Escolar Documentos

Profissional Documentos

Cultura Documentos

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Enviado por

Shyam SunderTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Enviado por

Shyam SunderDireitos autorais:

Formatos disponíveis

HANUNG TOYS & TEXTILES LTD.

Manufacturers & Exporters of Stuffed Toys Home Furnishings

Govt. Recognised Export House

Corporate Office:

CIN- L7 4999DL 1990PLC041722

108-109, NSEZ, NOIDA-201 305, INDIA

Tel. : 91-120-2567501 - 04, 4140200

Fax: 91-120-3042099,4140270

Web: www.hanung.com

E-mail: admin@hanung.com

hanungcorp@gmail.com

The Bombay Stock Exchange Limited

Phiroze Jeebhoy Towers

Dalal Street,

Mumbai-40001

Scrip Code: "532770"

SUB: Outcome of the Board Meeting

Date:13.08.2016

The National Stock Exchange of India Limited

Exchange Plaza, Bandra Kurla Complex

Bandra (East)

Mumbai-400051

Scrip Code: "Hanung"

and submission of Un-Audited

with Limited Review Report for the Quarter ended on

Financial Results along

so" June

2016

Dear Sir,

This is to inform

todayLe

you that the followings

rs" August

are the outcomes

of the meeting

of Board of Directors held

2016 :

Financial Results for the quarter ended on

1.

Un-Audited

2.

Limited Review Report on the Un-audited

3.

Appointment

so" June 2016.

Financial Results

of Mr. Mukesh Kumar(DIN 07231118) as non-executive

non-independent

Director

4.

Mrs. Anju Bansal (DIN 00028508) has resigned as non-executive

Director of the Company.

Pursuant to Regulation

33 of SEBI (Listing Obligation

copy ofthe

Financial Results along with the Limited Review Report as approved and adopted

Un-Audited

by the Board of Directors for the Quarter ended

This is for your information

and Disclosure Requirements)

so" June 2016

Regulation, 2015, a

is attached herewith.

and request to take on your record.

Thanking You

Yours faithfully,

F;n~~

andTextilesUmited

(Lalit Chawla)

Company Secretary

Encl: as above

Regd. Off.: E-93, 2nd Floor, Greater Kailash Enclave-I, New Delhi-110048

HANUNG TOYS AND TEXTILES LIMITED

CIN L74999DL1990PLC04I722

Regd. Office: E-93, 2nd Floor, Greater Kailash Enclave, Part-I, New Delhi-I 10048

Corporte Office: 108-109, NSEZ, Noida-201305, India

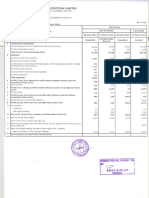

UNAUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED 30TH JUNE,

2016

(Rs in Lacs)

S.No.

Particulars

30.06.2016

(Unaudited)

I

2

a

b

c

d

e

f

3

4

5

6

7

8

9

10

11

12

13

14

15

16

INCOME FROM OPERATION

Revenue from Operations

EXPENDITURE:

Consumption of Raw Materials

Change in inventories (Increase) I Decrease

Emplovees Benefits Exos,

Depreciation

Other Expenses

Total

Profit/CLoss) from operation before other income,

Finance cost & Exceptional Items

Other Income

Profit/CLoss) from ordinary activities before

Finance Cost & Exceptional Items

Finance cost

Proflt/(Loss) from ordinary activities after Finance

Cost but before Exceptional Items

Exceptional Items

Profit/CLoss) from Ordinary Activities before Tax

Tax Expenses

Net Proflt/d.oss)

from Ordinary Activites after

Tax

Extraordinary items

Net Profit/CLoss) for tbe Period

Paid up Equity Share Capital

(Face Value ofRs. 101- each)

Reserve excluding Revaluation Reserves

(as per Balance Sheet)

Earning Per Share (before & after extraordinary items)

(ofRs. IO/-each) (Not annualised)

a) Basic

b) Diluted

Quarter Ended

31.03.2016

30.06.2015

(Unudited)

(Unaudited)

Year Ended

31.03.2016

(Audited)

208.77

852.92

2,679.72

9,404.23

(8.78

4871.71

5,772.19

114.96

1,312.69

774.32

142.54

1,321.39

13,031.42

1,492.91

113.42

2,193.19

(1,984.42)

2,908.15

15,015.98

(14,163.06)

1,315.62

846.94

16,800.31

(14,120.59)

29,186.59

36,925.47

494.79

5,282.63

5,604.10

77,493.58

(68,089.35)

24.00

(1,960.42)

14.76

(14,148.30)

15.60

(14,104.99)

106.95

(67,982.40)

7,259.61

(9,220.03)

8,481.46

(22,629.76)

5,782.85

(19,887.84)

27,819.71

(95,802.11 )

(456

(19,883.28'

18.30

(95,820.41)

13,528.00

(109,348.41 )

-(9,220.03)

-(9,220.03)

-(9,220.03)

3,082.28

(225,575.41 )

(29.91 ,

(29.91)

3.47

(22,633.23)

13,528.00

(36,161.23)

--

(19,883.28)

--

--

(36,161.23)

3,082.28

(19,883.28

3,082.28

(109,348.41

3,082.28

(216,355.38)

(126,889.25)

(216,355.38)

(I 17.3 1)

(117.31)

(64.52

(64.52)

(354.71

(354.71)

SEGMENTS-WISE

REVENUE

RESULTS

(Rs In Lacs)

S.N.

Particulars

Quarter

. 30.06.2016

(Unaudited)

I Segment Revenues

a Toys

b Textiles

Total Income

2 Segment Results:

a Toys

b Textiles

Total

GEOGRAPHICAL

a Exports

b Domestic

Total Sales

31.03.2016

(Unaudited)

Year Ended

30.06.2015

(Unaudited)

31.03.2016

(Audited)

24.23

184.54

208.77

26.53

826.39

852.92

127.29

2,552.43

2,679.72

188.71

9,215.52

(9,404.23)

(242.88)

(1,741.54)

(613.06)

(13,550.00)

(14,163.06)

(4,581.96)

(9,538.63)

(14,120.59)

(6,014.98)

(62,074.37)

(1,984.42)

Interest Costs

Unallocable Income

Unallocable Expenses

Total Profit Before Tax

Ended

7,259.61

24.00

8,481.46

14.76

3.47

-(9,220.03)

(22,633.23)

-29.84

29.84

9.13

573.78

582.91

5,782.85

15.60

(4.56)

(19,883.28)

(68,089.35)

27,819.71

106.95

18.3

(95,820.41 )

SEGMENT:

421.28

1,656.35

2,077.63

918.15

5,550.53

6,468.68

NOTES:

The above Un-Audited Financial Results (Provisional) for the Quarter ended on 30th June, 2016 were reviewed by

the Audit Committee and approved by the Board of Directors at its meeting held on 13th August 2016.

2

The above results have undergone "Limited Review" by the Statutory Auditors ofthe Company.

The Company operates in Two segments viz stuff toys and textiles. However the Capitals employed in the segments

are interchangeable hence not segregated.

Previous year's figures have been regrouped and reclassified, wherever necessary.

For Hanung

Toys & Textiles Ltd.

?7~/'

Place: Noida

Date: 13th August

2016

Ashok Kumar Bansal

Chairman-cumManaging Director

Ravindra Sharma & Associates

Chartered Accountants

Limited Review Report

To Board of Directors

lIANU G TOYS A D TEXTILES

LIMiTED

I. We have reviewed

the accompanying statement of un-audited financial results of Hanung Toys and

Textiles Limited for the quarter ended on 30lh June 2016 except for the disclosures regarding' Public

Shareholding'

and 'Promoter and Promoter Group Shareholding'

which have been traced from

disclosures made by the management and have not been audited by us. This statement is the

responsibility of the Company's Management and has been approved by the Board of Directors. Our

responsibility is to issue a report on these financial statements based on our review.

2. We conducted

our review in accordance with the Standard on Review Engagement (SRE) 2400,

Engagements to Review Financial Statements issued by the Institute of Chartered Accountants ofTndia.

This standard requires that we plan and perform the review to obtain moderate assurance as to whether

the financial statement are free of material misstatement. A review is limited primarily to inquiries of

company personnel and analytical procedures applied to financial data and thus provide less assurance

than an audit. We have not performed an audit and accordingly, we do not express an audit opinion.

3. Attention

is invited to the following :-

There are certain statutory dues which are pending to be paid beyond their due dates as on 30'h June 2016

a per the following details:i. ESI Payable :- Rs. 118.08 Lacs

ii. PF Payable :- Rs. 234.52 Lacs

iii. Service Tax Payable :- Rs. 5.17 Lacs

iv. Sales Tax Payable: Rs. 156.19 Lacs

v. TDS Payable :- Rs. 48.95 Lacs

4.

Based on

mentioned

statement

and other

disclosed

disclosed,

Date:

Place:

our review conducted as above, except for the effect of above paragraph regarding the issues

therein nothing has come to our attention that causes us to believe that the accompanying

of un-audited financial results prepared in accordance with applicable accounting standards

recognized accounting practices and policies has not disclosed the information required to be

in terms of Clause 41 of the Listing Agreement including the manner in which it is to be

or that it contains any material misstatement.

August 13, 2016

oida

12,1 st Floor, Satya Niketan (Opp. S.V. College), New Delhi - 110021

Phone: Off. : 011-2611 7997 Mobile: 98100-50791

Fax: 011-26117997 E-mail: rscompany1 @gmail.com

Você também pode gostar

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento6 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento8 páginasStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Documento6 páginasStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Updates On Financial Results For June 30, 2016 (Result)Documento4 páginasUpdates On Financial Results For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Documento5 páginasAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Documento11 páginasStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Revised Financial Results For June 30, 2016 (Result)Documento4 páginasRevised Financial Results For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Documento6 páginasStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Auditors Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Auditors Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento7 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento2 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento6 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento9 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionAinda não há avaliações

- Mutual Fund Holdings in DHFLDocumento7 páginasMutual Fund Holdings in DHFLShyam SunderAinda não há avaliações

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocumento6 páginasOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderAinda não há avaliações

- JUSTDIAL Mutual Fund HoldingsDocumento2 páginasJUSTDIAL Mutual Fund HoldingsShyam SunderAinda não há avaliações

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocumento5 páginasExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderAinda não há avaliações

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocumento2 páginasSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderAinda não há avaliações

- HINDUNILVR: Hindustan Unilever LimitedDocumento1 páginaHINDUNILVR: Hindustan Unilever LimitedShyam SunderAinda não há avaliações

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Documento1 páginaPR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results For September 30, 2013 (Result)Documento2 páginasFinancial Results For September 30, 2013 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocumento2 páginasSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderAinda não há avaliações

- Financial Results For Dec 31, 2013 (Result)Documento4 páginasFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results For June 30, 2014 (Audited) (Result)Documento3 páginasFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results For March 31, 2016 (Result)Documento11 páginasStandalone Financial Results For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results For Mar 31, 2014 (Result)Documento2 páginasFinancial Results For Mar 31, 2014 (Result)Shyam SunderAinda não há avaliações

- Financial Results For June 30, 2013 (Audited) (Result)Documento2 páginasFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- PDF Processed With Cutepdf Evaluation EditionDocumento3 páginasPDF Processed With Cutepdf Evaluation EditionShyam SunderAinda não há avaliações

- Standalone Financial Results For September 30, 2016 (Result)Documento3 páginasStandalone Financial Results For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Transcript of The Investors / Analysts Con Call (Company Update)Documento15 páginasTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results For June 30, 2016 (Result)Documento2 páginasStandalone Financial Results For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Investor Presentation For December 31, 2016 (Company Update)Documento27 páginasInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- PRINCIPLES OF APPRAISAL PRACTICE AND CODE OF ETHICSDocumento20 páginasPRINCIPLES OF APPRAISAL PRACTICE AND CODE OF ETHICSnaren_3456Ainda não há avaliações

- CLEANSING PROCESS FOR DIVIDENDS AND GAINSDocumento2 páginasCLEANSING PROCESS FOR DIVIDENDS AND GAINSAbdul Aziz MuhammadAinda não há avaliações

- Global Employer Branding PDFDocumento32 páginasGlobal Employer Branding PDFIuliana DidanAinda não há avaliações

- Partnership Operations Enabling AssessmentDocumento3 páginasPartnership Operations Enabling AssessmentVon Andrei MedinaAinda não há avaliações

- Draft Constitution of Made Men WorldwideDocumento11 páginasDraft Constitution of Made Men WorldwidebrightAinda não há avaliações

- This Study Resource Was: Pre-QE ExaminationDocumento8 páginasThis Study Resource Was: Pre-QE ExaminationMarcus MonocayAinda não há avaliações

- Glossary BAHARDocumento372 páginasGlossary BAHARJasmine AishaAinda não há avaliações

- Leonardo Bognot V RRI Lending CorporationDocumento10 páginasLeonardo Bognot V RRI Lending CorporationMarchini Sandro Cañizares KongAinda não há avaliações

- KomatsuDocumento54 páginasKomatsuhaiccdk6Ainda não há avaliações

- A Study On Customer Satisfaction of Reliance Life InsuranceDocumento57 páginasA Study On Customer Satisfaction of Reliance Life InsuranceRishabh PandeAinda não há avaliações

- ParametresDocumento2 páginasParametresgabyy7985Ainda não há avaliações

- NFLX Initiating Coverage JSDocumento12 páginasNFLX Initiating Coverage JSBrian BolanAinda não há avaliações

- Al-Baraka Islamic Bank Internship ReportDocumento69 páginasAl-Baraka Islamic Bank Internship Reportbbaahmad89100% (8)

- Notes - Timeliness of Reporting and Stock Price Reaction To Earnings AnnoucementsDocumento12 páginasNotes - Timeliness of Reporting and Stock Price Reaction To Earnings AnnoucementsChacko JacobAinda não há avaliações

- Test Transfer IPV To InventoryDocumento17 páginasTest Transfer IPV To Inventorykallol_panda1Ainda não há avaliações

- Adani Bill JADHAVDocumento5 páginasAdani Bill JADHAVsupriya thombreAinda não há avaliações

- Report On Salem Telephone CompanyDocumento11 páginasReport On Salem Telephone Companyasheesh100% (1)

- PrefaceDocumento49 páginasPrefaceManish RajakAinda não há avaliações

- Axis Bank - FINANCIAL OVERVIEW OF AXIS BANK & COMPARATIVE STUDY OF CURRENT ACCOUNT AND SAVING ACCDocumento93 páginasAxis Bank - FINANCIAL OVERVIEW OF AXIS BANK & COMPARATIVE STUDY OF CURRENT ACCOUNT AND SAVING ACCAmol Sinha56% (9)

- Credit Dispute FormDocumento2 páginasCredit Dispute FormcorvidspamAinda não há avaliações

- Curtain InvoiceDocumento1 páginaCurtain Invoicebilalahmad566Ainda não há avaliações

- Malaysian Trustee Incorporation Act SummaryDocumento19 páginasMalaysian Trustee Incorporation Act SummarySchen NgAinda não há avaliações

- Construction Project Controlled Insurance Program CIP FlyerDocumento8 páginasConstruction Project Controlled Insurance Program CIP FlyerMark DodsonAinda não há avaliações

- JPM Asia Pacific Equity 2011-07-07 624664Documento22 páginasJPM Asia Pacific Equity 2011-07-07 624664tommyphyuAinda não há avaliações

- Eros Sampoornam New Phase PL W.E.F 16.06.2020Documento1 páginaEros Sampoornam New Phase PL W.E.F 16.06.2020Gaurav SinghAinda não há avaliações

- The Debtors Are Electroglas, Inc. (EIN 77-0336101) and Electroglas International, Inc. (EIN 77-0345011)Documento20 páginasThe Debtors Are Electroglas, Inc. (EIN 77-0336101) and Electroglas International, Inc. (EIN 77-0345011)Chapter 11 DocketsAinda não há avaliações

- Asia Asindo Sukses, PT - PO00100764Documento2 páginasAsia Asindo Sukses, PT - PO00100764KELOMPOK 4 E501 MEKTAN 2Ainda não há avaliações

- Structural Adjustment: Structural Adjustments Are The Policies Implemented by TheDocumento13 páginasStructural Adjustment: Structural Adjustments Are The Policies Implemented by Theanon_246766821Ainda não há avaliações

- Fashion ShoeDocumento5 páginasFashion ShoeManal ElkhoshkhanyAinda não há avaliações