

32.8 33.1

manufactured products (weight 65%) also

declined by (-)1.7% and (-)1.4%, respectively.

(Source: EPWRF India Time Series, accessed

from www.epwrfits.in).

CPI is Consumer Price Index; GVO is gross value of output.

Source: CSO (2015a: 17681).

january 9, 2016

vol li no 2

EPW

Economic & Political Weekly

Você também pode gostar

- 14 TH Finance CommissionDocumento5 páginas14 TH Finance CommissionRaj MundaAinda não há avaliações

- Doga Ka EncounterDocumento91 páginasDoga Ka EncounterRaj Munda50% (2)

- A Brief Note For The Civil Services Aspirants: - (Others Can Skip This)Documento10 páginasA Brief Note For The Civil Services Aspirants: - (Others Can Skip This)Raj MundaAinda não há avaliações

- 201 Shubhasya SheeghramDocumento50 páginas201 Shubhasya SheeghramRaj MundaAinda não há avaliações

- 143 Haath Jor Hathiyaar ChorDocumento28 páginas143 Haath Jor Hathiyaar ChorRaj MundaAinda não há avaliações

- Doga Doga My Brother-.Documento59 páginasDoga Doga My Brother-.Raj Munda100% (1)

- Doga Andha Doga PDFDocumento59 páginasDoga Andha Doga PDFRaj Munda75% (4)

- Bhookha Doga PDFDocumento52 páginasBhookha Doga PDFRaj Munda0% (2)

- Doga Ka Encounter PDFDocumento91 páginasDoga Ka Encounter PDFRaj MundaAinda não há avaliações

- Doga GayabchandDocumento91 páginasDoga GayabchandRaj Munda60% (5)

- Hath Utha Doga Gun Jhuka SteelDocumento59 páginasHath Utha Doga Gun Jhuka SteelRaj MundaAinda não há avaliações

- Express Way DogaDocumento45 páginasExpress Way DogaRaj Munda100% (1)

- Doga - Sooraj Doga Ban - 3 PDFDocumento31 páginasDoga - Sooraj Doga Ban - 3 PDFRaj MundaAinda não há avaliações

- Doga Nirmulak PDFDocumento37 páginasDoga Nirmulak PDFRaj MundaAinda não há avaliações

- Doga WafadarDocumento50 páginasDoga WafadarRaj Munda100% (4)

- Doga Sooraj Doga Ban 3Documento31 páginasDoga Sooraj Doga Ban 3Raj Munda50% (2)

- Naram GaramDocumento62 páginasNaram GaramRaj MundaAinda não há avaliações

- GOLDEN RACER Hellsky PDFDocumento46 páginasGOLDEN RACER Hellsky PDFRaj MundaAinda não há avaliações

- Terms & Conditions 2016 18Documento15 páginasTerms & Conditions 2016 18Raj MundaAinda não há avaliações

- Tackling Mba InterviewDocumento86 páginasTackling Mba InterviewRaj MundaAinda não há avaliações

- The Institute Magazine 'Sarjana', 2011-12, 31st IssueDocumento254 páginasThe Institute Magazine 'Sarjana', 2011-12, 31st IssueRaj MundaAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- FMDS0903Documento13 páginasFMDS0903hhAinda não há avaliações

- Inflation Accounting PDFDocumento20 páginasInflation Accounting PDFadil sheikhAinda não há avaliações

- Indicadores Economicos Che Oct. 2014Documento1 páginaIndicadores Economicos Che Oct. 2014Mari Luz Hermoza MamaniAinda não há avaliações

- Price Adjustment Concept and Practice I & IIDocumento31 páginasPrice Adjustment Concept and Practice I & IIbunty0% (1)

- Cost Inflation IndexDocumento9 páginasCost Inflation IndexMansi AggarwalAinda não há avaliações

- Current Macroeconomic and Financial Situation Tables Based On Five Months Data of 2021.22Documento84 páginasCurrent Macroeconomic and Financial Situation Tables Based On Five Months Data of 2021.22Mohan PudasainiAinda não há avaliações

- CH 2Documento21 páginasCH 2Geoffroy ElmiliardoAinda não há avaliações

- CBCS - Macroeconomics - Unit 1 - National Income AccountingDocumento37 páginasCBCS - Macroeconomics - Unit 1 - National Income AccountingSouptik MannaAinda não há avaliações

- 11 ECO 08 Introduction To Index NumberDocumento4 páginas11 ECO 08 Introduction To Index NumberFebin Kurian FrancisAinda não há avaliações

- 2022 Morningstar Andex ChartDocumento2 páginas2022 Morningstar Andex Chartalt.sa-33bwuogAinda não há avaliações

- Unit 2 (Fundamental Analysis)Documento19 páginasUnit 2 (Fundamental Analysis)Ramya RamamurthyAinda não há avaliações

- Adjusting Prices For Inflation and Creating Price Indices: FEWS NET Markets Guidance, No 3 May 2009Documento23 páginasAdjusting Prices For Inflation and Creating Price Indices: FEWS NET Markets Guidance, No 3 May 2009mazamniaziAinda não há avaliações

- National Income AccountingDocumento42 páginasNational Income Accountingraemu26Ainda não há avaliações

- Unit III MakroekonomiksDocumento40 páginasUnit III MakroekonomiksLerton G. ClaudioAinda não há avaliações

- Principles of Macroeconomics 6th Edition Frank Test Bank 1Documento36 páginasPrinciples of Macroeconomics 6th Edition Frank Test Bank 1cynthiasheltondegsypokmj100% (24)

- Case For Momentum Investing by AQR (Summer 09)Documento12 páginasCase For Momentum Investing by AQR (Summer 09)rodmorley100% (1)

- Methodology SP Equity Indices Policies PracticesDocumento65 páginasMethodology SP Equity Indices Policies PracticesAndrew KimAinda não há avaliações

- Use of Statistics in Our Daily Life: Example 1 Data Types (P 54)Documento8 páginasUse of Statistics in Our Daily Life: Example 1 Data Types (P 54)KellyAinda não há avaliações

- Fs Morningstar Lsta Us Leveraged Loan 100 TR UsdDocumento4 páginasFs Morningstar Lsta Us Leveraged Loan 100 TR Usdtedsm55458Ainda não há avaliações

- CMEs Annual Tables 2074-75 FinalDocumento73 páginasCMEs Annual Tables 2074-75 FinalDebendra Dev KhanalAinda não há avaliações

- Financial Markets Assignment Sem-2Documento14 páginasFinancial Markets Assignment Sem-2Prerna BhansaliAinda não há avaliações

- ITC LTD PDFDocumento15 páginasITC LTD PDFFathi FathuAinda não há avaliações

- In 1999 The Economist Reported The Creation of An IndexDocumento1 páginaIn 1999 The Economist Reported The Creation of An Indextrilocksp SinghAinda não há avaliações

- Elcano Global Presence Report 2022Documento46 páginasElcano Global Presence Report 2022ifaloresimeonAinda não há avaliações

- Spinoffs and Wealth Transfers: The Marriott CaseDocumento34 páginasSpinoffs and Wealth Transfers: The Marriott CaseChura HariAinda não há avaliações

- C-5 BlockDocumento22 páginasC-5 BlockM Bilal KhattakAinda não há avaliações

- Investment Analysis Group ProjectDocumento134 páginasInvestment Analysis Group ProjectWei ming ThongAinda não há avaliações

- ISC EconomicsDocumento8 páginasISC EconomicsPrincess Soniya100% (1)

- Spdji Strategy Index DirectoryDocumento8 páginasSpdji Strategy Index DirectoryAayush MittalAinda não há avaliações

- Description: S&P Cryptocurrency Largecap IndexDocumento5 páginasDescription: S&P Cryptocurrency Largecap IndexAJ MagtotoAinda não há avaliações