Escolar Documentos

Profissional Documentos

Cultura Documentos

RMC Withholding Tax

Enviado por

HarryDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

RMC Withholding Tax

Enviado por

HarryDireitos autorais:

Formatos disponíveis

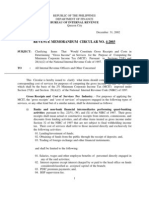

No.

of Issuance

RMC No. 21-2010

RMC No. 20-2011

RMC No. 38-2011

RMC No. 49-2011

RMC No. 2-2012

RMC No. 23-2012

RMC No. 39-2012

RMC No. 41-2012

RMC No. 63-2012

RMC No. 85-2012

RMC No. 91-2012

RMC No. 16-2013

RMC No. 17-2013

Subject Matter

Reiterates the applicable penalties for

employers who fail to withhold, remit, do the

year-end adjustment and refund employees of

the excess withholding taxes on compensation

Clarifies the Special Treatment of Fringe

Benefits under Section 2.33 of RR No. 3-98, as

last amended by RR No. 5-2011

Clarifies the

application

of

Expanded

Withholding Tax on the payments of PHIC to

medical

practitioners

and/or

hospitals

pertaining to PHIC members benefits

Further clarifies RMC No. 38-2011 on

Expanded Withholding Tax obligation of

Philippine Health Insurance Corporation

(PHIC), including the Income Tax withholding

obligation of hospitals/clinics on case rates of

PHIC and the matter of 5% Final Withholding

VAT for government money payments

Reiterates the existing rules and policies on the

acceptance of payments of internal revenue

taxes by RCOs during specified deadlines and

issuance of RORs in accepting tax payments, in

cash or in checks over the P20,000.00 threshold

Reiterates the responsibilities of officials and

employees of government offices for the

withholding of applicable taxes on certain

income payments and the imposition of

penalties for non-compliance thereof

Requires the withholding of Income Tax on

backwages, allowances and benefits received

by employees through garnishments of debts or

credits pursuant to a labor dispute award

Extends the August 10, 2012 deadline for the eFiling/Filing and e-Payment/Remittance using

BIR Forms 1600, 1606, 1601C and 1602;

1601E and 1601F; and 2200M for the specified

Revenue District Offices

Clarifies the issues affecting invoicing and

recording of income payments for media

advertising placements

Reminds withholding agents of their obligation

to issue withholding tax statement for taxes

withheld at source

Supplements the guidelines in RMC No. 632012 on invoicing and recording of income

payments for media advertising placements

Clarifies the tax implications and recording of

deposits/advances for expenses received by

taxpayers not covered by RMC No. 89-2012

Clarifies the taxes due from Financial or

Date of Issue

March 9, 2010

Page

13

May 13, 2011

September 1, 2011

57

October 11, 2011

8 10

January 3, 2012

11 13

May 8, 2012

14 22

August 6, 2012

23 24

August 9, 2012

25

October 29, 2012

26 29

December 26, 2012

30

December 28, 2012

31 33

February 15, 2013

34 36

February 15, 2013

37 39

RMC No. 5-2014

RMC No. 73-2014

RMC No. 15-2015

RMC No. 22-2015

RMC No. 45-2015

Technical Assistance Agreement (FTAA)

Contractors during Recovery Periods

Clarifies the provisions of RR No. 1-2014

pertaining to the submission of Alphabetical

List of Employees/Payees of Income Payments

Clarifies the Withholding Tax rates on dividend

payments to Philippine Central Depository

Nominees

Defers the implementation of eFiling of

identified Withholding Tax forms

Provides alternative modes in the filing of BIR

Form Nos. 1601-C and 1601-E using the

electronic platforms of BIR

Clarifies the withholding of VAT on

government money payments for OECF-funded

projects under Exchange of Notes between the

Republic of the Philippines and the

Government of Japan

January 29, 2014

40 60

September

15, 2014

61

April 8, 2015

62 63

April 28, 2015

64 65

August 24, 2015

66 69

Você também pode gostar

- 61716rmo 48-2011Documento1 página61716rmo 48-2011HarryAinda não há avaliações

- BIR Cuts Requirements For Brokers and Importers' ClearancesDocumento4 páginasBIR Cuts Requirements For Brokers and Importers' ClearancesPortCallsAinda não há avaliações

- 2001 RR 17 HousingDocumento7 páginas2001 RR 17 HousingCherry MaeAinda não há avaliações

- Revenue Regulations on Cooperative Tax ExemptionsDocumento5 páginasRevenue Regulations on Cooperative Tax ExemptionsmatinikkiAinda não há avaliações

- RR 14-01Documento9 páginasRR 14-01matinikkiAinda não há avaliações

- rr01 01 PDFDocumento1 páginarr01 01 PDFHarryAinda não há avaliações

- rr15 01Documento5 páginasrr15 01HarryAinda não há avaliações

- rr12 01Documento12 páginasrr12 01Bryant R. CanasaAinda não há avaliações

- RR 13-01Documento5 páginasRR 13-01Peggy SalazarAinda não há avaliações

- rr16 01Documento3 páginasrr16 01HarryAinda não há avaliações

- BIR Amends Agreement for Tax Collection Through BanksDocumento17 páginasBIR Amends Agreement for Tax Collection Through BanksHarryAinda não há avaliações

- RR 18-01Documento7 páginasRR 18-01JvsticeNickAinda não há avaliações

- BIR RMC 17 2006Documento2 páginasBIR RMC 17 2006Mary Anne BantogAinda não há avaliações

- rr21 01Documento1 páginarr21 01HarryAinda não há avaliações

- 1873rmc07 - 03 (Annex A)Documento1 página1873rmc07 - 03 (Annex A)HarryAinda não há avaliações

- BIR RMC 17 2006Documento2 páginasBIR RMC 17 2006Mary Anne BantogAinda não há avaliações

- Tax Guide Value Added TaxDocumento18 páginasTax Guide Value Added TaxBuenaventura RiveraAinda não há avaliações

- 1903rmc09 03 PDFDocumento3 páginas1903rmc09 03 PDFHarryAinda não há avaliações

- 1859rmc06 - 03 (Annex A)Documento2 páginas1859rmc06 - 03 (Annex A)HarryAinda não há avaliações

- 1845rmc05 03 PDFDocumento1 página1845rmc05 03 PDFHarryAinda não há avaliações

- 02-2003 Staggered Filing of ReturnDocumento4 páginas02-2003 Staggered Filing of Returnapi-247793055Ainda não há avaliações

- 1845rmc05 - 03 (Annex A)Documento1 página1845rmc05 - 03 (Annex A)HarryAinda não há avaliações

- Republic of The Philippines Department of Finance Bureau of Internal RevenueDocumento6 páginasRepublic of The Philippines Department of Finance Bureau of Internal RevenueJess FernandezAinda não há avaliações

- MCIT clarification on gross receipts and costs for servicesDocumento7 páginasMCIT clarification on gross receipts and costs for servicesjtilloAinda não há avaliações

- 02-2003 Staggered Filing of ReturnDocumento4 páginas02-2003 Staggered Filing of Returnapi-247793055Ainda não há avaliações

- Tax Collection Goals by Type 2004Documento1 páginaTax Collection Goals by Type 2004HarryAinda não há avaliações

- 1689rmc03 03 PDFDocumento1 página1689rmc03 03 PDFHarryAinda não há avaliações

- Republic of The Philippines Department of Finance Bureau of Internal RevenueDocumento6 páginasRepublic of The Philippines Department of Finance Bureau of Internal RevenueJess FernandezAinda não há avaliações

- Collection Goal, by Implementing Office and Major Tax Type, Cy 2004Documento1 páginaCollection Goal, by Implementing Office and Major Tax Type, Cy 2004HarryAinda não há avaliações

- 1798rmo04 06tab3Documento1 página1798rmo04 06tab3HarryAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Tax incentives for special Filipino taxpayersDocumento14 páginasTax incentives for special Filipino taxpayersKathlyn PostreAinda não há avaliações

- Taxation TX (MYS) SyllandSG Dec 2018 - Sep 2019 - FinalDocumento22 páginasTaxation TX (MYS) SyllandSG Dec 2018 - Sep 2019 - Finalkucing kerongAinda não há avaliações

- Taxation II Bar Questions 2006 - 2014Documento44 páginasTaxation II Bar Questions 2006 - 2014Ramir FamorcanAinda não há avaliações

- 2019 It-511 Individual Income Tax Booklet PDFDocumento52 páginas2019 It-511 Individual Income Tax Booklet PDFvinayak ShedgeAinda não há avaliações

- RMC No 100-2017 PDFDocumento1 páginaRMC No 100-2017 PDFGLEMICH BUILDERS INCAinda não há avaliações

- Annual income tax filing for self-employed individualsDocumento9 páginasAnnual income tax filing for self-employed individualsJessie Boy Balino BalderamaAinda não há avaliações

- Bonnie J. Dankanich 2016 NW Canoe PL Seattle WA 98117Documento43 páginasBonnie J. Dankanich 2016 NW Canoe PL Seattle WA 98117Anonymous nIieZAY2y8Ainda não há avaliações

- Allama Iqbal Open University, Islamabad (Department of Commerce)Documento7 páginasAllama Iqbal Open University, Islamabad (Department of Commerce)BakhtawarAinda não há avaliações

- COVID Relief Funds ApplicationDocumento10 páginasCOVID Relief Funds ApplicationMichael JohnsonAinda não há avaliações

- Princeton-Graduate School Costs and Funding - 2017-18Documento33 páginasPrinceton-Graduate School Costs and Funding - 2017-18Sathyanarayanan DAinda não há avaliações

- Tax Unit FourDocumento32 páginasTax Unit FourHabibuna MohammedAinda não há avaliações

- Acc 1152 Dol224 HandbookDocumento48 páginasAcc 1152 Dol224 Handbooksapphire8Ainda não há avaliações

- Taxation 1 Case DigestsDocumento26 páginasTaxation 1 Case DigestsIrene QuimsonAinda não há avaliações

- Accounting and Bookkeeping SOPDocumento22 páginasAccounting and Bookkeeping SOPJessa Mae Cac100% (2)

- Tax Deductions Upheld for Professional Services Despite Accrual of Expenses in Prior YearsDocumento2 páginasTax Deductions Upheld for Professional Services Despite Accrual of Expenses in Prior YearsDee ObriqueAinda não há avaliações

- ABS CBN V CB G.R. No. L-52306Documento5 páginasABS CBN V CB G.R. No. L-52306Evan TriolAinda não há avaliações

- TtraDocumento3 páginasTtralance757Ainda não há avaliações

- BIR Form 1600WPDocumento1 páginaBIR Form 1600WPCharmaine MejiaAinda não há avaliações

- The Supreme Court Declines to Act as Arbitrators in Rate DisputeDocumento150 páginasThe Supreme Court Declines to Act as Arbitrators in Rate DisputeCookie CharmAinda não há avaliações

- Preferential TaxDocumento2 páginasPreferential TaxattymanekaAinda não há avaliações

- Simplified RA 9504Documento3 páginasSimplified RA 9504thepurplehazeAinda não há avaliações

- Bir Form 1601E - Schedule I Alphabetical List of Payees From Whom Taxes Were Withheld For The Month of June, 2018Documento5 páginasBir Form 1601E - Schedule I Alphabetical List of Payees From Whom Taxes Were Withheld For The Month of June, 2018MaricrisAinda não há avaliações

- Income Tax Proforma PakistanDocumento16 páginasIncome Tax Proforma PakistanInayat UllahAinda não há avaliações

- Fleet Agreement 2018-05-11Documento20 páginasFleet Agreement 2018-05-11David PattyAinda não há avaliações

- Tax Cases CompletedDocumento310 páginasTax Cases CompletedAnjanette MangalindanAinda não há avaliações

- The Tamil Nadu Civil Services Discipline and Appeal RulesDocumento119 páginasThe Tamil Nadu Civil Services Discipline and Appeal RulesRaja Sekaran DuraiAinda não há avaliações

- Income Payee'S Sworn Declaration of Gross Receipts/SalesDocumento1 páginaIncome Payee'S Sworn Declaration of Gross Receipts/SalesTacloban Rebs100% (4)

- Other Percentage Taxes: Title V of The Tax Code, Sections 117 To 127Documento17 páginasOther Percentage Taxes: Title V of The Tax Code, Sections 117 To 127zelAinda não há avaliações

- SPT PPH BDN 2009 English OrtaxDocumento39 páginasSPT PPH BDN 2009 English Ortaxanon_265770590Ainda não há avaliações

- Understanding Your Paycheck and Tax FormsDocumento30 páginasUnderstanding Your Paycheck and Tax FormsdeepagAinda não há avaliações